An Investigation into the Spatial Distribution of British Housing Market Activity

Abstract

:1. Introduction

2. Literature

3. Land and Pricing

4. Transaction–Price–Expenditure Nexus

5. Method

6. Data

7. Results

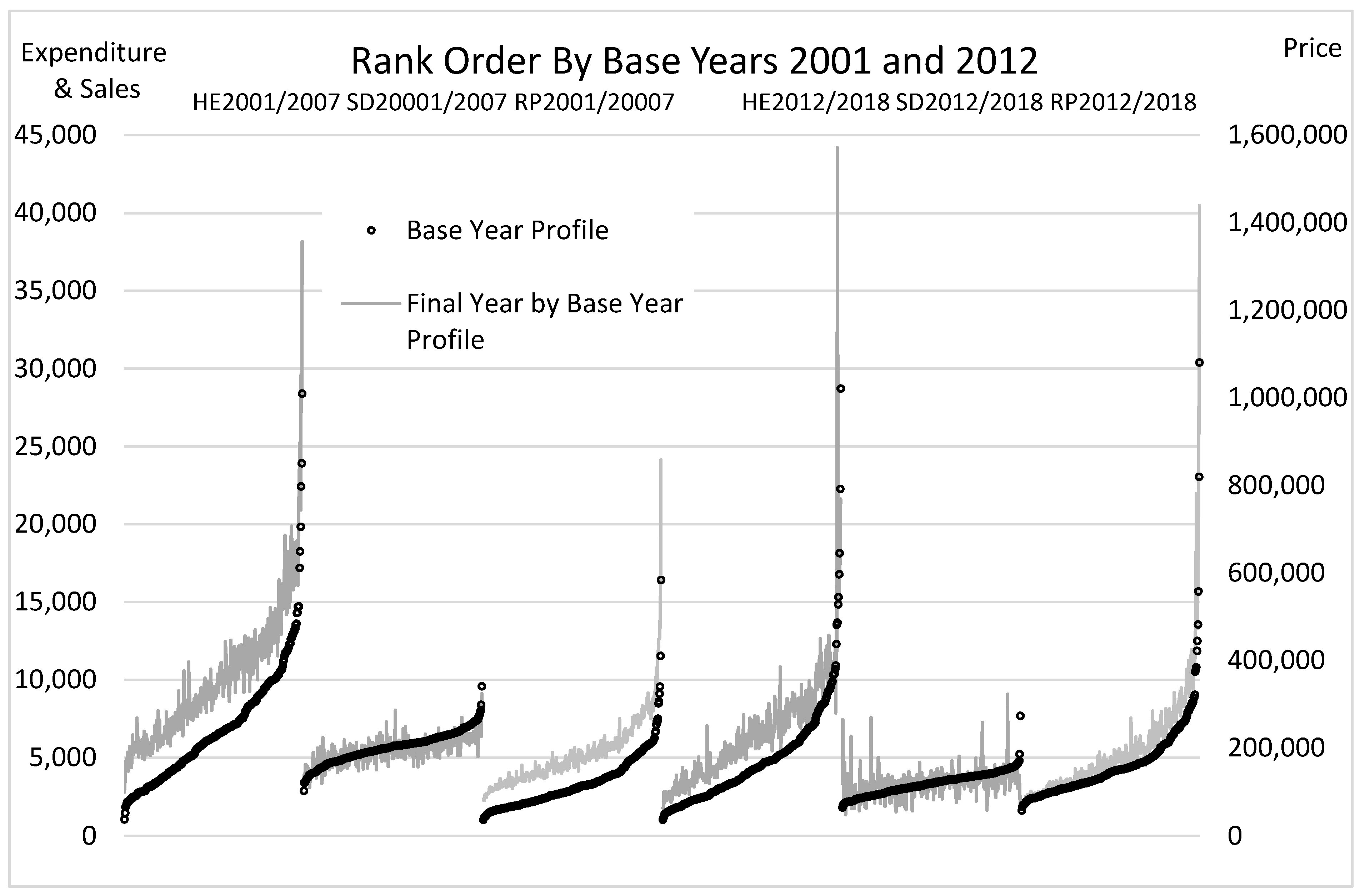

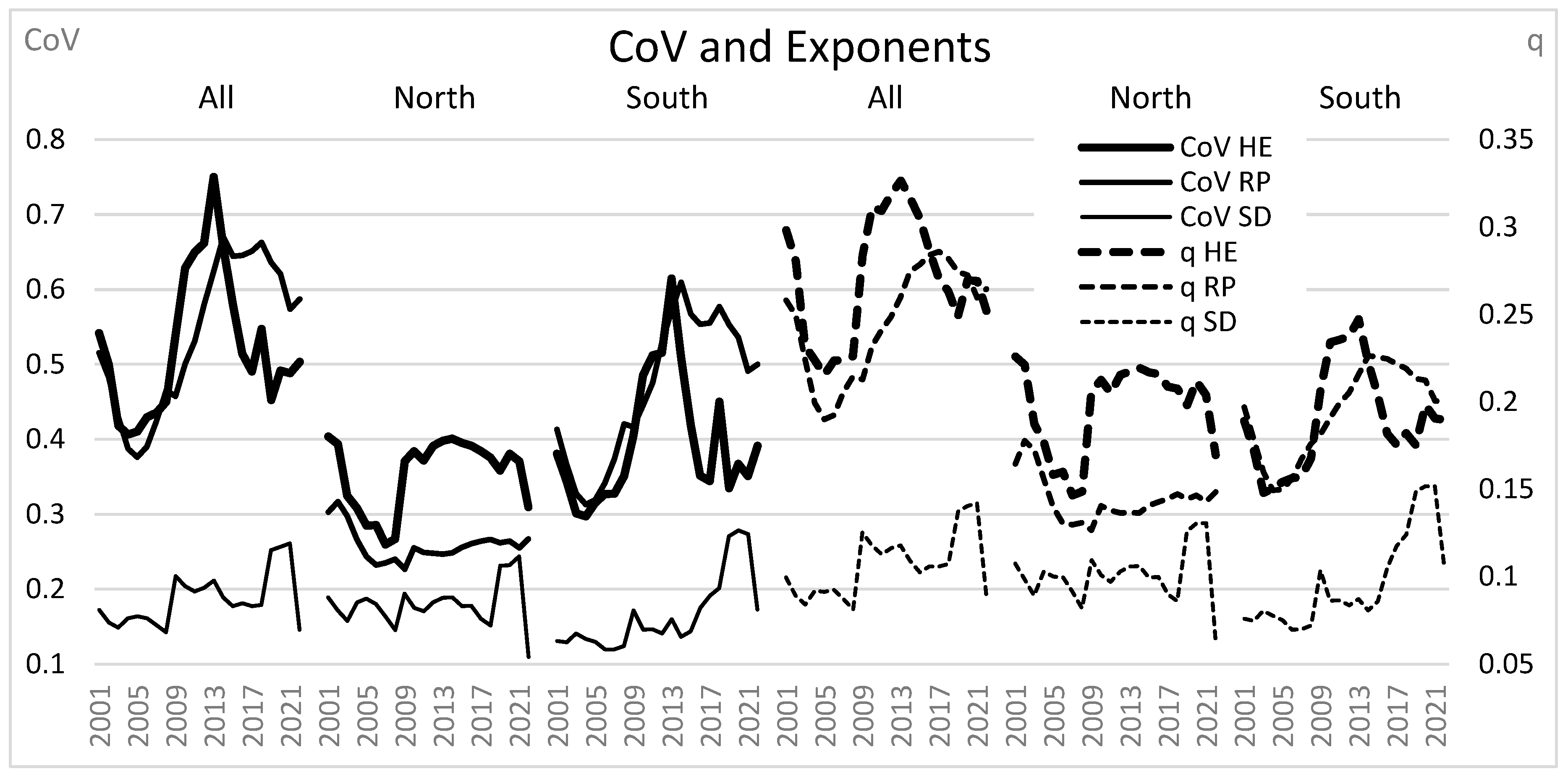

7.1. Exponents’ Time Paths

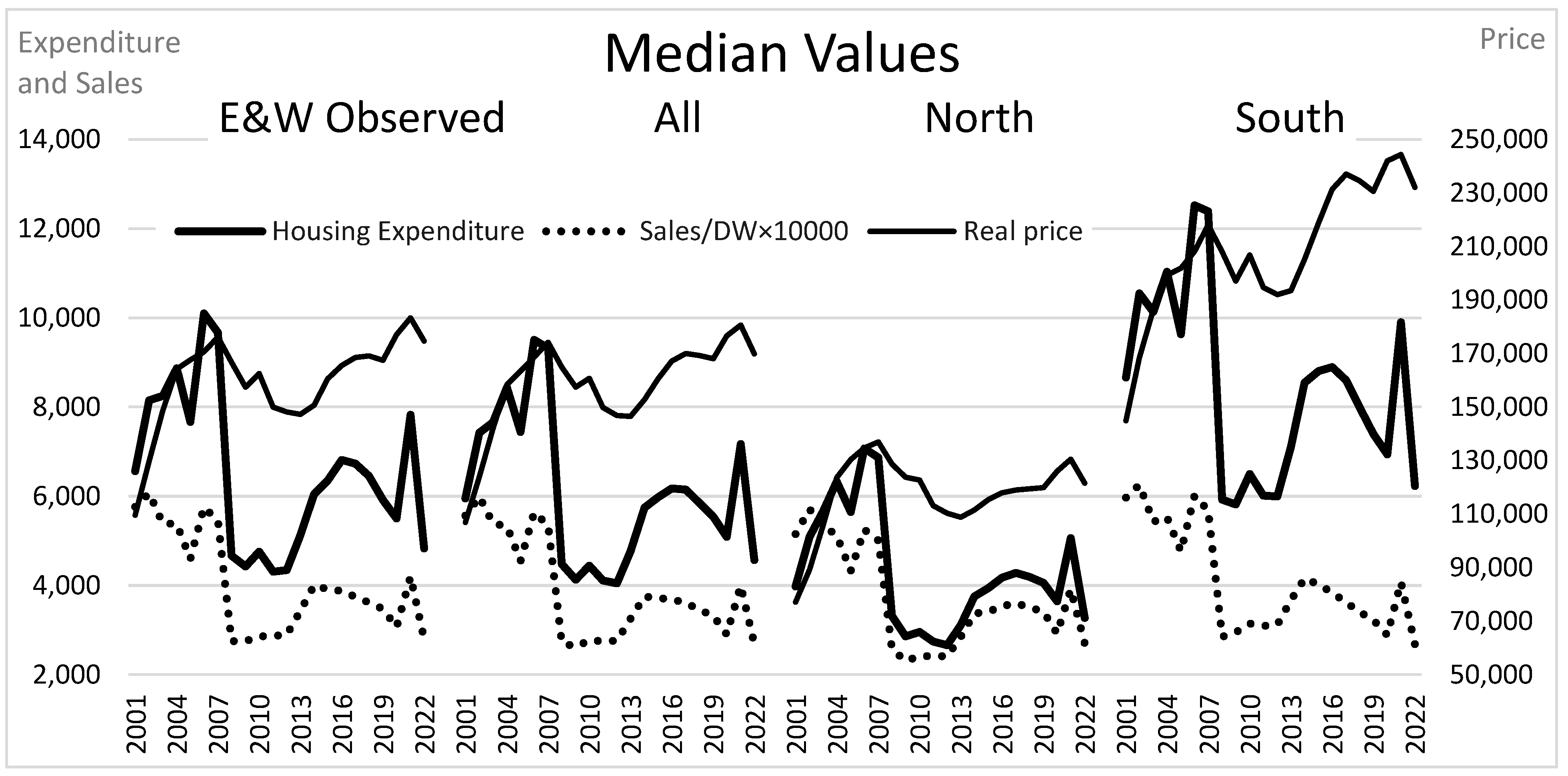

7.2. Expected Median Time Paths

7.3. Stein’s Dynamic Framework

7.4. Stylised Facts

7.5. COVID-19

8. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Allen, Franklin, and Douglas Gale. 2000. Bubbles and crises. The Economic Journal 110: 236–55. [Google Scholar] [CrossRef]

- Amaral, Francisco, Martin Dohmen, Sebastian Kohl, and Moritz Schularick. 2021. Superstar Returns. The New York Federal Staff Reports 999. New York: Federal Reserve Bank of New York. [Google Scholar] [CrossRef]

- Andrew, Mark, and Geoffrey Meen. 2003. House Price Appreciation, Transactions and Structural Change in the British Housing Market: A Macroeconomic Perspective. Real Estate Economics 31: 99–116. [Google Scholar] [CrossRef]

- Bank of England. 2015. The Financial Policy Committee’s Powers over Housing Tools. Available online: https://www.bankofengland.co.uk/-/media/boe/files/statement/2015/the-financial-policy-committees-powers-over-housing-tools.pdf?la=en&hash=824555A3E0E43904679511189F70706FC5EE5EA2 (accessed on 1 February 2018).

