Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures

Abstract

:1. Introduction

2. Literature Review and Hypotheses

2.1. Definition and Characteristics of International New Ventures

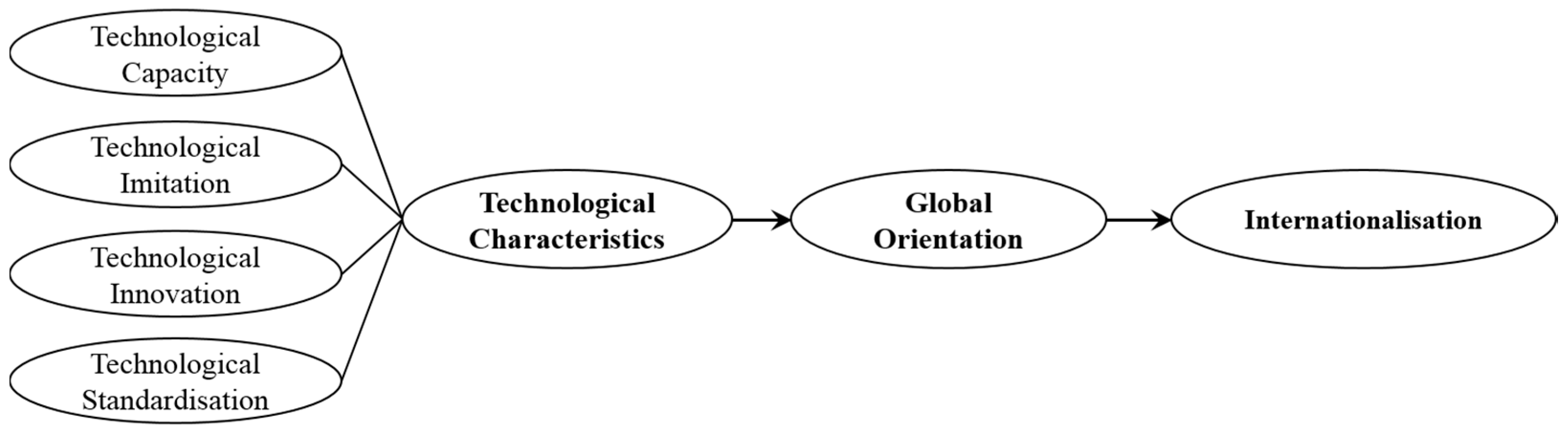

2.2. Relationships between Technological Characteristics and Internationalisation in INVs

2.3. Relationships among Technological Characteristics, CEOs’ Global Orientation, and Internationalisation

3. Methodology

3.1. Operational Definition of INVs

3.2. Sample and Data Collection

3.3. Measures

3.3.1. Technological Characteristics

3.3.2. Global Orientation

3.3.3. Internationalisation

3.3.4. Assessing Common Method Bias and Non-Response Bias

4. Analysis and Results

4.1. Measurement Model Results

4.2. Structural Model Results

4.3. Hypotheses Testing

4.3.1. Hypotheses 1 and 2

4.3.2. Hypothesis 3

5. Conclusions

5.1. Summary and Implications

5.2. Limitations and Future Research Directions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Variables | Items |

|---|---|

| Technological Capacity | My organisation leads the technology trend. |

| My organisation develops necessary technologies effectively. | |

| My organisation has a capacity to be able to supply more innovative products than rivals. | |

| My organisation has a technological ascendancy over rivals. | |

| Technological Imitation | The technology of my organisation can be used universally. |

| The technology of my organisation can be learned by observation. | |

| The technology of my organisation can be imitated more easily. | |

| The technology of my organisation can be learned more easily. | |

| Technological Innovation | The extent of technological innovation is higher than rivals. |

| The CEO of my organisation thinks that technological innovation is an important thing. | |

| My organisation can acquire useful information needed to carry out successful technological innovation. | |

| My organisation has a culture or environment needed to carry out successful technological innovation. | |

| Technological Standardisation | My organisation has more international certificates such as ISOs than rivals. |

| My organisation has more internal or domestic certificates than rivals. | |

| My organisation has been utilised technological standardisation strategies. | |

| The CEO of my organisation supports technological standardisation. | |

| Global Orientation | The CEO of my organisation has enough international experience. |

| The CEO of my organisation has carried out sufficient international business. | |

| The CEO of my organisation can speak foreign language such as English fluently. | |

| The CEO of my organisation has an intention to internationalise. | |

| The CEO of my organisation is interesting in penetrating into new international markets. | |

| Internationalisation | International sales |

| International assets | |

| The number of international branches | |

| The number of international markets or countries penetrated |

References

- Cerrato, D.; Piva, M. The effect of global orientation on the performance of international new ventures: Evidence from Italy. Manag. Int. Rev. 2015, 55, 857–883. [Google Scholar] [CrossRef]

