Price Differentiation and Inventory Decisions in a Socially Responsible Dual-Channel Supply Chain with Partial Information Stochastic Demand and Cannibalization

Abstract

:1. Introduction

2. Literature Review

2.1. Dual-Channel Supply Chain

2.2. Price Differentiation and Cannibalization

2.3. Corporate Social Responsibility

2.4. Partial Demand Information

3. Deterministic Demand

- (i)

- Centralized analysis: The manufacturer and seller simultaneously decide the , and

- (ii)

- Decentralized analysis: The manufacturer decides the and whereas the seller responds by setting the .

- Both the manufacturer and the retailer exhibit risk-neutral behavior and are rational decision makers.

- An information symmetry exists in the SC, hence, both players (manufacturer and retailer) have the same information.

3.1. Centralized Analysis (Deterministic Demand)

3.2. Decentralized Analysis (Deterministic Demand)

4. Stochastic Demand

4.1. Centralized Analysis

- 1.

- Given the pricing and CSR investment decisions, () the unique optimal order quantities/inventories are:where,, ,.

- 2.

- Given the pricing and CSR investment decisions (),is jointly concave in optimal order quantities/inventories.

- Step 1: Input , , , , , , . Select the probability distribution function for the demand.

- Step 2: Simultaneously solve (numerically) Equations (37)–(39) to determine , and

- Step 3: Set

- Step 4: Determine order quantity/inventory using Equation (32).

4.2. Decentralized Analysis

- 1.

- Maximum price,that satisfies

- 2.

- where.

- Step 1: Input , , , , , , , and choose the probability distribution for the demand.

- Step 2: Simultaneously solve (numerically) Equations (44)–(47) to determine , and

- Step 3: Set

- Step 4: Determine order quantity/inventory such that , where . and . Also, , .

5. Stochastic Demand with Partial Demand Information

5.1. Centralized Analysis

5.2. Decentralized Analysis

6. Numerical Analysis

6.1. Deterministic Demand

6.2. Stochastic Demand

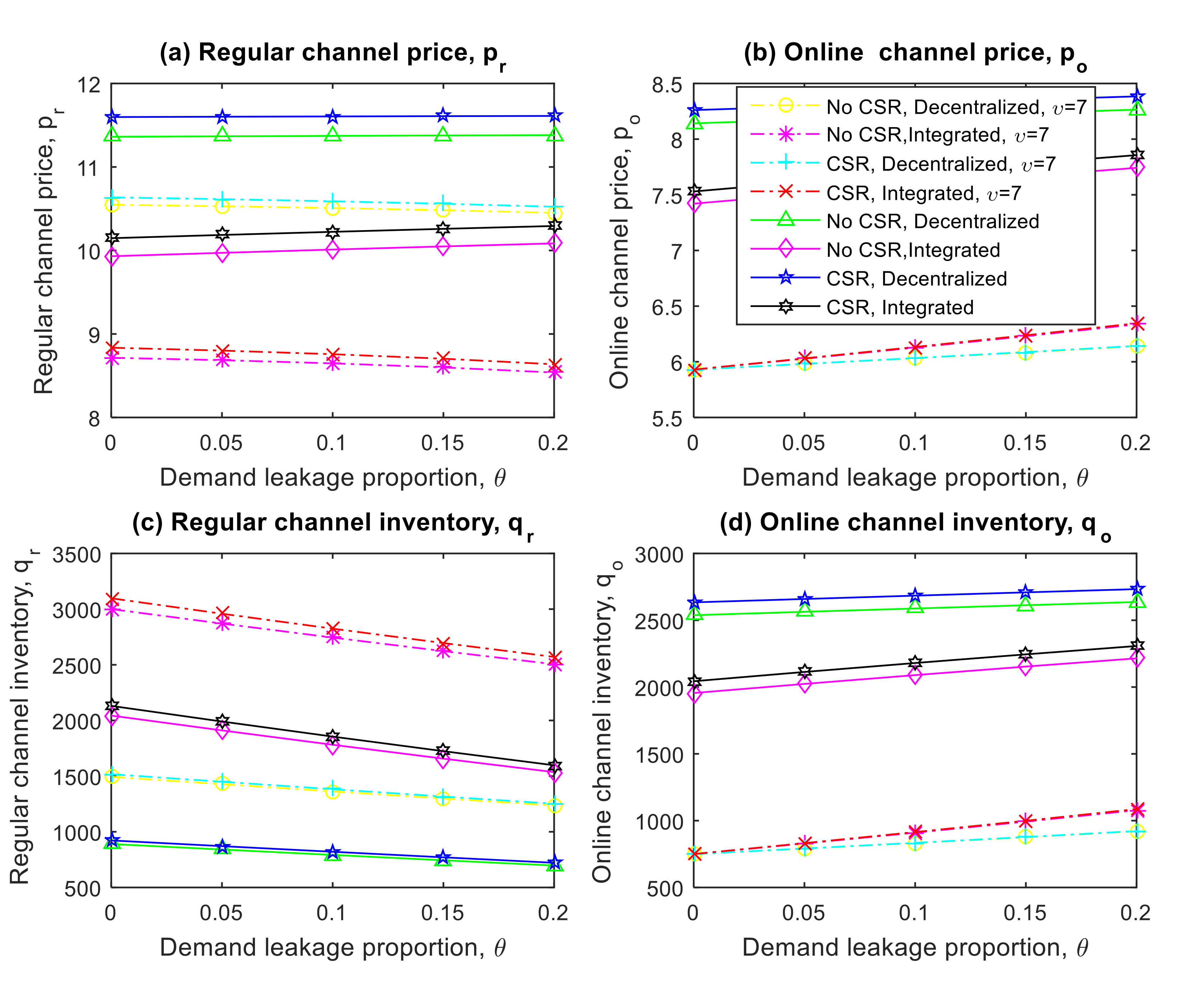

6.3. Impact of Differentiation Price

7. Conclusions, Limitations, and Future Research Suggestions

Funding

Conflicts of Interest

Appendix A. Proof of Proposition 1

| Scenarios | Remarks |

|---|---|

| , | Yields , which fails to achieve price differentiation. Therefore, discarded. |

| , | Infeasible, since Equation (A4) is violated. |

| , | A unique solution is obtainable, , since . Thus, , |

| , | Infeasible, since Equation (A4) is violated, since , thus |

Appendix B. Proof of Proposition 2

Appendix C. Proof of Proposition 3

- Part (1)

- Part (2)

Appendix D. Proof of Proposition 4

Appendix E. Proof of Proposition 5

- Part (1)

- Part (2)

Appendix F. Proof of Proposition 6

Appendix G. Proof of Proposition 7

Appendix H. Proof of Proposition 8

References

- Chiang, W.C.; Chen, J.C.; Xu, X. An Overview of Research on Revenue Management: Current Issues and Future Research. Int. J. Revenue Manag. 2007, 1, 97. [Google Scholar] [CrossRef]

- Xu, G.; Dan, B.; Zhang, X.; Liu, C. Coordinating a Dual-Channel Supply Chain with Risk-Averse under a Two-Way Revenue Sharing Contract. Int. J. Prod. Econ. 2014, 147, 171–179. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S.; Basu, M. Corporate Social Responsibility, Coordination and Profit Distribution in a Dual-Channel Supply Chain. Pac. Sci. Rev. 2014, 16, 235–249. [Google Scholar] [CrossRef] [Green Version]

- Modak, N.M.; Panda, S.; Sana, S.S. Channel Coordination, Pricing and Replenishment Policies in Three-Echelon Dual-Channel Supply Chain. Control Cybern. 2015; 44, 481–518. [Google Scholar] [CrossRef] [Green Version]

- Li, B.; Zhu, M.; Jiang, Y.; Li, Z. Pricing Policies of a Competitive Dual-Channel Green Supply Chain. J. Clean. Prod. 2016, 112, 2029–2042. [Google Scholar]

- Raza, S.A.; Govindaluri, S.M. Pricing Strategies in a Dual-Channel Green Supply Chain with Cannibalization and Risk Aversion. Oper. Res. Perspect. 2019, 6, 100118. [Google Scholar]

- Raza, S.A.; Govindaluri, S.M. Greening and Price Differentiation Coordination in a Supply Chain with Partial Demand Information and Cannibalization. J. Clean. Prod. 2019, 229, 706–726. [Google Scholar] [CrossRef]

- Keyes, D. E-Commerce Will Make up 17% of All US Retail Sales by 2022—and One Company Is the Main Reason. Business Insider, Business Insider, 11 August 2017. Available online: www.businessinsider.com/E-Commerce-Retail-Sales-2022-Amazon-2017-8 (accessed on 1 September 2020).

