An Imperfect Production Model for Breakable Multi-Item with Dynamic Demand and Learning Effect on Rework over Random Planning Horizon

Abstract

:1. Introduction

- Step 1

- Formulate the imperfect production-inventory model for first fully accommodated cycles considering production, screening, reworking, holding, and shortage costs.

- Step 2

- Determine the expression of the expected total cost for the first fully accommodated cycles concerning the random time horizon.

- Step 3

- Calculate the expression of the total cost for the last cycle under the following mutually exclusive and disjoint cases:

- –

- Case I: The random time horizon ends before the production period concludes.

- –

- Case II: The random time horizon ends in the between of the end of the production period and exhaust of inventory period.

- –

- Case III: The random time horizon ends during the shortage period.

- –

- Case IV: The random time horizon ends during the shortage period when the production restarts to cover the shortages.

- Step 4

- Compute the expression of the projected total cost for the last period which joins the four mutually exclusive and disjoint events described in Step-3.

- Step 5

- Minimize the expected total cost including the expressions determined in Step-2 and Step-4.

2. Notation and Assumptions

2.1. Notation

| : | Inventory level at time t for perfect quality items in each cycle except last cycle | |

| : | Inventory quantity in the last cycle at time t for perfect quality items | |

| : | Shortage level at time t for perfect quality items in each cycle except last cycle | |

| : | Shortage level in the last cycle at time t for perfect quality items | |

| : | Maximum shortage level | |

| : | Production rate | |

| : | Customers’ demand rate | |

| : | Time at which production stopped in each cycle | |

| : | Time at which inventory exhausted in each cycle | |

| : | Time at which production restarts in shortage period in each cycle | |

| : | Length of each cycle | |

| : | Portion of the demand that is not backlogged | |

| : | Portion of the demand that is backlogged | |

| : | Achieved learning parameter to increase the rework rate | |

| : | Achieved learning parameter for production and screening costs | |

| : | Rate of breakability of the produced items | |

| : | Percentage of rework for breakable items related to the learning effect | |

| : | Production cost per unit in the first cycle, is the unit productioncost in cycle | |

| : | Screening cost per unit in first cycle, is screening cost per unit in cycle | |

| : | Reworking cost per unit | |

| : | Holding cost per unit per unit time for perfect quality items | |

| : | Shortage cost per unit per unit time for perfect quality items | |

| : | Selling price per unit perfect quality items | |

| R | : | Difference between inflation and the time value of money |

| : | Number of entirely accommodated cycles | |

| M | : | Total number of items |

| H | : | Random time horizon length |

2.2. Assumptions

- (i)

- Non-perfect quality of multiple items is produced (breakable items) in the production system. A portion of breakable items is reworked to get a nearly perfect item. The perfect quality products are immediately set for sale.

- (ii)

- Demand rate () of item () is dependent on the displayed inventory level and selling price, which is of the form:where , and are positive constants.

- (iii)

- The time horizon H is not necessarily fixed and known. It has some uncertainty, therefore, it is finite and randomly distributed. Here, it is assumed that H follows an exponential distribution with the following probability density function (p.d.f)where is the distribution parameter and h is the real value of H.

- (iv)

- First cycles are completely contained in the time horizon and it finishes during th cycle.

- (v)

- Shortages are allowed in each cycle. After occurring shortage, some customers will wait in during the stockout period. So, it is considered the partial backlogging during the stockout period of unsatisfied market demand.

- (vi)

- The opening and terminal stock levels in each period are zero in each cycle.

- (vii)

- Due to fluctuation of the economy, the cost or price of every commodity is changed. For this reason, inflation and the time value of capital are considered.

- (viii)

- The learning experience of inspection process increases the rework rate of defective units and the amount of finished product. Learning effect influences the decision-maker to reduce more screening costs and rework costs to the next cycle.