- Behrens, Kristian, Gilles Duranton, and Frédéric Robert-Nicoud. 2014. Productive Cities: Sorting, Selection, and Agglomeration. Journal of Political Economy 122: 507–53. [Google Scholar]

- Blackwell, Calvin. 2018. Power Laws in Real Estate Prices? Some Evidence. The Quarterly Review of Economics and Finance 69: 90–98. [Google Scholar] [CrossRef]

- Bogin, Alexander, William Doerner, and William Larson. 2017. Local House Price Paths: Accelerations, Declines, and Recoveries. The Journal of Real Estate Finance and Economics 58: 201–22. [Google Scholar] [CrossRef]

- Brakman, Steven, Harry Garretsen, and Charles van Marrewijk. 2020. An Introduction to Geographical and Urban Economics: A Spiky World. Cambridge: Cambridge University Press. [Google Scholar]

- Brandily, Paul, Mimosa Distefano, Hélène Donnat, Immanuel Feld, Henry G. Overman, and Krishan Shah. 2022. Bridging the Gap: What Would It Take to Narrow the UK’s Productivity Disparities? Resolution Foundation. Available online: https://economy2030.resolutionfoundation.org/wp-content/uploads/2022/06/Bridging-the-gap.pdf (accessed on 1 November 2022).

- Bunn, Philip, Alice Pugh, and Chris Yeates. 2018. The Distributional Impact of Monetary Policy Easing in the UK between 2008 and 2014. March Staff Working Paper No. 720. Available online: https://www.bankofengland.co.uk/news/publications (accessed on 1 September 2022).

- Cerqueti, Roy, and Marcel Ausloos. 2015a. Cross ranking of cities and regions: Population versus income. Journal of Statistical Mechanics: Theory and Experiment 2015: P07002. [Google Scholar] [CrossRef]

- Cerqueti, Roy, and Marcel Ausloos. 2015b. Evidence of economic regularities and disparities of Italian regions from aggregated tax income size data. Physica A: Statistical Mechanics and Its Applications 421: 187–207. [Google Scholar] [CrossRef]

- Chlebus, Edward, and Gautam Divgi. 2007. A Novel Probability Distribution for Modeling Internet Traffic and its Parameter Estimation. Paper presented at IEEE Global Telecommunications Conference Global Telecommunications Conference, IEEE GLOBECOM Proceedings: 4670–4075, Washington, DC, USA, 26–30 November; Available online: https://ieeexplore.ieee.org/document/4411796 (accessed on 1 September 2022).

- Clayton, Jim, Norman Miller, and Liang Peng. 2010. Price-volume Correlation in the Housing Market: Causality and Co-movements. The Journal of Real Estate Finance and Economics 40: 14–40. [Google Scholar] [CrossRef]

- Coulson, N. Edward, Crocker H. Liu, and Sriram V. Villupuram. 2013. Urban economic base as a catalyst for movements in real estate prices. Regional Science and Urban Economics 43: 1023–40. [Google Scholar] [CrossRef]

- Cristelli, Matthieu, Michael Batty, and Luciano Pietronero. 2012. There is more than a power law in Zipf. Scientific Reports 2: 812. [Google Scholar] [CrossRef] [PubMed]

- D’Acci, Luca S. 2023. Is housing price distribution across cities, scale invariant? Fractal distribution of settlements’ house prices as signature of self-organized complexity. Choas Solitons and Fractals 174: 113766. [Google Scholar] [CrossRef]

- DiPasquale, Denise, and William Wheaton. 1996. Urban Economics and Real Estate Markets. Englewood Cliffs: Prentice Hall. [Google Scholar]

- Dröes, Martijn, and Marc Francke. 2018. What Causes the Positive Price-Turnover Correlation in European Housing Markets? The Journal of Real Estate Finance and Economics 57: 618–46. [Google Scholar] [CrossRef]

