Urban Disparities in Energy Performance Premium Prices: Towards an Unjust Transition?

Abstract

:1. Introduction

2. Background

3. Materials and Methods

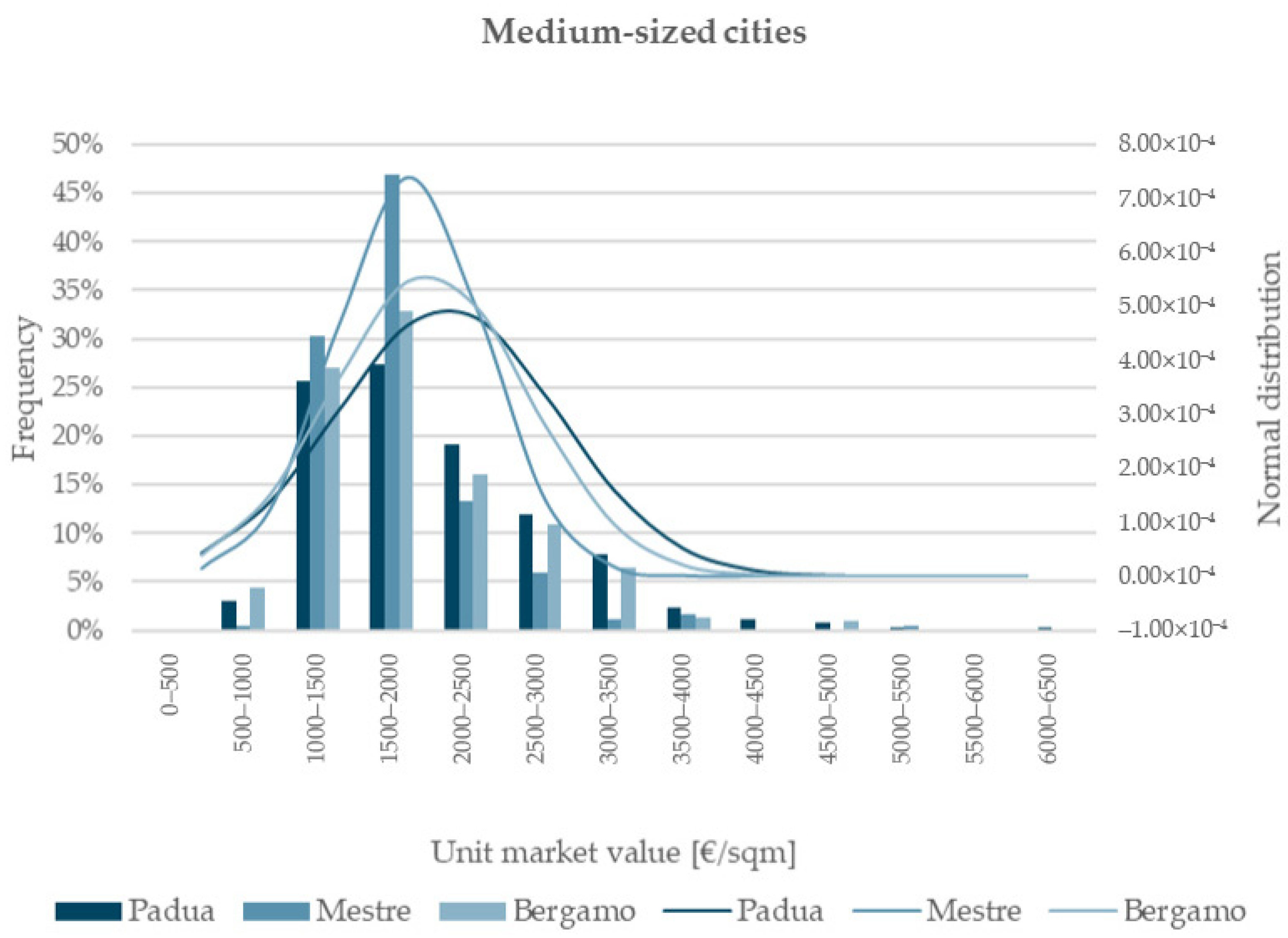

4. Results

- Pi is the natural logarithm of the price of a dwelling expressed in EUR/sqm;

- β0 is the constant of the model;

- βi represents the marginal price of the characteristic;

- Xi is the numerical value of the observed variables, including EPC;

- ei represents a random error.

