Real Business Applications and Investments in Blockchain Technology

Abstract

:1. Introduction

2. Materials and Methods

3. Results

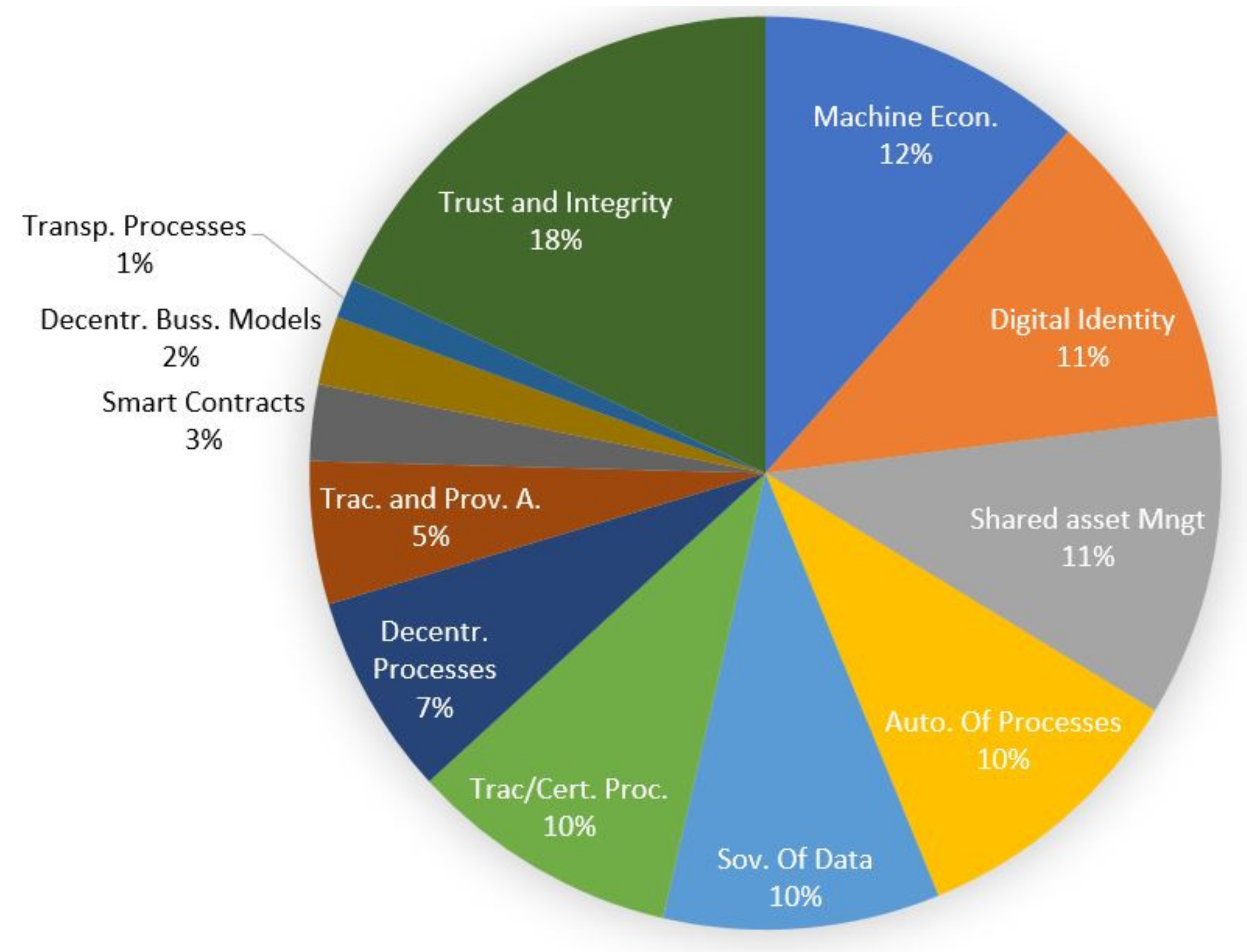

3.1. Perceived Value of Blockchain Technology

3.1.1. Decentralization of Processes

3.1.2. Decentralization of Business Models

3.1.3. Traceability and Provenance of Assets

3.1.4. Traceability/Certification of Processes and Regulatory Compliance

- Construction and industrial transformation processes linked to quality standards or circular economy certifications [34].

