An Event Study on the Reaction of Equity and Commodity Markets to the Onset of the Russia–Ukraine Conflict

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Event Study Model

3.2. Supplementing Event Study with EGARCH

4. Results

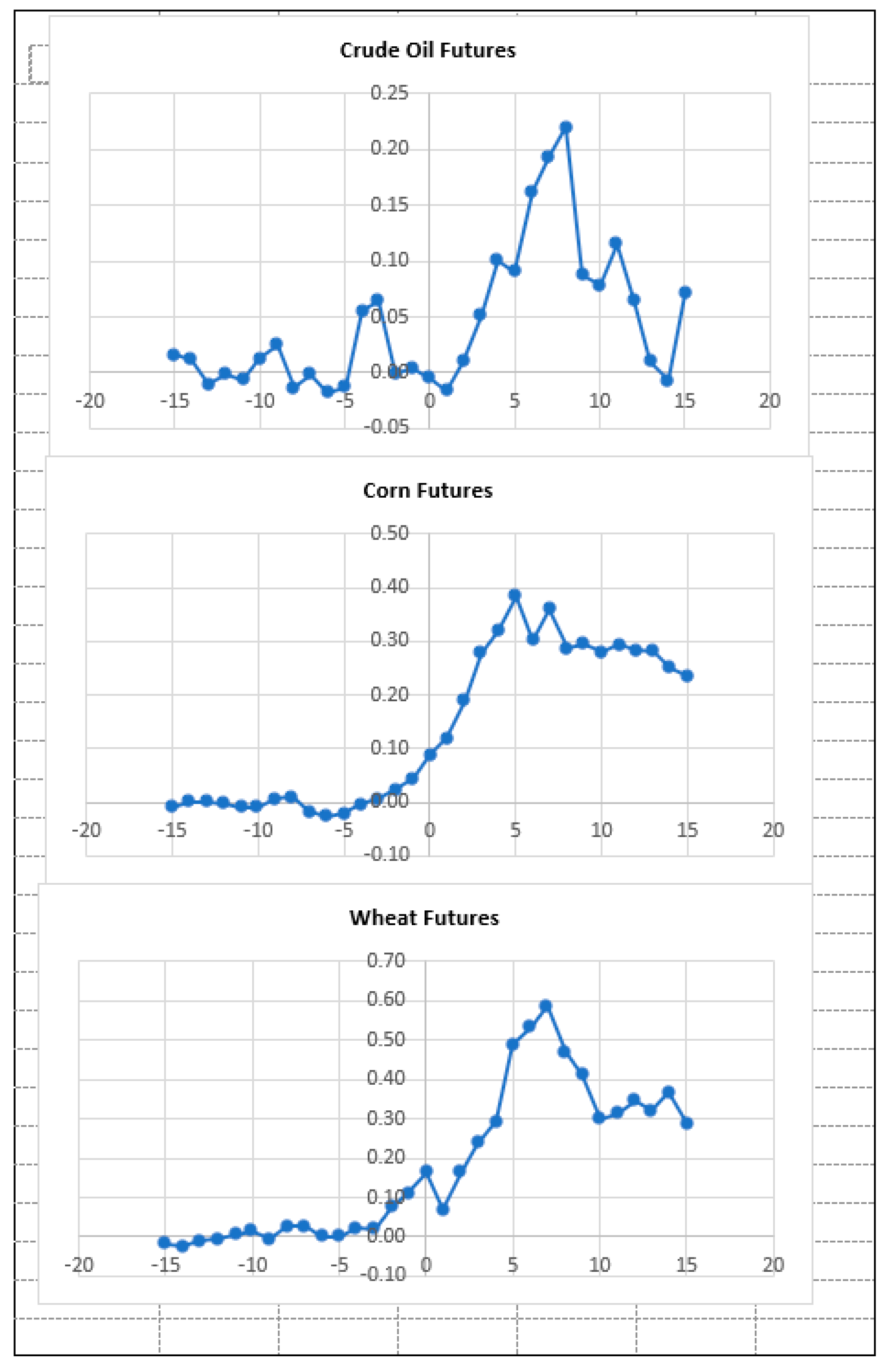

4.1. Pre-Event and Post-Event Abnormal Returns

4.2. EGARCH Results

5. Conclusions

6. Risk Management and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Timeline of Events Leading Up to the 2022 Russian Invasion of Ukraine

