3.1. Entrepreneurial Orientation of Social Entrepreneurs

Entrepreneurship has been recognized as one of the key driving forces for success in business as well as in the social sector. The definitions of social entrepreneurship in prior studies are diverse. Liu, et al. [

14] (p. 269) define the social entrepreneurship as ‘the act of recognizing and pursuing opportunities to solve social problems through the creativity of the typical entrepreneurial process.’ Dees and Anderson [

15] remark that the social entrepreneurship is related to the innovative activities for social value creation and Thompson [

16] insists that it is related to the business skill in non-profit organizations. The common elements of these definitions is that social entrepreneurship is an underlying factor for social value creation [

17,

18]. This is like the commercial entrepreneurship in for-profit companies which affects business activities for the maximization of firm performance.

Entrepreneurship builds an organizational process to explore business opportunities and to seize them through innovation [

19]. Hitt, et al. [

20] insists that the entrepreneurship anticipates changes of markets and develops products to meets the potential customers’ needs. Similarly, social entrepreneurship is deeply involved in the activities and process for social value creation and survive of SEs. Social entrepreneurship starts with discovering entrepreneurial opportunities which arise from market failure [

17]. In other words, social entrepreneurship has emerged because commercial enterprises cannot meet all social needs. Thus, social entrepreneurs seek innovative ways to overcome market failures and to create both social and economic values. Since SEs are hybrid organizations between commercial and non-profit organizations, social entrepreneurs have limitations to use the capital market that is fully utilized by commercial companies [

17]. Thus, one of the important role of social entrepreneurs is to mobilize resources from external organizations.

Prior studies insist that entrepreneurial orientation which forms the basis of entrepreneurship reflects a company’s strategic posture such as innovativeness, proactiveness and risk-taking [

21,

22,

23]. Lumpkin and Dess [

22] remark that entrepreneurial orientation affects a company’s decision-making activities such as exploration and exploitation new opportunities in the markets. Thus, entrepreneurial orientation of a social entrepreneur can promote product innovation and active utilization of social capital for following reasons. First, because the innovativeness of an entrepreneur reflects a company’s tendency to develop new products or services [

22], a social entrepreneur with strong entrepreneurial orientation tends to emphasize product innovation to create social values. In addition, since the risk-taking attribute of an entrepreneur reflects a company’s willingness to take uncertainty or failure in business [

24], a social entrepreneur with higher degree of entrepreneurial orientation tends to invest more actively in developing new technologies or products to create social values. The proactiveness attribute of an entrepreneur may affect social capital utilization of SEs. Because the proactiveness reflects a company’s tendency to anticipate and prepare for future demands or changes of business environments [

22], a social entrepreneur with strong entrepreneurial orientation tends to actively accumulate and use social capital. Especially, since creating social value or solving social problems is difficult for one SE alone, cooperation with local communities, for-profit companies and diverse stakeholders is essential [

25]. In other words, social entrepreneurs with strong entrepreneurial orientation can mobilize resources through relational networks to overcome lack of resources for social value creation. Consequently, we propose the following hypotheses.

Hypothesis 1 (H1). A social entrepreneur with higher degree of entrepreneurial orientation implements product innovation more actively.

Hypothesis 2 (H2). A social entrepreneur with higher degree of entrepreneurial orientation accumulates and uses social capital more actively.

3.2. Product Innovation Attributes in Low-End Markets

To determine the product innovation attributes of SEs, we first reviewed prior studies on product innovation in low-end markets, which constitute the targets of most SEs. Many researchers have identified certain patterns in product innovation and have found the characteristics of each innovation pattern [

26,

27,

28,

29]. Such categorization and analysis of product innovation helps business managers in planning strategies for their product innovation [

30]. Although there is not much literature on product innovation in low-end markets, some of it tries to explain product innovation with notions of disruptive technology, architectural innovations or frugal innovation [

31,

32,

33]. For example, Lettice and Parekh [

25] adopted concepts of disruptive technology and architectural innovation in order to explain the product innovation generated by SEs.

Christensen [

27] was the first to mention the notion of disruptive technology, which provides simpler and more modest versions of existing products. Although these simplified products are usually inferior compared to the existing ones in terms of performance, disruptive innovation offers different values such as low prices, product simplicity and convenience. Christenson also explained how enormous leading companies can be defeated by new emerging ones because of disruptive technology [

27,

34]. In focusing on satisfying their main customers and providing new and advanced features, leading companies sometimes make unnecessarily complicated products which overshoot customers’ needs and expectations. Emerging companies using disruptive technology initially serve only niche markets. As time passes, however, they absorb most of the customers in the market, apart from the most-demanding customers. For this reason, Hart and Christensen [

31] argued that it is important to develop products which focus on affordability and acceptability in low-end markets. In many cases of SEs’ product innovation, products are developed from outside mainstream thinking because most of SEs’ target customers are in the low end of the market. Thus, SEs need to transcend the boundaries or limitations of traditional product development in order to satisfy the demands imposed by these niche customers. In other words, SEs can meet the demands for affordability and acceptability in low-end markets which are their main target markets by improving the simplicity and usability of the product compared to existing products offered by for-profit companies [

25,

35,

36].

