A Study on Green Supplier Selection in Dynamic Environment

Abstract

:1. Introduction

2. Literature Review

3. PT3-Based Green Supplier Selection Decision-Making Model

3.1. The Supplier Selection Evaluation Index System

3.2. Green Supplier Decision Model Based on the Third-Generation Prospect Theory

- (1)

- When the index , record , in which is a real number, . .

- (2)

- When the index , record , in which is an interval number, i.e., . In reality, the index value takes a random value from the interval in uniform distribution, with the probability density function as:

- (3)

- When the index , record , in which is the intuitive trapezoidal fuzzy number, that is, , , , , , , , , , , and its membership function is:where, is non-membership function. In general, in the intuitive trapezoidal fuzzy number , when , which can be recorded as . In this paper, we discuss fuzzy numbers of this type, and is the degree of hesitation. The smaller the value, the more determined the fuzzy number.

3.3. Calculation of Gains and Losses

3.4. Prospect Value Calculation and Scheme Sorting

4. Weight Determination of Candidate Enterprises

4.1. Generalized Optimal Ordinal Number

4.2. Determine the Index Weight Based on the Correlation Coefficient Method

4.3. Timing Weight Based on Penalty Mechanism

4.4. Supplier Selection Process Description

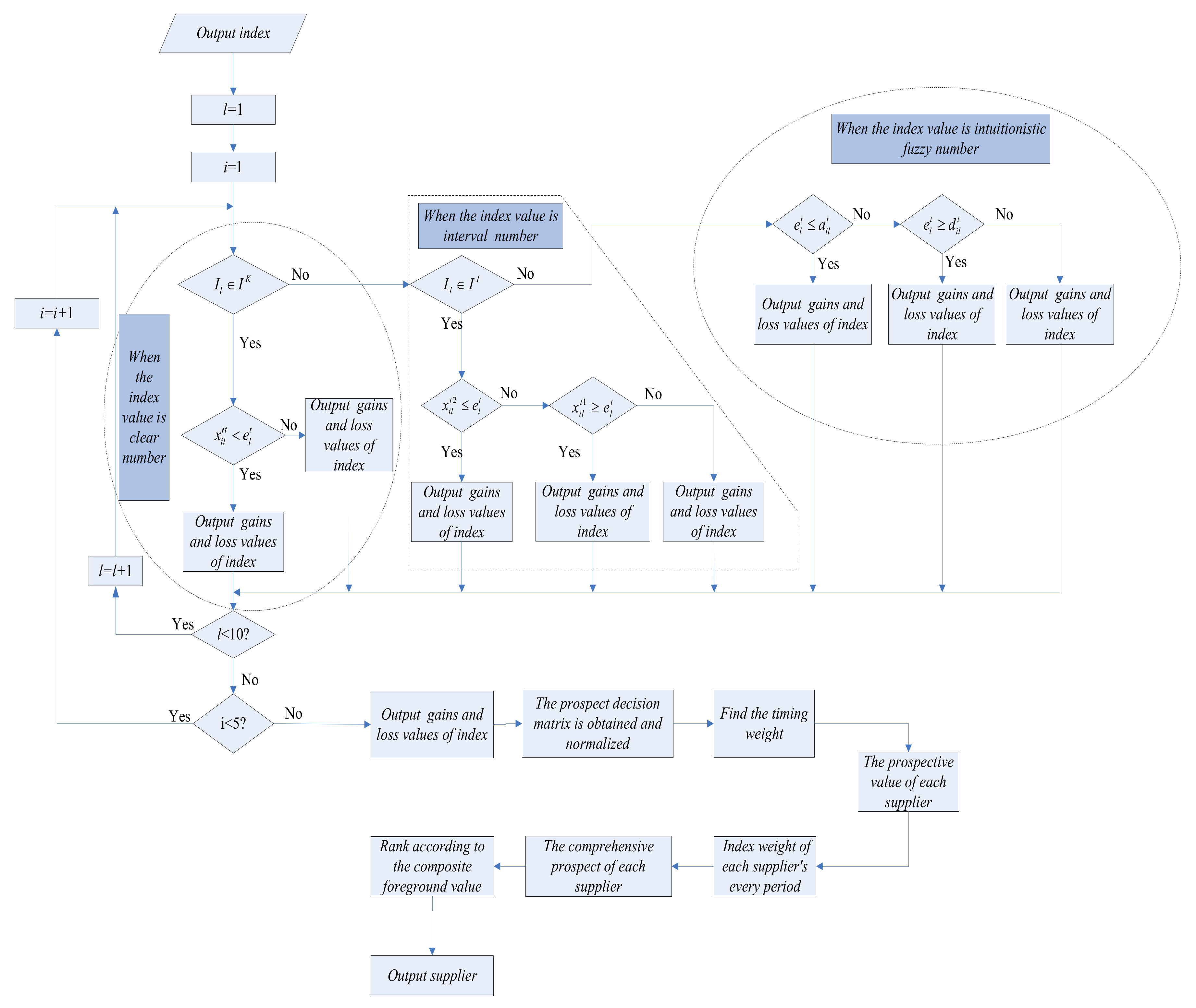

- Step 1: Develop the index system and index value of the reference point according to the enterprise development status.

- Step 2: Solve the corresponding gain and loss value according to the form and formula of each index value.

- Step 3: Convert the gain and loss value into a prospect decision matrix based on the gain and loss matrix and the corresponding probability weight.

- Step 4: Determine the weight of the generalized optimal ordinal number.

