The Impacts of Non-Fossil Energy, Economic Growth, Energy Consumption, and Oil Price on Carbon Intensity: Evidence from a Panel Quantile Regression Analysis of EU 28

Abstract

:1. Introduction

2. Literature Review

2.1. Studies Examining the Impacts of Economic Growth and Energy Consumption on Carbon Emission

2.2. Studies Examining the Influences of Economic Growth and Non-Fossil Energy Consumption on CO2 Emissions

3. Data and Method

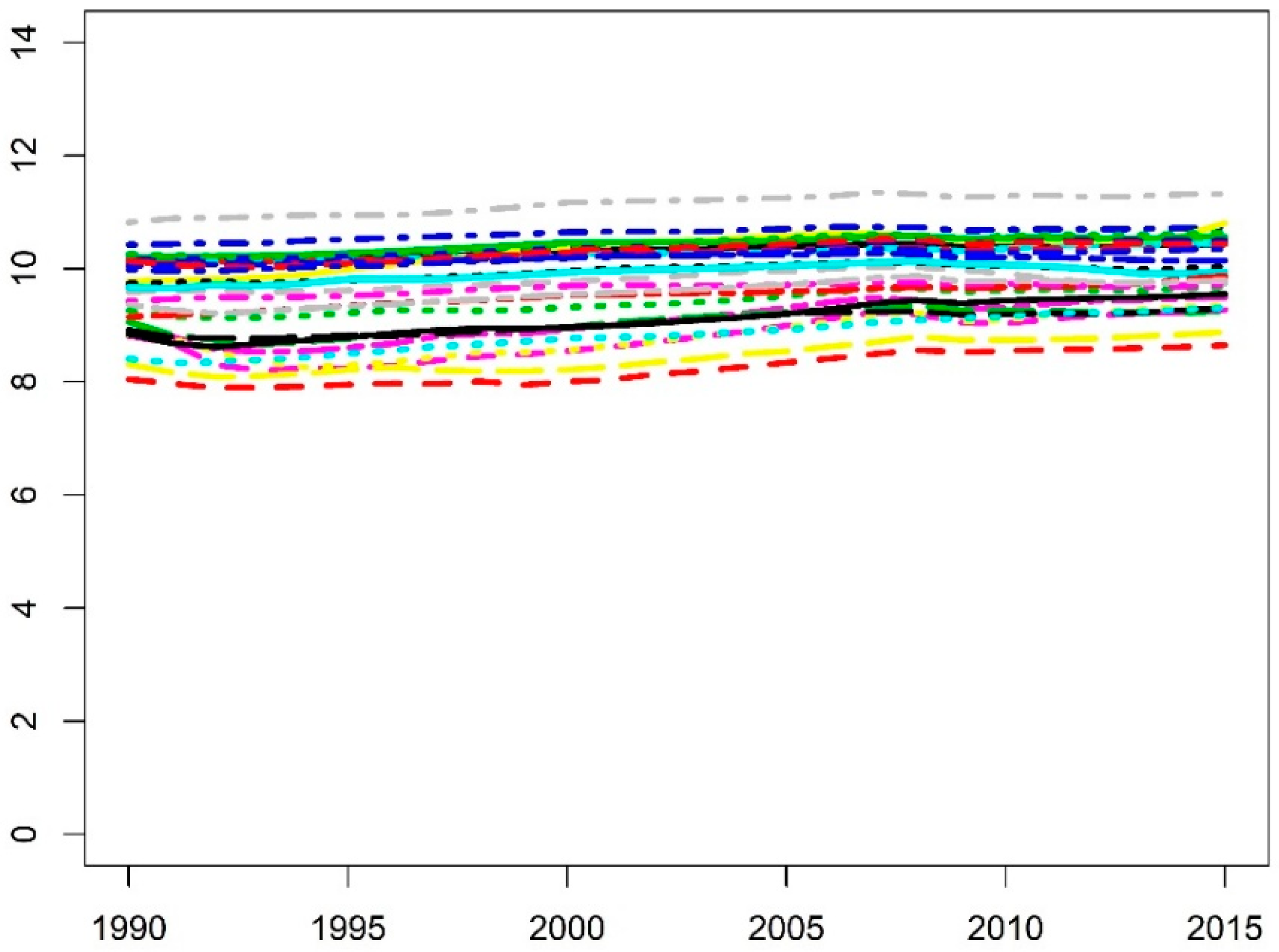

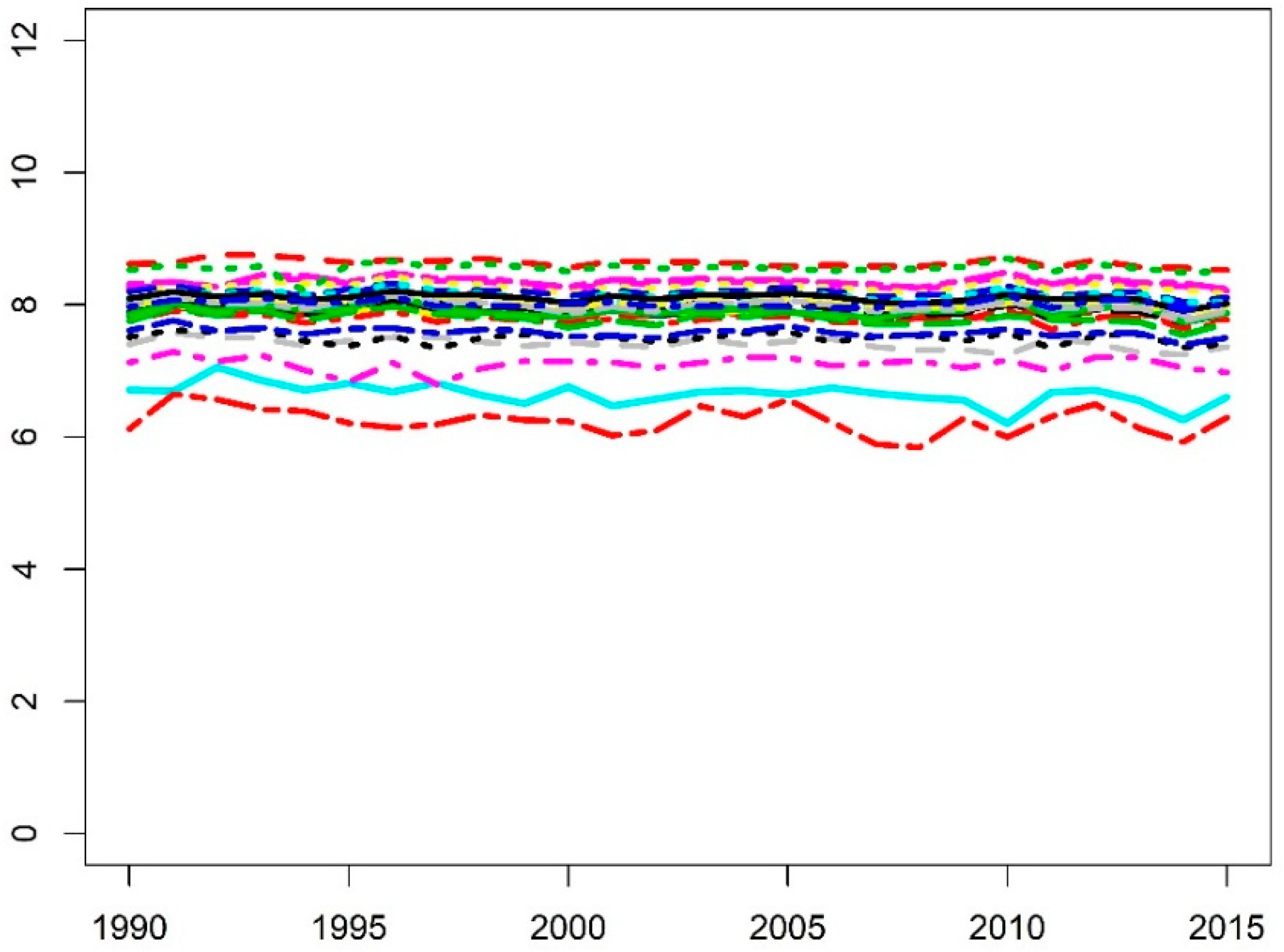

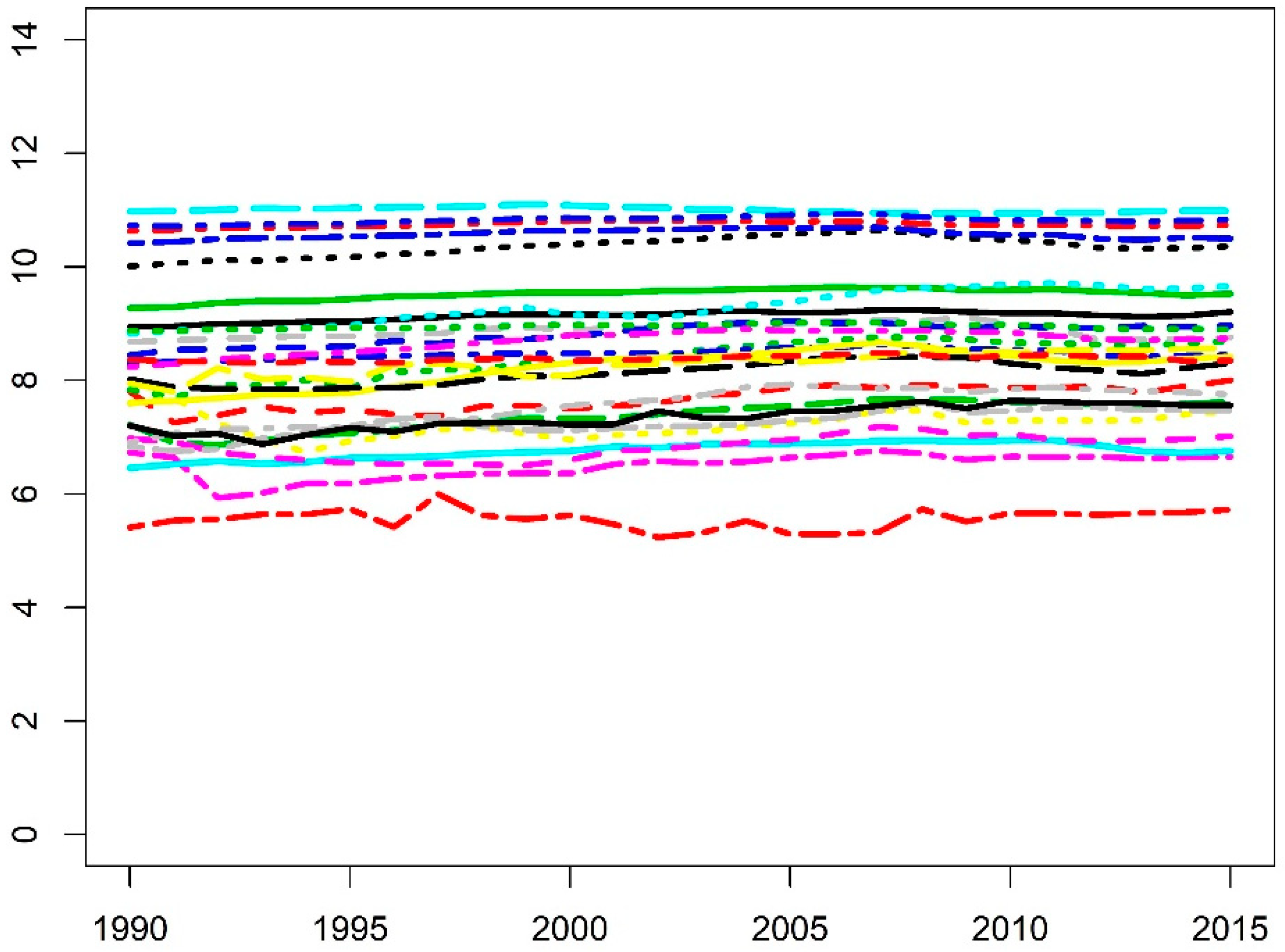

3.1. Date

3.2. Panel Quantile Regression

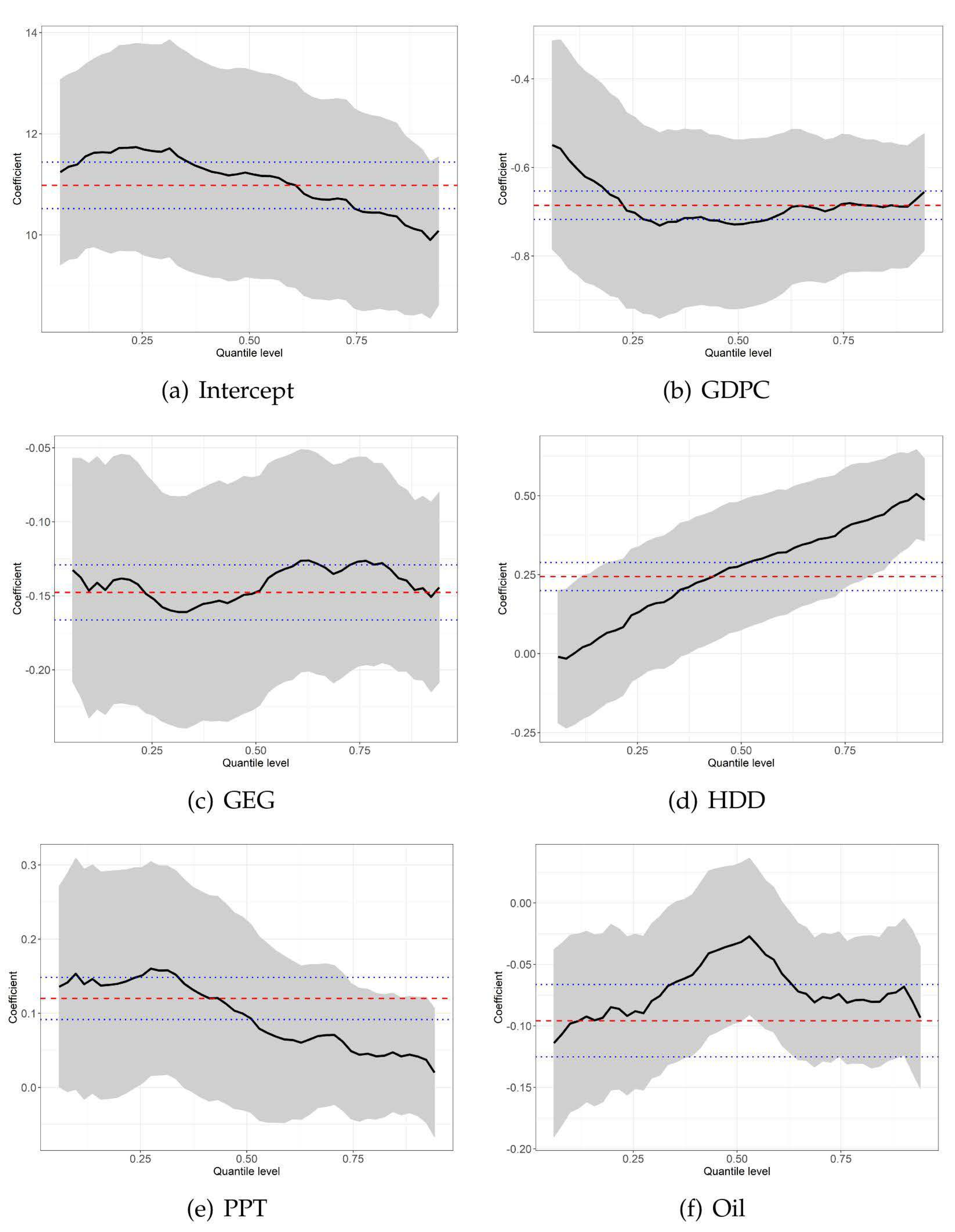

4. Empirical Findings and Analysis

4.1. Panel Unit Root Test

4.2. Panel Quantile Regression Results

4.3. Robustness Check

5. Conclusions and Suggestions

5.1. Conclusions

5.2. Suggestions

Author Contributions

Funding

Conflicts of Interest

References

- United Nations. United Nations Framework Convention on Climate Change; United Nations: New York, NY, USA, 1992. [Google Scholar]

