Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China

Abstract

:1. Introduction

2. Literature Review

3. Methodology and Data Source

3.1. Total Factor Energy Efficiency (TFEE) and DEA-SBM Model

3.2. Data and Variables

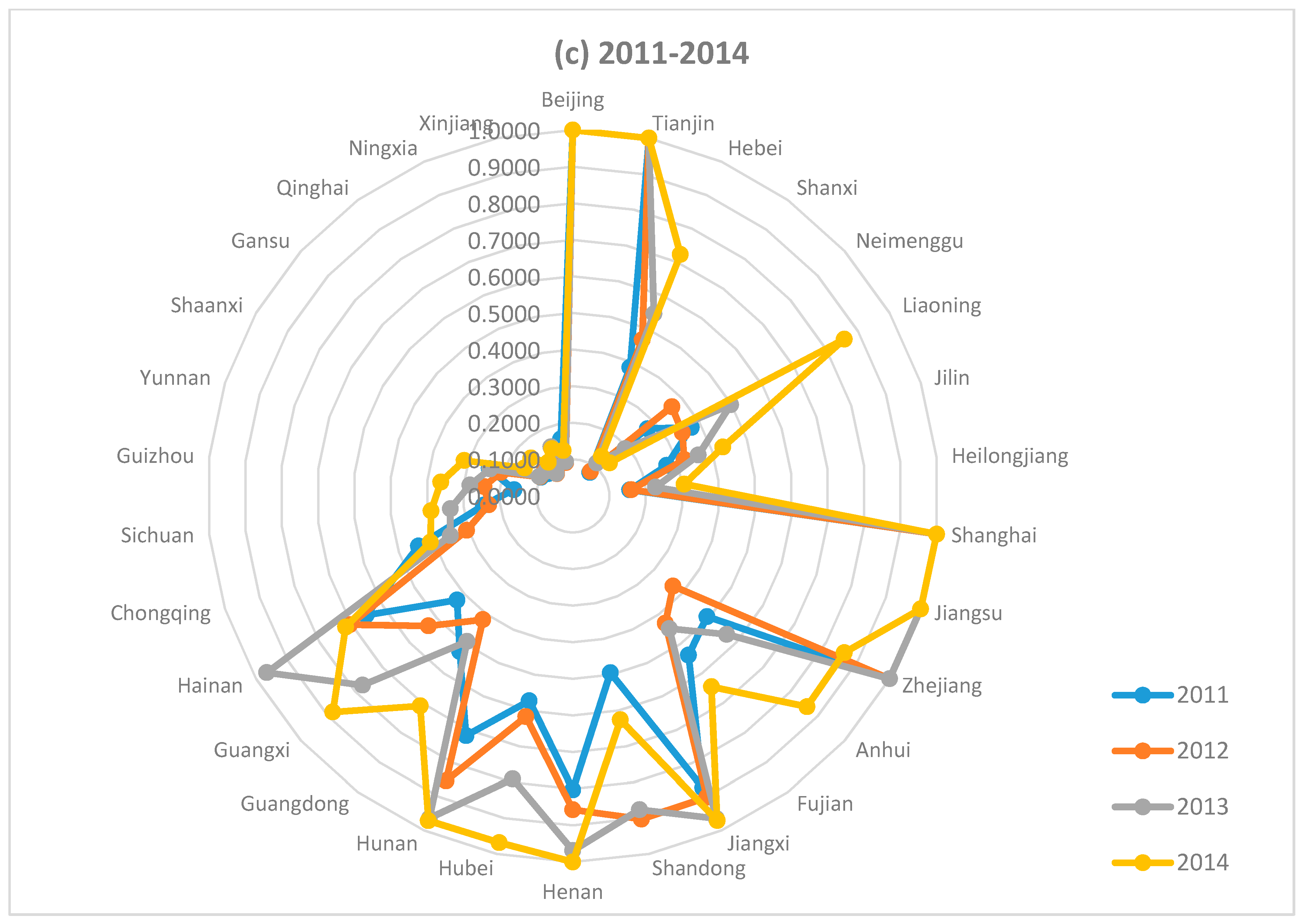

- Eastern Region: Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan.

- Northeast Region: Liaoning, Jilin, and Heilongjiang.

- Central Region: Shanxi, Anhui, Henan, Hubei, Hunan, and Jiangxi.

- Western Region: Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang.