- Step 5: Determine the timing weight of the penalty mechanism.

- Step 6: Calculate the comprehensive prospect value of each candidate green supplier, according to the prospect decision matrix, the weight of the generalized optimal ordinal number, and the timing weight of the penalty mechanism.

- Step 7: Select the partner green supplier based on the comprehensive prospect value.

5. Case Study

6. Discussion and Comparative Analysis

7. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Index Type | Relationship between the Expectation and the Reference Point | Calculation of the Gain and Loss Values (Gain Value ; Loss Value ) |

|---|---|---|

| (A1) (A2) | ||

| (A3) (A4) |

| Index Type | Relationship between the Expectation and the Reference Point | Calculation of the Gain and Loss Value(Gain Value ; Loss Value ) |

|---|---|---|

| (A5) (A6) | ||

| (A7) (A8) | ||

| (A9) (A10) |

| Index Type | Relationship between the Expectation and the Reference Point | Calculation of the Gain and Loss Value (Gain Value ; Loss Value ) |

|---|---|---|

| (A11) (A12) | ||

| (A13) (A14) | ||

| (A15) (A16) |

References

- Noci, G. Designing ‘green’ vendor rating systems for the assessment of a supplier’s environmental performance. Eur. J. Purch. Supply Manag. 1997, 3, 103–114. [Google Scholar] [CrossRef]

- Liu, A.J.; Hu, H.S.; Zhang, X.; Lei, D.M. Novel Two-Phase Approach for Process Optimization of Customer Collaborative Design Based on Fuzzy-QFD and DSM. IEEE Trans. Eng. Manag. 2017, 64, 193–207. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Lee, A.H.I.; Kang, H.Y.; Hsu, C.F.; Hung, H.-C. A green supplier selection model for high-tech industry. Expert Syst. Appl. 2009, 36, 7917–7927. [Google Scholar] [CrossRef]

- Awasthi, A.; Chauhan, S.S.; Goyal, S.K. A fuzzy multi criteria approach for evaluating environmental performance of suppliers. Int. J. Prod. Econ. 2010, 126, 370–378. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Green supplier development: Analytical evaluation using rough set theory. J. Clean. Prod. 2010, 18, 1200–1210. [Google Scholar] [CrossRef]

- Yu, M.C. Using Fuzzy DEA for Green Suppliers Selection Considering Carbon Footprints. Sustainability 2017, 9, 495. [Google Scholar] [CrossRef]

- Yeh, W.C.; Chuang, M.C. Using multi objective genetic algorithm for partner selection in green supply chain problems. Expert Syst. Appl. 2011, 38, 4244–4253. [Google Scholar] [CrossRef]

- Yu, F.; Yang, Y.; Chang, D.; Yu, F.; Yang, Y.; Chang, D. Carbon footprint based green supplier selection under dynamic environment. J. Clean. Prod. 2018, 170, 880–889. [Google Scholar] [CrossRef]

- Chai, J.; Liu, J.N.K.; Ngai, E.W.T. Application of decision-making techniques in supplier selection: A systematic review of literature. Expert Syst. Appl. 2013, 40, 3872–3885. [Google Scholar] [CrossRef]

- Tam, M.C.Y.; Tummala, V.M.R. An application of the AHP in vendor selection of a telecommunications system. Omega 2001, 29, 171–182. [Google Scholar] [CrossRef]

- Handfield, R.; Walton, S.V.; Sroufe, R.; Melnyk, S.A. Applying environmental criteria to supplier assessment: A study in the application of the Analytical Hierarchy Process. Eur. J. Oper. Res. 2002, 141, 70–87. [Google Scholar] [CrossRef]

- Kulak, O.; Kahraman, C. Fuzzy multi-attribute selection among transportation companies using axiomatic design and analytic hierarchy process. Inf. Sci. 2005, 170, 191–210. [Google Scholar] [CrossRef]

- Mafakheri, F.; Breton, M.; Ghoniem, A. Supplier selection-order allocation: A two-stage multiple criteria dynamic programming approach. Int. J. Prod. Econ. 2011, 132, 52–57. [Google Scholar] [CrossRef]

- Shaw, K.; Shankar, R.; Yadav, S.S.; Thakur, L.S. Supplier selection using fuzzy AHP and fuzzy multi-objective linear programming for developing low carbon supply chain. Expert Syst. Appl. 2012, 39, 8182–8192. [Google Scholar] [CrossRef]

- Boran, F.E.; Genç, S.; Kurt, M.; Akay, D. A multi-criteria intuitionistic fuzzy group decision making for supplier selection with TOPSIS method. Expert Syst. Appl. 2009, 36, 11363–11368. [Google Scholar] [CrossRef]

- Wang, J.W.; Cheng, C.H.; Huang, K.C. Fuzzy hierarchical TOPSIS for supplier selection. Appl. Soft Comput. 2009, 9, 377–386. [Google Scholar] [CrossRef]

- Liao, C.N.; Kao, H.P. An integrated fuzzy TOPSIS and MCGP approach to supplier selection in supply chain management. Expert Syst. Appl. 2011, 38, 10803–10811. [Google Scholar] [CrossRef]

- Sharma, S.; Balan, S. An integrative supplier selection model using Taguchi loss function, TOPSIS and multi criteria goal programming. J. Intell. Manuf. 2013, 24, 1123–1130. [Google Scholar] [CrossRef]

- Dalalah, D.; Hayajneh, M.; Batieha, F. A fuzzy multi-criteria decision making model for supplier selection. Expert Syst. Appl. 2011, 38, 8384–8391. [Google Scholar] [CrossRef]

