Bitcoin Cycle through Markov Regime-Switching Model †

Abstract

1. Introduction

2. Statistical Methodology and Data Description

2.1. MS Model

2.2. Data Description

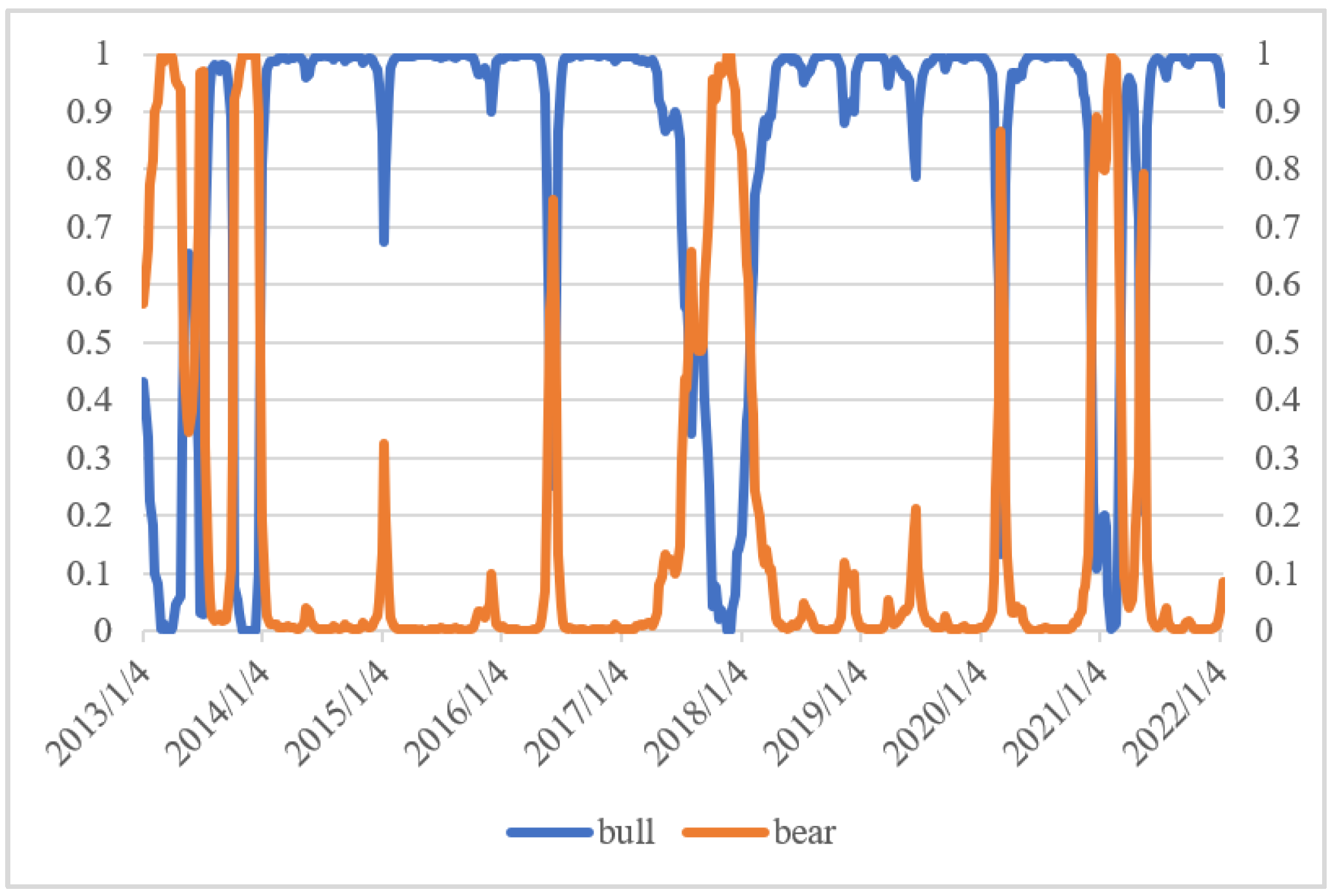