- Johanson, J.; Vahlne, J.E. The internationalisation process of the firm—A model of knowledge development and increasing foreign market commitment. J. Int. Bus. Stud. 1977, 8, 23–32. [Google Scholar] [CrossRef]

- Cavusgil, S.T.; Knight, G. The born global firm: An entrepreneurial and capabilities perspective on early and rapid internationalization. J. Int. Bus. Stud. 2015, 46, 3–16. [Google Scholar] [CrossRef]

- Sleuwaegen, L.; Onkelinx, J. International commitment, post-entry growth and survival of international new ventures. J. Bus. Ventur. 2014, 29, 106–120. [Google Scholar] [CrossRef]

- Oviatt, B.M.; McDougall, P.P. Challenges for internationalisation process theory: The case of international new ventures. Manag. Int. Rev. 1997, 37, 85–99. [Google Scholar]

- McDougall, P.; Shane, S.; Oviatt, B.M. Explaining the formation of international new ventures. J. Bus. Ventur. 1994, 9, 469–487. [Google Scholar] [CrossRef]

- Cavusgil, S.T. On the internationalisation process of firms. Eur. Res. 1980, 8, 273–281. [Google Scholar]

- Moen, O.; Servais, P. Born global or gradual global? Examining the export behavior of small and medium-sized enterprises. J. Int. Mark. 2002, 10, 49–72. [Google Scholar] [CrossRef]

- Burgel, O.; Murray, G.C. The international market entry choices of start-up companies in high technology industries. J. Int. Mark. 2000, 8, 33–62. [Google Scholar] [CrossRef]

- Chorev, S.; Anderson, A.R. Success in Israeli high-tech start-ups; Critical factors and process. Technovation 2006, 26, 162–174. [Google Scholar] [CrossRef]

- Rialp, A.; Rialp, J.; Knight, G.A. The phenomenon of early internationalizing firms: What do we know after a decade (1993–2003) of scientific enquiry? Int. Bus. Rev. 2005, 14, 147–166. [Google Scholar] [CrossRef]

- McDougall, P.P.; Oviatt, B.M.; Shrader, R.C. A comparison of international and domestic new ventures. J. Int. Entrep. 2003, 1, 59–82. [Google Scholar] [CrossRef]

- Manolova, T.S.; Brush, C.G.; Edelman, L.F.; Greene, P.G. Internationalization of small firms: Personal factors revisited. Int. Small Bus. J. 2002, 20, 9–31. [Google Scholar] [CrossRef]

- Ruzzier, M.; Antoncic, B.; Hisrich, R.D.; Konecnik, M. Human capital and SME internationalization: A structural equation modeling study. Can. J. Adm. Sci. 2007, 24, 15–29. [Google Scholar] [CrossRef]

- Knight, G.A.; Cavusgil, S.T. A taxonomy of born-global firms. Manag. Int. Rev. 2005, 45, 15–35. [Google Scholar]

- Fernhaber, S.A.; Gilbert, B.A.; McDougall, P.P. International entrepreneurship and geographic location: An empirical examination of new venture internationalization. J. Int. Bus. Stud. 2008, 39, 267–290. [Google Scholar] [CrossRef]

- Oviatt, B.M.; McDougall, P.P. Global start-ups: Entrepreneurs on a worldwide stage. Acad. Manag. Exec. 1994, 9, 30–43. [Google Scholar] [CrossRef]

- Madsen, T.K.; Servais, P. The internationalization of born globals: An evolutionary process? Int. Bus. Rev. 1997, 6, 561–583. [Google Scholar] [CrossRef]

- Acedo, F.; Jones, M.V. Speed of internationalization and entrepreneurial cognition: Insights and a comparison between international new ventures, exporters and domestic firms. J. World Bus. 2007, 42, 236–252. [Google Scholar] [CrossRef]