- Önüt, S.; Kara, S.S.; Işik, E. Long term supplier selection using a combined fuzzy MCDM approach: A case study for a telecommunication company. Expert Syst. Appl. 2009, 36, 3887–3895. [Google Scholar] [CrossRef]

- Iirajpour, A.; Hajimirza, M.; Najafabadi, A.F.; Kazemi, S. Identification and ranking of factors effective on performance of green supply chain suppliers: Case study: Iran Khodro Industrial Group. J. Basic Appl. Sci. Res. 2012, 2, 4633–4638. [Google Scholar]

- Shen, L.; Olfat, L.; Govindan, K.; Khodaverdi, R.; Diabat, A. A fuzzy multi criteria approach for evaluating green supplier’s performance in green supply chain with linguistic preferences. Resour. Conserv. Recycl. 2013, 74, 170–179. [Google Scholar] [CrossRef]

- Yang, J.L.; Chiu, H.N.; Tzeng, G.H.; Yeh, R.H. Vendor selection by integrated fuzzy MCDM techniques with independent and interdependent relationships. Inf. Sci. 2008, 178, 4166–4183. [Google Scholar] [CrossRef]

- Zhang, W.G.; Zhang, Q.; Mizgier, K.J.; Zhang, Y. Integrating the customers’ perceived risks and benefits into the triple-channel retailing. Int. J. Prod. Res. 2017, 55, 6676–6690. [Google Scholar] [CrossRef]

- Ishizaka, A. Comparison of fuzzy logic, AHP, FAHP and hybrid fuzzy AHP for new supplier selection and its performance analysis. Int. J. Integr. Supply Manag. 2014, 9, 1–22. [Google Scholar] [CrossRef] [Green Version]

- Liu, A.; Liu, H.; Xiao, Y.; Tsai, S.-B.; Lu, H. An Empirical Study on Design Partner Selection in Green Product Collaboration Design. Sustainability 2018, 10, 133. [Google Scholar] [CrossRef]

- Dou, Y.; Zhu, Q.; Sarkis, J. Evaluating green supplier development programs with a grey-analytical network process-based methodology. Eur. J. Oper. Res. 2014, 233, 420–431. [Google Scholar] [CrossRef]

- Zhang, X.; Xu, Z. Hesitant fuzzy QUALIFLEX approach with a signed distance-based comparison method for multiple criteria decision analysis. Expert Syst. Appl. 2015, 42, 873–884. [Google Scholar] [CrossRef]

- Li, J.; Wang, J.Q. An Extended QUALIFLEX Method under Probability Hesitant Fuzzy Environment for Selecting Green Suppliers. Int. J. Fuzzy Syst. 2017, 19, 1866–1879. [Google Scholar] [CrossRef]

- Darabi, S.; Heydari, J. An Interval-Valued Hesitant Fuzzy Ranking Method based on Group Decision Analysis for Green Supplier Selection. IFAC-PapersOnLine 2016, 49, 12–17. [Google Scholar] [CrossRef]

- Awasthi, A.; Kannan, G. Green supplier development program selection using NGT and VIKOR under fuzzy environment. Comput. Ind. Eng. 2016, 91, 100–108. [Google Scholar] [CrossRef]

- Awasthi, A.; Govindan, K.; Gold, S. Multi-tier sustainable global supplier selection using a fuzzy AHP-VIKOR based approach. Int. J. Prod. Econ. 2018, 195, 106–117. [Google Scholar] [CrossRef]

- Mousakhani, S.; Nazari-Shirkouhi, S.; Bozorgi-Amiri, A. A Novel Interval Type-2 Fuzzy Evaluation Model based Group Decision Analysis for Green Supplier Selection Problems: A Case Study of Battery Industry. J. Clean. Prod. 2017, 168, 205–218. [Google Scholar] [CrossRef]

- Tsui, C.-W.; Tzeng, G.-H.; Wen, U.-P. A hybrid MCDM approach for improving the performance of green suppliers in the TFT-LCD industry. Int. J. Prod. Res. 2015, 53, 6436–6454. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Çifçi, G. A novel hybrid MCDM approach based on fuzzy DEMATEL, fuzzy ANP and fuzzy TOPSIS to evaluate green suppliers. Expert Syst. Appl. 2012, 39, 3000–3011. [Google Scholar] [CrossRef]

- Mizgier, K.J.; Pasia, J.M.; Talluri, S. Multiobjective capital allocation for supplier development under risk. Int. J. Prod. Res. 2017, 55, 5243–5258. [Google Scholar] [CrossRef]

- Carrera, D.A.; Mayorga, R.V. Supply chain management: A modular Fuzzy Inference System approach in supplier selection for new product development. J. Intell. Manuf. 2008, 19, 1–12. [Google Scholar] [CrossRef]

- Guo, Z.; Liu, H.; Zhang, D.; Yang, J. Green supplier evaluation and selection in apparel manufacturing using a fuzzy multi-criteria decision-making approach. Sustainability 2017, 9, 650. [Google Scholar]

- Choy, K.L.; Lee, W.B.; Lo, V. An intelligent supplier management tool for benchmarking suppliers in outsources manufacturing. Expert Syst. Appl. 2002, 22, 213–224. [Google Scholar] [CrossRef]

- Demirtas, E.A.; Ustun, O. Analytic network process and multi-period goal programming integration in purchasing decisions. Comput. Ind. Eng. 2009, 56, 677–690. [Google Scholar] [CrossRef]

