Design and Simulation of a Capacity Management Model Using a Digital Twin Approach Based on the Viable System Model: Case Study of an Automotive Plant

Abstract

:1. Introduction

2. Fundamental Definitions and State of Research

- Extra hours or reduction of hours: This approach is closely related to the “additional shift” process; it allows great flexibility and is used with the advantage of existing employees.

- Additional shifts: This alternative allows dealing with short-term demand fluctuations. Extra costs and training depend on the demand fluctuation and staff availability.

- External production: This is used to react to demand peaks; it results mainly in higher unit prices and has the risk of knowledge transfer.

- Investments: This option requires good predictions of capacity needs, because, as capacity increases, fixed costs also increase.

- Limited availability;

- Long delivery times with decreasing reliability;

- Constantly changing priorities and quantities;

- Errors and cancellations;

- High personal commitment of the employees involved in order processing;

- Additional expenditure due to extensive internal clarifications or the search for external alternative suppliers;

- Additional costs through partial and express deliveries, special shifts, and temporary employees;

- Individual decisions instead of overall optimum.

3. Methodology

- The viable system model as a framework for developing the conceptual model;

- System dynamics for designing and controlling the production system’s behavior;

- Statistical process control for demand pattern monitoring;

- Forecasting methods for calculating a demand forecast per period.

4. Design and Simulation of the Conceptual Model for Capacity Planning of an OEM Plant

4.1. Design of a Generic Conceptual Model Development Applying the VSM

- Development of an economic target system depending on capacity utilization of a production network, plant, line, or group of machines;

- Capacity management tasks according to planning horizon levels;

- Definitions of recursion levels and operative units;

- Association of tasks to recursion levels and operative units;

- Identification of needed information flows between operative units and recursion levels.

- The focus of demand forecasting is not to bring about a difference between the models in terms of the accuracy of the used forecast methods, but to be able to respond to the changes in customers’ demands by detecting the pattern changes as soon as possible. Due to this premise, the model includes factors that allow for controlling the values that trigger the forecasting changes. Therefore, it is a fight between “detecting only the changes that are real changes” (but perhaps not before they have a negative impact on production and sales parameters) or “detecting more changes than the real ones but knowing that, if there is a change, it is going to be anticipated” (but knowing that, if a change is not a real one, the system will have more forecast failures at first).

- This viable system model deals with uncertainty in demand by calculating forecast values for each product separately. Then, the forecast for groups of customers is done by aggregation of customers′ forecasts.

- Trend: with regression analysis.

- Trend plus sporadic: with regression analysis plus an average sporadic quantity per day.

- Sporadic: the sum of outliers is divided by their frequency to obtain the average demand per day.

- Steady: with the cumulative moving average method.

- Steady plus sporadic: with the cumulative moving average method plus an average sporadic quantity per day.

- Seasonal: with the cumulative moving average method (however, this is not the appropriate forecast method in terms of accuracy for this kind of demand pattern).

- From steady to steady with a lower/higher mean;

- From steady to steady with a lower/higher standard deviation;

- From steady to steady plus a positive/negative sporadic pattern;

- From steady to an increasing/decreasing trend;

- From trend to trend plus a positive/negative sporadic pattern;

- From trend to steady;

- From trend to seasonal;

- From a sporadic pattern to another sporadic pattern.

- Ho = the mean is the same as before: the null hypothesis is accepted when mean of the last 10 values is within the control limits that are the mean plus/minus one standard deviation.

- H1 = the mean is higher/lower: one of the alternative hypotheses is accepted if the mean of the last 10 values is not within the control limits.

- Adjust the number of employees in order to produce more in the same number of shifts.

- Adjust the number of shifts, as well as working hours, on weekends or holidays.

- Increase external production capacities for peak or constant production requirements.

- Increase the production capacity with new investments.

- Calculate the daily production loss according to bottlenecks and extrapolate it for longer periods based on the available demand forecast.

- Increase maintenance planning and coordination, as well as the number of tools, in order to reduce breakdowns and increase plant availability.

- New investments for increasing production capacity. For this decision, the model requires a payback of less than two years. The return on investment is forecast to determine the increase in capacity that is pursued by the investment.