| 1991 Dec 25 | Ukraine declares independence after the fall of the Soviet Union. |

| 2004 Nov 21 | Pro-Russian candidate Viktor Yanukovich, who speaks only Russian, is declared president of Ukraine amid allegations of massive election fraud. Protests, dubbed the Orange Revolution, forced a rerun. Election results were also later overturned by the Ukrainian Supreme Court. |

| 2004 Dec 26 | In a new runoff, Yanukovych was defeated. Pro-Western candidate, Viktor Yushchenko, is elected president and declares intent to join NATO and EU. |

| 2010 Feb 7 | Yanukovich returns to win the presidential election with a narrow victory. Strengthens ties with Russia by extending Russia’s lease of Ukraine’s port at Sevastopol in exchange for a reduction in the price of Russian natural gas. |

| 2013 Nov | Yanukovich suspends trade talks with the EU and opts to revive economic ties with Russia, triggering months of mass protests in Kyiv, Ukraine’s capital. |

| 2014 Feb 22 | Ukraine’s parliament voted to remove Yanukovich for allowing the killing of protesters. Within days, pro-Russian armed men seized parliament in the Ukrainian region of Crimea and raised the Russian flag. Moscow later annexes Crimea. |

| 2014 Feb 28 | Yanukovych appears at the Kremlin, where he delivers a speech asserting that he is still the president of Ukraine. |

| 2014 Apr | Pro-Russian separatists in the Eastern Ukrainian region of Donbas declare independence following months of fighting between the separatists and the Ukrainian army. |

| 2016 Jan 1 | An association agreement between Ukraine and the EU opens markets for free trade of goods and services and visa-free travel to the EU for Ukrainians. |

| 2019 Jan | Yanukovych was found guilty of high treason and sentenced to 13 years in prison in absentia (he was still in exile in Russia). |

| 2019 Apr 21 | Volodymyr Zelenskiy is elected president of Ukraine and pledges to strengthen ties with the EU. |

| 2021 Jan | Zelenskiy appeals to U.S. President Joe Biden to allow Ukraine to join NATO amid mounting Russian support for separatists in eastern Ukraine. |

| 2021 Feb | Zelenskiy’s government freezes the assets of opposition leader Viktor Medvedchuk, Russia’s most prominent ally in Ukraine’s politics. |

| 2021 Spring-Fall | Russia begins amassing troops near Ukraine’s eastern border in what Russia’s President, Vladimir Putin, referred to as training exercises. |

| 2021 Dec 17 | Russia presents security demands which include that NATO pull back troops and weapons from Eastern Europe and bar Ukraine from ever joining NATO. |

| 2022 Jan 26 | U.S. states its commitment to NATO’s “open-door” policy while offering a “pragmatic evaluation” of Moscow’s concerns. Two days later, Russia said that its demands had not been addressed. |

| 2022 Feb 15 | Amid growing fears of imminent Russian attack, U.S. announces it would send 3000 additional troops to NATO members Poland and Romania for defense purposes but not to Ukraine. |

| 2022 Feb 21 | In a TV address, Russia’s President Putin says Ukraine is an integral part of Russian history and has a puppet regime managed by foreign powers. He ordered what he referred to as peacekeeping forces into two breakaway regions in Eastern Ukraine, recognizing them as independent. |

| 2022 Feb 22 | G7 and EU countries sanction Russian parliament members, Russian banks, and various Russian assets in response to Putin’s troop order. Germany halts the Nord Stream 2 gas pipeline project. |

