Value-at-Risk for South-East Asian Stock Markets: Stochastic Volatility vs. GARCH

Abstract

:1. Introduction

2. Methodology

2.1. Estimating Volatility

2.2. Value-at-Risk Forecasting and Backtesting

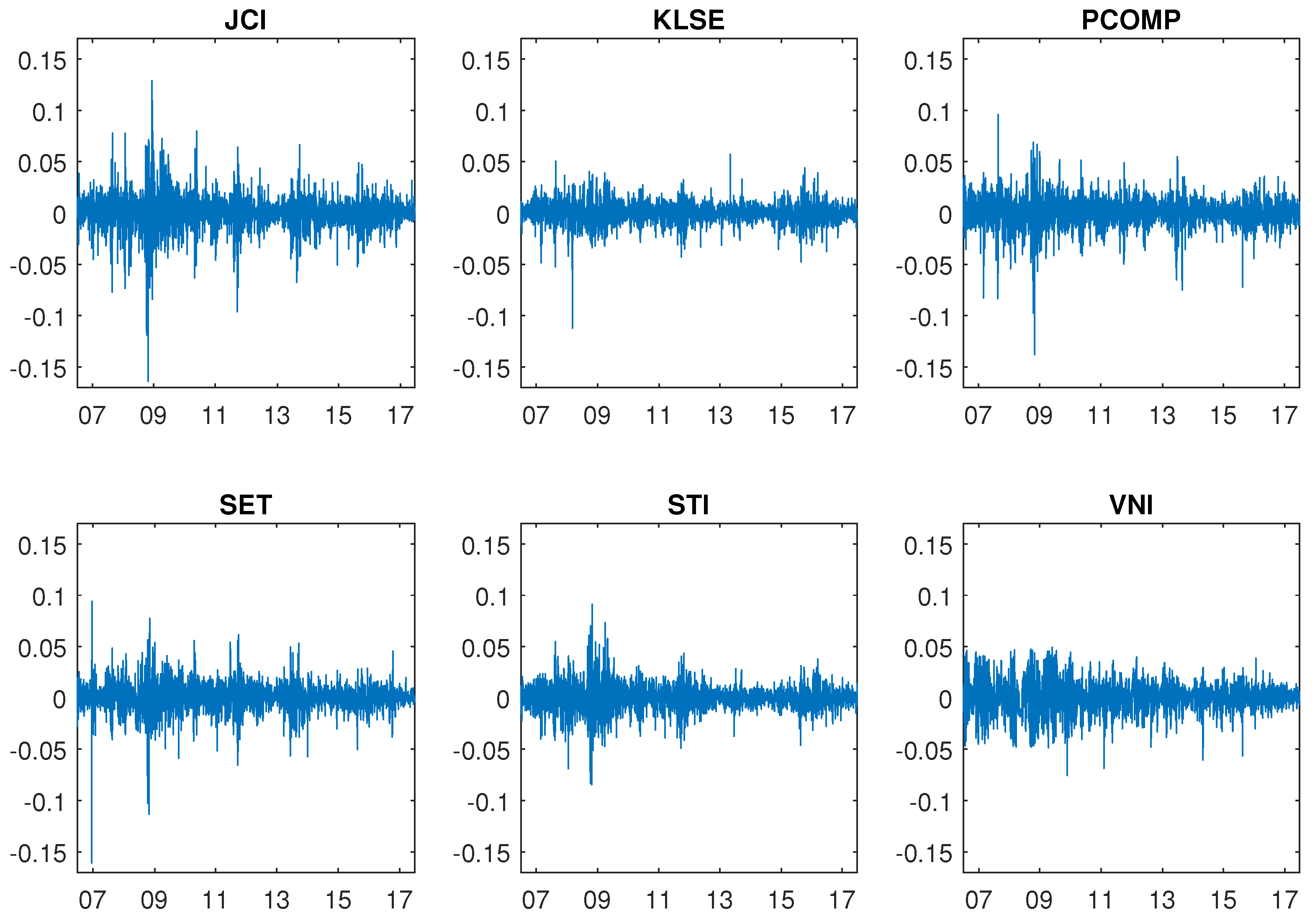

3. Data

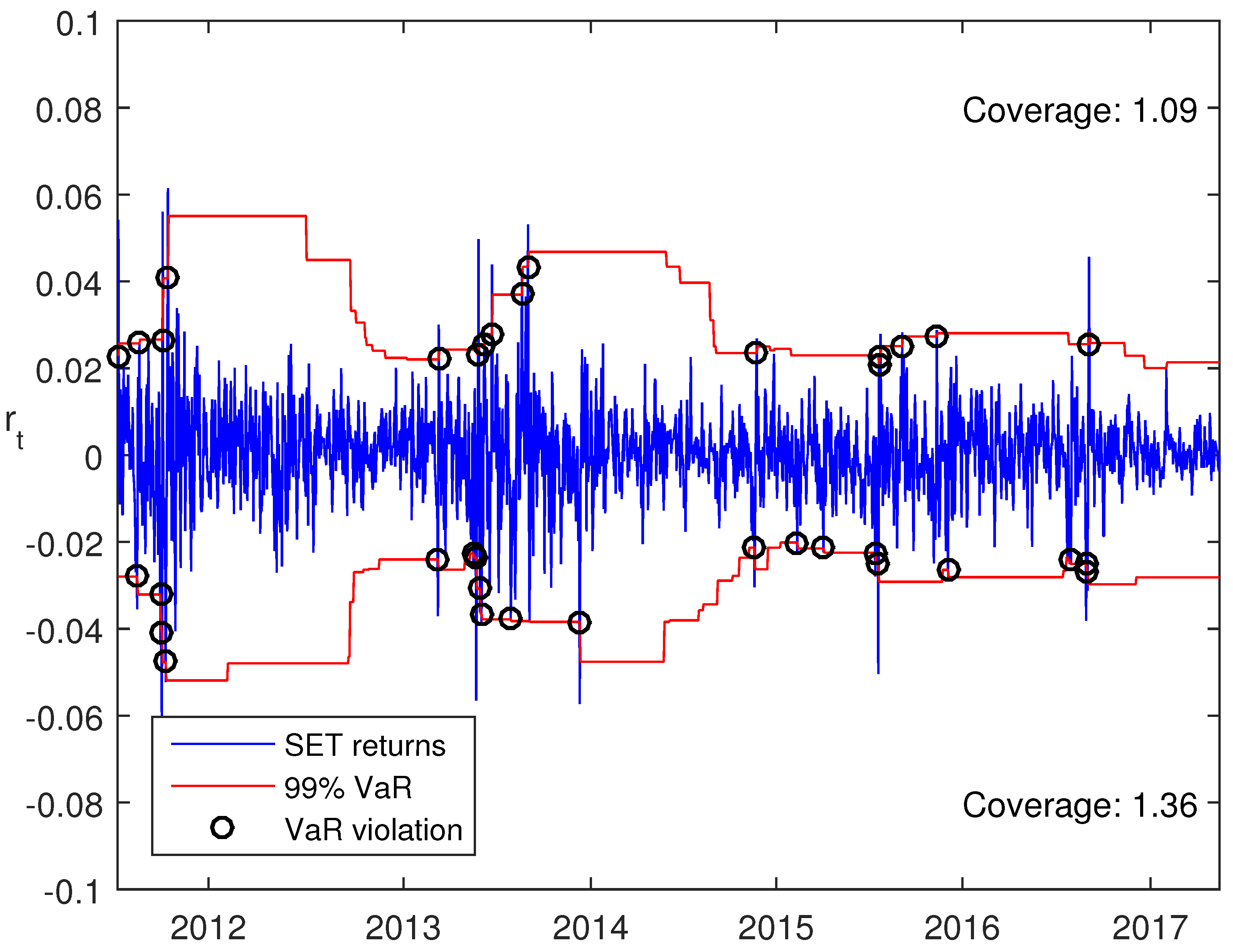

4. Results and Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| ASEAN | Association of Southeast Asian Nations |

| APARCH | Asymmetric Power Autoregressive Heteroskedasticity |

| GARCH | Generalized Autoregressive Heteroskedasticity |

| EWMA | Exponentially Weighted Moving Average |

| FHS | Filtered Historical Simulation |

| FIAPARCH | Fractionally Integrated Asymmetric Power Autoregressive Heteroskedasticity |

