A Probabilistic Alternative Approach to Optimal Project Profitability Based on the Value-at-Risk

Abstract

:1. Introduction

2. Related Work

3. Project-Evaluation Methodology

3.1. Traditional Decision-Making Process for the DCF Model

3.2. Improved Decision-Making Process for the VaR Model

4. Probabilistic Alternative Approach

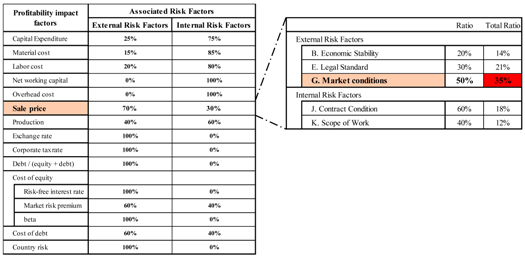

4.1. Identification of Overseas-Project Risk Factors

4.2. Developing Alternatives and the Alternative Selection Process

4.2.1. Business-Version of PDRI

4.2.2. TRIZ

4.2.3. Probabilistic Alternative Selection

5. Case Study

5.1. Traditional DCF-Based Decision-Making Process

5.2. Improved Decision-Making Process Based on the NPVaR Method

5.3. Probabilisic Alternative Approach for Optimal Profitability

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Category Element | Definition Level | Score | |||||||

