A Python Module for Implementing Cointegration Tests with Multiple Endogenous Structural Breaks †

Abstract

1. Introduction

2. A Simple Example of Cointegration

3. Tests for Cointegration with Two Structural Breaks

4. The Phyton Module

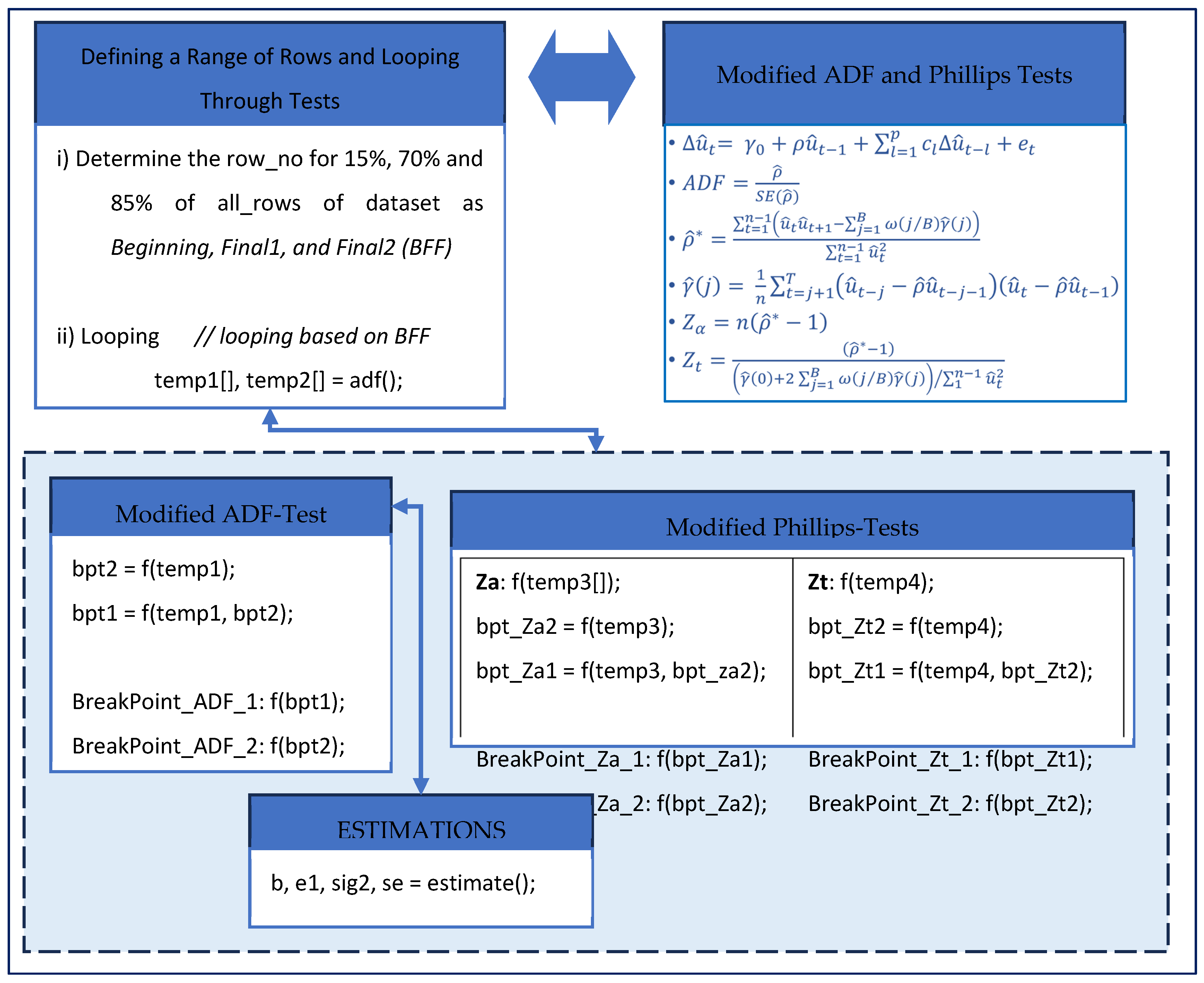

4.1. Pseudocode for the Module

4.2. The Graphical User Interface and a Numerical Application