| FIGARCH | Fractionally Integrated Generalized Autoregressive Heteroskedasticity |

| HS | Historical Simulation |

| JCI | Jakarta Stock Exchange Composite Index |

| KLSE | Kuala Lumpur Stock Exchange |

| MCS | Model Confidence Set |

| PCOMP | Philippines Stock Exchange Index |

| SET | Stock Exchange of Thailand |

| STI | Singapore Strait’s Time Index |

| SV | Stochastic Volatility |

| VaR | Value-at-Risk |

| VNI | Vietnam Ho Chi Minh Stock Index |

References

- Angelidis, Timotheos, and Stavros Degiannakis. 2007. Backtesting VaR models: A two-stage procedure. The Journal of Risk Model Validation 1: 27–48. [Google Scholar] [CrossRef]

- Baillie, Richard T., Tim Bollerslev, and Hans Ole Mikkelsen. 1996. Fractionally integrated generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 74: 3–30. [Google Scholar] [CrossRef]

- Baillie, Richard T., Ching-Fan Chung, and Margie A. Tieslau. 1996. Analysing Inflation by the Fractionally Integrated ARFIMA-GARCH Model. Journal of Applied Econometrics 11: 23–40. [Google Scholar] [CrossRef]

- Barone-Adesi, Giovanni, Kostas Giannopoulos, and Les Vosper. 1999. VaR without correlations for portfolios of derivative securities. Journal of Futures Markets 19: 583–602. [Google Scholar] [CrossRef]

- Basel Committee on Banking Supervision. 2016. Minimum Capital Requirements for Market Risk. Technical Report January 2016. Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Black, Fisher. 1976. Studies of Stock Price Volatility Changes. In Business and Economics Section. Washington: American Statistical Association, pp. 177–81. [Google Scholar]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bollerslev, Tim, and Jeffrey M. Wooldridge. 1992. Quasi-Maximum Likelihood Estimation and Inference in Dynamic Models with Time-Varying Covariances. Econometric Reviews 11: 143–72. [Google Scholar] [CrossRef]

- Brooks, Chris, and Gita Persand. 2003. The Effect of Asymmetries on Stock Index Return Value-at-Risk Estimates. The Journal of Risk Finance 4: 29–42. [Google Scholar] [CrossRef]

- Chan, Joshua C., and Angelia L. Grant. 2016. Modeling energy price dynamics: GARCH versus stochastic volatility. Energy Economics 54: 182–89. [Google Scholar] [CrossRef]

- Christie, Andrew A. 1982. The stochastic behavior of common stock variances. Value, leverage and interest rate effects. Journal of Financial Economics 10: 407–32. [Google Scholar] [CrossRef]

- Christoffersen, Peter F. 1998. Evaluating Interval Forecasts. International Economic Review 39: 841–62. [Google Scholar] [CrossRef]

- Ding, Zhuanxin, Clive W. J. Granger, and Robert F. Engle. 1993. A long memory property of stock market returns and a new model. Journal of Empirical Finance 1: 83–106. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Giot, Pierre, and Sébastien Laurent. 2003. Value-at-Risk for long and short trading positions. Journal of Applied Econometrics 18: 641–64. [Google Scholar] [CrossRef]

- Hansen, Bruce E. 1994. Autoregressive Conditional Density Estimation. International Economic Review 35: 705–30. [Google Scholar] [CrossRef]

- Hansen, Peter Reinhard. 2005. A Test for Superior Predictive Ability. Journal of Business & Economic Statistics 23: 365–80. [Google Scholar]

- Hansen, Peter R., Asger Lunde, and James M. Nason. 2011. The Model Confidence Set. Econometrica 79: 453–97. [Google Scholar] [CrossRef]

- Harvey, Andrew C., and Neil Shephard. 1996. Estimation of an asymmetric stochastic volatility model for asset returns. Journal of Business and Economic Statistics 14: 429–34. [Google Scholar]

- Hunter, William C., George G. Kaufman, and Thomas H. Krueger, eds. 1999. The Asian Financial Crisis: Origins, Implications, and Solutions. New York: Springer. [Google Scholar]

- Longerstaey, Jacques, and Martin Spencer. 1996. RiskMetrics—Technical Document. Technical Report. New York: Morgan Guaranty Trust Company. [Google Scholar]