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 209 | 23.9 |

| Semicentral zone | 224 | 25.7 | |

| Suburban zone | 440 | 50.4 | |

| Proximity to infrastructure | Up to 200 m | 265 | 30.4 |

| From 201 to 500 m | 518 | 59.3 | |

| Over 500 m | 90 | 10.3 | |

| Typology | Villa | 0 | 0.0 |

| Apartment | 873 | 100.0 | |

| Property class | Luxury | 53 | 6.1 |

| Prestigious | 469 | 53.7 | |

| Ordinary | 283 | 32.4 | |

| Economic | 19 | 2.2 | |

| Number of bathrooms | One bathroom | 489 | 56.0 |

| Two bathrooms | 295 | 33.8 | |

| Three bathrooms | 86 | 9.9 | |

| Four bathrooms | 2 | 0.2 | |

| Energy class | A4 | 7 | 0.8 |

| A3 | 8 | 0.9 | |

| A2 | 12 | 1.4 | |

| A1 | 11 | 1.3 | |

| A+ | 6 | 0.7 | |

| A | 24 | 2.7 | |

| B | 22 | 2.5 | |

| C | 20 | 2.3 | |

| D | 87 | 10.0 | |

| E | 130 | 14.9 | |

| F | 182 | 20.8 | |

| G | 362 | 41.5 | |

| Maintenance status | New—under construction | 48 | 5.5 |

| Excellent—renovated | 346 | 39.6 | |

| Good—habitable | 357 | 40.9 | |

| Poor—to be renovated | 110 | 12.6 |

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 208 | 27.6 |

| Semicentral zone | 151 | 20.0 | |

| Suburban zone | 395 | 52.4 | |

| Proximity to infrastructure | Up to 200 m | 133 | 17.6 |

| From 201 to 500 m | 333 | 44.2 | |

| Over 500 m | 288 | 38.2 | |

| Typology | Villa | 4 | 0.5 |

| Apartment | 750 | 99.5 | |

| Property class | Luxury | 25 | 3.3 |

| Prestigious | 320 | 42.4 | |

| Ordinary | 314 | 41.6 | |

| Economic | 41 | 5.4 | |

| Number of bathrooms | One bathroom | 485 | 64.3 |

| Two bathrooms | 234 | 31.0 | |

| Three bathrooms | 31 | 4.1 | |

| Four bathrooms | 2 | 0.3 | |

| Five bathrooms | 1 | 0.1 | |

| Energy class | A4 | 5 | 0.7 |

| A3 | 2 | 0.3 | |

| A2 | 2 | 0.3 | |

| A1 | 12 | 1.6 | |

| A+ | 3 | 0.4 | |

| A | 19 | 2.5 | |

| B | 25 | 3.3 | |

| C | 54 | 7.2 | |

| D | 125 | 16.6 | |

| E | 171 | 22.7 | |

| F | 137 | 18.2 | |

| G | 197 | 26.1 | |

| Maintenance status | New—under construction | 32 | 4.2 |

| Excellent—renovated | 250 | 33.2 | |

| Good—habitable | 357 | 47.3 | |

| Poor—to be renovated | 102 | 13.5 |

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 95 | 23.3 |

| Semicentral zone | 183 | 45.0 | |

| Suburban zone | 129 | 31.7 | |

| Proximity to infrastructure | Up to 200 m | 155 | 38.1 |

| From 201 to 500 m | 129 | 31.7 | |

| Over 500 m | 123 | 30.2 | |

| Typology | Villa | 0 | 0.0 |

| Apartment | 407 | 100.0 | |

| Property class | Luxury | 8 | 2.0 |

| Prestigious | 117 | 28.7 | |

| Ordinary | 220 | 54.1 | |

| Economic | 44 | 10.8 | |

| Number of bathrooms | One bathroom | 273 | 67.1 |

| Two bathrooms | 119 | 29.2 | |

| Three bathrooms | 15 | 3.7 | |

| Energy class | A4 | 0 | 0.0 |

| A3 | 2 | 0.5 | |

| A2 | 1 | 0.2 | |

| A1 | 7 | 1.7 | |

| A+ | 6 | 1.5 | |

| A | 4 | 1.0 | |

| B | 12 | 2.9 | |

| C | 3 | 0.7 | |

| D | 14 | 3.4 | |

| E | 30 | 7.4 | |

| F | 69 | 17.0 | |

| G | 255 | 62.7 | |

| Maintenance status | New—under construction | 22 | 5.4 |

| Excellent—renovated | 201 | 49.4 | |

| Good—habitable | 148 | 36.4 | |

| Poor—to be renovated | 33 | 8.1 |

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 206 | 58.2 |

| Semicentral zone | 42 | 11.9 | |

| Suburban zone | 106 | 29.9 | |

| Proximity to infrastructure | Up to 200 m | 130 | 36.7 |

| From 201 to 500 m | 96 | 27.1 | |

| Over 500 m | 128 | 36.2 | |

| Typology | Villa | 20 | 5.6 |

| Apartment | 334 | 94.4 | |

| Number of bathrooms | One bathroom | 111 | 31.4 |

| Two bathrooms | 184 | 52.0 | |

| Three bathrooms | 59 | 16.7 | |

| Energy class | A4 | 10 | 2.8 |

| A3 | 1 | 0.3 | |

| A2 | 2 | 0.6 | |

| A1 | 6 | 1.7 | |

| A+ | 0 | 0.0 | |

| A | 6 | 1.7 | |

| B | 6 | 1.7 | |

| C | 9 | 2.5 | |

| D | 34 | 9.6 | |

| E | 69 | 19.5 | |

| F | 90 | 25.4 | |

| G | 121 | 34.2 | |

| Maintenance status | New—under construction | 24 | 6.8 |

| Excellent—renovated | 100 | 28.2 | |

| Good—habitable | 177 | 50.0 | |

| Poor—to be renovated | 36 | 10.2 |

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 155 | 61.0 |

| Semicentral zone | 47 | 18.5 | |

| Suburban zone | 52 | 20.5 | |

| Proximity to infrastructure | Up to 200 m | 107 | 42.1 |

| From 201 to 500 m | 80 | 31.5 | |

| Over 500 m | 67 | 26.4 | |

| Typology | Villa | 3 | 1.2 |

| Apartment | 251 | 98.8 | |

| Number of bathrooms | One bathroom | 160 | 63.0 |

| Two bathrooms | 90 | 35.4 | |

| Three bathrooms | 2 | 0.8 | |

| Energy class | A4 | 13 | 5.1 |

| A3 | 1 | 0.4 | |

| A2 | 1 | 0.4 | |

| A1 | 2 | 0.8 | |

| A+ | 4 | 1.6 | |

| A | 2 | 0.8 | |

| B | 4 | 1.6 | |

| C | 7 | 2.8 | |

| D | 19 | 7.5 | |

| E | 31 | 12.2 | |

| F | 70 | 27.6 | |

| G | 100 | 39.4 | |

| Maintenance status | New—under construction | 21 | 8.3 |

| Excellent—renovated | 90 | 35.4 | |

| Good—habitable | 126 | 49.6 | |

| Poor—to be renovated | 9 | 3.5 |

| Variables | Categories | n | % |

|---|---|---|---|

| Zone | Central zone | 151 | 51.5 |

| Semicentral zone | 40 | 13.7 | |

| Suburban zone | 102 | 34.8 | |

| Proximity to infrastructure | Up to 200 m | 60 | 20.5 |