3.3. Calculation Methodology

4. Results and Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| function DEASBM = DEA(x) |

| clc |

| clear |

| global s; |

| global m; |

| global n; |

| global X; |

| global Y; |

| global i; |

| Xp = []; |

| Yp = []; |

| G =; |

| X = Xp’; |

| Y = Yp’; |

| [m,s] = size(X); |

| [n,s] = size(Y); |

| A = [X;-Y]; |

| r0 = zeros(s,1); |

| R = zeros(s,s); |

| fval = zeros(s,1); |

| Theta = zeros(s,1); |

| for i = 1:s |

| [R(:,i),fval(i)] = fmincon(@Efficiency,r0,A,A(:,i),[],[],zeros(s,1),[]); |

| Theta(i) = (X(g,:)*R(:,i))/X(g,i); |

| End |

| Theta |

| function P = Efficiency(r) |

| global m; |

| global n; |

| global X; |

| global Y; |

| global i; |

| Input = 0; Output = 0; |

| for j = 1:m |

| Input = Input + (X(j,:)*r)/X(j,i); |

| end |

| for j = 1:n |

| Output = Output + (Y(j,:)*r)/Y(j,i); |

| end |

| P = (n*Input)/(m*Output); |

References

- State Statistical Bureau of China. China Economic Census Yearbook; China Statistic Press: Beijing, China, 2000–2015.

- State Statistical Bureau of China. China Economic Census Yearbook; China Statistic Press: Beijing, China, 2004–2015.

- Anderson, D.; Cavendish, W. Dynamic Simulation and Environmental Policy Analysis: Beyond Comparative Statics and the Environmental Kuznets Curve. Oxf. Econ. Pap. 2001, 53, 721–746. [Google Scholar] [CrossRef]

- Birol, F.; Keppler, J.H. Prices, technology development and the rebound effect. Energy Policy 2000, 28, 457–469. [Google Scholar] [CrossRef]

- Saunders, H.D. Does predicted rebound depend on distinguishing between energy and energy services? Energy Policy 2000, 28, 497–500. [Google Scholar] [CrossRef]

- Lantz, V.; Feng, Q. Assessing income, population, and technology impacts on CO2 emissions in Canada: Where’s the EKC? Ecol. Econ. 2006, 57, 229–238. [Google Scholar] [CrossRef]

- Honma, S.; Hu, J.L. Total-factor energy efficiency of regions in Japan. Energy Policy 2008, 36, 821–833. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.V.D. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Lanjouw, J.O.; Mody, A. Innovation and the international diffusion of environmentally responsive technology. Res. Policy 1996, 25, 549–571. [Google Scholar] [CrossRef]

- Mehrara, M. Energy consumption and economic growth: The case of oil exporting countries. Energy Policy 2007, 35, 2939–2945. [Google Scholar] [CrossRef]

- Pao, H.T.; Li, Y.Y.; Fu, H.C. Clean energy, non-clean energy, and economic growth in the MIST countries. Energy Policy 2014, 67, 932–942. [Google Scholar] [CrossRef]

- Lin, B.Q. Electricity consumption and economic growth of China: A study based on production function. Manag. World 2003, 12, 18–27. (In Chinese) [Google Scholar]

- Wu, Q.S.; Chen, L.; Zhang, Y.T.; Cheng, J.H. A re-examination of the relationship between energy consumption and GDP in China: An empirical analysis based on provincial panel data. J. Quant. Tech. Econ. 2008, 6, 27–40. (In Chinese) [Google Scholar]

- Fried, H.O.; Lovell, C.A.K.; Schmidt, S.S.; Yaisawarng, S. Accounting for environmental effects and statistical noise in data envelopment analysis. J. Product. Anal. 2002, 17, 157–174. [Google Scholar] [CrossRef]

- Hu, J.L.; Wang, S.C. Total-factor energy efficiency of regions in China. Energy Policy 2006, 34, 3206–3217. [Google Scholar] [CrossRef]

- Sun, G.S.; Yang, X.M.; Huang, Y. Energy efficiency of China’s industry (1987–2005): Variation trend, potential of energy saving and influencing factors. China Soft Sci. 2011, 11, 34–44. (In Chinese) [Google Scholar]

- Chen, D.M.; Zhang, R.; Tan, Z.X. Total-factor energy efficiency and China’s economic growth convergence: Empirical test based on dynamic panel data. China Popul. Resour. Environ. 2012, 1, 136–143. (In Chinese) [Google Scholar]

- Wang, M. Discussion on energy ownership reform in China. Econ. Aff. 2014, 5, 29–33. [Google Scholar]