3. Mathematical Formulation of the Production-Inventory Model

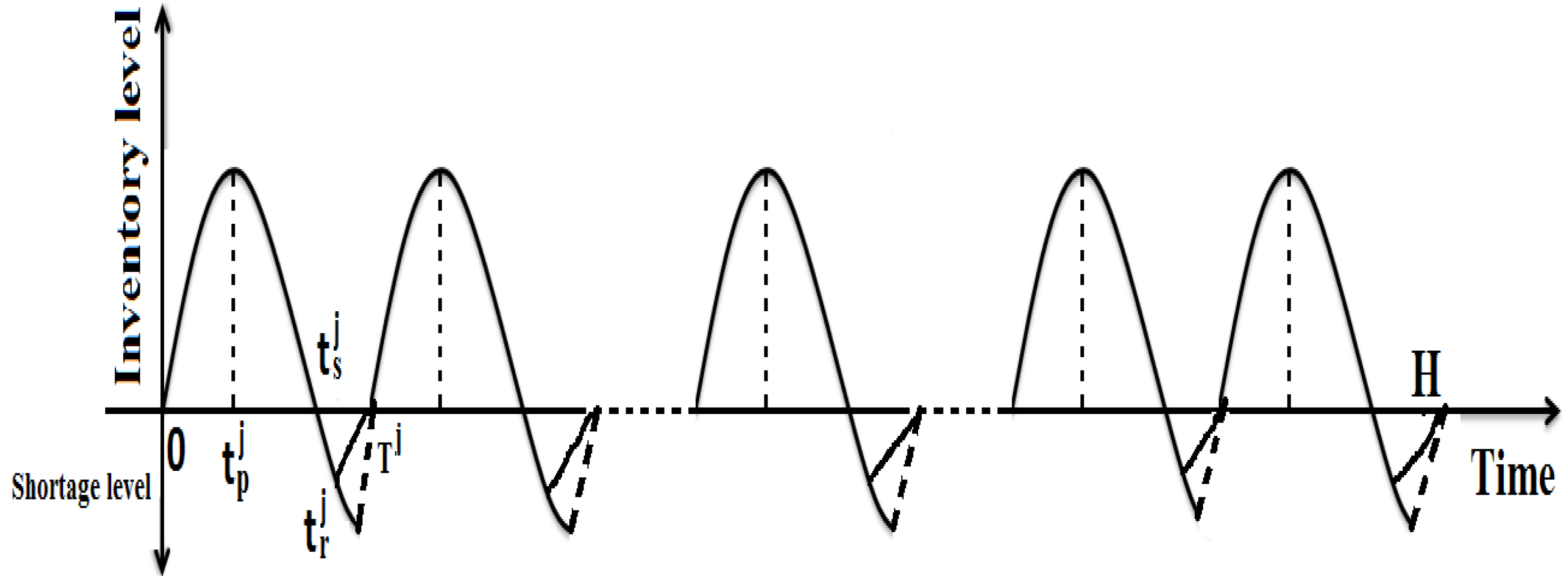

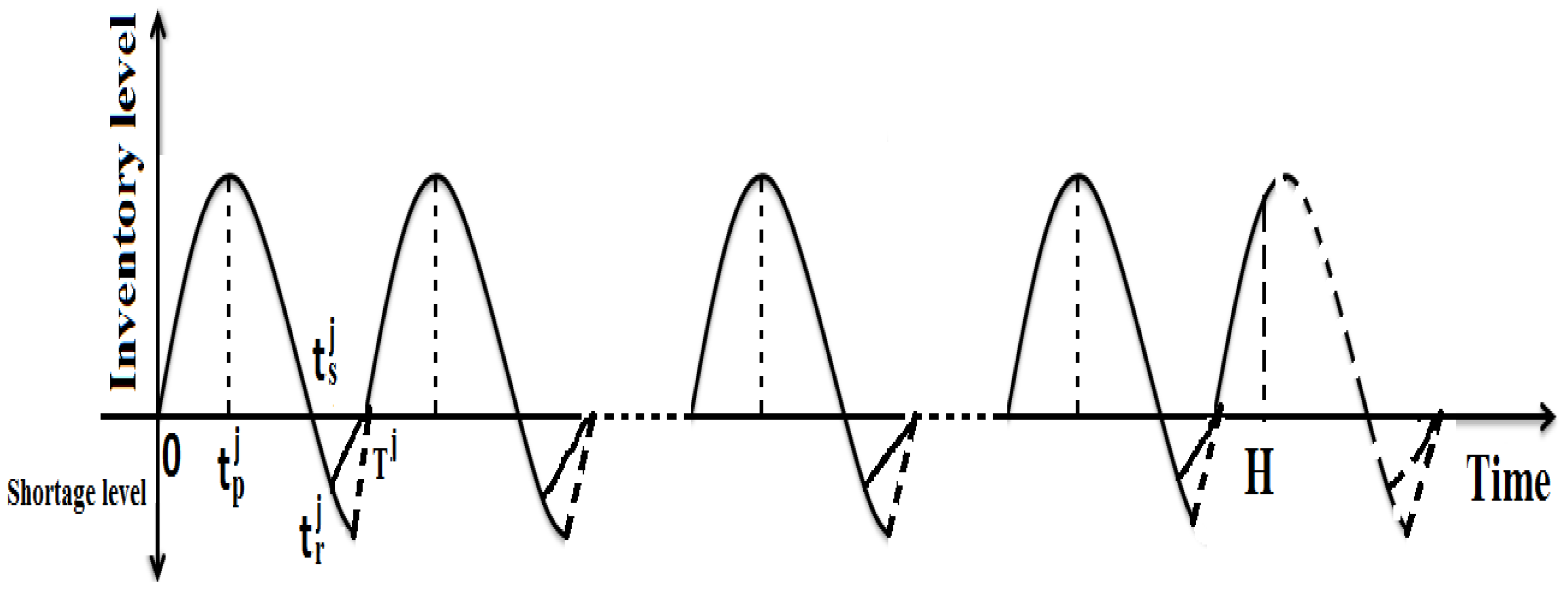

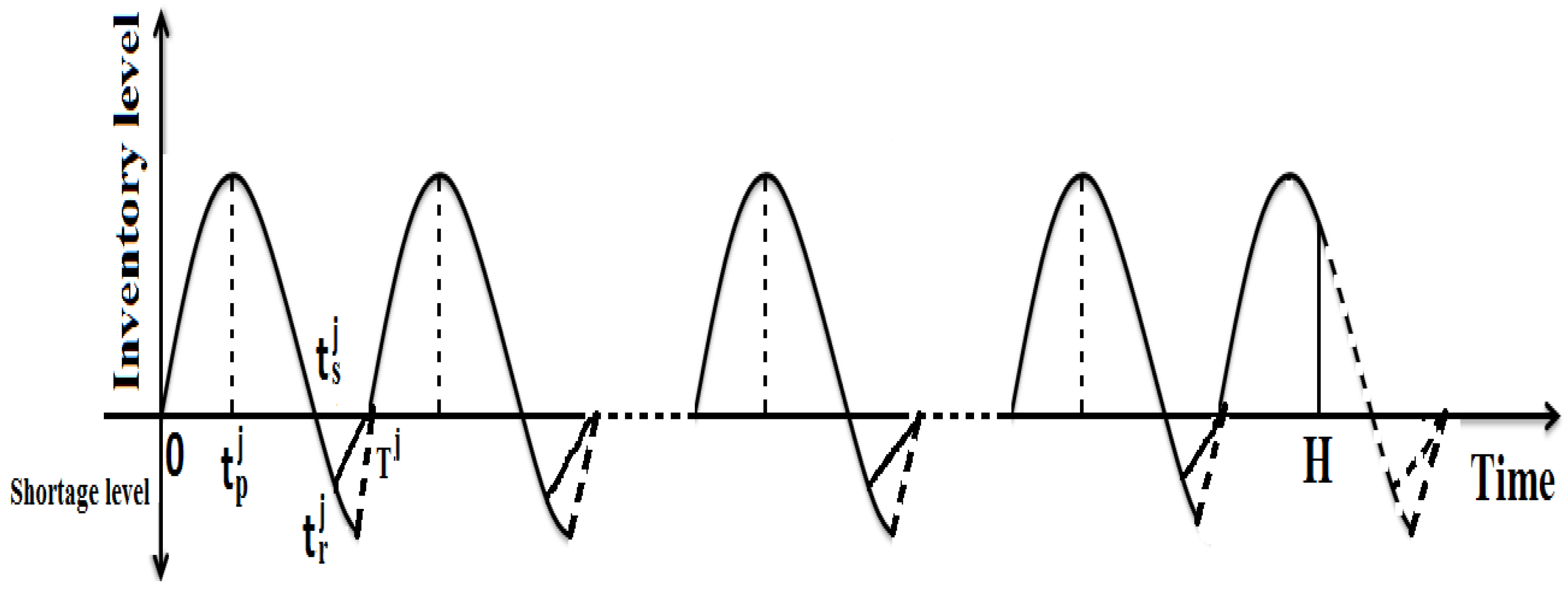

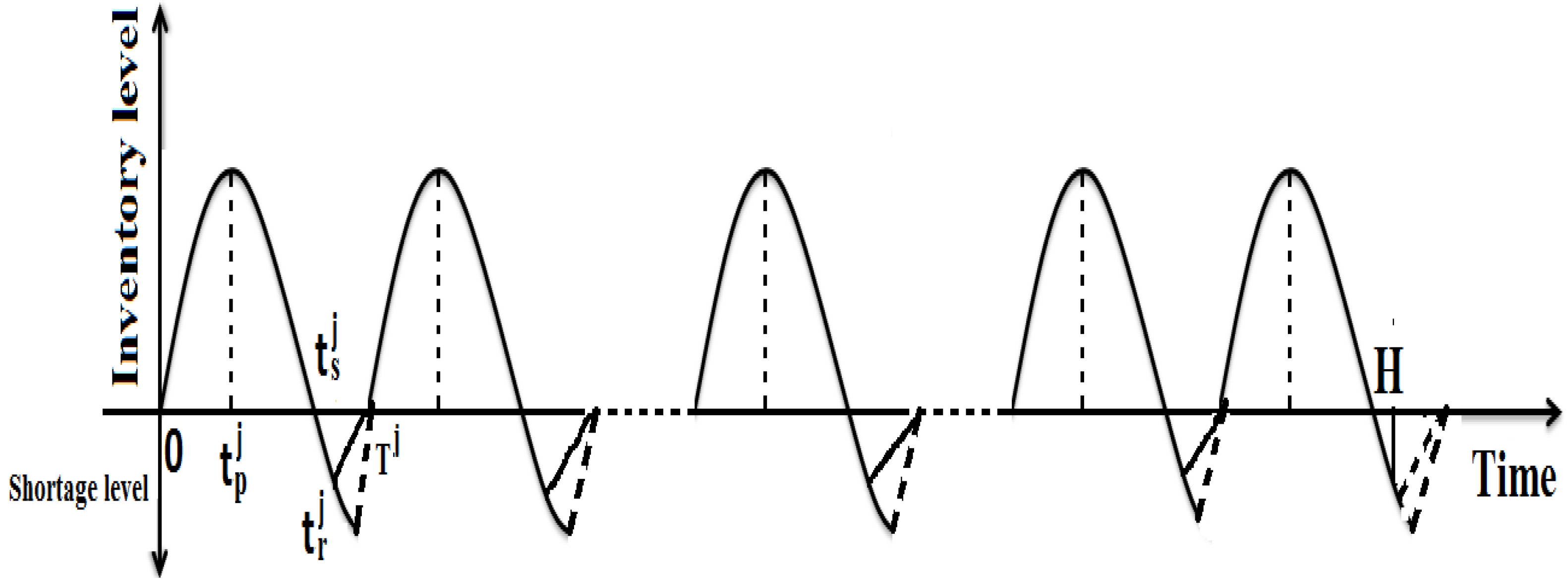

3.1. Formulation for the () Cycle for the Item

3.2. Formulation for the Last Cycle for the Item

3.2.1. Case-I ()

3.2.2. Case-II ()

3.2.3. Case-III ()

3.2.4. Case-IV ()

3.3. Objective Function of the Production-Inventory Model

4. Numerical Analysis

Sensitivity Analysis

5. Practical Implications

6. Conclusions

- (i)

- To avoid the loss due to presence of defective items, the manufacturers should adopt the rework policy.

- (ii)

- To decrease the total cost of the manufacturing system and to increase the rework rate of imperfect items, the learning effect plays an important role. So, keeping in mind this effect, the manufacturer should consider a learning effect policy.