| From 201 to 500 m | 124 | 42.3 | |

| Over 500 m | 109 | 37.2 | |

| Typology | Villa | 8 | 2.7 |

| Apartment | 285 | 97.3 | |

| Number of bathrooms | One bathroom | 177 | 60.4 |

| Two bathrooms | 103 | 35.2 | |

| Three bathrooms | 13 | 4.4 | |

| Energy class | A4 | 3 | 1.0 |

| A3 | 3 | 1.0 | |

| A2 | 1 | 0.3 | |

| A1 | 7 | 2.4 | |

| A+ | 4 | 1.4 | |

| A | 8 | 2.7 | |

| B | 20 | 6.8 | |

| C | 23 | 7.8 | |

| D | 29 | 9.9 | |

| E | 52 | 17.7 | |

| F | 44 | 15.0 | |

| G | 99 | 33.8 | |

| Maintenance status | New—under construction | 38 | 13.0 |

| Excellent—renovated | 116 | 39.6 | |

| Good—habitable | 118 | 40.3 | |

| Poor—to be renovated | 19 | 6.5 |

References

- Commissione Europea. Efficienza Energetica Nell’Edilizia. 17 February 2020. Available online: https://commission.europa.eu/news/focus-energy-efficiency-buildings-2020-02-17_it (accessed on 15 December 2023).

- Parlamento Europeo e Consiglio dell’Unione Europea. Direttiva 2010/31/UE del Parlamento Europeo e del Consiglio Sulla Prestazione Energetica Nell’Edilizia. 2010. Available online: https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2010:153:0013:0035:it:PDF (accessed on 15 December 2023).

- Commissione Europea. Comunicazione della Commissione al Parlamento Europeo, al Consiglio, al Comitato Economico e Sociale Europeo e al Comitato delle Regioni. 2019. Available online: https://eur-lex.europa.eu/legal-content/IT/TXT/?uri=COM%3A2019%3A640%3AFIN (accessed on 15 December 2023).

- Napoli, G.; Barbaro, S.; Giuffrida, S.; Trovato, M.R. The European Green Deal: New Challenges for the Economic Feasibility of Energy Retrofit at District Scale. In New Metropolitan Perspectives; Springer: Cham, Switzerland, 2021; pp. 1248–1258. ISBN 978-3-030-48278-7. [Google Scholar]

- PwC and the Urban Land Institute. Emerging Trends in Real Estate Europe 2023; PwC and the Urban Land Institute: London, UK, 2022; Available online: https://knowledge.uli.org/en/reports/emerging-trends/2023/emerging-trends-in-real-estate-europe (accessed on 12 December 2023).

- RICS Royal Institution of Chartered Surveyors. RICS Sustainability Report; RICS: London, UK, 2023; Available online: https://www.rics.org/news-insights/rics-sustainability-report-2023 (accessed on 20 December 2023).

- Aydin, E.; Brounen, D.; Kok, N. The Capitalization of Energy Efficiency: Evidence from the Housing Market. J. Urban Econ. 2020, 117, 103243. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Bragolusi, P.; D’Alpaos, C. The Valuation of Buildings Energy Retrofitting: A Multiple-Criteria Approach to Reconcile Cost-Benefit Trade-Offs and Energy Savings. Appl. Energy 2022, 310, 118431. [Google Scholar] [CrossRef]

- Brounen, D.; Kok, N. On the Economics of Energy Labels in the Housing Market. J. Environ. Econ. Manag. 2011, 62, 166–179. [Google Scholar] [CrossRef]

- Hyland, M.; Lyons, R.C.; Lyons, S. The Value of Domestic Building Energy Efficiency—Evidence from Ireland. Energy Econ. 2013, 40, 943–952. [Google Scholar] [CrossRef]

- Jensen, O.M.; Hansen, A.R.; Kragh, J. Market Response to the Public Display of Energy Performance Rating at Property Sales. Energy Policy 2016, 93, 229–235. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Does Energy Efficiency Matter to Home-Buyers? An Investigation of EPC Ratings and Transaction Prices in England. Energy Econ. 2015, 48, 145–156. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P.; Nanda, A.; Wyatt, P. Energy Performance Ratings and House Prices in Wales: An Empirical Study. Energy Policy 2016, 92, 20–33. [Google Scholar] [CrossRef]

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green Signalling Effects in the Market for Energy-Efficient Residential Buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef]

- De Ayala, A.; Galarraga, I.; Spadaro, J.V. The Price of Energy Efficiency in the Spanish Housing Market. Energy Policy 2016, 94, 16–24. [Google Scholar] [CrossRef]

- Marmolejo-Duarte, C.; Chen, A. The Uneven Price Impact of Energy Efficiency Ratings on Housing Segments and Implications for Public Policy and Private Markets. Sustainability 2019, 11, 372. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F.; Di Liddo, F.; Guarnaccia, C. The Value of the Energy Retrofit in the Italian Housing Market: Two Case-Studies Compared. WSEAS Trans. Bus. Econ. 2018, 15, 249–258. [Google Scholar]

- Bisello, A.; Antoniucci, V.; Marella, G. Measuring the Price Premium of Energy Efficiency: A Two-Step Analysis in the Italian Housing Market. Energy Build. 2020, 208, 109670. [Google Scholar] [CrossRef]

- Micelli, E.; Giliberto, G.; Righetto, E.; Tafuri, G. The Economic Value of Sustainability. Housing Market and Energy Performance of Homes. Valori E Valutazioni 2023, 34, 3–16. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E.; Saccani, F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability 2019, 11, 12. [Google Scholar] [CrossRef]

- Addae-Dapaah, K.; Wilkinson, J. Green Premium: What Is the Implied Prognosis for Sustainability? J. Sustain. Real Estate 2020, 12, 16–33. [Google Scholar] [CrossRef]

