Nonlinear Analysis of the U.S. Stock Market: From the Perspective of Multifractal Properties and Cross-Correlations with Comparisons

Abstract

1. Introduction

2. Literature Review

3. Methodology

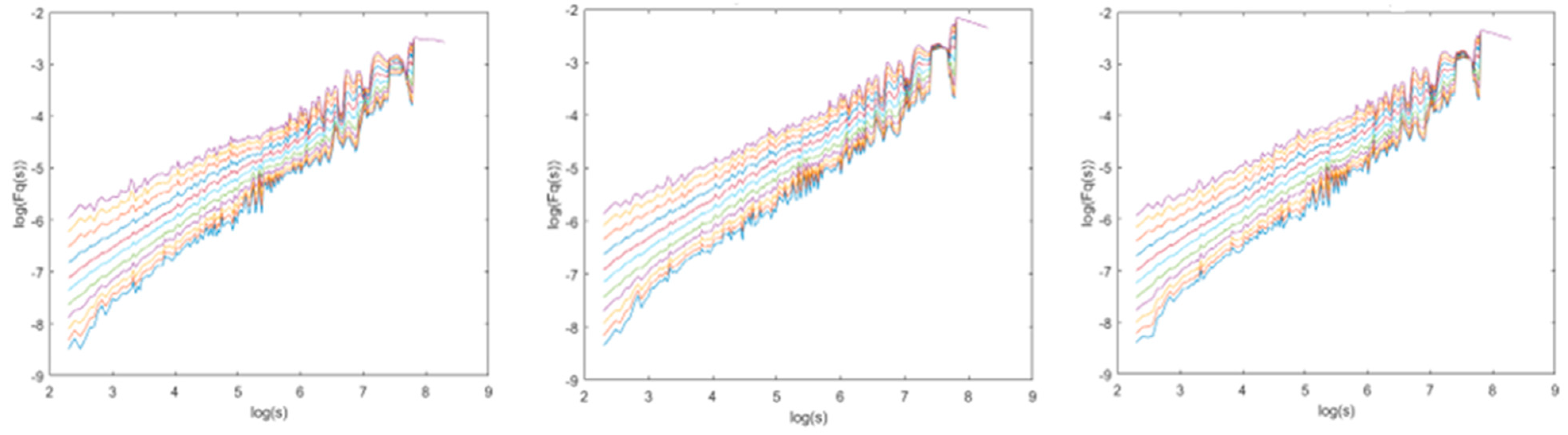

3.1. MF-DFA

3.2. MF-DCCA

4. Data

- (1)

- sub-period 1: from 9 October 2007 to 6 March 2009, containing 355 observations;

- (2)

- sub-period 2: from 9 March 2009 to 31 March 2024, containing 5502 observations.

