1 Introduction

China is one of the largest contributors to global carbon emissions, and it is currently facing ever-increasing pressure by the international community to reduce these emissions. At the Asia-Pacific Economic Cooperation (APEC) meeting in 2014, Xi Jinping, the General Secretary of the Communist Party of China, announced China’s emission reduction goal of reaching peak carbon dioxide emissions in approximately 2030. People are wondering whether China can carry out this commitment. To answer this question, it is crucial to predict China’s future energy consumption and carbon emission trends.

Studies on the trends of energy consumption and carbon emissions in different nations are becoming more numerous because of climate change. In terms of methods, studies that predict energy consumption and carbon emissions fall into several categories [

1,

2]. The first category includes studies based on traditional econometric methods, such as time series analyses, regression analyses, autoregressive integrated moving average (ARIMA) models, etc. Specifically, Parajuli et al. [

3] constructed a simple log-linear model on future energy consumption in Nepal using an econometric method, and Aydin [

1] predicted Turkey’s energy consumption according to the population and a gross domestic product (GDP)-based regression analysis model. Auffhammer and Carson [

4] studied China’s CO

2 emissions using province-level information with results rejecting the static EKC specification. Yuan et al. [

5] analyzed future energy consumption under different development scenarios in China using the Kaya formula; the results suggested that China’s energy consumption peak will occur between 2035 and 2040 at 5.2–5.4 billion tons of standard coal, whereas carbon dioxide emission will peak between 2030 and 2035 at 9.2–9.4 billion tons of CO

2. The second category of studies includes those that are based on non-numerical simulations conducted by artificial intelligence software, such as fuzzy logic, genetic algorithms, neural networks, support vector machines, ant colony algorithms and particle swarm optimization algorithms. Specifically, Uzlu et al. [

6] predicted Turkey’s energy consumption using the artificial neural network method; Ekonomou [

7] estimated Greece’s energy consumption in 2012 and 2015 by training a multilayer perceptron model with actual energy consumption data; and Ceylan and Ozturk [

8] used a genetic algorithm to predict Turkey’s energy consumption through 2025 based on gross national product (GNP), population, and import and export data. In addition to the above two categories, coherent models of the dynamic mechanisms involved in the relationship between economics, energy and emissions can be constructed to conduct comprehensive assessments of the driving force of energy consumption and economic impacts of emissions control, which leads to the third category of computable economics modeling to analyze energy consumption and carbon emissions. Specifically, Wing and Eckaus [

9] estimated energy consumption and carbon emissions in the United States through 2050 using computable general equilibrium (CGE) modeling. Wang Zheng et al. [

10] comprehensively assessed China’s future carbon emissions and energy consumption according to energy consumption, cement production and forest carbon sinks under an optimal economic growth trajectory and found that the energy consumption will experience a carbon peak of 2.6 GtC (Gigatonnes of Carbon) in 2031. Vaillancourt et al. [

11] constructed a multi-regional TIMES-Canada model to calculate the energy consumption trend in Canada through 2050, and the results showed that Canada’s energy consumption in 2050 will have increased by 43% compared with the 2007 level.

Although studies based on econometric modeling have revealed dynamic relationships between economic growth, energy consumption, and emissions, it is also important to examine micro-level contributions. To this end, agent-based modeling (ABM) has been widely applied in recent works on environmental policy simulations [

12,

13,

14,

15,

16]. Unlike the traditional top-down method, ABM takes a bottom-up approach and focuses on agents’ heterogeneities and interactions that lead to the evolution of the system [

17].

Because of the direct interaction among individuals’ behavior and energy consumption, ABM has been adopted as an important means of studying electricity and energy saving. Azar, Menassa [

18] researched the occupant agent impact on building’s energy saving. De Hann et al. [

19] used an agent-based model to study consumers’ decisions to buy energy-efficient cars. Lin et al. [

20] developed an agent-based model to simulate electricity consumption in an office building.

Agent-based modeling is also widely used to study carbon trading. Chappin [

21] used it to model the influence of CO

2 trading in the EU on investments in Dutch electricity generation. Tang et al. [

22] explored the carbon emission trading scheme in China with an agent-based model. Zhu et al. [

23] simulated the global carbon trading system as well as impacts from various trading mechanisms. These studies point to the utility of agent-based simulations in modeling heterogeneous entities, complex behavior interactions, macro-pattern evolution, multi-hierarchical issues, etc. However, agent-based simulation is rarely used to predict national, industrial, and sectoral energy consumption and carbon emissions.

In our study, which projects China’s energy consumption and emission peaks at multiple levels, the driving force of micro-level enterprises cannot be ignored. Micro-level enterprises not only drive the demand for energy consumption, which in turn results in carbon emissions, but also drive the evolution of energy and economic systems through technological change. Meanwhile, neoclassical macro-economic models are generally used for macro-level projections, but they ignore how industries and sectors will reach their energy consumption and carbon emission peaks. Micro-level, heterogeneous enterprises are best represented as a bottom-up system, which lends itself well to agent-based simulation modeling. For this reason, we will use micro-level heterogeneous enterprises as the basis for agent-based simulations to study future energy consumption and emissions in China. With this modeling method, we can figure out energy consumption and emissions not only at the macro level, but also at lower levels.

In this paper, the model developed by Lorentz and Savona [

24,

25] and Gong Yi et al. [

26], which incorporates agent-based simulation with an input-output model, will be expanded to forecast China’s energy consumption and carbon emissions through the year 2050. The intent is to see whether China can reach the target of peaking emissions at different levels.

We describe the model in

Section 2. In

Section 3 we introduce the data that we use for the model. In

Section 4 we analyze and compare the future energy consumption peak and carbon emission peak in China at multiple levels. We end with discussions and conclusions in

Section 5.

3. Data Processing

The 2000 input-output (IO) table of China, which is a 17-sector IO table, is taken as the basis for the initial values of parameters in the model, including intermediate consumption coefficients, final consumptions, and imports and exports data. The capital stocks, labor force, and capital elasticities at the sector level are from Xue [

27]. In addition, the exogenous growth rates of sector consumption and export are averaged from the annual growth rate from 1997 through 2010; thus, we assume that China’s economy will keep growing at its current rate.

