3.1. Database and Localization of FDIs in China

Our study makes use of several databases (

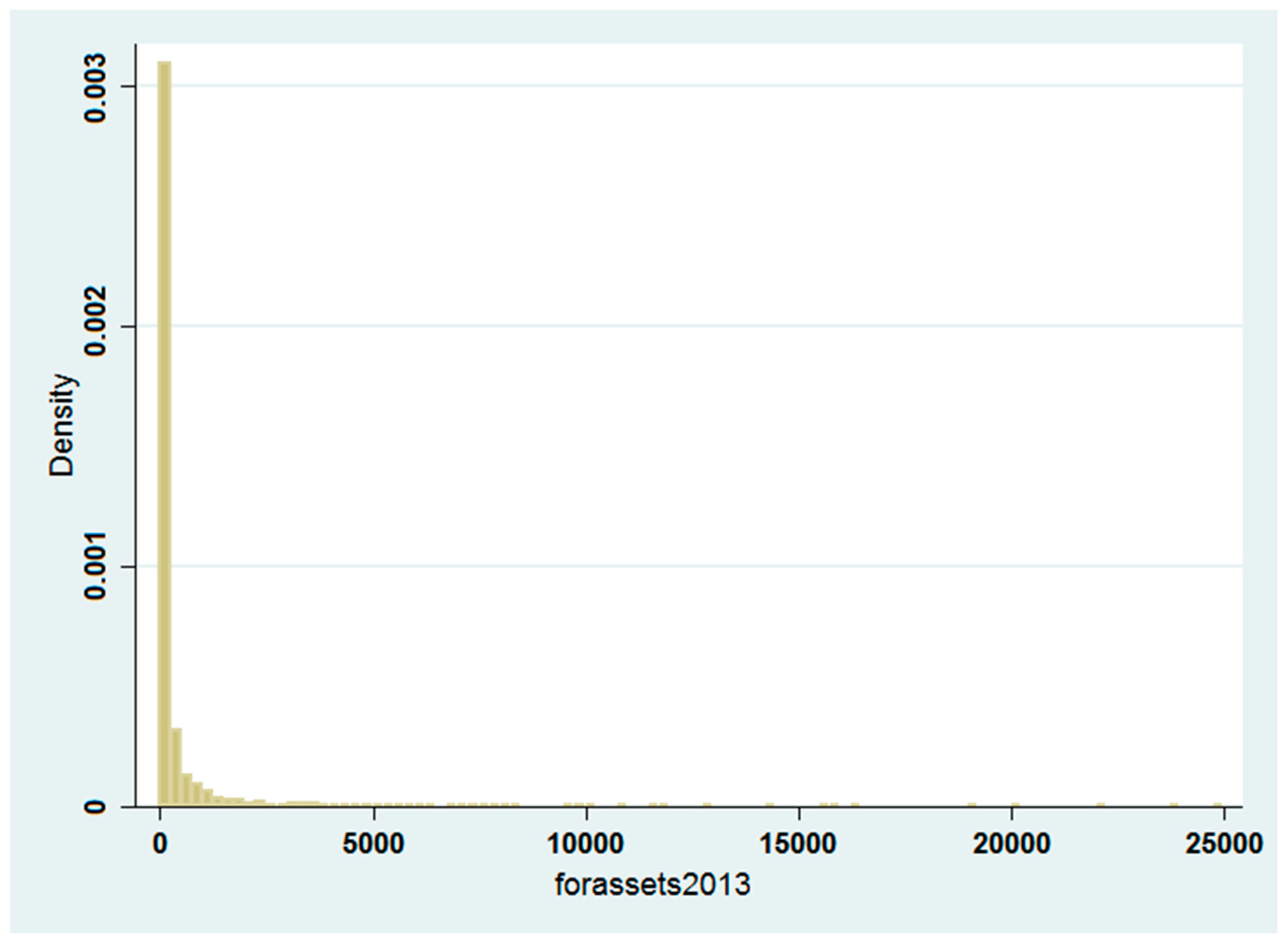

Table A1). In order to investigate the FDI localization dynamics in the pharmaceutical sector, we use China’s Industrial Database, which collects firm-level data obtained from the “Statistical Report on Scale Statistics” conducted by the National Bureau of Statistics of China over the 2004–2013 period. We aggregate the information related to foreign pharmaceutical firms’ total assets at the county-level. In addition, we use data and information from the China Statistical Yearbook, the government website and the software Arcgis. As mentioned before, the spatial distribution of pharmaceutical FDI across Chinese territories is quite heterogeneous, considering both the stock of total assets and the capital accumulation trends. Such a dynamic appears evident in