5. Empirical Results

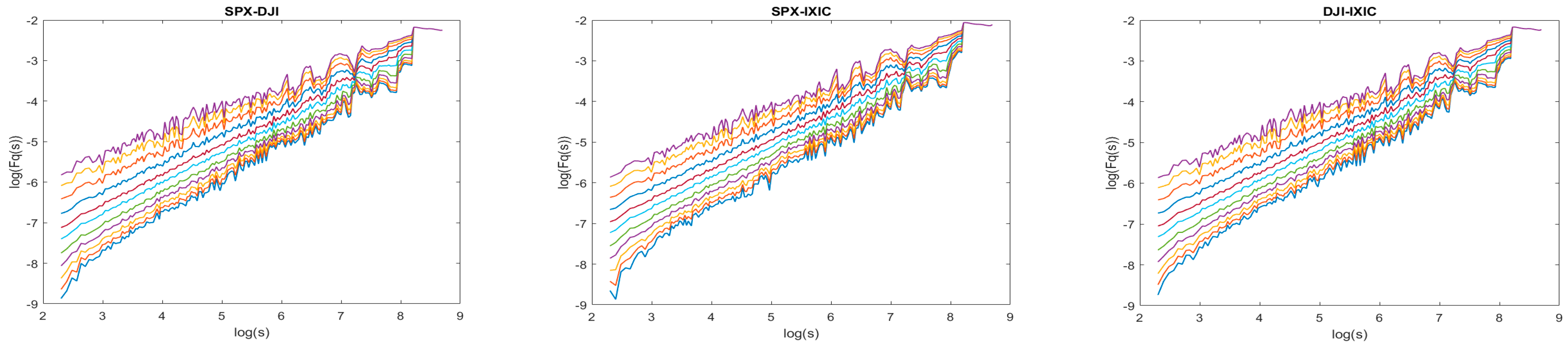

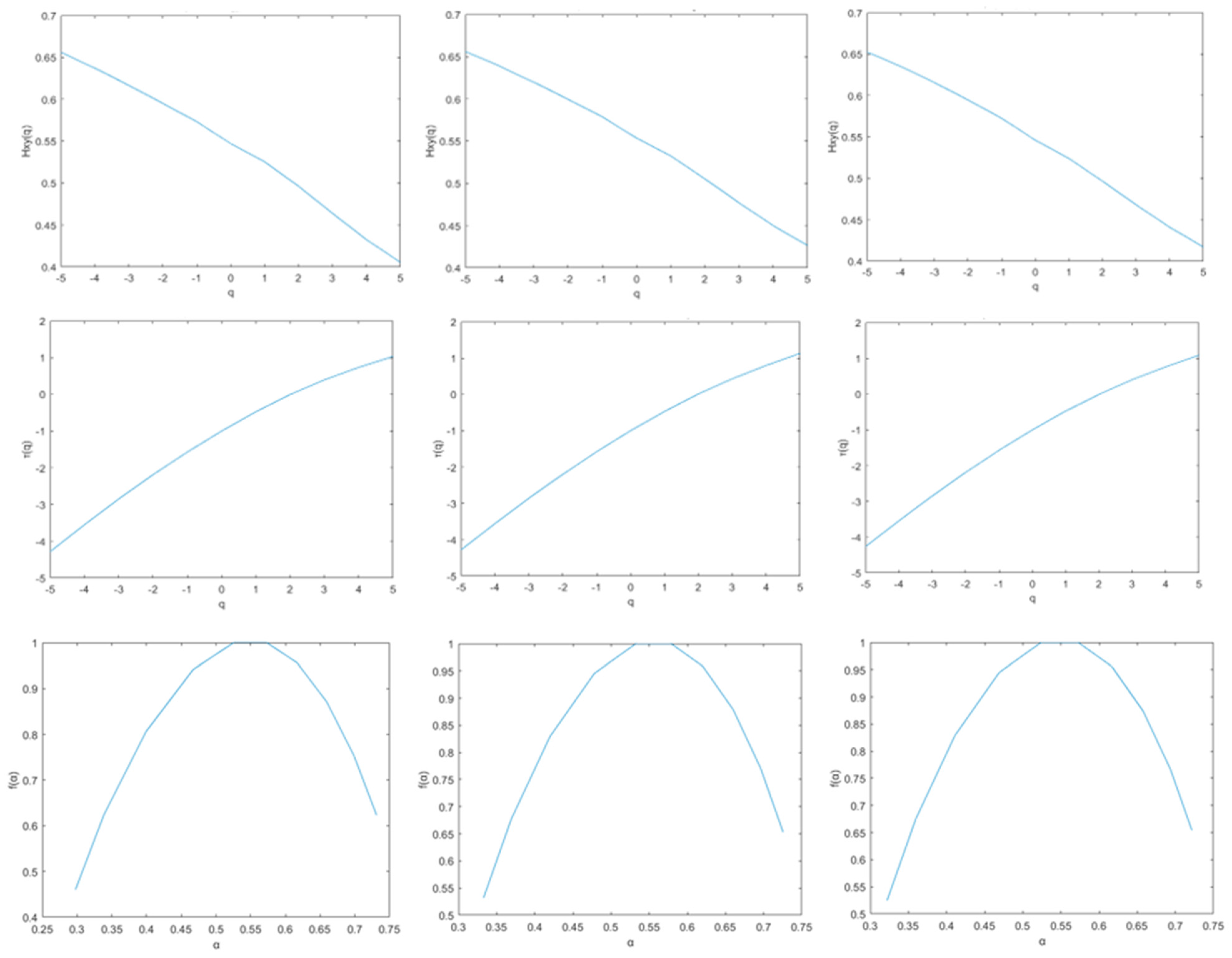

5.1. Multifractal Properties of the U.S. Stock Market

5.2. Multifractal Degree of the U.S. Stock Market

5.3. Efficiency of the U.S. Stock Market

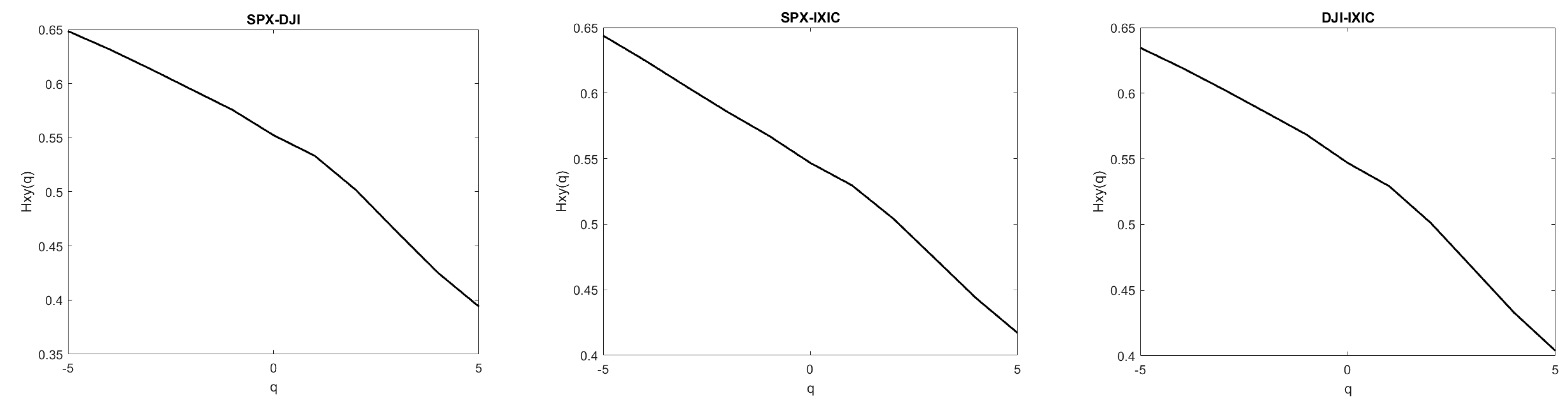

