Agglomeration Externalities vs. Network Externalities: Impact on Green Technology Innovation in 283 Chinese Cities

Abstract

:1. Introduction

2. Hypotheses

2.1. AEs and GTI

2.2. NEs and GTI

2.3. Spatial Spillover of AEs and NEs on GTI

3. Data and Methods

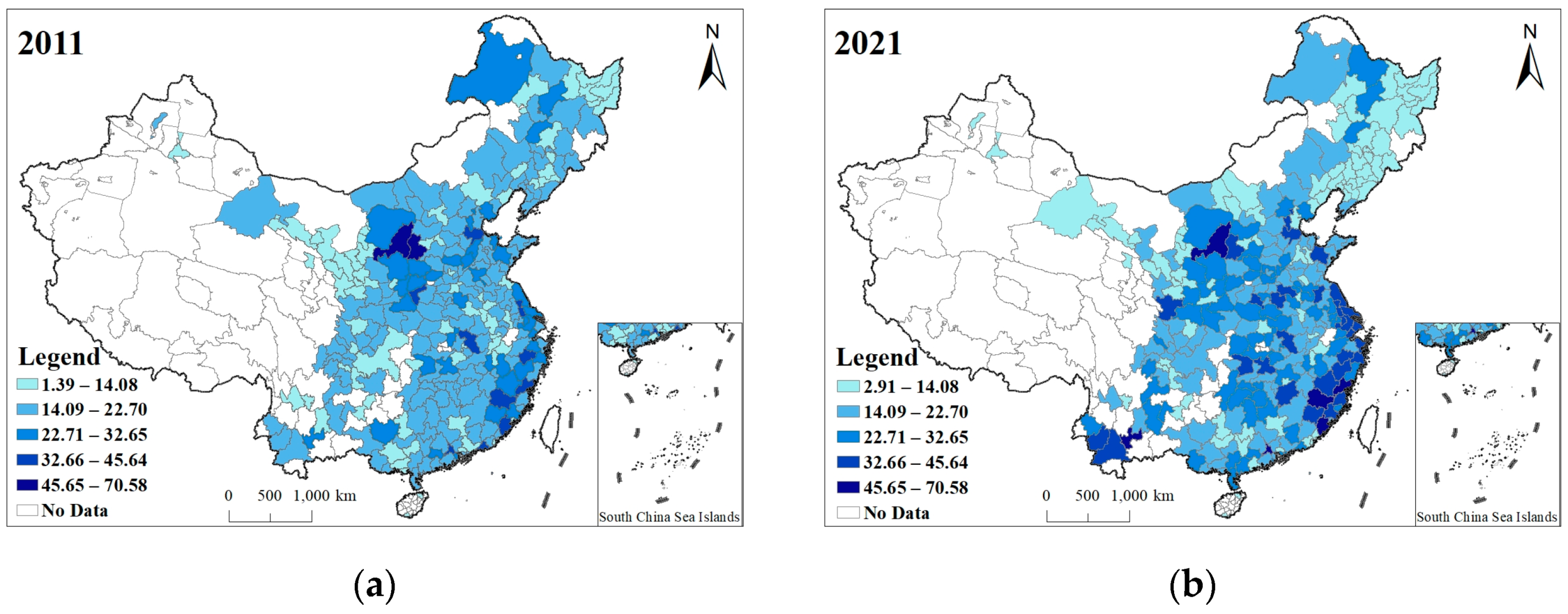

3.1. Selection and Description of Variables

3.1.1. Dependent Variable

3.1.2. Core Explanatory Variables

3.1.3. Control Variables

3.2. Methods

4. Results

4.1. Regression Results

4.2. Robustness Test

4.3. Heterogeneity Test

5. Discussion

5.1. The Impact of AEs on GTI

5.2. The Impact of NEs on GTI

5.3. Spatial Spillover Effects of AEs and NEs on GTI

5.4. Strengths and Limitations

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Porter, M.E. Cluster and the new economics of competition. Harv. Bus. Rev. 1998, 76, 11–12. [Google Scholar]

- Huang, Y.; Hong, T.; Ma, T. Urban network externalities, agglomeration economies and urban economic growth. Cities 2020, 107, 102882. [Google Scholar] [CrossRef]

- Rosenthal, S.S.; Strange, W.C. Chapter 49-Evidence on the nature and sources of agglomeration economies. Handb. Reg. Urban Econ. 2004, 4, 2119–2171. [Google Scholar]