- Hsu, B.M.; Chiang, C.Y.; Shu, M.H. Supplier selection using fuzzy quality data and their applications to touch screen. Expert Syst. Appl. 2010, 37, 6192–6200. [Google Scholar] [CrossRef]

- Park, S.C.; Lee, J.H. Supplier selection and stepwise benchmarking: A new hybrid model using DEA and AHP based on cluster analysis. J. Oper. Res. Soc. 2018, 69, 449–466. [Google Scholar] [CrossRef]

- Razmi, J.; Rafiei, H. An integrated analytic network process with mixed-integer non-linear programming to supplier selection and order allocation. Int. J. Adv. Manuf. Technol. 2010, 49, 1195–1208. [Google Scholar] [CrossRef]

- Lahdelma, R.; Salminen, P. SMAA-2: Stochastic Multicriteria Acceptability Analysis for Group Decision Making. Oper Res. 2001, 49, 444–454. [Google Scholar] [CrossRef]

- Wang, Z.; Li, K.W.; Wang, W. An approach to multiattribute decision making with interval-valued intuitionistic fuzzy assessments and incomplete weights. Inf. Sci. 2009, 179, 3026–3040. [Google Scholar] [CrossRef]

- Grabisch, M.; Labreuche, C.; Vansnick, J.C. On the extension of pseudo-Boolean functions for the aggregation of interacting criteria. Eur. J. Oper. Res. 2003, 148, 28–47. [Google Scholar] [CrossRef]

- Grabisch, M.; Greco, S.; Pirlot, M. Bipolar and bivariate models in multicriteria decision analysis: Descriptive and constructive approaches. Int. J. Intell. Syst. 2008, 23, 930–969. [Google Scholar] [CrossRef] [Green Version]

- Lawry, J. Probability, fuzziness and borderline cases. Int. J. Approx. Reason. 2014, 55, 1164–1184. [Google Scholar] [CrossRef]

- Singpurwalla, N.D.; Booker, J.M.; Lindley, D.V.; Laviolette, M.; Zadeh, L.A.; Dempster, A.P. Membership Functions and Probability Measures of Fuzzy Sets [with Comments, Rejoinder]. Publ. Am. Stat. Assoc. 2004, 99, 867–877. [Google Scholar] [CrossRef]

- Chu, T.C.; Varma, R. Evaluating suppliers via a multiple levels multiple criteria decision making method under fuzzy environment. Comput. Ind. Eng. 2012, 62, 653–660. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncedtain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Abdellaoui, M. Parameter-free elicitation of utility and probability weighting functions. Manag. Sci. 2000, 46, 1497–1512. [Google Scholar] [CrossRef]

- Tsai, S.-B.; Wei, Y.-M.; Chen, K.-Y.; Xu, L.; Du, P.; Lee, H.-C. Evaluating Green Suppliers from Green Environmental Perspective. Environ. Plan. B Plan. Des. 2016, 43, 941–959. [Google Scholar] [CrossRef]

- Lee, Y.C.; Wang, Y.-C.; Lu, S.-C.; Hsieh, Y.-F.; Chien, C.-H.; Tsai, S.-B.; Dong, W. An empirical research on customer satisfaction study: A consideration of different levels of performance. Springerplus 2016, 5, 1577. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Yang, J.; Chen, Q.; Tsai, S.-B. Creating the sustainable conditions for knowledge information sharing in virtual community. Springerplus 2016, 5, 1019. [Google Scholar] [CrossRef] [PubMed]

- Tsai, S.-B. Using the DEMATEL model to explore the job satisfaction of research and development professionals in China’s photovoltaic cell industry. Renew. Sustain. Energy Rev. 2018, 81, 62–68. [Google Scholar] [CrossRef]

- Lee, Y.-C.; Hsiao, Y.-C.; Peng, C.-F.; Tsai, S.-B.; Wu, C.-H.; Chen, Q. Using Mahalanobis–Taguchi system, logistic regression, and neural network method to evaluate purchasing audit quality. Proc. IMechE Part B J. Eng. Manuf. 2014. [Google Scholar] [CrossRef]

- Liu, B.; Li, T.; Tsai, S.-B. Low carbon strategy analysis of competing supply chains with different power structures. Sustainability 2017, 9, 835. [Google Scholar] [CrossRef]

- Huang, Z.; Nie, J.; Tsai, S.-B. Dynamic Collection Strategy and Coordination of a Remanufacturing Closed-Loop Supply Chain under Uncertainty. Sustainability 2017, 9, 683. [Google Scholar] [CrossRef]

- Qu, Q.; Tsai, S.-B.; Tang, M.; Xu, C.; Dong, W. Marine ecological environment management based on ecological compensation mechanisms. Sustainability 2016, 8, 1267. [Google Scholar] [CrossRef]

- Tsai, S.-B.; Yu, J.; Ma, L.; Luo, F.; Zhou, J.; Chen, Q.; Xu, L. A study on solving the production process problems of the photovoltaic cell industry. Renew. Sustain. Energy Rev. 2018, 82, 3546–3553. [Google Scholar] [CrossRef]

- Chin, T.; Tsai, S.-B.; Fang, K.; Zhu, W.; Yang, D.; Liu, R.H.; Tsuei, R.T.C. EO-Performance relationships in reverse internationalization by Chinese Global Startup OEMs: Social networks and strategic flexibility. PLoS ONE 2016, 11, e0162175. [Google Scholar] [CrossRef] [PubMed]

