Exploring Meal and Snacking Behaviour of Older Adults in Australia and China

Abstract

:1. Introduction

2. Materials and Methods

2.1. QMA Study

2.1.1. Participants

2.1.2. Procedure

2.2. Conjoint Study

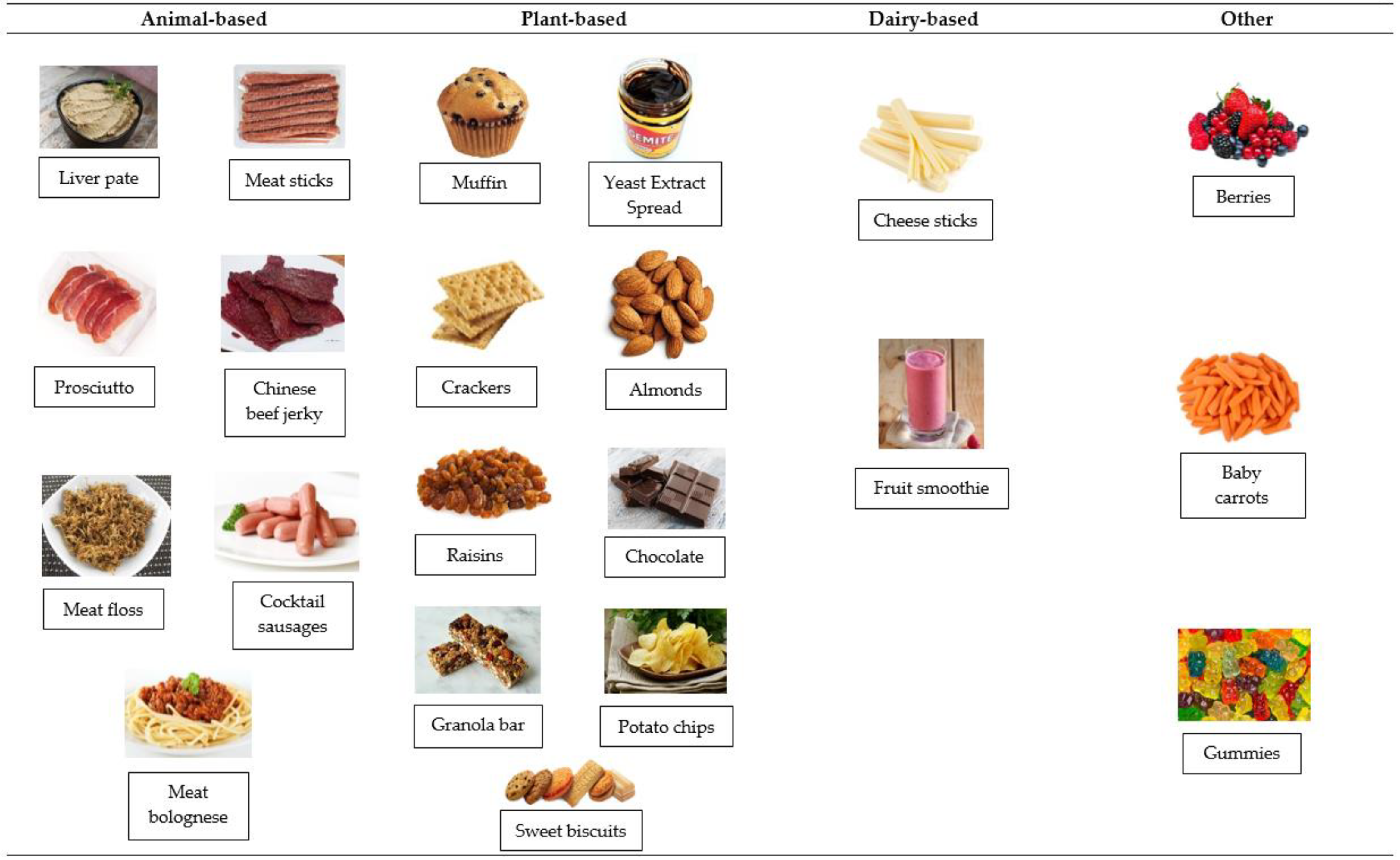

2.2.1. Selection of Foods and Respondents

2.2.2. Key Attributes

2.2.3. Conjoint Design

2.2.4. Experimental Design

2.3. Data Collection and Analysis

3. Results

3.1. QMA Study

3.1.1. Table of Meal/Snacking Behaviour

3.1.2. Meat Products Tasting

3.1.3. QMA Perceptual Mapping

3.2. Conjoint Study

3.2.1. Segments Classification into Laggard, Mainstream and Lead Users of Beef, Pork, Cheese and Chocolate Traits for Australians and Chinese Older Consumers

3.2.2. Utility Weight (Regression Coefficients) over Age and Gender for Most Important Beef, Pork, Cheese and Chocolate Traits for Australians and Chinese Consumers

4. Discussion

4.1. QMA Study

4.2. Conjoint Study

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- World Bank. Population Ages 65 and Above, Total. Available online: https://data.worldbank.org/indicator/SP.POP.65UP.TO (accessed on 18 January 2019).

- He, W.; Goodkind, D.; Kowal, P. An Aging World: 2015; US Census Bureau; U.S. Government Publishing Office: Washington, DC, USA, 2016. [CrossRef]

- ABS (Australian Bureau of Statistics). Population by Age and Sex, Australia: States and Territories. Available online: http://www.abs.gov.au/ausstats/[email protected]/0/1cd2b1952afc5e7aca257298000f2e76?opendocument (accessed on 20 January 2019).