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abad, Prakash L. 1996. Optimal pricing and lot-sizing under conditions of perishability and partial backordering. Management Science 42: 1093–104. [Google Scholar] [CrossRef]

- Abad, Prakash L. 2001. Optimal price and order size for a reseller under partial backordering. Computers and Operations Research 28: 53–65. [Google Scholar] [CrossRef]

- AlArjani, Ali, Md Miah, Md Uddin, Abu Hashan Md Mashud, Hui-Ming Wee, Shib Sankar Sana, and Hari Mohan Srivastava. 2021. A sustainable economic recycle quantity model for imperfect production system with shortages. Journal of Risk and Financial Management 14: 173. [Google Scholar] [CrossRef]

- Avinadav, Tal, Avi Herbon, and Uriel Spiegel. 2013. Optimal inventory policy for a perishable item with demand function sensitive to price and time. International Journal of Production Economics 144: 497–506. [Google Scholar] [CrossRef]

- Baker, R. C. A., and Timothy L. Urban. 1988. A deterministic inventory system with an inventory-level-dependent demand rate. Journal of the Operational Research Society 39: 823–31. [Google Scholar] [CrossRef]

- Banu, Ateka, Amalesh Kumar Manna, and Shyamal Kumar Mondal. 2021. Adjustment of credit period and stock-dependent demands in a supply chain model with variable imperfectness. RAIRO-Operations Research 55: 1291–324. [Google Scholar] [CrossRef]

- Ben-Daya, Mohamed. 2002. The economic production lot-sizing problem with imperfect production processes and imperfect maintenance. International Journal of Production Economics 76: 257–64. [Google Scholar] [CrossRef]

- Bhunia, Asoke Kumar, Ali Akbar Shaikh, Vinti Dhaka, Sarala Pareek, and Leopoldo Eduardo Cárdenas-Barrón. 2018. An application of genetic algorithm and PSO in an inventory model for single deteriorating item with variable demand dependent on marketing strategy and displayed stock level. Scientia Iranica 25: 1641–55. [Google Scholar] [CrossRef] [Green Version]

