Abstract

In this paper, the approximate stationarity of the second-order moment increments of the sub-fractional Brownian motion is given. Based on this, the pricing model for European options under the sub-fractional Brownian regime in discrete time is established. Pricing formulas for European options are given under the delta and mixed hedging strategies, respectively. Furthermore, European call option pricing under delta hedging is shown to be larger than under mixed hedging. The hedging error ratio of mixed hedging is shown to be smaller than that of delta hedging via numerical experiments.

1. Introduction

The most well-known model of option pricing is the Black–Scholes (BS) model [1]. As the random driving source of the risk asset price in the BS model is Brownian motion, it cannot capture many of the characteristic features of the risk asset price, including long-range dependence, heavy tails, and periods of constant values, etc. In order to overcome these shortcomings, scholars adopt other stochastic processes as the random source of the option pricing model, such as fractional Brownian motion [2,3,4,5,6,7], mixed fractional Brownian motion [8,9,10,11,12], time-changed Brownian motion [13,14,15,16], skew Brownian motion [17,18,19,20,21], etc.

Recently, researchers have proposed a new stochastic process called sub-fractional Brownian motion (sfBm) as the random driving source of the option pricing model. sfBm is a centered Gaussian process with and was proposed by Bojdecki et al. in 2004 [22]. The covariance of sfBm is given by

where is the Hurst parameter. For , becomes a standard Brownian motion.

From Equation (1), we can find that sfBm has the following properties: (1) self-similarity—for any , has the same distribution as ; (2) long-term dependence—for , . The above two properties are the same as in fractional Brownian motion. However, differing from fractional Brownian motion, sfBm has non-stationarity in the second moment increments. One can refer to [23,24,25,26,27] for more details of the sfBm.

In recent years, many scholars have studied the pricing problems for options under the sfBm regime. Araneda and Bertschinger [28] proposed the sub-fractional Constant Elasticity of Variance (CEV) model. Based on the transition probability density function of the underlying asset price, they derived the explicit formulas for European options. Wang et al. [29] researched the geometric Asian power option pricing model in the sfBm environment. They derived a closed-form pricing formula for geometric Asian power options based on the Itô formula of sfBm. Wang et al. [30] put forward a new Poisson process based on sfBm. Furthermore, they established the sub-fractional Poisson volatility model for option pricing and obtained the closed-form pricing formulas for European options. Bian and Li [31] considered the European option pricing model in an uncertain environment based on sfBm. Their results indicate that in an uncertain environment, a random source of underlying assets with long-term dependence is more suitable for the financial market. Xu and Li [32] gave the pricing formulas for compound options in the sub-fractional Brownian motion model using the risk neutral valuation method.

However, all the above models are continuous-time models. What about the case of discrete time? As the second moment increments of sfBm are not stationary, it is not easy to build a discrete-time model for options in the sfBm regime. Fortunately, we find that the second moment increments of sfBm are approximately stationary. Based on this, we consider the European option pricing under sfBm in discrete time. Moreover, in the discrete-time model of option pricing, delta hedging is the main hedging method. However, Wang [33] proposed a new hedging strategy called mixed hedging. Under this new hedging method, they obtained a discrete-time pricing formula for European options in the Brownian motion regime. Furthermore, their numerical experiments showed that the hedging error ratio of delta hedging was larger than in the mixed one. Kim et al. [34] considered the European option pricing model in the time-changed mixed fractional Brownian regime using the mixed hedging method. Their numerical results were consistent with those of Wang [32], i.e., the hedging error ratio of delta hedging is larger than that of the mixed one in some situations.

Based on the above, in this paper, we will consider the European option pricing model under the sfBm environment in discrete time. In Section 2, we will give the approximate stationarity of second-order moment increments of sfBm. Based on the approximate stationarity, in Section 3, we will establish the discrete-time model for European option pricing under the delta hedging strategy and mixed hedging strategy, respectively. In Section 4, we will give some numerical analysis to further evaluate the model. In Section 5, we conclude this paper.

2. Approximate Stationarity of the Second Moment Increments of sfBm

From the covariance of sfBm, we can obtain the following conclusion.

Lemma 1.

The sfBm satisfies the following property:

Proof.