- Zerkte, K. Importance of Information Technologies and Systems (ITS) in the Traceability of the Supply Chain. 2018 Int. Colloq. Logist. Supply Chain Manag. (Logistiqua) 2018, 2147483647, 13–18. [Google Scholar] [CrossRef]

- Imran, M.; Hamid, S.N.B.A.; Aziz, A.; Hameed, W.U. The Contributing Factors towards E-Logistic Customer Satisfaction: A Mediating Role of Information Technology. Uncertain Supply Chain Manag. 2019, 7, 63–72. [Google Scholar] [CrossRef]

- Hua, G.; Wang, S.; Cheng, T.C.E. Price and Lead Time Decisions in Dual-Channel Supply Chains. Eur. J. Oper. Res. 2010, 205, 113–126. [Google Scholar] [CrossRef]

- Tsay, A.A.; Agrawal, N. Channel Conflict and Coordination in the E-Commerce Age. Prod. Oper. Manag. 2009, 13, 93–110. [Google Scholar] [CrossRef] [Green Version]

- Kouvelis, P.; Chambers, C.; Wang, H. Supply Chain Management Research and Production and Operations Management: Review, Trends, and Opportunities. Prod. Oper. Manag. 2009, 15, 449–469. [Google Scholar] [CrossRef]

- Dumrongsiri, A.; Fan, M.; Jain, A.; Moinzadeh, K. A Supply Chain Model with Direct and Retail Channels. Eur. J. Oper. Res. 2008, 187, 691–718. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z.; Ghose, S. Reward Points, Profit Sharing, and Valuable Coordination Mechanism in the O2O Era. Int. J. Prod. Econ. 2019, 215, 34–47. [Google Scholar] [CrossRef]

- Phillips, R.L. Pricing and Revenue Optimization; Stanford University Press: Standford, CA, USA, 2005. [Google Scholar]

- Talluri, K.T.; Van Ryzin, G.J. The Theory and Practice of Revenue Management; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2004; Volume 68. [Google Scholar] [CrossRef]

- Quante, R.; Meyr, H.; Fleischmann, M. Revenue Management and Demand Fulfillment: Matching Applications, Models and Software. In Supply Chain Planning; Springer Science and Business Media LLC: Berlin/Heidelberg, Germany, 2009; pp. 57–88. [Google Scholar] [CrossRef] [Green Version]

- Haensel, A.; Mederer, M.; Schmidt, H. Revenue Management in the Car Rental Industry: A Stochastic Programming Approach. J. Revenue Pricing Manag. 2011, 11, 99–108. [Google Scholar] [CrossRef]

- Board, S.; Skrzypacz, A. Revenue Management with Forward-Looking Buyers. J. Politi- Econ. 1046. [Google Scholar] [CrossRef] [Green Version]

- Zhang, M.; Bell, P.C.; Cai, G.; Chen, X. Optimal Fences and Joint Price and Inventory Decisions in Distinct Markets with Demand Leakage. Eur. J. Oper. Res. 2010, 204, 589–596. [Google Scholar] [CrossRef]

- Dahlsrud, A. How Corporate Social Responsibility Is Defined: An Analysis of 37 Definitions. Corp. Soc. Responsib. Env. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Raza, S.A. Supply Chain Coordination under a Revenue-Sharing Contract with Corporate Social Responsibility and Partial Demand Information. Int. J. Prod. Econ. 2018, 205, 1–14. [Google Scholar] [CrossRef]

- Mohr, L.A.; Webb, D.J.; Harris, K.E. Do Consumers Expect Companies to Be Socially Responsible? The Impact of Corporate Social Responsibility on Buying Behavior. J. Consum. Aff. 2001, 35, 45–72. [Google Scholar] [CrossRef]

- Carter, C.R.; Jennings, M.M. Social Responsibility and Supply Chain Relationships. Transp. Res. Part E Logist. Transp. Rev. 2002, 38, 37–52. [Google Scholar] [CrossRef]

- Galvão, A.; Mendes, L.; Marques, C.; Mascarenhas, C. Factors Influencing Students’ Corporate Social Responsibility Orientation in Higher Education. J. Clean. Prod. 2019, 215, 290–304. [Google Scholar] [CrossRef]

- Chiang, W.-Y.K.; Monahan, G.E. Managing Inventories in a Two-Echelon Dual-Channel Supply Chain. Eur. J. Oper. Res. 2005, 162, 325–341. [Google Scholar] [CrossRef]

- Dan, B.; Xu, G.; Liu, C. Pricing Policies in a Dual-Channel Supply Chain with Retail Services. Int. J. Prod. Econ. 2012, 139, 312–320. [Google Scholar] [CrossRef]

- Zhou, Y.-W.; Guo, J.; Zhou, W. Pricing/Service Strategies for a Dual-Channel Supply Chain with Free Riding and Service-Cost Sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Aslani, A. Pricing and Greening Decisions in a Three-Tier Dual Channel Supply Chain. Int. J. Prod. Econ. 2019, 217, 185–196. [Google Scholar] [CrossRef]

- Modak, N.M.; Kelle, P. Using Social Work Donation as a Tool of Corporate Social Responsibility in a Closed-Loop Supply Chain Considering Carbon Emissions Tax and Demand Uncertainty. J. Oper. Res. Soc. 2019, 1–17. [Google Scholar] [CrossRef]

- Li, Y.Y. Overview of Research on Dual-Channel Supply Chain Management. In International Conference on Economic Management and Green Development (ICEMGD 2018) September 2018; Atlantis Press: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Zhang, F.; Wang, C. Dynamic Pricing Strategy and Coordination in a Dual-Channel Supply Chain Considering Service Value. Appl. Math. Model. 2018, 54, 722–742. [Google Scholar] [CrossRef]

- Li, W.; Chen, J.; Liang, G.; Chen, B. Money-Back Guarantee and Personalized Pricing in a Stackelberg manufacturer’s Dual-Channel Supply Chain. Int. J. Prod. Econ. 2018, 197, 84–98. [Google Scholar] [CrossRef]

- Saha, S.; Modak, N.M.; Panda, S.; Sana, S.S. Managing a retailer’s Dual-Channel Supply Chain under Price- and Delivery Time-Sensitive Demand. J. Model. Manag. 2018, 13, 351–374. [Google Scholar] [CrossRef]

- Jamali, M.-B.; Rasti-Barzoki, M. A Game Theoretic Approach for Green and Non-Green Product Pricing in Chain-to-Chain Competitive Sustainable and Regular Dual-Channel Supply Chains. J. Clean. Prod. 2018, 170, 1029–1043. [Google Scholar] [CrossRef]

- Pu, X.; Sun, S.; Han, G. Differentiated-product Distribution in a dual-channel Supply Chain. Manag. Decis. Econ. 2019, 40, 363–373. [Google Scholar] [CrossRef]

- Batarfi, R.; Jaber, M.Y.; Glock, C.H. Pricing and Inventory Decisions in a Dual-Channel Supply Chain with Learning and Forgetting. Comput. Ind. Eng. 2019, 136, 397–420. [Google Scholar] [CrossRef]

- Ranjan, A.; Jha, J. Pricing and Coordination Strategies of a Dual-Channel Supply Chain Considering Green Quality and Sales Effort. J. Clean. Prod. 2019, 218, 409–424. [Google Scholar] [CrossRef]

- Wang, L.; Song, Q. Pricing Policies for Dual-Channel Supply Chain with Green Investment and Sales Effort under Uncertain Demand. Math. Comput. Simul. 2020, 171, 79–93. [Google Scholar] [CrossRef]

- Yang, D.; Xiao, T.; Huang, J. Dual-Channel Structure Choice of an Environmental Responsibility Supply Chain with Green Investment. J. Clean. Prod. 2019, 210, 134–145. [Google Scholar] [CrossRef]

