Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness

Abstract

:1. Introduction

2. Mechanism Design for Peer-to-Peer Energy Trading

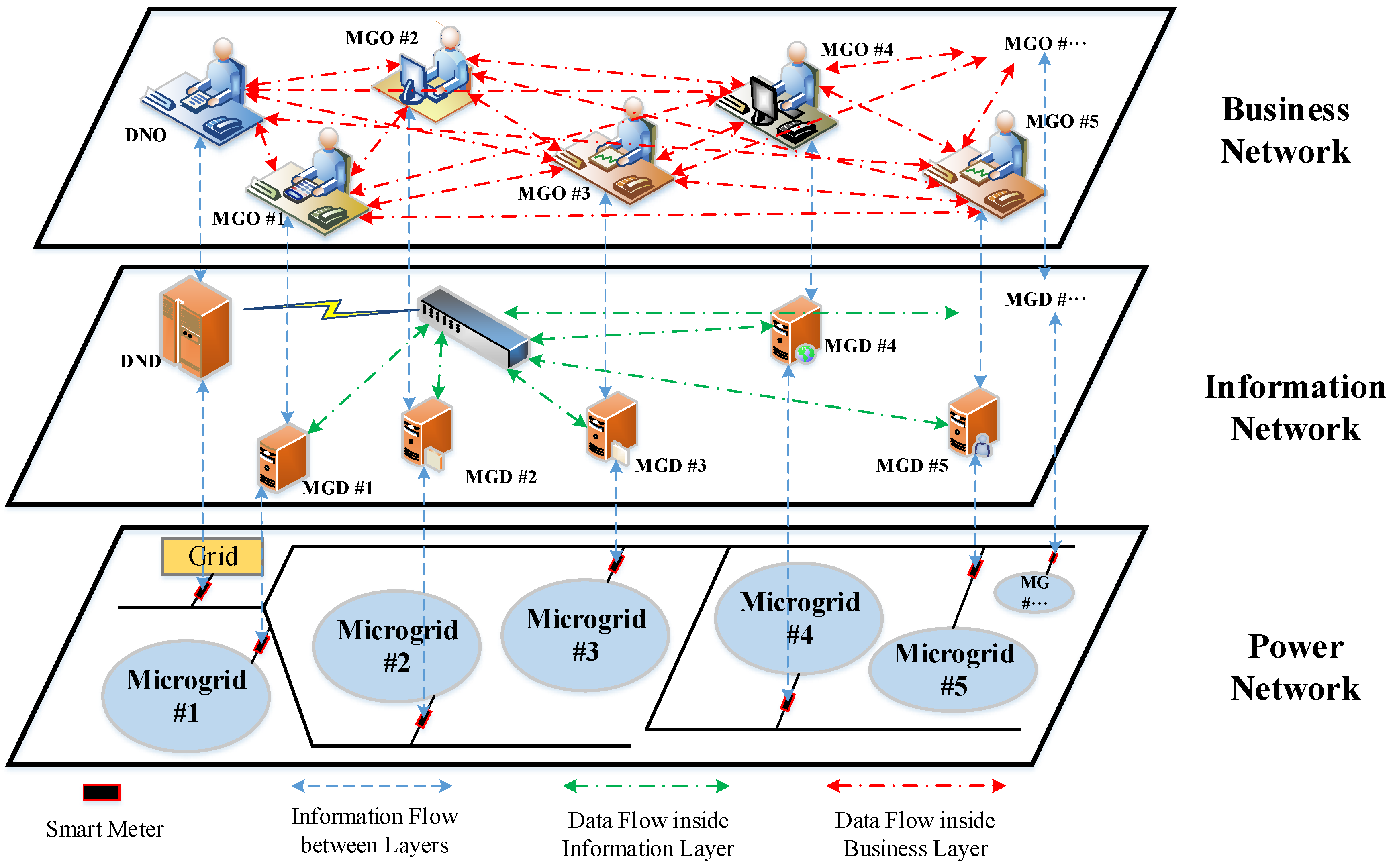

2.1. Three-Layer System Architecture for Peer-to-Peer Energy Trading

2.2. Peer-to-Peer Energy Trading Mechanism

2.2.1. Scheduling and Bidding Mechanism

2.2.2. Exchange Mechanism

2.2.3. Settlement Mechanism

3. Parallel Multidimensional Willingness Bidding Strategy

3.1. Multidimensional Willingness of Microgrids

3.1.1. Historical Trading Records

3.1.2. Counter Behavior to Bidding Price

3.1.3. Time Pressure

3.1.4. Matching Degree of Bidding Quantity

3.1.5. Real-Time Supply-Demand Relationship

3.2. Parallel Multidimensional Willingness Bidding Strategy

- is the highest bidding price limitation in the market, which is set as the selling price of the grid in time slot t.