- Duca, John, John Muellbauer, and Anthony Murphy. 2021. What Drives House Price Cycles? International Experience and Policy Issues. Journal of Economic Literature 59: 773–864. [Google Scholar] [CrossRef]

- Fernandez, Rodrigo, Annelore Hofman, and Manuel B. Aalbers. 2016. London and New York as a Safe Deposit Box for the Transnational Wealth Elite. Environment and Planning A 48: 2443–61. [Google Scholar]

- Fontanelli, Oscar, Pedro Miramontes, Yaning Yang, Germinal Cocho, and Wentian Li. 2016. Beyond Zipf’s Law: The Lavalette Rank Function and Its Properties. PLoS ONE 11: e0163241. [Google Scholar] [CrossRef]

- Geanakoplos, John. 2010. Solving the Present Crisis and Managing the Leverage Cycle. New York Federal Reserve Economic Policy Review 16: 101–31. [Google Scholar] [CrossRef]

- Genesove, David, and Christopher Mayer. 2001. Loss aversion and seller behavior: Evidence from the housing market. Quarterly Journal of Economics 87: 1233–60. [Google Scholar] [CrossRef]

- Glaeser, Edward L., and Joseph Gyourko. 2005. Urban Decline and Durable Housing. Journal of Political Economy 113: 345–75. [Google Scholar] [CrossRef]

- Gray, David. 2018. Convergence and divergence in British housing space. Regional Studies 52: 901–10. [Google Scholar] [CrossRef]

- Gray, David. 2022a. Do House Price-Earnings Ratios in England and Wales follow a Power Law? An Application of Lavalette’s Law to District Data. Environment and Planning B: Urban Analytics and City Science 49: 1184–96. [Google Scholar] [CrossRef]

- Gray, David. 2022b. How Have District-Based House Price-Earnings Ratios Evolved in England and Wales? Journal of Risk and Financial Management 15: 351. [Google Scholar] [CrossRef]

- Gray, David. 2023a. Housing market activity diffusion in England and Wales. National Accounting Review 5: 125–44. [Google Scholar] [CrossRef]

- Gray, David. 2023b. Power Laws and Inequalities: The Case of British District House Price Dispersion. Risks 11: 136. [Google Scholar] [CrossRef]

- Gregoriou, Andros, Alexandros Kontonikas, and Alberto Montagnoli. 2014. Aggregate and regional house price to earnings ratio dynamics in the UK. Urban Studies 51: 2916–27. [Google Scholar] [CrossRef]

- Hammond, George. 2022. Is the UK Housing Market at a Turning Point? Financial Times, August 12. [Google Scholar]

- Himmelberg, Charles, Christopher Mayer, and Todd Sinai. 2005. Assessing High House Prices: Bubbles, Fundamentals and Misperceptions. Journal of Economic Perspectives 19: 67–92. [Google Scholar] [CrossRef]

- Hsu, Wen-Tai. 2012. Central Place Theory and City Size Distribution. The Economic Journal 122: 903–32. [Google Scholar] [CrossRef]

- Hudson, Neal, and Brian Green. 2017. Missing Movers: A Long-Term Decline in Housing Transactions? Council of Mortgage Lenders. Available online: https://thinkhouse.org.uk/site/assets/files/1756/cmlmissing.pdf (accessed on 1 September 2022).

- Lavalette, Daniel. 1996. Facteur D’impact: Impartialité ou Impuissance? Orsay: Internal Report INSERM U350 Institut Curie—Recherche, Bât. 112, Centre Universitaire. Available online: http://www.curie.u-psud.fr/U350/ (accessed on 1 September 2022).

- Martin, Ron, Ben Gardiner, and Peter Tyler. 2014. The Evolving Economic Performance of UK Cities: City Growth Patterns, 1981–2011; Working Paper, Foresight Programme on The Future of Cities. London: UK Government Office for Science, Department of Business, Innovation and Skills.