- The World Bank. World Bank Open Data; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Zhu, H.; Duan, L.; Guo, Y.; Yu, K. The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 2016, 58, 237–248. [Google Scholar] [CrossRef] [Green Version]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- European Environment Agency. Progress towards 2008–2012 Kyoto Targets in Europe; Publications Office of the European Union: Luxembourg, 2014. [Google Scholar]

- Owusu, P.A.; Asumadu-Sarkodie, S. A review of renewable energy sources, sustainability issues and climate change mitigation. Cogent Eng. 2016, 3, 1167990. [Google Scholar] [CrossRef]

- International Energy Agency. CO2 Emissions from Fuel Combustion 2017; International Energy Agency: Paris, France, 2017. [Google Scholar]

- Dogan, E.; Inglesi-Lotz, R. Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: Empirical evidence from the panel of biomass-consuming countries. Energy 2017, 138, 721–727. [Google Scholar] [CrossRef]

- Liddle, B.; Sadorsky, P. How much does increasing non-fossil fuels in electricity generation reduce carbon dioxide emissions? Appl. Energy 2017, 197, 212–221. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 2014, 74, 439–446. [Google Scholar]

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Hochman, G. Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 2018, 141, 1466–1478. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, S.; Bae, J.; Liu, X.; Zhang, S.; Bae, J. The nexus of renewable energy-agriculture-environment in BRICS. Appl. Energy 2017, 204, 489–496. [Google Scholar] [CrossRef]

- Liu, X.; Zhang, S.; Bae, J. The impact of renewable energy and agriculture on carbon dioxide emissions: Investigating the environmental Kuznets curve in four selected ASEAN countries. J. Clean. Prod. 2017, 164, 1239–1247. [Google Scholar] [CrossRef]

- Jebli, M.B.; Youssef, S.B. The role of renewable energy and agriculture in reducing CO2 emissions: Evidence for North Africa countries. Ecol. Indic. 2017, 74, 295–301. [Google Scholar] [CrossRef]

- Hu, H.; Xie, N.; Fang, D.; Zhang, X. The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl. Energy 2018, 211, 1229–1244. [Google Scholar] [CrossRef]

- Baek, J. Do nuclear and renewable energy improve the environment? Empirical evidence from the United States. Ecol. Indic. 2016, 66, 352–356. [Google Scholar] [CrossRef]

- Azlina, A.A.; Law, S.H.; Mustapha, N.H.N. Dynamic linkages among transport energy consumption, income and CO2 emission in Malaysia. Energy Policy 2014, 73, 598–606. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M. Estimation of Environmental Kuznets Curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef]

- Piaggio, M.; Padilla, E.; Román, C. The long-term relationship between CO2 emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Econ. 2017, 65, 271–282. [Google Scholar] [CrossRef]

- Wang, S.; Zhou, C.; Li, G.; Feng, K. CO2, economic growth, and energy consumption in China’s provinces: Investigating the spatiotemporal and econometric characteristics of China’s CO2 emissions. Ecol. Indic. 2016, 69, 184–195. [Google Scholar] [CrossRef]

- Policies, Development and Current State of Non-Fossil Energy in European Union. Available online: http://www.europarl.europa.eu/portal/en (accessed on 15 October 2018).

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Energy consumption, CO2 emissions, and economic growth: An ethical dilemma. Renew. Sustain. Energy Rev. 2017, 68, 808–824. [Google Scholar] [CrossRef]

- Esteve, V.; Tamarit, C. Is there an environmental Kuznets curve for Spain? Fresh evidence from old data. Econ. Model. 2012, 29, 2696–2703. [Google Scholar] [CrossRef]

- Wang, P.; Wu, W.; Zhu, B.; Wei, Y. Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl. Energy 2013, 106, 65–71. [Google Scholar] [CrossRef]

- Zhao, X.; Burnett, J.W.; Fletcher, J.J. Spatial analysis of China province-level CO2 emission intensity. Renew. Sustain. Energy Rev. 2014, 33, 1–10. [Google Scholar] [CrossRef]

- Roinioti, A.; Koroneos, C. The decomposition of CO2 emissions from energy use in Greece before and during the economic crisis and their decoupling from economic growth. Renew. Sustain. Energy Rev. 2017, 76, 448–459. [Google Scholar] [CrossRef]

- Villar Rubio, E.; Rubio, Q.; Manuel, J.; Molina Moreno, V. Convergence Analysis of Environmental Fiscal Pressure across EU-15 Countries. Energy Environ. 2015, 26, 789–802. [Google Scholar] [CrossRef]

- Wang, Q.; Zhao, M.; Li, R.; Su, M. Decomposition and decoupling analysis of carbon emissions from economic growth: A comparative study of China and the United States. J. Clean. Prod. 2018, 197, 178–184. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175. [Google Scholar] [CrossRef] [PubMed]

- Fan, Y.; Liu, L.C.; Wu, G.; Wei, Y.M. Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ. Impact Assess. Rev. 2006, 26, 377–395. [Google Scholar] [CrossRef]

- Binder, M.; Coad, A. From Average Joe’s happiness to Miserable Jane and Cheerful John: Using quantile regressions to analyze the full subjective well-being distribution. J. Econ. Behav. Organ. 2011, 79, 275–290. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G. Regression Quantiles. Econometrica 1978, 46, 33–50. [Google Scholar] [CrossRef]

- Bera; Galvao, A.K.; Montes-Rojas, A.F.; Park, G.V.; Sung, Y. Asymmetric Laplace Regression: Maximum Likelihood, Maximum Entropy and Quantile Regression. J. Econom. Methods 2016, 5, 79–101. [Google Scholar] [CrossRef]