- Food safety processes in a supply chain [35], sometimes also linked to the process of obtaining labels of quality, bio, and ecological.

- Compliance with personal data protection regulations such as GDPR, monitoring the access and exploitation of sensitive data [36].

- Traceability of financial operations for regulatory compliance [37].

- Tenders or registration of power of attorney in the public sector [38].

3.1.5. Transparency of Processes

3.1.6. Shared Asset/Process Management

3.1.7. Trustworthiness and Integrity

3.1.8. Automation of Processes

3.1.9. Smart Contracts

3.1.10. Digital Identity

3.1.11. Sovereignty of Data and Data-Driven Services

3.1.12. Machine-to-Machine (M2M) Transactions and Machine Economy

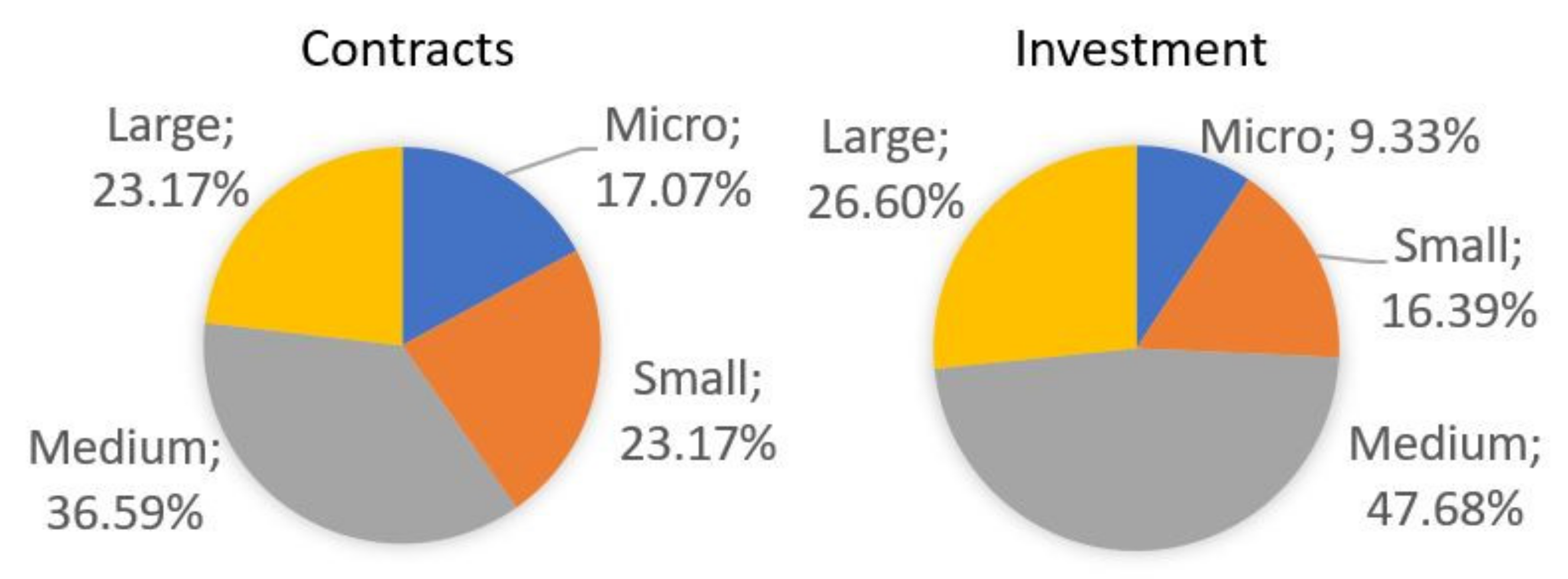

3.2. Blockchain Applications Impact Analysis

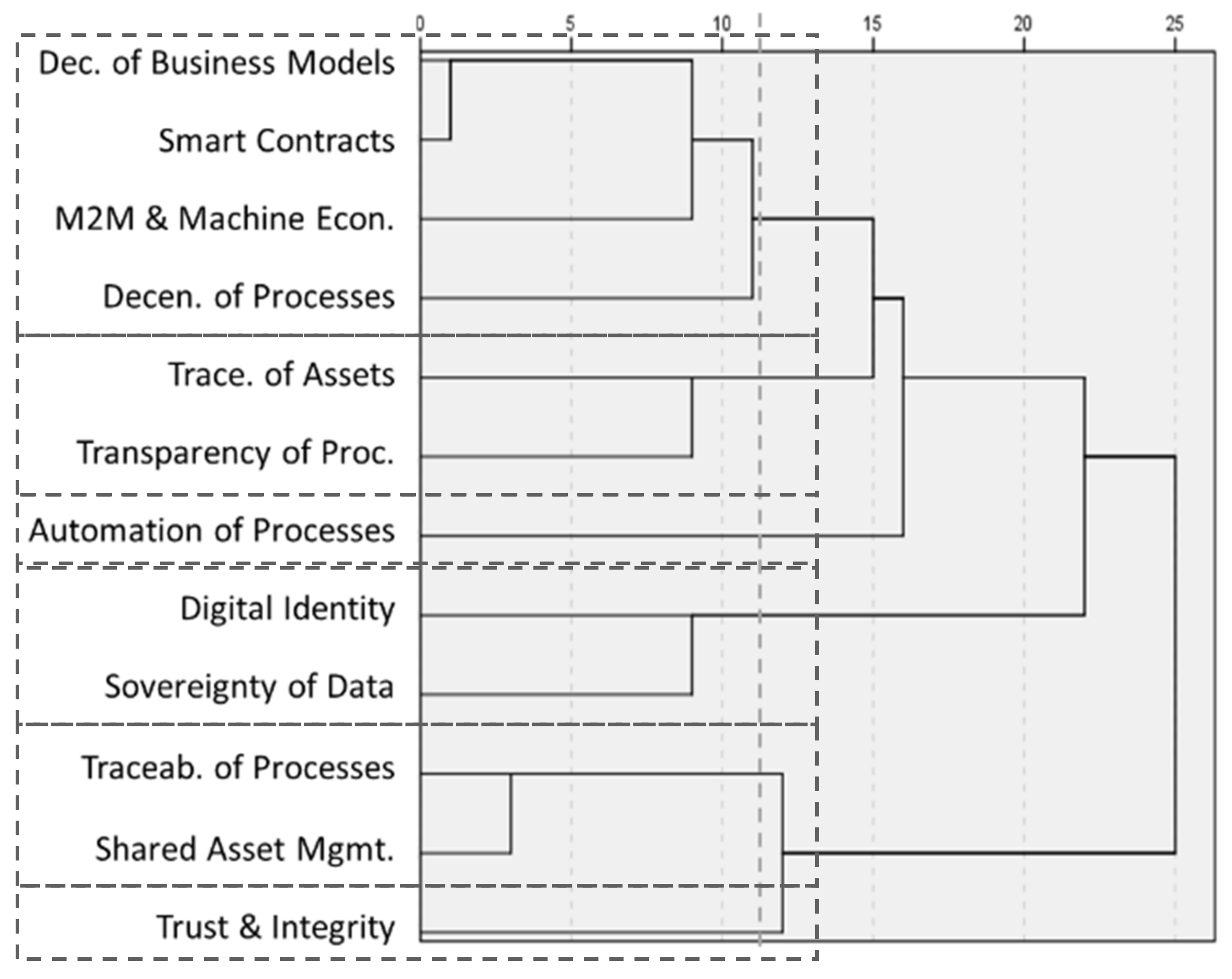

3.3. Relational Model of Blockchain Provided Value

4. Conclusions

4.1. Limitations

4.2. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System; 2008; Available online: https://bitcoin.org/bitcoin.pdf (accessed on 17 December 2021).