On the micro level, there are 500 enterprises in each of the 17 sectors. Due to the limitation of computation capacity, it is impossible to establish the same number of enterprises in each sector. The usual way of handling this issue is to set up a number of agents that can reflect the real characteristics of the real entities. For example, Basu et al. [

28] established the ASPEN model simulating the US economy and set up 1000 households, 3 food firms, 2 automakers, 2 banks, etc. in which the number of each entity is not the same as in reality. Therefore, to present the sectoral attributes, the capital stock and labor force of each enterprise are averaged from the sector level at the time of initialization. In other words, enterprises from the same sector have identical initial capital stock and labor force, but initial capital stock and labor force vary across sectors. The initial energy intensity and energy consumption structure of each enterprise are identical to those of the sector level, which are deduced from the China Energy Statistical Yearbook 2000 [

29]. Though enterprises have the same initial capital stock, labor force and other endowments, the enterprises’ innovation activities, which are influenced by a random shock as shown in Equation (22), will drive the different changes in such parameters, leading to the heterogeneity among enterprises.

4. Simulation Analyses

In the model, the enterprise’s innovation is impacted by normally distributed random impacts; therefore, the results of each simulation vary slightly. To fully consider the random impacts on the results, we simulated the model 50 times, and we analyzed the corresponding results of the 50 simulations using variance analyses and statistical tests of the differences between results. The p-values of the variance analysis were 1, indicating that the inter-group data showed no significant differences. Therefore, the average of the 50 sets of data can be used as representative results in the following analysis.

4.1. Model Verification

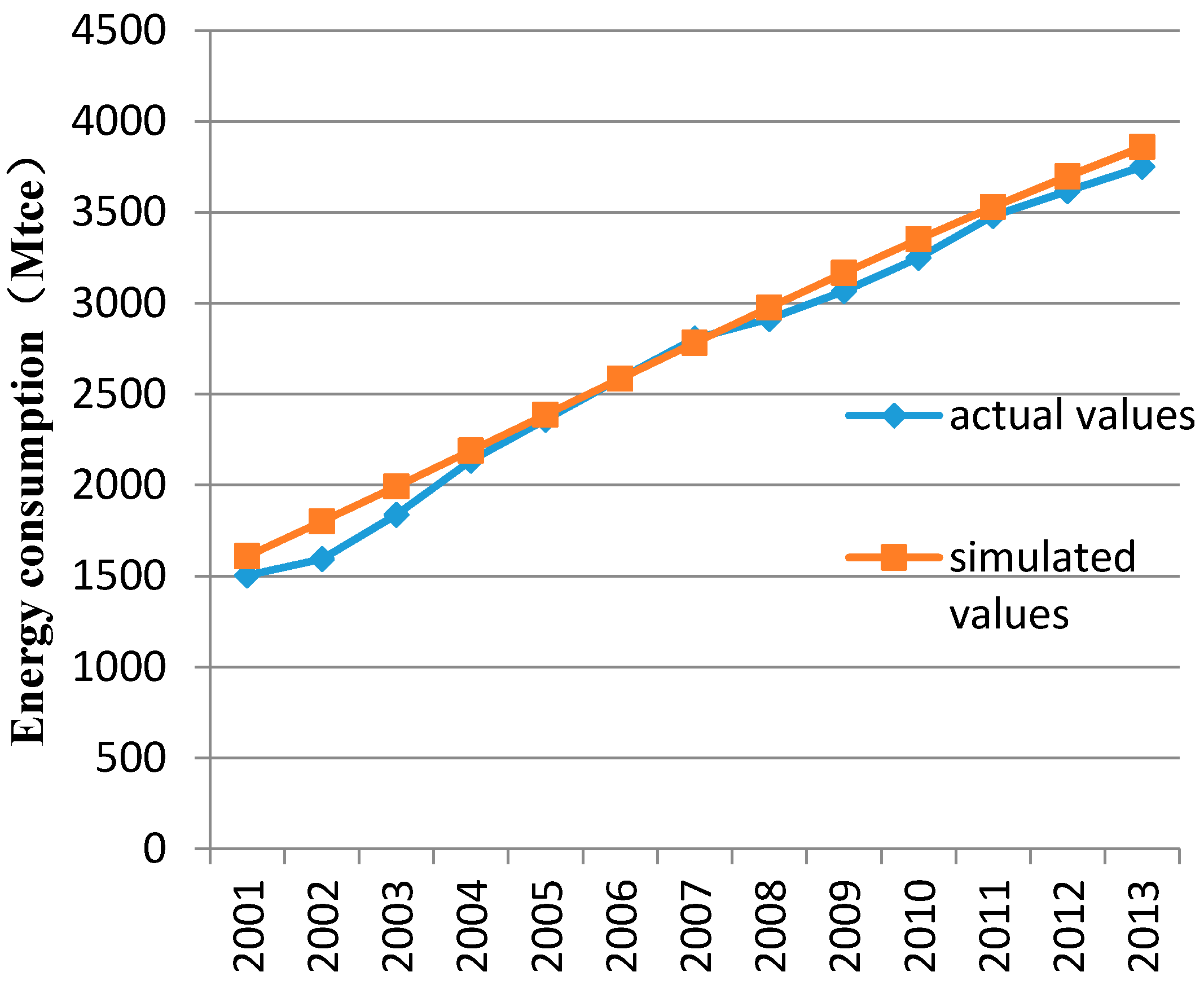

Before we estimated future energy consumption, we verified the reliability of the simulation results to determine whether the simulation reflects actual conditions; thus, the total energy consumption from 2001 to 2013 was simulated and compared with actual data. The results appear in

Figure 3. The actual and simulated values are consistent and have a correlation coefficient of 0.99 and an analysis of variance (ANOVA) significance of 0.79. These results indicate that the simulation values accurately reflect the historical trajectories of energy consumption. They also suggest that the models are reliable and suitable for further studies on trends in energy consumption that are based on an evolutionary perspective, though they do not consider the possibility of abrupt technological changes.

With the energy consumption projections, we can further analyze future carbon emissions. First, the 2001–2010 carbon emissions obtained by the simulation were calibrated with actual observation values (data obtained from the Carbon Dioxide Information Analysis Center, CDIAC, Oak Ridge, TN, USA). The results appear in

Figure 4. The correlation coefficient between the actual values and simulated values is 0.99, with a variance test significance of 0.22; this indicates that there is no significant difference between the two data sets, and the model can reproduce the historical trajectories of the emissions. However, compared with the simulation on energy consumption, the simulation on carbon emissions shows a bigger simulation error when compared to actual data from 2001 to 2010. This error can be explained by the fit of the energy structure transfer matrix, which is an average of the status of the historical energy consumption from 1991 to 2011 by Markov chain. Over the last several years, the proportion of coal in the energy consumption structures of the agricultural and industrial sectors has been increasing, which is difficult to reflect in the Markov fitting; thus, it caused discrepancies in the energy structure that led to differences between the simulated carbon emissions and actual values.