| 2022 Feb 24 | Putin authorizes “special military operations” in Ukraine. Russian forces begin missile and artillery attacks, striking major Ukrainian cities, including Kiev. |

| 2022 Feb 26 | Western allies announce new sanctions, including restrictions on Russia’s central bank. Russian banks are also barred from the global payments system. |

| 1 | Averting an African Food Crisis in the Wake of the Ukraine War. World Economic Forum, 16 May 2022. (https://www.weforum.org/agenda/2022/05/averting-an-african-food-crisis-in-the-wake-of-the-ukraine-war (accessed on 30 June 2022)). |

| 2 | Kenya scraps petrol subsidy after president warned it was unsustainable. Reuters, 15 September 2022. (https://www.reuters.com/world/africa/kenya-scraps-petrol-subsidy-after-president-warned-it-was-unsustainable-2022-09-15 (accessed on 19 September 2022)). |

References

- Abbassi, Wajih, Vineeta Kumari, and Dharen K. Pandey. 2022. What makes firms vulnerable to the Russia–Ukraine crisis? Journal of Risk Finance 24: 24–39. [Google Scholar] [CrossRef]

- Afego, Pyemo N. 2013. Stock Price Response to Earnings Announcements: Evidence from the Nigerian Stock Market. Journal of African Business 14: 141–49. [Google Scholar] [CrossRef]

- Ahmad, Tanveer, Shahzad Hussain, Muhammad Akbar, and Ajid Rehman. 2022. Impact of terrorism on stock market: Evidence from developed and developing markets. International Journal of Disaster Risk Reduction 70: 102786. [Google Scholar] [CrossRef]

- Ahmed, Walid. 2017. The impact of political regime changes on stock prices: The case of Egypt. International Journal of Emerging Markets 12: 508–31. [Google Scholar] [CrossRef]

- Aizenman, Joshua, Yothin Jinjarak, Minsoo Lee, and Donghyun Park. 2016. Developing countries’ financial vulnerability to the eurozone crisis: An event study of equity and bond markets. Journal of Economic Policy Reform 19: 1–19. [Google Scholar] [CrossRef]

- Alekneviciene, Vilija, Lauryna Kviedaraitiene, and Egle Alekneviciute. 2018. Semi-Strong Form Efficiency in the Baltic Stock Markets under Changing Economic Situation. Engineering Economics 29: 495–506. [Google Scholar] [CrossRef]

- Bagchi, Bhaskar, and Biswajot Paul. 2023. Effects of Crude Oil Price Shocks on Stock Markets and Currency Exchange Rates in the Context of Russia-Ukraine Conflict: Evidence from G7 Countries. Journal of Risk and Financial Management 16: 64. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Matteo Bonato, Riza Demirer, and Rangan Gupta. 2018. Geopolitical risks and stock market dynamics of the BRICS. Economic Systems 42: 295–306. [Google Scholar] [CrossRef]

- Berg, Andrew, and Eduardo Borensztein. 2000. The Pros and Cons of Full Dollarization. IMF Working Paper WP/00/50. Washington, DC: International Monetary Fund. [Google Scholar]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brown, Steven, and Jerold Warner. 1980. Measuring security price performance. Journal of Financial Economics 8: 205–58. [Google Scholar] [CrossRef]

- Brown, Steven, and Jerrold Warner. 1985. Using daily stock returns. Journal of Financial Economics 14: 3–31. [Google Scholar] [CrossRef]

- Buigut, Steven, and Brian Masinde. 2022. The Impact of General Elections on Kenya’s Tourism, Financial and Media Sector Stock Returns: An Event Study Approach. Journal of African Business 23: 497–515. [Google Scholar] [CrossRef]

- Campbell, John, Andrew Lo, and A. Craig MacKinlay. 1996. The Econometrics of Financial Markets. Princeton: Princeton University Press. [Google Scholar]