- Lee, S.-C.; Su, J.-M.; Tsai, S.-B.; Lu, T.-L.; Dong, W. A comprehensive survey of government auditors’ self-efficacy and professional Development for improving audit quality. Springerplus 2016, 5, 1263. [Google Scholar] [CrossRef] [PubMed]

- Lee, Y.-C.; Wang, Y.-C.; Chien, C.-H.; Wu, C.-H.; Lu, S.-C.; Tsai, S.-B.; Dong, W. Applying revised gap analysis model in measuring hotel service quality. Springerplus 2016, 5, 1191. [Google Scholar] [CrossRef] [PubMed]

- Wang, J.; Yang, J.; Chen, Q.; Tsai, S.-B. Collaborative Production Structure of Knowledge Sharing Behavior in Internet Communities. Mob. Inf. Syst. 2016. [Google Scholar] [CrossRef]

- Xu, Y.; Zhou, J.; Xu, W. A decision-making rule for modeling travelers’ route choice behavior based on cumulative prospect theory. Transp. Res. Part C 2011, 19, 218–228. [Google Scholar] [CrossRef]

- Liu, A.J.; Fowler, J.; Pfund, M. Dynamic co-ordinated scheduling in the supply chain considering flexible routes. Int. J. Prod. Res. 2016, 54, 322–335. [Google Scholar] [CrossRef]

| Index Type | Index Name |

|---|---|

| Cost index | Product prices: the prices of raw materials include both the price of the purchase itself and the cost of handling all kinds of emergencies in the production process. |

| Defective rate: the defective rate of raw materials directly affects the total purchase of the manufacturer. The provision of qualified raw materials is a basic requirement for manufacturer. | |

| Delivery cycle: the supply time of suppliers directly affects the production schedule and the manufacturer’s plan. | |

| Inventory costs: the suppliers’ level of inventory costs directly affects the direct costs of manufacturers. | |

| Poor environmental records: mainly refers to a history of environmental problems, with a bad record of legal penalties. | |

| Profitability index | After-sales service level: includes the performance of service commitments, the attitude and efficiency of after-sales service, customer satisfaction, etc. |

| Product environmental protection design ability: mainly refers to the product recycling and environmental protection ability. | |

| Research and innovation ability: it is not only critical to the survival of enterprises, but is also a key factor for manufacturing enterprises when choosing suppliers. | |

| Environmental efficiency: refers to the “three wastes” (waste gas, waste water and waste residues) emissions, and energy usage of the suppliers | |

| Resource recycling capacity: mainly refers to the ability of supplier to handle the defective product, the recycling goods, etc. |

| Variable | Meaning |

|---|---|

| A collection of alternative green suppliers | |

| A collection of indexes | |

| and | Profitability indexes, cost indexes |

| The weight vector of the indexes | |

| Natural state set | |

| and | The occurrence probability of state t |

| The vector of indicator expectation | |

| The decision makers’ expectations for index Il | |

| In the state t, the decision maker’s expectations for the index Il | |

| Risk decision matrix | |

| In the state t, the green supplier Si has the risk decision result for the index Il | |

| An indicator set whose value is clear numbers | |

| An indicator set whose value is interval numbers | |

| An indicator set whose value is intuitionistic fuzzy number | |

| Subscripted collections of index subset IK | |

| Subscripted collections of index subset IL | |

| Subscripted collections of index subset IF |

| Index | Statue | Probability | Green Suppliers | Exception | |||

|---|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | ||||

| I1 | A1 | 0.3 | 10 | 12 | 11 | 13 | 10 |

| A2 | 0.3 | 12 | 13 | 10 | 10 | 11 | |

| A3 | 0.2 | 13 | 11 | 13 | 12 | 12 | |

| A4 | 0.2 | 11 | 14 | 12 | 11 | 12 | |

| I2 | A1 | 0.3 | 0.05 | 0.02 | 0.05 | 0.08 | 0.05 |

| A2 | 0.3 | 0.05 | 0.07 | 0.05 | 0.07 | 0.06 | |

| A3 | 0.2 | 0.07 | 0.1 | 0.15 | 0.09 | 0.1 | |

| A4 | 0.2 | 0.09 | 0.11 | 0.11 | 0.1 | 0.1 | |

| I3 | A1 | 0.3 | 9 | 10 | 8 | 11 | 9 |

| A2 | 0.3 | 10 | 11 | 12 | 10 | 10 | |

| A3 | 0.2 | 11 | 9 | 10 | 12 | 11 | |

| A4 | 0.2 | 10 | 11 | 12 | 9 | 11 | |

| I4 | A1 | 0.3 | 9 | 10 | 11 | 10 | 9 |

| A2 | 0.3 | 10 | 11 | 9 | 11 | 10 | |

| A3 | 0.2 | 8 | 12 | 10 | 12 | 10 | |

| A4 | 0.2 | 11 | 10 | 12 | 9 | 10 | |

| I5 | A1 | 0.3 | (0.05, 0.06) | (0.04, 0.05) | (0.05, 0.06) | (0.03, 0.04) | 0.04 |

| A2 | 0.3 | (0.02, 0.03) | (0.02, 0.03) | (0.03, 0.04) | (0.03, 0.05) | 0.03 | |

| A3 | 0.2 | (0.04, 0.05) | (0.02, 0.03) | (0.05, 0.06) | (0.04, 0.05) | 0.05 | |

| A4 | 0.2 | (0.03, 0.04) | (0.03, 0.04) | (0.02, 0.04) | (0.01, 0.03) | 0.02 | |

| I6 | A1 | 0.3 | ([5, 6, 7, 8]; 0.7, 0.3) | ([5, 7, 8, 9]; 00.8, 0.2) | ([3, 4, 5, 6]; 0.6, 0.4) | ([4, 5, 6, 7]; 0.8, 0.2) | 5 |