| 0 | 1 | 2 | 3 | 4 | 5 | ||||

| A. | Credibility of Local Government | ||||||||

| A1. | Local administrative procedures and practices | ||||||||

| A2. | Maturity of legal system | ||||||||

| A3. | Consistent local policy | ||||||||

| Category Total | 0 | ||||||||

| B. | Economic Stability | ||||||||

| B1. | Economic condition of employer | ||||||||

| B2. | Economic condition of local country | ||||||||

| Category Total | 0 | ||||||||

| C. | Local Social & Cultural Characteristics | ||||||||

| C1. | Local social stability | ||||||||

| C2. | Local labor situation | ||||||||

| C3. | Cultural traits | ||||||||

| C4. | Local reactions of project | ||||||||

| Category Total | 0 | ||||||||

| D. | Geographical conditions | ||||||||

| D1. | Climate feature | ||||||||

| D2. | Soil condition | ||||||||

| D3. | Distance from Korea | ||||||||

| Category Total | 0 | ||||||||

| E. | Legal Standard | ||||||||

| E1. | Local standards of design | ||||||||

| E2. | Licensing standards | ||||||||

| E3. | Tariff standards | ||||||||

| E4. | Environmental regulations | ||||||||

| E5. | Repatriation of profits procedure | ||||||||

| E6. | Local content requirement | ||||||||

| Category Total | 0 | ||||||||

| F. | Status of infrastructure | ||||||||

| F1. | Local infra and utility level | ||||||||

| F2. | Difficulty of infra and utilities use contracts | ||||||||

| F3. | Future additional expansion possibilities | ||||||||

| Category Total | 0 | ||||||||

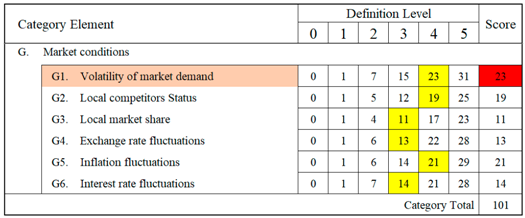

| G. | Market conditions | ||||||||

| G1. | Volatility of market demand | ||||||||

| G2. | Local competitors Status | ||||||||

| G3. | Local market share | ||||||||

| G4. | Exchange rate fluctuations | ||||||||

| G5. | Inflation fluctuations | ||||||||

| G6. | Interest rate fluctuations | ||||||||

| Category Total | 0 | ||||||||

| H. | Financing Plan | ||||||||

| H1. | Additional potential projects in progress | ||||||||

| H2. | Cash flow stability | ||||||||

| H3. | Debt equity ratio | ||||||||

| Category Total | 0 | ||||||||

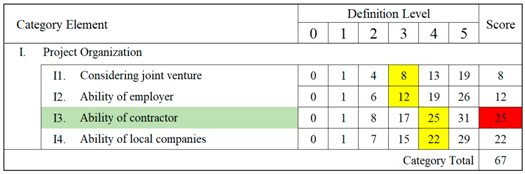

| I. | Project Organization | ||||||||

| I1. | Considering joint venture | ||||||||

| I2. | Ability of employer | ||||||||

| I3. | Ability of contractor | ||||||||

| I4. | Ability of local companies | ||||||||

| Category Total | 0 | ||||||||

| J. | Contract Condition | ||||||||

| J1. | Similar experiences | ||||||||

| J2. | Liquidated damages | ||||||||

| J3. | Contract terms changeability | ||||||||

| J4. | Unclear contract terms | ||||||||

| J5. | Steel purchase conditions | ||||||||

| J6. | Force majeure | ||||||||

| Category Total | 0 | ||||||||

| K. | Scope of Work | ||||||||

| K1. | Characteristics of product | ||||||||

| K2. | Construction schedule | ||||||||

| Category Total | 0 | ||||||||

| L. | Expenses | ||||||||

| L1. | Initial investment | ||||||||

| L2. | Operation costs | ||||||||

| L3. | Reasonable Contingencies | ||||||||

| Category Total | 0 | ||||||||

| M. | Process & Technology | ||||||||

| M1. | Conformity of new process | ||||||||

| M2. | Level of applied technology | ||||||||

| Category Total | 0 | ||||||||

| N. | Engineering Period | ||||||||

| N1. | Layout planning | ||||||||

| N2. | Constructability/Complexity | ||||||||

| N3. | Design for Scalability | ||||||||

| N4. | Major equipment selection | ||||||||

| N5. | Timeliness of design | ||||||||

| N6. | Value engineering | ||||||||

| Category Total | 0 | ||||||||

| O. | Health, Safety & Environment | ||||||||

| O1. | Work safety management | ||||||||

| O2. | Construction safety facilities | ||||||||

| O3. | Pollution prevention Plan | ||||||||

| Category Total | 0 | ||||||||

| P. | Procurements | ||||||||

| P1. | Personnel procurement plan | ||||||||

| P2. | Equipment procurement | ||||||||

| Category Total | 0 | ||||||||

| Q. | Construction Period | ||||||||

| Q1. | Suitable working method | ||||||||

| Q2. | Equip./Material transport | ||||||||

| Q3. | Local company collaboration | ||||||||

| Q4. | Local materials quality | ||||||||

| Q1. | Security & Safety | ||||||||

| Q2. | Commissioning & Acquisition requirements | ||||||||

| Category Total | 0 | ||||||||

| R. | Completion Requirements | ||||||||

| R1. | Document Management | ||||||||

| R2. | Performance requirements | ||||||||

| Category Total | 0 | ||||||||

| Total Score | 0 | ||||||||

Appendix B

References

- Kyeong-Chan, K. The reorganization of global steel industry and the implications for POSCO. SERI Q. 2009, 2, 78. [Google Scholar]

- Bal, M.; Bryde, D.; Fearon, D.; Ochieng, E. Stakeholder Engagement: Achieving Sustainability in the Construction Sector. Sustainability 2013, 5, 695–710. [Google Scholar] [CrossRef]

- Jillella, S.; Matan, A.; Newman, P. Participatory Sustainability Approach to Value Capture-Based Urban Rail Financing in India through Deliberated Stakeholder Engagement. Sustainability 2015, 7, 8091–8115. [Google Scholar] [CrossRef]

- Liang, X.; Yu, T.; Guo, L. Understanding Stakeholders’ Influence on Project Success with a New SNA Method: A Case Study of the Green Retrofit in China. Sustainability 2017, 9, 1927. [Google Scholar] [CrossRef]

- Tseng, Y.-C.; Lee, Y.-M.; Liao, S.-J. An Integrated Assessment Framework of Offshore Wind Power Projects Applying Equator Principles and Social Life Cycle Assessment. Sustainability 2017, 9, 1822. [Google Scholar] [CrossRef]

- Risk Management–Principles and Guidelines; ISO 31000: 2009; International Organization for Standardization: Geneva, Switzerland, 2009.

- Hubbard, D.W. The Failure of Risk Management: Why it’s Broken and How to Fix it; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Ye, S.; Tiong, R.L.K. NPV-at-Risk Method in Infrastructure Project Investment Evaluation. J. Construct. Eng. Manag. 2000, 126, 227–233. [Google Scholar] [CrossRef]

- Habibi, H.; Habibi, R. Applications of Simulation-Based Methods in Finance: The Use of ModelRisk Software. J. Adv. Stud. Financ. 2016, 7, 82. [Google Scholar]

- Caron, F.; Fumagalli, M.; Rigamonti, A. Engineering and contracting projects: A value at risk based approach to portfolio balancing. Int. J. Proj. Manag. 2007, 25, 569–578. [Google Scholar] [CrossRef]