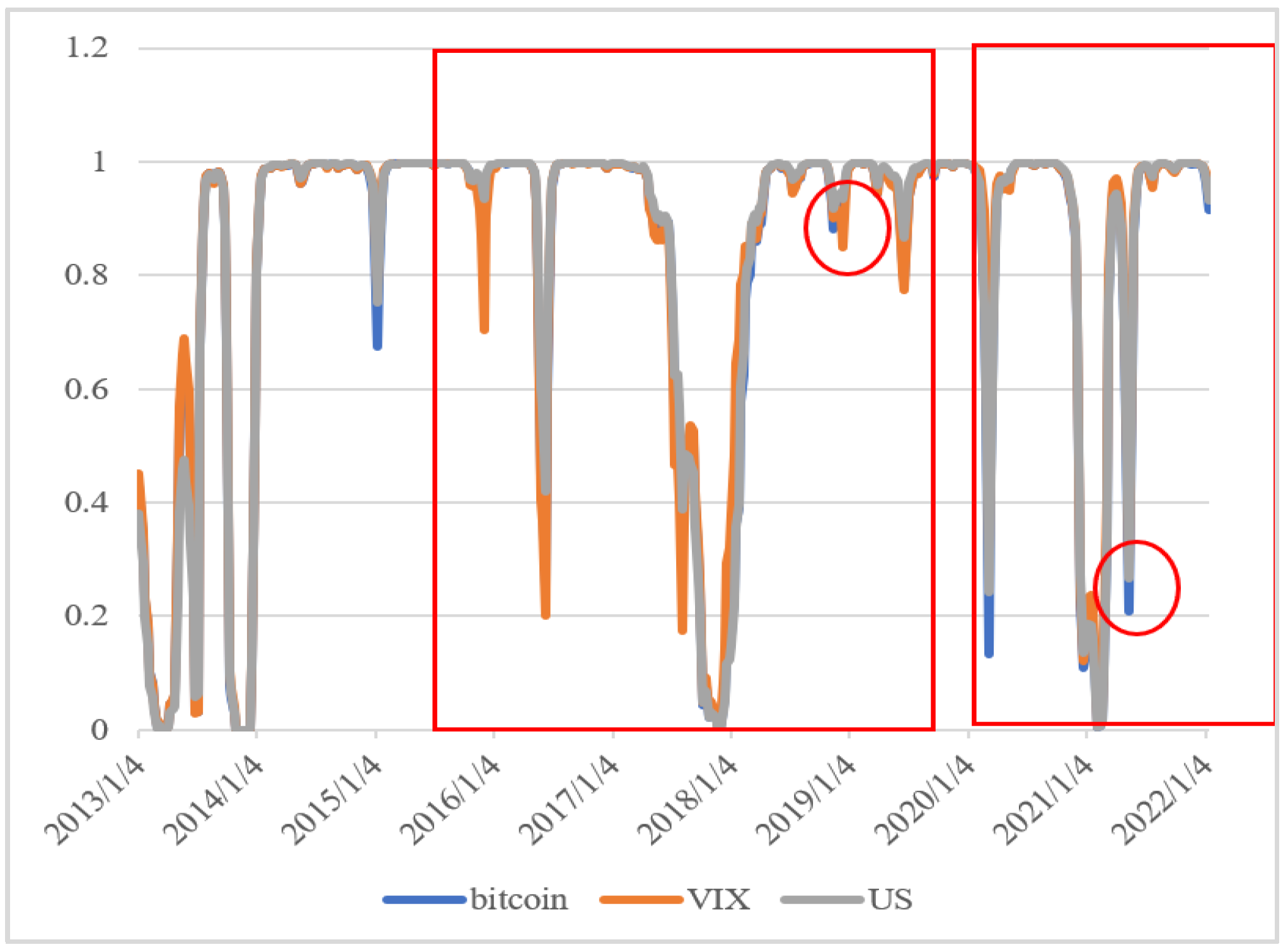

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Cross, J.L.; Hou, C.; Trinh, K. Returns, volatility and the cryptocurrency bubble of 2017–18. Econ. Model. 2021, 104, 105643. [Google Scholar] [CrossRef]