- Sherwood, B.; Wang, L. Partially linear additive quantile regression in ultra-high dimension. Ann. Stat. 2016, 44, 288–317. [Google Scholar] [CrossRef] [Green Version]

- Yu, K.; Jones, M.C. Local Linear Quantile Regression. Publ. Am. Stat. Assoc. 1998, 93, 228–237. [Google Scholar] [CrossRef]

- Granger, C.W.J.; White, H.; Kamstra, M. Interval forecasting: An analysis based upon ARCH-quantile estimators. J. Econom. 2006, 40, 87–96. [Google Scholar] [CrossRef]

- Koenker, R.; Zhao, Q. Conditional Quantile Estimation and Inference for Arch Models. Econom. Theory 1996, 12, 793–813. [Google Scholar] [CrossRef]

- Kuester, K.; Mittnik, S.; Paolella, M.S. Value-at-Risk Prediction: A Comparison of Alternative Strategies. J. Financ. Econom. 2006, 4, 53–89. [Google Scholar] [CrossRef]

- Koenker, R.; Hallock, K.F. Quantile Regression: An Introduction. J. Econ. Perspect. 2000, 101, 445–446. [Google Scholar]

- Yu, K.; Lu, Z.; Stander, J. Quantile Regression: Applications and Current Research Areas. J. R. Stat. Soc. 2003, 52, 331–350. [Google Scholar] [CrossRef]

- Koenker, R. Quantile regression for longitudinal data. J. Multivar. Anal. 2004, 91, 74–89. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.F.; Chu, C.S.J. Unit root tests in panel data: Asymptotic and finite-sample properties. J. Econom. 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Hadri, K. Testing for stationarity in heterogeneous panel data. Econom. J. 2000, 3, 148–161. [Google Scholar] [CrossRef]

- Choi, I. Unit root tests for panel data. J. Int. Money Financ. 2001, 20, 249–272. [Google Scholar] [CrossRef]

- Koenker, R.; Bassett, G. Tests of linear hypotheses and l 1 estimation. Econometrica 1982, 50, 1577–1583. [Google Scholar] [CrossRef]

- Molina-Moreno, V.; Núñez-Cacho Utrilla, P.; Cortés-García, F.; Peña-García, A. The Use of Led Technology and Biomass to Power Public Lighting in a Local Context: The Case of Baeza (Spain). Energies 2018, 11, 1783. [Google Scholar] [CrossRef]

- G20 Green Finance Study Group. G20 Green Finance Synthesis Report 2017; G20 Green Finance Study Group: Sanya, China, 2017. [Google Scholar]

- Nuñez-Cacho, P.; Górecki, J.; Molina-Moreno, V.; Corpas-Iglesias, F. What Gets Measured, Gets Done: Development of a Circular Economy Measurement Scale for Building Industry. Sustainability 2018, 10, 2340. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change. Climate Change 2014: Mitigation of Climate Change, 5th ed.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

| Authors | Countries | Period | Variables | Methodology | Main Findings and Causality Results | EKC Hypothesis |

|---|---|---|---|---|---|---|

| Part I: Issues about carbon emissions, economic growth, and energy consumption | ||||||

| Begum et al. | Malaysia | 1970–2009 | CO2 PC, GDP PC, GDP PC2, EC PC, POPG | ARDL, DFGLS, DOLS, SLM U | EC PC and GDP PC increase CO2 emissions | No |

| Wang et al. | 30 China’s provinces | 1995–2012 | CO2 PC, GDP PC, EC PC | LLC, ADF-Fisher, Pedroni cointegration, FMOLS, VECM granger causality | GDP ↔ EC; EC ↔ CO2; GDP → CO2 | Not investigated |

| Antonakakis et al. | 106 countries | 1971–2011 | CO2, GDP, EC | LLC, IPS, panel causality, PVAR, | REC is not conducive to economic growth; GDP increase CO2 emissions; GDP ↔ EC | No |

| Zhu et al. | ASEAN-5 | 1981–2011 | CO2, EC, GDP, POP, TR, shIND, FDI, FINAN | LLC, Breitung, IPS, ADF, PP, CADF, Johansen Fisher panel cointegration, OLS, Panel quantile regression | FDI and TR decreases CO2 emissions; EC increases CO2 emissions; GDP and POP decrease CO2 emissions among high-emission countries | No |

| Part II: Issues about carbon emissions, economic growth, energy consumption, and non-fossil energy consumption | ||||||

| Dogan & Inglesi-Lotz | 22 countries | 1985–2012 | CO2, GDP, GDP2, BIO, TR, URB | CADF, CIPS, Pedroni cointegration, LM bootstrap panel cointegration, group-mean FMOLS | BIO consumption decreases CO2 emissions; EKC hypothesis is valid | Yes |

| Dogan & Seker | EU-15 | 1980–2012 | CO2, GDP, GDP2, REC, NREC, TR | CADF, CIPS, LM bootstrap cointegration, DOLS, Dumitrescu-Hurlin non-causality | REC and TR decrease CO2 emissions; NREC increases CO2 emissions; EKC hypothesis is valid; REC ↔ CO2; GDP → CO2; CO2 → NREC; TR → CO2 | Yes |

| Dong et al. | BRICS | 1985–2016 | CO2, GDP, GDP2, NG, REC | CADF, CIPS, Westerlund panel cointegration, panel AMG, VECM Granger causality | NG and REC lowers CO2 emissions; EKC hypothesis is valid; short run: GDP → CO2; NG ↔ CO2; RE ↔ CO2; NG → RE; long run: NG ↔ CO2; RE ↔ CO2; NG ↔ RE | Yes |