- Charnes, A.; Cooper, W.W. Preface to topics in data envelopment analysis. Ann. Oper. Res. 1984, 2, 59–94. [Google Scholar] [CrossRef]

- Chang, M.C. A comment on the calculation of the total-factor energy efficiency (TFEE) index. Energy Policy 2013, 53, 500–504. [Google Scholar] [CrossRef]

- Zhang, J.; Xu, L.Y.; Yu, B.; Li, X.J. Environmentally feasible potential for hydropower development regarding environmental constraints. Energy Policy 2014, 73, 552–562. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Li, L.B.; Hu, J.L. Ecological total-factor energy efficiency of regions in China. Energy Policy 2012, 46, 216–224. [Google Scholar] [CrossRef]

- Huang, B.M. The research on energy efficiency, environmental constraints and the quality of economic growth in China. Dr. Diss. Jinlin Univ. China 2015, 7–10. (In Chinese) [Google Scholar]

- Hall, R.E.; Jones, C.I. Why do some countries produce so much more output per worker than others? Q. J. Econ. 1999, 1, 83–116. [Google Scholar] [CrossRef]

- Reinhard, S.; Lovell, C.A.K.; Thijssen, G.J. Environmental efficiency with multiple environmentally detrimental variables; estimated with SFA and DEA. Eur. J. Oper. Res. 2000, 121, 287–303. [Google Scholar] [CrossRef]

- Färe, R.; Grosskopf, S. Directional distance functions and slacks-based measures of efficiency. Eur. J. Oper. Res. 2010, 200, 320–322. [Google Scholar] [CrossRef]

- Chen, S.Y.; Zhang, S.J. Large-scale land use for construction and energy consumption after the new millennium with their impact on total-factor efficiency change in China’s regional economy. Energies 2014, 7, 1986–2003. [Google Scholar] [CrossRef]

- Xu, Y.S.; Qiao, B.Y. Measurement of fiscal decentralization: Theory and empirical analysis of China from 1985 to 2007. Econ. Res. J. 2012, 10, 5–14. (In Chinese) [Google Scholar]

- Feld, L.P.; Kirchgssner, G.; Huang, A.L. Fiscal policy and direct democracy: System design decisions. Academics 2014, 8, 30–55. [Google Scholar]

- Wang, L.L. Research on the audit of financial non-tax revenue collection and management under the new situation. Econ. Trade 2016, 1, 354. (In Chinese) [Google Scholar]

- Zhu, P.F.; Xu, W.M. On The Impact of Government’ s S&T Incentive Policy on the R&D input and its patent output of large and medium-sized Industrial enterprises in Shanghai. Econ. Res. J. 2003, 6, 45–53. [Google Scholar]

- Hu, H.; Li, Z.B.; Yu, Y.X. Study on the relationship between Regional R&D resources and patent output. Enterp. Econ. 2012, 1, 132–135. [Google Scholar]

- Ma, J.J.; Lu, R.; Liu, C.Y. Spatial econometric analysis on Chinese patent product efficiency. Sci. Res. Manag. 2013, 6, 99–105. [Google Scholar]

- Xu, M. Research on the elasticity relationship between patent application and R&D input factors: The empirical study on the panel data of thirty-six industries. Sci. Sci. Manag. Sci. Technol. 2016, 1, 30–37. [Google Scholar]

- Hou, B.B.; Zhou, A.N.; Li, H.X.; Zhang, Y.P.; Ma, X.; Xian, M.Y. An analysis of scientific research investment and patent output of universities based on DEA. Technol. Innov. Manag. 2016, 7, 381–385. [Google Scholar]

- The Central Committee of the Communist Party of China; The State Council of China. Several Opinions on Implementing the Strategy of Revitalizing Old Industrial Bases in Northeast Area; People’s Publishing House: Beijing, China, 2003.

- The State Council of China. Opinions of the State Council on Further Implementing the Revitalization of Old Industrial Bases in Northeast Area; People’s Publishing House: Beijing, China, 2009.

- The Central Committee of the Communist Party of China; The State Council of China. Several Opinions on the Comprehensive Revitalization of Old Industrial Bases in Northeast Area; People’s Publishing House: Beijing, China, 2016.

- State Statistical Bureau of China. China Economic Census Yearbook; China Statistic Press: Beijing, China, 2003–2005.

- General Office of Shanxi Province. Measures for the Disposal of the Resources Mining Rights Involved in the Merger and Reorganization of Coal Mining Enterprises; General Office of Shanxi Province: Taiyuan, China, 2008; Volume 83.