- Zucchella, A.; Danicolia, S.; Palamara, G. The drivers of the early internationalization of the firm. J. World Bus. 2007, 42, 268–280. [Google Scholar] [CrossRef]

- Knight, G.A.; Cavusgil, T.S. The Born Global Firm: A Challenge to Traditional Internationalization Theory. In Export Internationalizing Research—Enrichment and Challenges. Advances in International Marketing; Cavusgil, S.T., Madsen, T.K., Eds.; JAI Press: New York, NY, USA, 1996; Volume 8, pp. 11–26. [Google Scholar]

- Rhee, J.; Park, T. Born global: Effects of international orientation and network on international intensity. Korean Ventur. Manag. Rev. 2009, 12, 1–26. [Google Scholar]

- Lee, H.Y.; Park, G.S. An empirical study on technology characteristics and international performance in born-globals in accordance with CEOs’ international experience. J. Int. Trade Commer. 2013, 9, 237–261. [Google Scholar] [CrossRef]

- Moen, O. The born globals: A new generation of small European exporters. Int. Mark. Rev. 2002, 19, 156–175. [Google Scholar] [CrossRef]

- Sharma, D.D.; Blomstermo, D. The internationalization process of born globals: A network view. Int. Bus. Rev. 2003, 12, 739–753. [Google Scholar] [CrossRef]

- Chetty, S.K.; Campbell-Hunt, C. A strategic approach to internationalisation: A traditional versus a born-global approach. J. Int. Mark. 2004, 12, 57–81. [Google Scholar] [CrossRef]

- Bailetti, T. Technology entrepreneurship: Overview, definition, and distinctive aspects. Technol. Innov. Manag. Rev. 2012, 2, 5. [Google Scholar]

- Bloodgood, J.M.; Sapienza, H.J.; Almeida, J.G. The internationalization of new high-potential U.S. ventures: Antecedents and outcomes. Entrep. Theory Pract. 1996, 20, 61–76. [Google Scholar]

- McGuinness, N.W.; Little, B. The impact of R&D spending on the foreign sales of new Canadian industrial products. Res. Policy 1991, 10, 78–98. [Google Scholar]

- Onetti, A.; Zucchella, A.; Jones, M.V.; McDougall-Covin, P.P. Internationalization, innovation and entrepreneurship: Business models for new technology-based firms. J. Manag. Gov. 2012, 16, 337–368. [Google Scholar] [CrossRef]

- Madsen, T.K. Early and rapidly internationalizing ventures: Similarities and differences between classifications based on the original international new venture and born global literatures. J. Int. Entrep. 2013, 11, 65–79. [Google Scholar] [CrossRef]

- Tyebjee, T.T. Internationalization of high-tech firms: Initial vs. extended involvement. J. Glob. Mark. 1995, 7, 59–81. [Google Scholar] [CrossRef]

- Shrader, R.C. Collaboration and performance in foreign markets: The case of young high-technology manufacturing firms. Acad. Manag. J. 2001, 44, 45–60. [Google Scholar] [CrossRef]

- Tanev, S. Global from the start: The characteristics of born-global firms in the technology sector. Technol. Innov. Manag. Rev. 2012, 2, 5. [Google Scholar]

- Gabrielsson, M.; Gabrielsson, P.; Dimitratos, P. International entrepreneurial culture and growth of international new ventures. Manag. Int. Rev. 2014, 54, 445–471. [Google Scholar] [CrossRef]

- Kandasaami, S.; Huang, X. International Marketing Strategy of SMEs: A Comparison of Born-Global vs. Non Born-Global Firms in Australia. In Proceedings of the ICSB Conference, Brisbane, Australia, 7–10 June 2000.