- Kenourgios, Dimitris, and Dimitrios Dimitriou. 2015. Contagion of the Global Financial Crisis and the real economy: A regional analysis. Economic Modelling 44: 283–93. [Google Scholar] [CrossRef]

- Klein, Tony, and Thomas Walther. 2016. Oil price volatility forecast with mixture memory GARCH. Energy Economics 58: 46–58. [Google Scholar] [CrossRef]

- Klein, Tony, and Thomas Walther. 2017. Fast fractional differencing in modeling long memory of conditional variance for high-frequency data. Finance Research Letters 22: 274–79. [Google Scholar] [CrossRef]

- Lopez, Jose A. 1998. Methods for evaluating value-at-risk estimates. Economic Policy Review 2: 119–24. [Google Scholar] [CrossRef]

- McMillan, David G., and Dimos Kambouroudis. 2009. Are RiskMetrics forecasts good enough? Evidence from 31 stock markets. International Review of Financial Analysis 18: 117–24. [Google Scholar] [CrossRef]

- Pérignon, Christophe, and Daniel R. Smith. 2008. A New Approach to Comparing VaR Estimation Methods. The Journal of Derivatives 16: 54–66. [Google Scholar] [CrossRef]

- Sarkka, Simo. 2013. Bayesian Filtering and Smoothing. Cambridge: Cambridge University Press. [Google Scholar]

- Sharma, Prateek, and Vipul. 2015. Forecasting stock index volatility with GARCH models: International evidence. Studies in Economics and Finance 32: 445–63. [Google Scholar] [CrossRef]

- So, Mike K. P., and Philip L. H. Yu. 2006. Empirical analysis of GARCH models in value at risk estimation. Journal of International Financial Markets, Institutions and Money 16: 180–97. [Google Scholar] [CrossRef]

- Su, Ender, and Thomas W. Knowles. 2006. Asian Pacific Stock Market Volatility Modeling and Value at Risk Analysis. Emerging Markets Finance and Trade 42: 18–62. [Google Scholar] [CrossRef]

- Taylor, John B. 1986. New Econometric Approaches to Stabilization Policy in Stochastic Models of Macroeconomic Fluctuations. In Handbook of Econometrics. New York: Elsevier, vol. 3. [Google Scholar]

- Tse, Yiu Kuen. 1998. The conditional heteroscedasticity of the yen-dollar exchange rate. Journal of Applied Econometrics 13: 49–55. [Google Scholar] [CrossRef]

- Walther, Thomas. 2017. Expected Shortfall in the Presence of Asymmetry and Long Memory: An Application to Vietnamese Stock Markets. Pacific Accounting Review 29: 132–51. [Google Scholar] [CrossRef]

| 1 | The ASEAN consists of ten countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. |

| 2 | ASEAN-6 are the six biggest contributor to GDP of the ASEAN region, i.e., Indonesia, Thailand, Philippines, Singapore, Malaysia, and Vietnam. |

| 3 | Own calculations based on data.worldbank.org and www.imf.org. |

| 4 | The assumption of Skewed Student’s-t distributed errors is justified in the Data section. |

| 5 | We are thankful to Joshua Chan for providing the MatLab (MathWorks, Natick, Massachusetts, United States) code for estimating the stochastic volatility models on his personal webpage joshuachan.org. |

| 6 | An outline of forecasting conditional variance can be found in Klein and Walther (2016) and Walther (2017) for example. |

| Obs. | Mean | Min. | Max. | Std. Dev. | Skewn. | Kurtosis | LB(12) | ARCH(12) | ADF | |