| Baek | USA | 1960–2010 | CO2, GDP, EC, NUC, REC | ARDL, FMOLS, DOLS and CCR | Short run: GDP, NC and REC decrease CO2 emissions; EC increase CO2 emissions; Long run: NC decreases CO2 emissions; GDP and EC increase CO2 emissions | Not investigated |

| Azlina et al. | Malaysia | 1975–2011 | CO2, GDP, GDP2, RSE, REC, IVA | ADF, PP, JJ cointegration, OLS, VECM granger causality | REC and IVA decrease CO2 emissions; GDP and RSE increase CO2 emissions; short run: GDP ↔ RSE; GDP ← CO2; RSE ← IVA; REC ← CO2; Long run: GDP ← CO2; RSE ← CO2; RSE ← GDP; RSE ← IVA; RSE ← CRE; REC ← CO2; REC ← GDP | No |

| Sinha & Shahbaz | India | 1971–2015 | CO2, GDP, EC, REC, TR, TFP | ADF, KPSS, ZA, Clemente-Montañés-Reyes unit root test, ARDL | REC and TR decrease CO2 emission; EC increases CO2 emission; EKC hypothesis is valid; | Yes |

| Bölük & Mert | 16 EU countries | 1990–2008 | CO2 PC, GDP PC, GDP PC2, REC, NREC | FE panel estimation | GDP decreases CO2 emission; GDP2, REC and NREC increase CO2 emission; REC significantly lower CO2 emission (about 1/2) that of NREC | No |

| Liddle & Sadorsky | 93 countries | 1971–2011 | CO2E, GDP, REC, shInd, Pff, shRE | CIPS, CMG, AMG | REC and shaRE decrease CO2 emission | Not investigated |

| Liu et al. | 4 ASEAN countries | 1970–2013 | CO2 PC, GDP PC, GDP PC2, REC, NREC, AGR | LLC, Breitung, IPS, Fisher-ADF Fish-PP, Pedroni cointegration, Kao residual cointegration, VECM Granger causality, OLS, FMOLS, DOLS | REC and AGR decreases CO2 emissions; NREC increases CO2 emissions; short run: NREC → CO2, AGR; GDP → AGR; AGR → REC; long run: CO2 ↔ REC; CO2 ↔ NREC; AGR → CO2, REC, NREC; GDP → CO2, REC, NREC | No |

| Piaggio et al. | Uruguay | 1882–2010 | CO2, GDP, GDP2, shInd, shRE, TR | ADF, multi-equation model, VECM | GDP and shInd increase CO2 emissions; shRE and TR decrease CO2 emissions | No |

| Liu et al. | BRICS | 1992–2013 | CO2, GDP, REC, NREC, AGR | LLC, IPS, ADF, PP, Pedroni cointegration, Kao cointegration, VECM Granger causality, OLS, FMOLS, DOLS | GDP and REC decrease CO2 emissions; NREC and AGR increase CO2 emissions; short run: NREC ↔ CO2; REC → CO2, NREC; AGR → GDP; GDP → NREC; long run: GDP, REC, NREC, AGR → CO2; CO2, GDP, REC, AGR→NREC | Not investigated |

| Jebli & Youssef | 5 North Africa countries | 1980–2011 | CO2, GDP, REC, AGR | LLC, IPS, ADF, PP, Pedroni cointegration, VECM Granger causality, OLS, FMOLS, DOLS | GDP and REC increase CO2 emissions; AGR decreases CO2 emissions; short run: CO2 ↔ AGR; AGR → GDP; GDP → REC; REC → AGR; long run: CO2 ↔ AGR; REC → AGR, CO2; GDP → AGR, CO2 | Not investigated |

| Hu et al. | 25 developing countries | 1996–2012 | CO2 PC, GDP PC, GDP PC2, REC, shRE, EX, IM | LLC, Breitung, IPS, ADF, PP, Pedroni cointegration, VECM Granger causality, FMOLS, DOLS | shRE, EX and IM decrease CO2 emissions; REC increases CO2 emissions; EKC hypothesis is valid; short run: REC, shRE ↔ CO2; shRE ↔ GDP; long run: all variables have bidirectional relations | Yes |

| Variables | CEDI | GDPC | GEG | HDD | PPT | Oil |

|---|---|---|---|---|---|---|

| Minimum | 4.7131 | 7.8996 | 0.0000 | 5.8430 | 5.2364 | 2.5463 |

| Maximum | 8.1016 | 11.3530 | 8.5830 | 8.7661 | 11.1024 | 4.7152 |

| Q1 (0.25) | 5.7467 | 9.1933 | 3.6889 | 7.7672 | 7.4250 | 2.9611 |

| Q3 (0.75) | 6.5158 | 10.3124 | 6.1738 | 8.1621 | 9.1616 | 4.2828 |

| Mean | 6.2065 | 9.7196 | 4.7301 | 7.8751 | 8.4552 | 3.6133 |

| STDEV | 0.6244 | 0.7528 | 2.1478 | 0.5187 | 1.3920 | 0.7127 |

| Skewness | 0.6473 | −0.3705 | −0.6960 | −1.5327 | 0.1400 | 0.2628 |

| Kurtosis | 0.0925 | −0.6071 | 0.1065 | 2.6926 | −0.5832 | −1.4553 |

| Jarque–Bera | 51.362 *** | 27.661 *** | 59.424 *** | 508.68 *** | 12.471 *** | 72.281 *** |