- Fanning, K.; Centers, D.P. Blockchain and Its Coming Impact on Financial Services. J. Corp. Account. Financ. 2016, 27, 53–57. [Google Scholar] [CrossRef]

- Collomb, A.; Sok, K. Blockchain/distributed ledger technology (DLT): What impact on the financial sector? Digiworld Econ. J. 2016, 103, 93–111. [Google Scholar]

- Mettler, M. Blockchain technology in healthcare: The revolution starts here. In Proceedings of the 2016 IEEE 18th International Conference on e-Health Networking, Applications and Services (Healthcom), Munich, Germany, 14–16 September 2016; IEEE: New York, NY, USA, 2016; pp. 1–3. [Google Scholar]

- Ekblaw, A.; Azaria, A.; Halamka, J.D.; Lippman, A. A Case Study for Blockchain in Healthcare: “MedRec” prototype for electronic health records and medical research data. In Proceedings of the IEEE Open & Big Data Conference, Los Alamitos, CA, USA, 15–18 December 2021; p. 13. [Google Scholar]

- Wang, L.; Xie, Y.; Zhang, D.; Liu, J.; Jiang, S.; Zhang, Y.; Li, M. Credible Peer-to-Peer Trading with Double-Layer Energy Blockchain Network in Distributed Electricity Markets. Electronics 2021, 10, 1815. [Google Scholar] [CrossRef]

- Huang, Z.; Li, Z.; Lai, C.S.; Zhao, Z.; Wu, X.; Li, X.; Tong, N.; Lai, L.L. A novel power market mechanism based on blockchain for electric vehicle charging stations. Electronics 2021, 10, 307. [Google Scholar] [CrossRef]

- Ølnes, S. Beyond bitcoin-Public sector innovation using the bitcoin blockchain technology. In Proceedings of the Norsk Konferanse for Organisasjoners Bruk at IT, Oslo, Norway, 19–21 November 2015. [Google Scholar]

- Deloitte’s 2020 Goblal Blockchain Survey. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/6608_2020-global-blockchain-survey/DI_CIR%202020%20global%20blockchain%20survey.pdf (accessed on 7 December 2021).

- Seebacher, S.; Schüritz, R. Blockchain technology as an enabler of service systems: A structured literature review. In Proceedings of the International Conference on Exploring Services Science, Rome, Italy, 24–26 May 2017; pp. 12–23. [Google Scholar]

- Tama, B.A.; Kweka, B.J.; Park, Y.; Rhee, K.H. A critical review of blockchain and its current applications. In Proceedings of the 2017 International Conference on Electrical Engineering and Computer Science (ICECOS), Sriwijaya, Indonesia, 22–23 August 2017; 2017; pp. 109–113. [Google Scholar]

- Hawlitschek, F.; Notheisen, B.; Teubner, T. The limits of trust-free systems: A literature review on blockchain technology and trust in the sharing economy. Electron. Commer. Res. Appl. 2018, 29, 50–63. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Laroiya, C.; Saxena, D.; Komalavalli, C. Applications of blockchain technology. In Handbook of Research on Blockchain Technology; Academic Press: Cambridge, MA, USA, 2020; pp. 213–243. [Google Scholar]

- Perera, S.; Nanayakkara, S.; Rodrigo, M.N.N.; Senaratne, S.; Weinand, R. Blockchain technology: Is it hype or real in the construction industry? J. Ind. Inf. Integr. 2020, 17, 100125. [Google Scholar] [CrossRef]

- Ko, T.; Lee, J.; Ryu, D. Blockchain technology and manufacturing industry: Real-time transparency and cost savings. Sustainability 2018, 10, 4274. [Google Scholar] [CrossRef] [Green Version]

- Casado-Vara, R.; Chamoso, P.; De la Prieta, F.; Prieto, J.; Corchado, J.M. Non-linear adaptive closed-loop control system for improved efficiency in IoT-blockchain management. Inf. Fusion 2019, 49, 227–239. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.; Wang, H. An overview of blockchain technology: Architecture, consensus, and future trends. In Proceedings of the 2017 IEEE International Congress on Big Data, Honolulu, HI, USA, 25–30 June 2017; pp. 557–564. [Google Scholar]

