Abstract

The performance and scalability of energy storage systems play a key role in the transition toward intermittent renewable energy systems and the achievement of decarbonization targets through means of resilient electrical grids. Despite significant research and technology advancements, the scalability of innovative energy storage systems remains challenging due to the scarcity of raw materials (used for the production of energy storage media, cathodes, anodes, separators, conductive agents, and electrolytes). The European Commission has identified certain raw materials as both economically important and subject to supply risks, designating them as critical and strategic raw materials. In this review, a comprehensive analysis is conducted regarding 28 raw materials and rare earth elements which are essential for the production of batteries, supercapacitors, and other storage systems, emphasizing their criticality, strategic importance, supply chain vulnerabilities, and associated environmental and social impacts. This study also addresses potential substitute materials for energy storage devices and innovations that make these devices recyclable. Future trends are briefly discussed, including advancements in alternative chemistries and innovations to improve energy density in advanced batteries and supercapacitors, paving the way for hybrid energy solutions.

1. Introduction

The demand for energy storage devices is growing as the world is rapidly transitioning from fossil fuels like coal, gas, and petroleum products to renewable energy sources such as solar and wind. The major aim of this transition is to reduce carbon emissions and tackle climate change. According to Forbes, on a global scale, around 81.5% of the primary energy that is consumed is generated through fossil fuels. Renewable sources contribute a smaller share, including hydroelectric (6.4%) and other renewable energy sources (8.2%) such as solar, wind, and geothermal energy [1]. According to the World Economic Forum, in 2022, renewable energy sources, namely wind and solar, were the most significant sources of electricity in Europe, surpassing fossil gas. In a combined effort, wind and solar energy generated 22% of the European Union’s (EU) electricity, while fossil gas produced 20% [2]. In 2023, the overall share of energy from renewable energy sources in the EU was 24.5%. Sweden leads the EU member states in terms of renewable energy contributions, as 66.4% of its energy is generated from renewable energy sources. Finland and Denmark generate 50% and 45% of their total energy from renewables, while Malta, Belgium, and Luxembourg are among the countries that have the lowest renewable energy contributions [3]. However, in the first half of 2024, according to the Ninth Report on the State of the Energy Union [4], the EU achieved the 50% mark of energy generation from renewable sources for the first time. This development marks a significant milestone in Europe’s transition toward sustainable and cleaner energy systems. However, the inherently irregular nature of sourcing energy from renewable energy sources requires the use of energy storage devices in order to balance the grid’s supply and demand at a large scale and to power portable devices and electric vehicles [5]. Energy storage devices play a vital role in integrating renewable energy sources into the grid and household systems [6]. On a large scale, these devices store energy during periods of abundant supply, such as the daytime, when solar energy is available. Then, they release this stored energy during periods of high demand, such as during the night-time or off-peak hours. This process helps balance the grid’s supply and demand, ensuring the stable and reliable supply of energy [7]. In addition, energy storage devices also provide households with a dependable and sustainable source of energy, enabling them to reduce their reliance on traditional fossil fuels [8]. Considering the growing contribution of renewable energy sources to global energy demands, the demand for energy storage devices on the global stage is expected to grow. According to the Work Energy Outlook 2023 report published by the International Energy Agency (IEA), the rise of both electric vehicles and grid-scale energy storage for larger consumers will cause a six-fold increase in the global energy storage capacity by 2030 [9].

Raw materials are used to produce different components of energy storage devices, including cathodes [10], anodes [11], current collectors [12], conductive agents [13], electrolytes [14], supercapacitors [15], magnetic bearings [16], catalysts [17], and separators [18]. If a raw material is economically and strategically important for a particular application, country, or region, it is considered as “critical” [19]. The scarcity of critical raw materials (CRMs) has a significant impact on the development and deployment of energy storage devices. Some CRMs have limited global production, and their supply is controlled by a few countries, which creates geopolitical risks [20,21,22]. Moreover, the extraction, processing, and disposal of CRMs can have significant environmental and social impacts [23]. As the global climate crisis becomes more urgent, countries around the world are setting ambitious targets to reduce their carbon emissions and transition towards a cleaner and more sustainable future. For instance, the Paris Agreement aims to limit global warming to well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius [24]. Similarly, the European Union (EU) has set a target to achieve net-zero greenhouse gas emissions by 2050 [25].

To meet these targets, there is a growing need for energy storage devices that can support the integration of renewable energy sources into the electricity grid and reduce reliance on fossil fuels. The use of energy storage devices can help to balance the variability of renewable energy sources, ensuring a reliable and stable supply of electricity. However, the production of energy storage devices is heavily reliant on the availability of critical raw materials, many of which are rare, expensive, and geographically concentrated [19]. This creates a risk of supply chain disruptions and price volatility, which could undermine efforts to scale up the deployment of energy storage technologies [26]. Therefore, criticality assessments of raw materials used for the production of energy storage devices are vital for achieving these climate action targets [27]. The secure and sustainable supply of critical raw materials is essential to ensure the long-term viability and competitiveness of energy storage technologies [28]. CRMs, such as lithium, cobalt, and nickel, are essential for the development of high-performance batteries. These materials contribute significantly to improving the energy density, longevity, and efficiency of energy storage systems, making them essential in the global transition to renewable energy. However, the growing demand for CRMs, along with supply issues and geopolitical dependencies, highlights the urgent need to address energy storage challenges through sustainable materials. The complete understanding, knowledge, and quantitative assessment of the criticality of raw materials also encourage the development of substitute materials [29,30]. These substitute materials can replace the CRMs and can reduce reliance while also mitigating the environmental and social impacts associated with CRM extraction and processing [31,32].

This review paper gathers comprehensive information about the criticality of the raw materials used in energy storage devices. This paper provides an overview of the energy storage devices and raw materials used to produce these devices. The criticality assessments that have been made on these raw materials are reviewed. This study explores the potential substitute materials for these CRMs, the recyclability of energy storage devices, and the environmental and social impacts of their use.

2. Overview of Energy Storage Device Types

2.1. Electrical Storage Systems

Magnetic fields are used to store energy in electrical storage devices like superconducting coils and electrostatic fields like bi-layer capacitors. They only function as systems for supplementary energy storage. Capacitors can be used to electrostatically store electricity as a direct current. These are usually two-layer devices, hence the term “bi-layer capacitors”, sometimes known as “supercaps”. Electromagnetic fields can employ coils (inductors) to store electricity as an alternating current. Electrons that travel in a current-carrying coil are the moving electric charges that produce and are affected by magnetism. These fields must have extremely low internal resistance, ideally close to zero, in order to be maintained without a source of external energy to counteract standing losses. Superconducting magnetic energy storage (SMES) is the name given to electromagnetic energy storage that depends on superconductors. Permanent magnets are a component of another kind of electromagnetic storage. In this case, electrons circling the nucleus and their associated spin produce atomic ring currents [33].

2.2. Electrochemical Storage Systems

Electrochemical energy storage devices such as batteries and accumulators, along with the charged particles used in redox flow batteries, store energy in a chemical form. While they can be considered a subset of chemical energy storage systems, electrochemical storage systems possess distinct characteristics that differentiate them from the others. The materials used for electrochemical energy storage systems include nickel hydroxides, cobalt oxides, and nickel–cobalt oxides/hydroxides [34].

2.3. Mechanical Storage Systems

Depending on their potential, kinetics, or pressure of thermodynamics, systems for mechanical storage make use of the energy present in gases, liquids, or solid materials. They consist of springs, flywheels, pumped storage facilities, mechanically stored energy, Compressed Air Energy Storage Systems (CAES), and flywheels. They are mostly employed for secondary energy storage [35].

2.4. Thermal Storage Systems

The systems for storing secondary energy that store heat are called thermal energy storage systems. Their technical usage can be used to classify them. Systems for storing energy with sensible heat have a moderate alteration in temperature between charging and discharging that may be “sensed”. The magnitude of energy stored is observed by multiplying this by the medium’s mass and heat capacity. Most homes have sensible heat storage systems like hot water tanks, and these systems need to be adequately thermally insulated. Systems for storing latent heat do not involve the medium’s temperature change; hence, they cannot be sensed. Phase Change Materials (PCMs) are used in such systems to absorb or release heat during such transitions. Charging and discharging entail utilizing the enthalpy that results from this transition. Buildings may store and release heat using hidden heat storage systems with minimum temperature change and low self-discharge rates. Chemical processes that are thermo-reversible are used in thermochemical heat storage systems. An endothermic process charges the storage system by absorbing the ensuing enthalpy and then discharging it [36].