| Variables | CEDI | GDPC | GEG | HDD | PPT | Oil |

|---|---|---|---|---|---|---|

| LLC | −3.6437 *** | −2.3534 *** | −2.6079 *** | −10.055 *** | −12.691 *** | −33.028 *** |

| Fisher | 522.05 *** | 336.85 *** | 224.26 *** | 724.56 *** | 1503.4 *** | 1606.3 *** |

| Hadri Test | 78.491 *** | 75.596 *** | 57.479 *** | 10.388 *** | 50.714 *** | 75.105 *** |

| Modified p-test | 64.331 *** | 15.054 *** | 15.899 *** | 43.621 *** | 53.677 *** | 114.19 *** |

| Coefficients | Pooled OLS | Fix effect OLS | Quantiles | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | |||

| (Intercept) | 10.9797 *** | 13.9117 *** | 11.3894 *** | 11.7028 *** | 11.6457 *** | 11.2926 *** | 11.2787 *** | 10.9284 *** | 10.7357 *** | 10.4414 *** | 10.0754 *** |

| (0.2340) | (0.5442) | (0.9234) | (1.0999) | (1.1514) | (1.1488) | (1.1198) | (1.1402) | (1.1167) | (1.0100) | (0.8376) | |

| GDPC | −0.6854 *** | −1.1236 *** | −0.5851 *** | −0.6636 *** | −0.7259 *** | −0.7154 *** | −0.7335 *** | −0.7029 *** | −0.6970 *** | −0.6849 *** | −0.6889 *** |

| (0.0164) | (0.0454) | (0.1167) | (0.1146) | (0.1078) | (0.1005) | (0.0907) | (0.0871) | (0.0838) | (0.0755) | (0.0642) | |

| GEG | −0.1477 *** | −0.0785 *** | −0.1472 *** | −0.1415 *** | −0.1611 *** | −0.1556 *** | −0.1471 *** | −0.1308 *** | −0.1320 *** | −0.1275 *** | −0.1454 *** |

| (0.0095) | (0.0117) | (0.0429) | (0.0426) | (0.0408) | (0.0401) | (0.0401) | (0.0400) | (0.0381) | (0.0361) | (0.0354) | |

| HDD | 0.2440 *** | 0.0755 | 0.0041 | 0.0767 | 0.1623 * | 0.2276 *** | 0.2788 *** | 0.3230 *** | 0.3671 *** | 0.4206 *** | 0.4854 *** |

| (0.0227) | (0.0513) | (0.1179) | (0.1091) | (0.0984) | (0.0911) | (0.0898) | (0.0909) | (0.0873) | (0.0834) | (0.0778) | |

| PPT | 0.1200 *** | 0.3820 *** | 0.1541 * | 0.1429 * | 0.1600 ** | 0.1268 * | 0.0958 | 0.0673 | 0.0656 | 0.0425 | 0.0426 |

| (0.0145) | (0.0382) | (0.0803) | (0.0832) | (0.0807) | (0.0738) | (0.0663) | (0.0589) | (0.0477) | (0.0431) | (0.0428) | |

| Oil | −0.0958 *** | −0.0651 *** | −0.0978 ** | −0.0851 ** | −0.0772 *** | −0.0565 * | −0.0330 | −0.0502 * | −0.0800 *** | −0.0791 *** | −0.0673 ** |

| (0.0150) | (0.0102) | (0.0381) | (0.0333) | (0.0292) | (0.0300) | (0.0298) | (0.0256) | (0.0240) | (0.0244) | (0.0269) | |

| Against the 0.3 Quantile | Against the 0.5 Quantile | Against the 0.7 Quantile | Against the 0.9 Quantile | |||||

|---|---|---|---|---|---|---|---|---|

| Test Statistic | p-Value | Test Statistic | p-Value | Test Statistic | p-Value | Test Statistic | p-Value | |

| GDPC | 3.6786 * | 0.0551 | 2.3302 | 0.1269 | 1.0462 | 0.3064 | 0.6719 | 0.4124 |

| GEG | 0.1699 | 0.6802 | 0.0000 | 0.9991 | 0.0892 | 0.7653 | 0.0010 | 0.9747 |

| HDD | 3.6914 * | 0.0547 | 6.2669 ** | 0.0123 | 8.9585 *** | 0.0028 | 14.5115 *** | 0.0001 |

| PPT | 0.0124 | 0.9114 | 0.7839 | 0.3759 | 1.3950 | 0.2376 | 1.6361 | 0.2009 |

| Oil | 0.3978 | 0.5283 | 2.7082 * | 0.0998 | 0.2098 | 0.6469 | 0.5301 | 0.4666 |

| Coefficients | Quantiles | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | ||

| µ = 0.1 | GDPC | −0.5851 *** | −0.6636 *** | −0.7259 *** | −0.7154 *** | −0.7335 *** | −0.7029 *** | −0.6970 *** | −0.6849 *** | −0.6889 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| GEG | −0.1472 *** | −0.1415 *** | −0.1611 *** | −0.1556 *** | −0.1471 *** | −0.1308 *** | −0.1320 *** | −0.1275 *** | −0.1454 *** | |

| (0.0010) | (0.0017) | (0.0002) | (0.0001) | (0.0002) | (0.0011) | (0.0007) | (0.0005) | (0.0002) | ||

| HDD | 0.0041 | 0.0767 | 0.1623 | 0.2276 ** | 0.2788 *** | 0.3230 *** | 0.3671 *** | 0.4206 *** | 0.4854 *** | |

| (0.9743) | (0.5350) | (0.1588) | (0.0379) | (0.0086) | (0.0013) | (0.0001) | (0.0000) | (0.0000) | ||