4.2. Projections at the National Level

With the development of the economy and technological change driven by firms’ innovation, energy consumption and carbon emissions can be projected from the model.

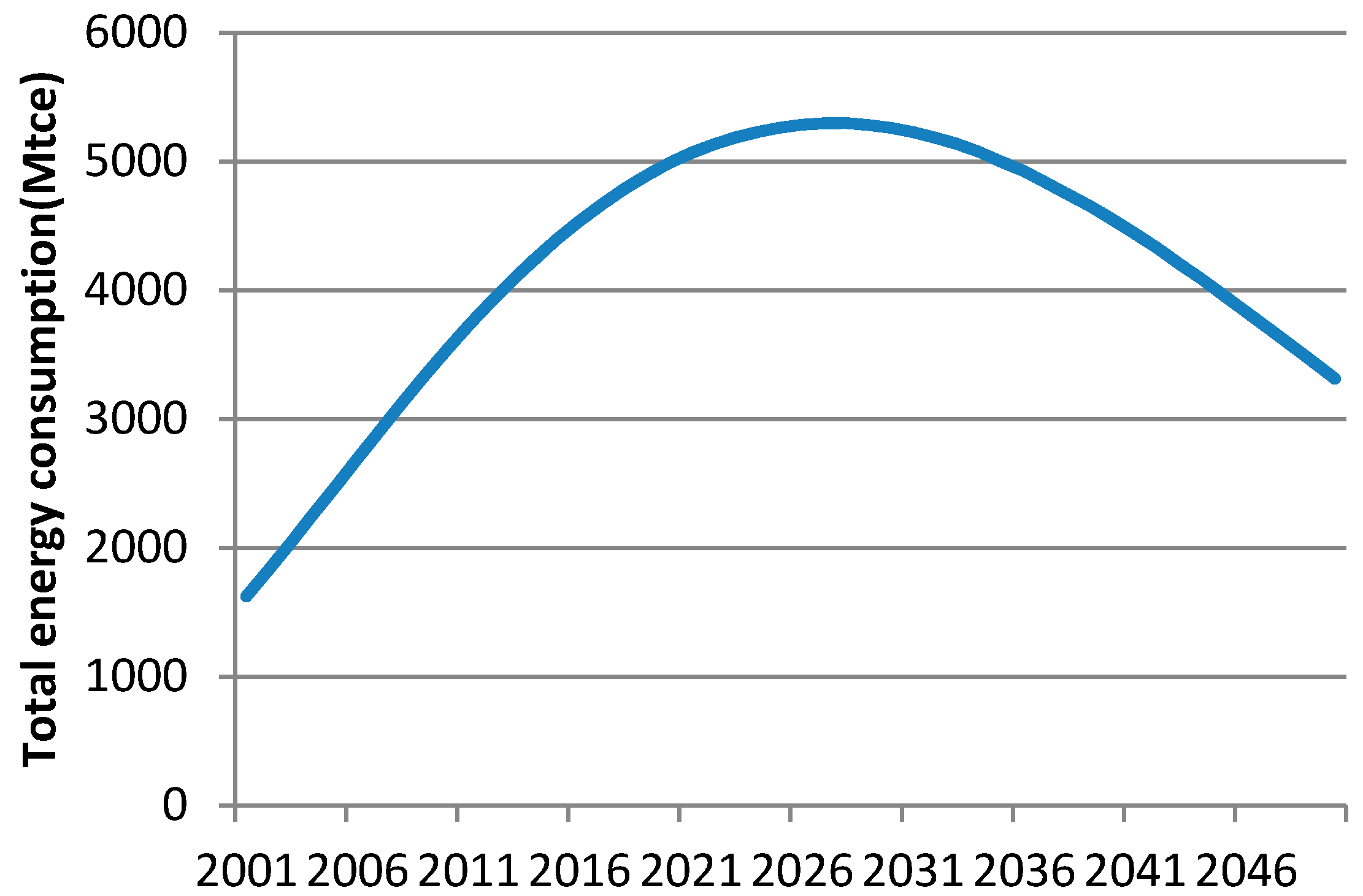

Figure 5 shows the simulated trend of China’s energy consumption by 2050. Overall, it exhibits a trend of initial increases and then decreases. Energy consumption will peak in 2028 at 5295 Mtce (mega tonnes of coal equivalent), which is a 1.6-fold increase over the 2010 amount (3249 Mtce). Thereafter, the total energy consumption decreases yearly and will be approximately 3314 Mtce in 2050. We also calculated the annual energy consumption intensity per unit GDP by 2050. Results show that the simulated energy consumption intensity per unit GDP in China in 2010 is about 123 tce per million yuan. It will gradually decrease to 62.2 tce per million yuan in 2030 and 21.8 tce per million yuan in 2050. The averaged decline rate is about 3.8%.