- Corrado, Charles. 1989. A nonparametric test for abnormal security-price performance in event studies. Journal of Financial Economics 23: 385–95. [Google Scholar] [CrossRef]

- Deaves, Richard, and Itzhak Krinsky. 1992. The Behavior of Oil Futures Returns Around OPEC Conferences. Journal of Futures Market 12: 563–74. [Google Scholar] [CrossRef]

- Devereux, Michael B., and Gregor W. Smith. 2018. Commodity Currencies and Monetary Policy. Working Paper 25076. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1991. Efficient capital markets II. The Journal of Finance 46: 1575–617. [Google Scholar] [CrossRef]

- Fama, Eugene, Lawrence Fisher, Michael Jensen, and Richard Roll. 1969. The Adjustment of Stock Prices to New Information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Gopane, Thabo J., and Reggy M. Mmotla. 2019. Stock Market Reaction to Mega Sport Events: Evidence from South Africa and Morocco. International Journal of Sports Finance 14: 193–210. [Google Scholar]

- Hoang, Khanh, Toan L. D. Huynh, and Steven Ongena, eds. 2022. DP1741 The Impact of Foreign Sanctions on Firm Performance in Russia. CEPR Press Discussion Paper No. 17415. Available online: cepr.org/voxeu/columns/impact-foreign-sanctions-firm-performance-russia (accessed on 4 April 2023).

- IEA. 2022. Russian Supplies to Global Energy Markets. Paris: IEA. Available online: https://www.iea.org/reports/russian-supplies-to-global-energy-markets/oil-market-and-russian-supply-2 (accessed on 29 June 2022).

- Jiun, Ricky C. C. 2018. The Effect of Political Elections on Stock Market Volatility in Malaysia. International Journal of Engineering and Technology 7: 114–19. [Google Scholar] [CrossRef]

- Kabiru, James N., Duncan E. Ochieng, and Hellen W. Kinyua. 2015. The Effect of General Elections on Stock Returns at the Nairobi Securities Exchange. European Scientific Journal 11: 435–60. [Google Scholar]

- Kothari, Sagar P., and Jerold B. Warner. 2007. Econometrics of Event Studies. Handbook of Empirical Corporate Finance 1: 3–36. [Google Scholar] [CrossRef]

- Kumara, H. V. U. D., and P. N. D. Fernando. 2020. Impact of Political Events on Stock Market Return: Empirical Evidence from Sri Lanka. Paper presented at International Conference on Business & Information (ICBI) 2020, Sharjah, United Arab Emirates, February 13–14. [Google Scholar] [CrossRef]

- Kutan, Ali M., and Riza Demirer. 2010. The Behavior of Crude Oil Spot and Futures Prices around OPEC and SPR Announcements: An Event Study Perspective. Energy Economics 32: 1467–76. [Google Scholar] [CrossRef]

- Kyriazis, Nikolaos A. 2022. Optimal Portfolios of National Currencies, Commodities and Fuel, Agricultural Commodities and Cryptocurrencies during the Russian-Ukrainian Conflict. International Journal of Financial Studies 10: 75. [Google Scholar] [CrossRef]

- Lehkonen, Heikki, and Kari Heimonen. 2015. Democracy, political risks and stock market performance. Journal of International Money and Finance 59: 77–99. [Google Scholar] [CrossRef]

- Liu, Yue, Hao Dong, and Pierre Failler. 2019. The Oil Market Reactions to OPEC’s Announcements. Energies 12: 3238. [Google Scholar] [CrossRef]

- Nazir, Sajid M., Hassan Younus, Ahmad Kaleem, and Zeshan Anwar. 2014. Impact of Political Events on Stock Market Returns: Empirical Evidence from Pakistan. Journal of Economic and Administrative Sciences 30: 60–78. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- Ngo, Vu M., Toan L. D. Huynh, Phuc V. Nguyen, and Huan H. Nguyen. 2022. Public sentiment towards economic sanctions in the Russia–Ukraine war. Scottish Journal of Political Economy 69: 564–73. [Google Scholar] [CrossRef]