3. Critical Raw Materials for Energy Storage Devices

Following the classification of modern-day typical energy storage systems, it is important to discuss the CRMs that strengthen their design, efficiency, and scalability. The ensuing section provides an in-depth review of each of the CRMs. CRMs such as lithium, cobalt, and rare earth elements are essential for producing energy storage devices. Their limited availability and geopolitical concentrations create risks for sustainable deployment.

3.1. Antimony

One of the 30 essential raw resources for the EU, which is completely dependent on importation, is antimony [37]. Several national governments, including those of Australia, Russia, the United Kingdom (UK), and the United States (US), claim that antimony is one of seven specialty metals whose supply risk is the highest over the middle period (i.e., 5 to 10 years) and the second biggest over a longer period. Antimony’s high criticality was demonstrated in 2021 when its price in China hit a seven-year high due to a lack of ore supply following a decline in imports because of COVID-19 and a stoppage of output at the nation’s biggest reserve when its license expired. This caused a several-month production slowdown at China’s refineries [38]. This resulted in a significant supply interruption because China accounts for more than 60% of the worldwide supply. Many different goods place a high value on antimony [38]. Flame retardancy in textiles, electrical and electronic devices, batteries made of lead acid, cables and wires, porcelain, and glass are some of its main applications [39]. In the realm of future energy-related technologies, antimony holds the potential to be a crucial component in various applications. For instance, there is a possibility that antimony could be used in the anode component of rechargeable lithium-ion batteries, which are commonly employed in electric vehicles. Antimony offers certain advantages over graphite, such as safer reactive potential and a significantly higher theoretical capacity. These properties make antimony a promising candidate for enhancing the performance of lithium-ion batteries.

Furthermore, antimony shows promise as an electrode material for liquid metal batteries. Liquid metal batteries are being explored as a potential large-scale energy storage solution due to their requirement for higher energy density. Antimony’s relatively low melting point makes it an appealing choice for such batteries. Researchers have been drawn to liquid metal batteries as an alternative for storing substantial amounts of energy, and antimony’s characteristics position it as a potentially valuable electrode material in this context. Last but not least, antimony selenide is evolving as a new material for photovoltaic applications that combines abundant, low-toxic components with rapidly increasing efficiency [40]. The antimony market will expand 5% yearly through to 2026, as predicted by Mordor Intelligence. However, research by Perpetua Resources predicts that until 2030, an additional 18 kt of mining output—or 12% of production in 2018—would be needed [41].

3.2. Baryte

Barium sulfate, often known as barite (baryte), is a mineral. The main source of the element barium, which has the chemical symbol Ba, is the mineral barite (BaSO4). Barium is a heavy metal that is silvery, soft, extremely reactive, and does not exist in nature in its pure form. The mineral barite frequently contains barium, which is linked to sulfur and oxygen. Pale yellow or colorless tabular crystals of barite are found naturally. Nearly 95% of the local usage and 90% of the worldwide consumption of barite are a result of the search for and development of natural gas and petroleum resources [42]. The mineral may also be used as a feedstock for the production of chemicals; an additive for friction materials, paints, plastics, rubbers, and other goods; as well as a shielding material for X-ray and gamma-ray applications. Barium, which makes up 59 percent of barite by weight, is used in a wide range of goods, including steel hardeners, welding fluxes, optical glass, primers, signal flares, and ceramic glazes [43]. It is used as a filler in rubbers, plastics, paints and paper, and in the chemical industry. It is used in the EU’s strategic industrial sectors, such as manufacturing and aerospace [44].

Baryte is used in the manufacturing of lead–acid batteries, where it acts as a filler material. The role of baryte is to enhance the performance and durability of batteries. For example, barium salts can be added to lead–acid batteries to enhance the electrochemical formation of active materials. The current acceptance in deeply discharged cells is enhanced by barium sulfate, resulting in the quicker electrochemical formation of lead dioxide [45]. In lithium–oxygen batteries, barium titanate (BaTiO3) has been shown to act as a piezoelectric catalyst that can leverage intrinsic stress-induced electric fields to enhance lithium-ion transport. This results in redox reaction kinetics at the cathode interface [46]. An innovative process for the production of batter-grade lithium hydroxide from crude Li2SO4 solution has been proposed [47]. In this case, barium hydroxide acts as a precipitating agent, and barium oxide is efficiently recycled. This enables waste-free lithium recovery for battery manufacturing.

According to the European Commission’s latest CRM list from 2023, baryte is designated as a critical raw material [48]. Baryte was listed as a CRM by the EC for the first time in 2017. Since then, it has been listed as a critical raw material.

3.3. Beryllium

Beryllium is a lightweight, high-performance metal used in a variety of advanced industrial applications, including automotive, aircraft, electronic products for consumers, electrical engineering, and healthcare devices [49]. With a density of 1.845 g/cm3, beryllium is significantly lighter than both titanium and aluminum. In copper alloys, beryllium is added in small amounts (typically 2% or less) to produce beryllium-copper alloys. In addition to being as strong as steel and a superior heat and electrical conductor, beryllium is also not magnetic and not sparking. It is utilized to create incredibly dependable connection terminals and to create springs because it resists bending over time at high temperatures. Due to its exceptional X-ray transparency, beryllium metal is a necessary component of computed tomography (CT) and X-ray medical equipment. The creation and recycling of magnesium and aluminum alloys both require the element beryllium. For the energy storage sector, beryllium copper alloys are prominently used as high-performance connectors [50]. The addition of beryllium in copper alloys results in the formation of beryllide precipitates. These precipitates are uniformly and finely dispersed and do not disrupt metallic bonding or electron flow since they impede the dislocation motion. This results in an increase in the electrical and thermal conductivity of the alloy. These properties make beryllium copper alloys favorable for relays, connectors for circuit boards, and appliance equipment.

The US processes 90% of the available beryl and bertrandite, with China processing the remaining 10%. The world’s main producers of beryllium metal, beryllium alloys, and beryllium oxide are the USA, Kazakhstan, Japan, and China; none are found in Europe. The International Thermonuclear Experimental Reactor (ITER), a fusion energy endeavor with the potential to create sustainable energy, is being constructed near Cadarache, France, and is one application that is expected to drive the growth in beryllium consumption from about 300 MT/year in 2014 to 425 MT/year by 2020 and to >450 MT/year by 2030. Beryllium was designated as a CRM in the first Critical Raw Materials report by the European Commission in 2010, and this designation was maintained in the CRM report’s 2014 version and 2017 iteration. The economic significance of beryllium has been proven due to a special set of characteristics that make it non-substitutable in numerous high-tech applications that would have worse outcomes if a replacement was used. Beryllium can only be substituted in low-demand applications where reduced reliability and minor performance degradation are acceptable. There are no commercially viable sources of beryllium in the EU. The ore required to meet more than 65% of global demand is produced by a US mine with reserves that extend over a century. Overly rigorous EU standards, such as occupational health and safety laws, do not always take into account the latest research and tried-and-true industry safety practices. This could change the environment in which crucial beryllium-containing components are manufactured, which would make it less profitable to continue supplying beryllium and using it in the EU [51]. Beryllium is expected to see significant increases in demand for industrial uses, including X-ray products, energy storage devices, semiconductor processing machinery, new forms of beryllium alloys, and the usage of AlMg and Mg alloys.

3.4. Bismuth

High-density, extremely brittle bismuth has a reddish, metallic sheen. Its melting point is low (271 °C). The minerals bismuthinite (sulfide), bismite (carbonate), and bismite (oxide) contain bismuth naturally. It is hardly ever mined as a primary metal; rather, it is usually created as a byproduct of lead and tungsten. Bismuth is essential in low-melting alloys because it can expand during solidification freezing. The metal is non-toxic and eco-friendly. As a result, the metal is frequently employed in cosmetics and pharmaceuticals, and it frequently replaces lead in other uses. The pharmaceutical and animal-feed sectors account for 62% of all applications of bismuth compounds. Compounds of bismuth are used in contemporary medicine to cure and prevent gastric and duodenal ulcers. In nuclear medicine, anticancer, antitumor, and antibacterial research, the metal also makes an appearance. Fusible alloys account for 28% of all uses of bismuth, making them the second most significant. The metal is frequently utilized in solders in place of metals that are thought to be more dangerous, like lead, because of its reputation as being environmentally beneficial. The presence of bismuth in metallurgical additives and other industrial uses, such as coatings, paint pigments, or electronics, accounts for 10% of the overall usage [52]. Bismuth-based semiconductors are the most promising photocatalysts because they are non-toxic and have high oxidation and reduction capabilities; they work effectively for air purification and water treatment methods [53].