- Van der Zanden, L.D.; Van Kleef, E.; de Wijk, R.A.; Van Trijp, H.C. Knowledge, perceptions and preferences of elderly regarding protein-enriched functional food. Appetite 2014, 80 (Suppl. C), 16–22. [Google Scholar] [CrossRef]

- Zizza, C.A.; Tayie, F.A.; Lino, M. Benefits of snacking in older Americans. J. Am. Diet. Assoc. 2007, 107, 800–806. [Google Scholar] [CrossRef] [PubMed]

- McNeill, S.; Van Elswyk, M.E. Red meat in global nutrition. Meat Sci. 2012, 92, 166–173. [Google Scholar] [CrossRef] [PubMed]

- Evans, W.J. Protein nutrition, exercise and aging. J. Am. Coll. Nutr. 2004, 23, 601S–609S. [Google Scholar] [CrossRef]

- Jenkinson, D. Red Meat Innovation Insights Report: The Snacking Opportunity; Meat and Livestock Australia Limited: North Sydney, NSW, Australia, 2015. [Google Scholar]

- Jervis, M.; Drake, M. The use of qualitative research methods in quantitative science: A review. J. Sens. Stud. 2014, 29, 234–247. [Google Scholar] [CrossRef]

- Hastie, M.; Ashman, H.; Torrico, D.; Ha, M.; Warner, R. A Mixed Method Approach for the Investigation of Consumer Responses to Sheepmeat and Beef. Foods 2020, 9, 126. [Google Scholar] [CrossRef] [Green Version]

- Drake, S.; Lopetcharat, K.; Drake, M. Comparison of two methods to explore consumer preferences for cottage cheese. J. Dairy Sci. 2009, 92, 5883–5897. [Google Scholar] [CrossRef]

- Beckley, J.; Paredes, D.; Lopetcharat, K. Future Trends and Directions. Prod. Innov. Toolbox 2012, 374. [Google Scholar] [CrossRef]

- WHO (World Health Organization). Female Life Expectancy. Available online: https://www.who.int/gho/women_and_health/mortality/situation_trends_life_expectancy/en/ (accessed on 16 March 2020).