Figure 1, representing the pharmaceutical FDI intensity in terms of total assets at the county level with respect to the year 2013. As it is possible to see from the map, most of the foreign pharmaceutical enterprises are located in the Eastern areas. In this regards, the first counties in terms of FDI pharmaceutical assets localization are: Huancui District, Yuhua District, Daxing District, Pudong New Area, Daoli District (

Table A2); on the other hand, many counties located in the Northern, Central and Western areas exhibit lower or no FDI in pharmaceuticals.

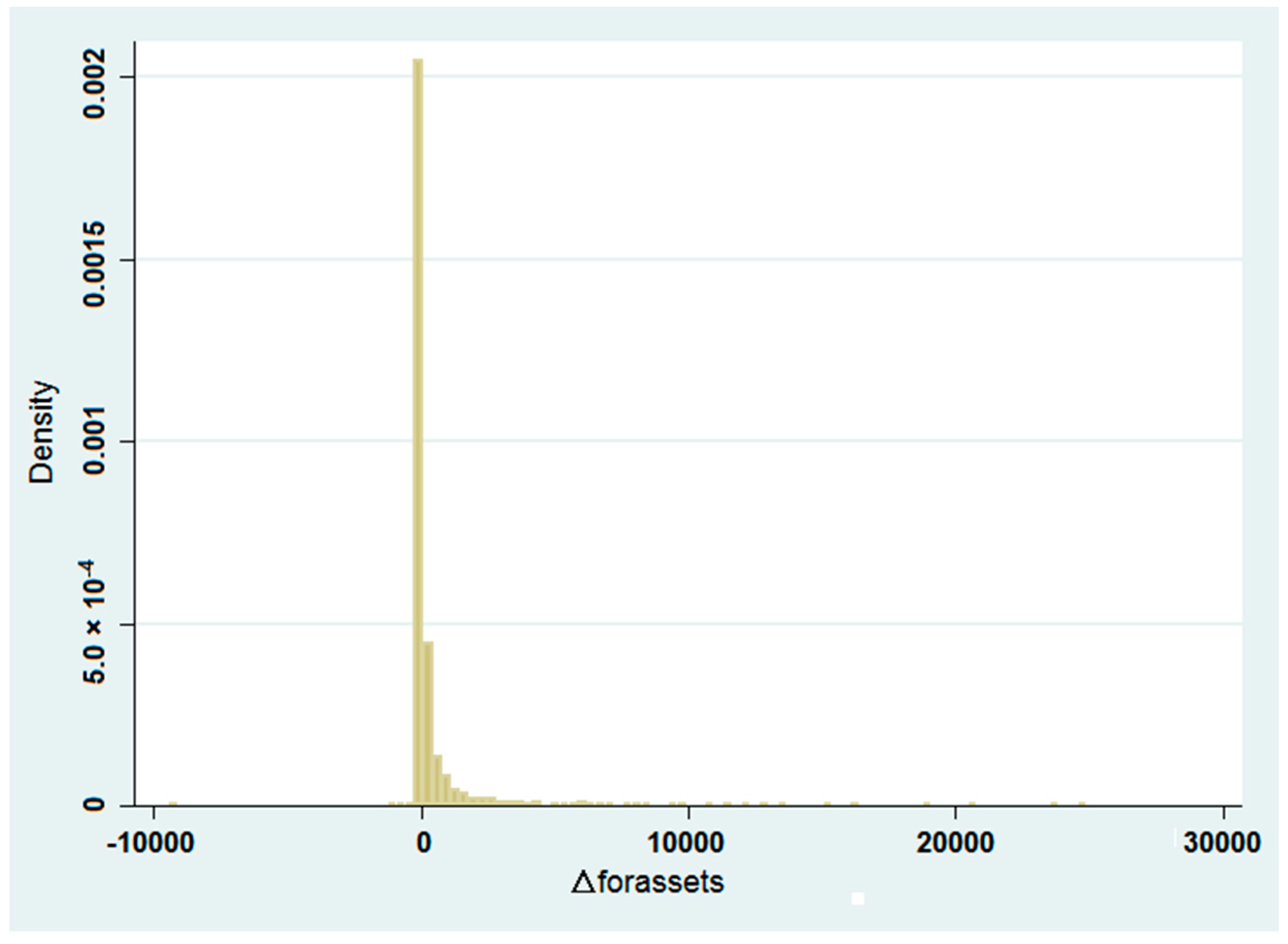

Focusing on the changes that occurred in pharmaceutical FDI total assets over the period from 2004–2013,

Figure 2 shows a similar heterogeneous spatial pattern, partially confirming the trends analysed previously. In particular, the map displays significant increases in pharmaceutical FDI total assets have mainly occurred in the Eastern coastal counties as well as in many counties located in the central provinces of Hubei, Hunan and Jianxi (

Table A3). At the same time, some other East and Southeast counties located in the Hebei, Liaoning, Jiangsu and Guangdong provinces have experienced a significant reduction in pharmaceutical FDI total assets.

From this perspective, this descriptive analysis of the spatial distribution of pharmaceutical FDI demonstrates that the counties located in the eastern side of the country are likely to be characterized by a higher degree of attractiveness. This may be partially due to their higher performance in terms of Gross Domestic Product (GDP) growth, industrial development and market competitiveness. However, there are many other factors that are likely to influence FDI localization trends. From this perspective, in the following sessions we develop a model to explore the determinants of pharmaceutical FDI localization across Chinese counties.

3.2. Variables Used

Our study is aimed at determining the impact of location advantages, agglomeration, information cost and environmental cost effects on the localization choice of foreign pharmaceutical firms’ in China.

As explanatory variables we have used sixteen different variables related to the categorization previously discussed (

Table A1). The analysis is performed at the county level. We have identified which are the counties that host foreign pharmaceutical enterprises and aggregated at the county level the total pharmaceutical FDI assets in the years 2004 and 2013. Then, we have formulated four different dependent variables to be tested (