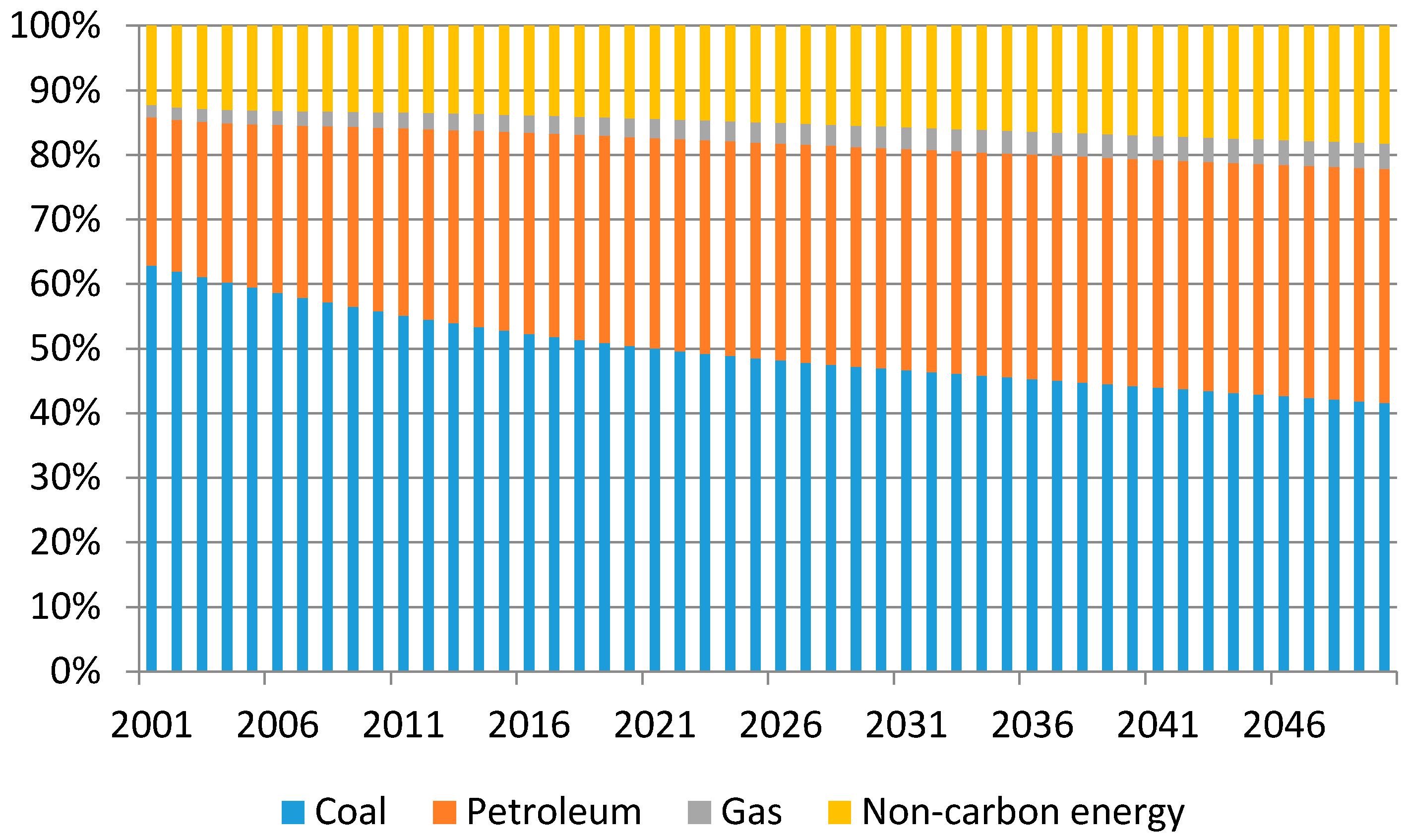

Figure 6 shows trends in the sources of China’s energy by 2050. China’s sources of energy will change dramatically: the proportion of coal consumption will continue to decline from 62.9% in 2001 to approximately 41.2% in 2050; the proportion of petroleum consumption will increase slightly from 23% in 2001 to 36.7% in 2050; the proportion of natural gas will still be low, accounting for only 3.6% in 2050, but this is significantly more than the 2001 proportion of 1.9%; and the proportion of non-carbon energy consumption will grow to 18.4%.

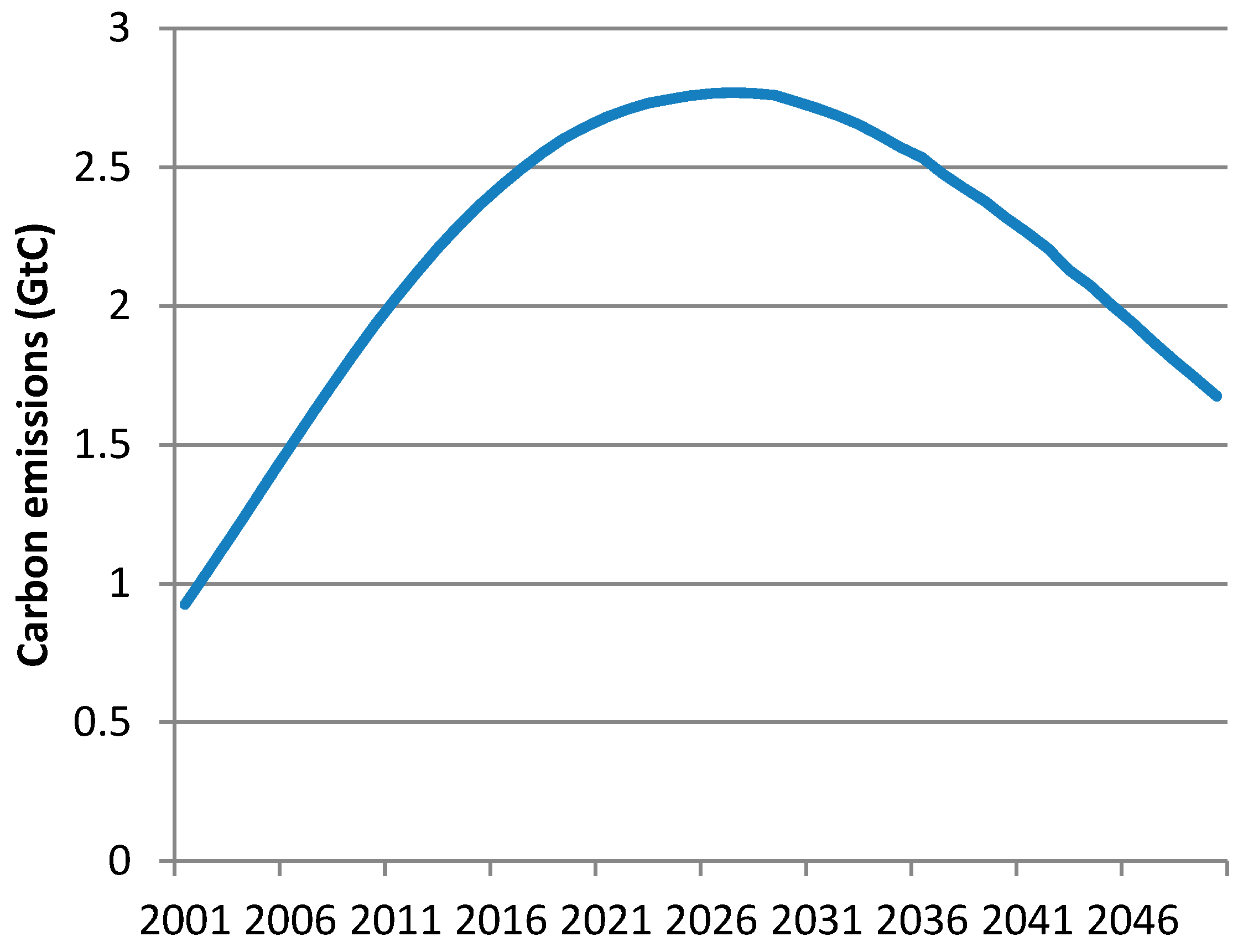

Based on the calculations of economic growth and energy consumption, the trend of China’s carbon emissions by 2050 is obtained and shown in

Figure 7. Carbon emissions will peak in 2027 at 2.77 GtC and then decline yearly until a value of 1.66 GtC is reached in 2050, a value that is almost equal to the 2005 level (1.58 GtC). Therefore, at the macro level, China’s peak emission year is around 2030, even a little bit earlier than 2030, meeting the INDC commitment China made at the 2015 Paris Climate Change Conference.