- Glaser, B.; Strauss, A.; Strauss, F. The Discovery of Grounded Theory: Strategies for Qualitative Research; Routledge: New York, NY, USA, 2017. [Google Scholar]

- Moskowitz, H.R.; Gofman, A.; Beckley, J.; Ashman, H. Founding a new science: Mind genomics. J. Sens. Stud. 2006, 21, 266–307. [Google Scholar] [CrossRef]

- Box, G.E.; Hunter, W.G.; Hunter, J.S. Statistics for Experimenters; John Wiley and Sons: New York, NY, USA, 1978; Volume 664. [Google Scholar]

- Anderson, N.H. Functional measurement and psychophysical judgment. Psychol. Rev. 1970, 77, 153. [Google Scholar] [CrossRef]

- Orme, B.K. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research; Research Publishers LLC: Madison, WI, USA, 2010. [Google Scholar]

- Hughson, A.; Ashman, H.; De la Huerga, V.; Moskowitz, H. Mind-sets of the wine consumer. J. Sens. Stud. 2004, 19, 85–105. [Google Scholar] [CrossRef]

- Foley, M.; Beckley, J.; Ashman, H.; Moskowitz, H.R. The mind-set of teens towards food communications revealed by conjoint measurement and multi-food databases. Appetite 2009, 52, 554–560. [Google Scholar] [CrossRef] [PubMed]

- Von Hippel, E. Lead users: A source of novel product concepts. Manag. Sci. 1986, 32, 791–805. [Google Scholar] [CrossRef] [Green Version]

- WHO (World Health Organization). Healthy Life Expectancy (HALE): Data by Country. Available online: https://apps.who.int/gho/data/node.main.HALE?lang=en (accessed on 28 January 2019).

- Roser, M.; Ortiz-Ospina, E.; Ritchie, H. Life Expectancy. Available online: https://ourworldindata.org/life-expectancy (accessed on 16 March 2020).

- Fellows, P.; Hampton, A. Small-Scale Food Processing: A Guide to Appropriate Equipment; Intermediate Technology Publications: London, UK, 1992. [Google Scholar]

- NZMP (New Zealand Milk Products). Top 5 Consumer Trends 2019. Available online: https://www.nzmp.com/global/en/news/top-5-consumer-trends-2019.html (accessed on 17 March 2020).

- AIFST (Australian Institute of Food Science and Technology). Top five trends in 2017 by Sarah Hyland. Digital Magazine, 31 January 2017; 28. [Google Scholar]

- Higgins, M.M. Food and Nutrition Professionals Can Help Older Adults Improve Dietary Practices. J. Am. Diet. Assoc. 2007, 107, 806–807. [Google Scholar] [CrossRef]

- USDA (US Department of Agriculture). MyPyramid. Available online: https://www.fns.usda.gov/mypyramid (accessed on 5 May 2017).

- Castellanos, V.H.; Litchford, M.D.; Campbell, W.W. Modular protein supplements and their application to long-term care. Nutr. Clin. Pract. 2006, 21, 485–504. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- ABS (Australian Bureau of Statistics). Australian Health Survey: Consumption of food groups from the Australian Dietary Guidelines, 2011–2012. Available online: https://www.abs.gov.au/ausstats/[email protected]/Lookup/by%20Subject/4364.0.55.012~201112~Main%20Features~Measuring%20the%20consumption%20of%20food%20groups%20from%20the%20Australian%20Dietary%20Guidelines~10000 (accessed on 17 January 2019).

- Baugreet, S.; Hamill, R.M.; Kerry, J.P.; McCarthy, S.N. Mitigating nutrition and health deficiencies in older adults: A role for food innovation? J. Food Sci. 2017, 82, 848–855. [Google Scholar] [CrossRef] [Green Version]

- Mioche, L.; Bourdiol, P.; Monier, S.; Martin, J.; Cormier, D. Changes in jaw muscles activity with age: Effects on food bolus properties. Physiol. Behav. 2004, 82, 621–627. [Google Scholar] [CrossRef]

- Farouk, M.M.; Yoo, M.J.Y.; Hamid, N.S.A.; Staincliffe, M.; Davies, B.; Knowles, S.O. Novel meat-enriched foods for older consumers. Food Res. Int. 2018, 104, 134–142. [Google Scholar] [CrossRef]