- Shi, J.; Wang, Y.; Fu, R.; Zhang, J. Operating Strategy for Local-Area Energy Systems Integration Considering Uncertainty of Supply-Side and Demand-Side under Conditional Value-At-Risk Assessment. Sustainability 2017, 9, 1655. [Google Scholar] [CrossRef]

- Gatti, S.; Rigamonti, A.; Saita, F.; Senati, M. Measuring Value-at-Risk in Project Finance Transactions. European Financial Manag. 2007, 13, 135–158. [Google Scholar] [CrossRef]

- Zhang, C.; Pu, Z.; Zhou, Q. Sustainable Energy Consumption in Northeast Asia: A Case from China’s Fuel Oil Futures Market. Sustainability 2018, 10, 261. [Google Scholar] [CrossRef]

- Zhu, L.; Ren, X.; Lee, C.; Zhang, Y. Coordination Contracts in a Dual-Channel Supply Chain with a Risk-Averse Retailer. Sustainability 2017, 9, 2148. [Google Scholar] [CrossRef]

- Kim, Y.; Shin, K.; Ahn, J.; Lee, E.-B. Probabilistic Cash Flow-Based Optimal Investment Timing Using Two-Color Rainbow Options Valuation for Economic Sustainability Appraisement. Sustainability 2017, 9, 1781. [Google Scholar] [CrossRef]

- Damodaran, A. Investment Valuation: Tools and Techniques for Determining the Value of any Asset; John Wiley & Sons: Hoboken, NJ, USA, 2012; Volume 666. [Google Scholar]

- Hacura, A.; Jadamus-Hacura, M.; Kocot, A. Risk analysis in investment appraisal based on the Monte Carlo simulation technique. Eur. Phys. J. B Condens. Matter Complex Syst. 2001, 20, 551–553. [Google Scholar] [CrossRef]

- Rezaie, K.; Amalnik, M.S.; Gereie, A.; Ostadi, B.; Shakhseniaee, M. Using extended Monte Carlo simulation method for the improvement of risk management: Consideration of relationships between uncertainties. Appl. Math. Comput. 2007, 190, 1492–1501. [Google Scholar] [CrossRef]

- Suslick, S.B.; Schiozer, D.; Rodriguez, M.R. Uncertainty and risk analysis in petroleum exploration and production. Terrae 2009, 6, 2009. [Google Scholar]

- Liu, J.; Jin, F.; Xie, Q.; Skitmore, M. Improving risk assessment in financial feasibility of international engineering projects: A risk driver perspective. Int. J. Proj. Manag. 2017, 35, 204–211. [Google Scholar] [CrossRef]

- Dempster, M.A.H. Risk Management: Value at Risk and Beyond; Cambridge University Press: Cambridge, UK, 2002. [Google Scholar]

- Hull, J.C. Options, Futures, and Other Derivatives, 8th ed.; Pearson Education: New York, NY, USA, 2012. [Google Scholar]

- Jorion, P. Value at Risk; McGraw-Hill: New York, NY, USA, 1997. [Google Scholar]

- Miles, L.D. Techniques of Value Analysis and Engineering; Miles Value Foundation: Portland, OR, USA, 2015. [Google Scholar]

- Ibusuki, U.; Kaminski, P.C. Product development process with focus on value engineering and target-costing: A case study in an automotive company. Int. J. Prod. Econ. 2007, 105, 459–474. [Google Scholar] [CrossRef]

- Mao, X.; Zhang, X.; AbouRizk, S.M. Enhancing value engineering process by incorporating inventive problem-solving techniques. J. Construct. Eng. Manag. 2009, 135, 416–424. [Google Scholar] [CrossRef]

- Ruchti, B.; Livotov, P. TRIZ-based innovation principles and a process for problem solving in business and management. TRIZ J. 2001, 1, 677–687. [Google Scholar]

- Kim, Y.-S.; Cochran, D.S. Reviewing TRIZ from the perspective of axiomatic design. J. Eng. Des. 2000, 11, 79–94. [Google Scholar] [CrossRef]

- Yamashina, H.; Ito, T.; Kawada, H. Innovative product development process by integrating QFD and TRIZ. Int. J. Prod. Res. 2002, 40, 1031–1050. [Google Scholar] [CrossRef]

- Jones, E.; Harrison, D. Investigating the use of TRIZ in Eco-innovation. TRIZ J. 2000. Available online: https://www.researchgate.net/profile/David_Harrison10/publication/49401085_Investigating_the_use_of_TRIZ_in_eco-innovation/links/54bccdbb0cf253b50e2d6200/investating-the-use-of-TRIZ-in-eco-innovation.pdf (accessed on 19 January 2015).