- Taruttis, L.; Weber, C. Estimating the Impact of Energy Efficiency on Housing Prices in Germany: Does Regional Disparity Matter? Energy Econ. 2022, 105, 105750. [Google Scholar] [CrossRef]

- Horner, R.; Schindler, S.; Haberly, D.; Aoyama, Y. Globalisation, Uneven Development and the North–South ‘Big Switch’. Camb. J. Reg. Econ. Soc. 2018, 11, 17–33. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A. The Revenge of the Places That Don’t Matter (and What to Do about It). Camb. J. Reg. Econ. Soc. 2018, 11, 189–209. [Google Scholar] [CrossRef]

- Marino, E.; Ribot, J. Special Issue Introduction: Adding Insult to Injury: Climate Change and the Inequities of Climate Intervention. Glob. Environ. Chang. 2012, 22, 323–328. [Google Scholar] [CrossRef]

- Dijkstra, L.; Poelman, H.; Rodríguez-Pose, A. The Geography of EU Discontent. Reg. Stud. 2020, 54, 737–753. [Google Scholar] [CrossRef]

- McCann, P. Perceptions of Regional Inequality and the Geography of Discontent: Insights from the UK. Reg. Stud. 2020, 54, 256–267. [Google Scholar] [CrossRef]

- Parlamento Europeo. Prestazione Energetica Nell’Edilizia (Rifusione) Emendamenti del Parlamento Europeo, Approvati il 14 Marzo 2023, alla Proposta di Direttiva del Parlamento Europeo e del Consiglio Sulla Prestazione Energetica Nell’Edilizia (Rifusione). 2023. Available online: https://www.europarl.europa.eu/doceo/document/TA-9-2023-0068_IT.html (accessed on 22 December 2023).

- Copiello, S.; Gabrielli, L.; Micelli, E. Building Industry and Energy Efficiency: A Review of Three Major Issues at Stake. Comput. Sci. Its Appl. ICCSA 2021 2021, 12954, 226–240. [Google Scholar] [CrossRef]

- Zhang, L.; Li, Y.; Stephenson, R.; Ashuri, B. Valuation of Energy Efficient Certificates in Buildings. Energy Build. 2018, 158, 1226–1240. [Google Scholar] [CrossRef]

- Wahlström, M.H. Doing Good but Not That Well? A Dilemma for Energy Conserving Homeowners. Energy Econ. 2016, 60, 197–205. [Google Scholar] [CrossRef]

- Bio Intelligence Service. Energy Performance Certificates in Buildings and Their Impact on Transaction Prices and Rents in Selected EU Countries, Final Report Prepared for European Commission (DG Energy). 2013. Available online: https://energy.ec.europa.eu/system/files/2014-11/20130619-energy_performance_certificates_in_buildings_0.pdf (accessed on 15 December 2023).

- Fregonara, E.; Rolando, D.; Semeraro, P.; Vella, M. The Impact of Energy Performance Certificate Level on House Listing Prices. First Evidence from Italian Real Estate. Aestimum 2015, 65, 143–163. [Google Scholar] [CrossRef]

- Morano, P.; Rosato, P.; Tajani, F.; Di Liddo, F. An Analysis of the Energy Efficiency Impacts on the Residential Property Prices in the City of Bari (Italy). In Green Energy and Technology; Springer: Heidelberg, Berlin, Germany, 2020; pp. 73–88. ISBN 978-3-030-23784-4. [Google Scholar]

- Massimo, D.; Paola, P.; Musolino, M.; Malerba, A.; Del Giudice, F.P. Green and Gold Buildings? Detecting Real Estate Market Premium for Green Buildings through Evolutionary Polynomial Regression. Buildings 2022, 12, 621. [Google Scholar] [CrossRef]

- Del Giudice, V.; Massimo, D.E.; Salvo, F.; De Paola, P.; De Ruggiero, M.; Musolino, M. Market Price Premium for Green Buildings: A Review of Empirical Evidence. Case Study. In New Metropolitan Perspectives; Bevilacqua, C., Calabrò, F., Della Spina, L., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 1237–1247. [Google Scholar] [CrossRef]

- Ruggeri, A.; Gabrielli, L.; Scarpa, M.; Marella, G. What Is the Impact of the Energy Class on Market Value Assessments of Residential Buildings? An Analysis throughout Northern Italy Based on Extensive Data Mining and Artificial Intelligence. Buildings 2023, 13, 2994. [Google Scholar] [CrossRef]

- Loberto, M.; Mistretta, A.; Spuri, M. The Capitalization of Energy Labels into House Prices. Evidence from Italy; Questioni di Economia e Finanza; Banca d’Italia Eurosistema: Roma, Italy, 2023; Available online: https://www.bancaditalia.it/pubblicazioni/qef/2023-0818/QEF_818_23.pdf (accessed on 22 December 2023).

- Guerrieri, G. Il Mercato Della Casa. Domanda, Offerta, Tassazione e Spesa Pubblica; Carocci: Roma, Italy, 2022. [Google Scholar]

- Dalla Zuanna, G.D.; Weber, G. Cose da non Credere: Il Senso Comune alla Prova dei Numeri; Laterza: Bari, Italy, 2012; ISBN 978-88-581-0375-3. [Google Scholar]

- Krawchenko, T.A.; Gordon, M. How Do We Manage a Just Transition? A Comparative Review of National and Regional Just Transition Initiatives. Sustainability 2021, 13, 6070. [Google Scholar] [CrossRef]

- Wang, X.; Lo, K. Just Transition: A Conceptual Review. Energy Res. Soc. Sci. 2021, 82, 102291. [Google Scholar] [CrossRef]

- Heffron, R.J. What Is the “Just Transition”. In Achieving a Just Transition to a Low-Carbon Economy; Heffron, R.J., Ed.; Springer International Publishing: Cham, Switzerland, 2021; pp. 9–19. ISBN 978-3-030-89460-3. [Google Scholar]

