Evaluation of Economic Interventions in Economic Blocks during an Economic and Sanitary Crisis †

Abstract

:1. Introduction

2. Literature Review

3. Data and Indicators

4. Methodology

yt = βt, 1GDPtMX,1 + βt, 2GDPtMX,2 + μt + εt

yt = βt, 1GDPtCA,1 + βt, 2GDPtCA,2 + μt + εt

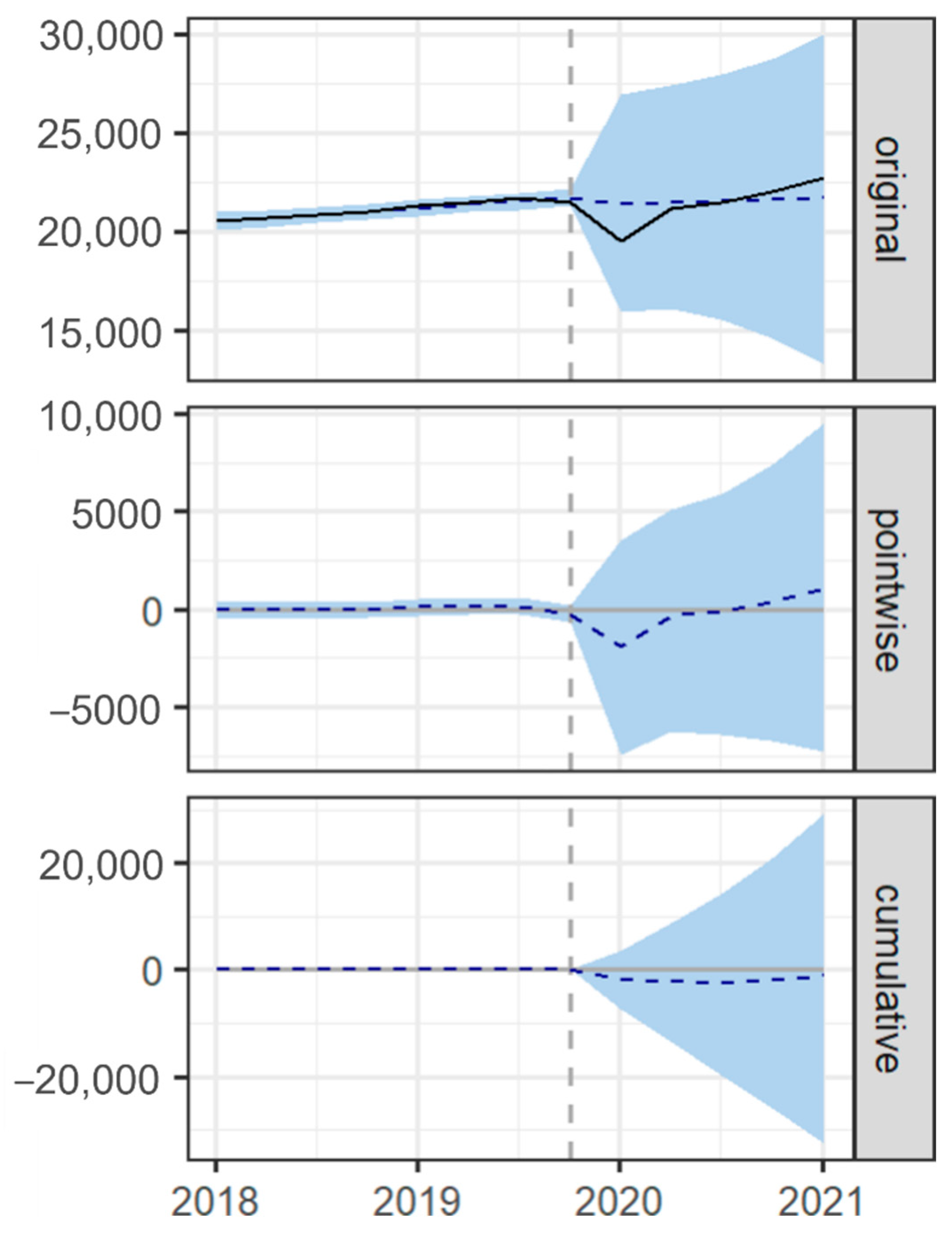

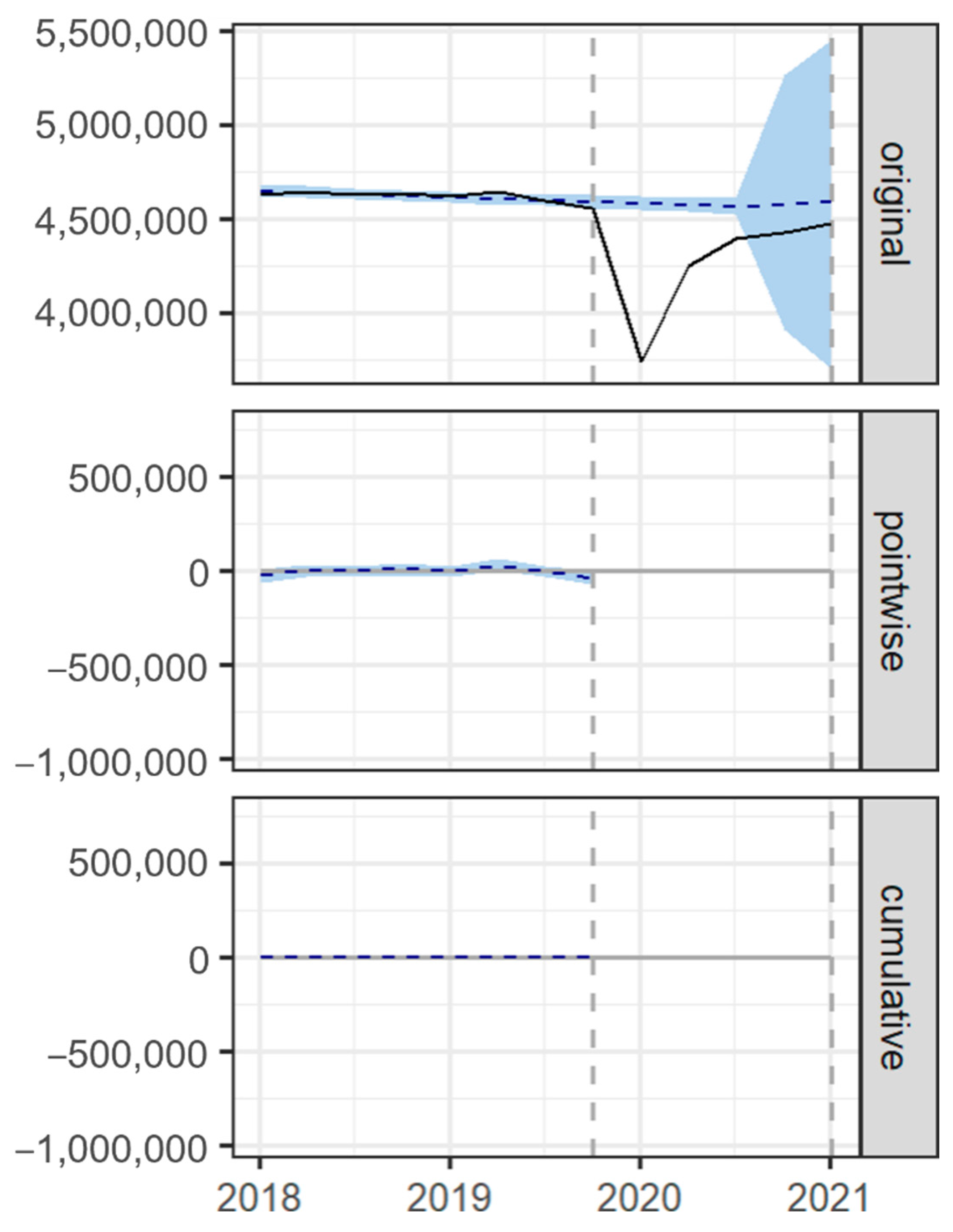

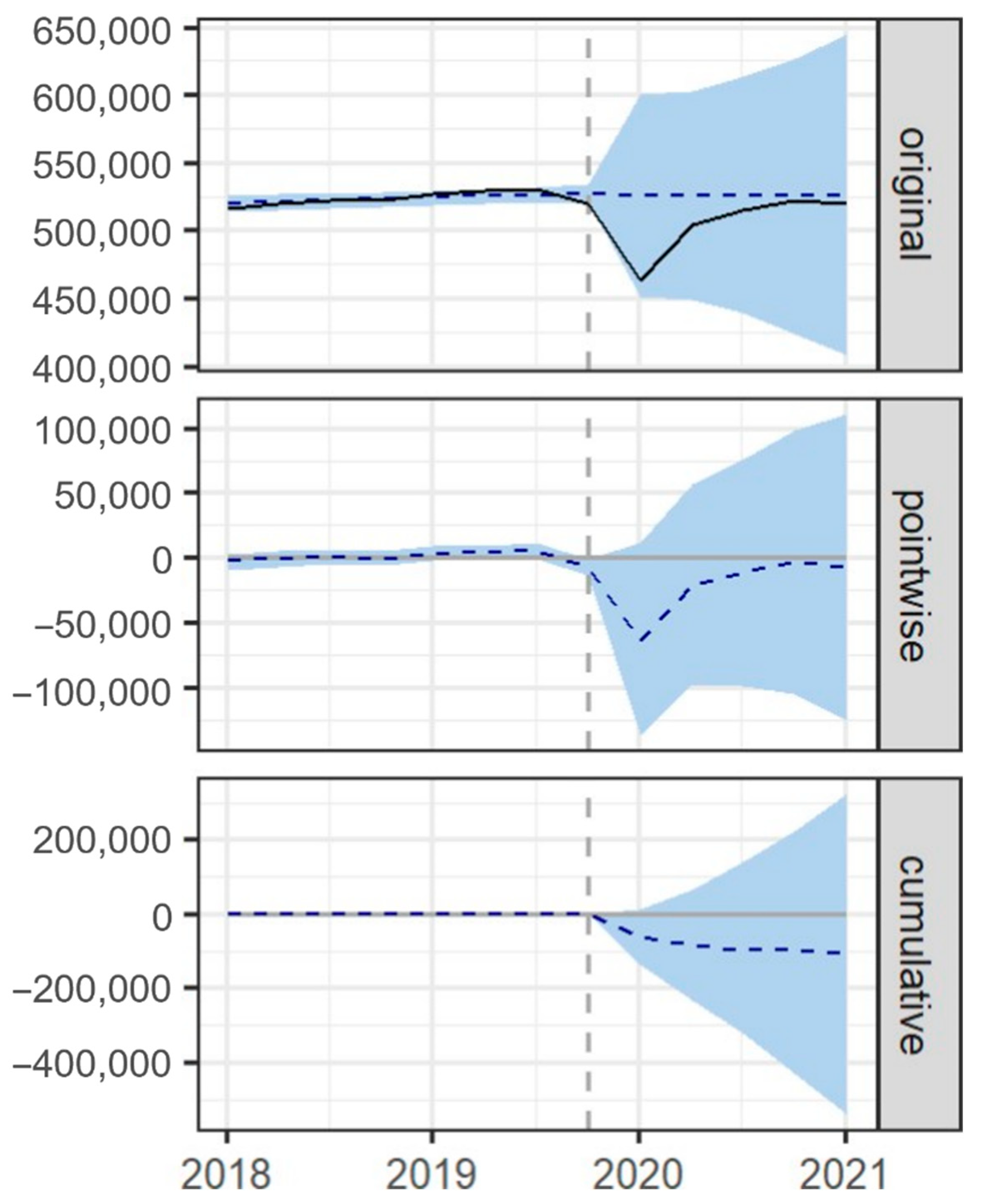

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Knaul, F.M.; Touchton, M.; Arreola-Ornelas, H.; Atun, R.; Calderon Anyosa, R.J.C.; Frenk, J.; Martínez-Valle, A.; McDonald, T.; Porteny, T.; Sánchez-Talanquer, M.; et al. Punt Politics