- Ilevbare, I.M.; Probert, D.; Phaal, R. A review of TRIZ, and its benefits and challenges in practice. Technovation 2013, 33, 30–37. [Google Scholar] [CrossRef]

- Souchkov, V. Breakthrough thinking with TRIZ for business and management: An overview. ICG Train. Consult. 2007, pp. 3–12. Available online: http://scinnovation.cn/wp-content/uploads/soft/100910/BreakthroughThinkingwithTRIZforBusinessandManagementAnOverview.pdf (accessed on 19 March 2007).

- Bodie, Z.; Kane, A.; Marcus, A.J. Investments, 10e; McGraw-Hill Education: New York, NY, USA, 2014. [Google Scholar]

- Trigeorgis, L. Real Options: Managerial Flexibility and Strategy in Resource Allocation; MIT Press: Cambridge, MA, USA, 1996. [Google Scholar]

- Wibowo, A.; Kochendörfer, B. Financial risk analysis of project finance in Indonesian toll roads. J. Constr. Eng. Manag. 2005, 131, 963–972. [Google Scholar] [CrossRef]

- Yun, S.; Han, S.H.; Kim, H.; Ock, J.H. Capital structure optimization for build–operate–transfer (BOT) projects using a stochastic and multi-objective approach. Can. J. Civ. Eng. 2009, 36, 777–790. [Google Scholar] [CrossRef]

- Bingham, E.; Gibson, G.E., Jr. Infrastructure Project Scope Definition Using Project Definition Rating Index. J. Manag. Eng. 2016, 32, 04016037. [Google Scholar] [CrossRef]

- Sindhu, J.R.N. Investigating the Effect of Front-End Planning in Fast-Track Delivery Systems for Industrial Projects; Texas A&M University: College Station, TX, USA, 2016. [Google Scholar]

- Yildiz, A.E.; Dikmen, I.; Birgonul, M.T.; Ercoskun, K.; Alten, S. A knowledge-based risk mapping tool for cost estimation of international construction projects. Autom. Constr. 2014, 43, 144–155. [Google Scholar] [CrossRef]

- Deng, X.; Low, S.P.; Li, Q.; Zhao, X. Developing competitive advantages in political risk management for international construction enterprises. J. Constr. Eng. Manag. 2014, 140, 04014040. [Google Scholar] [CrossRef]

- Lee, N.; Schaufelberger, J.E. Risk management strategies for privatized infrastructure projects: Study of the build–operate–transfer approach in east Asia and the Pacific. J. Manag. Eng. 2013, 30, 05014001. [Google Scholar] [CrossRef]

- Zhao, X.; Hwang, B.-G.; Yu, G.S. Identifying the critical risks in underground rail international construction joint ventures: Case study of Singapore. Int. J. Proj. Manag. 2013, 31, 554–566. [Google Scholar] [CrossRef]

- Subramanyan, H.; Sawant, P.H.; Bhatt, V. Construction project risk assessment: Development of model based on investigation of opinion of construction project experts from India. J. Constr. Eng. Manag. 2012, 138, 409–421. [Google Scholar] [CrossRef]

- Cheng, M.-Y.; Tsai, H.-C.; Chuang, K.-H. Supporting international entry decisions for construction firms using fuzzy preference relations and cumulative prospect theory. Expert Syst. Appl. 2011, 38, 15151–15158. [Google Scholar] [CrossRef]

- Han, S.H.; Kim, D.Y.; Kim, H. Predicting profit performance for selecting candidate international construction projects. J. Constr. Eng. Manag. 2007, 133, 425–436. [Google Scholar] [CrossRef]

- Ozorhon, B.; Dikmen, I.; Birgonul, M.T. Case-based reasoning model for international market selection. J. Constr. Eng. Manag. 2006, 132, 940–948. [Google Scholar] [CrossRef]

- Wang, S.Q.; Tiong, R.L.; Ting, S.; Ashley, D. Evaluation and management of political risks in China’s BOT projects. J. Constr. Eng. Manag. 2000, 126, 242–250. [Google Scholar] [CrossRef]

- Zou, P.X.; Zhang, G.; Wang, J. Understanding the key risks in construction projects in China. Int. J. Proj. Manag. 2007, 25, 601–614. [Google Scholar] [CrossRef]