- Reyes-Padilla, E.; Valenzuela-Melendres, M.; Camou, J.P.; Sebranek, J.G.; Alemán-Mateo, H.; Dávila-Ramírez, J.L.; Cumplido-Barbeitia, G.; González-Ríos, H. Quality evaluation of low fat bologna-type meat product with a nutritional profile designed for the elderly. Meat Sci. 2018, 135, 115–122. [Google Scholar] [CrossRef]

- Baugreet, S.; Kerry, J.P.; Botineştean, C.; Allen, P.; Hamill, R.M. Development of novel fortified beef patties with added functional protein ingredients for the elderly. Meat Sci. 2016, 122, 40–47. [Google Scholar] [CrossRef]

- Rothenberg, E.; Ekman, S.; Bülow, M.; Möller, K.; Svantesson, J.; Wendin, K. Texture-modified meat and carrot products for elderly people with dysphagia: Preference in relation to health and oral status. Scand. J. Food Nutr. 2007, 51, 141–147. [Google Scholar] [CrossRef]

- Boyce, J.M.; Shone, G. Effects of ageing on smell and taste. Postgrad. Med J. 2006, 82, 239–241. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Xue, S.A.; Hao, J.G. Normative standards for vocal tract dimensions by race as measured by acoustic pharyngometry. J. Voice 2006, 20, 391–400. [Google Scholar] [CrossRef] [PubMed]

- Ketel, E.C.; Aguayo-Mendoza, M.G.; de Wijk, R.A.; de Graaf, C.; Piqueras-Fiszman, B.; Stieger, M. Age, gender, ethnicity and eating capability influence oral processing behaviour of liquid, semi-solid and solid foods differently. Food Res. Int. 2019, 119, 143–151. [Google Scholar] [CrossRef] [PubMed]

- Bryant, C.J.; Szejda, K.; Deshpande, V.; Parekh, N.; Tse, B. A survey of consumer perceptions of plant-based and clean meat in the USA, India, and China. Front. Sustain. Food Syst. 2019, 3, 11. [Google Scholar] [CrossRef]

- Jahanmir, S.F.; Lages, L.F. The lag-user method: Using laggards as a source of innovative ideas. J. Eng. Technol. Manag. 2015, 37, 65–77. [Google Scholar] [CrossRef] [Green Version]

- Hengsberger, A. What Distinguishes Lead User from Customers? Available online: https://www.lead-innovation.com/english-blog/what-distinguishes-lead-user-from-customers (accessed on 26 January 2020).

- Gauthier, V. Three Reasons Why Extreme Users Boost Your Innovation. Available online: https://www.linkedin.com/pulse/3-reasons-why-extreme-users-boost-your-innovation-vivien-gauthier (accessed on 25 January 2019).

- Hasimu, H.; Marchesini, S.; Canavari, M. A concept mapping study on organic food consumers in Shanghai, China. Appetite 2017, 108 (Suppl. C), 191–202. [Google Scholar] [CrossRef]

- Del Giudice, T.; Caracciolo, F.; Cicia, G.; Grunert, K.G.; Krystallis, A. Consumatori cinesi e cibo: Tra tradizione millenaria e influenze culturali occidentali. Econ. Agro-Aliment. 2012, 14, 85–89. [Google Scholar]

- Hasimu, H.; Marchesini, S.; Canavari, M. Chinese distribution practitioners’ attitudes towards Italian quality foods. J. Chin. Econ. Foreign Trade Stud. 2008, 1, 214–231. [Google Scholar] [CrossRef] [Green Version]

- Lee, P.Y.; Lusk, K.; Mirosa, M.; Oey, I. The role of personal values in Chinese consumers’ food consumption decisions. A case study of healthy drinks. Appetite 2014, 73, 95–104. [Google Scholar] [CrossRef]