China dominates the supply. Mexico produces 11% and Japan produces 7% of the world’s refined bismuth (bimetal with a purity of at least 99.8%), respectively [54]. Bismuth is extremely complex to reuse since it is used in dissipative applications like paints or medicines. However, it is recovered throughout the lead and copper refining procedures of manufacturing. The majority of the main refined bismuth used in the global supply chain for bismuth comes from China, although even this bismuth still has a lot of impurities. The metal is largely refined in Europe, North America, and Southeast Asia. Nearly all of the refined bismuth used in the EU is imported. A total of 84% of the EU’s bismuth imports come from China. Because of the significant demand for pharmaceuticals, the demand for bismuth is anticipated to increase by 4–5% per year on a global scale. The EU’s list of key raw commodities now includes bismuth for the first time in 2017 [55]. A significant factor in determining the metal’s criticality is Chinese control at the start of the bismuth supply chain. The European Commission has recognized it as a crucial raw resource [56].

3.5. Borate

Borates refer to inorganic boron salts and substances derived from the element boron (B, atomic number 5). These substances are predominantly found in significant deposits in Turkey and California [57]. Borates find wide applications in various industries and products. They are utilized in manufacturing soda glass, Pyrex, fiberglass, and heat-resistant glass. Borates are also present in detergents, ceramic tiles, glazes, wood treatments, pest control products, flame retardants, and home insulation. Moreover, they play a role in the safety components of automobiles, like airbags and brake fluids, as well as in healthcare and agriculture as micronutrients. The global consumption of borates is projected to increase significantly, driven by their growing utilization in the ceramic, glass, and agricultural industries in South America and Asia. Additionally, policies focusing on energy efficiency in buildings are expected to lead to higher building standards in Europe and many developing nations. This, in turn, is likely to contribute to an increased demand for borates used in fiberglass building insulation [58].

3.6. Cobalt

Cobalt is a transition metal that is ferromagnetic, meaning it can be magnetized to produce permanent magnets. The EU imports ores, concentrates, impure carbonates, impure hydroxides, scrap, and metal from outside the EU to produce cobalt powders and cobalt chemicals. Cobalt is also used in biotechnology as it is a biologically essential nutrient for fermentation techniques. The Democratic Republic of the Congo (DRC) is the world’s leading producer of cobalt, accounting for 56% of global supply [59]. Other major producers of cobalt include China, the Russian Federation, and Zambia. The use of cobalt is growing in a variety of industries, including the automotive, electronics, and energy sectors. Their applications also include superalloys, hard-facing alloys, hard materials such as carbides and diamond tools, pigments, magnets, batteries, and catalysts. This growth is driving up demand for cobalt, which is making it a more valuable resource. The political situation in the DRC and the concentration of cobalt production in a few countries make cobalt a sensitive resource [59].

3.7. Coking Coal

Metallurgical coal, also known as coking coal, is a superior grade of coal that plays a crucial role in the manufacturing of steel. To produce one ton (1000 kg) of steel, approximately 0.6 tons (600 kg) of coke, derived from coking coal, is required. This means that about 770 kg of coal is utilized in the production of one ton of steel through this specific process. Its applications also include tar and benzol production. The main suppliers of coking coal are Australia and China, which dominate the market. However, the concentration of supply poses a risk, as demonstrated by the 2011 disruption caused by flooding in Australia’s coking coal supply. Australia, with a production of 152 million tons, along with Russia (72 million tons) and the USA (68.5 million tons), are significant contributors to coking coal production. In contrast, the total coking coal production within Europe represents only around 4% of global production. Among the EU countries, Poland and the Czech Republic are the largest producers of coking coal. Additionally, the economic significance of coking coal is high, particularly in the steel sector, where viable alternatives are limited [59].

3.8. Fluorspar

Fluorspar, also known as fluorite, is a naturally occurring mineral consisting of calcium and fluorine. Fluorine is a non-metallic element and the lightest among the halogens, making it difficult to substitute in various applications. Two main commercial grades of fluorspar exist: the metallurgical grade and the acid grade. Metallurgical grade fluorspar makes up around 35–40% of the overall fluorspar production and is primarily used in steel production and cement manufacturing. Acid-grade fluorspar represents approximately 60–65% of the total fluorspar production and finds its main applications in aluminum production and the manufacture of hydrofluoric acid. It is also used as UF6 in nuclear uranium fuel, HF in oil refining, and CFCs for refrigeration and air conditioning. None of the European countries are net exporters of fluorspar, and all member states of the European Union rely on imports for their fluorspar supply. China holds the largest share, producing over 50% of the world’s fluorspar. However, Chinese fluorspar exports have been decreasing since 2011, particularly in the case of acid-spar exports [60].

3.9. Gallium

Gallium is a soft, silvery-white metal that is part of the 13th group of the periodic table. It forms compounds with elements from the 15th group, such as gallium arsenide and gallium nitride, which have semiconductor properties. These compounds are used in the production of light-emitting diodes (LEDs), integrated circuits (ICs), and solar cells. According to a study, Gallium is classified as critical due to its rapidly increasing demand for semiconductors, particularly gallium arsenide used in the information technology industry. Their assessment included Gallium due to high supply risk driven by intensive material use, trade barriers, and the low political stability of supplier countries [61]. Gallium is primarily produced as a by-product of the processing of bauxite, which is the main source of aluminum, into alumina. Currently, it is estimated that only 10% of alumina producers extract gallium, creating a significant bottleneck in the global gallium supply [62]. Furthermore, there are concerns due to the limited number of high-purity gallium refiners, which may further impact the supply of gallium in the future. Currently, there is no known process for recycling Gallium from post-consumer products. China is the world’s leading producer of primary gallium, accounting for nearly 70% of the global production capacity. Germany is the leading European producer, with an estimated capacity of 40 tons in 2011. Hungary is the second-largest European producer, with a capacity of 8 tons in 2011, though the actual supply is estimated to be around 4–5 tons. The total primary production in Europe is approximately 29–34 tons per year, representing approximately 11.5% of global production in 2012 [63].

3.10. Germanium

Germanium is a brittle, silvery-white semi-metal that is not found naturally in its elemental form. It occurs as a trace metal in various minerals and ores, the most common of which is germanite. Germanium is currently obtained as a by-product of zinc production and from coal fly ash. Approximately 75% of global germanium production comes from zinc ores, mainly the mineral sphalerite, while the remaining 25% is derived from coal [64]. Germanium finds significant applications in three main areas: fiber optics, infrared optics, and polymerization catalysts for polyethene terephthalate plastics. It is also utilized in electronic applications and solar cells. Germanium and germanium oxide are transparent to infrared radiation, making them valuable in infrared spectroscopes. Germanium is a semi-metal that is transparent to infrared radiation. This makes it useful for manufacturing lenses and windows for infrared devices, such as night-vision goggles and thermal imaging cameras. Germanium is also used in advanced firefighting equipment, satellite imagery sensors, and medical diagnostics [59]. China holds the position of the primary global producer of germanium, contributing to approximately 60% of the total production. Within China’s production, it is estimated that 60% is sourced from zinc ores, while the remaining 40% is obtained from coal fly ash. Other countries such as Canada, Finland, Russia, and the US also contribute to the global production of germanium. The EU imports more germanium than it produces. The EU imports around 15 tonnes per year of unwrought germanium and germanium powders. This means that the EU relies on other countries to provide germanium. The main suppliers of germanium to the EU are China, Russia, and the US.