- Kim, D.Y.; Han, S.H.; Kim, H.; Park, H. Structuring the prediction model of project performance for international construction projects: A comparative analysis. Expert Syst. Appl. 2009, 36, 1961–1971. [Google Scholar] [CrossRef]

- Chen, H.L.; Chen, C.-I.; Liu, C.-H.; Wei, N.-C. Estimating a project’s profitability: A longitudinal approach. Int. J. Proj. Manag. 2013, 31, 400–410. [Google Scholar] [CrossRef]

- Qazi, A.; Quigley, J.; Dickson, A.; Kirytopoulos, K. Project Complexity and Risk Management (ProCRiM): Towards modelling project complexity driven risk paths in construction projects. Int. J. Proj. Manag. 2016, 34, 1183–1198. [Google Scholar] [CrossRef]

- Saltelli, A.; Chan, K.; Scott, E.M. Sensitivity Analysis; Wiley: New York, NY, USA, 2000; Volume 1. [Google Scholar]

- Ritzema, H. Drainage Principles and Applications; International Institute for Land Reclamation and Improvement (ILRI): Wageningen, The Netherlands, 1994. [Google Scholar]

- Altshuller, G.; Shulyak, L.; Rodman, S. 40 Principles: TRIZ keys to Innovation; Technical Innovation Center, Inc.: Worcester, MA, USA, 2002; Volume 1. [Google Scholar]

| Classification of Risk Factors | Literature List | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| L1 | * L2 | L3 | Risk Factor | ① [37] | ② [38] | ③ [39] | ④ [40] | ⑤ [41] | ⑥ [42] | ⑦ [43] | ⑧ [44] | ⑨ [45] | ⑩ [46] | ⑪ [47] |

| External Risk Factors | A. | A1. | Local administrative procedures and practices | √ | √ | √ | √ | √ | √ | |||||

| A2. | Maturity of legal system | √ | √ | √ | ||||||||||

| A3. | Consistent local policy | √ | √ | √ | √ | √ | √ | √ | √ | |||||

| B. | B1. | Economic condition of employer | √ | √ | ||||||||||

| B2. | Economic condition of local country | √ | √ | √ | √ | |||||||||

| C. | C1. | Local social stability | √ | √ | ||||||||||

| C2. | Local labor situation | √ | √ | √ | √ | |||||||||

| C3. | Cultural traits | √ | √ | √ | √ | √ | ||||||||

| C4. | Local reactions toward project | √ | √ | √ | ||||||||||

| D. | D1. | Climate feature | √ | √ | √ | |||||||||

| D2. | Soil condition | √ | √ | √ | √ | √ | ||||||||

| D3. | Distance from Republic of Korea | √ | ||||||||||||

| E. | E1. | Local standards of design | √ | √ | √ | |||||||||

| E2. | Licensing standards | √ | √ | |||||||||||

| E3. | Tariff standards | √ | √ | |||||||||||

| E4. | Environmental regulations | √ | √ | √ | √ | |||||||||

| E5. | Profit-repatriation procedure | √ | √ | √ | √ | √ | ||||||||

| E6. | Local-content requirement | √ | ||||||||||||

| F. | F1. | Local infra and utility levels | √ | √ | √ | √ | √ | |||||||

| F2. | Difficulty of infra- and utility-use contracts | √ | ||||||||||||

| F3. | Future additional expansion possibilities | √ | ||||||||||||

| G. | G1. | Volatility of market demand | √ | √ | √ | √ | √ | √ | ||||||

| G2. | Local-competitor statuses | √ | √ | |||||||||||

| G3. | Local market share | √ | √ | |||||||||||

| G4. | Exchange-rate fluctuations | √ | √ | √ | √ | |||||||||

| G5. | Inflation fluctuations | √ | √ | √ | √ | √ | ||||||||

| G6. | Interest-rate fluctuations | √ | √ | |||||||||||

| H. | H1. | Additional potential projects in progress | √ | |||||||||||

| H2. | Cash-flow stability | √ | √ | √ | ||||||||||

| H3. | Debt–equity ratio | √ | √ | |||||||||||

| Internal Risk Factors | I. | I1. | Joint-venture consideration | √ | √ | √ | √ | √ | ||||||