- Operational costs related to extra hours or extra shifts of operational employees. Based on the gap between production capacity and demand, operational costs are optimized by adjusting the number of employees, working days, and shifts.

- Customer demand loss based on the value of the customer order lead time. Customers buy from a company or not depending on the lead time. Therefore, the model assesses the customer requirements and evaluates the losses in sales due to a long delivery process. Based on this loss, a decision on whether to improve capacity and internal processes can be made.

4.2. Simulation of a Specific Model for the Case Study of an Automotive Plant

- Time restrictions: Firstly, the modeler must define a time horizon and units of time. It is easy to carry out this step by asking to what extent the simulation should be considered. In the case of the study, it was decided to simulate four working years to evaluate influences in the medium and long term. The simulation was performed with 1000 time periods, each representing one producing day counting in total for four years of production.

- Production capacity has a maximum of 600 units per day in three shifts at the beginning of the simulation. During the simulation, two investment options were considered: an increase of 100 units per day or an increase of 200 units per day. Both models assessed the same requirements for initiating one or the other investment. The difference between the viable system model and the nonviable system model was the lead time of the decision-making process.

- ○

- Viable system model: the decision-making process takes 10 days.

- ○

- Nonviable system model: the decision-making process takes 100 days.

- Demand characteristics and forecast: The model makes different forecasts using two methods, i.e., moving average and linear regression:

- Moving average: the simple moving average (SMA) is the non-weighted mean of the previous n data [16]. In the nonviable system model, it is calculated as the average for the last 10 days (n = 10). As the VSM is able to detect demand changes over time, all demand values were taken into account for the forecast until a new demand pattern was registered. Therefore, the formula of the cumulative moving average was applied.

- Linear regression: The regression analysis method is usually applicable to a steady course of a time series or a stable trend [16]. In the model, it is only used for trend demand patterns, when using only one leading indicator and the time since the trend demand pattern was detected. As a result, a simple linear regression can be defined as follows:where α is the slope, ttrend is the time since the trend demand pattern was detected, and β is the value at the time when the trend demand pattern was detected.F j (t) = demand forecast for customer j at time t = α × ttrend + β,

- The existing car model is in a mature stage with stable demand and provides 1000 euros/car of margin. The new model is in the process of being launched and provides 2000 euros/car. These values were used to calculate profits. If there is loss in volume, it is assumed that the new model will have the loss in volume due to unknown future demand.

- The simulation model considers sales loss starting from a customer order lead time greater than 60 days.

- A product is a finished product after it leaves the production facility.

- The warehouses have no stock limitation.

- There is no transport limitation (or limitation to the number of trucks) between the different stages.

- A steady supply of materials for the production process is provided.

- The available stock, as well as the number of products, is known at every moment of the transport process.

- Order information along the supply chain is available.

- Data on historical demand are available for both models one day after the demand.

- Operational adjustments allow for changing the shift model with a one-third increase in the capacity per extra shift with a maximum of three shifts. Moreover, a higher number of employees in an existing shift provide a flexibility of 10% to existing production capacities.

- Production is 50% make-to-stock and 50% make-to-order.