- Saiu, V.; Blečić, I.; Meloni, I. Making Sustainability Development Goals (SDGs) Operational at Suburban Level: Potentials and Limitations of Neighbourhood Sustainability Assessment Tools. Environ. Impact Assess. Rev. 2022, 96, 106845. [Google Scholar] [CrossRef]

- Marais, V. The Employment Crisis, Just Transition and the Universal Basic Income Grant. In The Climate Crisis: South African and Global Democratic Eco-Socialist Alternatives; Satgar, V., Ed.; Wits University Press: Johannesburg, South Africa, 2018; pp. 70–106. ISBN 978-1-77614-054-1. [Google Scholar]

- Williams, S.; Doyon, A. Justice in Energy Transitions. Environ. Innov. Soc. Transit. 2019, 31, 144–153. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Bartalucci, F. The Green Transition and Its Potential Territorial Discontents. Camb. J. Reg. Econ. Soc. 2023, 120, rsad039. [Google Scholar] [CrossRef]

- Broekel, T.; Alfken, C. Gone with the Wind? The Impact of Wind Turbines on Tourism Demand. Energy Policy 2015, 86, 506–519. [Google Scholar] [CrossRef]

- Arndt, C.; Halikiopoulou, D.; Vrakopoulos, C. The Centre-Periphery Divide and Attitudes towards Climate Change Measures among Western Europeans. Environ. Politics 2023, 32, 381–406. [Google Scholar] [CrossRef]

- Martin, M.; Islar, M. The “end of the World” vs. the “End of the Month”: Understanding Social Resistance to Sustainability Transition Agendas, a Lesson from the Yellow Vests in France. Sustain. Sci. 2021, 16, 601–614. [Google Scholar] [CrossRef]

- ANCI-IFEL L’Italia delle città medie; I Comuni Quaderni di Analisi. 2013. Available online: https://www.fondazioneifel.it/documenti-e-pubblicazioni/item/download/327_fcde9c60664006139b15e248dee78278 (accessed on 21 December 2023).

- Micelli, E.; Righetto, E. How Do Metropolitan Cities Evolve after the 2008/2012 Crisis and the COVID-19 Pandemic? An Analysis from Real Estate Market Values: Come Evolvono Le Città Metropolitane Dopo Crisi e Pandemia COVID-19? Un’analisi a Partire Dai Valori Del Mercato Immobiliare. Valori E Valutazioni 2023, 31, 49–67. [Google Scholar] [CrossRef]

- Longo, A.; Cicirello, L. Città Metropolitane e Pianificazione di Area Vasta. Prospettive di Governo Territoriale per la Gestione delle Metamorfosi Urbane; Angeli: Milano, Italy, 2016; ISBN 88-917-3762-3. [Google Scholar]

- Camagni, R.; Capello, R.; Caragliu, A. Le città metropolitane: Leader all’interno della gerarchia urbana in Italia? Arch. Di Studi Urbani E Reg. 2021, 132, 121–152. [Google Scholar] [CrossRef]

- Compagnucci, F. Manifattura ed attività della conoscenza nelle città: L’alleanza necessaria. Imprese Città Riv. Della Camera Di Commer. Di Milano 2013, 1, 51–58. [Google Scholar] [CrossRef]

- Gambarotto, F.; Leoncini, R.; Pedrini, G. Nuove Prospettive per La Manifattura Urbana. Sci. Reg. 2018, 8, 3110. [Google Scholar]

- Intesa San Paolo Economia e Finanza Dei Distretti Industriali. Available online: https://group.intesasanpaolo.com/content/dam/portalgroup/repositorydocumenti/public/Contenuti/RISORSE/Documenti%20PDF/PDF_sepa/CNT-05-00000004FDF04.pdf (accessed on 20 December 2023).

- Feldman, M.P.; Audretsch, D.B. Innovation in Cities: Science-Based Diversity, Specialization and Localized Competition. Eur. Econ. Rev. 1999, 43, 409–429. [Google Scholar] [CrossRef]

- ISTAT Istituto Nazionale Di Statistica, Resident Population. Available online: https://esploradati.istat.it/databrowser/#/it/dw/categories/IT1,POP,1.0/POP_POPULATION/DCIS_POPRES1 (accessed on 10 January 2024).

- Lancaster, K.J. A New Approach to Consumer Theory. J. Political Econ. 1966, 74, 132–157. [Google Scholar] [CrossRef]

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Simonotti, M. I prezzi marginali impliciti delle risorse immobiliari. In Estimo ed Economia Ambientale; Fusco Girard, L., Ed.; Angeli: Milano, Italy, 1993. [Google Scholar]

- Michelangeli, A. Il metodo dei prezzi edonici per la costruzione di indici dei prezzi per il mercato immobiliare. In Principi Metodologici per la Costruzione di Indici dei Prezzi del Mercato Immobiliare; Del Giudice, V., D’Amato, M., Eds.; Maggioli: Rimini, Italy, 2008. [Google Scholar]

- Parlamento Europeo; Consiglio dell’Unione Europea. Regulation 2017/1369 of the European Parliament and of the Council of 4 July 2017 Setting a Framework for Energy Labelling and Repealing Directive 2010/30/EU. 2017. Available online: http://www.bloomsburycollections.com/book/fundamental-texts-on-european-private-law-1 (accessed on 21 December 2023).