From the covariance of sfBm, we know that

□

As is , we have that

then

In this sense, the second moment increments of sfBm are approximately stationary.

3. European Option Pricing under the Sub-Fractional Geometric Brownian Motion (sfgBm) Model

In this section, we will derive the pricing formulas for European call options in discrete time under the sfgBm model. We choose the same basic assumptions as Guo et al. [35] except the following.

(1) The dynamics of the underlying asset price and a bond price are given by

and

respectively, where are constants, is sfBm, and is the Hurst parameter.

(2) The value of the option can be replicated by a portfolio with units of risk asset and units of risk-less bond.

3.1. Pricing Formula for European Call Option in Discrete Time under Delta Hedging Strategy

In this subsection, we will give the discrete-time formulas for European call options under the delta hedging strategy. By , we denote the European call option price; then, we have the following.

Theorem 1.

When the underlying asset price satisfies Equation (4), under the delta hedging strategy , it satisfies the following equation,

with the terminal condition , and K is the strike price. The European call option price at time t is given by

where

and is the cumulative normal density function.

Proof.

From Equation (4), we know that

By the definition of sfBm and Lemma 1, we have

By the same token, we can derive

It is obvious that

and

where .

Moreover, from Assumptions (1)–(2) and the delta hedging method, we know that and . Then, from Equations (6)–(9), we have

and

Subject to , we have

Denote , and we obtain

Furthermore, from the Black–Scholes equation [1], we have

where

The proof is completed. □

3.2. Pricing Formula for European Call Option in Discrete Time under Mixed Hedging Strategy

In this subsection, we will obtain the pricing formulas for European call options in discrete time under the sfBm model by using the mixed hedging strategy.

Theorem 2.

When the price of underlying asset satisfies Equation (4), the mixed hedging strategy under the sfBm model is given by

Proof.

From [33], a mixed hedging strategy is the solution of the following problem:

subject to

and

Denote

and

Let

then, from Lemma 1 we have

and

Furthermore,

Selecting satisfies the following equation:

and by calculation, we have

□

Remark 1.

The expression of the mixed hedging strategy under the sfBm model is the same as that under the Brownian motion model [33]. This is consistent with the result in [34].

Based on the expression of the mixed hedging strategy, the pricing formula for European call options in discrete time under the sfBm model is given by the following.

Theorem 3.

When we use the mixed hedging strategy, the European call option price satisfies the following equation,

and the pricing formula is given by

where

and

Proof.

Substituting Equation (28) into Equations (17)–(21), we can obtain

Then, satisfies the following final value problem of the partial differential equation:

It is easy to see that Equation (32) is a Black–Scholes-type equation. Therefore, from [1], the European call option price can be given by Equations (29)–(31). □

Table 1 shows that the European call option price under delta hedging is larger than under mixed hedging. As the exercise price K increases, the differences in the European call option price between delta hedging and mixed hedging are decreased.

Table 1.

European call option price under delta hedging and mixed hedging across strike price K.