3.11. Hafnium

Hafnium (Hf), with an atomic number of 72, is a hard and ductile metal that bears a strong resemblance to stainless steel in appearance and has similar chemical properties to zirconium. It is not found in its free form in nature but is always present with zirconium and is extracted as a by-product during the process of extracting zirconium. Hafnium ores are rare. The primary use of hafnium is in the production of superalloys used in the aerospace industry. Hafnium finds specific applications in turbine blades, vanes, and industrial gas turbines. Moreover, it holds notable importance in nuclear applications, including nuclear reactors and nuclear submarines. Its effectiveness in these areas stems from its high thermal neutron absorption cross-section and corrosion resistance, but it must be utilized in a pure form to ensure optimal performance [59]. France is the largest producer of hafnium worldwide, accounting for 45% of the global production. The US follows closely behind with a production share of 41%, while Ukraine and Russia each contribute 8%. France produces approximately 30 tons of hafnium per year. Within the EU, 71% of the supply of hafnium comes from France. The EU heavily relies on domestic production, with only 9% of its hafnium being imported. Among the hafnium metals that are imported to the EU, 33% come from China, while Canada accounts for the remaining 67% [65].

3.12. Rare Earth Elements (Heavy and Light)

Rare earth elements (REEs) encompass a group of 17 distinct elements that possess unique properties, making them highly challenging to substitute. REEs are divided into two categories: light rare earth elements (LREEs), consisting of atomic numbers 57 to 64, and heavy rare earth elements (HREEs), encompassing atomic numbers 65 to 71 along with number 39 (yttrium). These elements play a vital role in facilitating a wide range of technologies and are widely present in various consumer and industrial products across sectors such as the automotive, aerospace, consumer electronics, batteries, and electrical engineering sectors. REE-based permanent magnets hold significant importance as they find extensive use in applications such as motors, couplings, and sensors. They are particularly crucial for the efficient operation of large wind turbines and hybrid cars [66]. China currently dominates the global production of rare earth elements, accounting for approximately 87% of the world’s supply, as reported by the United States Geological Survey (USGS). It is noteworthy that although China holds roughly half of the world’s identified reserves, according to USGS data, there is no rare earth production within the EU.

3.13. Indium

Indium is a silver metal that is highly soft, ductile, and malleable. It is abundant in various host metals like zinc, lead, tin, and copper. Indium is typically not found in its pure form in the Earth’s crust but rather in minerals that are associated with other metals. The main commercial source of indium is the zinc mineral sphalerite. Indium is widely used as indium tin oxide in flat panel devices such as computer monitors, Liquid Crystal Display (LCD) smartphones, televisions, and notebooks. Additionally, it has various applications in alloys, solders, solar panels, LEDs, batteries and laser diodes. Indium production is primarily tied to its recovery as a by-product of zinc refining. Only around 25% of the indium present in mined zinc is refined, mainly because not all zinc ores containing indium are processed in refineries that can extract indium. This limitation is considered to be the main bottleneck in the supply of indium. China stands as the primary global manufacturer of zinc, responsible for over 50% of yearly production. Belgium takes the lead as the major European producer. Other notable producers in 2012 include Germany, Italy, Kazakhstan, the Netherlands, and the UK. In France, there exists a zinc smelter equipped with an indium recovery facility. This plant generates a concentrate containing 20% indium, which is subsequently sold to third-party entities for additional processing [67].

3.14. Lithium

Due to its usefulness in many applications, particularly in energy storage devices, lithium is a very important element. Lithium, the lightest metal and a three-atomic-number alkaline metal, has high heat conductivity. Due to its tremendous reactivity and great energy density, it is a fantastic material for batteries used in consumer devices, renewable energy storage systems, and electric car batteries. Numerous geological sources, including salt lakes, spodumene minerals, clays such as hectorite, and subsurface brine reservoirs, are used to manufacture lithium. In order to make things simpler, lithium is categorized into two sources: rock sources and brine sources. Specifically, rock sources include lithium from minerals like spodumene, amblygonite, and jadarite, as well as from clays such as hectorite. The lithium concentration in typical ore deposits ranges from 0.5% to 2% Li [68,69]. The present lithium production with respect to the type of resource, the deposits available, the country of production, and its production percentage, is shown in Table 1.

Table 1.

Global lithium production by country, company, and source type, with annual production volumes (kilotons of lithium carbonate equivalent, LCE) and market share distribution [70].

Applications of Lithium in Batteries

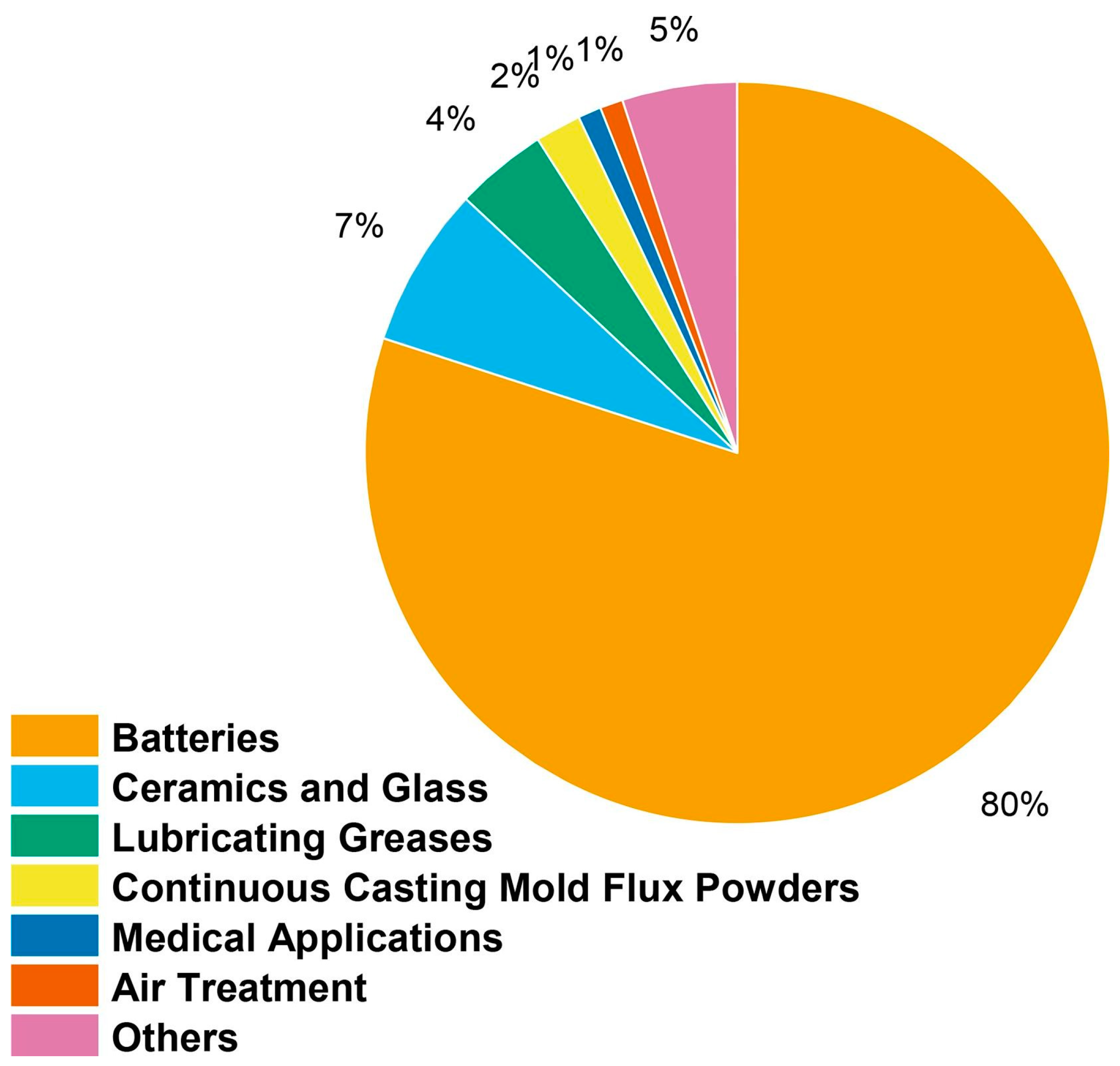

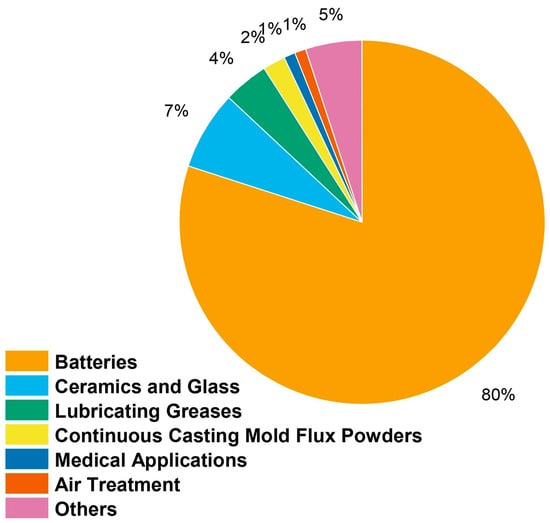

Lithium is mostly utilized in lithium-ion batteries, which are rechargeable batteries that are found in many modern products, such as electric cars, laptops, and smartphones [71]. The flow of lithium ions between the battery’s cathode and anode is how lithium-ion batteries store electrical energy. In comparison to other battery types, lithium-ion batteries feature reduced self-discharge rates, a longer lifespan, and a high energy density. Figure 1 illustrates how lithium is used in many industries around the world.