- Barbat, V.; Hlady Rispal, M.; Randerson, K. Disentangling the roles of international entrepreneurial orientation and networking in the internationalisation process of SESBs. Int. J. Entrep. Small Bus. 2014, 23, 363–384. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. International Entrepreneurship: The Current Status of the Field and Future Research Agenda. In Strategic Entrepreneurship: Creating a New Mind-Set; Hitt, M., Ireland, D., Sexton, D., Camp, M., Eds.; Blackwell Publishers: Oxford, UK, 2002; pp. 255–288. [Google Scholar]

- Rasmussen, E.; Madsen, T.K.; Evangelista, F. The founding of the Born Global Company in Denmark and Australia: Sense-making and networking. Asia Pac. J. Mark. Logist. 2001, 13, 75–107. [Google Scholar] [CrossRef]

- Kuemmerle, W. Home base and knowledge management in international new ventures. J. Bus. Ventur. 2002, 17, 99–122. [Google Scholar] [CrossRef]

- Sala, D.; Yalcin, E. Export experience of managers and the internationalisation of firms. World Econ. 2015, 38, 1064–1089. [Google Scholar] [CrossRef]

- Reuber, R.A.; Fischer, E. The influence of top management team’s international experience on the internationalization behaviors of SMEs. J. Int. Bus. Stud. 1997, 28, 807–825. [Google Scholar] [CrossRef]

- Johanson, J.; Mattsson, L. Internationalization in Industrial Systems: A Network Approach. In Strategies for Global Competition; Hood, N., Ed.; Croom Helm: London, UK, 1988; pp. 287–314. [Google Scholar]

- Melén Hånell, S.; Rovira Nordman, E.; Deo Sharma, D. The continued internationalisation of an international new venture. Eur. Bus. Rev. 2014, 26, 471–490. [Google Scholar] [CrossRef]

- Luostarinen, R.; Gabrielsson, M. Finnish Perspectives of International Entrepreneurship. In Handbook of Research on International Entrepreneurship; Dana, L.P., Ed.; Edward Elgar: Cheltenham, UK, 2004; pp. 383–403. [Google Scholar]

- Preece, S.B.; Miles, G.; Baetz, M.C. Explaining the international intensity and global diversity of early-stage technology-based firms. J. Bus. Ventur. 1998, 14, 259–281. [Google Scholar] [CrossRef]

- Harvestion, P.D. Synoptic Versus Incremental Internationalization: An Examination of ‘Born Global’ and ‘Gradual Globalizing’ Firms. Unpublished Thesis, University of Memphis, Memphis, TN, USA, 2000. [Google Scholar]

- Nummela, N.; Saarenketo, S.; Puumalainen, K. Global mindset—A prerequisite for successful internationalization? Can. J. Adm. Sci. 2004, 21, 51–64. [Google Scholar] [CrossRef]

- Kaplowitz, M.C.; Hadlock, T.D.; Levine, R. A comparison of web and mail survey response rates. Public Opin. Q. 2004, 68, 94–101. [Google Scholar] [CrossRef]

- Zahra, S.A.; Korri, J.S.; Yu, J. Cognition and international entrepreneurship: Implications for research on international opportunity recognition and exploitation. Int. Bus. Rev. 2005, 14, 129–146. [Google Scholar] [CrossRef]

- Oviatt, B.M.; McDougall, P.P. A Framework for Understanding Accelerated International Entrepreneurship. In Research in Global Strategic Management: International Entrepreneurship; Rugman, A.M., Wright, R.W., Eds.; JAI Press: Stamford, CT, USA, 1999; pp. 23–40. [Google Scholar]

- Bloodgood, J.M. Venture adolescence: Internationalization and performance Implications of Maturation. Int. J. Entrep. Behav. Res. 2006, 12, 67–84. [Google Scholar] [CrossRef]

- Kuivalainen, D.; Sundqvist, S.; Servais, P. Firms’ degree of born-globalness, international entrepreneurial orientation and export performance. J. World Bus. 2007, 42, 253–267. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; Organ, D.W. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 531–544. [Google Scholar] [CrossRef]

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1997, 14, 396–402. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Baumgartner, H. The Evaluation of Structural Equation Models and Hypothesis Testing. In Principles of Marketing Research; Bagozzi, R., Ed.; Mass Blackwell: Cambridge, UK, 1994; pp. 386–422. [Google Scholar]

- Joreskog, K.G.; Sorbom, D. LISREL V, Analysis of Linear Structural Relationships by Maximum Likelihood and Least Squares Methods; University of Uppsala: Uppsala, Sweden, 1981. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. On the evaluation of structural equation models. J. Acad. Mark. Sci. 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Kumar, N.; Siddharthan, N.S. Technology, Market. Structure and Internationalization: Issues and Policies for Developing Countries; Routledge: Abingdon-on-Thames, UK, 2013. [Google Scholar]