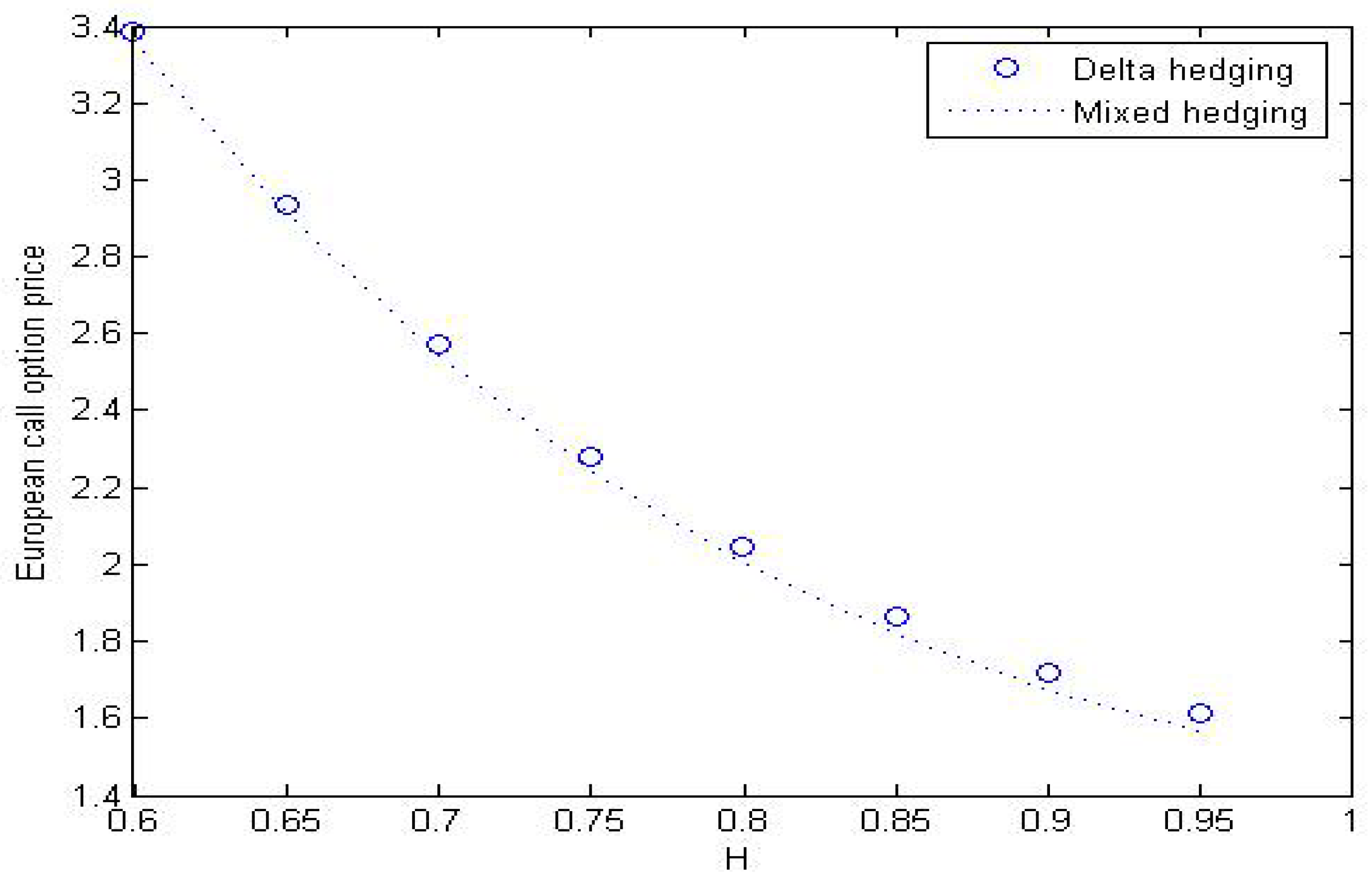

From Figure 1, we can see that the parameter H has an important influence on the European call option price. Moreover, as the parameter H increases, the difference in the European call option price between delta hedging and mixed hedging gradually becomes larger.

Figure 1.

European call option price across Hurst parameter H.

4. Numerical Analysis

4.1. Price of European Call Option in Discrete Time under sfBm Model

In this subsection, we will compare the European call option price between delta hedging and mixed hedging. We set , , , , , , .

4.2. Comparison of Delta Hedging Method and Mixed Hedging Method in sfBm Model

In this subsection, we will compare the delta hedging and the mixed hedging strategies in the sfBm model across the hedging error ratio.

In order to compare the hedging error ratios of the two hedging methods, we use the same example as in [33] (i.e., example 3.1 of [33]). The values of the parameters are .

From Table 2, we can see that the European call option price under delta hedging at week 0 is $71,778.710. The discount of the total cost of writing the option and hedging to week 0 is equal to $106,355.902. The hedging error of delta hedging is , which is close to .

Table 2.

Simulation of delta hedging per week with years.

From Table 3, we can see that the European call option price under mixed hedging is $69,141.684. The discount of the total cost of writing the option and hedging to week 0 is equal to $97,938.092. The hedging error of mixed hedging is , which is approximately . From Table 2 and Table 3, we can see that error ratio of mixed hedging is less than that of delta hedging.

Table 3.

Simulation of mixed hedging per week with years.