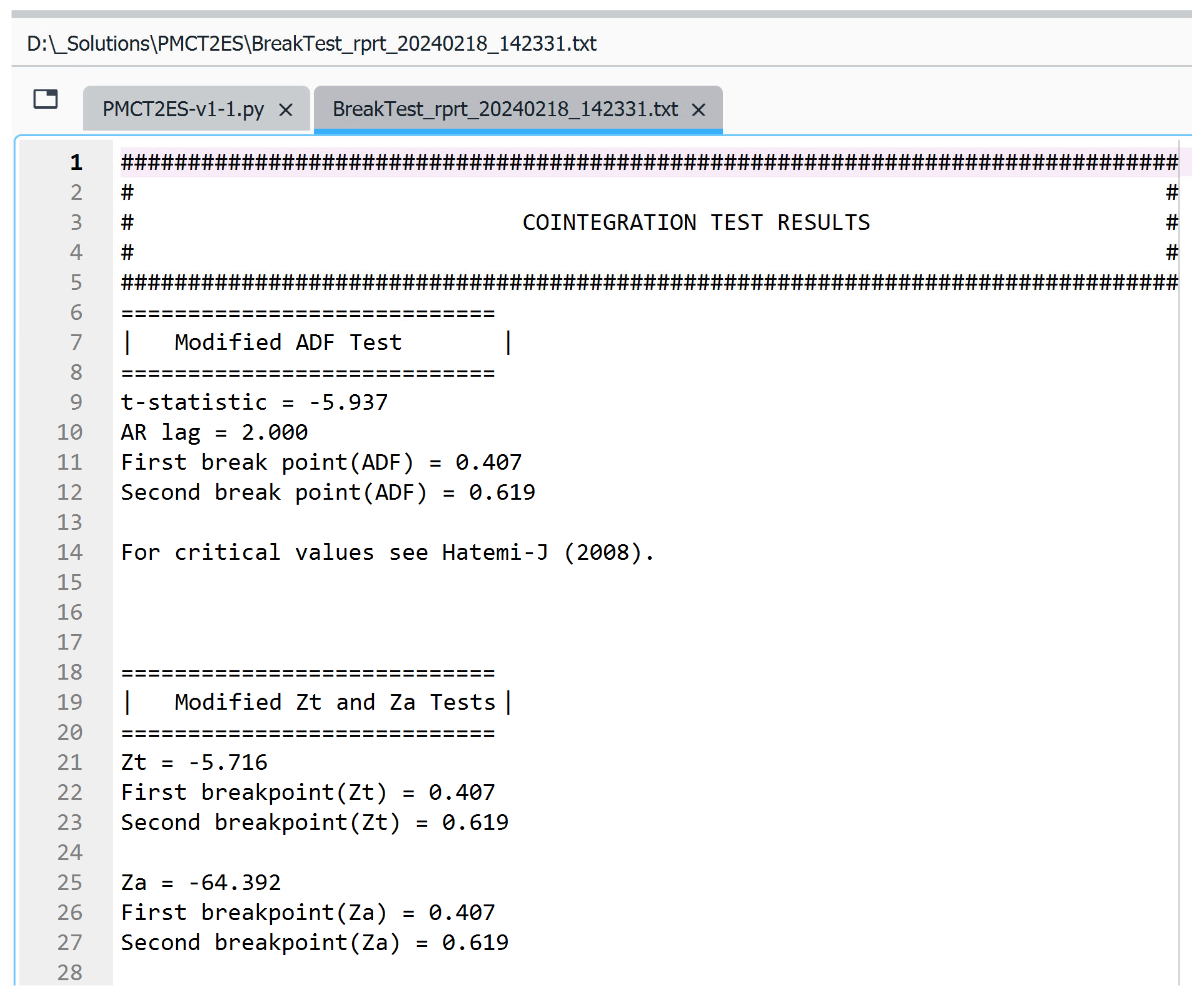

4.3. Outputs of the Module

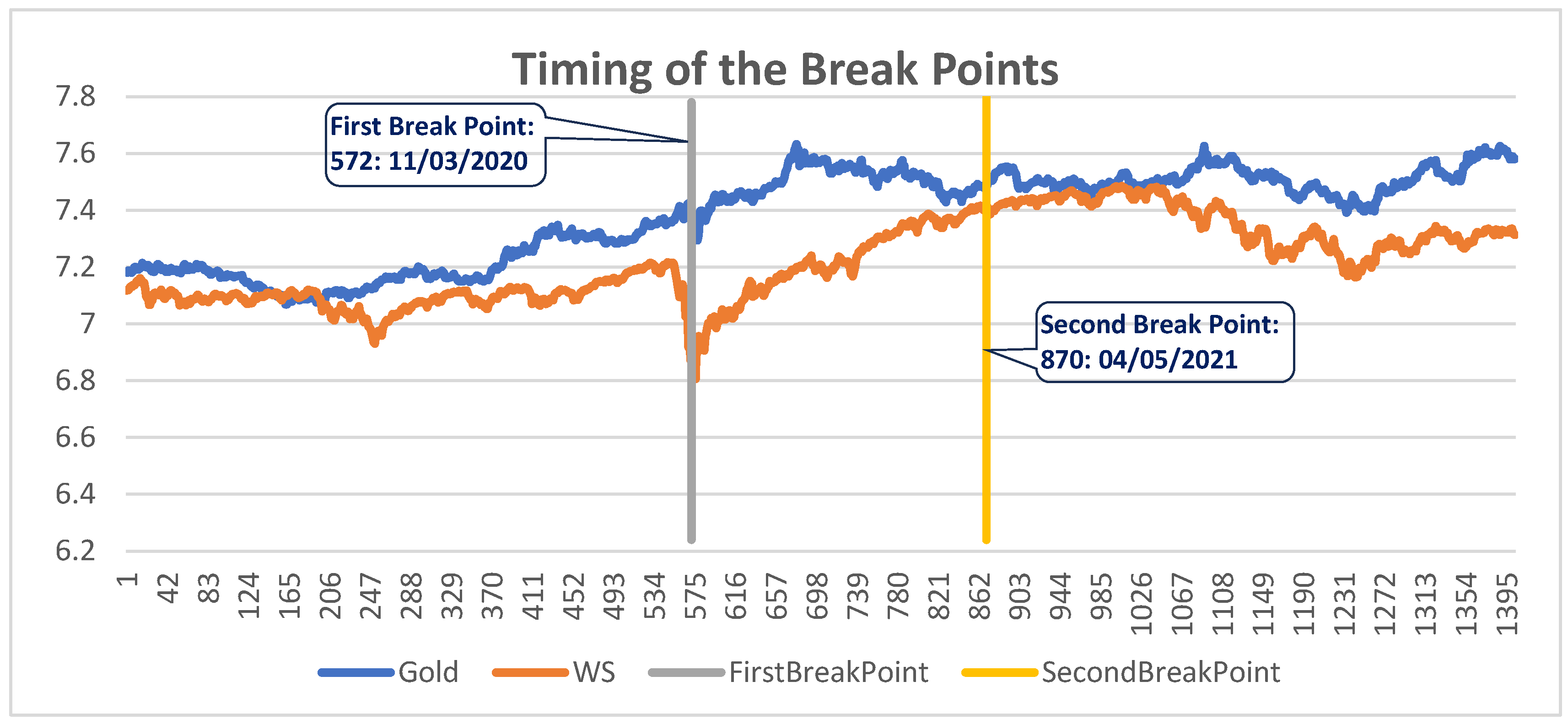

4.4. Chart Created Based on the Output of the Module

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Granger, C.W. Some properties of time series data and their use in econometric model specification. J. Econom. 1981, 16, 121–130. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C.W. Cointegration and error correction: Representation, estimation and testing. Econometrica 1987, 35, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Phillips, P.C. Time series regression with a unit root. Econometrica 1987, 5, 277–301. [Google Scholar] [CrossRef]