- Obi, Pat, Ebenezer B. Anarfo, and Greg Obi. 2019. Revenue Dampening Effect of the Oil–Dollar Inverse Relationship for Sub-Saharan African Economies. Journal of African Business 20: 305–16. [Google Scholar] [CrossRef]

- Obi, Pat, J. Surujlal, and O. Okubena. 2009. South African Equity Market Reaction to the 2010 FIFA World Cup Announcement. African Journal for Physical Health Education, Recreation and Dance 9: 284–96. [Google Scholar]

- Shaikh, Maria, Sumra H. Shaikh, Mahboob Ullah, and Aisha B. Shah. 2021. COVID-19 Outbreak and Stock Return of G7 Economies. International Journal of Management 12: 15–26. [Google Scholar] [CrossRef]

- Truong, Loc Dong, and H. Swint Friday. 2021. The Impact of the Introduction of Index Futures on the Daily Returns Anomaly in the Ho Chi Minh Stock Exchange. International Journal of Financial Studies 9: 43. [Google Scholar] [CrossRef]

- Yousaf, Imran, Ritesh Patel, and Larisa Yarovaya. 2022. The reaction of G20+ stock markets to the Russia–Ukraine conflict “black-swan” event: Evidence from event study approach. Journal of Behavioral and Experimental Finance 35: 100723. [Google Scholar] [CrossRef]

- Zaremba, Adam, Nusret Cakici, Ender Demir, and Huaigang Long. 2022. When bad news is good news: Geopolitical risk and the cross-section of emerging market stock returns. Journal of Financial Stability 58: 100964. [Google Scholar] [CrossRef]

| FX | Oil | Corn | Wheat | FX | Oil | Corn | Wheat | FX | Oil | Corn | Wheat | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 24 February 22 | 22 July 22 | % Change | ||||||||||

| U.S. | 1.0000 | $87 | $2.80 | $9.26 | 1.0000 | $110 | $5.75 | $11.58 | NA | 26% | 105% | 25% |

| Egypt | 15.73 | 1368 | 44.04 | 145.66 | 18.86 | 2074 | 108.44 | 218.29 | −17% | 52% | 146% | 50% |

| Ghana | 6.70 | 583 | 18.76 | 62.04 | 8.57 | 943 | 49.28 | 99.20 | −22% | 62% | 163% | 60% |

| Kenya | 113.75 | 9895 | 318.50 | 1053.33 | 118.02 | 12,982 | 678.62 | 1366.08 | −4% | 31% | 113% | 30% |

| Mauritius | 43.95 | 3823 | 123.06 | 406.98 | 45.835 | 5042 | 263.55 | 530.54 | −4% | 32% | 114% | 30% |

| Morocco | 9.4754 | 824 | 26.53 | 87.74 | 10.3300 | 1136 | 59.40 | 119.57 | −8% | 38% | 124% | 36% |

| Namibia | 15.46 | 1345 | 43.29 | 143.16 | 16.28 | 1790 | 93.59 | 188.41 | −5% | 33% | 116% | 32% |

| Nigeria | 576.00 | 50,106 | 1612.80 | 5333.76 | 630.00 | 69,300 | 3622.50 | 7292.25 | −9% | 38% | 125% | 37% |