| µ = 0.9 | GDPC | −0.5851 *** | −0.6636 *** | −0.7259 *** | −0.7154 *** | −0.7335 *** | −0.7029 *** | −0.6970 *** | −0.6849 *** | −0.6889 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| GEG | −0.1472 *** | −0.1415 *** | −0.1611 *** | −0.1556 *** | −0.1471 *** | −0.1308 *** | −0.1320 *** | −0.1275 *** | −0.1454 *** | |

| (0.0009) | (0.0011) | (0.0003) | (0.0005) | (0.0013) | (0.0028) | (0.0024) | (0.0021) | (0.0006) | ||

| HDD | 0.0041 | 0.0767 | 0.1623 | 0.2276 * | 0.2788 ** | 0.3230 *** | 0.3671 *** | 0.4206 *** | 0.4854 *** | |

| (0.9717) | (0.5148) | (0.1755) | (0.0615) | (0.0198) | (0.0052) | (0.0011) | (0.0001) | (0.0000) | ||

| µ = 2 | GDPC | −0.5851 *** | −0.6638 *** | −0.7259 *** | −0.7155 *** | −0.7335 *** | −0.7030 *** | −0.6970 *** | −0.6849 *** | −0.6888 *** |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| GEG | −0.1471 *** | −0.1416 *** | −0.1611 *** | −0.1556 *** | −0.1471 *** | −0.1307 *** | −0.1319 *** | −0.1275 *** | −0.1454 *** | |

| (0.0008) | (0.0009) | (0.0001) | (0.0000) | (0.0000) | (0.0001) | (0.0002) | (0.0004) | (0.0001) | ||

| HDD | 0.0042 | 0.0768 | 0.1623 | 0.2275 ** | 0.2789 *** | 0.3230 *** | 0.3670 *** | 0.4205 *** | 0.4854 *** | |

| (0.9710) | (0.5033) | (0.1328) | (0.0270) | (0.0029) | (0.0003) | (0.0000) | (0.0000) | (0.0000) | ||

| Coefficients | Quantiles | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | |

| GDPC | −0.5096 | −0.5599 | −0.6279 | −0.6619 | −0.6243 | −0.6547 | −0.6626 | −0.6637 | −0.6285 |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| GEG | −0.0536 | −0.0665 | −0.0759 | −0.0882 | −0.0998 | −0.0922 | −0.1002 | −0.1072 | −0.1234 |

| (0.0031) | (0.0020) | (0.0023) | (0.0008) | (0.0002) | (0.0007) | (0.0002) | (0.0001) | (0.0000) | |

| HDD | −0.0305 | 0.0365 | 0.1257 | 0.2210 | 0.2941 | 0.3223 | 0.3726 | 0.4185 | 0.4826 |

| (0.6903) | (0.7157) | (0.2449) | (0.0368) | (0.0029) | (0.0005) | (0.0000) | (0.0000) | (0.0000) | |

| Oil | −0.1414 | −0.1282 | −0.0851 | −0.0708 | −0.0652 | −0.0708 | −0.0702 | −0.0748 | −0.1055 |

| (0.0000) | (0.0000) | (0.0203) | (0.0464) | (0.0493) | (0.0181) | (0.0100) | (0.0051) | (0.0002) | |

| Coefficients | Quantiles | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | |

| GDPC | −0.5721 | −0.6152 | −0.6845 | −0.7173 | −0.7273 | −0.7649 | −0.7210 | −0.6806 | −0.6518 |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| GEG | −0.1493 | −0.1259 | −0.1218 | −0.1121 | −0.0945 | −0.0731 | −0.0647 | −0.0864 | −0.1112 |

| (0.0001) | (0.0018) | (0.0048) | (0.0143) | (0.0592) | (0.1737) | (0.2193) | (0.0819) | (0.0163) | |

| PPT | 0.1553 | 0.1232 | 0.1250 | 0.1343 | 0.1119 | 0.0785 | 0.0281 | 0.0074 | −0.0065 |

| (0.0294) | (0.1274) | (0.1553) | (0.1356) | (0.2199) | (0.3758) | (0.7296) | (0.9161) | (0.9101) | |

| Oil | −0.0982 | −0.1019 | −0.1017 | −0.0921 | −0.0898 | −0.0753 | −0.1279 | −0.1073 | −0.1057 |

| (0.0018) | (0.0001) | (0.0002) | (0.0037) | (0.0100) | (0.0481) | (0.0005) | (0.0003) | (0.0008) | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, C.; Ren, X.; Wang, Z.; Shi, Y. The Impacts of Non-Fossil Energy, Economic Growth, Energy Consumption, and Oil Price on Carbon Intensity: Evidence from a Panel Quantile Regression Analysis of EU 28. Sustainability 2018, 10, 4067. https://doi.org/10.3390/su10114067

Cheng C, Ren X, Wang Z, Shi Y. The Impacts of Non-Fossil Energy, Economic Growth, Energy Consumption, and Oil Price on Carbon Intensity: Evidence from a Panel Quantile Regression Analysis of EU 28. Sustainability. 2018; 10(11):4067. https://doi.org/10.3390/su10114067

Chicago/Turabian StyleCheng, Cheng, Xiaohang Ren, Zhen Wang, and Yukun Shi. 2018. "The Impacts of Non-Fossil Energy, Economic Growth, Energy Consumption, and Oil Price on Carbon Intensity: Evidence from a Panel Quantile Regression Analysis of EU 28" Sustainability 10, no. 11: 4067. https://doi.org/10.3390/su10114067