Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

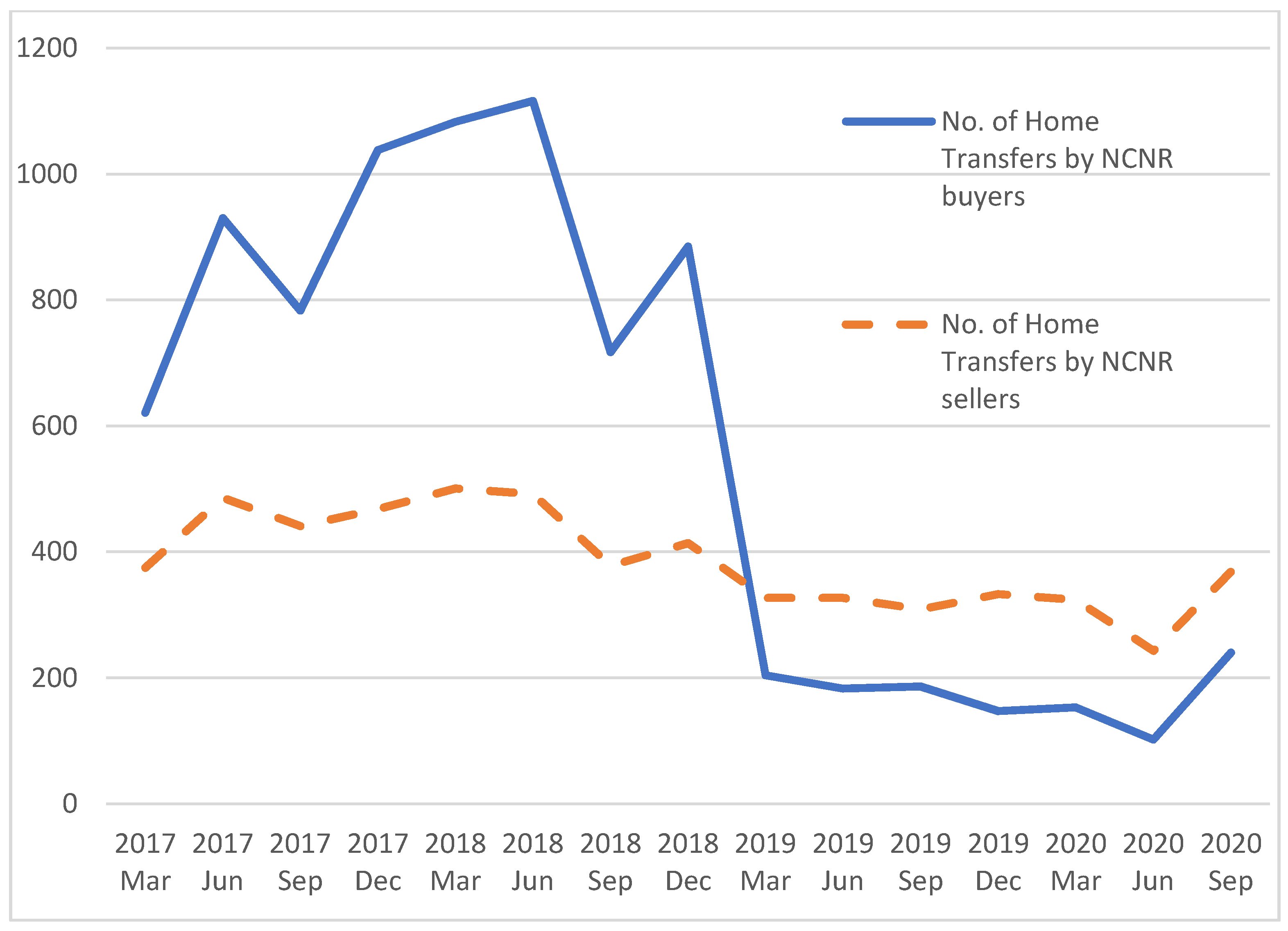

3.1. Data

3.2. Research Design

3.3. Controls by Quasi-Experiment

4. Results

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wetzstein, S. The global urban housing affordability crisis. Urban Stud. 2017, 54, 3159–3177. [Google Scholar] [CrossRef]