- Malpezzi, S. Hedonic Pricing Models: A Selective and Applied Review. In Housing Economics and Public Policy: Essays in Honor of Duncan Maclennan; Blackwell Science: Oxford, UK, 2002; pp. 67–89. [Google Scholar] [CrossRef]

- Bottero, M.; Bravi, M.; Dell’Anna, F.; Mondini, G. Valutazione dell’efficienza energetica degli edifici con il metodo dei prezzi edonici: Gli effetti spaziali sono rilevanti? Valori E Valutazioni 2018, 21, 27–39. [Google Scholar]

- Palmquist, R.B. Chapter 16 Property Value Models. In Handbook of Environmental Economics; Mler, K.-G., Vincent, J.R., Eds.; Valuing Environmental Changes; Elsevier: Amsterdam, The Netherlands, 2005; Volume 2, pp. 763–819. [Google Scholar] [CrossRef]

- Camagni, R. Principi Di Economia Urbana e Territoriale; Carocci editore: Roma, Italy, 1993; ISBN 978-88-430-1217-6. [Google Scholar]

- Marcoulides, K.M.; Raykov, T. Evaluation of Variance Inflation Factors in Regression Models Using Latent Variable Modeling Methods. Educ. Psychol. Meas. 2019, 79, 874–882. [Google Scholar] [CrossRef]

- Boza, E. Investigation of Housing Valuation Models Based on Spatial and Non-Spatial Techniques. Ph.D. Thesis, Middle East Technical University, Ankara, Turkey, 2015. [Google Scholar]

- Ottensmann, J.; Payton, S.; Man, J. Urban Location and Housing Prices within a Hedonic Model. J. Reg. Anal. Policy 2008, 38, 17. [Google Scholar]

- Arler, F. Global Partnership, Climate Change and Complex Equality. Environ. Values 2001, 10, 301–329. [Google Scholar] [CrossRef]

- Cornelius, M.; Adger, W.N.; Paavola, J.; Huq, S.; Mace, M.J. Fairness in Adaptation to Climate Change. Clim. Chang. 2009, 96, 259–267. [Google Scholar] [CrossRef]

- Ribot, J. Vulnerability Does Not Fall from the Sky: Toward Multiscale, pro-Poor Climate Policy. Soc. Dimens. Clim. Chang. Equity Vulnerability A Warm. World 2010, 47–74. [Google Scholar] [CrossRef]

- Fleming, R.; Mauger, R. Green and Just? An update on the ‘European Green Deal’. J. Eur. Environ. Plan. Law 2021, 18, 164–180. [Google Scholar] [CrossRef]

- Balletto, G.; Sinatra, M.; Milesi, A.; Ghiani, E.; Borruso, G.; Zullo, F. Spatial Regional Electricity Intensity and Equitable Well-Being to Support Just Transition. TeMA—J. Land Use Mobil. Environ. 2023, 16, 609–624. [Google Scholar] [CrossRef]

- Harrahill, K.; Douglas, O. Framework Development for ‘Just Transition’ in Coal Producing Jurisdictions. Energy Policy 2019, 134, 110990. [Google Scholar] [CrossRef]

- Galgoczi, B. Phasing out Coal—A Just Transition Approach. SSRN J. 2019. [Google Scholar] [CrossRef]

- Garvey, A.; Norman, J.B.; Büchs, M.; Barrett, J. A “Spatially Just” Transition? A Critical Review of Regional Equity in Decarbonisation Pathways. Energy Res. Soc. Sci. 2022, 88, 102630. [Google Scholar] [CrossRef]

- Carattini, S.; Kallbekken, S.; Orlov, A. How to Win Public Support for a Global Carbon Tax. Nature 2019, 565, 289–291. [Google Scholar] [CrossRef]

- Mehleb, R.I.; Kallis, G.; Zografos, C. A Discourse Analysis of Yellow-Vest Resistance against Carbon Taxes. Environ. Innov. Soc. Transit. 2021, 40, 382–394. [Google Scholar] [CrossRef]

- Mitsch, F.; McNeil, A. Political Implications of ‘Green’ Infrastructure in One’s ‘Backyard’: The Green Party’s Catch 22? LSE International Inequalities Institute: London, UK, 2022; Available online: https://eprints.lse.ac.uk/115269/1/WP_81_political_implications_of_green_infrastructure_published.pdf (accessed on 22 December 2023).

- Crespy, A.; Munta, M. Lost in Transition? Social Justice and the Politics of the EU Green Transition. Transf. Eur. Rev. Labour Res. 2023, 29, 235–251. [Google Scholar] [CrossRef]

- Butler, J. Excitable Speech: A Politics of the Performative; Routledge: London, UK, 1997. [Google Scholar]

- Bronen, R. Climate-Induced Community Relocations: Creating an Adaptive Governance Framework Based in Human Rights Doctrine. N.Y.U Rev. Law Soc. Chang. 2012, 35, 101–148. [Google Scholar]

- Blečić, I.; Cecchini, A.; Falk, M.; Marras, S.; Pyles, D.R.; Spano, D.; Trunfio, G.A. Urban Metabolism and Climate Change: A Planning Support System. Int. J. Appl. Earth Obs. Geoinf. 2014, 26, 447–457. [Google Scholar] [CrossRef]

| Studies | Geographical Coverage | Premium Price |

|---|---|---|

| [11] | The Netherlands | G → D: 5% |

| [12] | Ireland | D → A: 9.3% F/G → A: 10.6% |

| [13] | Denmark | D → A: 6.6% D → G: −9.3% |

| [14] | U.K. | D → A: 5% D → G: −7% |

| [15] | Wales | D → A: 12.8% D → F: −6.5% |

| [16] | Helsinki Metropolitan Area (HMA) | D → A/B/C: 3.5% |

| [17] | Spain | E/F/G → A/B/C/D: 5.4% |

| [18] | Barcelona Metropolitan Area | G → A: 7.8% G → D: 3.3% |

| Studies | Geographical Coverage | Premium Price |

|---|---|---|

| [19] | Bolzano Bari | Class A marginal contribution: Bolzano: 45% Bari: 30% Class G marginal contribution: Bolzano: −19% Bari: −27% |

| [20] | Bolzano | Class A marginal contribution: 6.3% |

| [36] | Bari | Class A marginal contribution: 27.94% Class G marginal contribution: 26.44% |