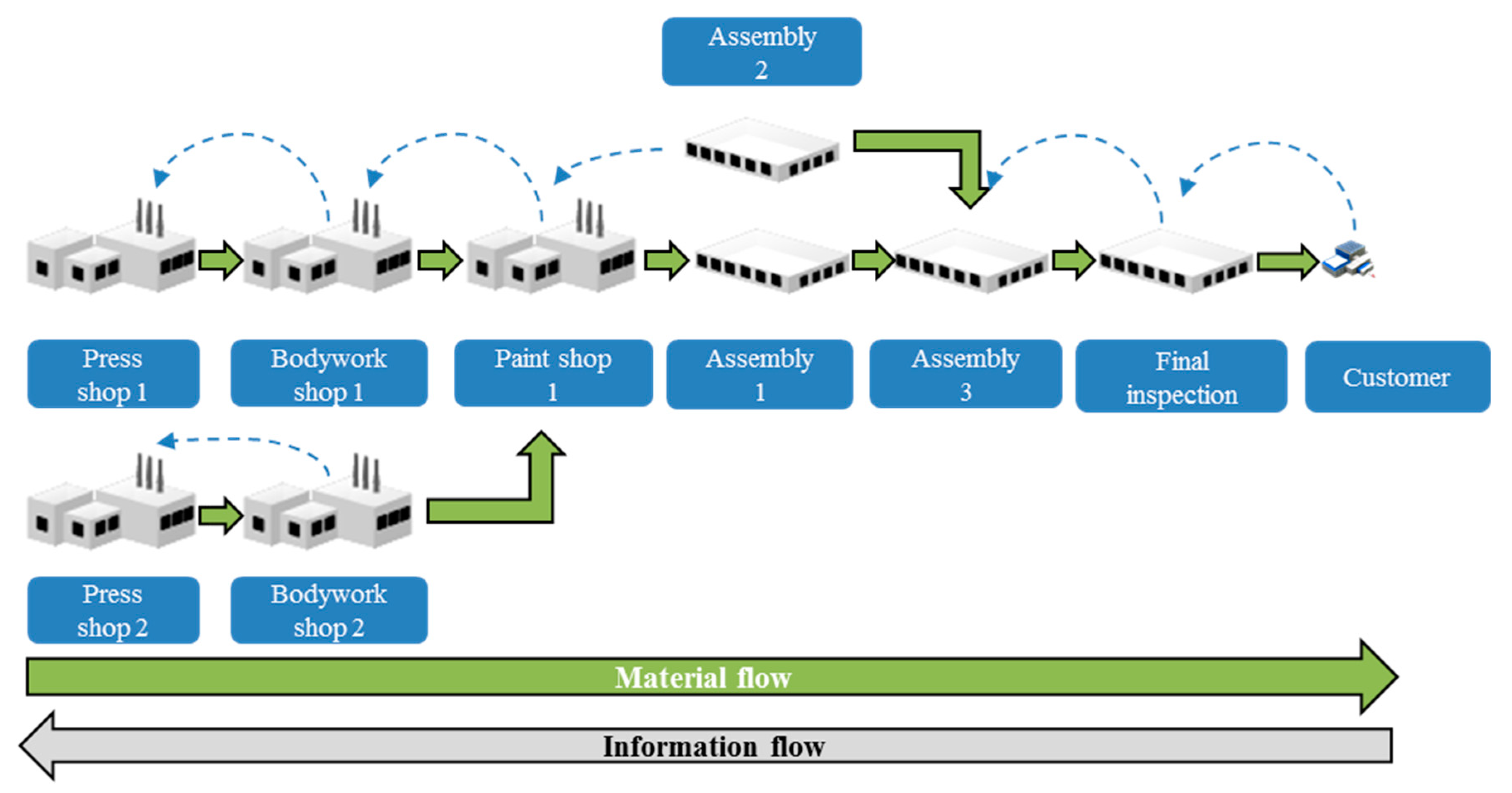

- Production consists of a process that begins with steel stamping and ends with final revision. The plants in the process are shown in Figure 3 and listed below.

- Press shop 1: a nominal capacity of 300 units per day.

- Bodywork shop 1: a nominal capacity of 300 units per day.

- Press shop 2: a nominal capacity of 300 units per day.

- Bodywork shop 2: a nominal capacity of 300 units per day.

- Paint shop: a nominal capacity of 600 units per day.

- Pre-assembly shop, assembly 1: a nominal capacity of 600 units per day.

- Mechanical assembly shop, assembly 2: a nominal capacity of 600 units per day.

- Final assembly shop, assembly 3: a nominal capacity of 600 units per day.

- Final inspection shop: a nominal capacity of 600 units per day.

- Profits (million euros): the result of the multiplication of the number of produced cars by the margin that was provided for the type of produced car.

- Total production (units): the cumulative sum of all car units produced over the 1000 simulated production days.

- Capacity utilization (%): the cumulative utilization of available capacities over the 1000 simulated production days.

- Maximum production capacity (units/day): both models were initialized with a demand of 600 units per day. This KPI shows the maximum capacity that was achieved during the simulated period.

- Service level (%): the quantity of units delivered on time divided by the total number of delivered units.

- Customer order lead time (days): the number of days between the placement of the order and the delivery of the product.

- Operational savings (million euros): the savings due to optimization of working hours, shifts, and maintenance activities.

