An Empirical Study on Entrepreneurial Orientation, Absorptive Capacity, and SMEs’ Innovation Performance: A Sustainable Perspective

Abstract

:1. Introduction

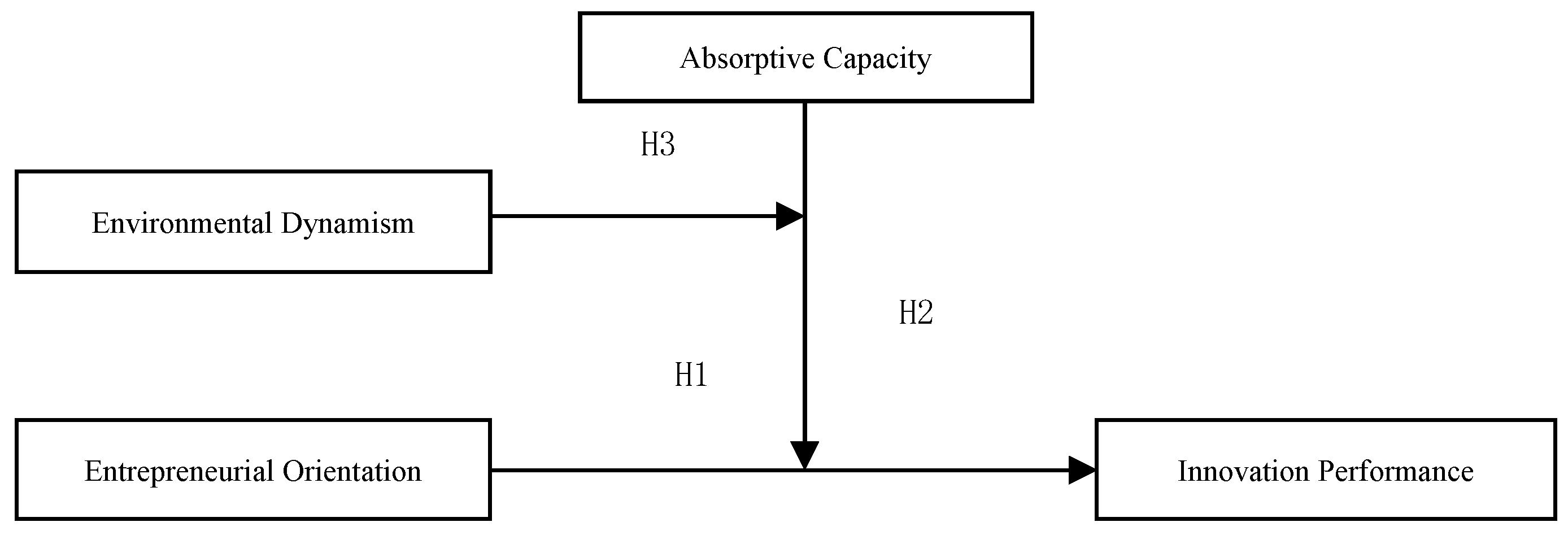

2. Theory Development and Hypothesis

2.1. Technological Innovation Performance

2.2. Entrepreneurial Orientation

2.3. Absorptive Capacity

2.4. Environmental Dynamism

3. Methodology and Variable Specifications

3.1. Data Collection

3.2. Measures

4. Results

4.1. Descriptive Statistics and Correlation Test

4.2. Test of Hypothesis

5. Conclusions

- (1)

- SMEs need to strengthen their cooperation with universities, scientific research institutions, and other external organizations. Universities and scientific research institutions can provide enterprises with more innovative resources, better experimental conditions, new technologies, and new knowledge. At the same time, through cooperation with them, we can broaden our horizons, cultivate enterprises’ advanced awareness, and understand the future market and technology development direction, so as to improve the level and ability of technological innovation.