- Haffner, M.E.A.; Hulse, K. A fresh look at contemporary perspectives on urban housing affordability. Int. J. Urban Sci. 2019, 25, 59–79. [Google Scholar] [CrossRef] [Green Version]

- Hirata, H.; Kose, A.; Otrok, C.; Terrones, M. Global House Price Fluctuations: Synchronization and Determinants, IMF Working Paper WP/13/38, International Monetary Fund. 2013. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Global-House-Price-Fluctuations-Synchronization-and-Determinants-40302 (accessed on 4 August 2021).

- Katagiri, M. House Price Synchronization and Financial Openness: A Dynamic Factor Model Approach, IMF Working Paper WP/18/209. 2018. Available online: https://www.imf.org/en/Publications/WP/Issues/2018/09/28/House-Price-Synchronization-and-Financial-Openness-A-Dynamic-Factor-Model-Approach-46220?fbclid=IwAR1_ueffnK9Zl8V5wsqQML_ipIiI3ktcRC8trZfvb-sgIRVC-wu95eOQNps (accessed on 4 August 2021).

- OECD. Unemployment Rate—Total % of Labour Force, January 2019–March 2021. 2021. Available online: https://data.oecd.org/unemp/unemployment-rate.htm (accessed on 26 July 2021).

- Francke, M.; Korevaar, M. Housing markets in a pandemic: Evidence from historical outbreaks. J. Urban Econ. 2021, 123, 103333. [Google Scholar] [CrossRef]

- Wang, B. How Does COVID-19 Affect House Prices? A Cross-City Analysis. J. Risk Financ. Manag. 2021, 14, 47. [Google Scholar] [CrossRef]

- Knight Frank. Global House Price Index, Research, Q2 2020 and Q1 2021, Knight Frank. 2020, 2021. Available online: https://www.knightfrank.co.nz/research/global-house-price-index-q1-2021-8146.aspx (accessed on 26 July 2021).

- Mack, A.; Dallas, F.R.B.O.; Martínez-García, E. A Cross-Country Quarterly Database of Real House Prices: A Methodological Note. Fed. Reserv. Bank Dallas, Glob. Monetary Policy Inst. Work. Pap. 2011, 1-99. [Google Scholar] [CrossRef] [Green Version]

- Sahin, T.; Girgin, Y. Central Banks Cut Interest Rates 207 Times in 2020, AA Economy, 18 January 2021. Available online: Aa.com.tr/en/economy/central-banks-cut-interest-rates-207-times-in-2020/2113971 (accessed on 26 July 2021).

- Cheung, K.; Yiu, C.; Xiong, C. Housing Market in the Time of Pandemic: A Price Gradient Analysis from the COVID-19 Epicentre in China. J. Risk Financ. Manag. 2021, 14, 108. [Google Scholar] [CrossRef]

- Duca, J.V.; Hoesli, M.; Montezuma, J. The resilience and realignment of house prices in the era of Covid-19. J. Eur. Real Estate Res. 2021. [Google Scholar] [CrossRef]

- Mian, A.; Sufi, A. House Prices, Home Equity–Based Borrowing, and the US Household Leverage Crisis. Am. Econ. Rev. 2011, 101, 2132–2156. [Google Scholar] [CrossRef] [Green Version]

- Favara, G.; Imbs, J. Credit Supply and the Price of Housing. Am. Econ. Rev. 2015, 105, 958–992. [Google Scholar] [CrossRef] [Green Version]

- Himmelberg, C.; Mayer, C.; Sinai, T. Assessing High House Prices: Bubbles, Fundamentals and Misperceptions. J. Econ. Perspect. 2005, 19, 67–92. [Google Scholar] [CrossRef] [Green Version]

- Mayer, C.; Sinai, T. House Price Dynamics and Behavioral Finance, in Ch.5. In Policy Making Insights from Behavioral Economics; Foote, C.L., Goette, L., Meier, S., Eds.; Federal Reserve Bank of Boston: Boston, MA, USA, 2009. [Google Scholar]