| SA | 15.36 | 1336 | 43.01 | 142.23 | 17.02 | 1872 | 97.87 | 197.01 | −10% | 40% | 128% | 39% |

| Abnormal Return | p-Value | |

|---|---|---|

| African Equities | −0.0224 *** | 0.0000 |

| G7 Equities | −0.0237 *** | 0.0000 |

| Oil | −0.0087 * | 0.0672 |

| Corn | 0.0434 ** | 0.0321 |

| Wheat | 0.0542 ** | 0.0203 |

| Asset | CAR | t-Statistic | p-Value |

|---|---|---|---|

| Panel A. Total Event Window: −15 to +15 | |||

| African Equities | −0.0480 *** | −7.0559 | 0.0000 |

| G7 Equities | −0.0593 *** | −4.0803 | 0.0000 |

| Oil | 0.0870 ** | 2.0649 | 0.0477 |

| Corn | 0.2375 *** | 6.5002 | 0.0000 |

| Wheat | 0.2980 *** | 4.7929 | 0.0000 |

| Panel B. Pre-Event Window: −15 to −1 | |||

| African Equities | −0.0156 *** | −5.4788 | 0.0001 |

| G7 Equities | −0.0470 *** | −6.3913 | 0.0000 |

| Oil | 0.0224 | 0.8034 | 0.4335 |

| Corn | 0.0443 *** | 3.4554 | 0.0040 |

| Wheat | 0.1195 *** | 5.4001 | 0.0001 |

| Panel C. Post-Event Inner Window: +1 to +7 | |||

| African Equities | −0.0146 | −1.5702 | 0.1604 |

| G7 Equities | −0.0523 ** | −2.6136 | 0.0347 |

| Oil | 0.1998 *** | 4.9777 | 0.0016 |

| Corn | 0.2719 *** | 4.1971 | 0.0041 |

| Wheat | 0.4221 *** | 4.2288 | 0.0039 |

| Panel D. Post-Event Extended Window: +1 to +15 | |||

| African Equities | −0.0100 | −1.3551 | 0.1970 |

| G7 Equities | 0.0113 | 0.6096 | 0.5520 |

| Oil | 0.0893 | 1.7259 | 0.1062 |

| Corn | 0.1478 *** | 3.0028 | 0.0090 |

| Wheat | 0.1495 * | 1.8048 | 0.0900 |

| Model | U.S. | U.K. | Japan | Canada | France | Germany | Italy |

|---|---|---|---|---|---|---|---|

| (p, q) | (1, 1) | (1, 1) | (1, 1) | (1, 1) | (1, 1) | (1, 1) | (1, 1) |

| Mean Equation: Coefficient (p-value) | |||||||

| Constant | 0.0006 *** (0.0000) | 0.0004 ** (0.0317) | 0.0003 (0.5874) | 0.0004 * (0.0811) | 0.0010 *** (0.0044) | 0.0007 ** (0.0300) | 0.0005 (0.1979) |

| Pre-event | −0.0067 *** (0.0081) | −0.0012 (0.8975) | −0.0041 (0.4538) | −0.0051 *** (0.0023) | −0.0023 (0.7586) | −0.0056 (0.4197) | −0.0028 (0.7200) |

| Postevent | 0.0040 * (0.0569) | −0.0073 ** (0.0469) | −0.0042 (0.4625) | −0.0040 *** (0.0006) | −0.0116 * (0.0601) | −0.0017 (0.7410) | −0.0158 *** (0.0051) |

| VIX | −0.0822 *** (0.0000) | −0.0416 *** (0.0000) | −0.0755 *** (0.0000) | −0.0539 *** (0.0000) | −0.0528 *** (0.0000) | −0.0296 *** (0.0000) | −0.0578 *** (0.0000) |

| AR(1) | 0.8994 *** (0.0000) | 0.4127 *** (0.0091) | −0.6249 * (0.0970) | 0.2801 (0.2735) | −1.1210 *** (0.0000) | 0.3432 * (0.0649) | −0.2337 (0.3667) |

| AR(2) | 0.0297 (0.5477) | −0.0544 (0.3921) | −0.0026 (0.9790) | 0.0599 (2793) | −0.1339 *** (0.0058) | −0.0803 (0.2160) | −0.0697 (0.2208) |