- (2)

- SMEs’ managers need to cultivate staff’s learning and research ability, enabling employees to have the ability to learn, transform, and apply new knowledge and new technologies. In addition, a team made up of such employees will have higher absorptive capacity, thereby promoting technological innovation performance.

- (3)

- Managers need to build up the enterprise innovation spirit. They should take technological innovation actively, and dare to undertake the risks brought by technological innovation. In addition, managers need to be forward-looking in order to take action ahead of time and take the initiative to challenge the competitors. Thus, the enterprise’s technological innovation performance will be improved and the firm performance will be enhanced.

6. Limitations

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Lin, H.; Zeng, S.; Liu, H.; Li, C. How do intermediaries drive corporate innovation? A moderated mediating examination. J. Bus. Res. 2016, 69, 4831–4836. [Google Scholar] [CrossRef]

- Xie, X.; Zeng, S.; Peng, Y.; Tam, C. What affects the innovation performance of small and medium-sized enterprises in China? Innov. Manag. Policy Pract. 2013, 15, 271–286. [Google Scholar] [CrossRef]

- Baker, W.E.; Sinkula, J.M. Learning Orientation, Market Orientation, and Innovation: Integrating and Extending Models of Organizational Performance. J. Mark.-Focused Manag. 1999, 4, 295–308. [Google Scholar] [CrossRef]

- Kaufmann, A.; Tödtling, F. How effective is innovation support for SMEs? An analysis of the region of Upper Austria. Technovation 2002, 22, 147–159. [Google Scholar] [CrossRef]

- Murphy, M.; Perrot, F.; Rivera-Santos, M. New perspectives on learning and innovation in cross-sector collaborations. J. Bus. Res. 2012, 65, 1700–1709. [Google Scholar] [CrossRef]

- Kim, Y.; Lui, S.S. The impacts of external network and business group on innovation: Do the types of innovation matter? J. Bus. Res. 2015, 68, 1964–1973. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990; pp. 151–155. [Google Scholar]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Firm size and dynamic technological innovation. Technovation 2002, 22, 537–549. [Google Scholar] [CrossRef]

- O’Regan, N.; Ghobadian, A.; Gallear, D. In search of the drivers of high growth in manufacturing SMEs. Technovation 2006, 26, 30–41. [Google Scholar] [CrossRef]

- Arundel, A. The relative effectiveness of patents and secrecy for appropriation. Res. Policy 2001, 30, 611–624. [Google Scholar] [CrossRef]

- Lai, W.; Change, P. Corporate Motivation and Performance in R&D Alliances. J. Bus. Res. 2010, 63, 490–496. [Google Scholar]

- Engelen, A.; Kube, H.; Schmidt, S.; Flatten, T.C. Entrepreneurial orientation in turbulent environments: The moderating role of absorptive capacity. Res. Policy 2014, 43, 1353–1369. [Google Scholar] [CrossRef]

- Engelen, A.; Gupta, V.; Strenger, L.; Brettel, M. Entrepreneurial orientation, firm performance, and the moderating role of transformational leadership behaviors. J. Manag. 2015, 41, 1069–1097. [Google Scholar] [CrossRef]

- Lechner, C.; Gudmundsson, S.V. Entrepreneurial orientation, firm strategy and small firm performance. Int. Small Bus. J. 2014, 32, 36–60. [Google Scholar] [CrossRef]

- Ireland, R.D.; Hitt, M.A.; Sirmon, D.G. A model of strategic entrepreneurship: The construct and its dimensions. J. Manag. 2003, 29, 963–989. [Google Scholar]

- Matsuno, K.; Mentzer, J.T.; Özsomer, A. The Effects of Entrepreneurial Proclivity and Market Orientation on Business Performance. J. Mark. 2002, 66, 18–32. [Google Scholar] [CrossRef]

- Walter, A.; Auer, M.; Ritter, T. The impact of network capabilities and entrepreneurial orientation on university spin-off performance. J. Bus. Ventur. 2006, 21, 541–567. [Google Scholar] [CrossRef]