- Lee, C.; Hsu, C.C.; Xu, X. Maximising manufacturer’s Profit in a Dual-Channel Supply Chain with Disruption Risk. Int. J. Serv. Oper. Manag. 2019, 33, 351. [Google Scholar] [CrossRef]

- Zhou, J.; Zhao, R.; Wang, W. Pricing Decision of a Manufacturer in a Dual-Channel Supply Chain with Asymmetric Information. Eur. J. Oper. Res. 2019, 278, 809–820. [Google Scholar] [CrossRef]

- Chen, H.; Dong, Z.; Li, G. Government Reward-Penalty Mechanism in Dual-Channel Closed-Loop Supply Chain. Sustainability 2020, 12, 8602. [Google Scholar] [CrossRef]

- Xideng, Z.; Xu, B.; Fei, X.; Yu, L. Research on Quality Decisions and Coordination with Reference Effect in Dual-Channel Supply Chain. Sustainability 2020, 12, 2296. [Google Scholar] [CrossRef] [Green Version]

- Rahmani, D.; Abadi, M.Q.H.; Hosseininezhad, S.J. Joint Decision on Product Greenness Strategies and Pricing in a Dual-Channel Supply Chain: A Robust Possibilistic Approach. J. Clean. Prod. 2020, 256, 120437. [Google Scholar] [CrossRef]

- Wang, J.; Jiang, H.; Yu, M. Pricing Decisions in a Dual-Channel Green Supply Chain with Product Customization. J. Clean. Prod. 2020, 247, 119101. [Google Scholar] [CrossRef]

- Li, S.; Li, M.; Zhou, N. Pricing and Coordination in a Dual-Channel Supply Chain with a Socially Responsible Manufacturer. Plos One 2020, 15, e0236099. [Google Scholar] [CrossRef]

- Zhang, M.; Bell, P. Price Fencing in the Practice of Revenue Management: An Overview and Taxonomy. J. Revenue Pricing Manag. 2010, 11, 146–159. [Google Scholar] [CrossRef]

- Liu, B.; Zhang, R.; Xiao, M. Joint Decision on Production and Pricing for Online Dual Channel Supply Chain System. Appl. Math. Model. 2010, 34, 4208–4218. [Google Scholar] [CrossRef]

- Cai, G.; Zhang, Z.G.; Zhang, M. Game Theoretical Perspectives on Dual-Channel Supply Chain Competition with Price Discounts and Pricing Schemes. Int. J. Prod. Econ. 2009, 117, 80–96. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing Coordination Contracts in a Manufacturer Stackelberg Dual-Channel Supply Chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

- Chen, J.; Liang, L.; Yao, D.-Q.; Sun, S. Price and Quality Decisions in Dual-Channel Supply Chains. Eur. J. Oper. Res. 2017, 259, 935–948. [Google Scholar] [CrossRef]

- Su, X. Intertemporal pricing with strategic customer behavior. Mgmt. Sci. 2007, 53, 726–741. [Google Scholar]

- Gupta, V.K.; Qu, T.; Tiwari, M.K. Multi-Period Price Optimization Problem for Omnichannel Retailers Accounting for Customer Heterogeneity. Int. J. Prod. Econ. 2019, 212, 155–167. [Google Scholar] [CrossRef]

- Raza, S.A. Optimal Fare Price Differentiation with Demand Leakage in Airline Industry. Int. J. Revenue Manag. 2015, 8, 99–129. [Google Scholar] [CrossRef]

- Raza, S.A. The Impact of Differentiation Price and Demand Leakage on a firm’s Profitability. J. Model. Manag. 2015, 10, 270–295. [Google Scholar] [CrossRef]

- Raza, S.A.; Rathinam, S. A Risk Tolerance Analysis for a Joint Price Differentiation and Inventory Decisions Problem with Demand Leakage Effect. Int. J. Prod. Econ. 2017, 183, 129–145. [Google Scholar] [CrossRef]

- Raza, S.A.; Rathinam, S.; Turiac, M.; Kerbache, L. An Integrated Revenue Management Framework for a firm’s Greening, Pricing and Inventory Decisions. Int. J. Prod. Econ. 2018, 195, 373–390. [Google Scholar] [CrossRef]

- Carter, C.R.; Jennings, M.M. The Role of Purchasing in Corporate Social Responsibility: A Structural Equation Analysis. J. Bus. Logist. 2004, 25, 145–186. [Google Scholar]

- Seuring, S.; Müller, M. From a Literature Review to a Conceptual Framework for Sustainable Supply Chain Management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Feng, Y.; Zhu, Q.; Lai, K.-H. Corporate Social Responsibility for Supply Chain Management: A Literature Review and Bibliometric Analysis. J. Clean. Prod. 2017, 158, 296–307. [Google Scholar] [CrossRef]

- Modak, N.; Panda, S.; Mishra, R.; Sana, S. A Three-Layer Supply Chain Coordination in Socially Responsible Distribution System. Tékhne, 2016; 14, 75–87. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S. Pricing Policy and Coordination for a Distribution Channel with Manufacturer Suggested Retail Price. Int. J. Syst. Sci. Oper. Logist. 2015, 3, 92–101. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S. Pricing Policy and Coordination for a Two-Layer Supply Chain of Duopolistic Retailers and Socially Responsible Manufacturer. Int. J. Logist. Res. Appl. 2015, 19, 487–508. [Google Scholar] [CrossRef]

- Modak, N.M.; Panda, S.; Sana, S.S. Three-Echelon Supply Chain Coordination Considering Duopolistic Retailers with Perfect Quality Products. Int. J. Prod. Econ. 2016, 182, 564–578. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M. Exploring the Effects of Social Responsibility on Coordination and Profit Division in a Supply Chain. J. Clean. Prod. 2016, 139, 25–40. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Pradhan, D. Corporate Social Responsibility, Channel Coordination and Profit Division in a Two-Echelon Supply Chain. Int. J. Manag. Sci. Eng. Manag. 2014, 11, 22–33. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Cárdenas-Barrón, L.E. Coordinating a Socially Responsible Closed-Loop Supply Chain with Product Recycling. Int. J. Prod. Econ. 2017, 188, 11–21. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Cárdenas-Barrón, L.E. Coordination and Benefit Sharing in a Three-Echelon Distribution Channel with Deteriorating Product. Comput. Ind. Eng. 2017, 113, 630–645. [Google Scholar] [CrossRef]

- Cruz, J.M.; Wakolbinger, T. Multiperiod Effects of Corporate Social Responsibility on Supply Chain Networks, Transaction Costs, Emissions, and Risk. Int. J. Prod. Econ. 2008, 116, 61–74. [Google Scholar] [CrossRef]

- Zhao, X.; Yin, R. Coordination of a Socially Responsible Two-Stage Supply Chain under Price-Dependent Random Demand. 4OR 2017, 16, 379–400. [Google Scholar] [CrossRef]

- Modak, N.M.; Sinha, S.; Panda, S.; Kazemi, N. Analyzing a Socially Responsible Closed-Loop Distribution Channel with Recycling Facility. SN Appl. Sci. 2019, 1, 1189. [Google Scholar] [CrossRef] [Green Version]

- Nematollahi, M.; Hosseini-Motlagh, S.-M.; Ignatius, J.; Goh, M.; Nia, M.S. Coordinating a Socially Responsible Pharmaceutical Supply Chain under Periodic Review Replenishment Policies. J. Clean. Prod. 2018, 172, 2876–2891. [Google Scholar] [CrossRef]

- Liu, B.; Ying, P.; Peng, L.; Wang, Y.; Tsai, S.-B.; Li, Y. Decision Models and Governance Mechanisms Considering Corporate Social Irresponsibility in Supply Chains. In Advances in Environmental Engineering and Green Technologies; IGI Global: Hershey, PA, USA, 2018; pp. 135–152. [Google Scholar] [CrossRef]

- Liu, Y.; Quan, B.-t.; Li, J.; Forrest, J.Y.-L. A supply chain coordination mechanism with cost sharing of corporate social responsibility. Sustainability 2018, 10, 1227. [Google Scholar]

- Kundu, S.; Chakrabarti, T. Joint Optimal Decisions on Pricing and Local Advertising Policy of a Socially Responsible Dual-Channel Supply Chain. Am. J. Math. Manag. Sci. 2017, 37, 117–143. [Google Scholar] [CrossRef]