| A2 | 0.3 | ([4, 6, 7, 8]; 0.6, 0.3) | ([5, 6, 8, 9]; 0.8, 0.2) | ([3, 4, 7, 8]; 0.6, 0.4) | ([5, 6, 7, 8]; 0.8,0.2) | 5 | |

| A3 | 0.2 | ([4, 5, 6, 7]; 0.8, 0.2) | ([3, 4, 5, 6]; 0.8, 0.2) | ([2, 4, 5, 6]; 0.6, 0.3) | ([1, 3, 4, 5]; 0.6, 0.3) | 5 | |

| A4 | 0.2 | ([2, 3, 5, 6]; 0.6, 0.3) | ([2, 4, 5, 6]; 0.6, 0.3) | ([4, 5, 6, 7]; 0.7, 0.2) | ([6, 7, 8, 9]; 0.8, 0.1) | 6 | |

| I7 | A1 | 0.3 | ([4, 5, 7, 8]; 0.8, 0.2) | ([4, 5, 6, 7]; 0.8, 0.2) | ([3, 4, 7, 8]; 0.6, 0.4) | ([4, 6, 7, 8]; 0.6, 0.3) | 4 |

| A2 | 0.3 | ([4, 5, 6, 7]; 0.8, 0.2) | ([3, 5, 6, 7]; 0.8, 0.2) | ([2, 4, 6, 7]; 0.8, 0.2) | ([3, 4, 6, 7]; 0.6, 0.2) | 5 | |

| A3 | 0.2 | ([2, 3, 4, 5]; 0.6, 0.3) | ([5, 6, 8, 9]; 0.8, 0.2) | ([6, 7, 8, 9]; 0.8, 0.1) | ([5, 6, 7, 8]; 0.7, 0.2) | 6 | |

| A4 | 0.2 | ([5, 6, 7, 8]; 0.8, 0.1) | ([3, 4, 5, 6]; 0.6, 0.2) | ([6, 7, 8, 9]; 0.8, 0.1) | ([6, 7, 8, 9]; 0.8, 0.2) | 6 | |

| I8 | A1 | 0.3 | ([5, 6, 7, 8]; 0.7, 0.3) | ([4, 5, 6, 7]; 0.7, 0.2) | ([4, 5, 6, 7]; 0.8, 2) | ([2, 4, 5, 6]; 0.6, 0.3) | 6 |

| A2 | 0.3 | ([3, 4, 5, 6]; 0.6, 0.2) | ([3, 4, 5, 6]; 0.8, 0.1) | ([4, 5, 6, 7]; 0.7, 0.2) | ([3, 4, 5, 6]; 0.6, 0.2) | 5 | |

| A3 | 0.2 | ([5, 6, 8, 9]; 0.8, 0.2) | ([3, 5, 6, 7]; 0.8, 0.2) | ([4, 5, 6, 7]; 0.7, 0.2) | ([3, 5, 6, 7]; 0.7, 0.2) | 5 | |

| A4 | 0.2 | ([5, 6, 7, 8]; 0.8, 0.1) | ([4, 5, 6, 7]; 0.8, 0.2) | ([2, 3, 4, 5]; 0.6, 0.4) | ([3, 5, 6, 7]; 0.8, 0.2) | 5 | |

| I9 | A1 | 0.3 | ([4, 5, 6, 7]; 0.7, 0.2) | ([3, 4, 7, 8]; 0.6, 0.3) | ([6, 7, 8, 9]; 0.8, 0.1) | ([3, 4, 5, 6]; 0.5, 0.4) | 6 |

| A2 | 0.3 | ([3, 4, 5, 6]; 0.6, 0.3) | ([2, 3, 4, 5]; 0.6, 0.3) | ([4, 5, 6, 7]; 0.8, 0.2) | ([3, 4, 6, 7]; 0.8,0.2) | 4 | |

| A3 | 0.2 | ([5, 6, 7, 8]; 0.7, 0.3) | ([6, 7, 8, 9]; 0.8, 0.1) | ([3, 4, 7, 8]; 0.6, 0.4) | ([3, 4, 5, 6]; 0.6, 0.4) | 5 | |

| A4 | 0.2 | ([3, 5, 6, 7]; 0.8, 0.2) | ([3, 4, 5, 6]; 0.6, 0.4) | ([3, 5, 6, 7]; 0.8, 0.2) | ([6, 7, 8, 9]; 0.8, 0.1) | 6 | |

| I10 | A1 | 0.3 | ([4, 5, 6, 7]; 0.8, 0.2) | ([3, 4, 7, 8]; 0.6, 0.3) | ([2, 3, 4, 5]; 0.6, 0.3) | ([4, 5, 6, 7]; 0.8, 0.2) | 6 |

| A2 | 0.3 | ([3, 4, 7, 8]; 0.6, 0.3) | ([6, 7, 8, 9]; 0.8, 0.1) | ([5, 6, 7, 8]; 0.8, 0.2) | ([3, 4, 6, 7]; 0.7, 0.2) | 5 | |

| A3 | 0.2 | ([6, 7, 8, 9]; 0.8, 0.1) | ([3, 4, 5, 6]; 0.6, 0.2) | ([5, 6, 7, 8]; 0.7, 0.2) | ([4, 5, 6, 7]; 0.7, 0.2) | 7 | |