- Dimitratos, P.; Lioukas, S.; Carter, S. The relationship between entrepreneurship and international performance: The importance of domestic environment. Int. Bus. Rev. 2004, 13, 19–41. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Linking two dimensions of entrepreneurial orientation to firm performance: The moderating role of environment and industry life cycle. J. Bus. Ventur. 2001, 16, 429–451. [Google Scholar] [CrossRef]

- Moreno, A.M.; Casillas, J.C. Entrepreneurial Orientation and Growth of SMEs: A Causal Model. Entrep. Theory Pract. 2008, 32, 507–528. [Google Scholar] [CrossRef]

- Covin, J.G.; Green, K.M.; Slevin, D.P. Strategic process effects on the entrepreneurial orientation–sales growth rate relationship. Entrep. Theory Pract. 2006, 30, 57–81. [Google Scholar] [CrossRef]

- Zahra, S.A.; Covin, J.G. Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis. J. Bus. Ventur. 1995, 10, 43–58. [Google Scholar] [CrossRef]

- Snyder, H.; Witell, L.; Gustafsson, A.; Fombelle, P.; Kristensson, P. Identifying categories of service innovation: A review and synthesis of the literature. J. Bus. Res. 2016, 69, 2401–2408. [Google Scholar] [CrossRef]

- Narvekar, R.S.; Jain, K. A new framework to understand the technological innovation process. J. Intell. Cap. 2006, 7, 174–186. [Google Scholar] [CrossRef]

- Mortensen, P.S.; Bloch, C.W. Oslo Manual-Guidelines for Collecting and Interpreting Innovation Data: Proposed Guidelines for Collecting and Interpreting Innovation Data; Organisation for Economic Co-Operation and Development, OECD: Paris, France, 2005. [Google Scholar]

- Hagedoorn, J.; Cloodt, M. Measuring innovative performance: Is there an advantage in using multiple indicators. Res. Policy 2003, 32, 1365–1379. [Google Scholar] [CrossRef]

- Zou, W.J.; Huang, C.W.; Chiu, Y.H.; Shen, N.; Wang, S.M. The dynamic DEA assessment of the intertemporal efficiency and optimal quantity of patent for China’s high-tech industry. Asian J. Technol. Innov. 2016, 24, 378–395. [Google Scholar] [CrossRef]

- Hong, J.; Feng, B.; Wu, Y.; Wang, L. Do government grants promote innovation efficiency in China’s high-tech industries? Technovation 2016, 57, 4–13. [Google Scholar] [CrossRef]

- Fang, J.W.; Chiu, Y. Research on Innovation Efficiency and Technology Gap in China Economic Development. Asia-Pac. J. Oper. Res. 2017, 34, 1750005. [Google Scholar] [CrossRef]

- Wu, J.; Tu, R. CEO stock option pay and R&D spending: A behavioral agency explanation. J. Bus. Res. 2007, 60, 482–492. [Google Scholar]

- Berrone, P.; Surroca, J.; Tribó, J.A. The Influence of Blockholders on R&D Investments Intensity: Evidence from Spain; Working Paper; Departamento de Economia de la Empresa, Universidad Carlos III de Madrid: Madrid, Spain, 2005. [Google Scholar]

- Li, X.B. Sources of External Technology, Absorptive Capacity, and Innovation Capability in Chinese State-Owned High-Tech Enterprises. World Dev. 2011, 39, 1240–1248. [Google Scholar] [CrossRef]

- Miller, D. The structural and environmental correlates of business strategy. Strateg. Manag. J. 1987, 8, 55–76. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar]

- Wiklund, J. The sustainability of the entrepreneurial orientation-performance relationship. Entrep. Theory Pract. 1999, 24, 37–48. [Google Scholar] [CrossRef]

- Menon, A.; Varadarajan, P.R. A model of marketing knowledge use within firms. J. Mark. 1992, 56, 53–71. [Google Scholar] [CrossRef]