as Failure of Health System Stewardship: Evidence from the COVID-19 Pandemic Response in Brazil and Mexico. Lancet Reg. Health Am. 2021, 4, 100086. [Google Scholar] [CrossRef] [PubMed]

- Coronado, S.; Martínez, J.; Venegas-Martínez, F. Spillover Effects of the US Economic Policy Uncertainty in Latin America. Estud. Econ. 2020, 47, 273–293. [Google Scholar] [CrossRef]

- Gómez-Zaldívar, M.; Fonseca, F.; Mosqueda, M.; Gómez-Zaldívar, F. Spillover effects of economic complexity on the per capita GDP growth rates of Mexican states, 1993–2013. Estud. Econ. 2020, 47, 221–243. Available online: https://estudiosdeeconomia.uchile.cl/index.php/EDE/article/view/59171/64326 (accessed on 11 March 2022). [CrossRef]

- Ciuriak, D. From NAFTA to USMCA and the Evolution of US Trade Policy (June 25, 2019). Verbatim, C.D. Howe Institute (2019). Available online: https://ssrn.com/abstract=3369291 (accessed on 4 March 2022).

- U.S. Census Bureau. 2020 Census Results. 2023. Available online: https://www.census.gov/programs-surveys/decennial-census/decade/2020/2020-census-results.html (accessed on 15 July 2024).

- U.S. Department of the Treasury. COVID-19 Economic Relief. (n.d.). Frontpage. Available online: https://home.treasury.gov/policy-issues/coronavirus (accessed on 6 March 2022).