- Guchhait, R.; Pareek, S.; Sarkar, B. Application of Distribution-Free Approach in Integrated and Dual-Channel Supply Chain Under Buyback Contract. In Encyclopedia of Organizational Knowledge, Administration, and Technology; IGI Global: Hershey, PA, USA, 2018; pp. 388–426. [Google Scholar] [CrossRef]

- Xu, J.; Yang, X.; Xiao, A.; Chen, L. Optimisation Strategy of Online Dual-Channel Supply Chain under Differentiated Products. Int. J. of Manuf. Technol. Manag. 2018, 32, 450–469. [Google Scholar]

- Lau, A.K.; Lee, P.K.; Cheng, T. An Empirical Taxonomy of Corporate Social Responsibility in China’s Manufacturing Industries. J. Clean. Prod. 2018, 188, 322–338. [Google Scholar] [CrossRef]

- Ortiz-Avram, D.; Domnanovich, J.; Kronenberg, C.; Scholz, M. Exploring the integration of corporate social responsibility into the strategies of small-and medium-sized enterprises: A systematic literature review. J. Clean. Prod. 2018, 201, 254–271. [Google Scholar]

- López-González, E.; Martínez-Ferrero, J.; Garcia-Meca, E. Corporate Social Responsibility in Family Firms: A Contingency Approach. J. Clean. Prod. 2019, 211, 1044–1064. [Google Scholar] [CrossRef]

- Liu, Y.; Quan, B.-T.; Xu, Q.; Forrest, B. Corporate Social Responsibility and Decision Analysis in a Supply Chain through Government Subsidy. J. Clean. Prod. 2019, 208, 436–447. [Google Scholar] [CrossRef]

- Yuan, K.; Wu, G.; Dong, H.; He, B.; Wang, D. Differential Pricing and Emission Reduction in Remanufacturing Supply Chains with Dual-Sale Channels under CCT-Mechanism. Sustainability 2020, 12, 8150. [Google Scholar]

- Cruz, J.M. Dynamics of Supply Chain Networks with Corporate Social Responsibility through Integrated Environmental Decision-Making. Eur. J. Oper. Res. 2008, 184, 1005–1031. [Google Scholar] [CrossRef]

- Cruz, J.M. The Impact of Corporate Social Responsibility in Supply Chain Management: Multicriteria Decision-Making Approach. Decis. Support Syst. 2009, 48, 224–236. [Google Scholar] [CrossRef]

- Cruz, J.M.; Matsypura, D. Supply Chain Networks with Corporate Social Responsibility through Integrated Environmental Decision-Making. Int. J. Prod. Res. 2008, 47, 621–648. [Google Scholar] [CrossRef]

- Ni, D.; Li, K.W.; Tang, X. Social Responsibility Allocation in Two-Echelon Supply Chains: Insights from Wholesale Price Contracts. Eur. J. Oper. Res. 2010, 207, 1269–1279. [Google Scholar] [CrossRef] [Green Version]

- Cruz, J.M. Modeling the Relationship of Globalized Supply Chains and Corporate Social Responsibility. J. Clean. Prod. 2013, 56, 73–85. [Google Scholar] [CrossRef]

- Cruz, J.M. Mitigating Global Supply Chain Risks through Corporate Social Responsibility. Int. J. Prod. Res. 2013, 51, 3995–4010. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.; Sana, S.; Basu, M. Pricing and Replenishment Policies in Dual-Channel Supply Chain under Continuous Unit Cost Decrease. Appl. Math. Comput. 2015, 256, 913–929. [Google Scholar] [CrossRef]

- Kong, J.; Yang, F.; Liu, T. Socially Responsible Supply Chains with Cost Learning Effects. Rairo Oper. Res. 2020, 54, 119–142. [Google Scholar] [CrossRef]

- Liu, Y.; Li, J.; Quan, B.-T.; Yang, J.-B. Decision Analysis and Coordination of Two-Stage Supply Chain Considering Cost Information Asymmetry of Corporate Social Responsibility. J. Clean. Prod. 2019, 228, 1073–1087. [Google Scholar] [CrossRef]

- Modak, N.M.; Kazemi, N.; Cárdenas-Barrón, L.E. Investigating Structure of a Two-Echelon Closed-Loop Supply Chain Using Social Work Donation as a Corporate Social Responsibility Practice. Int. J. Prod. Econ. 2019, 207, 19–33. [Google Scholar] [CrossRef]

- Phan, D.A.; Vo, T.L.H.; Lai, A.N.; Nguyen, T.L.A. Coordinating Contracts for VMI Systems under Manufacturer-CSR and Retailer-Marketing Efforts. Int. J. Prod. Econ. 2019, 211, 98–118. [Google Scholar] [CrossRef]

- Zhao, X.; Li, N.; Song, L. Coordination of a Socially Responsible Two-Stage Supply Chain Under Random Demand. Asia-Pac. J. Oper. Res. 2019; 36, 1–27. [Google Scholar] [CrossRef]

- Modak, N.M.; Kelle, P. Managing a Dual-Channel Supply Chain under Price and Delivery-Time Dependent Stochastic Demand. Eur. J. Oper. Res. 2019, 272, 147–161. [Google Scholar] [CrossRef]

- Lariviere, M.A.; Porteus, E.L. Selling to the Newsvendor: An Analysis of Price-Only Contracts. Manuf. Serv. Oper. Manag. 2001, 3, 293–305. [Google Scholar] [CrossRef]

- Gallego, G.; Moon, I. The Distribution Free Newsboy Problem: Review and Extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar]

- Hu, J.; Xu, Y. Distribution Free Approach for Coordination of a Supply Chain with Consumer Return. Phys. Procedia 2012, 24, 1500–1506. [Google Scholar] [CrossRef] [Green Version]

- Raza, S.A. A Distribution Free Approach to Newsvendor Problem with Pricing. 4OR. 2014, 12, 335–358. [Google Scholar]

- Fu, Q.; Sim, C.-K.; Teo, C.-P. Profit Sharing Agreements in Decentralized Supply Chains: A Distributionally Robust Approach. Oper. Res. 2018, 66, 500–513. [Google Scholar] [CrossRef]

- Petruzzi, N.C.; Dada, M. Pricing and the Newsvendor Problem: A Review with Extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef] [Green Version]

- Bai, T.; Wu, M.; Zhu, S.X. Pricing and Ordering by a Loss Averse Newsvendor with Reference Dependence. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 343–365. [Google Scholar] [CrossRef]

- Xiao, H.; Xu, M.; Yang, H. Pricing Strategies for Shared Parking Management with Double Auction Approach: Differential Price vs. Uniform Price. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101899. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and Service Effort Strategy in a Dual-Channel Supply Chain with Showrooming Effect. Transp. Res. Part E Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Maihami, R.; Govindan, K.; Fattahi, M. The Inventory and Pricing Decisions in a Three-Echelon Supply Chain of Deteriorating Items under Probabilistic Environment. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 118–138. [Google Scholar] [CrossRef]

- Huang, S.; Fan, Z.-P.; Wang, N. Green Subsidy Modes and Pricing Strategy in a Capital-Constrained Supply Chain. Transp. Res. Part E Logist. Transp. Rev. 2020, 136, 101885. [Google Scholar] [CrossRef]

- Hong, Z.; Wang, H.; Yu, Y. Green Product Pricing with Non-Green Product Reference. Transp. Res. Part E Logist. Transp. Rev. 2018, 115, 1–15. [Google Scholar] [CrossRef]

- Chen, S.; Wang, X.; Wu, Y.; Zhou, F. Pricing Policies of a Dual-Channel Supply Chain Considering Channel Environmental Sustainability. Sustainability 2017, 9, 382. [Google Scholar] [CrossRef] [Green Version]

- Chen, F.Y.; Yan, H.; Yao, L. A newsvendor pricing game. IEEE Transactions on Systems, Man, and Cybernetics-Part. A: Systems and Humans 2004, 34, 450–456. [Google Scholar]