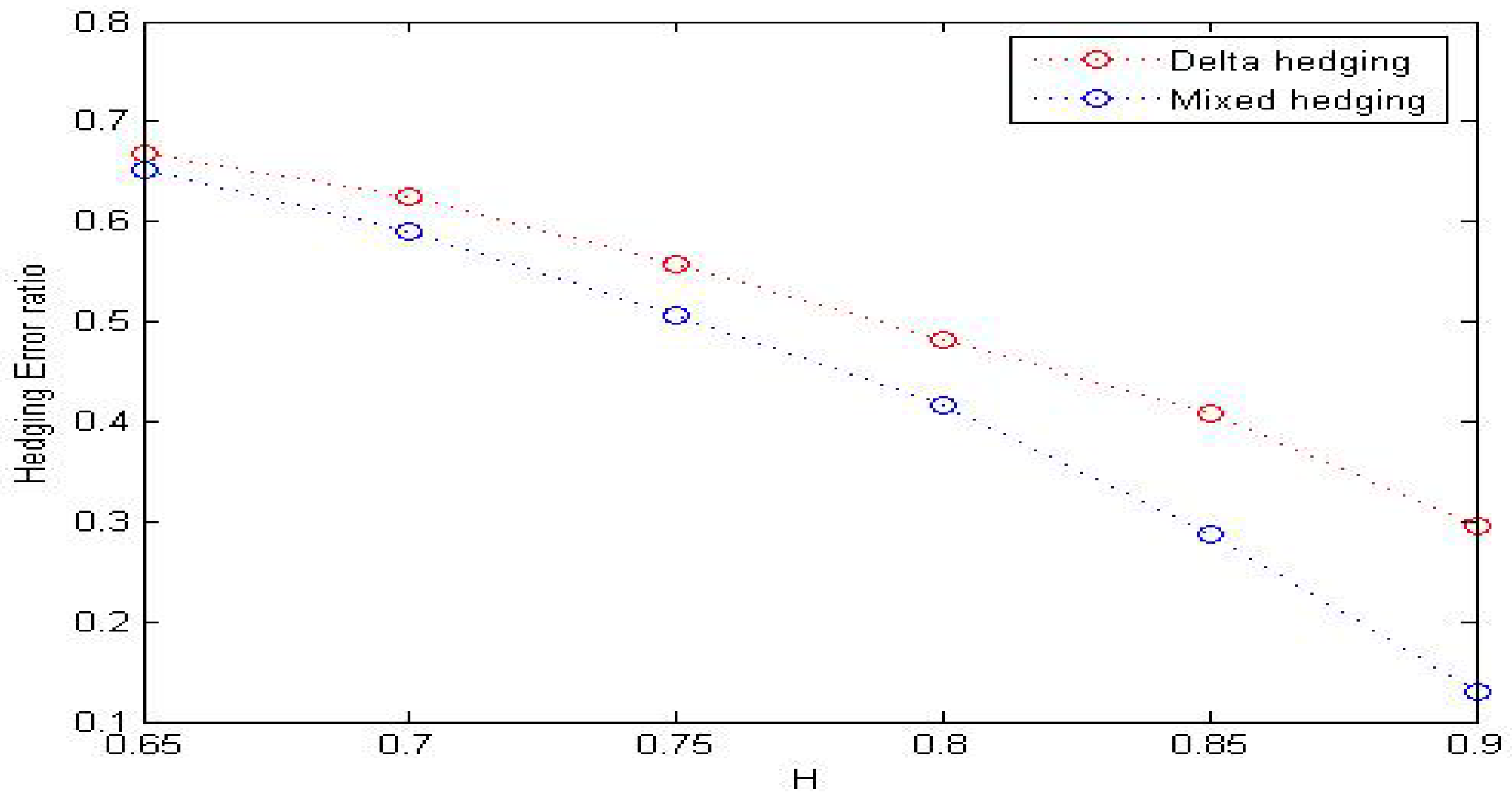

Table 4 and Figure 2 show the effects of Hurst parameter H on the hedging cost and hedging error ratio when H only varies from to .

Table 4.

Hedging error ratios under different Hurst parameters H.

Figure 2.

Hedging error ratio across Hurst parameter H.