- Marshall, A. Principles of Economics, 8th ed.; Macmillan: London, UK, 1920; pp. 12–23. [Google Scholar]

- Jacobs, J.M. The Economy of Cities, 1st ed.; Random House: New York, NY, USA, 1969; pp. 119–141. [Google Scholar]

- Tang, C.A.; Qiu, J.W.; Zhang, L.J.; Li, H.Y. Spatial econometric analysis on the influence of elements flow and industrial collaborative agglomeration on regional economic growth: Based on manufacturing and producer services. Econ. Geogr. 2021, 41, 146–154. [Google Scholar]

- Jiang, J.L.; Xu, Z.S.; Lu, J.Y.; Sun, D.Q. Does network externality of urban agglomeration benefit urban economic growth-A case study of the Yangtze River Delta. Land 2022, 11, 586. [Google Scholar] [CrossRef]

- Peng, D.; Li, R.R.; Shen, C.R.; Wong, Z.Y. Industrial agglomeration, urban characteristics, and economic growth quality: The case of knowledge-intensive business services. Int. Rev. Econ. Financ. 2022, 81, 18–28. [Google Scholar] [CrossRef]

- Liu, H.; Li, X.M.; Li, S.B.; Tian, S.Z.; Gong, Y.L.; Guan, Y.Y.; Sun, H. Agglomeration externalities, network externalities and urban high-quality development: A case study of urban agglomeration in the middle reaches of the Yangtze River. ISPRS Int. J. Geoinf. 2023, 11, 555. [Google Scholar] [CrossRef]

- Yang, N.N.; Liu, Q.M.; Chen, Y.E. Does industrial agglomeration promote regional innovation convergence in China? Evidence from high-tech industries. IEEE Trans. Eng. Manag. 2021, 70, 1416–1429. [Google Scholar] [CrossRef]

- Yao, C.C.; Wu, K. Agglomeration externalities, network externalities and urban innovation development. Geogr. Res. 2022, 41, 2330–2349. [Google Scholar]

- Li, N.; Song, S.H. A quasi-natural experimental study on enterprise innovation driven by urban agglomeration policies in China. Sci. Rep. 2023, 13, 10297. [Google Scholar] [CrossRef]

- Liu, K.W.; Deng, H.B.; Wu, T.; Yi, Y.; Zhang, Y.; Ren, Y.L. Technological innovation, urban spatial structure, and haze pollution: Empirical evidence from the middle reaches of the Yangtze River urban agglomeration. Energies 2023, 16, 6553. [Google Scholar] [CrossRef]

- Shen, N.; Peng, H. Can industrial agglomeration achieve the emission-reduction effect. Socio-Econ. Plan. Sci. 2021, 75, 100867. [Google Scholar] [CrossRef]

- Wang, L.P.; Long, Y.; Li, C. Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 2022, 322, 116127. [Google Scholar] [CrossRef]

- Katz, M.L.; Shapiro, C. Network externalities, competition, and compatibility. Am. Econ. Rev. 1985, 75, 424–440. [Google Scholar]

- Camagni, R.P.; Salone, C. Network urban structures in northern Italy: Elements for a theoretical framework. Urban Stud. 1993, 30, 1053–1064. [Google Scholar] [CrossRef]

- Capello, R. The city network paradigm: Measuring urban network externalities. Urban Stud. 2000, 37, 1925–1945. [Google Scholar] [CrossRef]

- Zhou, Y.; Zheng, W.S.; Wang, X.F.; Xiong, Y.J.; Wang, X.Z. The mechanism behind urban population growth and shrinkage from the perspective of urban network externalities. Chin. Geogr. Sci. 2023, 33, 189–204. [Google Scholar] [CrossRef]

- Li, X.W.; Long, H.Y. Research focus, frontier and knowledge base of green technology in China: Metrological research based on mapping knowledge domains. Pol. J. Environ. Stud. 2020, 29, 3003–3011. [Google Scholar] [CrossRef]

- Liu, K.; Dong, S.M.; Wang, Y.L.; Chen, Z.F. The green innovation efficiency of Chinese cities: Regional differences, distribution dynamics, and convergences. J. Environ. Plan. Manag. 2023, 1–26. [Google Scholar] [CrossRef]

- Lin, B.Q.; Ma, R.Y. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Change 2022, 176, 121434. [Google Scholar] [CrossRef]