- Investment value (million euros): the amount of the investment made to increase capacities. The value can be 30 million euros for an increase of up to 700 units per day or 60 million euros for an increase of up to 800 units per day.

- Return on investment (million euros): the margin of the products that can be produced thanks to the investment minus the investment value.

4.3. Simulation Results for the Case Study of an Automotive Plant

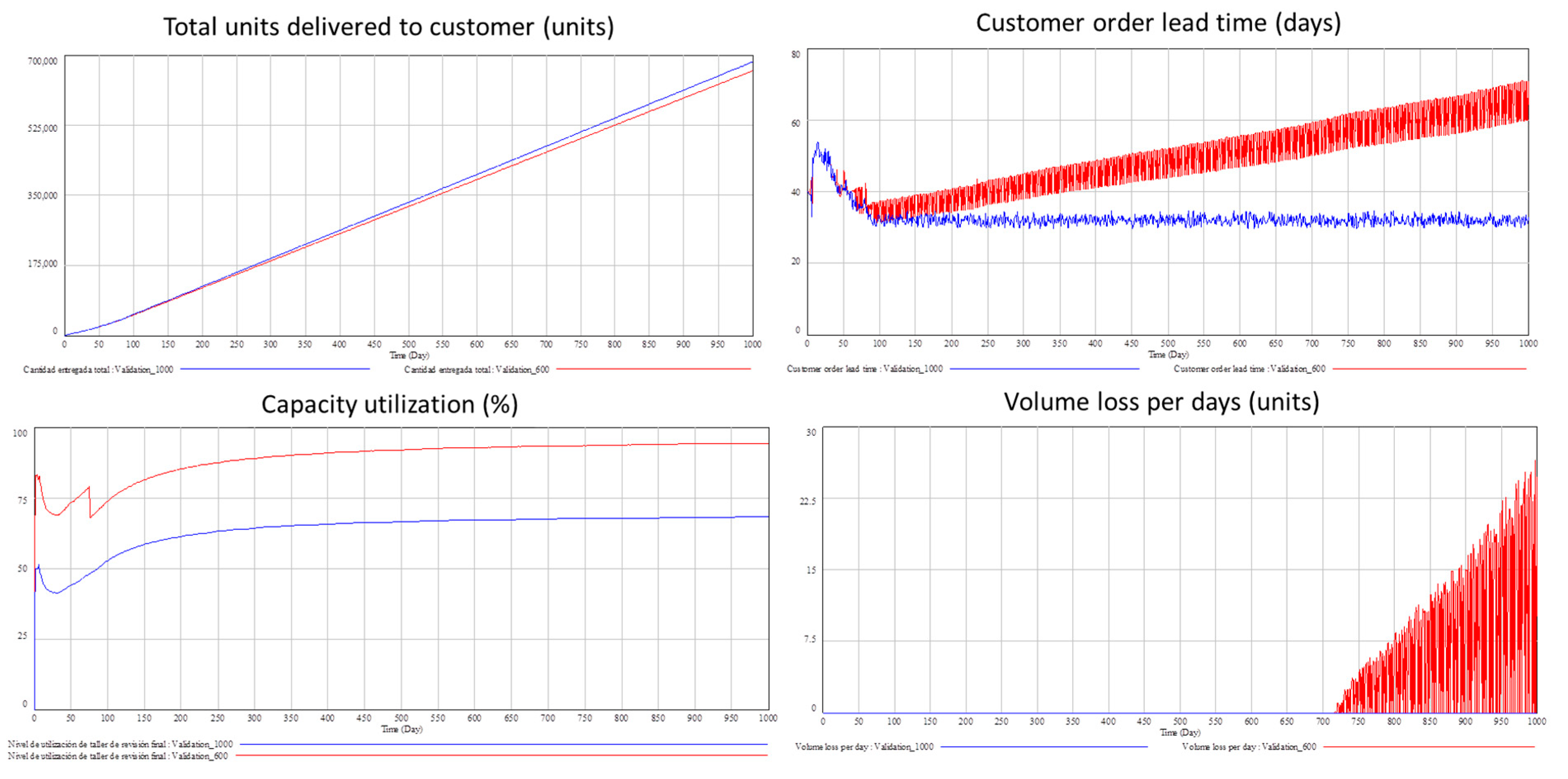

- For a lower nominal capacity (units per day), the customer order lead time, volume loss, and capacity utilization must be higher, and the total number of units delivered to customers must be lower, as shown in Figure 5. The red lines indicate the lower nominal capacity, and the blue ones indicate the higher nominal capacity.