- Taylor, J.B. Getting off Track: How Government Actions and Interventions Caused, Prolonged, and Worsened the Financial Crisis; Hoover Institution Press: Stanford, CA, USA, 2009. [Google Scholar]

- Yiu, C.Y. Negative real interest rate and housing bubble implosion—an empirical study in Hong Kong. J. Financ. Manag. Prop. Constr. 2009, 14, 257–270. [Google Scholar] [CrossRef] [Green Version]

- Yiu, C.Y.; Liusman, E. Negative Real Interest Rates and the Bursting of Spain’s Housing Bubbles: The Fourth Confirmed Case. In Proceedings of the International Conference on Banking, Real Estate and Financial Crises: Hong Kong, China and the World, Hong Kong, China, 17 January 2015. [Google Scholar]

- Landvoigt, T.; Piazzesi, M.; Schneider, M. The Housing Market (s) of San Diego. Am. Econ. Rev. 2015, 105, 1371–1407. [Google Scholar] [CrossRef] [Green Version]

- Ryan-Collins, J. Breaking the housing–finance cycle: Macroeconomic policy reforms for more affordable homes. Environ. Plan. A Econ. Space 2019, 53, 480–502. [Google Scholar] [CrossRef]

- Favilukis, J.; Ludvigson, S.; Nieuwerburgh, S.V. Macroeconomic implications of housing wealth, housing finance, and limited risk-sharing in general equilibrium. J. Political Econ. 2017, 125, 140–223. [Google Scholar] [CrossRef] [Green Version]

- Khandani, A.E.; Lo, A.W.; Merton, R.C. Systemic risk and the refinancing ratchet effect. J. Financ. Econ. 2013, 108, 29–45. [Google Scholar] [CrossRef] [Green Version]

- Ahearne, A.G.; Ammer, J.; Doyle, B.M.; Kole, L.S.; Martin, R.F. House Prices and Monetary Policy: A Cross-Country Study; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2005.

- Tsatsaronis, K.; Zhu, H. What Drives Housing Price Dynamics: Cross Country Evidence. 2004. Available online: https://www.bis.org/publ/qtrpdf/r_qt0403f.pdf (accessed on 27 July 2021).

- Égert, B.; Mihaljek, D. Determinants of House Prices in Central and Eastern Europe. Comp. Econ. Stud. 2007, 49, 367–388. [Google Scholar] [CrossRef] [Green Version]

- Algieri, B. House Price Determinants: Fundamentals and Underlying Factors. Comp. Econ. Stud. 2013, 55, 315–341. [Google Scholar] [CrossRef]

- Vogiazas, S.; Alexiou, C. Determinants of Housing Prices and Bubble Detection: Evidence from Seven Advanced Economies. Atl. Econ. J. 2017, 45, 119–131. [Google Scholar] [CrossRef] [Green Version]

- Tripathi, S. Macroeconomic Determinants of Housing Prices: A Cross Country Level Analysis, MPRA Paper No. 98089. 2019. Available online: https://mpra.ub.uni-muenchen.de/98089/ (accessed on 27 July 2021).

- Antonakis, J.; Bendahan, S.; Jacquart, P.; Lalive, R. Causality and Endogeneity: Problems and Solutions, The Oxford Handbook of Leadership and Organizations. 2014. Available online: https://www.oxfordhandbooks.com/view/10.1093/oxfordhb/9780199755615.001.0001/oxfordhb-9780199755615-e-007 (accessed on 27 July 2021).