- Qiu, Y.; Wang, H.N.; Wu, J.J. Impact of industrial structure upgrading on green innovation: Evidence from Chinese cities. Environ. Sci. Pollut. Res. 2022, 30, 3887–3900. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.Q.; Ma, R.Y. How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manag. 2022, 320, 115833. [Google Scholar] [CrossRef] [PubMed]

- Dong, S.M.; Ren, G.X.; Xue, Y.T.; Liu, K. Urban green innovation’s spatial association networks in China and their mechanisms. Sust. Cities Soc. 2023, 93, 104536. [Google Scholar] [CrossRef]

- Feldman, M.P. The Geography of Innovation, 1st ed.; Kluwer Academic: Boston, MA, USA, 1994; pp. 29–49. [Google Scholar]

- Capello, R. Spatial transfer of knowledge in high technology milieux: Learning versus collective learning processes. Reg. Stud. 1999, 33, 353–365. [Google Scholar] [CrossRef]

- Magrini, M.B.; Galliano, D. Agglomeration economies, firms’ spatial organization and innovation performance: Some evidence from the French industry. Ind. Innov. 2012, 19, 607–630. [Google Scholar] [CrossRef]

- Hervas-Oliver, J.L.; Sempere-Ripoll, F.; Alvarado, R.R.; Estelles-Miguel, S. Agglomerations and firm performance: Who benefits and how much? Reg. Stud. 2018, 52, 338–349. [Google Scholar] [CrossRef]

- Bryan, G.; Glaeser, E.; Tsivanidis, N. Cities in the developing world. Annu. Rev. Econ. 2020, 12, 273–297. [Google Scholar] [CrossRef]

- Scherer, F.M. Firm size, market structure, opportunity, and the output of patented inventions. Am. Econ. Rev. 1965, 55, 1097–1125. [Google Scholar]

- Pindado, E.; Sanchez, M.; Martinez, M.G. Entrepreneurial innovativeness: When too little or too much agglomeration hurts. Res. Policy 2022, 52, 104625. [Google Scholar] [CrossRef]

- Duranton, G.; Puga, D. Micro-foundations of urban agglomeration economies. Handb. Reg. Urban Econ. 2004, 4, 2063–2117. [Google Scholar]

- Meijers, E.J.; Burger, M.J. Spatial structure and productivity in US metropolitan areas. Environ. Plan. A 2010, 42, 1383–1402. [Google Scholar] [CrossRef]

- Huang, X.D.; Ma, H.T.; Miao, C.H. Connectivity characteristics for city networks in China based on innovative enterprises. Acta Geol. Sin. 2021, 76, 835–852. [Google Scholar]

- Feng, Z.J.; Cai, H.C.; Chen, Z.N.; Zhou, W. Influence of an interurban innovation network on the innovation capacity of China: A multiplex network perspective. Technol. Forecast. Soc. Change 2022, 180, 121651. [Google Scholar] [CrossRef]

- Alonso, W. Urban zero population growth. Dædalus J. Am. Acad. Arts Sci. 1973, 102, 191–206. [Google Scholar]

- Fu, W.F.; Luo, C.J.; Yan, M.D. Does urban agglomeration promote the development of Cities? Evidence from the urban network externalities. Sustainability 2023, 15, 9850. [Google Scholar] [CrossRef]

- Tobler, W. A computer movie simulating urban growth in the Detroit region. Econ. Geogr. 1970, 46, 234–240. [Google Scholar] [CrossRef]

- Burger, M.J.; Meijers, E.J. Agglomerations and the rise of urban network externalities. Pap. Reg. Sci. 2016, 95, 5–16. [Google Scholar] [CrossRef]

- Liu, K.; Xue, Y.T.; Chen, Z.F.; Miao, Y.; Shi, J.L. Economic spatial structure of China’s urban agglomerations: Regional differences, distribution dynamics, and convergence. Sustain. Cities Soc. 2022, 87, 104253. [Google Scholar] [CrossRef]

- Li, X.W.; Liu, X.; Huang, Y.C.; Li, J.R.; He, J.R. Theoretical framework for assessing construction enterprise green innovation efficiency and influencing factors: Evidence from China. Environ. Technol. Innov. 2023, 32, 103293. [Google Scholar] [CrossRef]

- Song, Z.G.; Tang, J.J.; Zeng, H.J.; Pang, F.Y. How urban-level credit expansion affects the quality of green innovation: Evidence from China. Sustainability 2024, 16, 1725. [Google Scholar] [CrossRef]