5. Conclusions

This paper deals with the European call option pricing in discrete time under the sfBm model. The numerical results show that the European call option price of delta hedging is larger than the price of mixed hedging. The hedging error ratio of the mixed hedging strategy is less than that of the delta hedging strategy in some situations. Moreover, the Hurst parameter H plays an important role in the European call option price and hedging error ratio. Based on the results of this study, we can study option pricing under sfBm in discrete time; the future research directions mainly include the following.

(i) The real financial market is not smooth. The trading of the risk asset (like stock) always incurs transaction costs and dividends. Therefore, the study of the option pricing model with transaction costs or dividends in the sfBm regime is of great significance.

(ii) The changes in the risk asset price often accompany jumps. Both Brownian motion and sfBm cannot describe this situation. Thus, one can generalize the sfBm model to the jump-diffusion model in discrete time.

Author Contributions

Writing—original draft preparation, Z.G. and Y.L.; methodology, Z.G.; writing—review and editing, Z.G. and L.D. All authors have read and agree to the published version of the manuscript.

Funding

This work is supported by the Foundation of Anqing Normal University (100001199) and the Nature Science Foundation of Anhui Province (1908085QA29).

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Black, F.; Scholes, M.S. The pricing of options and corporate liabilities. J. Polit. Econ. 1973, 81, 637–659. [Google Scholar] [CrossRef]

- Necula, C. Option pricing in a fractional Brownian motion environment. Math. Rep. 2002, 2, 259–273. [Google Scholar] [CrossRef]

- Xiao, W.L.; Zhang, W.G.; Zhang, X.L.; Wang, Y.L. Pricing currency options in a fractional Brownian motion with jumps. Econ. Model. 2010, 27, 935–942. [Google Scholar] [CrossRef]

- Manley, B. How does real option value compare with Faustmann value when log prices follow fractional Brownian motion? Forest Policy Econ. 2017, 85, 76–84. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, R.; Yang, L.; Su, Y.; Ma, F. Pricing geometric Asian rainbow options under fractional Brownian motion. Physica A 2018, 494, 8–16. [Google Scholar] [CrossRef]

- Yang, P.; Xu, Z.L. Numerical Valuation of European and American Options under Fractional Black-Scholes Model. Fractal Fract. 2022, 6, 143. [Google Scholar] [CrossRef]

- Dufera, T.T. Fractional Brownian motion in option pricing and dynamic delta hedging: Experimental simulations. N. Am. J. Econ. Financ. 2024, 69, 102017. [Google Scholar] [CrossRef]

- Nouty, C.E. The fractional mixed fractional Brownian motion. Stat. Probabil. Lett. 2003, 65, 111–120. [Google Scholar] [CrossRef]

- Sun, L. Pricing currency options in the mixed fractional Brownian motion. Physica A 2013, 392, 3441–3458. [Google Scholar] [CrossRef]

- Kim, K.H.; Yun, S.; Kim, N.U.; Ri, J.H. Pricing formula for European currency option and exchange option in a generalized jump mixed fractional Brownian motion with time-varying coefficients. Physica A 2019, 522, 215–231. [Google Scholar] [CrossRef]

- Chen, Q.S.; Zhang, Q.; Liu, C. The pricing and numerical analysis of lookback options for mixed fractional Brownian motion. Chaos Solitons Fractals 2019, 128, 123–128. [Google Scholar] [CrossRef]

- Xu, F.; Yang, X.J. Pricing European Options under a Fuzzy Mixed Weighted Fractional Brownian Motion Model with Jumps. Fractal Fract. 2023, 7, 859. [Google Scholar] [CrossRef]

- Magdziarz, M. Black scholes formula in subdiffusive regime. J. Stat. Phys. 2009, 136, 553–564. [Google Scholar] [CrossRef]

- Gu, H.; Liang, J.R.; Zhang, Y.X. Time-changed geometric fractional Brownian motion and option pricing with transaction costs. Physica A 2012, 391, 3971–3977. [Google Scholar] [CrossRef]

- Guo, Z.D. Option pricing under the Merton model of the short rate in subdiffusive Brownian motion regime. J. Stat. Comput. Sim. 2017, 87, 519–529. [Google Scholar] [CrossRef]