- Miller, N.; Peng, L.; Sklarz, M. House Prices and Economic Growth. J. Real Estate Financ. Econ. 2009, 42, 522–541. [Google Scholar] [CrossRef]

- Chan, H.L.; Woo, K.Y. Studying the Dynamic Relationships between Residential Property Prices, Stock Prices, and GDP: Lessons from Hong Kong. J. Hous. Res. 2013, 22, 75–89. [Google Scholar] [CrossRef]

- Bachman, V.R.; Schutt, R.K. The Practice of Research in Criminology and Criminal Justice; Sage: Thousand Oaks, CA, USA, 2006. [Google Scholar]

- Hoogendoorn, S.; Van Gemeren, J.; Verstraten, P.; Folmer, K. House prices and accessibility: Evidence from a quasi-experiment in transport infrastructure. J. Econ. Geogr. 2017, 19, 57–87. [Google Scholar] [CrossRef]

- Zheng, X.; Peng, W.; Hu, M. Airport noise and house prices: A quasi-experimental design study. Land Use Policy 2019, 90, 104287. [Google Scholar] [CrossRef]

- Kessel, D.; Tyrefors, B.; Vestman, R. The Housing Wealth Effect: Quasi-Experimental Evidence. Swedish House of Finance Research Paper, No. 19-5. 2019. Available online: http://dx.doi.org/10.2139/ssrn.3329395 (accessed on 27 July 2021).

- Deng, Y.; Liao, L.; Yu, J.; Zhang, Y. Capital Spillover, House Prices, and Consumer Spending: Quasi-Experimental Evidence from House Purchase Restrictions. Rev. Financ. Stud. 2021. [Google Scholar] [CrossRef]

- OECD. GDP, Unemployment Rate, Short-Term Interest Rate, Inflation Rate, Q1 2015–Q1 2021, OECD Data. 2021. Available online: https://data.oecd.org/ (accessed on 30 July 2021).

- Hyslop, D.R.; Le, T.; Mare, D.C.; Stillman, S. Housing Markets and Migration—Evidence from New Zealand, Motu Working Paper 19–14, Motu Economic and Public Policy Research. July 2019. Available online: http://motu-www.motu.org.nz/wpapers/19_14.pdf (accessed on 27 July 2021).

- Watson, E. A Closer Look at Some of the Supply and Demand Factors Influencing Residential Property Markets, Reserve Bank of New Zealand Analytical Note Series, AN2013/11. December 2013. Available online: https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Analytical%20notes/2013/an2013-11.pdf?revision=5f2ad9d5-e9a8-4837-b456-84a6aae50ebf (accessed on 27 July 2021).

- Stats, N.Z. Property Transfer Statistics: September 2020 Quarter, Stats NZ. 2020. Available online: https://www.stats.govt.nz/information-releases/property-transfer-statistics-september-2020-quarter (accessed on 30 October 2020).

- Ninness, G. Auckland’s Housing Crisis Starting to Ease as Supply Starts to Overtake Demand and Accumulated Housing Shortage Starts to Shrink, Interest.co.nz. 24 November 2020. Available online: https://www.interest.co.nz/property/108084/aucklands-housing-crisis-starting-ease-supply-starts-overtake-demand-and-accumulated (accessed on 28 July 2021).

- Stats, N.Z. Dwelling and Household Estimates: Sep 2020 Quarter, Stats NZ. 2020. Available online: https://www.stats.govt.nz/information-releases/dwelling-and-household-estimates-september-2020-quarter (accessed on 7 October 2020).

- Our World in Data. Daily New Confirmed COVID-19 Deaths Per Million People, Johns Hopkins University CSSE COVID-19 Data Extracted from Our World in Data COVID-19 Dataset. 2021. Available online: https://ourworldindata.org/coronavirus (accessed on 29 July 2021).

- Kingsly, K.; Henri, K. Central Banks Respond to COVID-19 to Stave off a Financial Crisis, They Need for Targeted Fiscal Measures Should Not Be Understated, SSRN. 2020. Available online: https://ssrn.com/abstract=3562320 (accessed on 26 July 2021).

- Taylor, p. New Zealand House Prices Soar Despite COVID Recession, Worsening Affordability Crisis, Guardian, 29 October 2020. Available online: https://www.theguardian.com/world/2020/oct/29/new-zealand-house-prices-soar-despite-covid-recession-worsening-affordability-crisis (accessed on 26 July 2021).