- Song, A.F.; Rasool, Z.; Nazar, R.; Anser, M.K. Towards a greener future: How green technology innovation and energy efficiency are transforming sustainability. Energy 2024, 290, 129891. [Google Scholar] [CrossRef]

- Zhang, G.S.; Ding, Z.W.; Zhao, M.; Wang, F.Z.; Ma, Q. Spatial variation and its influencing factors of economic density in CPER at county level. Econ. Geogr. 2014, 34, 19–26+39. [Google Scholar]

- Liang, C.Y.; Liu, X.Y.; Tavera, C. Environmental externalities of urban agglomeration in China: New evidence from the perspective of economic density. Singap. Econ. Rev. 2023, 1–25. [Google Scholar] [CrossRef]

- Arentze, T.; van den Berg, P.; Timmermans, H. Modeling social networks in geographic space: Approach and empirical application. Environ. Plan. A 2012, 44, 1101–1120. [Google Scholar] [CrossRef]

- Bai, C.Q.; Zhou, L.; Xia, M.L.; Feng, C. Analysis of the spatial association network structure of China’s transportation carbon emissions and its driving factors. J. Environ. Manag. 2020, 253, 109765. [Google Scholar] [CrossRef] [PubMed]

- Li, F.B.; Zhang, H.F.; Zhang, D.; Yan, H.Q. Structural diffusion model and urban green innovation efficiency-A hybrid study based on DEA-SBM, NCA, and fsQCA. Sustainability 2023, 15, 12705. [Google Scholar] [CrossRef]

- Chou, T.L.; Ching, C.H.; Fan, S.M.; Chang, J.Y. Global linkages, the Chinese high-tech community and industrial cluster development: The semiconductor industry in Wuxi, Jingsu. Urban Stud. 2011, 48, 3019–3042. [Google Scholar] [CrossRef]

- Li, H.Y.; Liu, Q.; Ye, H.Z. Digital development influencing mechanism on green innovation performance: A perspective of green innovation network. IEEE Access 2023, 11, 22490–22504. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C. Toward a new conception of the environment: Competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Dong, S.M.; Xue, Y.T.; Ren, G.X.; Liu, K. Urban green innovation efficiency in China: Spatiotemporal evolution and influencing factors. Land 2023, 12, 75. [Google Scholar] [CrossRef]

- Deng, H.H.; Yang, L.X. Haze governance, local competition and industrial green transformation. China Ind. Econ. 2019, 10, 118–136. [Google Scholar]

- Deng, Y.M.; Li, X.M.; Zhu, J.M. Effect of planning and construction of intercity railways on the economic development of the pearl river delta urban agglomeration: An analysis based on the spatial Durbin model. Sustainability 2024, 16, 738. [Google Scholar] [CrossRef]

- Qiao, W.Y.; Huang, X.J. The impact of land urbanization on ecosystem health in the Yangtze River Delta urban agglomerations, China. Cities 2022, 130, 103981. [Google Scholar] [CrossRef]

- Liu, K.; Xue, Y.T.; Chen, Z.F.; Miao, Y. The spatiotemporal evolution and influencing factors of urban green innovation in China. Sci. Total Environ. 2023, 857, 159426. [Google Scholar] [CrossRef] [PubMed]

- Duranton, G. Economics of agglomeration: Cities, industrial location and regional growth. Urban Stud. 2003, 40, 854–856. [Google Scholar]

- Niu, F.Q.; Jiang, Y.P. Economic sustainability of China’s growth from the perspective of its resource and environmental supply system: National scale modeling and policy analysis. J. Geogr. Sci. 2021, 31, 1171–1186. [Google Scholar] [CrossRef]

- Wang, X.H.; Yang, Y.Q.; Luo, X.Y.; Wen, T. The spatial correlation network and formation mechanism of China’s high-quality economic development. Acta Geol. Sin. 2022, 77, 1920–1936. [Google Scholar]

- Feldman, M.P.; Audretsch, D.B. Innovation in cities: Science-based diversity, specialization and localized competition. Eur. Econ. Rev. 1999, 42, 409–429. [Google Scholar] [CrossRef]

- Díez-Vial, I.; Belso-Martínez, J.A.; Gregorio, M.D.C. Extending green innovations across clusters: How can firms benefit most? Int. Reg. Sci. Rev. 2023, 46, 149–178. [Google Scholar] [CrossRef]