- Fan, Z.L.; Ma, Z.H. Thoughts on the integration of coal resources in Shanxi. West. Resour. 2010, 1, 9–11. (In Chinese) [Google Scholar]

- Gao, M.K. Analysis on the reasons for the slow construction of coal resources integration in Shanxi. Energy Energy Conserv. 2014, 7, 36–38. (In Chinese) [Google Scholar]

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eastern Provinces | Beijing | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Tianjin | 0.4706 | 0.7037 | 1.0000 | 0.4811 | 0.4457 | 0.2937 | 0.2793 | 0.2761 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| Hebei | 0.8881 | 0.9046 | 0.7618 | 0.5470 | 0.8056 | 0.9582 | 0.9742 | 0.6839 | 0.3844 | 0.4675 | 0.5453 | 0.7226 | |

| Shanghai | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| Jiangsu | 0.3442 | 0.4364 | 0.9045 | 0.9381 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| Zhejiang | 0.6373 | 0.5926 | 0.7708 | 0.9013 | 0.7244 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.8573 | |

| Fujian | 1.0000 | 0.9702 | 0.7733 | 0.5088 | 0.4612 | 0.5280 | 0.6971 | 0.5164 | 0.5381 | 0.4302 | 0.4485 | 0.6449 | |

| Shandong | 0.4004 | 0.5763 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.9404 | 0.4942 | 0.9025 | 0.8762 | 0.6260 | |

| Guangdong | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.5257 | 0.4183 | 0.4920 | 0.7099 | |

| Hainan | 0.8145 | 0.3417 | 0.1879 | 0.2623 | 0.7550 | 0.7361 | 0.7054 | 0.8168 | 0.6519 | 0.7042 | 0.9663 | 0.7171 | |

| Northeast Provinces | Liaoning | 0.6948 | 0.5578 | 0.9766 | 0.9014 | 0.9066 | 0.9637 | 0.8880 | 0.5018 | 0.3740 | 0.3457 | 0.4982 | 0.8572 |

| Jilin | 0.7006 | 0.9595 | 1.0000 | 0.8606 | 0.7649 | 0.6995 | 0.6065 | 0.3579 | 0.2701 | 0.3204 | 0.3608 | 0.4314 | |

| Heilongjiang | 1.0000 | 1.0000 | 1.0000 | 0.5021 | 0.5347 | 0.4087 | 0.4217 | 0.1957 | 0.1563 | 0.1604 | 0.2275 | 0.3061 | |

| Central Provinces | Shanxi | 0.2424 | 0.2115 | 0.2406 | 0.1827 | 0.1961 | 0.2076 | 0.2169 | 0.1283 | 0.0789 | 0.0828 | 0.1112 | 0.1333 |

| Anhui | 0.6991 | 0.4112 | 0.5109 | 0.3960 | 0.4434 | 0.5488 | 0.7231 | 0.6043 | 0.4933 | 0.3686 | 0.5660 | 0.8613 | |

| Henan | 0.5129 | 0.5092 | 0.7235 | 0.7356 | 0.8867 | 0.8137 | 0.8470 | 0.9227 | 0.8031 | 0.8572 | 0.9687 | 1.0000 | |

| Hubei | 0.2638 | 0.2835 | 0.5027 | 0.3851 | 0.5350 | 0.6366 | 0.6189 | 0.5181 | 0.5727 | 0.6171 | 0.7904 | 0.9683 | |

| Hunan | 0.6618 | 0.6294 | 0.8188 | 0.6608 | 0.6860 | 0.7935 | 0.9657 | 0.8314 | 0.7174 | 0.8520 | 0.9636 | 0.9711 | |

| Jiangxi | 0.5087 | 0.6103 | 0.9120 | 0.7396 | 0.9040 | 0.9811 | 0.9678 | 0.9442 | 0.8733 | 0.9008 | 0.9648 | 0.9705 | |

| Western Provinces | Neimenggu | 0.1547 | 0.1617 | 0.2366 | 0.2006 | 0.2371 | 0.1947 | 0.1690 | 0.1156 | 0.2746 | 0.3643 | 0.1922 | 0.1348 |

| Guangxi | 0.5640 | 0.5491 | 0.8611 | 0.6475 | 0.8455 | 0.9728 | 0.6534 | 0.4652 | 0.4257 | 0.5314 | 0.7736 | 0.8831 | |