| [37] | Reggio Calabria | Marginal contribution classes A/B: 41.52% |

| [38] | Reggio Calabria | Marginal contribution classes A/B: 29.07% |

| [39] | 13 cities in Northern Italy (Bologna, Modena, Parma, Trieste, Genoa, Bergamo, Brescia, Milan, Novara, Turin, Padua, Mestre, Verona) | G → A: 28% G → A4: 36% (Authors’ calculations based on the variation in property values according to energy classification in absolute terms, as presented by Ruggeri et al., 2023) |

| [40] | Italy | D → A/B: 12–16% E/F → A/B: 33–37% |

| Global Model Test | ||||||

|---|---|---|---|---|---|---|

| Models A | R2 | Adjusted R2 | F | df1 | df2 | p-Value |

| Milan | 0.626 | 0.623 | 192.859 | 7 | 807 | <0.001 |

| Turin | 0.529 | 0.524 | 128.001 | 6 | 685 | <0.001 |

| Florence | 0.606 | 0.600 | 96.301 | 6 | 375 | <0.001 |

| Padua | 0.519 | 0.513 | 75.223 | 5 | 348 | <0.001 |

| Mestre | 0.522 | 0.512 | 54.111 | 5 | 248 | <0.001 |

| Bergamo | 0.359 | 0.348 | 32.200 | 5 | 287 | <0.001 |

| Global Model Test | ||||||

|---|---|---|---|---|---|---|

| Models B | R2 | Adjusted R2 | F | df1 | df2 | p-Value |

| Milan | 0.620 | 0.617 | 188.129 | 7 | 807 | <0.001 |

| Turin | 0.534 | 0.530 | 112.109 | 7 | 684 | <0.001 |

| Florence | 0.603 | 0.597 | 94.981 | 6 | 375 | <0.001 |

| Padua | 0.516 | 0.507 | 58.591 | 6 | 330 | <0.001 |

| Mestre | 0.520 | 0.510 | 52.041 | 5 | 240 | <0.001 |

| Bergamo | 0.349 | 0.337 | 30.542 | 5 | 285 | <0.001 |

| Milan | Turin | Florence | ||||

|---|---|---|---|---|---|---|

| Predictors Xi | βi | VIF | βi | VIF | βi | VIF |

| Constant | 10.306 ** | 8.827 ** | 9.357 ** | |||

| Zone | −0.314 ** | 1.242 | −0.187 ** | 1.169 | −0.177 ** | 1.055 |

| Proximity to infrastructure | −0.076 ** | 1.061 | −0.076 ** | 1.043 | −0.053 ** | 1.012 |

| Typology | - | - | 0.384 * | 1.007 | - | - |

| Property class | −0.170 ** | 1.408 | −0.139 ** | 1.309 | - | - |

| Number of bathrooms | 0.064 * | 2.413 | - | - | 0.074 ** | 1.476 |

| Surface (sqm) | −0.001 ** | 2.496 | - | - | −0.004 ** | 1.612 |

| Energy class | −0.027 ** | 1.409 | −0.021 ** | 1.693 | −0.016 * | 1.253 |

| Maintenance status | −0.036 * | 1.381 | −0.117 ** | 1.629 | −0.094 ** | 1.445 |

| Padua | Mestre | Bergamo | ||||

|---|---|---|---|---|---|---|

| Predictors Xi | βi | VIF | βi | VIF | βi | VIF |

| Constant | 9.190 ** | - | 8.233 ** | - | 7.970 ** | - |

| Zone | −0.244 ** | 1.141 | - | - | −0.061 * | 1.015 |

| Proximity to infrastructure | −0.115 ** | 1.047 | −0.032 * | 1.122 | - | - |

| Typology | - | - | - | - | - | - |

| Property class | NA | - | NA | - | NA | - |

| Number of bathrooms | - | - | 0.161 ** | 1.667 | 0.275 ** | 1.834 |

| Surface (sqm) | −0.001 ** | 1.073 | −0.003 ** | 1.530 | −0.002 ** | 1.757 |

| Energy class | −0.049 ** | 1.667 | −0.039 ** | 1.537 | −0.043 ** | 1.767 |

| Maintenance status | −0.114 ** | 1.682 | −0.097 ** | 1.462 | −0.066 * | 1.789 |

| Milan | Turin | Florence | ||||

|---|---|---|---|---|---|---|

| Predictors Xi | βi | VIF | βi | VIF | βi | VIF |

| Constant | 10.247 ** | 8.709 ** | 9.312 ** | |||

| Zone | −0.314 ** | 1.242 | −0.186 ** | 1.169 | −0.177 ** | 1.057 |

| Proximity to infrastructure | −0.076 ** | 1.064 | −0.073 ** | 1.047 | −0.052 ** | 1.014 |

| Typology | - | - | 0.392 * | 1.018 | - | - |

| Property class | −0.175 ** | 1.402 | −0.131 ** | 1.370 | - | - |

| Number of bathrooms | 0.066 * | 2.411 | 0.035 * | 1.110 | 0.074 ** | 1.476 |

| Surface (sqm) | −0.001 ** | 2.504 | - | - | −0.004 ** | 1.615 |

| Energy class | −0.074 ** | 1.413 | −0.074 ** | 1.583 | −0.043 * | 1.204 |

| Maintenance status | −0.044 ** | 1.393 | −0.112 ** | 1.558 | −0.099 ** | 1.403 |

| Padua | Mestre | Bergamo | ||||

|---|---|---|---|---|---|---|

| Predictors Xi | βi | VIF | βi | VIF | βi | VIF |

| Constant | 9.091 ** | 8.447 ** | 7.846 ** | |||

| Zone | −0.236 ** | 1.123 | - | - | −0.061 * | 1.015 |

| Proximity to infrastructure | −0.117 ** | 1.050 | - | - | - | - |

| Typology | - | - | −0.226 * | 1.076 | - | - |

| Property class | NA | - | NA | - | NA | - |

| Number of bathrooms | 0.065 * | 1.958 | 0.176 ** | 1.639 | 0.286 ** | 1.841 |

| Surface (sqm) | −0.002 ** | 2.012 | −0.003 ** | 1.612 | −0.002 * | 1.757 |

| Energy class | −0.165 ** | 1.544 | −0.164 ** | 1.441 | −0.114 ** | 1.658 |

| Maintenance status | −0.123 ** | 1.622 | −0.104 ** | 1.442 | −0.083 * | 1.708 |