- Oh, S.H.; See, M.T. Pork preference for consumers in China, Japan and South Korea. Asian-Australas. J. Anim. Sci. 2012, 25, 143. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Xu, J.; Wu, Y. A Comparative Study of the Role of Australia and New Zealand in Sustainable Dairy Competition in the Chinese Market after the Dairy Safety Scandals. Int. J. Environ. Res. Public Health 2018, 15, 2880. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Shan, L.C.; Regan, A.; Monahan, F.J.; Li, C.; Murrin, C.; Lalor, F.; Wall, P.G.; McConnon, A. Consumer views on “healthier” processed meat. Br. Food J. 2016, 118, 1712–1730. [Google Scholar] [CrossRef] [Green Version]

- Hodder Education. Tasting Word Bank—Sensory Descriptors. OCR Design & Technology For GCSE: Food Technology. Available online: https://www.john-spendluffe.lincs.sch.uk/documents/food/word%20bank%20-%20Examples%20of%20words%20to%20use%20when%20filling%20in%20sensory%20sheets.pdf (accessed on 15 May 2017).

| Time of Consumption | Australian * | Chinese ** |

|---|---|---|

| Early morning | No food consumed | Consumption of warm water first thing in the morning |

| Breakfast | Only tea or orange juice | Consumption of proper breakfast, lunch and dinner across the day for health, habit, hunger or share with family and friends |

| Mid-morning | A dry/crunchy food with coffee, consumed with partner | |

| Lunch | A dry/crunchy food, combination of sweet and salty, eaten at home, solo or with partner | |

| Afternoon | Most food consumption (cheese, biscuits, fruit/vegetables and sweets) due to hunger or habit with coffee or tea, eaten solo or with partner | Mid-morning and afternoon snacks only if hungry but unlikely |

| Dinner | No ‘proper’ dinner is consumed. Consumption of something sweet or crunchy for a treat | |

| After dinner | The trend is to consume mostly sweet, crunchy foods for a treat, boredom or habit. Eaten at home with a hot beverage (coffee, tea, hot chocolate) | Snack for gut health or sleep better. Mainly dairy-based, i.e., plain yogurt, milk |

| Other comments | Do not cook very often, prefer ready-to-eat/convenient foods | No liquids are consumed during meals, just before or after, still cook by themselves, enjoy homemade and fresh food, warm water is consumed before bed |

| Meat Product | Australian (n = 16) | Chinese (n = 21) |

|---|---|---|

| Liver pate | Spreadable, special occasions, too peppery, uninviting appearance (familiar) | Too soft, too peppery, uninviting appearance (not familiar) |

| Meat floss | Disgusting, hard to eat in terms of familiarity, ‘fibrous’ (not familiar) | Delicious, easy to eat, crispy and soft, umami (familiar) |

| Meat bolognese | Appetising, easy to eat, bland (familiar) | Meaty, moist, soft, easy to eat, umami (familiar) |

| Cocktail sausage | Party food, easy to eat filling, skin too hard (familiar) | Meaty, soft, easy to eat, too processed, umami (familiar) |

| Prosciutto | Appetising, snack food, fatty, chewy, salty (familiar) | Convenient, nutritious, too salty, not tasty, umami (not familiar) |

| Beef jerky | ‘Beefy’ (not familiar) | ‘Beefy’, meaty, hard to eat, chewy, umami (familiar) |

| Meat sticks | Party food, soft filling, hard skin, flavourless, difficult to bite (familiar) | Meaty, tasty, convenient, dry, tough skin, non-nutritious, umami (familiar) |

| Country: | AUSTRALIA | CHINA | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gender: | Male | Female | Male | Female | |||||||||

| Age Group: | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | |

| Number of Respondents: | 48 | 40 | 89 | 92 | 58 | 71 | 131 | 41 | 15 | 151 | 44 | 17 | |

| Attribute | Element | ||||||||||||

| PRODUCT | Beef stir fry, cut in just the right size | 0.04 | 0.18 | −0.20 | −0.11 | 0.16 | 0.07 | 0.40 | 0.12 | 1.17 | 0.11 | 0.28 | 0.64 |