- Ryan-Collins, J. Why Can’t You Afford a Home? Polity Press: Cambridge, UK, 2019. [Google Scholar]

- García, I. Historically Illustrating the Shift to Neoliberalism in the U.S. Home Mortgage Market. Societies 2019, 9, 6. [Google Scholar] [CrossRef] [Green Version]

| Variable | Country | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| HPI, House Price Index | AUS | 153.64 | 6.46 | 141.94 | 165.71 |

| CAN | 186.87 | 12.14 | 178.16 | 223.75 | |

| NZ | 167.60 | 10.64 | 157.88 | 193.36 | |

| UK | 114.41 | 2.62 | 112.13 | 121.97 | |

| US | 98.62 | 4.42 | 91.34 | 106.85 | |

| RIR, Real Interest Rate (%) | AUS | −0.31 | 0.55 | −1.42 | 0.62 |

| CAN | −0.35 | 0.45 | −1.25 | 0.39 | |

| NZ | −0.44 | 0.25 | −0.88 | 0.10 | |

| UK | −1.17 | 0.40 | −1.86 | −0.53 | |

| US | −0.47 | 0.73 | −1.78 | 0.88 | |

| ΔGDP, Gross Domestic Products Quarter-on-Quarter Change (%) | AUS | 0.48 | 3.46 | −6.97 | 2.16 |

| CAN | 0.38 | 9.10 | −11.28 | 3.74 | |

| NZ | 0.67 | 14.07 | −10.83 | 4.48 | |

| UK | −0.10 | 16.95 | −19.47 | 6.52 | |

| US | 0.43 | 7.48 | −8.99 | 3.00 | |

| UNE, Unemployment Rate (%) | AUS | 5.66 | 0.65 | 5.03 | 7.02 |

| CAN | 6.99 | 2.02 | 5.60 | 13.10 | |

| NZ | 4.45 | 0.37 | 4.00 | 5.20 | |

| UK | 4.25 | 0.42 | 3.77 | 5.22 | |

| US | 5.08 | 2.49 | 3.60 | 13.07 | |

| Period | 2017Q1–2021Q1 | ||||

| Number of Observations | 85 Obs (17 periods × 5 countries) | ||||

| Variable | Level | First-Difference | ||

|---|---|---|---|---|

| ADF—Fisher Chi-Square | ADF—Choi Z-Stat | ADF—Fisher Chi-Square | ADF—Choi Z-Stat | |

| HPI, House Price Index and dlog (HPI), House Price Quarter-on-Quarter Change (%) | 2.35 | 4.07 | 21.21 ** | −2.18 ** |

| RIR, Real Interest Rate (%) | 23.04 ** | −2.40 *** | ||

| dlog (GDP), Gross Domestic Products Quarter-on-Quarter Change (%) | 45.48 *** | −5.13 *** | ||

| UNE, Unemployment Rate (%) and d(UNE) | 13.17 | −1.36 | 32.92 *** | −3.90 *** |

| Dependent Variables | Model 1—One-Country Time Series | Model 2—Five-Country Panel |

|---|---|---|

| Constant | 0.005 (0.25) | 0.001 (0.30) |

| RIR | −0.014 (−0.41) | −0.015 (−3.739) *** |

| dlog (GDP) | 0.001 (0.52) | 0.001 (1.69) * |

| d (UNE) | 0.008 (0.24) | 0.002 (1.33) |

| AR (1) | 0.285 (1.00) | 0.434 (3.84) *** |

| Dependent Variable | dlog (HPI) | |

| Fixed Effect | NA | Cross-country fixed effects |

| No. of Observations | 17 | 85 |

| Adj. R-sq | 0.02 | 0.31 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yiu, C.Y. Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis. Urban Sci. 2021, 5, 77. https://doi.org/10.3390/urbansci5040077

Yiu CY. Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis. Urban Science. 2021; 5(4):77. https://doi.org/10.3390/urbansci5040077

Chicago/Turabian StyleYiu, Chung Yim. 2021. "Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis" Urban Science 5, no. 4: 77. https://doi.org/10.3390/urbansci5040077

APA StyleYiu, C. Y. (2021). Why House Prices Increase in the COVID-19 Recession: A Five-Country Empirical Study on the Real Interest Rate Hypothesis. Urban Science, 5(4), 77. https://doi.org/10.3390/urbansci5040077