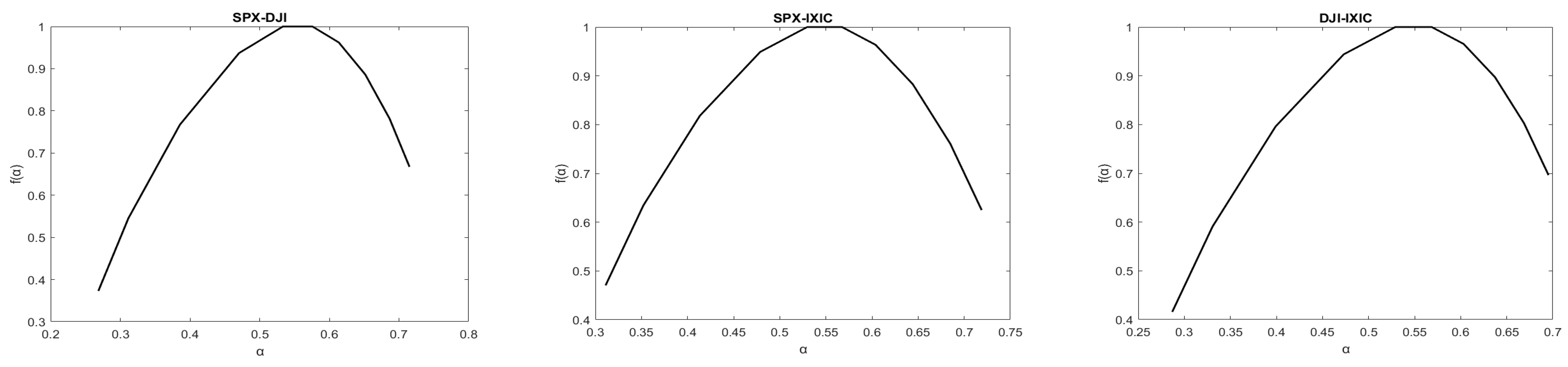

5.4. Cross-Correlations in the U.S. Stock Market

5.5. Robustness Tests

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Mandelbrot, B.B. A multifractal walk down wall street. Sci. Am. 1999, 280, 70–73. [Google Scholar] [CrossRef]