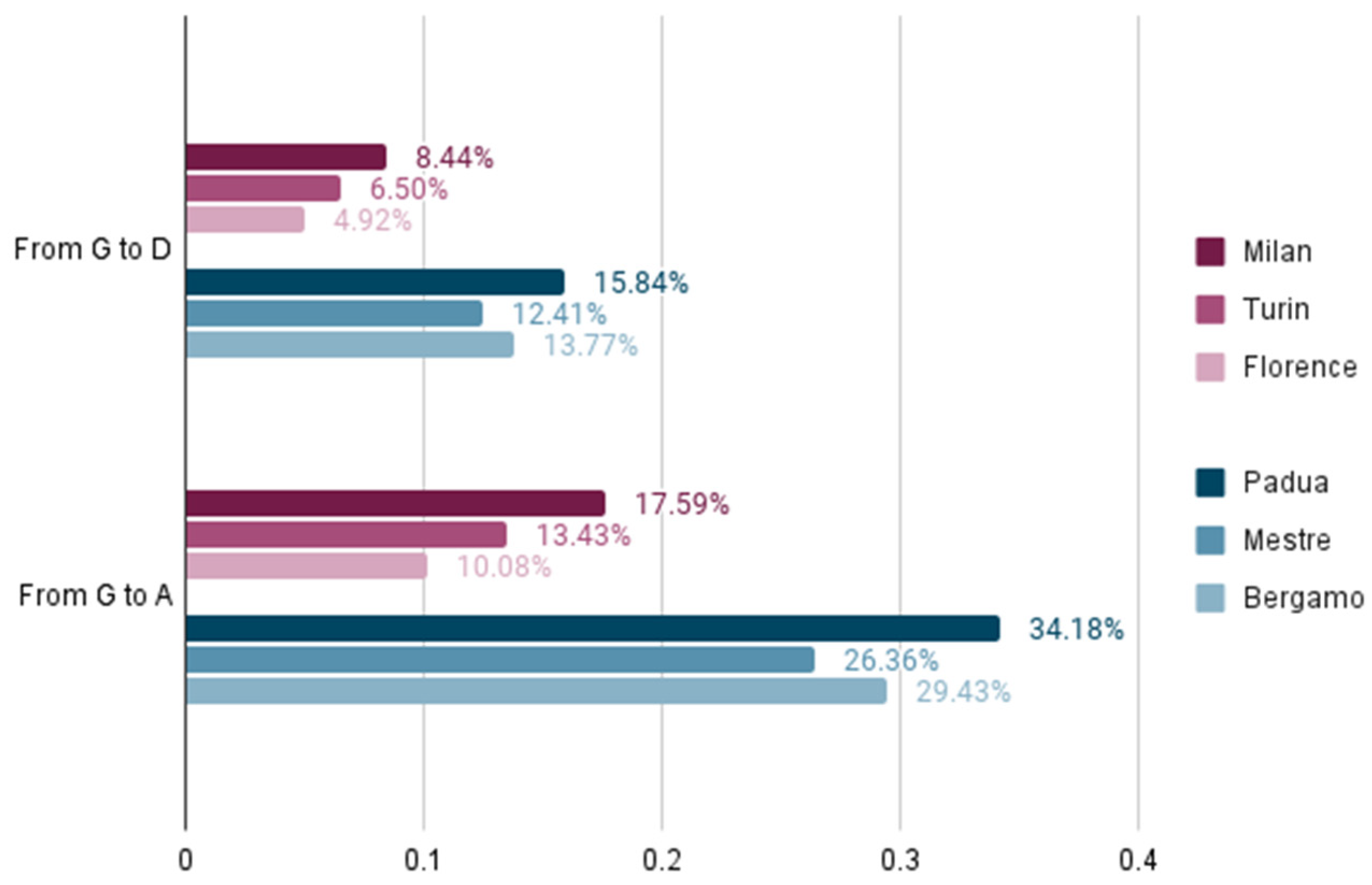

| Samples | From G to D | From G to A |

|---|---|---|

| Metropolitan cities (Milan, Turin, Florence) | 4.92–8.44% (average 6.62%) | 10.08–17.59% (average 13.70%) |

| Medium-sized cities (Padua, Mestre, Bergamo) | 12.41–15.84% (average 14.01%) | 26.36–34.18% (average 29.99%) |

| Samples | From E/F/G to C/D | From E/F/G to A/B |

|---|---|---|

| Metropolitan cities (Milan, Turin, Florence) | 4.39–7.68% (average 6.59%) | 8.98–15.95% (average 13.63%) |

| Medium-sized cities (Padua, Mestre, Bergamo) | 12.08–17.94% (average 15.95%) | 25.61–39.10% (average 34.51%) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Micelli, E.; Giliberto, G.; Righetto, E.; Tafuri, G. Urban Disparities in Energy Performance Premium Prices: Towards an Unjust Transition? Land 2024, 13, 224. https://doi.org/10.3390/land13020224

Micelli E, Giliberto G, Righetto E, Tafuri G. Urban Disparities in Energy Performance Premium Prices: Towards an Unjust Transition? Land. 2024; 13(2):224. https://doi.org/10.3390/land13020224

Chicago/Turabian StyleMicelli, Ezio, Giulia Giliberto, Eleonora Righetto, and Greta Tafuri. 2024. "Urban Disparities in Energy Performance Premium Prices: Towards an Unjust Transition?" Land 13, no. 2: 224. https://doi.org/10.3390/land13020224