- Song, H.; Gao, X. Green Supply Chain Game Model and Analysis under Revenue-Sharing Contract. J. Clean. Prod. 2018, 170, 183–192. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.; Basu, M.; Goyal, S. Channel Coordination and Profit Distribution in a Social Responsible Three-Layer Supply Chain. Int. J. Prod. Econ. 2015, 168, 224–233. [Google Scholar] [CrossRef]

- Raza, S.A. An Integrated Approach to Price Differentiation and Inventory Decisions with Demand Leakage. Int. J. Prod. Econ. 2015, 164, 105–117. [Google Scholar]

| Literature | SC Configuration (Closed-Loop, Network, Others) | SC Coordination Contracts (Revenue-Sharing, Cost-Sharing, Others) | Societal Consideration (Greening, Corporate Investment, Govt. Incentives, Others) | Market Demand Behavior (Deterministic, Stochastic, Uncertain) | SC Players Attitude (Risk-Less, Risk-Neutral, Risk-Averse) | Decisions (Pricing, Inventory, Others) |

|---|---|---|---|---|---|---|

| [85] | Channel selection in supply chain | None | Greening investment | Deterministic | Risk-less | Pricing |

| [71] | Multi-period network | None | CRS investment | Deterministic | Risk-less | Multi-criteria (Pricing, Quantity, CSR activities) |

| [86] | Multi-level supply chain network | None | CSR activities | Deterministic | Risk-less | Pricing, CSR activities |

| [87] | Supply chain network | None | Emission reduction | Deterministic | Risk-less | Pricing, CRS activities |

| [88] | Single product, Single channel | Wholesale price via subgames | CSR activities | Deterministic | Risk-less | Pricing, CRS activities |

| [89] | Multi-agent network | None | CSR activities | Uncertain (supply-side disruptions, social risks) | Risk-less | Pricing, CRS activities |

| [90] | Multi-level global supply chain network | None | CSR activities | Deterministic | Risk-less | Pricing, CSR investment |

| [3] | Dual-channel supply chain | Franchise-fee | Consumer-surplus | Deterministic | Risk-less | Quantity, replenishment cycles |

| [4] | Dual-channel, Three echelon | Quantity discount, Franchise fee | None | Deterministic | Risk-less | Quantity, replenishment cycles |

| [91] | Single product, Single channel | Discount | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [64] | Multi-channel, Multi-echelon | Two-part tariff | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [65] | Duopolistic retailers, Two-layer supply chain | Two-part tariff | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [66] | Three-echelon supply chain | All unit quantity discount | None | Deterministic | Risk-less | Pricing |

| [63] | Three-layer supply chain | Revenue-sharing | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [67] | Single product, Single channel | Profit division | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [68] | Single product, Single channel | All unit quantity discount | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [69] | Closed-loop supply chain | Revenue-sharing | Consumer-surplus | Deterministic | Risk-less | Pricing |

| [76] | Single channel, Multiple retailers | Cost-sharing | CSR investment, Consumer-surplus | Deterministic | Risk-less | Pricing |

| [23] | Single channel, Single product | Revenue-sharing | CSR activities | Stochastic | Risk-neutral | Pricing |

| [72] | Single product, Single channel | Profit-sharing | CSR activities | Stochastic | Risk-neutral | Pricing, CRS investment, Inventory |

| [92] | Two-period manufacturer-retailer supply chain | two-part tariff contracts | Cost learning effects | Deterministic | Risk-neutral | Pricing |

| [93] | Single product, Single channel | Transfer payment mechanism | CSR activities | Deterministic | Risk-neutral | Pricing, CSR effort |

| [83] | Single product, Single channel, Multiple retailers | Price | CSR activities, Govt. Subsidiary | Deterministic | Risk-neutral | Pricing, CSR investment, Govt. subsidiary |

| [94] | Single product, Single channel, Multiple retailers, Third party collectors | Profit-sharing | CRS investment | Deterministic | Risk-neutral | Pricing, CSR investment |

| [73] | Closed-loop | Revenue-sharing | CSR investment | Deterministic | Risk-neutral | Pricing |

| [95] | Closed-loop | Revenue-sharing | CSR investment | Deterministic | Risk-neutral | Pricing, CSR investment |

| [7] | Single channel, Market differentiation | None | Greening investment | Stochastic | Risk-neutral | Pricing, Greening effort, Inventory |

| [6] | Dual-channel, Market differentiation | Cost-sharing, Revenue-sharing | Greening investment | Deterministic | Risk-averse | Pricing, Greening effort |

| [96] | Single product, Single channel | Profit-sharing | CSR investment | Stochastic | Risk-neutral | Pricing, CSR (effort) investment, Inventory |

| [97] | Single product, Closed-loop | None | Carbon tax | Stochastic | Risk-neutral | Pricing, Carbon emission, Inventory |

| This paper | Dual-channel, Market differentiation | None | CSR investment | Stochastic | Risk-neutral | Pricing, CSR (effort) investment, Inventory |

| Parameters | Description |

|---|---|

| Cost of manufacturing per unit | |

| Maximum perceived cumulative deterministic (riskless) demand (Market share), | |

| Price sensitivity, | |

| Coefficient of Corporate Social Responsibility (CSR) investment impact on demand, | |

| Cannibalization (demand leakage) proportion, | |

| Adjusted price-and CSR dependent deterministic demand in retail (regular) channel | |

| Adjusted price-and CSR dependent deterministic demand in online (direct) channel demand | |

| Mean of stochastic demand factor, , = online | |

| Standard deviation of stochastic demand factor, , , = online | |

| Probability distribution function of price-and CSR dependent stochastic demand in market segment , = online/direct | |

| Cumulative Probability distribution function of price-and CSR dependent stochastic demand in market segment , = online | |

| Price-and CSR dependent stochastic demand, | |

| Manufacturer’s revenue (payoff), | |

| Retailer (sellers)’s revenue (payoff), | |

| Supply chain (total) revenue (payoff), | |

| Decisions | |

| Manufacturer (m) | |

| Wholesale price per unit, | |

| Price per unit of standard product in direct (online) channel | |

| Differentiation price, | |

| Investment on CSR activities, | |

| Seller/retailer (s) | |

| Price per unit for a product in regular channel, | |

| Order quantity (inventory) for regular channel, | |

| Order quantity (inventory) for online channel, | |

| Scripts and Accents | |

| “ | Superscript for decentralized analysis, () |

| “ | Superscript for centralized analysis, () |

| “ | Accent used for a control decision, when price-and-CSR dependent demand is deterministic |

| “ | Accent used for a control decision, when price-and-CSR dependent demand is stochastic with partial information (unknown distribution) |

| Expected value of random variable, such that |

| Decisions/Outcomes | Remarks/Conditions | |

|---|---|---|

| , if | ||

| , if | ||

| if , | ||

| if |

| Decisions/Outcomes | Remarks/Conditions | |

|---|---|---|

| , | ||

| if , and | ||

| , if and | ||

| - | ||

| , if | ||

| if , |

| Decisions/Outcomes | Remarks/Conditions | |

|---|---|---|

| , if | ||

| , if | ||

| , if | ||

| if , | ||

| , if , | ||

| if , | ||

| if , |

| Decisions/Outcomes | Remarks/Conditions | |

|---|---|---|

| , if | ||

| , if , | ||

| , if , | ||

| if , | ||

| if, | ||

| , if and |

| Decentralized Analysis | Centralized Analysis | |||||||||||||||

| 0 | 0 | 11.43 | 8.21 | 10.36 | 0.00 | 857.14 | 2571.43 | 918.37 | 12,857.10 | 13,775.50 | 10.00 | 7.50 | 0.00 | 2000.00 | 2000.00 | 15,000.00 |

| 2 | 0 | 11.44 | 8.22 | 10.36 | 18.42 | 858.37 | 2575.11 | 921.00 | 12,875.50 | 13,796.50 | 10.01 | 7.50 | 25.08 | 2003.34 | 2003.34 | 14,924.70 |

| 4 | 0 | 11.47 | 8.23 | 10.39 | 74.32 | 862.07 | 2586.21 | 928.95 | 12,931.00 | 13,860.00 | 10.03 | 7.52 | 101.35 | 2013.42 | 2013.42 | 14,695.30 |

| 6 | 0 | 11.51 | 8.26 | 10.43 | 169.64 | 868.31 | 2604.92 | 942.45 | 13,024.60 | 13,967.00 | 10.08 | 7.54 | 231.91 | 2030.46 | 2030.46 | 14,300.80 |