- For a lower customer demand (units per day), the customer order lead time, volume loss, capacity utilization, and total number of units delivered to customers must be lower.

5. Conclusions

- Thanks to a new conceptual model for capacity planning able to make decisions for reduction or increase of production capacity, the viability of a company can be assured. As a result, it proves the need for such a system as a standard tool for managers in the future in order to increase the efficiency and adaptability of manufacturing organizations.

- The viable system model provides the necessary structure to determine the interrelationships among areas and parameters that allow decisions to be made regarding capacity in an autonomous process based on selected control limits.

- The simulation of an OEM plant using the developed conceptual model presents better results compared with currently available structures regarding how to deal with customer demand volatility.

Author Contributions

Funding

Conflicts of Interest

References

- Kühnapfel, J.B. Vertriebsprognosen. In Vertriebscontrolling; Springer Gabler: Wiesbaden, Germany, 2014. [Google Scholar]

- Stadtler, H.; Kilger, C. Supply Chain Management and Advanced Planning; Springer: Berlin, Germany, 2002–2005; Volume 4, p. 139. [Google Scholar]

- Schuh, G.; Stich, V.; Wienholdt, H. Logistikmanagement; Springer Vieweg: Berlin, Germany, 2013; p. 89. [Google Scholar]

- Campuzano, F.; Mula, J. Supply Chain Simulation: A System Dynamics Approach for Improving Performance; Springer Science & Business Media: Berlin, Germany, 2011; p. 23. [Google Scholar]

- Schönsleben, P. Integrales Logistikmanagement: Operations and Supply Chain Management in Umfassenden Wertschöpfungsnetzwerken; Springer: Berlin, Germany, 2011; p. 668. [Google Scholar]

- Frazelle, E. Supply Chain Strategy: The Logistics of Supply Chain Management; McGraw Hill: New York, NY, USA, 2002; p. 117. [Google Scholar]

- Gupta, M.C.; Boyd, L.H. Theory of constraints: A theory for operations management. Int. J. Oper. Prod. Manag. 2008, 28, 991–1012. [Google Scholar] [CrossRef]

- Beschaffungsmanagement Revue De L’acheteur; Verein procure.ch: Aarau, Switzerland, 2010; Volume 10/10, pp. 16–17.

- Biedermann, H. Ersatzteilmanagement: Effiziente Ersatzteillogistik Für Industrieunternehmen; Springer: Berlin, Germany, 2008. [Google Scholar]

- Espejo, R.; Harnden, R. The Viable System Model: Interpretations and Applications of Stafford Beer’s VSM; Wiley: Hoboken, NJ, USA, 1989. [Google Scholar]

- Auerbach, T.; Bauhoff, F.; Beckers, M.; Behnen, D.; Brecher, C.; Brosze, T.; Esser, M. Selbstoptimierende produktionssysteme. In Integrative Produktionstechnik Für Hochlohnländer; Springer: Berlin, Germany, 2011; pp. 747–1057. [Google Scholar]

- Schuh, G.; Stich, V.; Brosze, T.; Fuchs, S.; Pulz, C.; Quick, J.; Bauhoff, F. High resolution supply chain management: Optimized processes based on self-optimizing control loops and real time data. Prod. Eng. 2011, 5, 433–442. [Google Scholar] [CrossRef]

- Beer, S. Brain of the Firm: A Development in Management Cybernetics Herder and Herder; Verlag Herder: Freiburg im Breisgau, Germany, 1972. [Google Scholar]

- Coyle, R.G. System Dynamics Modelling: A Practical Approach; Chapman & Hall: London, UK, 2008. [Google Scholar]

- Schuh, G.; Stich, V. Logistikmanagement. 2., vollständig neu bearbeitete und erw. Auflage; 2013. [Google Scholar]