- Shokrollahi, F. The evaluation of geometric Asian power options under time changed mixed fractional Brownian motion. J. Comput. Appl. Math. 2018, 344, 716–724. [Google Scholar] [CrossRef]

- Corns, T.R.A.; Satchell, S.E. Skew Brownian Motion and Pricing European Options. Eur. J. Financ. 2007, 13, 523–544. [Google Scholar] [CrossRef]

- Zhu, S.P.; He, X.J. A new closed-form formula for pricing European options under a skew Brownian motion. Eur. J. Financ. 2018, 24, 1063–1074. [Google Scholar] [CrossRef]

- Pasricha, P.; He, X.J. Skew-Brownian motion and pricing European exchange options. Int. Rev. Financ. Anal. 2022, 82, 102120. [Google Scholar] [CrossRef]

- Hussain, S.; Arif, H.; Noorullah, M.; Pantelous, A. Pricing American Options under Azzalini Ito-McKean Skew Brownian Motions. Appl. Math. Comput. 2023, 451, 128040. [Google Scholar] [CrossRef]

- Song, S.Y.; Wang, X.C.; Zhang, X.W. Valuation of spread options under correlated skew Brownian motions. Eur. J. Financ. 2023, 2023, 2202821. [Google Scholar] [CrossRef]

- Bojdecki, T.; Gorostiza, L.G.; Talarczyk, A. Sub-fractional Brownian motion and its relation to occupation times. Stat. Probabil. Lett. 2004, 69, 405–419. [Google Scholar] [CrossRef]

- Tudor, C. Some properties of the sub-fractional Brownian motion. Stoch. Int. J. Probab. Stoch. Process. 2007, 79, 431–448. [Google Scholar] [CrossRef]

- Shen, G.J.; Chen, C. Stochastic integration with respect to the sub-fractional Brownian motion with H ∈ . Stat. Probabil. Lett. 2012, 82, 240–251. [Google Scholar] [CrossRef]

- Yan, L.; Shen, G.J.; He, K. Itô’s formula for a sub-fractional Brownian motion. Comm. Stoch. Anal. 2011, 5, 9. [Google Scholar]

- Nouty, C.E.; Zili, M. On the sub-mixed fractional Brownian motion. Appl. Math. Ser. B 2015, 30, 27–43. [Google Scholar]

- Rao, B.L.S.P. More on maximal inequalities for sub-fractional Brownian motion. Stoch. Anal. Appl. 2019, 38, 1686395. [Google Scholar]

- Araneda, A.A.; Bertschinger, N. The sub-fractional CEV model. Physica A 2021, 573, 125974. [Google Scholar] [CrossRef]

- Wang, W.; Cai, G.H.; Tao, X.X. Pricing geometric asian power options in the sub-fractional brownian motion environment. Chaos Solitons Fractals 2021, 145, 110754. [Google Scholar] [CrossRef]

- Wang, X.T.; Yang, Z.J.; Cao, P.Y.; Wang, S.L. The closed-form option pricing formulas under the sub-fractional Poisson volatility models. Chaos Solitons Fractals 2021, 148, 111012. [Google Scholar] [CrossRef]

- Bian, L.; Li, Z. Fuzzy simulation of European option pricing using sub-fractional Brownian motion. Chaos Solitons Fractals 2021, 153, 111442. [Google Scholar] [CrossRef]

- Xu, F.; Li, R.Z. The pricing formulas of compound option based on the sub-fractional Brownian motion model. J. Phys. Conf. Ser. 2018, 1053, 012027. [Google Scholar] [CrossRef]

- Wang, X.T.; Zhao, Z.F.; Fang, X.F. Option pricing and portfolio hedging under the mixed hedging strategy. Physica A 2015, 424, 194–206. [Google Scholar] [CrossRef]

- Kim, K.H.; Kim, S.H.; Jo, H.B. Option pricing under mixed hedging strategy in time-changed mixed fractional Brownian model. J. Comput. Appl. Math. 2022, 416, 114496. [Google Scholar] [CrossRef]

- Guo, Z.D.; Yuan, H.J. Pricing European option under the time-changed mixed. Physica A 2014, 406, 73–79. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).