| 8 | 0 | 11.58 | 8.29 | 10.48 | 307.79 | 877.19 | 2631.58 | 961.83 | 13,157.90 | 14,119.70 | 10.14 | 7.57 | 422.22 | 2054.79 | 2054.79 | 13,722.10 |

| 10 | 0 | 11.67 | 8.33 | 10.56 | 493.83 | 888.89 | 2666.67 | 987.65 | 13,333.30 | 14,321.00 | 10.22 | 7.61 | 680.53 | 2086.96 | 2086.96 | 12,930.10 |

| 0 | 0.05 | 11.44 | 8.24 | 10.37 | 0.00 | 808.51 | 2595.74 | 860.12 | 12,766.00 | 13,626.10 | 10.04 | 7.58 | 0.00 | 1868.85 | 2065.57 | 14,754.10 |

| 2 | 0.05 | 11.45 | 8.25 | 10.38 | 18.16 | 809.66 | 2599.43 | 862.56 | 12,784.10 | 13,646.70 | 10.05 | 7.59 | 24.27 | 1871.92 | 2068.97 | 14,681.30 |

| 4 | 0.05 | 11.47 | 8.26 | 10.40 | 73.26 | 813.12 | 2610.56 | 869.96 | 12,838.80 | 13,708.80 | 10.07 | 7.60 | 98.03 | 1881.19 | 2079.21 | 14,459.40 |

| 6 | 0.05 | 11.52 | 8.29 | 10.44 | 167.21 | 818.97 | 2629.31 | 882.51 | 12,931.00 | 13,813.50 | 10.12 | 7.62 | 224.25 | 1896.84 | 2096.51 | 14,078.00 |

| 8 | 0.05 | 11.59 | 8.32 | 10.50 | 303.34 | 827.29 | 2656.02 | 900.53 | 13,062.40 | 13,962.90 | 10.18 | 7.65 | 408.12 | 1919.19 | 2121.21 | 13,519.00 |

| 10 | 0.05 | 11.67 | 8.36 | 10.57 | 486.59 | 838.24 | 2691.18 | 924.52 | 13,235.30 | 14,159.80 | 10.26 | 7.69 | 657.46 | 1948.72 | 2153.85 | 12,754.80 |

| 0 | 0.1 | 11.44 | 8.27 | 10.39 | 0.00 | 760.56 | 2619.72 | 803.41 | 12,676.10 | 13,479.50 | 10.08 | 7.66 | 0.00 | 1741.94 | 2129.03 | 14,516.10 |

| 2 | 0.1 | 11.45 | 8.28 | 10.39 | 17.90 | 761.64 | 2623.41 | 805.68 | 12,693.90 | 13,499.60 | 10.09 | 7.67 | 23.49 | 1744.75 | 2132.47 | 14,445.60 |

| 4 | 0.1 | 11.48 | 8.29 | 10.42 | 72.23 | 764.87 | 2634.56 | 812.54 | 12,747.90 | 13,560.40 | 10.11 | 7.68 | 94.87 | 1753.25 | 2142.86 | 14,230.90 |

| 6 | 0.1 | 11.53 | 8.32 | 10.46 | 164.84 | 770.33 | 2653.35 | 824.17 | 12,838.80 | 13,663.00 | 10.16 | 7.70 | 216.97 | 1767.59 | 2160.39 | 13,862.10 |

| 8 | 0.1 | 11.59 | 8.35 | 10.51 | 298.98 | 778.10 | 2680.12 | 840.88 | 12,968.30 | 13,809.20 | 10.22 | 7.73 | 394.72 | 1788.08 | 2185.43 | 13,321.80 |

| 10 | 0.1 | 11.68 | 8.39 | 10.58 | 479.51 | 788.32 | 2715.33 | 863.13 | 13,138.70 | 14,001.80 | 10.29 | 7.77 | 635.55 | 1815.13 | 2218.49 | 12,583.90 |

| 0 | 0.15 | 11.45 | 8.30 | 10.40 | 0.00 | 713.29 | 2643.36 | 748.20 | 12,587.40 | 13,335.60 | 10.12 | 7.74 | 0.00 | 1619.05 | 2190.48 | 14,285.70 |

| 2 | 0.15 | 11.46 | 8.31 | 10.41 | 17.65 | 714.29 | 2647.06 | 750.30 | 12,605.00 | 13,355.30 | 10.13 | 7.74 | 22.75 | 1621.62 | 2193.96 | 14,217.40 |

| 4 | 0.15 | 11.49 | 8.32 | 10.43 | 71.21 | 717.30 | 2658.23 | 756.65 | 12,658.20 | 13,414.90 | 10.15 | 7.76 | 91.87 | 1629.39 | 2204.47 | 14,009.50 |

| 6 | 0.15 | 11.53 | 8.35 | 10.47 | 162.51 | 722.38 | 2677.05 | 767.40 | 12,747.90 | 13,515.30 | 10.19 | 7.78 | 210.04 | 1642.51 | 2222.22 | 13,652.60 |

| 8 | 0.15 | 11.60 | 8.38 | 10.53 | 294.72 | 729.61 | 2703.86 | 782.85 | 12,875.50 | 13,658.40 | 10.25 | 7.81 | 381.97 | 1661.24 | 2247.56 | 13,130.10 |

| 10 | 0.15 | 11.68 | 8.42 | 10.60 | 472.59 | 739.13 | 2739.13 | 803.40 | 13,043.50 | 13,846.90 | 10.33 | 7.85 | 614.71 | 1685.95 | 2280.99 | 12,417.20 |

| 0 | 0.2 | 11.46 | 8.33 | 10.42 | 0.00 | 666.67 | 2666.67 | 694.44 | 12,500.00 | 13,194.40 | 10.16 | 7.81 | 0.00 | 1500.00 | 2250.00 | 14,062.50 |

| 2 | 0.2 | 11.47 | 8.34 | 10.42 | 17.41 | 667.59 | 2670.38 | 696.38 | 12,517.40 | 13,213.80 | 10.16 | 7.82 | 22.04 | 1502.35 | 2253.52 | 13,996.30 |

| 4 | 0.2 | 11.49 | 8.35 | 10.45 | 70.22 | 670.39 | 2681.56 | 702.23 | 12,569.80 | 13,272.10 | 10.19 | 7.83 | 89.00 | 1509.43 | 2264.15 | 13,794.90 |

| 6 | 0.2 | 11.54 | 8.38 | 10.49 | 160.23 | 675.11 | 2700.42 | 712.14 | 12,658.20 | 13,370.40 | 10.23 | 7.85 | 203.44 | 1521.39 | 2282.09 | 13,449.30 |

| 8 | 0.2 | 11.61 | 8.41 | 10.54 | 290.55 | 681.82 | 2727.27 | 726.37 | 12,784.10 | 13,510.50 | 10.29 | 7.88 | 369.82 | 1538.46 | 2307.69 | 12,943.80 |

| 10 | 0.2 | 11.69 | 8.45 | 10.61 | 465.81 | 690.65 | 2762.59 | 745.30 | 12,949.60 | 13,694.90 | 10.37 | 7.93 | 594.88 | 1560.98 | 2341.46 | 12,254.60 |

| Decentralized Analysis | Centralized Analysis | |||||||||||||||

| 0 | 0 | 11.36 | 8.14 | 10.29 | 890.03 | 2538.17 | 0.00 | 597.62 | 12,162.00 | 12,759.60 | 9.93 | 7.42 | 2043.97 | 1955.45 | 0.00 | 14,317.10 |

| 2 | 0 | 11.37 | 8.15 | 10.30 | 891.28 | 2541.87 | 17.82 | 599.57 | 12,179.80 | 12,779.40 | 9.94 | 7.42 | 2047.30 | 1958.83 | 24.40 | 14,341.40 |

| 4 | 0 | 11.40 | 8.16 | 10.32 | 895.03 | 2553.04 | 71.91 | 605.49 | 12,233.50 | 12,839.00 | 9.96 | 7.44 | 2057.38 | 1969.06 | 98.58 | 14,415.00 |