- Peters, E.E. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics; John Wiley Sons: New York, NY, USA, 1994; Volume 24. [Google Scholar]

- Seth, N.; Sharma, A.K. International stock market efficiency and integration: Evidences from Asian and U.S. markets. J. Adv. Manag. Res. 2015, 12, 88–106. [Google Scholar] [CrossRef]

- Ito, M.; Noda, A.; Wada, T. The Evolution of Stock Market Efficiency in the U.S.: A Non-Bayesian Time-Varying Model Approach. Appl. Econ. 2016, 48, 621–635. [Google Scholar] [CrossRef]

- Benkraiem, R.; Lahiani, A.; Miloudi, A.; Shahbaz, M. New insights into the U.S. stock market reactions to energy price shocks. J. Int. Financ. Mark. Inst. Money 2018, 56, 169–187. [Google Scholar] [CrossRef]

- Kyle, A.S.; Obizhaeva, A.A.; Tuzun, T. Microstructure invariance in U.S. stock market trades. J. Financ. Mark. 2020, 49, 100513. [Google Scholar] [CrossRef]

- Oleg, S.; Grigory, P.; Alexander, S.; Sergiy, B.; Alexander, V.; Eduardo, L.P.; Vladimir, B. Networks of causal relationships in the U.S. stock market. Depend. Model. 2022, 10, 177–190. [Google Scholar]

- Beckmann, L.; Debener, J.; Hark, P.F.; Pfingsten, A. CBDC and the shadow of bank disintermediation: US stock market insights on threats and remedies. Financ. Res. Lett. 2024, 67, 105868. [Google Scholar] [CrossRef]

- Ammy-Driss, A.; Garcin, M. Efficiency of the financial markets during the COVID-19 crisis: Time-varying parameters of fractional stable dynamics. Phys. A Stat. Mech. Its Appl. 2023, 609, 128335. [Google Scholar] [CrossRef]

- Belhoula, M.M.; Mensi, W.; Al Yahyaee, K.H. Dynamic speculation and efficiency in European natural gas markets during the COVID-19 and Russia-Ukraine crises. Resour. Policy 2024, 98, 105362. [Google Scholar] [CrossRef]

- Sharif, T.; Ghouli, J.; Bouteska, A.; Abedin, M.Z. The impact of COVID-19 uncertainties on energy market volatility: Evidence from the US markets. Econ. Anal. Policy 2024, 84, 25–41. [Google Scholar] [CrossRef]

- Koangsung, C.; Francesco, R.; Chung, C. The impact of COVID-19 on the Korean and US labour markets. Appl. Econ. 2024, 56, 4529–4543. [Google Scholar]

- Benjamin, C.; Martin, H.; Kai, Z. The Impact of High-Frequency Trading on Modern Securities Markets. Bus. Inf. Syst. Eng. 2022, 65, 7–24. [Google Scholar]

- Inés, J.; Andrés, M.-V.; Javier, P. Multivariate dynamics between emerging markets and digital asset markets: An application of the SNP-DCC model. Emerg. Mark. Rev. 2023, 56, 101054. [Google Scholar]

- Kocaarslan, B. Dynamic spillovers between oil market, monetary policy, and exchange rate dynamics in the US. Financ. Res. Lett. 2024, 69, 106137. [Google Scholar] [CrossRef]

- Shaw, P.K.; Saha, D.; Ghosh, S.; Janaki, M.S.; Iyengar, A.N.S. Investigation of multifractal nature of floating potential fluctuations obtained from a dc glow discharge magnetized plasma. Phys. A Stat. Mech. Its Appl. 2017, 469, 363–371. [Google Scholar] [CrossRef]

- Al-Yahyaee, K.H.; Mensi, W.; Yoon, S.M. Efficiency; multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Financ. Res. Lett. 2018, 27, 228–234. [Google Scholar] [CrossRef]

- Stosic, D.; Stosic, D.; de Mattos Neto, P.S.; Stosic, T. Multifractal characterization of Brazilian market sectors. Phys. A Stat. Mech. Its Appl. 2019, 525, 956–964. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Aye, G.C.; Gupta, R. Stock market efficiency analysis using long spans of Data: A multifractal detrended fluctuation approach. Financ. Res. Lett. 2019, 28, 398–411. [Google Scholar] [CrossRef]