Figure 1.

Global distribution of lithium’s many applications across different industries [72].

In addition, lithium is essential to energy storage systems, including grid-scale energy storage systems and lithium-ion battery banks. These systems provide a consistent power supply to the grid during moments of peak demand by storing the renewable energy produced by solar or wind power. Due to their substantial energy capacity, prolonged cycle life, and quick charging and discharging rates, lithium-ion batteries are widely employed in a wide range of applications [73]. Lithium is also used in many other industries, including the manufacture of glass and ceramics, air conditioning, and the aerospace sector. Additionally, it is prescribed to treat some types of mental illnesses. In conclusion, lithium’s criticality results from a variety of uses, particularly in the energy storage sector. Lithium-ion batteries are becoming a vital part of our energy infrastructure as we transition to a more sustainable energy economy.

3.15. Magnesium

Magnesium (Mg), with an atomic number of 12, belongs to the group of alkaline earth metals and is not naturally found in its pure elemental form. It exists in various forms within seawater, minerals, brine, and rocks and ranks as the eighth most abundant element in the Earth’s crust. Although there is no primary production of magnesium within the EU, neighboring countries like Serbia and Ukraine engage in magnesium mining. Car manufacturers utilize magnesium die-castings in applications where weight reduction is crucial, while the aerospace industry, sports goods manufacturers, steel desulfurization agents, packaging, construction, and power tool producers also employ magnesium for their respective products [74].

3.16. Niobium

Niobium, a rare transition metallic material, is becoming an appropriate component for energy storage applications because of its unique properties [75]. One kind of crystal structure that has recently received a lot of interest in this area is the Wadsley–Roth crystallographic shear structure. This structure’s three-dimensional open crystalline framework, which permits the addition and removal of lithium ions during charging and discharging cycles, is what gives it its distinctive properties. The potential of a number of niobium-based oxides with Wadsley–Roth crystallography in shearing structures as high-rate anode materials in lithium-ion batteries (LIBs) has been investigated [76,77,78,79]. The reversible redox couplings exhibited by these materials, such as Nb12O29, TiNb2O7, Ti2Nb10O29, TiNb24O62, Nb16W5O55, Nb18W8O69, PNb9O25, and others, enable next-generation LIBs to have high power density and long lifespans. Wadsley–Roth phase anode materials have the notable benefit that Li-ion insertion primarily takes place above 1.0 V (vs. Li+/Li), where the production of a solid electrolyte interphase film is not required. Wadsley–Roth phase niobium-based oxides are attractive candidates for high-power LIB anodes in hybrid electric vehicles (HEVs) because of this property, which results in superior rate capability and safety performance compared to the standard graphite anode [80]. Despite their exceptional qualities, Wadsley–Roth crystallo-graphic shear structure niobium-based oxides’ electrochemical kinetics still have a lot of space for growth. To improve their functionality, streamline their synthesis, and investigate their commercial viability as LIB anode materials, more study is required. Next-generation energy storage devices are an intriguing area of research, and it is important to look into the possible applications of niobium-based oxides that have a Wadsley–Roth crystallographic shear structure.

Due to its distinct physical and chemical characteristics, niobium is an essential mineral for many industries. It is primarily used to increase the strength, corrosion resistance, and heat resistance of high-strength alloys like steel and superalloys. Superconductors, capacitors, and lithium-ion batteries, which are essential parts of energy storage technologies, also utilize niobium. However, there is a finite supply of niobium in the world, with Brazil producing about 90% of it. For niobium-dependent businesses, this supply concentration raises serious supply chain risks. Additionally, the expanding use of electric vehicles, which require high-performance batteries, is driving up demand for niobium. Niobium is listed as a critical mineral, having uses in the creation of superalloys, on the 2022 list of critical minerals published by the National Science and Technology Council (NSTC) of the US [81]. Because of the risk to the global supply of niobium and the UK’s economic vulnerability, the British Geological Survey classified niobium as a highly critical mineral for the country [82].

3.17. Natural Graphite

One of the cleanest and most crystalline forms of carbon is graphite, which can be produced artificially or by mining. There are three different types of natural graphite powder that are mined: flake, amorphous but actually microcrystalline, and vein. By using a high-temperature electrochemical technique, synthetic graphite particles are produced from carbon precursors such as natural carbon or pet coke. Natural and synthetic graphite powders are used in products like batteries, carbon brushes, brake pads, lubricants, foils, refractories, and steel re-carburize as illustrated in Figure 2. The majority of natural graphite powders are made in China, which accounts for 70% of global production. Latin America comes in second with 20%. Less than 1% of the world’s natural graphite powder is produced in Europe. The lithium-ion batteries that will power tomorrow’s electric and hybrid vehicles must have graphite as a key component. As a result, the future graphite demand is anticipated to rise significantly [83]. There is currently no substitute for pure graphite in refractories. Expandable graphite for foul, insulation, and fire-retardant products is expected to be another rapidly expanding market. REACH regulations do not apply to pure graphite [84].

Figure 2.

Industrial applications of graphite materials across various sectors.

Batteries are made with the help of minerals like lithium and cobalt, as well as graphite. Batteries made of lithium-ion are utilized in virtually all movable consumer electronics, including laptops, cell phones, and cameras. Power tools and larger devices like Battery Electric Vehicles (BEVs) and grid storage applications are quickly adopting batteries. The choice of mineral for lithium-ion batteries and the applications they serve is graphite since it improves battery performance and durability. Specifically, the anode in lithium-ion batteries is made of graphite [85]. Lithium-ion battery manufacturing on a wide scale and technological advancements over the previous 10 years reduced overall costs by 90% [86]. However, increased raw material costs suggest that typical battery pack prices could nominally increase in the near future. The day when BEVs are equally priced to conventional internal combustion engine vehicles would be delayed in the absence of additional advancements that can lessen this effect. This would have an adverse effect on the price of BEVs or the profit margins of manufacturers, as well as the viability of large-scale energy storage projects. Since governments want to hasten the transition to renewable energy systems, it is essential to secure raw minerals like graphite. By 2030, the lithium-ion battery capacity must expand to 2000 GWh annually in order to meet the supply from renewable energy applications such as BEVs and stationary storage systems [85].

3.18. Natural Rubber

Natural rubber is a biotic material that is obtained from rubber trees and is considered a critical raw material within the EU. It primarily consists of isoprene polymers. The extraction of natural rubber involves harvesting latex from rubber trees found in tropical forests, which is subsequently processed to create various rubber products. To enhance elasticity and durability, dried natural rubber is often vulcanized before being used in final rubber goods. Natural rubber finds application in the production of tires, as well as in sectors such as automotive, tubing, footwear, construction materials, and food contact materials. The EU relies entirely on imports for its natural rubber supply. The three largest producers of natural rubber—Thailand, Indonesia, and Malaysia—contribute to 72% of the global production. Although end-of-life tires in the EU have a high recovery rate, it is currently not feasible to recycle tire materials and incorporate them into new tires due to security and environmental concerns. Recovered biotic waste cannot be recycled back into the same application or used with the original raw materials due to the risk of contamination [87].