Table A1).

For the location advantage, we selected seven variables to measure its effects on the localization and investment decisions of foreign pharmaceutical enterprises. Firstly, we use four variables to estimate market factors.

gdpgrowth is the growth rate of GDP at the province level and it is used to estimate the effects of local economic performances on FDI attraction. In order to control for the potential distortions on the coefficients due to the faster growth rates of the backward provinces, we combine the previous variable with

gdppc, i.e., the GDP per capita at provincial level. As wealthier and highly performing economies are generally associated with higher returns, we expect that the impact of the two variables on the location selection should be positive.

market_ind consists of the Marketization index value—an indicator, firstly proposed by Fan, Wang and Zhang [

40], intended to estimate the degree of marketization reforms at the provincial level. It provides a relatively objective way to measure marketization and is widely used in the academic literature.

In our paper, we expect that the counties located in provinces characterized by a higher marketization index will be more likely to be selected as a destination for a foreign investment.

srdexp corresponds to the amount of R&D expenditure at the provincial level that indicates the local degree of support for science and technology. Dunning [

20] implies that R&D is a crucial factor influencing location decision. In our framework, as the pharmaceutical industry is highly sensitive to R&D investment, we expect that the counties situated in provinces with a higher expenditure on research and development activities will be more likely to be selected as a destination for foreign pharmaceutical enterprises. Secondly, we try to estimate the effects of trader barriers on investment location by adopting

HHI, i.e., the Herfindahl index that is commonly used as an indicator of the regional market concentration and competitiveness at the industrial level. From this perspective, a high HHI value is associated with a monopolistic structure of the local market and to a lower degree of industrial competitiveness. According to Audretsch and Keilbach [

41], market concentration reduces the opportunities for small and medium sized enterprises to purchase labor, capital or intermediate goods at lower prices. Therefore, we expect that a high HHI will negatively affect foreign firms’ location and investment decisions in a county.