|---|---|---|---|---|---|---|---|---|---|---|

| JCI | 2674 | 0.0413 | −16.3976 | 12.8918 | 1.5024 | −0.5791 | 12.5428 | 58.6283 * | 414.1944 * | −46.7885 * |

| KLSE | 2683 | 0.0493 | −13.7896 | 9.5896 | 1.4425 | −0.7345 | 10.2419 | 69.4031 * | 354.3988 * | −45.7856 * |

| PCOMP | 2709 | 0.0152 | −11.2295 | 5.7262 | 1.0244 | −0.5489 | 10.5371 | 34.8944 * | 96.5796 * | −46.7559 * |

| SET | 2687 | 0.0353 | −16.0911 | 9.4139 | 1.3997 | −0.9414 | 15.2982 | 41.0240 * | 308.1694 * | −49.2268 * |

| STI | 2761 | 0.0158 | −8.4502 | 9.1221 | 1.2931 | −0.1834 | 8.5997 | 51.0448 * | 845.2581 * | −49.7627 * |

| VNI | 2737 | 0.0027 | −7.5612 | 4.9411 | 1.5211 | −0.2330 | 4.4559 | 210.0781 * | 604.1086 * | −40.7110 * |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 91/1120/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| Historical Simulation | 755/456/0 | − | − | − | − | − | − | − | − | − | 0.2996 | 0.3007 | 0.3053 |

| Filtered Historical Simulation | 1211/0/0 | 0.0740 | − | 0.0868 | 0.1526 | − | − | 0.2174 | − | − | 0.2758 | − | − |

| GARCH-SkSt | 1211/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1211/0/0 | 0.0828 | − | − | − | − | − | − | − | − | 0.2469 | − | − |

| FIGARCH-SkSt | 758/453/0 | 0.1047 | − | − | 0.1635 | 0.1526 | − | 0.2385 | − | − | 0.3075 | 0.3007 | 0.3173 |

| FIAPARCH-SkSt | 1173/38/0 | 0.0828 | − | − | − | − | − | − | − | − | − | − | − |

| SV | 653/558/0 | 0.1111 | − | − | 0.1813 | − | − | 0.2297 | − | − | 0.3130 | 0.2961 | 0.2695 |

| SV-t | 362/849/0 | − | − | − | 0.1696 | 0.1571 | − | 0.2312 | − | − | 0.3141 | − | − |

| SV-L | 627/584/0 | 0.1141 | − | − | 0.1526 | − | − | 0.2205 | 0.2110 | − | 0.2914 | 0.2733 | − |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 847/364/0 | 0.1110 | − | − | 0.1655 | 0.1736 | − | 0.2126 | 0.2174 | 0.2174 | 0.2914 | − | − |

| Historical Simulation | 961/250/0 | 0.0979 | − | − | − | − | − | − | − | − | 0.2891 | 0.2891 | 0.2926 |

| Filtered Historical Simulation | 946/265/0 | 0.0907 | − | − | − | − | − | − | − | − | − | − | − |

| GARCH-SkSt | 1211/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1019/192/0 | 0.0907 | 0.1047 | 0.0944 | − | − | 0.1434 | − | − | − | − | 0.2669 | − |

| FIGARCH-SkSt | 926/285/0 | 0.1079 | − | − | 0.1716 | − | − | 0.2427 | − | − | 0.3162 | − | − |

| FIAPARCH-SkSt | 1025/186/0 | 0.0907 | 0.0868 | 0.0828 | − | − | − | − | − | − | − | − | − |

| SV | 1211/0/0 | 0.0740 | − | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1211/0/0 | 0.0785 | 0.0868 | − | − | − | − | − | − | − | − | − | − |

| SV-L | 1152/59/0 | 0.0785 | 0.0828 | − | − | − | − | − | − | − | − | − | − |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 195/925/104 | − | − | − | − | − | − | − | − | − | − | − | − |

| Historical Simulation | 679/545/0 | − | − | − | − | − | − | − | − | − | 0.3159 | 0.3181 | 0.3234 |

| Filtered Historical Simulation | 569/655/0 | 0.1136 | − | 0.1074 | − | 0.1519 | − | 0.2180 | − | − | 0.3016 | 0.2708 | − |

| GARCH-SkSt | 974/250/0 | 0.0864 | 0.0939 | 0.0903 | 0.1542 | − | 0.1474 | 0.2101 | − | − | 0.2745 | − | − |

| APARCH-SkSt | 1034/190/0 | 0.0903 | − | 0.1009 | 0.1627 | 0.1519 | − | 0.2117 | − | − | 0.2818 | 0.2842 | − |