The architectural innovation enables innovators to have different applications by using and reconfiguring existing technologies [

37]. An architectural innovation can be created with relatively minor changes but bring about significant outcomes for low-end markets. Hellström [

38] insists that the notion of architectural innovation can be extended into eco-innovation and be expanded further into social innovation. Because of the lack of technology competencies or financial resources, SEs may be better suited to reconfigure the existing systems in new ways instead of developing completely new systems or technologies in developing new products.

Prahalad [

35] states that there is still a large and underserved low-end market and that individuals within that market cannot easily use the products or services offered by the mainstream market due to a harsh environment or a lack of financial resources. Therefore, new product innovation is required to meet the unique needs of low-end markets. Zeschky, Widenmayer and Gassmann [

33] studied frugal innovation, a new form of product innovation in emerging countries. Many for-profit companies previously tried to sell outdated products in developing countries since these products were no longer competitive in developed countries [

35]. However, given the fact that the products were originally developed for people in developed countries, there are still limitations such as environmental and maintenance costs. Therefore, companies need the frugal innovation, which involves modifying products using limited local resources. Frugal innovation has three distinct attributes: product localization is necessary to make it applicable to a local market; it is initiated by overcoming a limitation of resources and environmental conditions in developing new products; it is accompanied by lowering the cost of products, since most target customers are quite poor. Therefore, with the perspective of frugal innovation, SEs need to focus on standardizing their products to lower the maintenance cost of their main customers and to overcome limited local resources in the low-end market [

25,

35,

36].

As previously discussed, in meeting the needs of the low-end market, product innovation by SEs usually needs to focus on product simplification, improved product usability, the reconfiguration of existing technologies and standardized products or components.

Table 1 summarizes product innovation attributes in low-end markets based on prior studies and they can be applied to SEs due to the similarity of target market.

Many prior researches have studied the relationship the product innovation and firm performance. Product innovation of SEs can positively contribute to a company’s financial performance and non-financial performance for the following reasons. First, companies with high innovation competitiveness can achieve better firm performance by satisfying new customers’ needs and actively responding to rapidly changing market conditions [

39]. SEs with high competitiveness in product innovation attributes such as product simplicity, usability and standardization that are discussed above can create better firm performance by catching the new needs of the underprivileged and developing related products. Second, innovative products enhance firm performance by contributing to the superiority and the differentiation of products [

40,

41]. Product innovation of SEs can also secure differentiation advantage in the market through providing new social values and this can contribute to the company’s financial performance. Third, in case of frugal innovation, new product development is highly relevant to the company’s existing resources and previous experience and thus additional investments such as financial and human resources for product development are not much necessary [

33]. These attributes improve a company’s speed in time-to-market and shorten time to gain profits through new products [

42,

43]. Product innovation of SEs can also have positive impacts on improving profitability by reducing investment costs and contributing to fast product launch by focusing on product simplicity, usability and standardization rather than on developing new technologies that require huge investment costs.

Since the performance of a SE is mainly measured by non-financial performance such as social value creation and financial performance such as sales amount and operating income, we propose the following hypotheses regarding the relationship between the attributes of product innovation and firm performance in SEs.

Hypothesis 3 (H3). The attributes of product innovation in low-end markets such as product simplicity, usability and standardization positively affect the social value creations of SEs.

Hypothesis 4 (H4). The attributes of product innovation in low-end markets such as product simplicity, usability and standardization positively affect the financial performance of SEs.

3.3. Social Capital of Social Enterprises

There are some differences between the innovation undertaken by SEs and that by for-profit companies. Innovation by SEs emerges when they try to meet the unmet needs of individuals within the low-end market, or in solving societal problems; the innovation of for-profit companies, on the other hand, is driven by the existing mainstream market or the development of advanced technologies [

25]. Bessant and Tidd [

44] (p. 299) also insist that innovation by SEs is ‘generating value rather than wealth’ and that ‘Wealth creation may be part of the process but it is not an end in itself.’ In this context, Hall and Vredenburg [

45] ascertain that the type of innovation undertaken by SEs is more vague and complicated than traditional innovation in the mainstream market. This is because SEs need to consider different types of market conditions and to satisfy a more diverse body of stakeholders. Hall and Vredenburg [

45] also insist that the innovation undertaken by SEs bears greater uncertainty, which is ultimately absorbed into markets or communities. With respect to product innovation, they state that SEs should consider non-technical issues (such as public perceptions or social reactions), as well as technical problems.