| I2. | Ability of employer | √ | √ | √ | √ | √ | √ | |||||||

| I3. | Ability of contractor | √ | √ | √ | √ | √ | √ | |||||||

| I4. | Ability of local companies | √ | √ | √ | √ | √ | √ | √ | ||||||

| J. | J1. | Similar experiences | √ | √ | √ | √ | √ | |||||||

| J2. | Liquidated damages | √ | √ | |||||||||||

| J3. | Contract-terms changeability | √ | ||||||||||||

| J4. | Unclear contract terms | √ | √ | √ | √ | |||||||||

| J5. | Steel-purchase conditions | √ | ||||||||||||

| J6. | Force majeure | √ | √ | √ | √ | √ | ||||||||

| K. | K1. | Product characteristics | √ | √ | √ | √ | √ | √ | ||||||

| K2. | Construction schedule | √ | √ | √ | √ | |||||||||

| L. | L1. | Initial investment | √ | √ | ||||||||||

| L2. | Operation costs | √ | ||||||||||||

| L3. | Reasonable contingencies | √ | √ | |||||||||||

| M. | M1. | Conformity of new process | √ | |||||||||||

| M2. | Level of applied technology | √ | √ | √ | ||||||||||

| N. | N1. | Layout planning | √ | √ | ||||||||||

| N2. | Constructability/Complexity | √ | √ | |||||||||||

| N3. | Design for scalability | √ | ||||||||||||

| N4. | Major-equipment selection | √ | √ | √ | ||||||||||

| N5. | Timeliness of design | √ | ||||||||||||

| N6. | Value engineering | √ | ||||||||||||

| O. | O1. | Work-safety management | √ | √ | √ | |||||||||

| O2. | Construction-safety facilities | √ | ||||||||||||

| O3. | Pollution-prevention plan | √ | √ | √ | ||||||||||

| P. | P1. | Personnel-procurement plan | √ | √ | √ | √ | √ | √ | √ | √ | ||||

| P2. | Equipment procurement | √ | √ | √ | √ | √ | √ | √ | ||||||

| Q. | Q1. | Suitable working method | √ | √ | √ | |||||||||

| Q2. | Equip./Material transport | √ | ||||||||||||

| Q3. | Local-company collaboration | √ | ||||||||||||

| Q4. | Local-material quality | √ | √ | √ | √ | |||||||||

| Q5. | Security & Safety | √ | ||||||||||||

| Q6. | Commissioning & Acquisition requirements | √ | ||||||||||||

| R. | R1. | Document management | √ | |||||||||||

| R2. | Performance requirements | √ | √ | |||||||||||

| Profitability Impact Factors | Associated Major Risk Factors | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| External Risk Factors | Internal Risk Factors | |||||||||

| Capital Expenditure | C. | D. | F. | I. | J. | L. | N. | Q. | ||

| Material cost | G. | J. | L. | M. | N. | |||||

| Labor cost | C. | L. | O. | P. | ||||||

| Net working capital | L. | M. | ||||||||

| Overhead cost | L. | M. | ||||||||

| Sale price | B. | E. | G. | J. | K. | |||||

| Production | B. | G. | K. | R. | ||||||

| Exchange rate | G. | |||||||||

| Corporate tax rate | A. | B. | C. | E. | ||||||

| Debt/(equity + debt) | H. | |||||||||

| Cost of equity | ||||||||||

| Risk-free interest rate | H. | |||||||||

| Market risk premium | B. | I. | J. | |||||||

| Beta | B. | |||||||||

| Cost of debt | H. | I. | J. | |||||||

| Country risk | A. | B. | C. | |||||||

| Profitability Impact Factors | Unit | Project K (Indonesia, 2009) | Project C (Brazil, 2011) |

|---|---|---|---|

| Construction/Operation period | Year | 3/15 | 4/20 |

| * Capital expenditure | Million USD | 3000 | 3800 |

| Material cost | Million USD per year | 480 | 460 |

| Labor cost | Million USD per year | 300 | 280 |

| Net working capital | Million USD per year | 40 | 30 |

| Overhead cost | Million USD per year | 50 | 30 |

| Sale price | Million USD/Million tons | 680 | 640 |

| Production | Million USD per year | 3 | 3 |

| Revenue | Million USD per year | 2040 | 1920 |

| Exchange rate | KRW/USD | 1065.92 | 1122.10 |

| Corporate-tax rate | % | 28 | 34 |

| Debt-to-equity ratio | 1.5 (60%/40%) | 1.0 (50%/50%) | |

| Cost of equity | % | 7.758 | 6.901 |

| Risk-free interest rate | % | 4.341 | 3.691 |

| Market risk premium | % | 7.392 | 7.219 |

| Beta | 1.12 | 0.91 | |

| Cost of debt after tax | % | 3.622 | 2.845 |

| Cost of debt before tax | % | 5.031 | 4.311 |

| WACC | % | 5.277 | 4.873 |

| Country risk premium | % | 3.400 | 3.400 |

| Discount rate | % | 8.677 | 8.273 |

| Period | Construction | Operation | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | 1 | 2 | 3 | 4 | 5 | … | 15 | 16 | 17 | 18 |