To provide a framework for comparison,

Table 1 shows the carbon emissions peaks from other studies, as well as the methodology used in each study. Results show that most proposed emission peak years are between 2025 and 2040. The prediction presented in this study falls into the previously reported ranges.

4.3. Projections at the Industrial Level

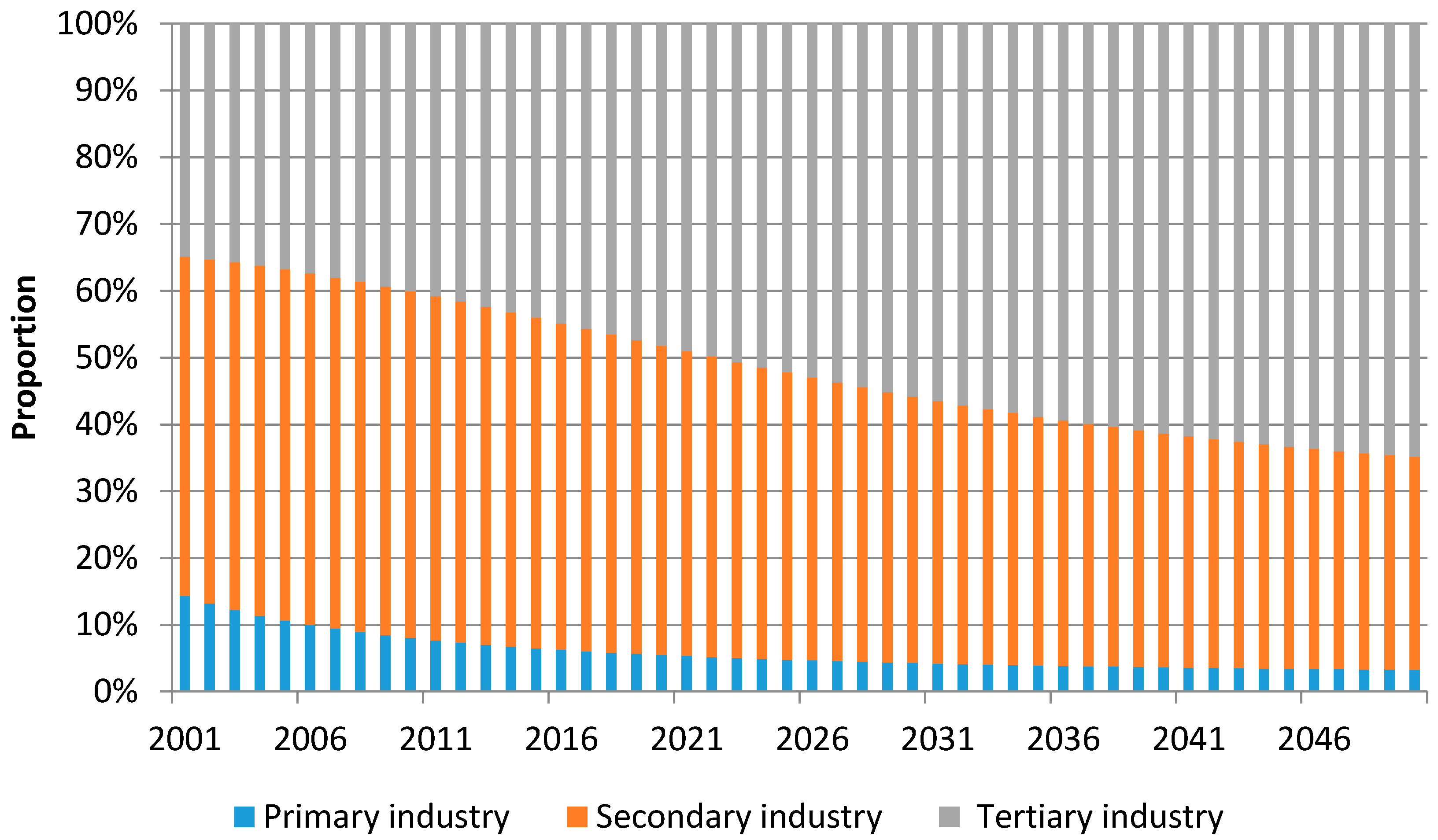

R&D activities on the micro level can lead to a new intermediate coefficient matrix on the macro level, so that the industrial structure keeps evolving. Considering the three major industries (the primary industry, the secondary industry and the tertiary industry), we can obtain the proportion of each industry’s gross value added in GDP by summarizing the value added of each firm in the corresponding industry.

Figure 8 shows changes in the proportions of China’s three major industries through 2050, reflecting the future evolution of industrial structures change in China. The proportions of the primary and secondary industries assume gradually decreasing trends, whereas the proportion of the tertiary industry assumes an increasing trend. By 2050, the proportions of the three major industries will be 3.3%, 31.7%, and 65%.