| Beef sirloin, tender and juicy every time | 2.78 | 2.59 | 2.15 | 2.27 | 2.53 | 2.44 | 0.83 | 0.62 | 0.38 | 0.67 | 0.62 | 0.69 | |

| INGREDIENT | Lean heart healthy beef, raised to have monosaturated fats to lower your blood pressure and cholesterol, but still have lots of flavour | −0.59 | −0.46 | −0.50 | −0.28 | −0.66 | −0.55 | 0.34 | 0.57 | 0.71 | 0.58 | 0.71 | 0.72 |

| Premium pasture fed beef from Blackmore’s Wagyu, Cape Grim, or Minderoo | 0.84 | 0.52 | 0.31 | 0.54 | 0.77 | 0.23 | −0.23 | −0.18 | −0.26 | −0.15 | −0.20 | −0.67 | |

| PROVENANCE | Authenticated, traceable back to the farm | 0.74 | 0.96 | 1.10 | 0.64 | 1.00 | 0.98 | −0.01 | 0.41 | −0.03 | 0.15 | 0.17 | 0.14 |

| Raised on a small family farm, grass feed using biodiverse pastures, hormone free, using sustainable farming practices | 1.50 | 1.36 | 1.58 | 1.61 | 1.74 | 1.99 | 0.33 | 0.20 | 0.11 | 0.39 | 0.44 | 0.10 | |

| CHANNEL | Available at my local store | 1.45 | 1.43 | 1.75 | 1.69 | 1.50 | 1.86 | 0.10 | 0.03 | 0.96 | −0.01 | 0.00 | −0.14 |

| Available in the supermarket | 1.34 | 1.33 | 1.57 | 1.37 | 1.62 | 1.83 | 0.59 | 0.40 | 1.01 | 0.67 | 0.71 | 0.34 | |

| Country: | AUSTRALIA | CHINA | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gender: | Male | Female | Male | Female | |||||||||

| Age Group: | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | |

| Number of Respondents: | 55 | 41 | 86 | 83 | 66 | 56 | 157 | 39 | 25 | 122 | 50 | 11 | |

| Attribute: | Levels: | ||||||||||||

| PRODUCT | Pork loin chop | −0.46 | −0.64 | −0.70 | −0.58 | −0.53 | −0.47 | −0.46 | −0.18 | −0.69 | −0.38 | −0.63 | −0.19 |

| Authentic, tender and juicy Australian pork loin chop | 0.47 | 0.10 | 0.01 | 0.13 | 0.17 | 0.07 | 1.25 | 0.79 | 1.10 | 1.16 | 1.50 | 1.10 | |

| PROVENANCE | Australian meat packaged and prepared in Australia | 1.05 | 1.19 | 1.02 | 0.87 | 0.82 | 1.37 | 0.15 | −0.01 | 0.39 | 0.08 | −0.02 | −0.18 |

| Raised on a small family farm, grass feed using biodiverse pastures, hormone free, using sustainable farming practices | 2.05 | 2.01 | 2.20 | 2.39 | 2.07 | 2.24 | 0.12 | 0.15 | 0.32 | 0.15 | −0.01 | −0.11 | |

| CHANNEL | Available at a small market/specialty store | 0.77 | 1.02 | 1.21 | 0.75 | 0.64 | 1.31 | −0.16 | −0.51 | 0.21 | −0.51 | −0.51 | −0.83 |

| Available online from a Chinese seller | 0.11 | 0.04 | −0.12 | 0.15 | 0.22 | −0.39 | 0.78 | 1.05 | 0.84 | 0.91 | 0.76 | 1.05 | |

| Country: | AUSTRALIA | CHINA | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gender: | Male | Female | Male | Female | |||||||||

| Age group: | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | |

| Number of respondents: | 46 | 46 | 62 | 92 | 65 | 72 | 146 | 32 | 14 | 164 | 28 | 17 | |