| Cash outflow | *(1000) | *(1000) | *(1040) | *(40) | *(40) | … | *(40) | *(40) | *(40) | - |

| Capital Expenditure | *(1000) | *(1000) | *(1000) | - | - | … | - | - | - | - |

| Net working capital | - | - | *(40) | *(40) | *(40) | … | *(40) | *(40) | *(40) | - |

| Cash Inflow | - | - | - | *718 | *718 | … | *628 | *634 | *641 | *647 |

| Profit after tax | - | - | - | *622 | *622 | … | *572 | *578 | *585 | *591 |

| Depreciation saving | - | - | - | *56 | *56 | … | *56 | *56 | *56 | *56 |

| Net cash flow | *(1000) | *(1000) | *(1040) | *678 | *678 | … | *588 | *594 | *601 | *647 |

| Period | Construction | Operation | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | 1 | 2 | 3 | 4 | 5 | … | 21 | 22 | 23 | 24 |

| Cash outflow | *(950) | *(950) | *(950) | *(980) | *(30) | … | *(30) | *(30) | *(30) | - |

| Capital Expenditure | *(950) | *(950) | *(950) | *(950) | - | … | - | - | - | - |

| Net working capital | - | - | - | *(30) | *(30) | … | *(30) | *(30) | *(30) | - |

| Cash Inflow | - | - | - | - | *644 | … | *600 | *604 | *607 | *611 |

| Profit after tax | - | - | - | - | *580 | … | *536 | *539 | *543 | *546 |

| Depreciation saving | - | - | - | *64 | … | *64 | *64 | *64 | *64 | |

| Net cash flow | *(950) | *(950) | *(950) | *(950) | *614 | … | *570 | *574 | *577 | *611 |

| Profitability Indicators | Project K (Indonesia, 2009) | Project C (Brazil, 2011) |

|---|---|---|

| NPV (Million USD/Billion KRW) | 1432/1525 | 901/1011 |

| IRR (%) | 15.25% | 11.08% |

| Decision Making Result | Investment approval | Investment approval |

| Profitability Impact Factors | Unit | Project K (Indonesia, 2009) | Project C (Brazil, 2011) | |||

|---|---|---|---|---|---|---|

| Probability Distribution | Variation | Probability Distribution | Variation | |||

| Capital expenditure | Million USD | Triangular | Min: 2900 Mode: 3000 Max: 3200 | Triangle | Min: 3600 Mode: 3800 Max: 4600 | |

| Material cost | Million USD/Year | Triangular | Min: 470 Mode: 490 Max: 530 | Triangle | Min: 440 Mode: 460 Max: 490 | |

| Labor cost | Million USD/Year | Uniform | Min: 280 Max: 310 | Uniform | Min: 260 Max: 290 | |

| Net working capital | Million USD/Year | Uniform | Min: 30 Max: 50 | Uniform | Min: 25 Max: 35 | |

| Overhead cost | Million USD/Year | Uniform | Min: 40 Max: 60 | Uniform | Min: 25 Max: 35 | |

| Sale price | Million USD/Million tons | Exponential | β: 26.7 Min: 620 Mean: 680 | Triangle | Min: 600 Mode: 630 Max: 650 | |

| Production | Million USD/Year | Uniform | Min: 2.8 Max: 3.1 | Uniform | Min: 2.95 Max: 3.1 | |

| Exchange rate | KRW/USD | Beta | α1: 1.1427, α2: 3.4881 Min: 755.75 Max: 1973.80 | Normal | μ: 1122.10 σ: 175.92 | |

| Corporate tax rate | % | Triangular | Min: 25 Mode: 28 Max: 30 | Uniform | Min: 34 Max: 34 | |

| Debt/(equity + debt) | Uniform | Min: 0.55 Max: 0.70 | Uniform | Min: 0.45 Max: 0.60 | ||

| Cost of equity | Risk-free interest rate | % | Uniform | Min: 1.0783 Max: 5.8217 | Uniform | Min: 0.9135 Max: 5.1265 |

| Market risk premium | % | Triangular | Min: 5.6759 Mode: 5.6759 Max: 10.4031 | Uniform | Min: 5.2502 Max: 8.8857 | |

| Beta | Uniform | Min: 1.07 Max: 1.17 | Uniform | Min: 0.89 Max: 0.91 | ||

| Cost of debt before tax | % | Uniform | Min: 2.90 Max: 6.70 | Triangular | Min: 3.128 Mode: 3.128 Max: 6.106 | |

| Country risk | % | Uniform | Min: 2.4 Max: 4.4 | Uniform | Min: 3.0 Max: 3.8 | |