3.19. Platinum Group Metals

Platinum Group Metals (PGMs) are a group of six precious metals with similar properties. They are found in the same geological sources and have high melting points, high densities, and catalytic activity. These unique properties make them valuable in a variety of applications, including jewelry, electronics, and catalysis. The rarity of PGMs and their poor substitutability further contribute to their high value. The pre-treatment and refining process allows for the recovery of PGMs from various applications. However, the amount of PGMs that can be recovered varies depending on the application. To illustrate, PGMs can be more readily recovered from automotive catalysts compared to electrical items. Furthermore, the resale market for jewelry containing PGMs provides a significant opportunity for recovering more PGMs from this particular application. The main sources of platinum–palladium are four large deposits: the Bushveld Complex in South Africa, the Stillwater deposit in the US, the Great Dyke in Zimbabwe, and the Lac des Iles deposit in Canada. These deposits account for the vast majority of known PGM reserves, with the Bushveld Complex alone containing about 95% of the world’s known reserves [88].

3.20. Phosphate Rock

Phosphate rock primarily comprises apatite minerals and serves as a collective term for various phosphorus-rich minerals extracted for commercial purposes, primarily in the production of fertilizers, food additives, detergents, and flame retardants. Phosphate rock serves as the primary and essential resource for global phosphorus production. Major phosphate rock producers are situated in North Africa, the Middle East, the USA, and China. Europe, on the other hand, does not possess any phosphate mines and relies entirely on foreign producers for its phosphate rock supply [89].

3.21. Phosphorus

Phosphorus, represented by the symbol P and atomic number 15, exists in two primary forms: white phosphorus and red phosphorus. In the context of minerals, it is commonly referred to as phosphate. Phosphorus is vital for plant nutrition and is essential for the functioning of all living organisms. The majority of phosphorus production is dedicated to the production of concentrated phosphoric acids used in fertilizers. Additionally, phosphorus plays a significant role in steel manufacturing and the creation of phosphor bronze. It also holds a key position in the structural framework of DNA and RNA. While phosphorus itself is recyclable, the primary input material for its production, phosphate rock, is not recyclable, resulting in a recycling input rate of essentially zero. The majority of phosphorus-based fertilizers are derived from rock phosphate obtained through mining in countries outside of Europe. It is important to note that rock phosphate is a non-renewable resource. Based on current extraction rates, it is estimated that China and the US each have approximately 30 years of supply from their known recoverable reserves of rock phosphate. As a result, most countries rely heavily on importing ore and are net importers in terms of phosphorus resources [90].

3.22. Scandium

Scandium, denoted by the chemical symbol Sc and atomic number 21, is a rare-earth element classified as a silver–white light transitional metal. Its addition to lightweight aluminum alloys is highly prized for its exceptional strength-boosting properties. Scandium alloys, by refining grain structure, effectively mitigate hot cracking in welds, enhance weld strength, and improve fatigue resistance. In Europe, scandium shows considerable promise in two major applications: solid oxide fuel cells for energy storage and Sc-Al alloys in the aerospace and automotive industries.

The only known sources of concentrated scandium are ores like thortveitite, euxenite, and gadolinite, which exist in limited quantities in Scandinavia. Dedicated scandium mines do not exist, and primary production is achieved through metallurgical processes. China is the primary producer of scandium, followed by Russia, Ukraine, and Kazakhstan. In the EU, there is no production of scandium, and the number of participants in the value chain is limited. Consequently, the EU relies entirely on imports, resulting in a 100% import reliance for scandium [91].

3.23. Silicon Metal

Silicon (Si), with an atomic number of 14, belongs to group 14 of non-metals and is positioned between carbon and germanium on the periodic table. In its pure form, silicon appears as a lustrous grey metallic solid. It is the second most abundant element in the Earth’s crust. However, silicon is not found naturally in its elemental state but rather in the form of silicates and oxides, predominantly silica. Silicates make up approximately 75% of the Earth’s crust, with quartz being the most prevalent free silica form. Metallurgical-grade silicon is applied in various applications involving aluminum and chemicals. It also acts as a base material for producing solar and electronic-grade silicon, but additional refining is necessary to achieve ultra-high purity grades. Pure silicon possesses semiconductor properties, wherein its electrical resistivity decreases with rising temperature and the concentration of certain elements like boron, aluminum, gallium, and phosphorus. The conductivity of silicon can be precisely controlled through a process called doping. As a result, silicon has extensive use in electronic devices like transistors, printed circuit boards, integrated circuits, and solar panels. Despite its crucial role in electronics, the quantities of silicon required are relatively small due to the miniaturized dimensions of electronic devices. The primary demand for silicon, in terms of quantity, lies in metallurgy, particularly in the production of aluminum, and in the chemical industries. It is also used as a semiconductor for photovoltaics, wind turbines, electronics, and Li-ion batteries. China stands as the dominant producer of silicon metal, accounting for 56% of the global production. Other significant producers include Brazil, Norway, France, and the US. Within the EU, notable silicon metal producers are Germany and Spain, among others [92,93].

3.24. Tantalum

Tantalum is a dense, silver–grey transition metal with one of the highest melting points among elements. It is not found in its free metal form in nature but rather as complex oxides and minerals like microlite or tantalite–columbite. The primary worldwide application of tantalum is in manufacturing capacitors for electronic devices. However, within the EU, most tantalum usage relies on imported semi-finished products instead of domestic manufacturing. Tantalum is also employed in producing alloys to enhance strength, ductility, and corrosion resistance. In the EU, superalloys containing tantalum are particularly significant in the aerospace sector. Presently, there is only one tantalum mine in France within the EU, and tantalum is obtained as a by-product of mining operations. Rwanda and the DRC are the two main global producers of tantalum, together contributing about half of the world’s primary supply of this metal [94].

3.25. Tungsten

Tungsten is a scarce element in the Earth’s crust and stands out as having the highest melting point among all metals, making it a perfect choice for creating filaments in light bulbs, which is its primary and widespread use. Furthermore, tungsten boasts high density. In its natural form, tungsten is brittle and difficult to manipulate. Nonetheless, when combined with carbon to form tungsten carbide, it becomes one of the hardest materials known. This compound is heavily utilized for cutting tools, making it the most significant application of tungsten. Naturally, tungsten is not found in its metallic form but rather in 45 different minerals. However, only two of these minerals, wolframite and scheelite, hold economic importance. Major deposits of tungsten are primarily located in China, Canada, and Russia. In Europe, the largest currently operational tungsten deposits are situated in Portugal and Austria. The EU has a significant dependence on tungsten imports. Estimates indicate that around 74% of tungsten consumed in Europe is imported from external sources. This high import reliance demonstrates Europe’s heavy reliance on foreign suppliers to meet its tungsten needs [95].

3.26. Vanadium

Vanadium is a robust, silver-colored metallic element known for its good structural strength and high melting point. It naturally occurs in more than 60 different minerals, including aluminum ore, vanadate, carnotite, roscoelite, and patronize. As a trace mineral, vanadium is typically found within other mineral ores and is often extracted as a by-product. Additionally, vanadium can be obtained as a by-product of petroleum refining and processing. A significant portion, ranging from 0% to 90% of produced vanadium, is used in the production of metal, particularly in the form of alloys, especially steel. Vanadium plays a crucial role in vanadium redox-flow batteries (VRBs), which differ chemically and structurally from lithium-based batteries [96]. Currently, over 80% of vanadium production is concentrated in China (59%), Russia (17%), South Africa (7%), and Brazil (5%). Efforts are being made in Sweden and Finland within the EU to begin producing vanadium as a by-product of mining operations. However, at present, the EU remains highly dependent on vanadium imports, primarily from China and Russia [97].

3.27. Bauxite

Bauxite is a sedimentary rock typically characterized by its reddish-brown color, and it consists of a group of aluminum oxides. The primary importance of bauxite lies in its role as the main source of aluminum. However, bauxite also finds uses as an abrasive material and in hydraulic fracking for oil exploration. Bauxite deposits are mainly concentrated in a wide belt around the equator. In 2018, Australia was the top bauxite producer with 86,000 tons, followed by China with 79,000 tons and Guinea with 57,000 tons. Brazil (29,000 tons) and India (23,000 tons) are also notable bauxite producers [98]. Greece stands as the major bauxite producer within the EU [99].

3.28. Titanium

Titanium is a robust, gray metal known for its exceptional corrosion resistance. It also possesses a high melting point. In terms of strength, titanium is comparable to steel but is 45% lighter. It is twice as strong as aluminum but 60% heavier. While titanium is abundant in nature, it does not occur in its pure form. Titanium, the fourth rarest element on Earth, can be found in various forms, including in the Earth’s crust, water, rocks, stones, and minerals. Titanium ores are typically refined into titanium dioxide, known for its excellent light-scattering properties. This characteristic makes it highly valuable for providing whiteness, opacity, and brightness to a wide range of products. Titanium dioxide finds common applications in white paint, paper, rubber, and plastic industries. It was introduced as a substitute for lead in paint due to environmental concerns. Moreover, the metal is frequently used in medical implants. China holds the distinction of being the world’s largest producer of titanium, followed by Japan, Russia, Kazakhstan, the US, Ukraine, and India [100].