- Jia, J.; Zhao, X.; Yu, X.; Wang, G. Will entrepreneurial orientation help to improve corporate performance: A study based on the mediating effects of competency of top managers in entrepreneurial-oriented companies. Nankai Bus. Rev. 2013, 16, 47–56. [Google Scholar]

- Wiklund, J.; Shepherd, D. Entrepreneurial orientation and small business performance: A configurational approach. J. Bus. Ventur. 2005, 20, 71–91. [Google Scholar] [CrossRef]

- Wiklund, J.; Shepherd, D. Knowledge-based resources, entrepreneurial orientation, and the performance of small and medium-sized businesses. Strateg. Manag. J. 2003, 24, 1307–1314. [Google Scholar] [CrossRef]

- Christensen, C.M. The Innovator’s Dilemma; Harvard Business School Press: Boston, MA, USA, 1997; p. 382. [Google Scholar]

- Slocum, J.W.; McGill, M.; Lei, D.T. The new learning strategy: Anytime, anything, anywhere. Organ. Dyn. 1994, 23, 33–47. [Google Scholar] [CrossRef]

- Lin, J.; Sun, Y.; He, J. The relationship between the entrepreneurial orientation and firm growth performance: Under the action of absorptive capacity. Soft Sci. 2009, 23, 135–140. [Google Scholar]

- Lyon, D.W.; Lumpkin, G.T.; Dess, G.D. Enhancing entrepreneurial orientation research: Operationalizing and measuring a key strategic decision making process. J. Manag. 2000, 26, 1055–1085. [Google Scholar] [CrossRef]

- Alegre, J.; Chiva, R. Linking entrepreneurial orientation and firm performance: The role of organizational learning capability and innovation performance. J. Small Bus. Manag. 2013, 51, 491–507. [Google Scholar] [CrossRef]

- Ireland, R.D.; Webb, J.W. A cross-disciplinary exploration of entrepreneurship research. J. Manag. 2007, 33, 891–927. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Strateg. Learn. Knowl. Econ. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Anand, B.N.; Khanna, T. Do firms learn to create value? The case of alliances. Strateg. Manag. J. 2000, 21, 295–315. [Google Scholar] [CrossRef]

- Keh, H.T.; Nguyen, T.T.M.; Ng, H.P. The effects of entrepreneurial orientation and marketing information on the performance of SMEs. J. Bus. Ventur. 2007, 22, 592–611. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market orientation: Antecedents and consequences. J. Mark. 1993, 57, 53–70. [Google Scholar] [CrossRef]

- Simerly, R.L.; Li, M. Environmental Dynamism, Capital Structure and Performance: A Theoretical Integration and an Empirical Test. Strateg. Manag. J. 2000, 21, 31–49. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; Vera, D.; Crossan, M. Strategic leadership for exploration and exploitation: The moderating role of environmental dynamism. Leadersh. Q. 2009, 20, 5–18. [Google Scholar] [CrossRef]

- Wheelwright, S.C.; Clark, K.B. Revolutionizing Product Development; Free Press: New York, NY, USA, 1992. [Google Scholar]

- Miller, D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983, 29, 770–791. [Google Scholar] [CrossRef]

- Appiahadu, K.; Ranchhod, A. Market orientation and performance in the biotechnology industry: An exploratory empirical analysis. Technol. Anal. Strateg. Manag. 1998, 10, 197–210. [Google Scholar] [CrossRef]

- Kohli, A.K.; Jaworski, B.J. Market orientation: The construct, research proposition, and managerial implications. J. Mark. 1990, 54, 1–18. [Google Scholar] [CrossRef]

- Helfat, C.; Finkelstein, S.; Mitchell, W.; Peteraf, M.A.; Singh, H.; Teece, D.; Winter, S. Dynamic Capabilities: Understanding Strategic Chance in Organizations; Blackwell Publishing: Oxford, UK, 2007. [Google Scholar]