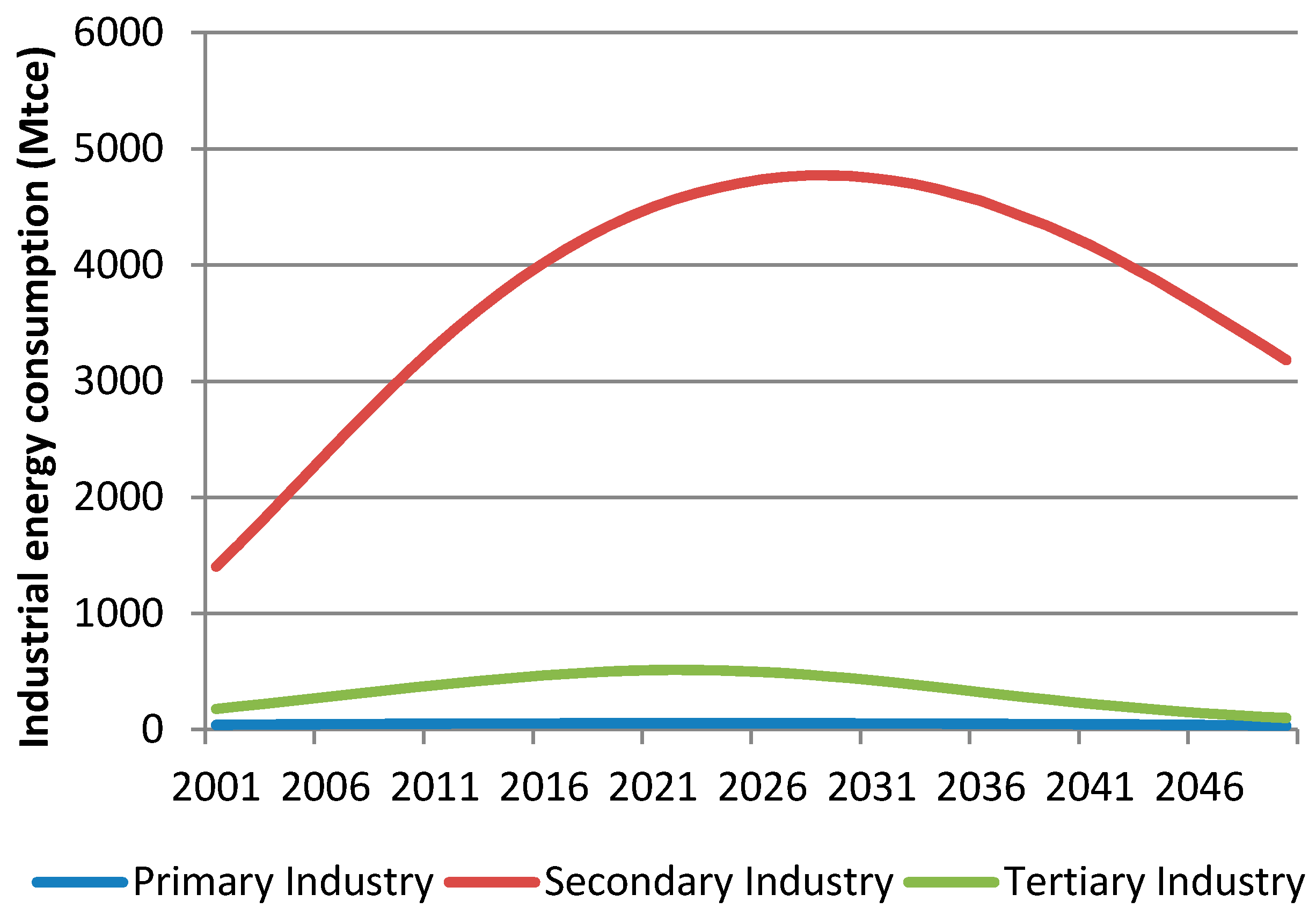

Due to the significant changes in China’s industrial structure, we are concerned about future energy consumption and carbon emissions at the industrial level.

Figure 9 shows that industrial energy consumption also peaks by 2050. However, the peak year varies by industry. Specifically, the tertiary industry will experience its peak year in 2022, earlier than the other two industries, followed by the primary industry in 2023, while the secondary industry will have the latest peak year of energy consumption in 2029. It is obvious that due to energy intensive production in the secondary industry, its peak energy consumption is much later than the other two industries’ and even two years later than the national energy consumption peak. The peak energy consumption for the primary, secondary, and tertiary industries will be 53.71, 4770.95, and 512.87 Mtce, respectively. These results indicate remarkably high energy consumption in the secondary industry.

Moreover, because of differences in the production processes and technology levels in each of the major industries, the consumption structures of each of the energy sources also show differences.

Table 2 shows the simulated energy consumption structures for each of the energy sources by 2050. The energy consumption of the primary industry is mainly non-carbon-based energy, which accounts for approximately 23.01%; the energy consumption of the secondary industry is mainly coal, which accounts for approximately 35.55%, with the highest consumption occurring in the machinery and equipment manufacturing sector; the energy consumption of the tertiary industry is mainly petroleum, which accounts for approximately 66.66%. Tertiary industries have a lower proportion of non-carbon energy consumption than primary or secondary industries. This is because the proportion of transportation and postal services accounts for only 3.3% of this sector (although the proportions of non-carbon energy consumption by all sectors except for transportation and postal services will reach approximately 34% in 2050). Thus, the overall proportion of the tertiary industry’s non-carbon energy consumption falls to merely 13.87%.