- Cárdenas-Barrón, Leopoldo Eduardo. 2001a. The economic production quantity without backlogging derived with algebra. Paper presented at the Sixth International Conference of the Decision Sciences Institute, Chihuahua, Mexico, July 8–11. [Google Scholar]

- Cárdenas-Barrón, Leopoldo Eduardo. 2001b. The economic production quantity (EPQ) with shortage derived algebraically. International Journal of Production Economics 70: 289–92. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, Leopoldo Eduardo. 2009. Economic production quantity with rework process at a single-stage manufacturing system with planned backorders. Computers & Industrial Engineering 57: 1105–13. [Google Scholar]

- Cárdenas-Barrón, Leopoldo Eduardo. 2011. The derivation of EOQ/EPQ inventory models with two backorders costs using analytic geometry and algebra. Applied Mathematical Modelling 35: 2394–407. [Google Scholar] [CrossRef] [Green Version]

- Chakraborty, Dipankar, Dipak Kumar Jana, and Tapan Kumar Roy. 2020. Multi-warehouse partial backlogging inventory system with inflation for non-instantaneous deteriorating multi-item under imprecise environment. Soft Computing 24: 14471–90. [Google Scholar] [CrossRef]

- Chen, Y.-C. 2006. Optimal inspection and economical production quantity strategy for an imperfect production process. International Journal of Systems Science 37: 295–302. [Google Scholar] [CrossRef]

- Chiu, Yuanshyi P. 2003. Determining the optimal lot size for the finite production model with random defective rate, the rework process and backlogging. Engng Optimization 35: 427–37. [Google Scholar] [CrossRef]

- Chiu, Singa Wang, Chia-Kuan Ting, and Yuan-Shyi Peter Chiu. 2007. Optimal production lot sizing with rework, scrap rate, and service level constraint. Mathematical and Computer Modelling 46: 535–49. [Google Scholar] [CrossRef]

- Datta, T.K., and A.K. Pal. 1990. A note on an inventory model with inventory-level-dependent demand rate. Journal of the Operation Research Society 41: 971–75. [Google Scholar] [CrossRef]

- Debnath, Bijoy Krishna, Pinki Majumder, and Uttam Kumar Bera. 2018. Two warehouse inventory models of breakable items with stock dependent demand under trade credit policy with respect to both supplier and retailer. International Journal of Logistics Systems and Management 31: 151–66. [Google Scholar] [CrossRef]

- Dey, Jayanta Kumar, Shyamal Kumar Mondal, and Manoranjan Maiti. 2008. Two storage inventory problem with dynamic demand and interval valued lead-time over finite time horizon under inflation and time-value of money. European Journal of Operational Research 185: 170–94. [Google Scholar] [CrossRef]

- Dye, Chung-Yuan, and Liang-Yuh Ouyang. 2005. An EOQ model for perishable items under stock-dependent selling rate and time-dependent partial back logging. European Journal of Operational Research 163: 776–83. [Google Scholar] [CrossRef]

- Flapper, Simme Douwe P., and Ruud H. Teunter. 2004. Logistic planning of rework with deteriorating work-in-process. International Journal of Production Economics 88: 51–59. [Google Scholar] [CrossRef]

- Fu, Kaifang, Zh Chen, Yunrong Zhang, and Hui Ming Wee. 2020. Optimal production inventory decision with learning and fatigue behavioral effects in labor-intensive manufacturing. Scientia Iranica 27: 918–34. [Google Scholar]

- Gupta, Rakesh, and Prem Vrat. 1986. Inventory model with multi-items under constraint systems for stock dependent consumption rate. Operations Research 24: 41–42. [Google Scholar]

- Halim, Mohammad Abdul, A. Paul, Mona Mahmoud, B. Alshahrani, Atheelah Y. M. Alazzawi, and Gamal M. Ismail. 2021. An overtime production inventory model for deteriorating items with nonlinear price and stock dependent demand. Alexandria Engineering Journal 60: 2779–86. [Google Scholar] [CrossRef]

- Hayek, Pascale A., and Moueen K. Salameh. 2001. Production lot sizing with the reworking of imperfect quality items produced. Production Planning Control 12: 584–90. [Google Scholar] [CrossRef]

- Hemapriya, S., and R. Uthayakumar. 2021. Inflation and time value of money in a vendor-buyer inventory system with transportation cost and ordering cost reduction. Journal of Control and Decision 8: 98–105. [Google Scholar] [CrossRef]

- Inderfurth, K., M. Y. Kovalyov, C. T. Ng, and F. Werner. 2007. Cost minimizing scheduling of work and rework processes on a single facility under deterioration of reworkables. International Journal of Production Economics 105: 345–56. [Google Scholar] [CrossRef]