- Martin, Ron, Peter Sunley, Ben Gardiner, Emil Evenhuis, and Peter Tyler. 2018. The city dimension of the productivity growth puzzle: The relative role of structural change and within-sector slowdown. Journal of Economic Geography 18: 539–70. [Google Scholar] [CrossRef]

- McCombie, John. 1988. A synoptic view of regional growth and unemployment: II The post-Keynesian theory. Urban Studies 25: 399–417. [Google Scholar] [CrossRef]

- Mian, Atif, and Amir Sufi. 2018. Finance and Business Cycles: The Credit-Driven Household Demand Channel. Journal of Economic Perspectives 32: 31–58. [Google Scholar] [CrossRef]

- Miles, David, and Victoria Monro. 2019. UK House Prices and Three Decades of Decline in the Risk Free Real Interest Rate, Staff Working Paper No. 837. London: Bank of England. [Google Scholar]

- Montagnoli, Alberto, and Jun Nagayasu. 2015. UK house price convergence clubs and spillovers. Journal of Housing Economics 30: 50–58. [Google Scholar] [CrossRef]

- Novy-Marx, Robert. 2009. Hot and Cold Markets. Real Estate Economics 37: 1–22. [Google Scholar] [CrossRef]

- Ohnishi, Takaaki, Takayuki Mizuno, and Tsutomu Watanabe. 2020. House price dispersion in boom–bust cycles: Evidence from Tokyo. The Japanese Economic Review 71: 511–39. [Google Scholar] [CrossRef]

- Ortalo-Magné, François, and Sven Rady. 2004. Housing transactions and macroeconomic fluctuations: A case study of England and Wales. Journal of Housing Economics 13: 287–303. [Google Scholar] [CrossRef]

- Peachey, Kevin. 2021. How COVID Has Changed Where We Want to Live. BBC News, March 19. [Google Scholar]

- Perline, Richard. 2005. Strong, Weak and False Inverse Power Laws. Statistical Science 20: 68–88. Available online: http://www.jstor.org/stable/20061161 (accessed on 1 September 2022). [CrossRef]

- Pike, Andy, Danny MacKinnon, Mike Coombes, Tony Champion, David Bradley, Andrew Cumbers, Liz Robson, and Colin Wymer. 2016. Uneven Growth: Tackling City Decline. New York: Joseph Rowntree Foundation. Available online: https://www.jrf.org.uk/report/uneven-growth-tackling-city-decline (accessed on 8 August 2023).

- Ravallion, Martin. 2004. Pro-Poor Growth: A Primer. Policy Research Working Paper; No. 3242. Washington, DC: World Bank. Available online: http://hdl.handle.net/10986/14116 (accessed on 8 August 2023).

- Richmond, Peter. 2007. A roof over your head; house price peaks in the UK and Ireland. Physica A: Statistical Mechanics and its Applications 375: 281–87. [Google Scholar] [CrossRef]

- Roback, Jennifer. 1982. Wages, Rents, and the Quality of Life. Journal of Political Economy 90: 1257–78. Available online: https://www.jstor.org/stable/1830947 (accessed on 1 September 2022). [CrossRef]

- Rodrigues, Guilherme, and Stuart Bridgett. 2023. Capital Losses: The Role of London in the UK’s Productivity Puzzle. Centre for Cities’ Report. March 2. Available online: https://www.centreforcities.org/press/londons-productivity-lags-well-behind-global-competitors/ (accessed on 1 September 2022).

- Rozenfeld, Hernan, Diego Rybski, Xavier Gabaix, and Hernan Makse. 2011. The Area and Population of Cities: New Insights from a Different Perspective on Cities. The American Economic Review 101: 2205–25. [Google Scholar] [CrossRef]

- Sala-i-Martin, Xavier. 1996. Regional cohesion: Evidence and theories of regional growth and convergence. European Economic Review 40: 1325–52. [Google Scholar] [CrossRef]

- Sinai, Todd. 2010. Feedback Between Real Estate and Urban Economics. Journal of Regional Science 50: 423–48. [Google Scholar] [CrossRef]

- Stein, Jeremy. 1995. Prices and trading volume in the housing market: A model with downpayment effects. The Quarterly Journal of Economics 110: 379–405. [Google Scholar] [CrossRef]

- Tang, Pan, Ying Zhang, Belal E. Baaquie, and Boris Podobnik. 2016. Classical convergence versus Zipf rank approach: Evidence from China’s local-level data. Physica A: Statistical Mechanics and its Applications 443: 246–53. [Google Scholar] [CrossRef]

- Tsai, I-Chun. 2015. Spillover Effect between the Regional and the National Housing Markets in the UK. Regional Studies 49: 1957–76. [Google Scholar] [CrossRef]