3.29. Strontium

Strontium is a soft, silver–white and yellowish metal that exhibits high chemical reactivity. It is primarily obtained from the minerals celestine and strontianite through mining processes. Strontium aluminate is commonly utilized in “glow-in-the-dark” paints, as it absorbs light during the day and slowly releases it for several hours afterward. Natural strontium, in its stable form, does not pose a health hazard. However, synthetic strontium-90, which is radioactive, is one of the most hazardous components of nuclear fallout. Strontium-90 is known for being one of the most efficient high-energy beta emitters and can be employed to generate electricity for space vehicles or remote water stations. It is also used for the production of glass, ceramics, pyrotechnics, magnets, master alloys, and drilling fluid. In terms of production, China, Mexico, and Spain stand as the largest producers of strontium [101].

3.30. Nickel

Nickel is listed as a strategic raw material as it does not meet the CRM threshold but is included in the CRM list within the Critical Raw Materials Act [102]. Nickel is mined largely in Indonesia, followed by the Philippines and Russia [103]. They are found as sulfide and laterite ores. Sulfides represent 60% of the nickel supply, as laterites are complex and their processing is more expensive, despite the material being abundant [104]. It plays an important role in the development of cathode materials for rechargeable batteries, particularly in LIBs and SIBs; because of its high electrochemical activity, it offers great capacity retention, improved energy density, and enhanced thermal stability [105]. Recent analysis suggests that while the initial supply projections appear sufficient, several factors, such as the ore grade, government regulations, and environmental and social pressure, significantly limit the amount of high-purity nickel suitable for energy storage in EVs. Currently, only 4% of globally produced nickel meets the required grade, with approximately 70% of battery-grade nickel derived from sulfide ores [106]. Projections suggest that supply constraints could emerge as early as 2027 [107]. With LIBs increasingly using higher nickel content in their cathodes, it is crucial to increase the supply and demand modelling not only for lithium and cobalt but also for nickel.

4. Environmental and Social Impacts of CRMs

Although CRMs play a vital role in the development of various energy storage devices, their extraction and utilization pose a significant challenge from both environmental and social perspectives. The next section digs into these dimensions, emphasizing lifecycle impacts and associated risks linked to CRMs.

Significant environmental implications result from the extraction and refinement of essential basic materials, and some products and technologies that use them, like wind turbines and solar panels, were partially created to minimize the effects on the environment. As a result, the hazards and effects on the environment connected with essential raw resources are typically a contentious issue. Furthermore, alternative solutions are usually motivated by utility and performance, resulting in unclear environmental consequences. Given the importance of these sectors in securing a low-carbon economy and a carbon-neutral Europe, it is extremely likely that in the near future, the demand for and usage of some raw materials will increase in tandem with the development of these vital sectors. The environmental costs involved with mining, quarrying, harvesting, and producing essential raw materials for storage devices have been analyzed [108]. Depending on the particular vital raw material, different procedures have different environmental impacts. For instance, the energy required to reduce naturally occurring metal oxides and sulfides presents hotspots for environmental effects in the majority of metal life cycles. As the infrastructure required for mining and processing metal ores expands, there is a concern that ecosystems may become destabilized. The discharge of metal compounds into the environment, along with the associated activities involved in mining and beneficiation, can have detrimental effects. The impact on delicate local ecosystems can be especially severe when mining operations take place in less developed areas with newly discovered resource deposits. In these cases, the pursuit of foreign income from mining concessions may take priority over domestic environmental concerns, potentially exacerbating the environmental damage caused by such activities [109]. The environmental hotspots for other key raw materials, such as key raw materials for non-metals like phosphates, may differ or be connected to various phases of their own production processes.

4.1. Risks and Impacts of Critical Raw Materials in Applications

The three main raw materials used in lithium-ion batteries are cobalt, natural graphite, and silicon. The main basic materials used in nickel metal hydride batteries are cerium, lanthanum, neodymium, and praseodymium. Pure graphite signals generally indicate low risk, while cobalt and rare earth element mining and production have a medium-to-high potential for environmental risks.

4.2. The Impact of Applications from a Life Cycle Perspective

The environmental impacts of a battery’s life cycle are greatest during the extraction and refining of electrode materials. The lithium-ion battery cathode typically contains cobalt in addition to other metals, including lithium, nickel, manganese, and aluminum. High cobalt and nickel concentration cathodes require the most energy to generate [110].

Dai and his team [111] analyzed the cradle-to-gate lifetime of the industrial production of these batteries, since lithium nickel manganese cobalt oxide batteries—more specifically, NMC111—are the most popular variety used in the electrical automobiles that are now being offered in Europe, Japan, and the US. According to their research, the production of battery cells and the active cathode material, aluminum, have the worst environmental impact. Its total impact on batteries is likely minimal. The environmental impact of a battery varies depending on where it is made and where the components are obtained [104]

The assumption utilized in the majority of life cycle assessments is that synthetic graphite was used and that its influence on a battery is minimal. Studies indicate that natural graphite production may result in lower toxic byproducts, energy consumption, and pollutant release compared to synthetic graphite, suggesting reduced potential harm to human health and the environment under equivalent processing conditions [111,112].

Crucial raw minerals, particularly cobalt, contribute significantly to the batteries’ environmental effects. However, it represents just a small portion of the end-use application’s overall environmental effect. For instance, lithium nickel manganese cobalt oxide battery’s manufacturing accounts for no more than 25% of an electric vehicle’s lifetime greenhouse gas emissions [113]. However, this result is from a cutting-edge, low-throughput battery manufacturing facility. The amount of power used by an electric vehicle when it is in operation has a significant influence on the environment; the bigger the battery, the more electricity is used. Thus, achieving a high energy density is crucial for applications in electric vehicles. Figure 3 categorizes the consequences of critical raw materials usage by the industry into social and environmental impacts. Social impacts include community displacement, health risks, resource conflicts, and poor working conditions. Whereas, the environmental impacts encompass habitat destruction, water pollution, air emissions, and soil degradation. These interconnected challenges highlight the broader implications of increasing global demand for critical raw materials essential to clean energy, digital technologies, and advanced manufacturing.

Figure 3.

The extraction and processing of critical raw materials lead to a range of interconnected social and environmental impacts, underscoring the complex trade-offs associated with their growing global demand. Social and Environmental Impacts of CRMs.

5. Recyclability of Energy Storage Devices

Given the significant environmental and social challenges linked to CRMs, the recyclability of energy storage systems offers a promising pathway towards circular economy integration. The following section explores the current advancements related to the recycling and end-of-life management of energy storage technologies.

A circular economy preserves the economic worth of goods, materials, and resources for as long as possible [114]. Future vehicles and ecologically friendly batteries will power transportation. The Commission has put forward a new regulatory framework aimed at accelerating the promotion of sustainability within the growing battery value chain for electro-mobility and the maximization of the circularity of all types of batteries. The objective is to expedite progress in these areas and ensure that batteries used in various applications adhere to sustainable practices while also fostering a circular economic approach.

Requirements for recycled content, measures to boost total battery collection and recycling rates, and instructions for consumers all ensure the recovery of valuable resources, concentrating on non-rechargeable batteries to phase them out gradually if alternatives are available; standards for battery sustainability and transparency that consider the carbon footprint of battery manufacture, the safety of raw material supply, and the ease of recycling, reusing, and repurposing should be adopted. In order to encourage more circular business models, the Commission also suggests revising the regulations for end-of-life vehicles by tying design considerations to end-of-life treatments, taking into account regulations that require recycled content for specific materials and components, and enhancing recycling efficiency. Furthermore, the Commission will also consider effective methods to ensure the collection and environmentally responsible disposal of waste oil. In a broader context, the upcoming Comprehensive European Strategy on Sustainable and Smart Mobility will explore opportunities to enhance the integration between the transition to a circular economy and sustainable and smart mobility. This includes implementing product-as-service solutions to reduce the consumption of new materials, promoting the use of sustainable alternative fuels in transportation, optimizing infrastructure and vehicle utilization, increasing occupancy rates and load factors, and reducing waste and pollution. The strategy aims to synergize these efforts for a more sustainable and efficient mobility sector.