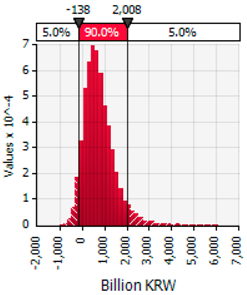

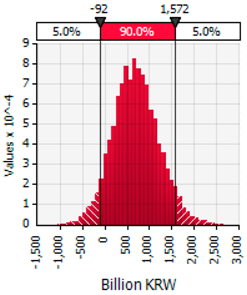

| Item | Project K (Indonesia, 2009) | Project C (Brazil, 2011) |

|---|---|---|

| Probability Distributions of the Net Present Value (NPV) |  |  |

| Minimum | *(1030) | *(1047) |

| Maximum | *6139 | *2665 |

| Mean | *764 | *704 |

| Std. Dev. | *673 | *506 |

| NPV0.05 | *(138) | *(92) |

| Decision-making Result | Investment rejection | Investment rejection |

| Project K (Indonesia, 2009) | Project C (Brazil, 2011) |

|---|---|

|  |

| Project K | Weighted Relation between Major Profitability Impact Factors & Risk Factors |  |

| Business-Version PDRI |  | |

| Project C | Weighted Relation between Major Profitability Impact Factors & Risk Factors |  |

| Business-Version PDRI |  |

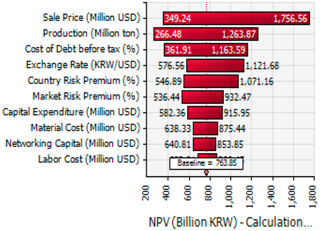

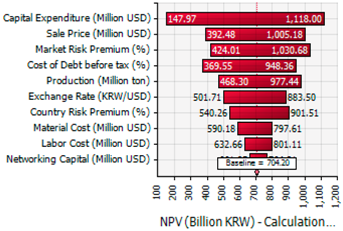

| Risk Factor | TRIZ Method | Probability Distribution | Variation | NPV0.05 (Billion KRW) | Proposed Decision Making |

|---|---|---|---|---|---|

| Alternative Solution | |||||

| G1. Volatility of Market Demand (Project K) | 9. Continuous action—Interrupted action | Uniform | Min: 630 Max: 630 | (204) | Rejection |

| → Planning associated downstream project | |||||

| 11. Direct action—Indirect action → Ensuring local buyers | Exponential | β: 26.7 Min: 626.2 Mean: 686.8 | (40) | Rejection | |

| 12. Preliminary action—Preliminary counteraction → Ensuring long-term off-takers √ | Triangular | Min: 626 Mode: 656 Max: 676 | 65 | Approval | |

| I3. Ability of Contractor (Project C) | 3. Homogeneity—Diversity → Ordering EPC Lump-sum Turnkey √ | Triangular | Min: 3900 Mode: 4000 Max: 4200 | 26 | Approval |

| 4. Expansion—Reduction → Utilizing competitive bid techniques | Triangular | Min: 3400 Mode: 3400 Max: 4800 | (147) | Rejection | |

| 7. Standardization—Specialization → Collaboration-capable local companies | Triangular | Min: 3500 Mode: 3600 Max: 4700 | (126) | Rejection |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, Y.; Lee, E.-B. A Probabilistic Alternative Approach to Optimal Project Profitability Based on the Value-at-Risk. Sustainability 2018, 10, 747. https://doi.org/10.3390/su10030747

Kim Y, Lee E-B. A Probabilistic Alternative Approach to Optimal Project Profitability Based on the Value-at-Risk. Sustainability. 2018; 10(3):747. https://doi.org/10.3390/su10030747

Chicago/Turabian StyleKim, Yonggu, and Eul-Bum Lee. 2018. "A Probabilistic Alternative Approach to Optimal Project Profitability Based on the Value-at-Risk" Sustainability 10, no. 3: 747. https://doi.org/10.3390/su10030747