- Al-Hyari, K.; Al-Weshah, G.; Alnsour, M. Barriers to internationalisation in SMEs: Evidence from Jordan. Mark. Intell. Plan. 2012, 30, 188–211. [Google Scholar] [CrossRef]

- Lee, H.O.; Park, J.S.; Choi, Y.J. Motives and strategies behind born-globals’ internationalization: Cases from the culture and contents industry. Int. Manag. Res. 2007, 18, 103–139. [Google Scholar]

| Scale | Mean | S.D. | Cross-Construct Correlations | |||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |||

| (1) | 2.3006 | 0.99317 | 1 | |||||

| (2) | 2.6648 | 0.91214 | 0.309 ** | 1 | ||||

| (3) | 3.3052 | 0.91033 | 0.444 ** | 0.404 ** | 1 | |||

| (4) | 2.3911 | 0.89275 | 0.640 ** | 0.504 ** | 0.419 ** | 1 | ||

| (5) | 3.1475 | 1.05869 | 0.508 ** | 0.227 ** | 0.276 ** | 0.402 ** | 1 | |

| (6) | 2.4588 | 0.95827 | 0.646 ** | 0.295 ** | 0.371 ** | 0.575 ** | 0.421 ** | 1 |

| Cronbach’s α | 0.874 | 0.812 | 0.872 | 0.905 | 0.952 | 0.918 | ||

| Construct Reliability | 0.852 | 0.807 | 0.881 | 0.968 | 0.910 | 0.930 | ||

| AVE | 0.596 | 0.512 | 0.598 | 0.858 | 0.719 | 0.729 | ||

| Goodness-of-fit statistics | χ2 = 830.283 (df = 309), χ2/df = 2.687, RMR = 0.051, GFI = 0.921, AGFI = 0.902, NFI = 0.919, CFI = 0.943, TLI = 0.922, RMSEA = 0.055 | |||||||

| Path | Estimate | C.R * | p-Value |

|---|---|---|---|

| Direct Effects | |||

| Technological Capacity → Internationalisation | 0.297 | 4.122 | 0.000 |

| Technological Imitation → Internationalisation | −0.199 | −2.000 | 0.043 |

| Technological Innovation → Internationalisation | 0.239 | 4.819 | 0.000 |

| Technological Standardisation → Internationalisation | 0.147 | 2.133 | 0.033 |

| Technological Capacity → Global orientation | 0.215 | 2.385 | 0.017 |

| Technological Imitation → Global orientation | −0.117 | −1.989 | 0.048 |

| Technological Innovation → Global orientation | 0.425 | 4.662 | 0.000 |

| Technological Standardisation → Global orientation | 0.318 | 4.886 | 0.000 |

| Global orientation → Internationalisation | 0.505 | 9.385 | 0.000 |

| Indirect Effects | |||

| Technological Capacity → Global orientation → Internationalisation | 0.122 | 0.035 | |

| Technological Imitation → Global orientation → Internationalisation | 0.146 | 0.027 | |

| Technological Innovation → Global orientation → Internationalisation | 0.176 | 0.010 | |

| Technological Standardisation → Global orientation → Internationalisation | 0.232 | 0.010 | |

| Goodness-of-fit statistics | |||

| χ2 = 847.241 (df = 309); χ2/df = 2.742; RMR = 0.051; GFI = 0.921; AGFI = 0.901; NFI = 0.918; CFI = 0.943; TLI = 0.922; RMSEA = 0.053 | |||

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yoon, J.; Kim, D.-s. Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures. Sustainability 2016, 8, 1254. https://doi.org/10.3390/su8121254

Yoon J, Kim D-s. Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures. Sustainability. 2016; 8(12):1254. https://doi.org/10.3390/su8121254

Chicago/Turabian StyleYoon, Junghyun, and Dae-su Kim. 2016. "Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures" Sustainability 8, no. 12: 1254. https://doi.org/10.3390/su8121254

APA StyleYoon, J., & Kim, D.-s. (2016). Empirical Relationships among Technological Characteristics, Global Orientation, and Internationalisation of South Korean New Ventures. Sustainability, 8(12), 1254. https://doi.org/10.3390/su8121254