| Chongqing | 0.5011 | 0.7515 | 0.8905 | 0.4598 | 0.6877 | 0.9551 | 0.9002 | 0.7442 | 0.4436 | 0.3055 | 0.3521 | 0.4094 | |

| Sichuan | 0.5221 | 0.4733 | 0.6738 | 0.4326 | 0.5196 | 0.7085 | 0.7688 | 0.4304 | 0.2454 | 0.2313 | 0.3366 | 0.3895 | |

| Guizhou | 0.0777 | 0.1041 | 0.1913 | 0.1717 | 0.2454 | 0.2436 | 0.2637 | 0.1992 | 0.1618 | 0.2441 | 0.2829 | 0.3627 | |

| Yunnan | 0.4462 | 0.3147 | 0.4350 | 0.2857 | 0.4258 | 0.4070 | 0.3118 | 0.2680 | 0.2402 | 0.2074 | 0.2381 | 0.3125 | |

| Shaanxi | 0.1410 | 0.1682 | 0.2726 | 0.2404 | 0.2658 | 0.3095 | 0.2829 | 0.2010 | 0.1007 | 0.1036 | 0.1057 | 0.1528 | |

| Gansu | 0.1368 | 0.1903 | 0.3095 | 0.2833 | 0.2952 | 0.2771 | 0.1989 | 0.1280 | 0.0908 | 0.1034 | 0.0997 | 0.1544 | |

| Qinghai | 0.1253 | 0.1674 | 0.5289 | 0.2606 | 0.4597 | 0.5369 | 0.2802 | 0.3035 | 0.1128 | 0.0749 | 0.0761 | 0.1140 | |

| Ningxia | 0.1462 | 0.2797 | 0.2500 | 0.1999 | 0.1733 | 0.1853 | 0.1551 | 0.1914 | 0.0940 | 0.1255 | 0.1468 | 0.1407 | |

| Xinjiang | 0.2324 | 0.3611 | 0.6208 | 0.4685 | 0.5775 | 0.4116 | 0.2995 | 0.2081 | 0.1588 | 0.0933 | 0.0953 | 0.1267 |

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eastern Provinces | Beijing | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Tianjin | 0.0568 | 0.0958 | 0.0949 | 0.0432 | 0.1133 | 0.0277 | 0.0469 | 0.0886 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| Hebei | 0.3526 | 0.2936 | 0.1090 | 0.0860 | 0.1923 | 0.0708 | 0.1963 | 0.2098 | 0.1823 | 0.3366 | 0.3068 | 0.2165 | |

| Shanghai | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | |

| Jiangsu | 0.1253 | 0.1172 | 0.1937 | 0.2452 | 0.8351 | 0.3301 | 0.7995 | 0.9065 | 1.0000 | 1.0000 | 0.8595 | 0.6030 | |

| Zhejiang | 0.0512 | 0.1815 | 0.2051 | 0.3451 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.6935 | |

| Fujian | 1.0000 | 0.6362 | 0.3475 | 0.0877 | 0.3867 | 0.0796 | 0.1282 | 0.1584 | 0.2575 | 0.4964 | 0.4592 | 0.2965 | |

| Shandong | 0.0231 | 0.0946 | 0.0996 | 0.0799 | 0.2643 | 0.1066 | 0.2018 | 0.2936 | 0.2606 | 0.3621 | 0.3284 | 0.2595 | |

| Guangdong | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 1.0000 | 0.4568 | 0.4841 | 0.2814 | 0.7637 | |

| Hainan | 0.6725 | 0.8969 | 0.2439 | 0.1424 | 0.6573 | 0.4571 | 0.3411 | 0.2750 | 0.1804 | 0.2899 | 0.2623 | 0.2118 | |

| Northeast Provinces | Liaoning | 0.2509 | 0.1176 | 0.1271 | 0.0869 | 0.1990 | 0.0681 | 0.1237 | 0.1103 | 0.1379 | 0.2704 | 0.2420 | 0.2392 |

| Jilin | 0.1806 | 0.2420 | 0.0906 | 0.0550 | 0.1404 | 0.0448 | 0.1277 | 0.1074 | 0.1126 | 0.1683 | 0.2170 | 0.1580 | |

| Heilongjiang | 1.0000 | 1.0000 | 1.0000 | 0.0564 | 0.0747 | 0.0275 | 0.0642 | 0.1134 | 0.1269 | 0.2364 | 0.2525 | 0.2839 | |

| Central Provinces | Shanxi | 0.0453 | 0.0356 | 0.0319 | 0.0248 | 0.0655 | 0.0250 | 0.0556 | 0.0598 | 0.0390 | 0.0863 | 0.0927 | 0.0744 |