- Jaber, M. Y., S. K. Goyal, and M. Imran. 2008. Economic production quantity model for items with imperfect quality subject to learning effects. International Journal of Production Economics 115: 143–50. [Google Scholar] [CrossRef]

- Khanna, Aditi, Priyamvada Pritam, and Chandra K. Jaggi. 2020. Optimizing preservation strategies for deteriorating items with time-varying holding cost and stock-dependent demand. Yugoslav Journal of Operations Research 30: 237–50. [Google Scholar] [CrossRef]

- Konstantaras, I., K. Skouri, and M. Y. Jaber. 2012. Inventory models for imperfect quality items with shortages and learning in inspection. Applied Mathematical Modelling 36: 5334–43. [Google Scholar] [CrossRef]

- Lau, Amy Hing-Ling, and Hon-Shiang Lau. 1998. The newsboy problem with price-dependent demand distribution. IIE Transactions 20: 168–75. [Google Scholar] [CrossRef]

- Lee, Yu-Ping, and Chung-Yuan Dye. 2012. An inventory model for deteriorating items under stock-dependent demand and control label deterioration rate. Computers & Industrial Engineering 63: 474–82. [Google Scholar]

- Mandal, B. N. A., and S. Phaujdar. 1989. An inventory model for deteriorating items and stock-dependent consumption rate. Journal of the Operation Research Society 40: 483–88. [Google Scholar] [CrossRef]

- Manna, Amalesh Kumar, Barun Das, Jayanta Kumar Dey, and Shyamal Kumar Mondal. 2016. An EPQ model with promotional demand in random planning horizon: Population varying genetic algorithm approach. Journal of Intelligent Manufacturing 27: 1–19. [Google Scholar] [CrossRef]

- Manna, Amalesh Kumar, Barun Das, Jayanta Kumar Dey, and Shyamal Kumar Mondal. 2017a. Multi-item EPQ model with learning effect on imperfect production over fuzzy-random planning horizon. Journal of Management Analytics 4: 80–110. [Google Scholar] [CrossRef]

- Manna, Amalesh Kumar, Jayanta Kumar Dey, and Shyamal Kumar Mondal. 2017b. Imperfect production inventory model with production rate dependent defective rate and advertisement dependent demand. Computers & Industrial Engineering 104: 9–22. [Google Scholar]

- Nobil, Amir Hossein, Amir Hosein Afshar Sedigh, Sunil Tiwari, and Hui Ming Wee. 2019. An imperfect multi-item single machine production system with shortage, rework, and scrapped considering inspection, dissimilar deficiency levels, and non-zero setup times. Scientia Iranica 26: 557–70. [Google Scholar] [CrossRef] [Green Version]

- Padmanabhan, G., and Prem Vrat. 1995. EOQ models for perishable items under stock dependent selling rate. European Journal of Operational Research 86: 281–92. [Google Scholar] [CrossRef]

- Pal, S., A. Goswami, and K. S. Chaudhuri. 1993. A deterministic inventory model for deteriorating items with stock-dependent demand rate. International Journal of Production Economics 32: 291–99. [Google Scholar] [CrossRef]

- Pervin, Magfura, Sankar Kumar Roy, and Gerhard Wilhelm Weber. 2019. Multi-item deteriorating two-echelon inventory model with price-and stock-dependent demand: A trade-credit policy. Journal of Industrial & Management Optimization 15: 1345–73. [Google Scholar]

- Shah, Nita H., and Chetansinh R. Vaghela. 2018. Imperfect production inventory model for time and effort dependent demand under inflation and maximum reliability. International Journal of Systems Science: Operations & Logistics 5: 60–68. [Google Scholar]

- Shaikh, Ali Akbar, Leopoldo Eduardo Cárdenas-Barrón, Amalesh Kumar Manna, and Armando Céspedes-Mota. 2020. An economic production quantity (EPQ) model for a deteriorating item with partial trade credit policy for price dependent demand under inflation and reliability. Yugoslav Journal of Operations Research 31: 139–51. [Google Scholar]

- Sheu, Shey-Huei, and Jih-An Chen. 2004. Optimal lot-sizing problem with imperfect maintenance and imperfect production. International Journal of Systems Science 35: 69–77. [Google Scholar] [CrossRef]

- Taleizadeh, Ata Allah, Seyed Taghi Akhavan Niaki, and Amir Abbas Najafi. 2010. Multiproduct single-machine production system with stochastic scrapped production rate, partial backordering and service level constraint. Journal of Computational and Applied Mathematics 233: 1834–49. [Google Scholar] [CrossRef]

- Taleizadeh, Ata Allah, Babak Mohammadi, Leopoldo Eduardo Cárdenas-Barrón, and Hadi Samimi. 2013. An EOQ model for perishable product with special sale and shortage. International Journal of Production Economics 145: 318–38. [Google Scholar] [CrossRef]