- is the lowest bidding price limitation in the market, which is set as the purchasing price of the grid in time slot t.

- is the reservation price for the seller microgrid. Seeing that the energy from the seller microgrid is produced by RES, is calculated by the equation below:in which represents the price caused by the daily maintenance of DERs and represents the power transmission price from microgrid i to j. ensures that the trading price is no less than the marginal price of generation.

- is the reservation price for the buyer microgrid, which is set as the selling price of the grid in time slot t. It is guaranteed that energy will not be purchased at a price higher than the current selling price of the grid.

- / is the price offer given by the seller/buyer microgrid in the current market.

- is the basic size of the pricing step and remains unchanged during a round of bidding, which is calculated at the beginning of a round using:

4. Case Studies and Simulation Results

4.1. Case Study 1: Effectiveness Verification of the Proposed PMWBS

4.2. Case Study 2: Bidding Performance of P2P Energy Trading

4.2.1. Bidding Results of P2P Energy Trading

4.2.2. Preference Analysis for Trading Target

4.2.3. Quantity Analysis on P2P Energy Trading

4.2.4. Profit Analysis on Two Energy-Trading Mechanisms

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Distributed Power Flow Calculation and Congestion Price Formation

Appendix B. Supplementary Case Data from the Guizhou Grid, China

| j | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| i | ||||||||||||||||

| 1 | 0 | 10.2 | 14.5 | 149.7 | 162 | 171.1 | 50.3 | 21.6 | 175.0 | 178.2 | 182.3 | 75 | 184.3 | 119.6 | ||

| 2 | 10.2 | 0 | 17.9 | 159.2 | 171.9 | 183.4 | 60.1 | 17 | 183.2 | 188.3 | 192 | 85.6 | 197.2 | 131 | ||

| 3 | 14.5 | 17.9 | 0 | 165.3 | 177 | 185.3 | 5.6 | 24.8 | 186.8 | 193.5 | 196 | 91.7 | 202.9 | 135.2 | ||

| 4 | 149.7 | 159.2 | 165.3 | 0 | 12.1 | 220.5 | 102.6 | 175 | 22.7 | 27.1 | 231.5 | 125.2 | 234.9 | 172 | ||

| 5 | 162 | 171.9 | 177 | 12.1 | 0 | 232 | 112.2 | 187.3 | 34.8 | 39.3 | 242.6 | 137 | 247.5 | 182.4 | ||

| 6 | 171.1 | 183.4 | 185.3 | 220.5 | 232 | 0 | 122.4 | 95.9 | 242 | 247.7 | 10.2 | 145.6 | 15 | 192.1 | ||

| 7 | 50.3 | 60.1 | 5.6 | 102.6 | 112.2 | 122.4 | 0 | 75.2 | 122.3 | 127.8 | 130.5 | 25 | 135.9 | 70.4 | ||

| 8 | 21.6 | 17 | 24.8 | 175 | 187.3 | 95.9 | 75.2 | 0 | 197.1 | 202.3 | 205.7 | 100.4 | 213.8 | 145 | ||

| 9 | 175.0 | 183.2 | 186.8 | 22.7 | 34.8 | 242 | 122.3 | 197.1 | 0 | 36.2 | 252.3 | 147.6 | 257 | 192.9 | ||

| 10 | 178.2 | 188.3 | 193.5 | 27.1 | 39.3 | 247.7 | 127.8 | 202.3 | 36.2 | 0 | 257 | 152.4 | 262.6 | 197 | ||

| 11 | 182.3 | 192 | 196 | 231.5 | 242.6 | 10.2 | 130.5 | 205.7 | 252.3 | 257 | 0 | 155.1 | 15.9 | 204.7 | ||

| 12 | 75 | 85.6 | 91.7 | 125.2 | 137 | 145.6 | 25 | 100.4 | 147.6 | 152.4 | 155.1 | 0 | 160.5 | 95.1 | ||

| 13 | 184.3 | 197.2 | 202.9 | 234.9 | 247.5 | 15 | 135.9 | 213.8 | 257 | 262.6 | 15.9 | 160.5 | 0 | 205.7 | ||