Social capital is defined by institutional norms and relational networks of social bonds and behavior [

46,

47,

48,

49,

50]. social capital enhances trust in the organization or community and acts as a bridge between internal norms and morality [

48]. Social capital of SEs contributes to making relationship with various partners for social value creation and the sustainability of SEs [

51,

52]. In other words, social capital helps social entrepreneurs to create social values through cooperation with employees, NGOs, central government, local government and target users [

53,

54,

55,

56]. Because SEs mobilize resources through relational assets with external organizations and the relational assets create social value that exceeds transaction costs, social capital can have a positive impact on the social value creation and financial performance of SEs. Relational assets strengthen organizational competency and enhance cooperation in the community or region [

57].

The relational networks in social capital are also one of the most important factors in value creation through product innovation. Many studies have also addressed the importance of information and knowledge sharing between organizations in improving corporate innovation capabilities [

58,

59,

60,

61,

62]. In addition, Kogut [

63] and Gulati [

64] asserted that corporations secure diverse resource portfolios and improve their innovation capabilities by effectively combining and exploiting partners’ resources. The relational networks also contribute to reducing costs, uncertainties and risks in developing new technologies or exploiting new markets [

65,

66,

67].

Spear [

68] says that networks with external organizations often hold a critical role in the entrepreneurial activities of SEs. Being part of a network with external organizations usually helps a SE promote its presence in the market, or to solve some legal or technical issue by providing pro bono advice or funding. Chell [

69] remarks that SEs need to overcome their business-resource limitations, as well as any stress that comes with reconciling social benefits with financial profits. Johnstone and Lionais [

70] reveal that successful social entrepreneurs usually build suitable relational networks with external organizations in order to overcome difficulties that arise in the course of entrepreneurial activities and to achieve innovation. For these reasons, SEs need to cooperate actively with external stakeholders to create social values effectively and efficiently.

In particular, it is more important to accumulate social capital with external stakeholders in manufacturing industry due to its complex supply chain. Krause, et al. [

71] uncovered that close relationship with suppliers and accumulation of social capital with core suppliers contribute to improving buying firm performance. The accumulation of social capital with suppliers can improve buying firm performance for following reasons. First, inter-firm social capital promotes knowledge sharing and consequently contributes to value creation [

72,

73,

74]. Knowledge sharing such as production schedules or technology development roadmaps can ensure that components are delivered in a timely manner from suppliers and can help to reduce costs and improve quality by improvement of suppliers’ competence [

75,

76]. Second, inter-firm social capital accumulation improves firm performance efficiently through consistency of cognitive capital which is embodied in shared goals and visions [

77,

78]. If goals and visions among companies are aligned, efficient interactions and collaborations are promoted, while misinterpretation and conflict are reduced, resulting in improved productivity and performance of companies [

79,

80]. Consequently, social capital accumulation of SEs in manufacturing industry can positively affect social value creation and improve financial performance.

Hypothesis 5 (H5). The social capital of SEs positively affects the social value creations of SEs.

Hypothesis 6 (H6). The social capital of SEs positively affects the financial performance of SEs.

3.4. Social Value Creation and Financial Performance

Although there are some previous studies on methodology and measurement indicators for analyzing the performance of SEs, it is still difficult to compare the performance of SEs. Because the scope of the SEs is very wide, it is difficult to evaluate the performance uniformly. Some prior studies provide only a conceptual framework for the performance of SEs but do not disclose specific indicators and measurement tools [

81]. On the other hand, other previous researches develop the measurement methods that are too specific for some fields and are difficult to apply to SEs in other fields. For example, Bellucci, et al. [

82] studied the performance of Fairtrade stores in Italy but the measurement indicators tailored to the value chain of Fairtrade are difficult to apply to other SEs. Crucke and Decramer [

83] also argue that it is not easy to develop performance measurement models that are appropriate for all types of SEs, because the performances of SEs are different with respect to the firm size, purpose, activity and stakeholders. Despite the diversity of performance measurement of SEs, prior studies have reached the consensus that the performance of SEs is multidimensional. In other words, non-financial performance such as social value as well as financial performance such as sales revenue or operating profits should be measured for the performance of SEs [

81,

84].