| A4 | 0.2 | ([2, 3, 4, 5]; 0.7, 0.3) | ([6, 7, 8, 9]; 0.8, 0.1) | ([2, 3, 4, 5]; 0.6, 0.3) | ([5, 6, 7, 8]; 0.8, 0.2) | 5 | |

| Index | Statue | Probability | Suppliers (Prospect Value of Index) | |||

|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | |||

| I1 | A1 | 0.02342 | 0.00000 | −1.35644 | −0.73705 | −1.93803 |

| A2 | 0.02778 | −0.73705 | −1.35644 | 0.31837 | 0.31837 | |

| A3 | 0.02503 | −0.57831 | 0.26076 | −0.57831 | 0.00000 | |

| A4 | 0.02793 | 0.26076 | −1.06430 | 0.00000 | 0.26076 | |

| I2 | A1 | 0.02608 | 0.00000 | 0.01455 | 0.00000 | −0.03368 |

| A2 | 0.02896 | 0.00553 | −0.01281 | 0.00553 | −0.01281 | |

| A3 | 0.02426 | 0.01192 | 0.00000 | −0.04142 | 0.00453 | |

| A4 | 0.02519 | 0.00453 | −0.01005 | −0.01005 | 0.00000 | |

| I3 | A1 | 0.02384 | 0.00000 | −0.73705 | 0.31837 | −1.35644 |

| A2 | 0.02775 | 0.00000 | −0.73705 | −1.35644 | 0.00000 | |

| A3 | 0.02417 | 0.00000 | 0.47990 | 0.26076 | −0.57831 | |

| A4 | 0.02395 | 0.26076 | 0.00000 | −0.57831 | 0.47990 | |

| I4 | A1 | 0.02538 | 0.00000 | −0.73705 | −1.35644 | −0.73705 |

| A2 | 0.02485 | 0.00000 | −0.73705 | 0.31837 | −0.73705 | |

| A3 | 0.02449 | 0.47990 | −1.06430 | 0.00000 | −1.06430 | |

| A4 | 0.02409 | −0.57831 | 0.00000 | −1.06430 | 0.26076 | |

| I5 | A1 | 0.02557 | −0.01830 | −0.00696 | −0.01830 | 0.00301 |

| A2 | 0.02811 | 0.00301 | 0.00301 | −0.00696 | −0.01281 | |

| A3 | 0.02607 | 0.00246 | 0.01015 | −0.00546 | 0.00246 | |

| A4 | 0.02595 | −0.01436 | −0.01436 | −0.01850 | −0.00163 | |

| I6 | A1 | 0.02358 | 0.72558 | 1.31227 | −0.79169 | 0.25325 |

| A2 | 0.02377 | 1.01138 | 1.35835 | 0.20373 | 0.76301 | |

| A3 | 0.02390 | 0.21267 | −0.64137 | −1.07268 | 0.00000 | |

| A4 | 0.02536 | 0.00000 | 0.00000 | −0.62847 | 0.62495 | |

| I7 | A1 | 0.02387 | 1.26596 | 0.76301 | 1.89386 | 1.19607 |

| A2 | 0.02377 | 0.25325 | −0.11030 | −1.04971 | −0.47233 | |

| A3 | 0.02407 | 0.00000 | 0.83133 | 0.62495 | 0.32107 | |

| A4 | 0.02805 | 0.20154 | −0.11953 | 0.62495 | 0.62495 | |

| I8 | A1 | 0.02380 | 0.23966 | −0.80721 | −0.82297 | 0.00000 |

| A2 | 0.02478 | −0.79169 | −0.82297 | 0.23966 | −0.79169 | |

| A3 | 0.02353 | 1.11257 | −0.07258 | 0.20154 | −0.08371 | |

| A4 | 0.02399 | 0.62495 | 0.21267 | 0.00000 | −0.07258 | |

| I9 | A1 | 0.02338 | −0.80721 | −1.84648 | 0.76301 | 0.00000 |

| A2 | 0.02405 | 0.22601 | −0.79169 | 0.76301 | 1.00858 | |

| A3 | 0.02386 | 0.59429 | 0.97966 | 0.19956 | −0.61575 | |

| A4 | 0.02393 | −1.09904 | 0.00000 | −1.09904 | 0.62495 | |

| I10 | A1 | 0.02513 | −0.82297 | −1.84648 | 0.00000 | −0.82297 |

| A2 | 0.02364 | 0.20373 | 1.19607 | 0.76301 | −0.47233 | |

| A3 | 0.02585 | 0.21267 | 0.00000 | −0.62847 | 0.00000 | |

| A4 | 0.02480 | 0.00000 | 0.97966 | 0.00000 | 0.62495 | |

| Index | Statue | Probability | Suppliers (Penalty Function) | |||

|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | |||

| I1 | A1 | 0.02342 | 1.00000 | 0.98394 | 1.00000 | 0.95419 |

| A2 | 0.02778 | 0.98318 | 0.94497 | 1.00000 | 1.00000 | |

| A3 | 0.02503 | 0.98181 | 1.00000 | 0.98348 | 1.00000 | |

| A4 | 0.02793 | 1.00000 | 0.94529 | 0.98192 | 1.00000 | |

| I2 | A1 | 0.02608 | 1.00000 | 1.00000 | 1.00000 | 0.94754 |

| A2 | 0.02896 | 1.00000 | 0.97684 | 1.00000 | 0.97855 | |

| A3 | 0.02426 | 1.00000 | 0.98130 | 0.95116 | 1.00000 | |

| A4 | 0.02519 | 1.00000 | 0.98147 | 0.97693 | 1.00000 | |