| Attribute: | Levels: | ||||||||||||

| INGREDIENT | Made with fresh Australian milk | 1.31 | 1.54 | 2.12 | 1.57 | 1.99 | 2.15 | −0.11 | −0.55 | −0.61 | −0.18 | 0.11 | −0.51 |

| Made with milk from a single cow free to roam on green pastures | 0.87 | 1.06 | 1.15 | 1.09 | 0.97 | 1.48 | 0.51 | 0.89 | 1.23 | 0.41 | 0.50 | 0.86 | |

| CHANNEL | Available at all stores where food and beverages are sold | 1.05 | 1.32 | 1.39 | 1.22 | 1.57 | 1.36 | 0.11 | −0.21 | −0.46 | 0.15 | 0.32 | 0.30 |

| Available online from an Australian seller | 0.02 | −0.05 | −0.26 | 0.00 | 0.04 | 0.17 | 0.42 | 0.18 | 0.31 | 0.65 | 0.07 | 0.47 | |

| Country: | AUSTRALIA | CHINA | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gender: | Male | Female | Male | Female | |||||||||

| Age Group: | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | 25–44 | 45–54 | ≥55 | |

| Number of Respondents: | 136 | 44 | 66 | 155 | 49 | 78 | 144 | 40 | 15 | 143 | 40 | 14 | |

| Attribute: | Levels: | ||||||||||||

| PACKAGE | Individual wrap | 0.42 | 0.80 | 0.56 | 0.64 | 0.68 | 0.68 | 0.52 | 0.68 | 0.42 | 0.64 | 0.59 | 0.80 |

| Gift pack | 1.38 | 2.38 | 1.22 | 1.50 | 1.81 | 0.86 | 1.05 | 0.81 | 1.14 | 1.08 | 1.19 | 0.84 | |

| INGREDIENT | Made from wild bush grown cocoa beans that provide the maximum health benefits from antioxidants | 0.52 | 0.20 | 0.56 | 0.72 | 0.68 | 0.73 | 0.31 | 0.45 | 0.49 | 0.35 | 0.27 | 0.42 |

| Australian cocoa beans blended with all Australian ingredients for a premium chocolate | 2.01 | 2.03 | 2.35 | 2.14 | 2.22 | 2.74 | 0.14 | 0.20 | 0.13 | 0.33 | −0.05 | 0.11 | |

| CHANNEL | Available at all stores where food and beverages are sold | 1.07 | 1.06 | 1.30 | 1.04 | 1.18 | 1.26 | 0.05 | 0.21 | 0.03 | 0.16 | 0.00 | 0.36 |

| Available in the supermarket | 0.92 | 1.34 | 1.34 | 1.02 | 1.48 | 1.50 | 0.57 | 0.33 | 0.69 | 0.57 | 0.61 | 0.35 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mena, B.; Ashman, H.; Dunshea, F.R.; Hutchings, S.; Ha, M.; Warner, R.D. Exploring Meal and Snacking Behaviour of Older Adults in Australia and China. Foods 2020, 9, 426. https://doi.org/10.3390/foods9040426

Mena B, Ashman H, Dunshea FR, Hutchings S, Ha M, Warner RD. Exploring Meal and Snacking Behaviour of Older Adults in Australia and China. Foods. 2020; 9(4):426. https://doi.org/10.3390/foods9040426

Chicago/Turabian StyleMena, Behannis, Hollis Ashman, Frank R. Dunshea, Scott Hutchings, Minh Ha, and Robyn D. Warner. 2020. "Exploring Meal and Snacking Behaviour of Older Adults in Australia and China" Foods 9, no. 4: 426. https://doi.org/10.3390/foods9040426

APA StyleMena, B., Ashman, H., Dunshea, F. R., Hutchings, S., Ha, M., & Warner, R. D. (2020). Exploring Meal and Snacking Behaviour of Older Adults in Australia and China. Foods, 9(4), 426. https://doi.org/10.3390/foods9040426