- Shane, S. Prior knowledge and the discovery of entrepreneurial opportunities. Organ. Sci. 2000, 11, 448–469. [Google Scholar] [CrossRef]

- Slater, S.F.; Narver, J.C. Market orientation, customer value, and superior performance. Bus. Horizon. 1994, 37, 22–28. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Alexandre, M.T. Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organ. Sci. 2009, 20, 759–780. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship and dynamic capabilities: A review, model and research agenda. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef] [Green Version]

- Zhang, X.; Zhu, H.; Wu, X. The influence of financial redundancy structure on enterprise performance: Under dynamic environment regulation-taking Chinese manufacturing as an example. Soft Sci. 2014, 28, 125–129. [Google Scholar]

- Koberg, C.S.; Detienne, D.R.; Heppard, K.A. An empirical test of environmental, organizational, and process factors affecting incremental and radical innovation. J. High Technol. Manag. Res. 2003, 14, 21–45. [Google Scholar] [CrossRef]

- Ling, Y.A.N.; Simsek, Z.; Lubatkin, M.H.; Veiga, J.F. Transformational leader-ship’s role in promoting corporate entrepreneurship: Examining the CEO-TMT interface. Acad. Manag. J. 2008, 51, 557–576. [Google Scholar] [CrossRef]

- Dillman, D.A. Mail and internet surveys: The tailored design method. J. Contin. Educ. Health Prof. 2000, 30, 206. [Google Scholar]

- Kumar, N.; Stern, L.W.; Anderson, J.C. Conducting interorganizational research using key informants. Acad. Manag. J. 1993, 36, 1633–1651. [Google Scholar] [CrossRef]

- Covin, J.G.; Slevin, D.P. Strategic management of small firms in hostile and benign environments. Strateg. Manag. J. 1989, 10, 75–87. [Google Scholar] [CrossRef]

- Tan, J.; Litschert, R.J. Environment-strategy relationship and its performance implications: An empirical study of Chinese electronics industry. Strateg. Manag. J. 1994, 15, 1–20. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 2009, 52, 822–846. [Google Scholar] [CrossRef]

| Industry | Percentage | Cumulative Percentage |

|---|---|---|

| food and beverage | 10 | 3.31 |

| textiles, garments, fur | 27 | 8.94 |

| paper making and printing | 26 | 8.61 |

| petroleum, chemical, plastics | 29 | 9.60 |

| metals, non-metals | 49 | 16.23 |

| electronics, machinery, equipment, instruments | 72 | 23.84 |

| medical and biological products | 14 | 4.64 |

| wood, furniture, other | 75 | 24.83 |

| Total | 302 | 100.00 |

| Variable | Cronbach’s alpha | KMO |

|---|---|---|

| Entrepreneurial orientation | 0.927 | 0.911 |

| Innovation performance | 0.894 | 0.725 |

| Absorptive capacity | 0.912 | 0.904 |

| Environmental dynamism | 0.831 | 0.836 |

| Construct | N | Min | Max | Mean | SD |

|---|---|---|---|---|---|

| Entrepreneurial orientation | 302 | 2 | 7 | 5.22 | 1.096 |

| Innovation performance | 302 | 1 | 5 | 4.27 | 1.532 |

| Absorptive capacity | 302 | 2 | 7 | 4.97 | 1.106 |

| Environmental dynamism | 302 | 1 | 7 | 4.75 | 1.042 |

| Ownership | 302 | 0 | 1 | 0.89 | 0.317 |

| Financial performance | 302 | 1 | 7 | 4.65 | 1.340 |

| R&D intensity | 302 | 1 | 7 | 4.39 | 1.521 |

| Firm size | 302 | 1 | 5 | 3.17 | 0.863 |

| Firm age | 302 | 2 | 168 | 17.44 | 22.405 |

| Construct | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| Entrepreneurial orientation | 1 | ||||||||