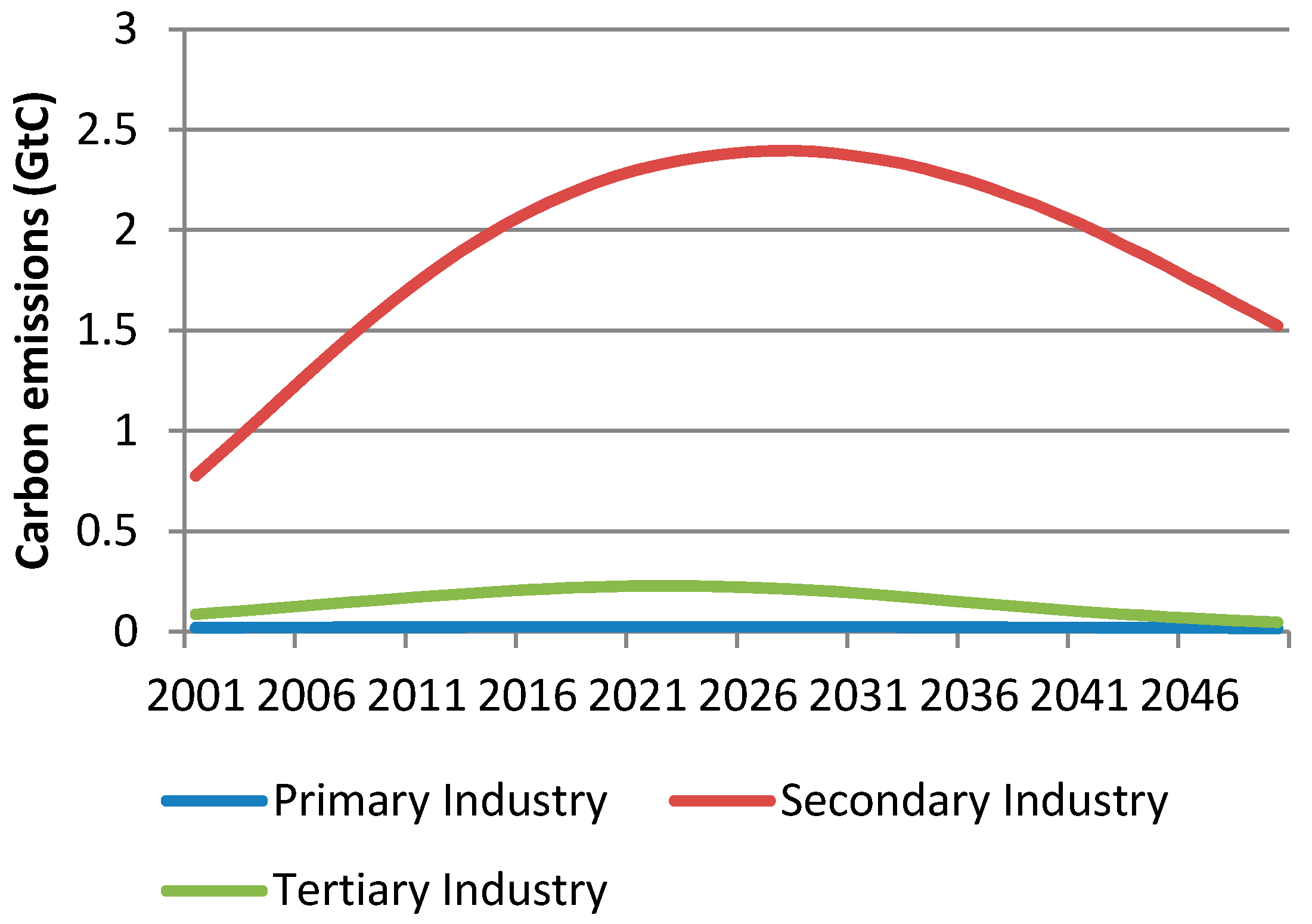

In addition to forecasting energy consumption forecasting, we also project carbon emissions at the industrial level.

Figure 10 shows the results. The secondary industry continues to contribute most in China’s total emission through 2050. In 2027, the peak year of national emissions, emissions from the secondary industry account for 90% of the total due to the high proportion of fossil fuel consumption in this industry. With the influence of tremendous energy consumption, the secondary industry would reach its peak emission year in 2028 with emissions of 2.40 GtC, much later than the other two industries. The primary industry and the tertiary industry will reach their emission peaks together in 2022, with emissions of 0.024 GtC and 0.23 GtC, respectively.

4.4. Projections at the Sectoral Level

Section 4.3 notes the discrepancy between energy consumption trends at the industrial level and the national level; this discrepancy is also present in the carbon emission trends. Different industries have different peak years, because each industry has specific modes of production. Therefore, we examine how energy consumption and carbon emissions at the sectoral level differ from those at the national and industrial levels.

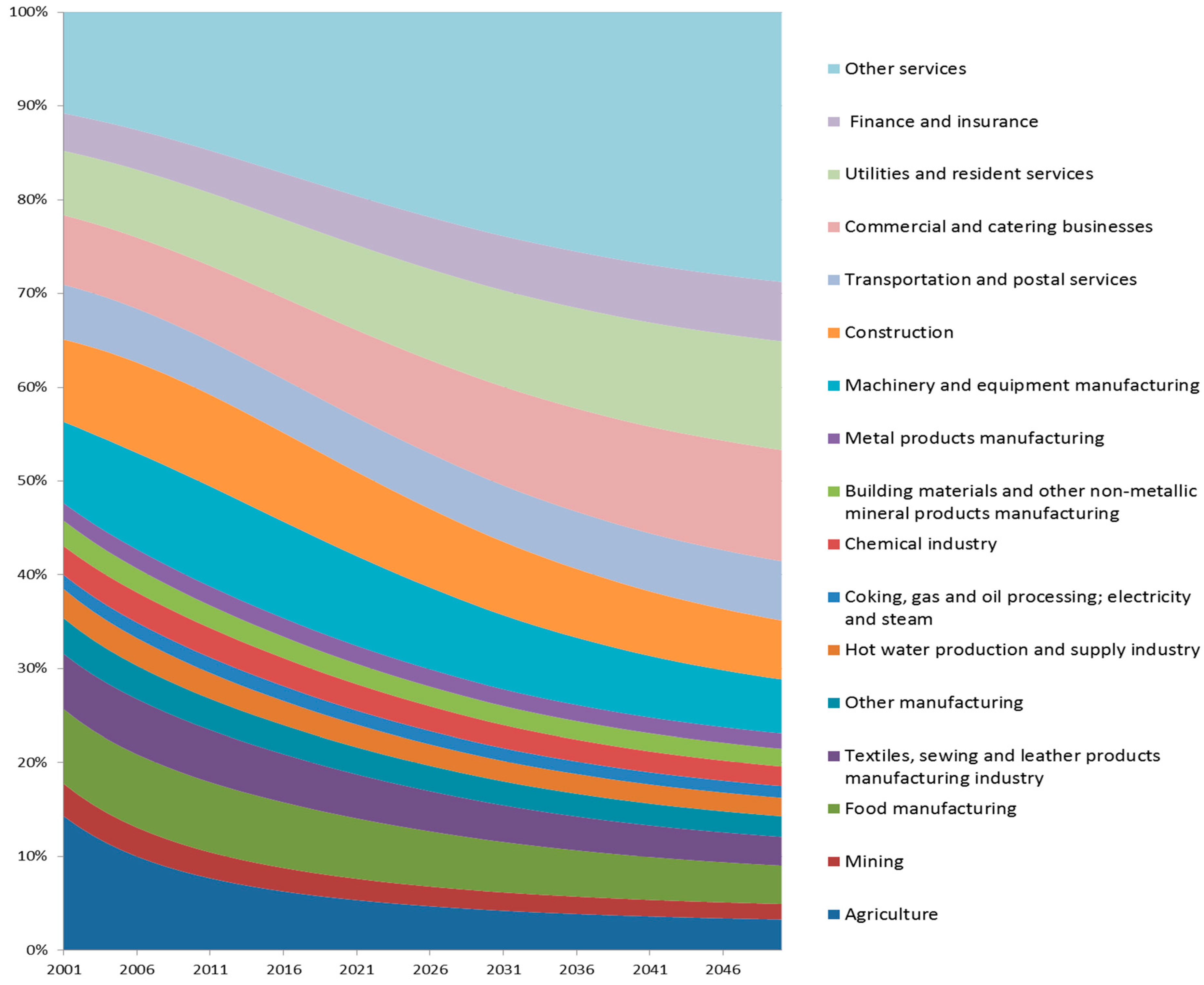

First, we explore the trend of sectoral development in China.