- Wang, F.; Ye, X.; Wu, C. Multifractal characteristics analysis of crude oil futures prices fluctuation in China. Phys. A Stat. Mech. Its Appl. 2019, 533, 122021. [Google Scholar] [CrossRef]

- Mensi, W.; Kumar, A.S.; Vo, X.V.; Kang, S.H. Asymmetric multifractality and dynamic efficiency in DeFi markets. J. Econ. Financ. 2023, 48, 280–297. [Google Scholar] [CrossRef]

- de Salis, E.A.; dos Santos Maciel, L. How does price (in)efficiency influence cryptocurrency portfolios performance? The role of multifractality. Quant. Financ. 2023, 23, 1637–1658. [Google Scholar] [CrossRef]

- Li, W.; Lu, X.; Ren, Y.; Zhou, Y. Dynamic relationship between RMB exchange rate index and stock market liquidity: A new perspective based on MF-DCCA. Phys. A Stat. Mech. Its Appl. 2018, 508, 726–739. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, P.; Li, X.; Shen, D. The inefficiency of cryptocurrency and its cross-correlation with Dow Jones Industrial Average. Phys. A Stat. Mech. Its Appl. 2018, 510, 658–670. [Google Scholar] [CrossRef]

- Ruan, Q.; Yang, B.; Ma, G. Detrended cross-correlation analysis on RMB exchange rate and Hang Seng China Enterprises Index. Phys. A Stat. Mech. Its Appl. 2017, 468, 91–108. [Google Scholar] [CrossRef]

- Fang, S.; Lu, X.; Li, J.; Qu, L. Multifractal detrended cross-correlation analysis of carbon emission allowance and stock returns. Phys. A Stat. Mech. Its Appl. 2018, 509, 551–566. [Google Scholar] [CrossRef]

- Ghosh, D.; Chakraborty, S.; Samanta, S. Study of translational effect in Tagore’s Gitanjali using Chaos based Multifractal analysis technique. Phys. A Stat. Mech. Its Appl. 2019, 523, 1343–1354. [Google Scholar] [CrossRef]

- Ahmed, H.; Aslam, F.; Ferreira, P. Navigating Choppy Waters: Interplay between Financial Stress and Commodity Market Indices. Fractal Fract. 2024, 8, 96–118. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Its Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef]

- He, L.-Y.; Chen, S.-P. Are crude oil markets multifractal? Evidence from MF-DFA and MF-SSA perspectives. Phys. A Stat. Mech. Its Appl. 2010, 389, 3218–3229. [Google Scholar] [CrossRef]

- Alvarez-Ramirez, J.; Cisneros, M.; Ibarra-Valdez, C.; Soriano, A. Multifractal Hurst analysis of crude oil prices. Phys. A Stat. Mech. Its Appl. 2002, 313, 651–670. [Google Scholar] [CrossRef]

- Cao, G.; Cao, J.; Xu, L. Asymmetric multifractal scaling behavior in the Chinese stock market: Based on asymmetric MF-DFA. Phys. A Stat. Mech. Its Appl. 2013, 392, 797–807. [Google Scholar] [CrossRef]

- Onali, E.; Goddard, J. Unifractality and multifractality in the Italian stock market. Int. Rev. Financ. Anal. 2009, 18, 154–163. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Pan, Z. Multifractal detrending moving average analysis on the U.S. Dollar exchange rates. Phys. A Stat. Mech. Its Appl. 2011, 390, 3512–3523. [Google Scholar] [CrossRef]

- Ning, Y.; Wang, Y.; Yang, Z.; Geng, Y. Measurement and multifractal properties of short-term international capital flows in China. Phys. A Stat. Mech. Its Appl. 2017, 468, 714–721. [Google Scholar] [CrossRef]

- Ihlen, E.A.F. Introduction to multifractal detrended fluctuation analysis in Matlab. Front. Physiol. 2012, 3, 141. [Google Scholar] [CrossRef] [PubMed]

- Zhou, W. Multifractal detrended cross-correlation analysis for two nonstationary signals. Phys. Rev. E 2008, 77, 066211. [Google Scholar] [CrossRef]

- He, L.-Y.; Chen, S.-P. Nonlinear bivariate dependency of price–volume relationships in agricultural commodity futures markets: A perspective from multifractal detrended cross-correlation analysis. Phys. A Stat. Mech. Its Appl. 2011, 390, 297–308. [Google Scholar] [CrossRef]