| 14 | 119.6 | 131 | 135.2 | 172 | 182.4 | 192.1 | 70.4 | 145 | 192.9 | 197 | 204.7 | 95.1 | 205.7 | 0 | ||

| Time Interval | Interval Type | Price (CNY/kWh) |

|---|---|---|

| 08:00–11:00, 18:00–21:00 | Peak | 1.197 |

| 06:00–08:00, 11:00–18:00, 21:00–22:00 | Flat | 0.744 |

| 22:00–06:00 | Valley | 0.356 |

References

- Soares, J.; Silva, M.; Sousa, T.; Vale, Z.; Morais, H. Distributed energy resource short-term scheduling using Signaled Particle Swarm Optimization. Energy 2012, 42, 466–476. [Google Scholar] [CrossRef] [Green Version]

- Yang, Y.; Zhang, S.; Xiao, Y. Optimal design of distributed energy resource systems coupled with energy distribution networks. Energy 2015, 85, 433–448. [Google Scholar] [CrossRef]

- Li, J.; Poulton, G.; James, G. Coordination of Distributed Energy Resource Agents. Appl. Artif. Intell. 2010, 24, 351–380. [Google Scholar] [CrossRef]

- Liu, Y.; Yuen, C.; Hassan, N.U.; Huang, S.; Yu, R.; Xie, S. Electricity Cost Minimization for a Microgrid with Distributed Energy Resource under Different Information Availability. IEEE Trans. Ind. Electron. 2015, 62, 2571–2583. [Google Scholar] [CrossRef]

- Kim, J.; Jeon, J.; Kim, S.; Cho, C.; Park, J.H.; Kim, H.; Nam, K. Cooperative Control Strategy of Energy Storage System and Microsources for Stabilizing the Microgrid during Islanded Operation. IEEE Trans. Power Electron. 2010, 25, 3037–3048. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. Energy-Sharing Model with Price-Based Demand Response for Microgrids of Peer-to-Peer Prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, R.; Zhang, T.; Liu, Y.; Guo, B. Model predictive control-based operation management for a residential microgrid with considering forecast uncertainties and demand response strategies. IET Gener. Transm. Distrib. 2016, 10, 2367–2378. [Google Scholar] [CrossRef]

- Peik-Herfeh, M.; Seifi, H.; Sheikh-El-Eslami, M.K. Decision making of a virtual power plant under uncertainties for bidding in a day-ahead market using point estimate method. Int. J. Electr. Power Energy Syst. 2013, 44, 88–98. [Google Scholar] [CrossRef]

- Oprea, S.V.; Bâra, A.; Ifrim, G. Flattening the electricity consumption peak and reducing the electricity payment for residential consumers in the context of smart grid by means of shifting optimization algorithm. Comput. Ind. Eng. 2018, 122, 125–139. [Google Scholar] [CrossRef]

- Najafi, F.; Hamzeh, M.; Fripp, M. Unbalanced Current Sharing Control in Islanded Low Voltage Microgrids. Energies 2018, 11, 2776. [Google Scholar] [CrossRef]

- Pouttu, A.; Haapola, J.; Ahokangas, P.; Xu, Y.; Kopsakangas-Savolainen, M.; Porras, E.; Matamoros, J.; Kalalas, C.; Alonso-Zarate, J.; Gallego, F.D.; et al. P2P model for distributed energy trading, grid control and ICT for local smart grids. In Proceedings of the 2017 European Conference on Networks and Communications (EuCNC), Oulu, Finland, 12–15 June 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Liu, Y.; Guo, L.; Wang, C. A robust operation-based scheduling optimization for smart distribution networks with multi-microgrids. Appl. Energy 2018, 228, 130–140. [Google Scholar] [CrossRef]

- Liu, Y.; Zuo, K.; Liu, X.A.; Liu, J.; Kennedy, J.M. Dynamic pricing for decentralized energy trading in micro-grids. Appl. Energy 2018, 228, 689–699. [Google Scholar] [CrossRef]