| 6 | 0 | 11.44 | 8.18 | 10.36 | 901.35 | 2571.87 | 164.18 | 615.54 | 12,324.10 | 12,939.60 | 10.01 | 7.46 | 2074.39 | 1986.34 | 225.60 | 14,539.20 |

| 8 | 0 | 11.51 | 8.22 | 10.41 | 910.37 | 2598.68 | 297.94 | 630.00 | 12,453.10 | 13,083.10 | 10.07 | 7.49 | 2098.70 | 2011.02 | 410.83 | 14,716.80 |

| 10 | 0 | 11.60 | 8.26 | 10.49 | 922.23 | 2633.98 | 478.15 | 649.30 | 12,622.90 | 13,272.20 | 10.15 | 7.53 | 2130.84 | 2043.64 | 662.34 | 14,951.60 |

| 0 | 0.05 | 11.37 | 8.17 | 10.30 | 840.70 | 2563.39 | 0.00 | 535.65 | 12,067.80 | 12,603.40 | 9.97 | 7.51 | 1910.65 | 2023.67 | 0.00 | 14,063.40 |

| 2 | 0.05 | 11.38 | 8.18 | 10.31 | 841.87 | 2567.10 | 17.56 | 537.44 | 12,085.30 | 12,622.80 | 9.98 | 7.51 | 1913.72 | 2027.11 | 23.59 | 14,086.90 |

| 4 | 0.05 | 11.40 | 8.19 | 10.33 | 845.39 | 2578.29 | 70.87 | 542.81 | 12,138.30 | 12,681.10 | 10.00 | 7.52 | 1922.98 | 2037.48 | 95.29 | 14,158.10 |

| 6 | 0.05 | 11.45 | 8.22 | 10.37 | 851.33 | 2597.15 | 161.78 | 551.92 | 12,227.50 | 12,779.40 | 10.05 | 7.54 | 1938.64 | 2055.00 | 218.01 | 14,278.20 |

| 8 | 0.05 | 11.52 | 8.25 | 10.43 | 859.79 | 2624.01 | 293.53 | 565.01 | 12,354.60 | 12,919.60 | 10.11 | 7.57 | 1961.00 | 2080.02 | 396.84 | 14,449.70 |

| 10 | 0.05 | 11.60 | 8.29 | 10.50 | 870.92 | 2659.35 | 470.99 | 582.55 | 12,521.90 | 13,104.50 | 10.19 | 7.62 | 1990.53 | 2113.06 | 639.45 | 14,676.40 |

| 0 | 0.1 | 11.37 | 8.20 | 10.32 | 792.08 | 2588.25 | 0.00 | 475.33 | 11,974.90 | 12,450.20 | 10.01 | 7.59 | 1781.70 | 2089.62 | 0.00 | 13,818.00 |

| 2 | 0.1 | 11.38 | 8.21 | 10.32 | 793.17 | 2591.97 | 17.31 | 476.93 | 11,992.20 | 12,469.10 | 10.02 | 7.59 | 1784.52 | 2093.10 | 22.81 | 13,840.80 |

| 4 | 0.1 | 11.41 | 8.22 | 10.35 | 796.47 | 2603.17 | 69.84 | 481.81 | 12,044.30 | 12,526.20 | 10.04 | 7.60 | 1793.03 | 2103.60 | 92.16 | 13,909.60 |

| 6 | 0.1 | 11.45 | 8.25 | 10.39 | 802.03 | 2622.06 | 159.42 | 490.03 | 12,132.30 | 12,622.30 | 10.09 | 7.63 | 1807.40 | 2121.34 | 210.79 | 14,025.70 |

| 8 | 0.1 | 11.52 | 8.28 | 10.44 | 809.95 | 2648.95 | 289.22 | 501.80 | 12,257.50 | 12,759.30 | 10.14 | 7.66 | 1827.92 | 2146.66 | 383.55 | 14,191.60 |

| 10 | 0.1 | 11.61 | 8.32 | 10.51 | 820.37 | 2684.35 | 463.99 | 517.59 | 12,422.40 | 12,940.00 | 10.22 | 7.70 | 1855.02 | 2180.09 | 617.72 | 14,410.60 |

| 0 | 0.15 | 11.38 | 8.23 | 10.33 | 744.14 | 2612.75 | 0.00 | 416.62 | 11,883.30 | 12,299.90 | 10.05 | 7.67 | 1656.91 | 2153.41 | 0.00 | 13,580.60 |

| 2 | 0.15 | 11.39 | 8.24 | 10.34 | 745.16 | 2616.47 | 17.06 | 418.05 | 11,900.40 | 12,318.40 | 10.06 | 7.67 | 1659.49 | 2156.93 | 22.08 | 13,602.60 |

| 4 | 0.15 | 11.41 | 8.25 | 10.36 | 748.24 | 2627.69 | 68.84 | 422.38 | 11,951.80 | 12,374.10 | 10.08 | 7.68 | 1667.29 | 2167.55 | 89.18 | 13,669.20 |

| 6 | 0.15 | 11.46 | 8.28 | 10.40 | 753.43 | 2646.61 | 157.12 | 429.73 | 12,038.40 | 12,468.20 | 10.12 | 7.71 | 1680.45 | 2185.48 | 203.92 | 13,781.50 |

| 8 | 0.15 | 11.52 | 8.31 | 10.45 | 760.83 | 2673.54 | 285.01 | 440.31 | 12,161.90 | 12,602.20 | 10.18 | 7.74 | 1699.24 | 2211.07 | 370.91 | 13,942.00 |

| 10 | 0.15 | 11.61 | 8.35 | 10.52 | 770.56 | 2708.97 | 457.14 | 454.45 | 12,324.30 | 12,778.80 | 10.26 | 7.78 | 1724.04 | 2244.83 | 597.07 | 14,153.70 |

| 0 | 0.2 | 11.38 | 8.26 | 10.34 | 696.87 | 2636.91 | 0.00 | 359.47 | 11,793.00 | 12,152.50 | 10.09 | 7.74 | 1536.07 | 2215.15 | 0.00 | 13,350.60 |

| 2 | 0.2 | 11.39 | 8.27 | 10.35 | 697.82 | 2640.63 | 16.82 | 360.73 | 11,809.80 | 12,170.60 | 10.09 | 7.75 | 1538.43 | 2218.70 | 21.38 | 13,372.00 |

| 4 | 0.2 | 11.42 | 8.28 | 10.37 | 700.69 | 2651.87 | 67.86 | 364.58 | 11,860.50 | 12,225.10 | 10.12 | 7.76 | 1545.55 | 2229.42 | 86.33 | 13,436.40 |

| 6 | 0.2 | 11.46 | 8.31 | 10.41 | 705.53 | 2670.80 | 154.87 | 371.10 | 11,945.90 | 12,317.00 | 10.16 | 7.78 | 1557.58 | 2247.52 | 197.37 | 13,545.20 |

| 8 | 0.2 | 11.53 | 8.34 | 10.46 | 712.41 | 2697.77 | 280.88 | 380.49 | 12,067.60 | 12,448.10 | 10.22 | 7.81 | 1574.73 | 2273.35 | 358.88 | 13,700.40 |

| 10 | 0.2 | 11.61 | 8.38 | 10.54 | 721.47 | 2733.23 | 450.44 | 393.03 | 12,227.70 | 12,620.70 | 10.29 | 7.86 | 1597.37 | 2307.42 | 577.43 | 13,905.30 |

| Decentralized Analysis | Centralized Analysis | |||||||||||||||

| 0 | 0 | 11.37 | 8.15 | 10.29 | 0.00 | 907.14 | 2571.43 | 403.64 | 12,500.00 | 12,903.60 | 9.94 | 7.44 | 0.00 | 2050.00 | 2000.00 | 14,128.10 |

| 2 | 0 | 11.36 | 8.16 | 10.30 | 17.89 | 916.81 | 2566.60 | 405.76 | 12,536.40 | 12,942.10 | 9.95 | 7.44 | 24.46 | 2053.30 | 2003.30 | 14,152.50 |

| 4 | 0 | 11.36 | 8.17 | 10.33 | 72.16 | 945.98 | 2552.01 | 411.11 | 12,646.50 | 13,057.60 | 9.97 | 7.45 | 98.83 | 2063.26 | 2013.26 | 14,226.30 |