- Liu, S.C.; Wu, P.J. The impact of high-tech industrial agglomeration on China’s green innovation efficiency: A spatial econometric analysis. Front. Environ. Sci. 2023, 11, 1167918. [Google Scholar] [CrossRef]

- Yang, Y.Q.; Lu, X.Y.; Chen, J.; Li, N. Factor mobility, transportation network and green economic growth of the urban agglomeration. Environ. Sci. Pollut. Res. 2022, 12, 20094. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Ye, W.Z.; Chen, L.M. Research on green innovation of the great Changsha-Zhuzhou-Xiangtan city group based on network. Land 2021, 10, 1198. [Google Scholar] [CrossRef]

- Nathan, M. Ethnic diversity and business performance: Which firms? Which cities? Environ. Plan. A 2016, 48, 2462–2483. [Google Scholar] [CrossRef]

- Qi, M.; Zhang, B.; Li, J.J.; Liu, B.F. The Three-dimensional analytical and governance logic of China’s digital divide bridging policy. Sustainability 2023, 15, 7220. [Google Scholar] [CrossRef]

| Name | Units | Size | Mean | Std. Dev. | Max. | Min. |

|---|---|---|---|---|---|---|

| Green patent (X) | PCS | 3113 | 596.09 | 1703.47 | 26,056.00 | 0 |

| AEs (Y1) | 100 million CNY/square kilometer | 3113 | 19.16 | 9.47 | 70.58 | 1.39 |

| Nes (Y2) | — | 3113 | 73.71 | 45.59 | 275.00 | 17.00 |

| Pgdp (Z1) | CNY 10,000 | 3113 | 54,641.85 | 33,492.33 | 256,877.00 | 6457.00 |

| Tertiary (Z2) | % | 3113 | 42.86 | 10.42 | 84.64 | 10.15 |

| RD (Z3) | Person/year | 3113 | 14,333.58 | 27,472.02 | 345,858.93 | 496.52 |

| Tech (Z4) | CNY 10,000 | 3113 | 124,423.29 | 404,010.16 | 6,118,019.15 | 771.00 |