The social value creation is an ultimate goal of SEs. According to the prior studies, the main difference between for-profit companies and SEs is that the former pursues the maximization of financial performance, while the latter focuses on the social value creation [

14]. This difference causes false assumption that financial performance is less critical than social value creation in SEs [

14]. Many prior studies point out this erroneous assumption. The emphasizing financial performance may negatively impact on the legitimate status of SEs due to the conflicting priorities even though it is important to reduce financial dependency on external subsidies [

85,

86,

87]. Dacin, et al. [

88] insists that creating social value does not diminish the importance or necessity of financial performance in SEs. In fact, Liu, Eng and Takeda [

14] present that SEs must develop strategies and implementation plans to secure a certain level of financial performance to sustainably create social value. Therefore, social entrepreneurs necessarily build their business model that links between social value creation and economic profits.

Consequently, we propose a following hypothesis regarding a relationship between social value creation of SEs and their financial performance.

Hypothesis 7 (H7). The social value creation of SEs has a positive relationship with financial performance of SEs.

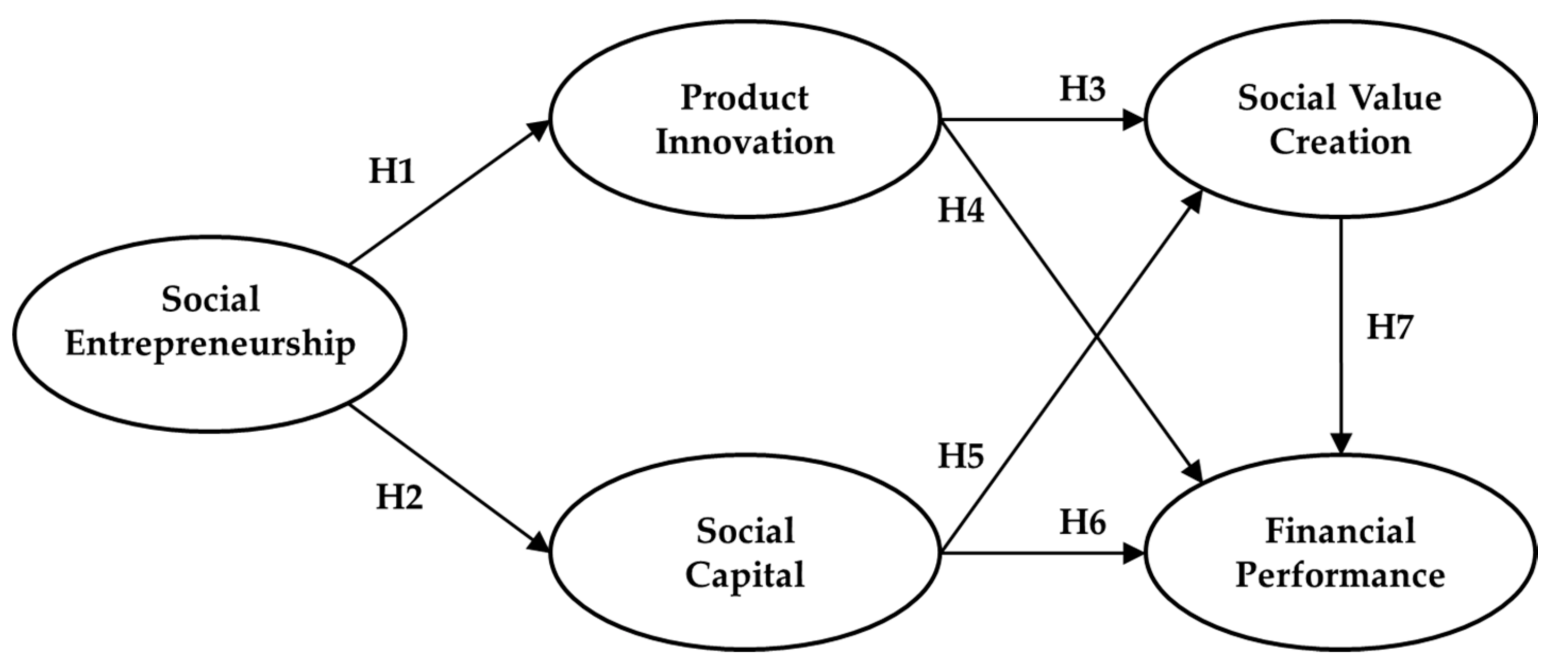

The social entrepreneurship, attributes of product innovation, social capital of SEs and their effects on social value creation and firm performance, which our study focuses on, are summarized based on the seven hypotheses given. These relationships and hypotheses among all relevant variables are condensed in

Figure 3.