- Taleizadeh, Ata Allah, Solaleh Sadat Kalantari, and Leopoldo Eduardo Cárdenas-Barrón. 2016. Pricing and lot sizing for an EPQ inventory model with rework and multiple shipments. Top 24: 143–55. [Google Scholar] [CrossRef]

- Taleizadeh, Ata Allah. 2017. A constrained integrated imperfect manufacturing-inventory system with preventive maintenance and partial backordering. Annals of Operations Research 261: 303–37. [Google Scholar] [CrossRef]

- Wu, Kun-Shan, Liang-Yuh Ouyang, and Chih-Te Yang. 2006. An optimal replenishment policy for non-instantaneous deteriorating items with stock-dependent demand and partial backlogging. International Journal of Production Economics 101: 369–84. [Google Scholar] [CrossRef]

| Author(s) (Year) | Model | Learning Effect | Inflation | Backlogging | Demand Rate Depends on | Multi-Item |

|---|---|---|---|---|---|---|

| Mandal and Phaujdar (1989) | Production | No | No | Yes | Stock level | No |

| Datta and Pal (1990) | Purchase | No | No | No | Stock level | No |

| Lau and Lau (1998) | Purchase | No | No | Yes | Random | No |

| Abad (2001) | Purchase | No | No | Yes | Price and time | No |

| Hayek and Salameh (2001) | Production | No | No | Yes | Constant | No |

| Ben-Daya (2002) | Production | No | No | No | Time | No |

| Chiu (2003) | Production | No | No | Yes | Constant | No |

| Sheu and Chens (2004) | Production | No | No | No | Constant | No |

| Dye and Ouyang (2005) | Purchase | No | No | Yes | Stock level | No |

| Wu et al. (2006) | Purchase | No | No | Yes | Stock level | No |

| Lee and Dye (2012) | Purchase | No | No | Yes | Stock level | No |

| Avinadav et al. (2013) | Purchase | No | No | No | Price and time | No |

| Taleizadeh et al. (2013) | Purchase | Yes | No | Yes | Constant | No |

| Manna et al. (2016) | Production | No | Yes | No | Price and advertisement | Yes |

| Manna et al. (2017a) | Production | Yes | Yes | Yes | Stock level | Yes |

| Bhunia et al. (2018) | Purchase | No | No | No | Stock level | No |

| Pervin et al. (2019) | Supply chain | No | No | No | Price and stock level | Yes |

| Banu et al. (2021) | Supply chain | No | No | No | Stock level | No |

| Present paper | Production | Yes, effect on | Yes | Yes | Price and stock level | Yes |