- Tsai, I-Chun. 2018. The cause and outcomes of the ripple effect: Housing prices and transaction volume. The Annals of Regional Science 61: 351–73. [Google Scholar] [CrossRef]

- Van Nieuwerburgh, Stijn, and Pierre-Olivier Weill. 2010. Why Has House Price Dispersion Gone Up? The Review of Economic Studies 77: 1567–606. [Google Scholar] [CrossRef]

- Wheaton, William, and Nai Lee. 2009. The Co-Movement of Housing Sales and Housing Prices: Empirics and Theory. SSRN Electronic Journal. [Google Scholar] [CrossRef]

| Housing Expenditure (Price × Sales/D) | Real Price | Sales/Dwelling × 10,000 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| K–S | Laval Ette | R2 | Normal | Log-Normal | Laval Ette | R2 | Normal | Log-Normal | Laval Ette | R2 | Normal | Log-Normal |

| Kolmogorov–Smirnov | ||||||||||||

| 2001 | 0.579 | 0.982 | 0.00 ** | 0.014 * | 0.645 | 0.979 | 0.00 ** | 0.20 | 0.26 | 0.982 | 0.20 | 0.00 ** |

| 2006 | 0.774 | 0.986 | 0.00 ** | 0.20 | 0.645 | 0.982 | 0.00 ** | 0.20 | 0.46 | 0.984 | 0.20 | 0.00 ** |

| 2007 | 0.579 | 0.986 | 0.00 ** | 0.20 | 0.774 | 0.975 | 0.00 ** | 0.20 | 0.30 | 0.986 | 0.20 | 0.007 ** |

| 2009 | 0.710 | 0.984 | 0.00 ** | 0.20 | 0.049 * | 0.967 | 0.00 ** | 0.004 ** | 0.032 * | 0.949 | 0.00 ** | 0.00 ** |

| 2012 | 0.516 | 0.983 | 0.00 ** | 0.20 | 0.06 | 0.959 | 0.00 ** | 0.003 ** | 0.09 | 0.962 | 0.036 * | 0.00 ** |

| 2014 | 0.456 | 0.982 | 0.00 ** | 0.06 | 0.109 | 0.949 | 0.00 ** | 0.00 ** | 0.004 ** | 0.942 | 0.00 ** | 0.00 ** |

| 2018 | 0.516 | 0.979 | 0.00 ** | 0.022 * | 0.456 | 0.964 | 0.00 ** | 0.015 * | 0.13 | 0.932 | 0.034 * | 0.00 ** |

| 2022 | 0.456 | 0.980 | 0.00 ** | 0.07 | 0.516 | 0.972 | 0.00 ** | 0.07 | 0.002 ** | 0.879 | 0.00 ** | 0.00 ** |

| Median Values | ||||||||||||

| Obs | Est | BS L | BS U | Obs | Est | BS L | BS U | Obs | Est | BS L | BS U | |

| 2001 | 6294 | 5951 | 5758 | 6207 | 104,810 | 106,933 | 102,535 | 111,409 | 5730 | 5566 | 5466 | 5667 |

| 2006 | 9755 | 9509 | 9275 | 9770 | 167,172 | 168,706 | 162,741 | 176,119 | 5738 | 5636 | 5564 | 5710 |

| 2007 | 9222 | 9318 | 9070 | 9592 | 172,507 | 174,176 | 165,847 | 184,024 | 5453 | 5350 | 5291 | 5409 |

| 2009 | 4198 | 4133 | 3995 | 4293 | 154,134 | 157,485 | 148,909 | 167,391 | 2692 | 2624 | 2534 | 2729 |

| 2012 | 4185 | 4052 | 3874 | 4255 | 144,349 | 146,928 | 136,039 | 159,803 | 2828 | 2758 | 2674 | 2842 |

| 2014 | 5935 | 5747 | 5483 | 6048 | 146,518 | 152,864 | 140,548 | 166,925 | 3922 | 3760 | 3656 | 3878 |

| 2018 | 6188 | 5858 | 5606 | 6214 | 161,986 | 169,294 | 156,905 | 182,115 | 3596 | 3460 | 3341 | 3602 |

| 2022 | 4688 | 4569 | 4372 | 4784 | 168,992 | 169,914 | 160,339 | 180,060 | 2781 | 2689 | 2586 | 2810 |