| Anhui | 0.5938 | 0.2691 | 0.1194 | 0.1029 | 0.3595 | 0.1639 | 0.4805 | 0.4000 | 0.4439 | 0.2547 | 0.8604 | 0.5759 | |

| Henan | 0.2989 | 0.2739 | 0.0901 | 0.0632 | 0.1982 | 0.0836 | 0.1806 | 0.2484 | 0.2403 | 0.5765 | 0.5099 | 0.4521 | |

| Hubei | 0.2287 | 0.2416 | 0.1632 | 0.0987 | 0.3462 | 0.1566 | 0.3331 | 0.4093 | 0.4632 | 0.9547 | 0.9567 | 0.7720 | |

| Hunan | 0.5587 | 0.6764 | 0.1618 | 0.0888 | 0.2619 | 0.0940 | 0.2411 | 0.2289 | 0.2590 | 0.5516 | 0.4964 | 0.3538 | |

| Jiangxi | 0.0858 | 0.2231 | 0.2443 | 0.1751 | 0.5120 | 0.1687 | 0.2754 | 0.4742 | 0.3365 | 0.8691 | 0.7483 | 0.6028 | |

| Western Provinces | Neimenggu | 0.0138 | 0.0355 | 0.0378 | 0.0258 | 0.0692 | 0.0171 | 0.0341 | 0.0373 | 0.1603 | 0.2606 | 0.2469 | 0.1830 |

| Guangxi | 0.2656 | 0.2696 | 0.0827 | 0.0468 | 0.2620 | 0.0661 | 0.2543 | 0.4510 | 0.5285 | 0.7365 | 0.5000 | 0.4332 | |

| Chongqing | 0.0424 | 0.1321 | 0.1264 | 0.0890 | 0.3440 | 0.1372 | 0.2825 | 0.2866 | 0.2724 | 0.4374 | 0.4235 | 0.2882 | |

| Sichuan | 0.0297 | 0.0796 | 0.0850 | 0.0565 | 0.1664 | 0.0676 | 0.1767 | 0.1742 | 0.1520 | 0.3009 | 0.3268 | 0.2940 | |

| Guizhou | 0.0408 | 0.0929 | 0.0655 | 0.0436 | 0.1225 | 0.0464 | 0.1057 | 0.1086 | 0.0650 | 0.2316 | 0.2142 | 0.2552 | |

| Yunnan | 0.1200 | 0.0526 | 0.0452 | 0.0298 | 0.0739 | 0.0288 | 0.0753 | 0.0815 | 0.0964 | 0.1739 | 0.1758 | 0.1737 | |

| Shaanxi | 0.0522 | 0.1507 | 0.1756 | 0.0884 | 0.2166 | 0.0671 | 0.1236 | 0.1507 | 0.0833 | 0.1612 | 0.1277 | 0.1335 | |

| Gansu | 0.0273 | 0.1134 | 0.1145 | 0.0520 | 0.1316 | 0.0441 | 0.0742 | 0.0897 | 0.0820 | 0.0943 | 0.0845 | 0.0571 | |

| Qinghai | 0.0143 | 0.0308 | 0.0300 | 0.0208 | 0.0579 | 0.0220 | 0.0662 | 0.0854 | 0.0619 | 0.0914 | 0.0991 | 0.0637 | |

| Ningxia | 0.0433 | 0.0590 | 0.0596 | 0.0415 | 0.1956 | 0.0523 | 0.0641 | 0.1038 | 0.0457 | 0.0680 | 0.1238 | 0.0675 | |

| Xinjiang | 0.0068 | 0.0237 | 0.0261 | 0.0150 | 0.0328 | 0.0145 | 0.0327 | 0.0343 | 0.0316 | 0.0768 | 0.0591 | 0.0346 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, W.; Li, L. Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China. Sustainability 2017, 9, 912. https://doi.org/10.3390/su9060912

Yang W, Li L. Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China. Sustainability. 2017; 9(6):912. https://doi.org/10.3390/su9060912

Chicago/Turabian StyleYang, Weixin, and Lingguang Li. 2017. "Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China" Sustainability 9, no. 6: 912. https://doi.org/10.3390/su9060912

APA StyleYang, W., & Li, L. (2017). Energy Efficiency, Ownership Structure, and Sustainable Development: Evidence from China. Sustainability, 9(6), 912. https://doi.org/10.3390/su9060912