- Dong, F.; Xu, Z.; Zhang, Y. Bubbly Bitcoin. Econ. Theory 2021, 74, 973–1015. [Google Scholar] [CrossRef]

- Choi, S.; Shin, J. Bitcoin: An inflation hedge but not a safe haven. Financ. Res. Lett. 2022, 46, 102379. [Google Scholar] [CrossRef] [PubMed]

- Zhu, Y.; Dickinson, D.; Li, J. Analysis on the influence factors of Bitcoin’s price based on VEC model. Financ. Innov. 2017, 3, 3. [Google Scholar] [CrossRef]

- Blau, B.M.; Griffith, T.G.; Whitby, R.J. Inflation and Bitcoin: A descriptive time-series analysis. Econ. Lett. 2021, 203, 109848. [Google Scholar] [CrossRef]

- Hsu, P.-P.; Chen, Y.-H.C.; Wang, C.-H. Currency or commodity competition? Bitcoin price trends in the post-pandemic era. Int. J. Appl. Econ. Financ. Account. 2023, 15, 61–70. [Google Scholar] [CrossRef]

- Chen, C.; Liu, L.; Zhao, N. Fear Sentiment, Uncertainty, and Bitcoin Price Dynamics: The Case of COVID-19. Emerg. Mark. Financ. Trade 2020, 56, 2298–2309. [Google Scholar] [CrossRef]

- Burns, A.F.; Mitchell, W.C. Measuring Business Cycles; Columbia University Press (for NBER): New York, NY, USA, 1946. [Google Scholar]

- Wang, J.; Ma, F.; Bouri, E.; Guo, Y. Which factors drive Bitcoin volatility: Macroeconomic, technical, or both? J. Forecast. 2022, 42, 970–988. [Google Scholar] [CrossRef]

- Hamilton, J.D. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Mérida, A.; Golpe, A.A. Tourism-Led Growth Revisited for Spain: Causality, Business Cycles and Structural Breaks. Int. J. Tour. Res. 2014, 18, 39–51. [Google Scholar] [CrossRef]

- Hsu, P.-P. Examination of Taiwan’s travel and tourism market cycle through a two-period Markov regime-switching model. Tour. Manag. 2017, 63, 201–208. [Google Scholar] [CrossRef]

| Model I | Model II | Model III | Model IV | ||||

|---|---|---|---|---|---|---|---|

| 0.007 | 0.007 | 0.007 | 0.007 | ||||

| 0.053 | 0.053 | 0.053 | 0.053 | ||||

| 0.010 | −0.061 | −0.654 | −0.063 | ||||

| 0.091 | 0.010 | 0.010 | −0.753 | ||||

| 0.975 | 0.101 | 0.091 | 0.010 | ||||

| 0.119 | 0.975 | 0.979 | 0.102 | ||||

| 0.025 | 0.128 | 0.103 | 0.982 | ||||

| 0.881 | 0.025 | 0.021 | 0.098 | ||||

| 0.872 | 0.897 | 0.018 | |||||

| 0.902 | |||||||

| Duration | |||||||

| 40.357 | 39.508 | 47.970 | 54.595 | ||||

| 8.409 | 7.843 | 9.701 | 10.212 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shih, Y.-C.; Huang, W.-T.; Hsu, P.-P. Bitcoin Cycle through Markov Regime-Switching Model. Eng. Proc. 2024, 74, 12. https://doi.org/10.3390/engproc2024074012

Shih Y-C, Huang W-T, Hsu P-P. Bitcoin Cycle through Markov Regime-Switching Model. Engineering Proceedings. 2024; 74(1):12. https://doi.org/10.3390/engproc2024074012

Chicago/Turabian StyleShih, Yi-Chun, Wen-Tsung Huang, and Pao-Peng Hsu. 2024. "Bitcoin Cycle through Markov Regime-Switching Model" Engineering Proceedings 74, no. 1: 12. https://doi.org/10.3390/engproc2024074012

APA StyleShih, Y.-C., Huang, W.-T., & Hsu, P.-P. (2024). Bitcoin Cycle through Markov Regime-Switching Model. Engineering Proceedings, 74(1), 12. https://doi.org/10.3390/engproc2024074012