| Exponents (-q) | ||||||||||||

| Est | BS L | BS U | Est | BS L | BS U | Est | BS L | BS U | ||||

| 2001 | 0.298 | 0.292 | 0.305 | 0.251 | 0.243 | 0.259 | 0.100 | 0.097 | 0.103 | |||

| 2006 | 0.224 | 0.219 | 0.228 | 0.188 | 0.181 | 0.195 | 0.092 | 0.090 | 0.094 | |||

| 2007 | 0.224 | 0.219 | 0.229 | 0.197 | 0.189 | 0.207 | 0.087 | 0.085 | 0.089 | |||

| 2009 | 0.284 | 0.277 | 0.291 | 0.202 | 0.192 | 0.212 | 0.125 | 0.120 | 0.131 | |||

| 2012 | 0.319 | 0.31 | 0.328 | 0.231 | 0.218 | 0.245 | 0.116 | 0.112 | 0.121 | |||

| 2014 | 0.317 | 0.308 | 0.326 | 0.250 | 0.236 | 0.266 | 0.109 | 0.104 | 0.114 | |||

| 2018 | 0.263 | 0.255 | 0.273 | 0.263 | 0.250 | 0.276 | 0.107 | 0.101 | 0.114 | |||

| 2022 | 0.251 | 0.243 | 0.260 | 0.248 | 0.238 | 0.259 | 0.088 | 0.081 | 0.096 | |||

| 2001–2007 (1) 2012–2018 (2) | All Districts | North | South | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Real Exp/Dw | Sale/Dw | Real Price | Real Exp/Dw | Sale/Dw | Real Price | Real Exp/Dw | Sale/Dw | Real Price | |

| Observed (1) | |||||||||

| Lower Q | 9.27 | −0.34 | 10.45 | 11.72 | −0.33 | 10.56 | 6.75 | −0.97 | 7.63 |

| Median | 6.57 | −0.82 | 8.66 | 9.54 | −0.55 | 10.46 | 5.91 | −0.50 | 6.96 |

| Upper Q | 5.27 | −1.02 | 7.08 | 7.80 | −0.84 | 8.91 | 5.57 | −1.14 | 5.91 |

| Estimated (1) | |||||||||

| Lower Q | 9.24 | −0.43 | 9.54 | 11.12 | −0.17 | 10.72 | 6.77 | −0.73 | 7.64 |

| Median | 7.76 | −0.66 | 8.47 | 9.51 | −0.46 | 10.02 | 6.15 | −0.84 | 7.05 |

| Upper Q | 6.3 | −0.89 | 7.41 | 7.93 | −0.75 | 9.32 | 5.53 | −0.95 | 6.47 |

| Observed (2) | |||||||||

| Lower Q | 8.26 | 4.82 | 1.50 | 7.89 | 6.92 | 1.01 | 5.73 | 1.66 | 3.29 |

| Median | 6.74 | 4.09 | 1.94 | 8.28 | 6.40 | 1.32 | 5.24 | 2.17 | 3.38 |

| Upper Q | 5.31 | 3.30 | 3.52 | 8.44 | 5.87 | 2.00 | 3.51 | 2.30 | 3.13 |

| Estimated (2) | |||||||||

| Lower Q | 7.42 | 4.03 | 1.79 | 4.93 | 6.81 | 1.14 | 5.97 | 0.72 | 3.12 |

| Median | 6.34 | 3.85 | 2.39 | 4.57 | 6.47 | 1.34 | 4.90 | 1.47 | 3.39 |

| Upper Q | 5.26 | 3.68 | 2.99 | 4.20 | 6.14 | 1.54 | 3.84 | 2.23 | 3.65 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gray, D.P. An Investigation into the Spatial Distribution of British Housing Market Activity. J. Risk Financial Manag. 2024, 17, 22. https://doi.org/10.3390/jrfm17010022

Gray DP. An Investigation into the Spatial Distribution of British Housing Market Activity. Journal of Risk and Financial Management. 2024; 17(1):22. https://doi.org/10.3390/jrfm17010022

Chicago/Turabian StyleGray, David Paul. 2024. "An Investigation into the Spatial Distribution of British Housing Market Activity" Journal of Risk and Financial Management 17, no. 1: 22. https://doi.org/10.3390/jrfm17010022