- Phillips, P.C.; Ouliaris, S. Asymptotic properties of residual based tests for cointegration. Econometrica 1990, 58, 165–193. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. Testing for common trends. J. Am. Stat. Assoc. 1988, 83, 1097–1107. [Google Scholar] [CrossRef]

- Gregory, A.W.; Hansen, B.E. Residual-based tests for cointegration in models with regime shifts. J. Econom. 1996, 70, 99–126. [Google Scholar] [CrossRef]

- Hatemi-J, A. Tests for cointegration with two unknown regime shifts with an application to financial market integration. Empir. Econ. 2008, 35, 497–505. [Google Scholar] [CrossRef]

- Aptech Systems. GAUSS Platform. 2024. Available online: https://www.aptech.com/ (accessed on 10 January 2024).

- Hatemi-J, A. CItest2b: GAUSS Module to Implement Tests for Cointegration with Two Unknown Structural Breaks, Statistical Software Components G00006, Boston College Department of Economics. 2009. Available online: https://ideas.repec.org/c/boc/bocode/g00006.html (accessed on 5 February 2023).

- Hatemi-J, A. Essays on the Use of VAR Models in Macroeconomics. Ph.D. Thesis, Econometrics, Department of Economics, Lund University, Lund, Sweden, 1999. [Google Scholar]

- Hatemi-J, A. Time-Series Econometrics Applied to Macroeconomic Issues. Ph.D. Thesis, Internationella Handelshögskolan, Jonkoping University, Jönköping, Sweden, 2001. [Google Scholar]

- Hatemi-J, A. A new method to choose optimal lag order in stable and unstable VAR models. Appl. Econ. Lett. 2003, 10, 135–137. [Google Scholar] [CrossRef]

- Hacker, R.; Hatemi-J, A. Optimal lag-length choice in stable and unstable VAR models under situations of homoscedasticity and ARCH. J. Appl. Stat. 2008, 35, 601–615. [Google Scholar] [CrossRef]

- Mustafa, A.; Hatemi-J, A. A VBA module simulation for finding optimal lag order in time series models and its use on teaching financial data computation. Appl. Comput. Inform. 2022, 18, 208–220. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Mustafa, A.; Hatemi-J, A. PMCT2ES: Python Module for Cointegration Tests with Two Endogenous Structural Shifts. Statistical Software Components, Nr. P00002, Boston College Department of Economics. 2022. Available online: https://ideas.repec.org/c/boc/bocode/p00002.html (accessed on 21 March 2024).

| Parameters | Estimated Parameters | Standard Errors | t-Statistics |

|---|---|---|---|

| 1.345052 | 0.356620 | 3.771663 | |

| 4.784411 | 0.403131 | 11.868144 | |

| 0.510514 | 0.298069 | 1.712736 | |

| 0.825965 | 0.050246 | 16.438452 | |

| −0.636381 | 0.056591 | −11.245172 | |

| −0.071286 | 0.040834 | −1.745746 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hatemi-J, A.; Mustafa, A. A Python Module for Implementing Cointegration Tests with Multiple Endogenous Structural Breaks. Eng. Proc. 2024, 68, 10. https://doi.org/10.3390/engproc2024068010

Hatemi-J A, Mustafa A. A Python Module for Implementing Cointegration Tests with Multiple Endogenous Structural Breaks. Engineering Proceedings. 2024; 68(1):10. https://doi.org/10.3390/engproc2024068010

Chicago/Turabian StyleHatemi-J, Abdulnasser, and Alan Mustafa. 2024. "A Python Module for Implementing Cointegration Tests with Multiple Endogenous Structural Breaks" Engineering Proceedings 68, no. 1: 10. https://doi.org/10.3390/engproc2024068010

APA StyleHatemi-J, A., & Mustafa, A. (2024). A Python Module for Implementing Cointegration Tests with Multiple Endogenous Structural Breaks. Engineering Proceedings, 68(1), 10. https://doi.org/10.3390/engproc2024068010