In order to estimate the effects of transportation costs, we introduce

HWAY, i.e., the length of the highway and

flightcargo, i.e., the freight volume by air at the provincial level. As widely stressed in the literature, the configuration of an extended and efficient transport system is one of the most important preconditions for doing business activities and for FDI attraction [

42,

43,

44]. On the other hand, it is worth considering that the latest regulation concerning GOOD MANUFACTURING PRACTICE (GMP) has invited pharmaceutical enterprises to pay more attention to product transportation modes. On this basis, we assume that transportation related factors will positively affect the location decision of pharmaceutical enterprises.

In our study, we use two variables to measure the agglomeration effect. Specifically, we adopt

gini, i.e., the Gini coefficient of industrial location intended to measure the degree of agglomeration of the pharmaceutical sector at the provincial level. The Gini coefficient as an indicator of industrial agglomeration was first introduced by Krugman [

45]. In our specification, we elaborate the Gini coefficient for industrial location on the basis of the model provided by Wen [

46]. We assume that the provinces with a higher spatial Gini coefficient are more likely to appeal to foreign firms for localization and investment. In addition, we use

ratio_phar, i.e., the pharmaceutical industry output share out of the total provincial manufacturing output to measure the local degree of sectoral specialization. We predict that the provinces with higher degrees of pharmaceutical sector value added tend to positively benefit from pharmaceutical FDI inflows.

We deal with the estimation of information cost effects by taking into account four different variables.

ratio_forind measures the share of FDI on output at the provincial level. According to Mariotti and Piscitello [

29], locating near existing FDI enterprises helps to achieve low-cost information by means of “knowledge spillover effects” due to staff turnover or business dealings. On this basis, we expect a positive effect of FDI localization.

city_lvl is a dummy variable that informs whether the city is one of the municipalities directly under the central government, or is a city under separate state planning at the city level, thus being characterized by more direct decision-making processes, as well as well-developed fundamental infrastructure and business services. From this perspective, valuable business information is more easily collected by foreign investors.

coastcity is a dummy variable measuring whether the city is located in the East coastal areas of the country. According to Wei et al. [

47], the coastal area has long been appealing to FDI investment choices for its openness and outward orientation both from a geographic and cultural point of view [

48].

city_dev is a dummy variable informing on whether the city has benefitted from place-based preferential policies aimed at attracting foreign investments. Several studies have analysed the positive effects of place-based policies on FDI attraction and economic performances at city and sub-regional levels [

49,

50].

Finally, in our research we use three variables to estimate the influences of environmental regulation on FDI localization choices. ratio_envinvest measures the amount of investment in environmental pollution control over the GDP at the provincial level. It is worth emphasizing that environmental regulation may consist of either qualitative policies or quantitative investment and fees. From this perspective, environmental regulation intensity has to be considered not only as a constraint but also as a factor that is likely to foster desirable outcomes, such as an improvement in environmental conditions, which in principle may address the demands of the foreign pharmaceutical firms. However, following a standard profit-maximizing firm approach, we assume that places with higher investment in environmental pollution control will be less attractive to pharmaceutical industries due to the possibility of increased costs. river_dist measures how distant from the nearest river is the county in which the pharmaceutical enterprises are located. lake_dist assesses how distant the county in which the pharmaceutical enterprises are located is from the nearest lake. According to the Guidelines for Environmental Information Disclosure of Listed Companies published by the Ministry of Environmental Protection in 14 September 2010, the pharmaceutical industry is categorized as one of the 16 heavy polluting industries. Within such a normative framework, enterprises should consider their own obligations to environmental protection and to meeting environmental standards, and this may influence their localization choices. Following this logic, if enterprises locate in well-regulated areas, it is more likely that they will have enough space and channels for treating waste, so they do not have an incentive to place their operations close to rivers and lakes in order to discharge sewage at a lower cost. Conversely, in the absence of environmental regulation constraints, they would be more likely to locate in proximity to rivers and lakes to exploit the advantages of cheap waste disposal. Therefore, we use these distances to proxy the stringency of environmental regulation.