Figure 11 shows the change in the sectors’ proportion of the national economy through 2050.

Other services in the tertiary industry will develop rapidly in the future and account for approximately 29.5% of the sector in 2050. Simultaneously, the sectors of

finance and insurance,

utilities and residential services,

commercial and catering businesses, etc. will also expand in the tertiary industry, with increasing proportions within the total economy. The proportions of the secondary industry sectors exhibit a gradually decreasing trend, and the sectors with the highest proportions in 2050 will be

construction and

machinery and equipment manufacturing, which will account for approximately 6% of the total economy. Change in sectoral development is consistent with change at industrial level: the tertiary industry expands, and the primary and secondary industries shrink.

Meanwhile, the energy consumption and carbon emission peak years in each sector are abstracted and illustrated in

Figure 12. There is significant variation across sectors. Sectors’ peak energy consumption is between 2020 and 2034, and peak carbon emission is between 2020 and 2032. Generally speaking, the sectoral carbon emission peak years arise prior to corresponding energy peak years, which is the same phenomenon we found at the national and industrial levels. The reason is that technological change reduces consumption of fossil fuel and increases consumption of non-fossil fuel, diminishing carbon emission from energy consumption. However, sectors in the tertiary industry are exceptional. They meet energy consumption peaks and carbon emission peaks in the same year despite the discrepancy in peak years by sector.

When comparing peak years across sectors, we find that the peak years of sectors in the primary and tertiary industries are earlier than those in the secondary industry, which are all prior to 2025. The first sectors achieving energy consumption peak and carbon emission peak come from the tertiary industry, including commercial and catering businesses, utilities and resident services, and finance and insurance. In these sectors, both energy and emissions peak in 2020. In agriculture, the sole sector in the primary industry, the energy consumption peak and carbon emission peak are the same as those at the industrial level: 2023 and 2022, respectively. Energy peaks for the sectors in the secondary industry appear from 2027 to 2034, about 5 to 10 years later than those of sectors in other industries. Building materials and other non-metallic mineral products manufacturing and metal products manufacturing are the two sectors with the latest energy peak year, 2034, while the first sector to reach peak energy consumption in the secondary industry is machinery and equipment manufacturing in 2026, followed by food manufacturing and textiles, sewing and leather products manufacturing industry in 2027. Though sectoral emission peaks occur before energy consumption peaks in the secondary industry, they still occur about 5 years later than in the primary industry and tertiary industries. Food manufacturing is the first sector in the secondary industry to reach emission peak, in 2025, which is 7 years earlier than emission peak of building materials and other non-metallic mineral products manufacturing and metal products manufacturing in 2032. These two sectors are the only ones to reach emission peak later than the 2030 target.

5. Conclusions and Discussion

Enterprise can change not only intermediate consumption patterns, but also the energy consumption structure and carbon emissions through technological progress promoted by its own innovative behavior. Therefore, it is necessary to use a typical bottom-up system when considering the future emission pathway in China. In this study, a 17-sector input-output model was integrated with an agent-based simulation, in which enterprise agents’ innovation affects industrial structure and energy demand at both the micro and macro levels and ultimately affects future trends in energy consumption and carbon emissions at multiple levels. The main results are as follows.

At the national level, China’s energy consumption will peak at 5295 Mtce in approximately 2028 and then fall to 3314 Mtce by 2050. The carbon emission at the national level will peak at 2.77 GtC in 2027 and decline to 1.66 GtC by 2050. Meanwhile, the dominant source of energy will be coal, which will account for 41.2% of consumption in 2050, while the proportion of petroleum consumption in 2050 will be 36.7%. The proportion of natural gas and non-carbon energy consumption will increase to 3.6% and 18.4%, respectively, by 2050.

At the industrial level, significant structural change will occur. By 2050, the proportions of the primary, secondary, and tertiary industries will be 3.3%, 31.7%, and 65%, respectively, indicating shrinkage in the primary and secondary industries and expansion in the tertiary industry. The energy consumption peaks for the primary, secondary, and tertiary industries will be reached in 2023, 2029, and 2022, respectively; while their carbon emission peaks will occur in 2022, 2022, and 2028. The energy consumption and carbon emission peak years of the secondary industry are both later than those at the national level, revealing a pressure for the secondary industry to curb its emission induced by its heavy dependence on fossil fuel energy consumption.

At the sectoral level, sectors’ proportions in the national economy also keep changing through 2050. Other services in the tertiary industry will develop rapidly and account for the greatest proportion of approximately 29.5% in 2050. Construction and machinery and equipment manufacturing will make up the largest part of the secondary industry by 2050. Due to the evolution of sectoral development, there is a remarkable discrepancy in energy consumption and carbon emission among sectors. Sectors’ peak energy consumption occurs between 2020 and 2034, and their peak carbon emissions occurs between 2020 and 2032. The first sectors to achieve peak energy consumption and peak carbon emission come from the tertiary industry, including commercial and catering businesses, utilities and resident services, and finance and insurance, which peak in 2020 for both energy and emissions. We see 5- to 10-year and 5-year lags, respectively, for the energy consumption peaks and carbon emissions peaks of sectors in the secondary industries as compared to sectors from the other two industries. Together, building materials and other non-metallic mineral products manufacturing and metal products manufacturing will experience the latest energy consumption peak and emission peak in 2034 and 2032, respectively.

This study demonstrates that agent-based simulation, in which micro behaviors can be integrated with the evolution of macroeconomic structures, is a powerful and suitable tool to apply in the field of energy and emission forecasting. However, the model we present in this paper is still preliminary, and more research is needed to improve it. For instance, in our model, enterprises’ innovation is costless, which may not be the case in reality. The model also ignores enterprises’ knowledge accumulation, which is necessary to represent different capabilities in innovation. Finally, knowledge diffusion and spillovers should be considered in future improvements to the model.