| FIGARCH-SkSt | 523/701/0 | − | − | − | − | − | − | − | − | − | 0.3337 | − | − |

| FIAPARCH-SkSt | 1139/85/0 | 0.0864 | 0.1009 | 0.0782 | 0.1519 | − | − | − | − | − | − | − | − |

| SV | 468/756/0 | − | − | 0.1009 | 0.1786 | − | − | 0.2316 | − | − | 0.3159 | 0.3039 | 0.2695 |

| SV-t | 670/554/0 | − | − | − | 0.1767 | − | − | 0.2374 | − | − | 0.3181 | 0.3170 | 0.2794 |

| SV-L | 750/474/0 | − | − | − | 0.1767 | 0.1606 | − | 0.2286 | − | − | 0.3105 | 0.2994 | 0.2733 |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 890/334/0 | 0.1074 | 0.1106 | 0.1194 | 0.1497 | 0.1519 | 0.1668 | 0.2117 | 0.2117 | 0.2226 | 0.2806 | 0.2830 | 0.3027 |

| Historical Simulation | 792/353/79 | 0.1165 | − | − | 0.1648 | − | − | − | − | − | 0.3005 | 0.3072 | − |

| Filtered Historical Simulation | 735/402/87 | − | 0.1194 | − | − | − | − | 0.2444 | − | − | − | 0.3061 | − |

| GARCH-SkSt | 969/255/0 | 0.0940 | 0.0864 | 0.0864 | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1046/178/0 | 0.0940 | 0.0782 | 0.0824 | − | − | − | − | − | − | − | − | − |

| FIGARCH-SkSt | 974/250/0 | 0.0975 | 0.0975 | 0.1106 | 0.1648 | 0.1563 | − | 0.2241 | 0.2241 | 0.2286 | 0.2948 | 0.2902 | 0.3072 |

| FIAPARCH-SkSt | 1059/165/0 | 0.0824 | − | − | − | − | − | − | − | − | − | − | − |

| SV | 1046/178/0 | 0.0903 | 0.0824 | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1059/165/0 | 0.0824 | 0.0782 | − | − | − | − | − | − | − | − | − | − |

| SV-L | 1216/8/0 | 0.0864 | 0.0737 | − | − | − | − | − | − | − | − | − | − |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 216/996/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| Historical Simulation | 968/244/0 | − | − | − | − | − | − | − | − | − | 0.2972 | 0.3040 | 0.3107 |

| Filtered Historical Simulation | 1017/195/0 | 0.0906 | − | − | 0.1716 | − | − | − | − | − | 0.2972 | 0.2719 | 0.2757 |

| GARCH-SkSt | 1003/209/0 | 0.0785 | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1035/177/0 | − | − | − | 0.1360 | − | − | 0.2044 | − | − | 0.2550 | − | − |

| FIGARCH-SkSt | 554/658/0 | 0.1199 | − | − | 0.1775 | − | − | − | − | − | 0.3289 | 0.3340 | − |

| FIAPARCH-SkSt | 1043/169/0 | 0.0785 | − | − | − | − | − | − | − | − | − | − | − |

| SV | 661/551/0 | 0.1141 | − | − | − | − | − | 0.2384 | − | − | 0.3118 | 0.2890 | − |

| SV-t | 767/445/0 | 0.1047 | − | − | − | − | − | 0.2326 | − | − | 0.3051 | 0.2914 | − |

| SV-L | 916/296/0 | 0.0979 | − | − | 0.1433 | − | − | 0.2158 | − | − | 0.2769 | 0.2732 | − |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 983/229/0 | 0.1013 | − | − | − | − | − | − | − | − | 0.2769 | − | − |

| Historical Simulation | 717/495/0 | − | − | − | − | − | − | − | − | − | 0.2960 | 0.3029 | − |

| Filtered Historical Simulation | 613/599/0 | 0.1199 | − | − | − | − | − | − | − | − | − | 0.3161 | − |

| GARCH-SkSt | 1212/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1109/103/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| FIGARCH-SkSt | 1009/203/0 | 0.0979 | − | − | − | 0.1696 | − | − | − | − | 0.3051 | 0.3073 | − |

| FIAPARCH-SkSt | 1109/103/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV | 1109/103/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1212/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-L | 1109/103/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 387/738/95 | − | − | − | − | − | − | 0.2363 | − | − | − | − | − |

| Historical Simulation | 699/521/0 | 0.1167 | − | − | 0.1630 | − | − | 0.2199 | − | 0.2260 | 0.2975 | 0.3032 | 0.3032 |