| MA(1) | −0.9661 *** (0.0000) | −0.6107 *** (0.0000) | 0.4507 (0.2229) | −0.3919 (0.1264) | 0.9961 *** (0.0000) | −0.4942 *** (0.0083) | 0.1215 (0.6445) |

| Variance Equation: Coefficient (p-value) | |||||||

| Constant | −0.1374 *** (0.0000) | −0.0143 (0.7550) | −0.3176 *** (0.0000) | −0.4111** (0.0233) | −0.3393 *** (0.0003) | −0.5491 *** (0.0001) | −0.5091 *** (0.0025) |

| ARCH | −0.0182 (0.4758) | −0.0103 (0.7232) | −0.1153 *** (0.0000) | 0.1629 *** (0.0035) | 0.0524 (0.1247) | 0.0692 * (0.0999) | 0.0882 * (0.0606) |

| EGARCH | −0.1638 *** (0.0000) | −0.0674 (0.1180) | −0.0067 (0.9366) | −0.1616 ** (0.0160) | −0.0573 (0.3420) | −0.0766 (0.2084) | −0.1413 * (0.0528) |

| GARCH | 0.9853 *** (0.0000) | 0.9983 *** (0.0000) | 0.9558 *** (0.0000) | 0.9729 *** (0.0000) | 0.9692 *** (0.0000) | 0.9473 (0.0000) | 0.9529 *** (0.0000) |

| Pre-event | −0.1621 (0.2136) | 0.2161 * (0.0869) | 0.1102 (0.5322) | −0.1874 (0.3496) | 0.0595 (0.6165) | 0.0244 (0.8689) | 0.0278 (0.8364) |

| Postevent | 0.1765 (0.1374) | −0.0593 (0.5419) | 0.0462 (0.7762) | 0.0959 (0.5977) | 0.2211 * (0.0942) | 0.1500 * (0.0633) | 0.3034 (0.1106) |

| VIX | 3.7059 *** (0.0000) | 3.5093 *** (0.0000) | 1.7388 ** (0.0257) | 2.3527 *** (0.0042) | 3.3284 *** (0.0000) | 3.3311 *** (0.0000) | 2.7671 *** (0.0007) |

| 12.4365 *** (0.0171) | 9.3127 (0.3278) | −0.0931 (0.9902) | 5.4630 (0.6216) | −0.3670 (0.9617) | −5.6376 0.4667) | 2.4754 (0.7758) | |

| Residual Diagnostics | |||||||

| ARCH-LM Statistic (p-value) | |||||||

| χ2 | 1.1166 (0.2906) | 0.3290 (0.5674) | 0.7950 (0.3726) | 1.8510 (0.1737) | 0.6708 (0.4128) | 0.0185 (0.8918) | 0.6950 (0.4045) |

| Ljung−Box Q2 Statistic p-value | |||||||

| 5 lags | 0.269 | 0.648 | 0.690 | 0.828 | 0.048 | 0.288 | 0.282 |

| 10 lags | 0.484 | 0.673 | 0.180 | 0.911 | 0.134 | 0.197 | 0.349 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Obi, P.; Waweru, F.; Nyangu, M. An Event Study on the Reaction of Equity and Commodity Markets to the Onset of the Russia–Ukraine Conflict. J. Risk Financial Manag. 2023, 16, 256. https://doi.org/10.3390/jrfm16050256

Obi P, Waweru F, Nyangu M. An Event Study on the Reaction of Equity and Commodity Markets to the Onset of the Russia–Ukraine Conflict. Journal of Risk and Financial Management. 2023; 16(5):256. https://doi.org/10.3390/jrfm16050256

Chicago/Turabian StyleObi, Pat, Freshia Waweru, and Moses Nyangu. 2023. "An Event Study on the Reaction of Equity and Commodity Markets to the Onset of the Russia–Ukraine Conflict" Journal of Risk and Financial Management 16, no. 5: 256. https://doi.org/10.3390/jrfm16050256