- Zhu, P.; Tang, Y.; Wei, Y.; Dai, Y. Portfolio strategy of international crude oil markets: A study based on multiwavelet denoising-integration MF-DCCA method. Phys. A Stat. Mech. Its Appl. 2019, 535, 122515. [Google Scholar] [CrossRef]

- Yuan, Y.; Zhuang, X.-T.; Liu, Z.-Y. Price–volume multifractal analysis and its application in Chinese stock markets. Phys. A Stat. Mech. Its Appl. 2012, 391, 3484–3495. [Google Scholar] [CrossRef]

- Cao, G.; Zhang, M.; Li, Q. Volatility-constrained multifractal detrended cross-correlation analysis: Cross-correlation among Mainland China, US, and Hong Kong stock markets. Phys. A Stat. Mech. Its Appl. 2017, 472, 67–76. [Google Scholar] [CrossRef]

| Index | Sample Period | Number of Observations | Mean (%) | Standard Deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| SPX | 1 January 2005~1 November 2024 | 7245 | 0.0214 | 0.0101 | −0.6085 | 23.2028 | |

| Whole sample | DJI | 1 January 2005~1 November 2024 | 7245 | 0.0187 | 0.0095 | −0.5518 | 27.8727 |

| IXIC | 1 January 2005~1 November 2024 | 7245 | 0.0293 | 0.0113 | −0.4859 | 15.5791 | |

| SPX | 9 October 2007~6 March 2009 | 355 | −0.2312 | 0.0240 | −0.0595 | 6.7637 | |

| Sub-period 1 | DJI | 9 October 2007~6 March 2009 | 355 | −0.2116 | 0.0219 | 0.1947 | 6.9598 |

| IXIC | 9 October 2007~6 March 2009 | 355 | −0.2162 | 0.0243 | −0.0159 | 5.8424 | |

| SPX | 9 March 2009~31 March 2024 | 5502 | 0.0371 | 0.0094 | −0.6176 | 21.7133 | |

| Sub-period 2 | DJI | 9 March 2009~31 March 2024 | 5502 | 0.0326 | 0.0090 | −0.7795 | 30.3792 |

| IXIC | 9 March 2009~31 March 2024 | 5502 | 0.0461 | 0.0108 | −0.5192 | 14.7032 |

| Index | Δα | Δf | R |

|---|---|---|---|

| SPX | 1.8104 | 2.4475 | −0.4300 |

| DJI | 1.4446 | 1.6499 | −0.3300 |

| IXIC | 1.5452 | 1.5410 | −0.2909 |

| Whole Sample | Sub-Period 1 | Sub-Period 2 | △MD | |

|---|---|---|---|---|

| SPX | 1.8104 | 1.1691 | 2.3010 | 1.1319 |

| DJI | 1.4446 | 1.4413 | 1.9491 | 0.5078 |

| IXIC | 1.5452 | 1.0412 | 1.6371 | 0.5959 |

| Index | Δα | Δf | R |

|---|---|---|---|

| SPX | 1.1719 | 1.3489 | −0.3412 |

| DJI | 1.2672 | 1.6787 | −0.3553 |

| IXIC | 0.9365 | 0.7183 | −0.1428 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, C.; Xu, Y. Nonlinear Analysis of the U.S. Stock Market: From the Perspective of Multifractal Properties and Cross-Correlations with Comparisons. Fractal Fract. 2025, 9, 73. https://doi.org/10.3390/fractalfract9020073

Han C, Xu Y. Nonlinear Analysis of the U.S. Stock Market: From the Perspective of Multifractal Properties and Cross-Correlations with Comparisons. Fractal and Fractional. 2025; 9(2):73. https://doi.org/10.3390/fractalfract9020073

Chicago/Turabian StyleHan, Chenyu, and Yingying Xu. 2025. "Nonlinear Analysis of the U.S. Stock Market: From the Perspective of Multifractal Properties and Cross-Correlations with Comparisons" Fractal and Fractional 9, no. 2: 73. https://doi.org/10.3390/fractalfract9020073

APA StyleHan, C., & Xu, Y. (2025). Nonlinear Analysis of the U.S. Stock Market: From the Perspective of Multifractal Properties and Cross-Correlations with Comparisons. Fractal and Fractional, 9(2), 73. https://doi.org/10.3390/fractalfract9020073