| Filtered Historical Simulation | 814/345/61 | 0.1167 | − | − | 0.1650 | − | − | 0.2290 | − | − | 0.3054 | − | − |

| GARCH-SkSt | 1009/211/0 | 0.0825 | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 978/242/0 | 0.0904 | 0.0976 | 0.0865 | 0.1521 | 0.1453 | − | 0.2104 | − | − | 0.2749 | − | − |

| FIGARCH-SkSt | 613/607/0 | 0.1224 | − | − | − | − | − | − | − | 0.2245 | − | − | − |

| FIAPARCH-SkSt | 1159/61/0 | 0.0825 | 0.1076 | 0.0941 | 0.1381 | 0.1429 | − | 0.2071 | − | − | 0.2622 | − | 0.2557 |

| SV | 620/600/0 | 0.1107 | − | 0.0904 | 0.1808 | − | − | 0.2391 | − | − | 0.3196 | − | − |

| SV-t | 732/488/0 | 0.1107 | 0.1076 | 0.0904 | 0.1826 | 0.1566 | − | 0.2475 | − | − | 0.3269 | 0.2929 | 0.2583 |

| SV-L | 1015/205/0 | 0.0865 | 0.1076 | 0.0865 | 0.1608 | 0.1587 | − | 0.2245 | − | − | 0.2894 | 0.2858 | − |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 629/591/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| Historical Simulation | 760/460/0 | − | − | − | − | − | − | − | − | − | 0.2798 | 0.2798 | 0.2858 |

| Filtered Historical Simulation | 759/461/0 | − | − | − | − | − | − | − | − | − | 0.3196 | 0.2648 | − |

| GARCH-SkSt | 1018/202/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1220/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| FIGARCH-SkSt | 1043/177/0 | − | − | − | − | − | − | − | − | − | 0.2774 | 0.2774 | − |

| FIAPARCH-SkSt | 990/230/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV | 1220/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1146/74/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-L | 1220/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 234/1004/17 | − | − | − | − | − | − | − | − | − | − | − | − |

| Historical Simulation | 830/425/0 | − | − | − | 0.1710 | − | − | − | − | − | 0.2996 | 0.2996 | 0.3105 |

| Filtered Historical Simulation | 764/491/0 | 0.0965 | − | − | 0.1651 | − | − | 0.2157 | − | − | 0.2883 | − | − |

| GARCH-SkSt | 1255/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 895/360/0 | 0.0893 | − | − | 0.1481 | − | − | 0.2014 | − | − | 0.2655 | − | − |

| FIGARCH-SkSt | 628/627/0 | − | − | − | − | − | − | − | − | − | 0.3302 | − | 0.3137 |

| FIAPARCH-SkSt | 950/305/0 | 0.0999 | − | − | 0.1436 | − | − | − | − | − | − | − | − |

| SV | 747/508/0 | − | − | 0.0855 | 0.1768 | − | 0.1436 | 0.2419 | − | − | 0.3221 | 0.3148 | 0.2655 |

| SV-t | 608/647/0 | − | − | − | 0.1710 | − | 0.1504 | 0.2433 | − | − | 0.3221 | 0.3105 | 0.2741 |

| SV-L | 897/358/0 | 0.1031 | − | − | 0.1569 | − | − | 0.2173 | − | − | 0.2871 | − | 0.2473 |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 1036/219/0 | 0.1094 | 0.1153 | − | 0.1691 | 0.1710 | 0.1691 | 0.2203 | 0.2203 | 0.2203 | 0.2985 | 0.3018 | − |

| Historical Simulation | 729/526/0 | 0.1094 | 0.1124 | 0.1237 | 0.1730 | − | − | − | − | − | 0.2985 | 0.3007 | − |

| Filtered Historical Simulation | 809/387/59 | 0.1209 | 0.0999 | 0.1031 | − | 0.1526 | 0.1590 | 0.2391 | − | − | 0.3252 | − | − |

| GARCH-SkSt | 1255/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1030/225/0 | 0.0999 | 0.0965 | 0.0999 | 0.1526 | 0.1481 | 0.1389 | 0.2111 | 0.2047 | − | 0.2789 | 0.2704 | − |