| I3 | A1 | 0.02384 | 1.00000 | 0.98491 | 1.00000 | 0.95226 |

| A2 | 0.02775 | 1.00000 | 0.98052 | 0.94285 | 1.00000 | |

| A3 | 0.02417 | 0.98316 | 1.00000 | 1.00000 | 0.95652 | |

| A4 | 0.02395 | 1.00000 | 0.98036 | 0.95086 | 1.00000 | |

| I4 | A1 | 0.02538 | 1.00000 | 1.00000 | 0.95037 | 1.00000 |

| A2 | 0.02485 | 1.00000 | 0.98474 | 1.00000 | 0.98388 | |

| A3 | 0.02449 | 1.00000 | 0.98362 | 1.00000 | 0.98475 | |

| A4 | 0.02409 | 0.98352 | 1.00000 | 0.95619 | 1.00000 | |

| I5 | A1 | 0.02557 | 0.98290 | 1.00000 | 0.98409 | 1.00000 |

| A2 | 0.02811 | 1.00000 | 1.00000 | 0.98033 | 0.94548 | |

| A3 | 0.02607 | 1.00000 | 1.00000 | 0.94650 | 1.00000 | |

| A4 | 0.02595 | 1.00000 | 1.00000 | 0.95045 | 1.00000 | |

| I6 | A1 | 0.02358 | 1.00000 | 1.00000 | 0.95370 | 0.98645 |

| A2 | 0.02377 | 1.00000 | 1.00000 | 0.95232 | 0.98089 | |

| A3 | 0.02390 | 1.00000 | 0.98618 | 0.95564 | 1.00000 | |

| A4 | 0.02536 | 1.00000 | 1.00000 | 0.94987 | 1.00000 | |

| I7 | A1 | 0.02387 | 1.00000 | 0.95376 | 1.00000 | 0.98426 |

| A2 | 0.02377 | 1.00000 | 1.00000 | 0.95645 | 0.97876 | |

| A3 | 0.02407 | 0.95366 | 1.00000 | 1.00000 | 0.98271 | |

| A4 | 0.02805 | 0.98307 | 0.94543 | 1.00000 | 1.00000 | |

| I8 | A1 | 0.02380 | 1.00000 | 0.98433 | 0.95211 | 1.00000 |

| A2 | 0.02478 | 1.00000 | 0.95162 | 1.00000 | 1.00000 | |

| A3 | 0.02353 | 1.00000 | 0.98595 | 1.00000 | 0.95533 | |

| A4 | 0.02399 | 1.00000 | 1.00000 | 0.98237 | 0.95494 | |

| I9 | A1 | 0.02338 | 0.98611 | 0.95830 | 1.00000 | 1.00000 |

| A2 | 0.02405 | 0.98565 | 0.95609 | 1.00000 | 1.00000 | |

| A3 | 0.02386 | 1.00000 | 1.00000 | 0.98673 | 0.95205 | |

| A4 | 0.02393 | 0.98076 | 1.00000 | 0.98335 | 1.00000 | |

| I10 | A1 | 0.02513 | 1.00000 | 0.95240 | 1.00000 | 1.00000 |

| A2 | 0.02364 | 0.98226 | 1.00000 | 1.00000 | 0.95614 | |

| A3 | 0.02585 | 1.00000 | 1.00000 | 0.94947 | 1.00000 | |

| A4 | 0.02480 | 0.98167 | 1.00000 | 0.98095 | 1.00000 | |

| S1 | S2 | S3 | S4 | |

|---|---|---|---|---|

| A1 | 0.69793 | 0.69663 | 0.69832 | 0.69667 |

| A2 | 0.14829 | 0.14755 | 0.14770 | 0.14860 |

| A3 | 0.08680 | 0.08814 | 0.08669 | 0.08714 |

| A4 | 0.06045 | 0.06079 | 0.05994 | 0.06138 |

| Value of the Time Attenuation Factor | Comprehensive Prospect Value of Suppliers | Results | |||

|---|---|---|---|---|---|

| 0.01489 | −0.09507 | −0.0186 | −0.06297 | ||

| 0.01299 | −0.09601 | −0.01982 | −0.05846 | ||

| 0.01306 | −0.08817 | −0.02007 | −0.05228 | ||

| 0.01314 | −0.08251 | −0.02036 | −0.04781 | ||

| Method | Evaluation Results |

|---|---|

| TOPSIS | |

| Dynamic multi-attribute decision-making method | |

| Generalized Ordinal Number Based on the Third Generation Prospect Theory |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, W.; Chen, Z.; Liu, A.; Zhu, Q.; Zhao, W.; Tsai, S.-B.; Lu, H. A Study on Green Supplier Selection in Dynamic Environment. Sustainability 2018, 10, 1226. https://doi.org/10.3390/su10041226

Song W, Chen Z, Liu A, Zhu Q, Zhao W, Tsai S-B, Lu H. A Study on Green Supplier Selection in Dynamic Environment. Sustainability. 2018; 10(4):1226. https://doi.org/10.3390/su10041226

Chicago/Turabian StyleSong, Wei, Zhiya Chen, Aijun Liu, Qiuyun Zhu, Wei Zhao, Sang-Bing Tsai, and Hui Lu. 2018. "A Study on Green Supplier Selection in Dynamic Environment" Sustainability 10, no. 4: 1226. https://doi.org/10.3390/su10041226