- Wang, Z.; Chen, B.; Wang, J.; kim, J. Decentralized Energy Management System for Networked Microgrids in Grid-Connected and Islanded Modes. IEEE Trans. Smart Grid 2016, 7, 1097–1105. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of Existing Peer-to-Peer Energy Trading Projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Liu, G.; Xu, Y.; Tomsovic, K. Bidding Strategy for Microgrid in Day-Ahead Market Based on Hybrid Stochastic/Robust Optimization. IEEE Trans. Smart Grid 2016, 7, 227–237. [Google Scholar] [CrossRef]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Mattila, J.; Seppälä, T.; Naucler, C.; Stahl, R.; Tikkanen, M.; Bådenlid, A.; Seppälä, J. Industrial Blockchain Platforms: An Exercise in Use Case Development in the Energy Industry; Technical Report 43; The Research Institute of the Finnish Economy: Helsinki, Finland, 2016. [Google Scholar]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Moffaert, K.V.; de Abril, I.M.; Nowé, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 11th International Conference on the European Energy Market (EEM14), Kraków, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar] [CrossRef]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium Blockchain for Secure Energy Trading in Industrial Internet of Things. IEEE Trans. Ind. Inform. 2018, 14, 3690–3700. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Salomie, I.; Bertoncini, M.; Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; et al. Blockchain Based Decentralized Management of Demand Response Programs in Smart Energy Grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef]

- Aitzhan, N.Z.; Svetinovic, D. Security and Privacy in Decentralized Energy Trading Through Multi-Signatures, Blockchain and Anonymous Messaging Streams. IEEE Trans. Dependable Secure Comput. 2018, 15, 840–852. [Google Scholar] [CrossRef]

- Noor, S.; Yang, W.; Guo, M.; van Dam, K.H.; Wang, X. Energy Demand Side Management within micro-grid networks enhanced by blockchain. Appl. Energy 2018, 228, 1385–1398. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Gärttner, J.; Rock, K.; Kessler, S.; Orsini, L.; Weinhardt, C. Designing microgrid energy markets: A case study: The Brooklyn Microgrid. Appl. Energy 2018, 210, 870–880. [Google Scholar] [CrossRef]

- Hahn, A.; Singh, R.; Liu, C.; Chen, S. Smart contract-based campus demonstration of decentralized transactive energy auctions. In Proceedings of the 2017 IEEE Power Energy Society Innovative Smart Grid Technologies Conference (ISGT), Torino, Italy, 26–29 September 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Kang, J.; Yu, R.; Huang, X.; Maharjan, S.; Zhang, Y.; Hossain, E. Enabling Localized Peer-to-Peer Electricity Trading Among Plug-in Hybrid Electric Vehicles Using Consortium Blockchains. IEEE Trans. Ind. Inform. 2017, 13, 3154–3164. [Google Scholar] [CrossRef]

- Wang, G.; Wong, T.N.; Yu, C. A computational model for multi-agent E-commerce negotiations with adaptive negotiation behaviors. J. Comput. Sci. 2013, 4, 135–143. [Google Scholar] [CrossRef]

- Ma, H. Bidding Strategies in Agent-Based Continuous Double Auctions; Springer Science & Business Media: Berlin, Germany, 2008; Google-Books-ID: JC0o9RXsZoEC. [Google Scholar]

- Khorasany, M.; Mishra, Y.; Ledwich, G. Peer-to-peer market clearing framework for DERs using knapsack approximation algorithm. In Proceedings of the 2017 IEEE PES Innovative Smart Grid Technologies Conference Europe (ISGT-Europe), Torino, Italy, 26–29 September 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, L. Negotiation agent with adaptive attitude bidding strategy for facilitating energy exchanges between smart building and utility grid. In Proceedings of the Transmission and Distribution Conference and Exposition (T&D), Orlando, FL, USA, 7–10 May 2012; pp. 1–8. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, L. Adaptive Negotiation Agent for Facilitating Bi-Directional Energy Trading Between Smart Building and Utility Grid. IEEE Trans. Smart Grid 2013, 4, 702–710. [Google Scholar] [CrossRef]

- Yan, X.; Lin, J.; Hu, Z.; Song, Y. P2P trading strategies in an industrial park distribution network market under regulated electricity tariff. In Proceedings of the 2017 IEEE Conference on Energy Internet and Energy System Integration (EI2), Beijing, China, 26–28 November 2017; pp. 1–5. [Google Scholar] [CrossRef]

- Wang, J.; Wang, Q.; Zhou, N.; Chi, Y. A Novel Electricity Transaction Mode of Microgrids Based on Blockchain and Continuous Double Auction. Energies 2017, 10, 1971. [Google Scholar] [CrossRef]