- SBA’s Office of Advocacy. Small Businesses Generate 44 Percent of U.S. Economic Activity. 30 January 2019. Available online: https://advocacy.sba.gov/2019/01/30/small-businesses-generate-44-percent-of-u-s-economic-activity/ (accessed on 4 March 2022).

- Baig, A.S.; Butt, H.A.; Haroon, O.; Rizvi, S.A. Deaths, panic, Lockdowns and US equity markets: The case of Covid-19 pandemic. Financ. Res. Lett. 2021, 38, 101701. [Google Scholar] [CrossRef] [PubMed]

- IMF. Policy Responses to COVID19; IMF: Washington, DC, USA, 2020; Available online: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19 (accessed on 11 March 2022).

- Hetzel, R. COVID-19 and the Fed’s Credit Policy; Working Paper; Mercatus Center, George Mason University: Arlington, VA, USA, 2020. [Google Scholar]

- Oyewale, A.; Adebayo, O.; Kehinde, O. Estimating the Impact of COVID-19 on Small and Medium Scale Enterprise: Evidence from Nigeria. OJBM 2020, 9, 1–19. [Google Scholar] [CrossRef]

- Selgin, G. The fiscal and monetary response to COVID-19: What the Great Depression has—and hasn’t—taught us. Econ. Aff. 2021, 41, 3–20. [Google Scholar] [CrossRef]

- Ritchie, H.; Mathieu, E.; Rodés-Guirao, L.; Appel, C.; Giattino, C.; Ortiz-Ospina, E.; Hasell, J.; Macdonald, B.; Dattani, S.; Roser, M. Canada: Coronavirus Pandemic Country Profile. Our World in Data. 2022. Available online: https://ourworldindata.org/coronavirus/country/canada (accessed on 26 March 2022).

- Consolidated Canadian Government Finance Statistics, 2020; Statistics Canada: Canada’s National Statistical Agency/Statistique Canada: Organisme Statistique National du Canada: Ottawa, ON, Canada, 2021. Available online: https://www150.statcan.gc.ca/n1/daily-quotidien/211122/dq211122a-eng.htm (accessed on 5 March 2022).

- Harris, K. Part-Time, Contract, and Seasonal Workers Now Qualify for COVID-19 Emergency. CBC News, 15 April 2020. Available online: https://www.cbc.ca/news/politics/cerb-emergency-benefits-trudeau-1.5532767(accessed on 5 March 2022).

- Government of Canada. Claims to Date—Canada Emergency Wage Subsidy (CEWS). 2020. Available online: https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-wage-subsidy/cews-statistics.html (accessed on 10 March 2022).

- International Monetary Fund. Real Gross Domestic Product for Canada [NGDPRSAXDCCAQ], Retrieved from FRED, Federal Reserve Bank of St. Louis. Available online: https://fred.stlouisfed.org/series/NGDPRSAXDCCAQ (accessed on 22 May 2023).

- Béland, D.; Dinan, S.; Rocco, P.; Waddan, A. Social policy responses to COVID-19 in Canada and the United States: Explaining policy variations between two liberal welfare state regimes. Soc. Policy Adm. 2020, 55, 280–294. [Google Scholar] [CrossRef]

- Ritchie, H.; Mathieu, E.; Rodés-Guirao, L.; Appel, C.; Giattino, C.; Ortiz-Ospina, E.; Hasell, J.; Macdonald, B.; Dattani, S.; Roser, M. Mexico: Coronavirus Pandemic Country Profile. Our World in Data. 2022. Available online: https://ourworldindata.org/coronavirus/country/mexico (accessed on 16 March 2022).

- Hannan, S.A.; Honjo, K.; Raissi, M. Mexico needs a fiscal twist: Response to COVID-19 and beyond. Int. Econ. 2022, 169, 175–190. [Google Scholar] [CrossRef]

- Wagner, A.K.; Soumerai, S.B.; Zhang, F.; Ross-Degnan, D. Segmented regression analysis of interrupted time series studies in medication use research. J. Clin. Pharm. Ther. 2002, 27, 299–309. [Google Scholar] [CrossRef]

- Galster, G.; Temkin, K.; Walker, C.; Sawyer, N. Measuring the impacts of community development initiatives: A new application of the adjusted interrupted time-series method. Eval. Rev. 2004, 28, 502–538. [Google Scholar] [CrossRef] [PubMed]

- Jandoc, R.; Burden, A.M.; Mamdani, M.; Lévesque, L.E.; Cadarette, S.M. Interrupted time series analysis in drug utilization research is increasing: Systematic review and recommendations. J. Clin. Epidemiol. 2015, 68, 950–956. [Google Scholar] [CrossRef] [PubMed]