The European Commission’s Joint Research Centre (JRC) published a report on a material system analysis of five battery-related raw materials, including cobalt, lithium, manganese, natural graphite, and nickel [115]. For this, two key indicators were used: the End-of-Life Recycling Rate (EOL-RR) and the End-of-Life Recycling Input Rate (EOL-RIR). EOL-RR represents the percentage of a material in the end-of-life products that is functionally recycled. In contrast, the EOL-RIR describes the percentage of a material in end-of-life products that is recovered and reintroduced into manufacturing. According to the EC JRC report, cobalt, manganese, and nickel are recovered in significantly high percentages from end-of-life products (i.e., 32%, 40%, and 42%) (see Table 2). However, their reintroduction to manufacturing is significantly low (i.e., 22%, 9%, and 16%). The recovery efficiency is low due to technical and economic barriers. For lithium, the amount of recovery and reuse in manufacturing is close to none. These figures indicate the high urgency to improve recovery technologies and support circularity in battery value chains. Black Mass (BM), the intermediate product from recycled lithium-ion batteries, is essential to closing this loop and improving the circularity of lithium [116]. However, its effective use in precursor synthesis is still hampered by its low standardization, uneven composition, and lack of appropriate pretreatment technologies. The hydrometallurgy process is widely used for recycling. However, it has drawbacks in terms of cost, purity control, and scalability, which highlights the necessity of recycling process innovation.

Table 2.

End-of-Life Recycling Rates (EOL-RR) and End-of-Life Recycling Input Rates (EOL-RIR) for key raw materials used in energy storage devices [115].

While numerous studies have explored the extraction, processing, and application of raw materials, there remains a lack of cohesive understanding of the overarching challenges across the value chain. A thematic synthesis of current research identifies three primary concerns: (i) environmentally damaging extraction methods, (ii) limited recycling techniques, and (iii) significant geopolitical risks due to supply concentration. For instance, although solvent extraction techniques are widely used, they produce hazardous waste and are economically inefficient when applied to low-grade ores [117]. Similarly, many recycling methods have shown promising results at the laboratory level, but they face considerable hurdles in terms of scalability and cost-effectiveness. Another factor is the risk within the global supply chain; China has emerged as the world’s leading producer and exporter of various CRMs. Trade restrictions on CRMs can cause significant disruptions in many of the leading industries linked to renewable energy, robotics, drones, 3D printing, and various digital technologies [118]. The EU is dependent on imports for nearly all of the CRMs essential to strategic technologies. Addressing these multifaceted obstacles requires collaborative efforts in research, technological innovations, and policymaking to ensure a sustainable, diversified, and circular approach to CRM management.

6. Future Trends and Innovations in Energy Storage

As recycling strategies continue to enhance the circularity, resource efficiency, and overall sustainability of existing solutions, ongoing research and technological advancements are simultaneously redefining the landscape. At the same time, there is increasing pressure to develop more sustainable solutions that reduce the environmental and ethical concerns associated with CRMs. This includes efforts to reduce reliance on critical elements through material substitution and innovations in designing energy storage systems. The following section highlights the future trends and cutting-edge developments braced to shape the next generation of energy storage devices, with a particular focus on sustainability-driven solutions.

6.1. Advanced Batteries

Lithium sulfur batteries offer better energy density than lithium-ion batteries, providing larger-scale energy storage options. Sulfur, when acting as a cathode, has improved the electrolyte challenge, leading to better efficiency and a longer lifespan. This has helped in reducing the cost of energy storage systems. Other research published has also focused on anode materials for the improved operation of lithium-ion batteries. Anode materials such as silicon, transition metal oxides, alloys, and carbons have significant benefits, but there are numerous challenges to be explored. On the other hand, liquid or gel electrolytes in typical lithium-ion batteries are replaced by solid electrolytes. World-famous companies like Toyota and QuantumScape have vowed to use solid-state batteries to attain faster charging times and longer lifespans [119].

6.2. Alternative Chemistries

Advancements in battery technology have enabled the development of sodium-ion and zinc-air batteries, which, despite their lower energy density compared to conventional lithium-ion systems, demonstrate improved cost-effectiveness and sustainability due to their reliance on abundant raw materials and their reduced environmental footprint during production and recycling. Sodium has similar physiochemical properties to those of lithium. Hence, it is a suitable alternative to lithium-ion batteries. Not only this, but sodium is abundant in the Earth’s crust, providing significant promise for large-scale energy storage. Successful commercial products based upon sodium and nickel chloride, like high-temperature Zero-Emission Battery Research Activity (ZEBRA), have already proven to be a great replacement for sodium-based batteries. As a cost-effective alternative to lithium-ion batteries, room-temperature sodium-ion batteries prove to be effective. Sodium can be extracted from seawater, indicating that Earth’s sodium reserves are infinite. The reserves of sodium-containing minerals are relatively cheaper than those of lithium-containing chemicals. Faradion is the first non-aqueous sodium ion battery company in the world. HiNa Battery Technology Co., Ltd. is another leading company for long-cycle life, low-cost, high-power, and safe sodium-ion batteries. HiNa’s sodium-ion batteries are constructed using copper-based oxides and anthracite-derived soft carbon for the cathodes and anodes, respectively [120].

6.3. Supercapacitors

To effectively integrate renewable energy sources into active power systems, it is necessary to have Electrical Energy Storage (EES) devices with high energy and power densities. This is where supercapacitors (SCs) come into play. Supercapacitors have the potential to offer high energy storage capabilities, allowing for the efficient utilization of renewable energy. They can store and release energy rapidly, making them well suited for applications that require quick bursts of power. By developing supercapacitors with improved energy and power densities, researchers aim to overcome the limitations of current renewable energy systems and pave the way for their broader implementation. SCs and batteries are the two primary EES systems, with SCs serving as a link between batteries and capacitors. Combining these two storage devices enables the creation of hybrid electric vehicles that produce zero emissions, offering a promising solution to the pressing issue of global warming. However, SCs and batteries operate differently in terms of charge storage. Batteries utilize a chemical charge storage technique, providing high energy density but low power density. On the other hand, SCs are renowned for their excellent power density. Furthermore, SCs can be classified into electric double-layer capacitors and pseudo capacitors based on their charge storage mechanisms, with a hybrid or composite capacitor formed when the two are combined. SC cells typically consist of three components, an electrode, an electrolyte, and a separator, with the electrodes playing a crucial role in determining the SC’s performance. Carbon-based materials have been extensively used as SC electrodes since their inception. However, recent advancements in SC technology have led to significant scientific interest in synthesizing carbon-based SC electrodes from various natural resources. Biomass-derived carbon materials have gained attention due to their abundance, renewability, cost-effectiveness, and environmentally friendly characteristics [121].

Table 3 provides a comparative summary of selected battery technologies, highlighting the key metrics such as energy density, cost per kilowatt-hour, and cycle life at 80% discharge. The comparison is provided for both well-established and widely available batteries, as well as emerging sodium-ion batteries that offer lower energy density but will be available at lower costs.

Table 3.

Technical comparison of selected battery technologies based on energy density, cost, and life cycle (to 80% depth of discharge). Values are drawn from recent peer-reviewed studies and industry reports.

7. Discussions

The trade-offs between energy storage system performance and their dependence on critical raw materials should be considered before transitioning to renewable energy sources. One example of these materials is cobalt, which has the most acute supply risk, with 56% of global production in the Democratic Republic of Congo. This brings concerns towards documented human rights issues and creates challenges for scaling the production of lithium-ion batteries. However, with the new technologies emerging due to ongoing research and development in the industrial sectors, studies have been conducted on lower cobalt chemistries like lithium iron phosphate, which can reduce a significant amount of cobalt dependency but have a lower energy density relative to cobalt.

In contrast, natural graphite and rare earth elements, majorly extracted and produced by China, are currently considered to be in high supply risk and have less to no near-term substitution options.

These supply risks create a need for countries to adopt mitigation strategies that could include the following:

- i.

- Diversification of supply sources through the development of mines,

- ii.

- Development of recycling frameworks,

- iii.

- Material substitutions where feasible,

- iv.

- Strategic stockpiling of critical raw materials for mitigating short-term disruption in industrial supply chains.