| Environmental dynamism | 0.428 ** | 1 | |||||||

| Absorptive capacity | 0.663 ** | 0.432 ** | 1 | ||||||

| Innovation performance | 0.351 ** | 0.330 ** | 0.449 ** | 1 | |||||

| Ownership | 0.144 * | 0.008 | 0.106 | 0.045 | 1 | ||||

| Financial performance | 0.301 ** | 0.274 ** | 0.367 ** | 0.461 ** | 0.048 | 1 | |||

| R&D intensity | 0.363 ** | 0.292 ** | 0.384 ** | 0.289 ** | 0.072 | 0.216 ** | 1 | ||

| Firm size | 0.070 | 0.004 | 0.163 ** | 0.255 ** | −0.052 | 0.306 ** | 0.078 | 1 | |

| Firm age | −0.015 | 0.045 | 0.031 | 0.148 ** | −0.086 | 0.046 | −0.015 | 0.209 ** | 1 |

| Variables | Dependent Variable: Technological Innovation Performance | |||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Controls: | ||||

| C0 | −0.175 | −0.165 | −0.176 | −0.176 |

| C1 | −0.380 * | −0.361 * | −0.378 * | −0.387 * |

| C3 | −0.401 * | −0.390 * | −0.400 * | −0.407 * |

| C4 | −0.420 * | −0.396 * | −0.424 * | −0.430 * |

| C6 | −0.514 * | −0.481 * | −0.507 * | −0.515 * |

| C5 & C7 | −0.563 * | −0.515 * | −0.552 * | −0.559 * |

| C8 | −0.183 | −0.172 | −0.191 | −0.192 |

| C2 & C9 | −0.671 * | −0.629 * | −0.641 * | −0.664 * |

| Ownership | 0.013 | −0.006 | 0.005 | 0.021 |

| Financial performance | 0.366 *** | 0.321 *** | 0.267 *** | 0.267 *** |

| R&D intensity | 0.214 *** | 0.159 ** | 0.111 * | 0.119 * |

| Firm size | 0.122 * | 0.125 * | 0.108 * | 0.105 * |

| Firm age | 0.069 | 0.071 | 0.065 | 0.071 |

| Main effects: | ||||

| EO | 0.184 *** | 0.100 * | 0.064 | |

| absorptive capacity (AC) | 0.231 ** | 0.253 *** | ||

| environmental dynamism (ED) | 0.149 ** | 0.210 ** | ||

| Interaction effects: | ||||

| EO × AC | 0.098 * | 0.094 * | ||

| EO × ED | −0.155 | |||

| ED × AC | 0.100 * | |||

| EO × AC × ED | 0.088 * | |||

| F | 10.087 *** | 10.544 *** | 10.499 *** | 9.118 *** |

| Adjusted R2 | 0.282 | 0.307 | 0.349 | 0.394 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhai, Y.-M.; Sun, W.-Q.; Tsai, S.-B.; Wang, Z.; Zhao, Y.; Chen, Q. An Empirical Study on Entrepreneurial Orientation, Absorptive Capacity, and SMEs’ Innovation Performance: A Sustainable Perspective. Sustainability 2018, 10, 314. https://doi.org/10.3390/su10020314

Zhai Y-M, Sun W-Q, Tsai S-B, Wang Z, Zhao Y, Chen Q. An Empirical Study on Entrepreneurial Orientation, Absorptive Capacity, and SMEs’ Innovation Performance: A Sustainable Perspective. Sustainability. 2018; 10(2):314. https://doi.org/10.3390/su10020314

Chicago/Turabian StyleZhai, Yu-Ming, Wan-Qin Sun, Sang-Bing Tsai, Zhen Wang, Yu Zhao, and Quan Chen. 2018. "An Empirical Study on Entrepreneurial Orientation, Absorptive Capacity, and SMEs’ Innovation Performance: A Sustainable Perspective" Sustainability 10, no. 2: 314. https://doi.org/10.3390/su10020314