- Meyer, J.C.; Sander, U.; Wetzchewald, P. Bestände Senken, Lieferservice Steigern-Ansatzpunkt Bestandsmanagement; FIR: Aachen, Germany, 2019. [Google Scholar]

- Wensing, T. Periodic Review Inventory Systems; Springer: Berlin, Germany, 2011; Volume 651. [Google Scholar]

| Simulation Level | Demand Scenario 1 | Key performance Indicator (KPI) | VSM Simulation Model | Nonviable Simulation Model |

|---|---|---|---|---|

| Plant level |

| Profits (million euros) | 1021 | 1012 |

| Total production (units) | 660,129 | 655,761 | ||

| Capacity utilization (%) | 94.3 | 82.0 | ||

| Maximum production capacity (units/day) | 700 | 800 | ||

| Service level (%) | 98.5 | 97.6 | ||

| Customer order lead time (days) | 49.7 | 58.6 | ||

| Operational savings (million euros) | 1.0 | 0.0 | ||

| Investment value (million euros) | 30.0 | 60.0 | ||

| Return on investment (million euros) | 70.0 | 70.0 |

| Simulation Level | Demand Scenario 2 | Key Performance Indicator (KPI) | VSM Simulation Model | Nonviable Simulation Model |

|---|---|---|---|---|

| Plant level |

| Profits (million euros) | 934 | 925 |

| Total production (units) | 617,021 | 612,520 | ||

| Capacity utilization (%) | 88.2 | 76.7 | ||

| Maximum production capacity (units/day) | 700 | 800 | ||

| Service level (%) | 97.2 | 95.3 | ||

| Customer order lead time (days) | 46.3 | 54.4 | ||

| Operational savings (million euros) | 3.5 | 0.0 | ||

| Investment value (million euros) | 30.0 | 60.0 | ||

| Return on investment (million euros) | 28.8 | 15.4 |

| Simulation Level | Demand Scenario 3 | Key Performance Indicator (KPI) | VSM Simulation Model | Nonviable Simulation Model |

|---|---|---|---|---|

| Plant level |

| Profits (million euros) | 887 | 794 |

| Total production (units) | 593,280 | 546,885 | ||

| Capacity utilization (%) | 84.8 | 91.2 | ||

| Maximum production capacity (units/day) | 700 | 600 | ||

| Service level (%) | 96.3 | 94.0 | ||

| Customer order lead time (days) | 41.0 | 70.9 | ||

| Operational savings (million euros) | 10.0 | 0.0 | ||

| Investment value (million euros) | 30.0 | 0.0 | ||

| Return on investment (million euros) | 70.0 | - |

| Simulation Level | Demand Scenario 4 | Key Performance Indicator (KPI) | VSM Simulation Model | Nonviable Simulation Model |

|---|---|---|---|---|

| Plant level |

| Profits (million euros) | 935 | 842 |

| Total production (units) | 617.390 | 565.968 | ||

| Capacity utilization (%) | 88.2 | 94.3 | ||

| Maximum production capacity (units/day) | 700 | 600 | ||

| Service level (%) | 97.9 | 91.8 | ||

| Customer order lead time (days) | 44.2 | 88.2 | ||

| Operational savings (million euros) | 12.5 | 0.0 | ||

| Investment value (million euros) | 30.0 | 0.0 | ||

| Return on investment (million euros) | 20.4 | - |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gallego-García, S.; Reschke, J.; García-García, M. Design and Simulation of a Capacity Management Model Using a Digital Twin Approach Based on the Viable System Model: Case Study of an Automotive Plant. Appl. Sci. 2019, 9, 5567. https://doi.org/10.3390/app9245567

Gallego-García S, Reschke J, García-García M. Design and Simulation of a Capacity Management Model Using a Digital Twin Approach Based on the Viable System Model: Case Study of an Automotive Plant. Applied Sciences. 2019; 9(24):5567. https://doi.org/10.3390/app9245567

Chicago/Turabian StyleGallego-García, Sergio, Jan Reschke, and Manuel García-García. 2019. "Design and Simulation of a Capacity Management Model Using a Digital Twin Approach Based on the Viable System Model: Case Study of an Automotive Plant" Applied Sciences 9, no. 24: 5567. https://doi.org/10.3390/app9245567