| 6 | 0 | 11.35 | 8.19 | 10.36 | 164.73 | 995.15 | 2527.42 | 416.51 | 12,833.20 | 13,249.70 | 10.01 | 7.48 | 226.14 | 2080.08 | 2030.08 | 14,350.90 |

| 8 | 0 | 11.34 | 8.23 | 10.42 | 298.88 | 1065.20 | 2492.40 | 416.38 | 13,101.40 | 13,517.80 | 10.07 | 7.51 | 411.73 | 2104.11 | 2054.11 | 14,528.90 |

| 10 | 0 | 11.33 | 8.27 | 10.49 | 479.53 | 1157.41 | 2446.30 | 402.18 | 13,458.60 | 13,860.70 | 10.15 | 7.54 | 663.62 | 2135.87 | 2085.87 | 14,764.10 |

| 0 | 0.05 | 11.37 | 8.18 | 10.31 | 0.00 | 857.80 | 2596.10 | 343.19 | 12,406.80 | 12,750.00 | 9.98 | 7.52 | 0.00 | 1917.21 | 2066.39 | 13,876.10 |

| 2 | 0.05 | 11.37 | 8.19 | 10.32 | 17.63 | 866.91 | 2591.76 | 345.14 | 12,441.80 | 12,786.90 | 9.99 | 7.52 | 23.64 | 1920.24 | 2069.74 | 13,899.70 |

| 4 | 0.05 | 11.37 | 8.20 | 10.34 | 71.11 | 894.39 | 2578.65 | 350.02 | 12,547.60 | 12,897.60 | 10.01 | 7.54 | 95.51 | 1929.39 | 2079.85 | 13,971.00 |

| 6 | 0.05 | 11.36 | 8.22 | 10.38 | 162.30 | 940.72 | 2556.55 | 354.86 | 12,726.80 | 13,081.70 | 10.05 | 7.56 | 218.50 | 1944.84 | 2096.93 | 14,091.40 |

| 8 | 0.05 | 11.35 | 8.26 | 10.43 | 294.43 | 1006.71 | 2525.08 | 354.44 | 12,984.30 | 13,338.70 | 10.11 | 7.59 | 397.65 | 1966.90 | 2121.31 | 14,263.30 |

| 10 | 0.05 | 11.33 | 8.30 | 10.50 | 472.30 | 1093.55 | 2483.66 | 340.76 | 13,326.90 | 13,667.70 | 10.19 | 7.63 | 640.59 | 1996.05 | 2153.53 | 14,490.40 |

| 0 | 0.1 | 11.38 | 8.21 | 10.32 | 0.00 | 809.16 | 2620.42 | 284.35 | 12,315.00 | 12,599.30 | 10.02 | 7.60 | 0.00 | 1788.71 | 2130.65 | 13,632.20 |

| 2 | 0.1 | 11.37 | 8.22 | 10.33 | 17.37 | 817.71 | 2616.56 | 286.13 | 12,348.60 | 12,634.70 | 10.02 | 7.61 | 22.87 | 1791.49 | 2134.04 | 13,655.00 |

| 4 | 0.1 | 11.37 | 8.23 | 10.35 | 70.08 | 843.54 | 2604.91 | 290.56 | 12,450.10 | 12,740.60 | 10.05 | 7.62 | 92.36 | 1799.87 | 2144.29 | 13,723.90 |

| 6 | 0.1 | 11.36 | 8.25 | 10.39 | 159.93 | 887.06 | 2585.26 | 294.88 | 12,622.10 | 12,917.00 | 10.09 | 7.64 | 211.22 | 1814.03 | 2161.59 | 13,840.30 |

| 8 | 0.1 | 11.35 | 8.29 | 10.44 | 290.08 | 949.06 | 2557.29 | 294.18 | 12,869.10 | 13,163.30 | 10.15 | 7.67 | 384.26 | 1834.24 | 2186.29 | 14,006.50 |

| 10 | 0.1 | 11.34 | 8.33 | 10.52 | 465.24 | 1030.62 | 2520.47 | 281.02 | 13,197.60 | 13,478.70 | 10.23 | 7.71 | 618.71 | 1860.92 | 2218.91 | 14,225.90 |

| 0 | 0.15 | 11.38 | 8.24 | 10.33 | 0.00 | 761.19 | 2644.41 | 227.07 | 12,224.40 | 12,451.50 | 10.05 | 7.68 | 0.00 | 1664.29 | 2192.86 | 13,396.00 |

| 2 | 0.15 | 11.38 | 8.25 | 10.34 | 17.12 | 769.21 | 2641.02 | 228.69 | 12,256.60 | 12,485.30 | 10.06 | 7.68 | 22.13 | 1666.82 | 2196.29 | 13,418.10 |

| 4 | 0.15 | 11.37 | 8.26 | 10.36 | 69.06 | 793.40 | 2630.80 | 232.69 | 12,354.00 | 12,586.70 | 10.08 | 7.70 | 89.36 | 1674.49 | 2206.66 | 13,484.80 |

| 6 | 0.15 | 11.37 | 8.28 | 10.40 | 157.60 | 834.17 | 2613.56 | 236.50 | 12,519.00 | 12,755.50 | 10.13 | 7.72 | 204.30 | 1687.43 | 2224.17 | 13,597.40 |

| 8 | 0.15 | 11.36 | 8.32 | 10.46 | 285.82 | 892.23 | 2589.03 | 235.56 | 12,755.80 | 12,991.40 | 10.18 | 7.75 | 371.54 | 1705.90 | 2249.15 | 13,758.10 |

| 10 | 0.15 | 11.34 | 8.36 | 10.53 | 458.32 | 968.61 | 2556.75 | 222.93 | 13,070.60 | 13,293.50 | 10.26 | 7.79 | 597.92 | 1730.27 | 2282.13 | 13,970.20 |

| 0 | 0.2 | 11.38 | 8.27 | 10.35 | 0.00 | 713.89 | 2668.06 | 171.31 | 12,135.10 | 12,306.40 | 10.09 | 7.75 | 0.00 | 1543.75 | 2253.13 | 13,167.20 |

| 2 | 0.2 | 11.38 | 8.28 | 10.35 | 16.88 | 721.38 | 2665.13 | 172.77 | 12,166.00 | 12,338.70 | 10.10 | 7.76 | 21.42 | 1546.06 | 2256.60 | 13,188.60 |

| 4 | 0.2 | 11.38 | 8.29 | 10.38 | 68.07 | 743.96 | 2656.32 | 176.36 | 12,259.40 | 12,435.70 | 10.12 | 7.77 | 86.50 | 1553.05 | 2267.08 | 13,253.20 |

| 6 | 0.2 | 11.37 | 8.31 | 10.41 | 155.33 | 782.02 | 2641.47 | 179.69 | 12,417.50 | 12,597.20 | 10.16 | 7.79 | 197.71 | 1564.84 | 2284.76 | 13,362.20 |

| 8 | 0.2 | 11.36 | 8.35 | 10.47 | 281.66 | 836.22 | 2620.32 | 178.52 | 12,644.40 | 12,822.90 | 10.22 | 7.83 | 359.42 | 1581.67 | 2310.00 | 13,517.70 |

| 10 | 0.2 | 11.35 | 8.39 | 10.54 | 451.56 | 907.50 | 2592.50 | 166.42 | 12,945.80 | 13,112.20 | 10.29 | 7.87 | 578.15 | 1603.86 | 2343.29 | 13,722.80 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Raza, S.A. Price Differentiation and Inventory Decisions in a Socially Responsible Dual-Channel Supply Chain with Partial Information Stochastic Demand and Cannibalization. Sustainability 2020, 12, 9577. https://doi.org/10.3390/su12229577

Raza SA. Price Differentiation and Inventory Decisions in a Socially Responsible Dual-Channel Supply Chain with Partial Information Stochastic Demand and Cannibalization. Sustainability. 2020; 12(22):9577. https://doi.org/10.3390/su12229577

Chicago/Turabian StyleRaza, Syed Asif. 2020. "Price Differentiation and Inventory Decisions in a Socially Responsible Dual-Channel Supply Chain with Partial Information Stochastic Demand and Cannibalization" Sustainability 12, no. 22: 9577. https://doi.org/10.3390/su12229577