- Shao, W.; Xu, W.; Xu, Z.; Wang, N.; Nong, J. Research on Virtual Power Plant Model based on Blockchain. Comput. Sci. 2018, 45, 25–31. [Google Scholar]

| Time Slot | Item | MG 3 | MG 4 | MG 8 | MG 10 | MG 13 |

|---|---|---|---|---|---|---|

| 9th | Target | MG 13/Grid | MG 10/Grid | MG 6 | MG 4 | MG 3/MG 5/MG 6 |

| Price | 0.527/0.744 | 0.485/0.744 | 0.490 | 0.485 | 0.527/0.500/0.489 | |

| (CNY/kWh) | (26.9%) | (46.0%) | (100.0% ) | (100.0%) | (11.9%/19.7%/68.4%) | |

| 22nd | Target | MG 13/Grid | MG 8 | MG 4/MG 5 | Grid | MG 3 |

| Price | 0.696/1.197 | 0.711 | 0.711/0.691 | 0.300 | 0.696 | |

| (CNY/kWh) | (99.8%) | (100.0%) | (84.1%/15.9%) | (-) | (100.0%) | |

| 33rd | Target | Grid | MG 9 | Grid | Grid | Grid |

| Price | 0.356 | 0.324 | 0.300 | 0.300 | 0.300 | |

| (CNY/kWh) | (-) | (100.0%) | (-) | (-) | (-) |

| MG 1 | MG 2 | MG 3 | MG 4 | MG 5 | MG 6 | MG 7 | |

| Input Before (kWh) | 530.0 | 351.3 | 1540.7 | 1747.2 | 2840.3 | 6787.7 | 2167.5 |

| Input From P2P (kWh) | 267.7 | 146.7 | 617.2 | 956.6 | 1703.8 | 3346.7 | 957.8 |

| (50.5%) | (41.8%) | (40.1%) | (54.8%) | (60.0%) | (49.3%) | (44.2%) | |

| Output Before (kWh) | - | - | - | - | - | - | - |

| Output from P2P (kWh) | - | - | - | - | - | - | - |

| (-) | (-) | (-) | (-) | (-) | (-) | (-) | |

| MG 8 | MG 9 | MG 10 | MG 11 | MG 12 | MG 13 | MG 14 | |

| Input Before (kWh) | - | - | 67.2 | 395.7 | 46.6 | - | 142.1 |

| Input From P2P (kWh) | - | - | 15.2 | 96.3 | 0 | - | 53.17 |

| (-) | (-) | (22.6%) | (24.3%) | (0%) | (-) | (37.4%) | |

| Output Before (kWh) | 3754.1 | 1640.0 | 1208.2 | 813.5 | 1570.3 | 4427.7 | 2088.5 |

| Output From P2P (kWh) | 2364.0 | 1297.7 | 608.0 | 0 | 726.9 | 2545.2 | 619.5 |

| (63.0%) | (79.1%) | (50.3%) | (0%) | (46.3%) | (57.5%) | (29.7%) |

| MG 1 | MG 2 | MG 3 | MG 4 | MG 5 | MG 6 | MG 7 | |

| Profit without P2PET (CNY) | −428.3 | −281.5 | −1224.7 | −1429.4 | −1989.0 | −4542.4 | −1516.6 |

| Profit with P2PET (CNY) | −340.9 | −230.0 | −993.5 | −1090.6 | −1483.0 | −3539.1 | −1199.6 |

| Growth Rate | 20.4% | 18.3% | 18.9% | 23.7% | 25.4% | 22.1% | 20.9% |

| MG 8 | MG 9 | MG 10 | MG 11 | MG 12 | MG 13 | MG 14 | |

| Profit without P2PET (CNY) | 1126.2 | 491.9 | 295.4 | −110.1 | 421.2 | 1328.3 | 515.6 |

| Profit with P2PET (CNY) | 1687.4 | 808.4 | 459.3 | −70.5 | 581.0 | 1874.2 | 708.4 |

| Growth Rate | 49.8% | 64.3% | 55.5% | 36.0% | 37.9% | 41.1% | 37.4% |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, N.; Xu, W.; Xu, Z.; Shao, W. Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness. Energies 2018, 11, 3312. https://doi.org/10.3390/en11123312

Wang N, Xu W, Xu Z, Shao W. Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness. Energies. 2018; 11(12):3312. https://doi.org/10.3390/en11123312

Chicago/Turabian StyleWang, Ning, Weisheng Xu, Zhiyu Xu, and Weihui Shao. 2018. "Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness" Energies 11, no. 12: 3312. https://doi.org/10.3390/en11123312

APA StyleWang, N., Xu, W., Xu, Z., & Shao, W. (2018). Peer-to-Peer Energy Trading among Microgrids with Multidimensional Willingness. Energies, 11(12), 3312. https://doi.org/10.3390/en11123312