| FIGARCH-SkSt | 619/636/0 | 0.1237 | − | − | − | − | 0.1749 | 0.2277 | 0.2363 | − | − | 0.3221 | 0.3116 |

| FIAPARCH-SkSt | 958/297/0 | 0.1031 | 0.0774 | − | 0.1459 | − | − | − | − | − | 0.2680 | − | − |

| SV | 1237/18/0 | 0.0855 | − | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1117/138/0 | − | − | 0.0729 | − | − | − | 0.1997 | − | − | 0.2500 | − | − |

| SV-L | 1255/0/0 | 0.0774 | − | − | − | − | − | − | − | − | − | − | − |

| Model | Traffic Light | Christoffersen (1998) | Pérignon and Smith (2008) | ||||||||||

| 1% | 2.5% | 5% | |||||||||||

| 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | 1-Day | 5-Days | 20-Days | ||

| long trading position | |||||||||||||

| EWMA/RiskMetrics | 325/764/159 | − | − | − | − | 0.1809 | − | 0.2268 | − | − | − | − | − |

| Historical Simulation | 1122/126/0 | 0.0731 | 0.0775 | 0.0731 | − | − | − | − | − | − | − | − | − |

| Filtered Historical Simulation | 748/500/0 | 0.0967 | − | − | 0.1529 | − | − | 0.2002 | − | − | 0.2699 | − | − |

| GARCH-SkSt | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 872/376/0 | 0.0857 | 0.0967 | − | − | − | − | − | − | − | − | − | − |

| FIGARCH-SkSt | 782/466/0 | 0.1127 | 0.1212 | 0.1185 | 0.1791 | 0.1791 | − | − | 0.2253 | 0.2253 | 0.3155 | 0.3123 | 0.3102 |

| FIAPARCH-SkSt | 1036/212/0 | 0.0775 | − | − | − | − | − | − | − | − | − | − | − |

| SV | 864/384/0 | 0.0967 | 0.0967 | − | 0.1392 | 0.1368 | − | 0.2068 | − | − | 0.2674 | − | − |

| SV-t | 864/384/0 | 0.0967 | 0.0817 | − | 0.1343 | 0.1343 | − | 0.2068 | 0.2002 | − | 0.2649 | 0.2546 | − |

| SV-L | 929/319/0 | 0.0967 | 0.0932 | − | 0.1507 | 0.1368 | − | 0.1968 | − | − | 0.2661 | − | − |

| short trading position | |||||||||||||

| EWMA/RiskMetrics | 965/283/0 | − | − | − | − | − | − | − | − | − | 0.3025 | 0.3176 | − |

| Historical Simulation | 1072/176/0 | 0.0857 | 0.0857 | 0.0817 | − | − | − | − | − | − | 0.2636 | 0.2598 | 0.2546 |

| Filtered Historical Simulation | 845/384/19 | 0.0967 | 0.0731 | − | 0.1485 | − | − | 0.2051 | − | − | 0.2711 | − | − |

| GARCH-SkSt | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| APARCH-SkSt | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| FIGARCH-SkSt | 384/841/23 | − | − | − | − | − | − | − | − | − | − | − | − |

| FIAPARCH-SkSt | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-t | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

| SV-L | 1248/0/0 | − | − | − | − | − | − | − | − | − | − | − | − |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bui Quang, P.; Klein, T.; Nguyen, N.H.; Walther, T. Value-at-Risk for South-East Asian Stock Markets: Stochastic Volatility vs. GARCH. J. Risk Financial Manag. 2018, 11, 18. https://doi.org/10.3390/jrfm11020018

Bui Quang P, Klein T, Nguyen NH, Walther T. Value-at-Risk for South-East Asian Stock Markets: Stochastic Volatility vs. GARCH. Journal of Risk and Financial Management. 2018; 11(2):18. https://doi.org/10.3390/jrfm11020018

Chicago/Turabian StyleBui Quang, Paul, Tony Klein, Nam H. Nguyen, and Thomas Walther. 2018. "Value-at-Risk for South-East Asian Stock Markets: Stochastic Volatility vs. GARCH" Journal of Risk and Financial Management 11, no. 2: 18. https://doi.org/10.3390/jrfm11020018