| Environ (Z5) | % | 3113 | 0.27 | 1.33 | 35.10 | 0.000001 |

| Green (Z6) | % | 3113 | 40.13 | 5.80 | 82.32 | 6.75 |

| Variable | Coef. | Std. Err. | z | p > |z| | [95% Conf. Interval] | |

|---|---|---|---|---|---|---|

| Ln Y1 | −0.6141272 *** | 0.1898513 | −3.23 | 0.01 | −0.9862289 | −0.2420255 |

| sq Ln Y1 | 0.060033 * | 0.0338073 | 1.78 | 0.076 | −0.0062281 | 0.126294 |

| Ln Y2 | 0.2217026 *** | 0.0657502 | 3.37 | 0.01 | 0.0928346 | 0.3505707 |

| sq Ln Y2 | 0.077561 *** | 0.0099858 | 7.77 | 0.000 | 0.0579892 | 0.0971329 |

| Ln Z1 | 0.2019515 *** | 0.0554718 | 3.64 | 0.000 | 0.0932288 | 0.3106741 |

| Ln Z2 | 0.8195157 *** | 0.0711606 | 11.52 | 0.000 | 0.6800436 | 0.9589879 |

| Ln Z3 | 0.9905141 *** | 0.0468609 | 21.14 | 0.000 | 0.8986685 | 1.08236 |

| Ln Z4 | 0.0765685 *** | 0.0188129 | 4.07 | 0.000 | 0.0396958 | 0.1134412 |

| Z5 | 0.0108684 * | 0.0058804 | 1.85 | 0.065 | −0.000657 | 0.0223938 |

| Ln Z6 | 0.1656033 *** | 0.0560202 | 2.96 | 0.003 | 0.0558057 | 0.2754009 |

| W* Ln Y1 | 1.540577 *** | 0.2923329 | 5.27 | 0.000 | 0.9676154 | 2.113539 |

| W* Ln Y2 | 0.0383755 | 0.0993834 | 0.39 | 0.699 | −0.1564144 | 0.2331613 |

| _cons | −11.38657 | 0.8140973 | −13.99 | 0.000 | −12.98217 | −9.790967 |

| Variable | Coef. | Std. Err. | Z | p > |Z| | [95% Conf. Interval] | |

|---|---|---|---|---|---|---|

| Ln Y1 | −0.5526026 *** | 0.1386982 | −3.98 | 0.000 | −0.8244461 | −0.280759 |

| sq Ln Y1 | 0.0652718 *** | 0.0244637 | 2.67 | 0.008 | 0.0173239 | 0.1132198 |

| Ln Y2 | 0.4701083 * | 0.2694453 | 1.74 | 0.081 | −0.0579947 | 0.9982113 |

| sq Ln Y2 | 0.321144 *** | 0.0435038 | 7.38 | 0.000 | 0.2358718 | 0.4064099 |

| Ln Z1 | 0.216237 *** | 0.0558513 | 3.87 | 0.000 | 0.1067706 | 0.3257035 |

| Ln Z2 | 0.859301 *** | 0.0715998 | 12.00 | 0.000 | 0.718968 | 0.999634 |

| Ln Z3 | 0.9960589 *** | 0.0463767 | 21.48 | 0.000 | 0.9051623 | 1.086956 |

| Ln Z4 | 0.0805032 *** | 0.0188731 | 4.27 | 0.000 | 0.0435127 | 0.1174938 |

| Z5 | 0.0095607 | 0.0059127 | 1.62 | 0.106 | −0.002028 | 0.0211494 |

| Ln Z6 | 0.1426199 ** | 0.0561135 | 2.54 | 0.011 | 0.0326395 | 0.2526002 |

| W* Ln Y1 | 1.023703 *** | 0.2220545 | 4.61 | 0.000 | 0.5884837 | 1.458921 |

| W* Ln Y2 | 0.2834411 | 0.4238008 | 0.67 | 0.504 | −0.5471932 | 1.114075 |

| _cons | −12.55287 | 1.754625 | −7.15 | 0.000 | −15.99188 | −9.11387 |

| Variable | Eastern Region | Central Region | Western Region | Northeastern Region |

|---|---|---|---|---|

| Ln Y1 | −0.704 (0.345) ** | −1.458 (0.504) *** | −1.006 (0.458) ** | 0.155 (0.354) |

| sq Ln Y1 | 0.103 (0.056) * | 0.190 (0.085) ** | 0.133 (0.084) | 0.104 (0.076) |

| Ln Y2 | 2.234 (0.356) *** | 0.312 (0.107) *** | 1.042 (0.246) *** | 0.695 (0.300) * |

| sq Ln Y2 | −0.200 (0.039) *** | 0.086 (0.015) *** | 0.190 (0.031) *** | 0.138 (0.041) *** |

| Ln Z1 | 0.090 (0.058) | 0.289 (0.081) *** | 0.167 (0.121) | −0.396 (0.173) ** |

| Ln Z2 | 1.051 (0.137) *** | −0.010 (0.070) | 0.118 (0.074) | 0.113 (0.112) |

| Ln Z3 | 0.706 (0.039) *** | 0.834 (0.084) *** | 0.665 (0.138) *** | 1.101 (0.144) *** |

| Ln Z4 | 0.185 (0.031) *** | 0.102 (0.035) ** | 0.035 (0.044) | 0.131 (0.038) *** |

| Z5 | 0.050 (0.025) ** | 0.003 (0.007) | 0.008 (0.012) | 0.016 (0.027) |

| Ln Z6 | 0.453 (0.108) *** | 0.085 (0.099) | −0.051 (0.108) | 0.405 (0.171) ** |

| W* Ln Y1 | 1.653 (0.585) *** | 5.077 (3.176) | 15.988 (3.44) *** | 3.032 (2.271) |

| W* Ln Y2 | 1.400 (0.629) ** | 0.164 (0.763) | −0.763 (1.109) | 3.829 (1.868) ** |

| _cons | −16.420 | −11.113 | −25.456 | −30.352 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, S.; Liu, K. Agglomeration Externalities vs. Network Externalities: Impact on Green Technology Innovation in 283 Chinese Cities. Sustainability 2024, 16, 3540. https://doi.org/10.3390/su16093540

Dong S, Liu K. Agglomeration Externalities vs. Network Externalities: Impact on Green Technology Innovation in 283 Chinese Cities. Sustainability. 2024; 16(9):3540. https://doi.org/10.3390/su16093540

Chicago/Turabian StyleDong, Shumin, and Kai Liu. 2024. "Agglomeration Externalities vs. Network Externalities: Impact on Green Technology Innovation in 283 Chinese Cities" Sustainability 16, no. 9: 3540. https://doi.org/10.3390/su16093540