- Kandogan, Y. Consistent Estimates of Regional Blocs’ Trade Effects. Rev. Int. Econ. 2008, 16, 301–314. [Google Scholar] [CrossRef]

- Brauner, J.M.; Mindermann, S.; Sharma, M.; Johnston, D.; Salvatier, J.; Gavenciak, T.; Stephenson, A.B.; Leech, G.; Altman, G.; Mikulik, V.; et al. Inferring the effectiveness of government interventions against COVID-19. Science 2020, 371, eabd9338. [Google Scholar] [CrossRef] [PubMed]

- Brodersen, K.H.; Gallusser, F.; Koehler, J.; Remy, N.; Scott, S.L. Inferring causal impact using Bayesian structural time-series models. Ann. Appl. Stat. 2015, 9, 247–274. [Google Scholar] [CrossRef]

- OECD Policy Responses to Coronavirus (COVID-19): First Lessons from Government Evaluations of COVID-19 Responses a Synthesis; OECD: Paris, France, 2022; Available online: https://www.oecd.org/coronavirus/policy-responses/first-lessons-from-government-evaluations-of-covid-19-responses-a-synthesis-483507d6/#section-d1e638 (accessed on 1 March 2022).

- Eryarsoy, E.; Shahmanzari, M.; Tanrisever, F. Models for government intervention during a pandemic. Eur. J. Oper. Res. 2022, 304, 69–83. [Google Scholar] [CrossRef]

- Antwi-Boasiako, J.; Abbey, C.O.; Ogbey, P.; Ofori, R.A. Policy responses to fight COVID-19; the case of Ghana. Rev. Adm. Pública 2021, 55, 122–139. [Google Scholar] [CrossRef]

- Sullivan, E.; Wolff, E.A. Politics, pandemics, and support: The role of political actors in Dutch state aid during COVID-19. Rev. Adm. Pública 2021, 55, 50–71. [Google Scholar] [CrossRef]

- Ashford, N.A.; Hall, R.P.; Arango-Quiroga, J.; Metaxas, K.A.; Showalter, A.L. Addressing inequality: The first step beyond COVID-19 and towards Sustainability. Sustainability 2020, 12, 5404. [Google Scholar] [CrossRef]

- Aspachs, O.; Durante, R.; Graziano, A.; Mestres, J.; Reynal-Querol, M.; Montalvo, J.G. Tracking the impact of COVID-19 on economic inequality at High Frequency. PLoS ONE 2021, 16, e0249121. [Google Scholar] [CrossRef] [PubMed]

- Danielli, S.; Patria, R.; Donnelly, P.; Ashrafian, H.; Darzi, A. Economic interventions to ameliorate the impact of COVID-19 on the economy and health: An international comparison. J. Public Health 2020, 43, 42–46. [Google Scholar] [CrossRef] [PubMed]

- Zaremba, A.; Aharon, D.Y.; Demir, E.; Kizys, R.; Zawadka, D. COVID-19, government policy responses, and stock market liquidity around the world: A note. Res. Int. Bus. Financ. 2021, 56, 101359. [Google Scholar] [CrossRef] [PubMed]

- Tuyiseng, G.; Goldenberg, S.M. COVID-19, structural racism, and migrant health in Canada. Lancet 2021, 397, 650–652. [Google Scholar] [CrossRef] [PubMed]

| Country | Variables | Obs. | Median | SD | Var | Min | Max |

|---|---|---|---|---|---|---|---|

| US | GDP | 16 | 2.148 | 1.126 | 1.268 | 1.948 | 2.401 |

| Mexico | GDP | 16 | 4.558 | 2.342 | 5.486 | 3.744 | 4.646 |

| Canada | GDP | 16 | 5.218 | 1.697 | 2.881 | 4.630 | 5.354 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Montante, C.; Hernandez-Rodriguez, C. Evaluation of Economic Interventions in Economic Blocks during an Economic and Sanitary Crisis. Eng. Proc. 2024, 68, 55. https://doi.org/10.3390/engproc2024068055

Montante C, Hernandez-Rodriguez C. Evaluation of Economic Interventions in Economic Blocks during an Economic and Sanitary Crisis. Engineering Proceedings. 2024; 68(1):55. https://doi.org/10.3390/engproc2024068055

Chicago/Turabian StyleMontante, Carmin, and Clemente Hernandez-Rodriguez. 2024. "Evaluation of Economic Interventions in Economic Blocks during an Economic and Sanitary Crisis" Engineering Proceedings 68, no. 1: 55. https://doi.org/10.3390/engproc2024068055