| reworked rate |

| Production | Screening | Rework Cost | Holding | Shortage | Selling | |

|---|---|---|---|---|---|---|

| Cost () | Cost () | Cost () | Cost () | Cost () | Price () | |

| item-1 | $1.15 | $ 6 | $4.5 | $ 14 | $ 43 | |

| item-2 | $1.20 | $ 5 | $4.5 | $ 11 | $ 38 |

| item-1 | 12 | 0.010 | 0.038 | 0.29 | 0.70 | |||

| item-2 | 14 | 0.011 | 0.040 | 0.25 | 0.75 |

| Item | ETC | |||||

|---|---|---|---|---|---|---|

| item-1 | 11.139 | 5.21 | 7.04 | 8.17 | 9.83 | 1774.941 |

| item-2 | 17.683 | 5.78 | 7.26 | 8.25 | 10.29 |

| Item | Reworking Cost | Holding Cost | ETC | |||

|---|---|---|---|---|---|---|

| item-1 | 0.15 | 0.54 | 10.18 | 10.37 | 184.78 | 1727.29 |

| item-2 | 0.21 | 0.59 | 16.75 | 11.24 | ||

| item-1 | 0.15 | 0.64 | 10.65 | 12.26 | 200.32 | 1737.23 |

| item-2 | 0.21 | 0.69 | 16.91 | 13.17 | ||

| item-1 | 0.18 | 0.44 | 11.27 | 8.87 | 176.20 | 1764.52 |

| item-2 | 0.25 | 0.49 | 17.86 | 9.74 | ||

| item-1 | 0.18 | 0.54 | 11.14 | 10.86 | 190.30 | 1774.94 |

| item-2 | 0.25 | 0.59 | 17.68 | 11.74 | ||

| item-1 | 0.18 | 0.64 | 11.01 | 12.83 | 204.46 | 1785.45 |

| item-2 | 0.25 | 0.69 | 17.86 | 13.76 | ||

| item-1 | 0.22 | 0.54 | 11.67 | 11.44 | 193.62 | 1832.32 |

| item-2 | 0.29 | 0.59 | 18.72 | 12.21 | ||

| item-1 | 0.22 | 0.64 | 11.51 | 13.52 | 208.34 | 1843.26 |

| item-2 | 0.29 | 0.69 | 18.92 | 14.31 |

| Item | Reworking Cost | Production & Screening Cost | ETC | ||||

|---|---|---|---|---|---|---|---|

| item-1 | 0.16 | 0.25 | 0.14 | 10.68 | 10.03 | 405.95 | 1726.87 |

| item-2 | 0.14 | 0.21 | 0.22 | 16.92 | 10.75 | 568.71 | |

| item-1 | 0.16 | 0.25 | 0.18 | 11.16 | 10.54 | 484.37 | 1770.26 |

| item-2 | 0.14 | 0.21 | 0.25 | 17.62 | 11.02 | 592.34 | |

| item-1 | 0.16 | 0.29 | 0.18 | 11.16 | 10.54 | 424.37 | 1770.23 |

| item-2 | 0.14 | 0.25 | 0.25 | 17.62 | 11.02 | 592.33 | |

| item-1 | 0.20 | 0.29 | 0.18 | 11.14 | 10.86 | 423.53 | 1774.97 |

| item-2 | 0.18 | 0.25 | 0.25 | 17.68 | 11.74 | 594.49 | |

| item-1 | 0.24 | 0.25 | 0.14 | 10.65 | 10.37 | 405.08 | 1735.61 |

| item-2 | 0.22 | 0.21 | 0.22 | 17.03 | 12.03 | 572.47 | |

| item-1 | 0.24 | 0.33 | 0.14 | 10.65 | 10.37 | 405.07 | 1735.59 |

| item-2 | 0.22 | 0.30 | 0.22 | 17.03 | 12.03 | 572.46 | |

| item-1 | 0.24 | 0.33 | 0.22 | 11.63 | 11.90 | 442.31 | 1848.50 |

| item-2 | 0.22 | 0.30 | 0.30 | 19.04 | 13.30 | 641.99 |

| Item | R | Reworking Cost | Production & Screening Cost | Holding Cost | ETC | |

|---|---|---|---|---|---|---|

| item-1 | 0.35 | 11.24 | 09.56 | 375.88 | 154.18 | 1447.43 |

| item-2 | 17.67 | 10.21 | 519.84 | |||

| item-1 | 0.30 | 11.14 | 10.86 | 423.53 | 190.30 | 1774.94 |

| item-2 | 17.68 | 11.74 | 594.50 | |||

| item-1 | 0.25 | 11.03 | 12.68 | 488.17 | 240.58 | 2257.23 |

| item-2 | 17.69 | 13.91 | 697.01 |

| Item | Reworking Cost | Production & Screening Cost | Holding Cost | ETC | ||

|---|---|---|---|---|---|---|

| item-1 | 0.0005 | 11.14 | 10.88 | 424.13 | 146.92 | 1682.69 |

| item-2 | 17.68 | 11.76 | 595.37 | |||

| item-1 | 0.0010 | 11.14 | 10.86 | 423.53 | 190.30 | 1774.94 |

| item-2 | 17.68 | 11.74 | 594.50 | |||

| item-1 | 0.0015 | 11.14 | 10.84 | 422.94 | 233.32 | 1866.45 |

| item-2 | 17.68 | 11.72 | 593.62 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manna, A.K.; Cárdenas-Barrón, L.E.; Das, B.; Shaikh, A.A.; Céspedes-Mota, A.; Treviño-Garza, G. An Imperfect Production Model for Breakable Multi-Item with Dynamic Demand and Learning Effect on Rework over Random Planning Horizon. J. Risk Financial Manag. 2021, 14, 574. https://doi.org/10.3390/jrfm14120574

Manna AK, Cárdenas-Barrón LE, Das B, Shaikh AA, Céspedes-Mota A, Treviño-Garza G. An Imperfect Production Model for Breakable Multi-Item with Dynamic Demand and Learning Effect on Rework over Random Planning Horizon. Journal of Risk and Financial Management. 2021; 14(12):574. https://doi.org/10.3390/jrfm14120574

Chicago/Turabian StyleManna, Amalesh Kumar, Leopoldo Eduardo Cárdenas-Barrón, Barun Das, Ali Akbar Shaikh, Armando Céspedes-Mota, and Gerardo Treviño-Garza. 2021. "An Imperfect Production Model for Breakable Multi-Item with Dynamic Demand and Learning Effect on Rework over Random Planning Horizon" Journal of Risk and Financial Management 14, no. 12: 574. https://doi.org/10.3390/jrfm14120574