- Mendling, J.; Weber, I.; Aalst, W.V.D.; Brocke, J.V.; Cabanillas, C.; Daniel, F.; Debois, S.; Di Chiccio, C.; Dumas, M.; Dustar, S.; et al. Blockchains for business process management-challenges and opportunities. ACM Trans. Manag. Inf. Syst. 2018, 9, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Harmon, P. Business Process Change: A Business Process Management Guide for Managers and Process Professionals; Morgan Kaufmann: Burlington, VT, USA, 2019. [Google Scholar]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. FRB Int. Financ. Discuss. Pap. 2018, 2018, 1222. [Google Scholar] [CrossRef]

- Nowiński, W.; Kozma, M. How can blockchain technology disrupt the existing business models? Entrep. Bus. Econ. Rev. 2017, 5, 173–188. [Google Scholar] [CrossRef]

- Lage, O.; Saiz-Santos, M. Blockchain and the decentralisation of the cybersecurity Industry. DYNA 2021, 96, 239. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Täuscher, K.; Laudien, S.M. Understanding platform business models: A mixed methods study of marketplaces. Eur. Manag. J. 2018, 36, 319–329. [Google Scholar] [CrossRef] [Green Version]

- Stoletov, N. Uberisation Business Model Based on Blockchain for Implementation Decentralized Application for Lease/Rent Lodging. In Proceedings of the Information Systems and Technologies to Support Learning: Proceedings of EMENA-ISTL, Fez, Morocco, 25–27 October 2018; Volume 111, p. 225. [Google Scholar]

- Mezquita, Y.; Casado-Vara, R.; González Briones, A.; Prieto, J.; Corchado, J.M. Blockchain-based architecture for the control of logistics activities: Pharmaceutical utilities case study. Log. J. IGPL 2021, 29, 974–985. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCAllum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Ito, K.; O’dair, M. A Critical Examination of the Application of Blockchain Technology to Intellectual Property Management. In Business Transformation through Blockchain; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 317–335. [Google Scholar]

- Finck, M.; Moscon, V. Copyright Law on Blockchains: Between New Forms of Rights Administration and Digital Rights Management 2.0. IIC-Int. Rev. Intellect. Prop. Compet. Law 2019, 50, 77–108. [Google Scholar] [CrossRef] [Green Version]

- Montecchi, M.; Plangger, K.; Etter, M. It’s real, trust me! Establishing supply chain provenance using blockchain. Bus. Horiz. 2019, 62, 283–293. [Google Scholar] [CrossRef] [Green Version]

- Kouhizadeh, M.; Sarkis, J.; Zhu, Q. At the nexus of blockchain technology, the circular economy, and product deletion. Appl. Sci. 2019, 9, 1712. [Google Scholar] [CrossRef] [Green Version]

- Hatzivasilis, G.; Ioannidis, S.; Fysarakis, K.; Spanoudakis, G.; Papadakis, N. The green blockchains of circular economy. Electronics 2021, 10, 2008. [Google Scholar] [CrossRef]

- Shih, C.S.; Yang, K.W. Design and implementation of distributed traceability system for smart factories based on blockchain technology. In Proceedings of the Conference on Research in Adaptive and Convergent Systems, Chongqing, China, 24–27 September 2019; 2019; pp. 181–188. [Google Scholar]

- Caro, M.P.; Ali, M.S.; Vecchio, M.; Giaffreda, R. Blockchain-based traceability in Agri-Food supply chain management: A practical implementation. In Proceedings of the 2018 IoT Vertical and Topical Summit on Agriculture-Tuscany (IOT Tuscany), Tuscany, Italy, 8–9 May 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 1–4. [Google Scholar]

- Compert, C.; Luineti, M.; Portier, B. Blockchain and GDPR: How blockchain could address five areas associated with GDPR compliance. IBM Secur. White Pap. 2018. Available online: https://iapp.org/media/pdf/resource_center/blockchain_and_gdpr.pdf (accessed on 17 December 2021).

- YOO, S. Blockchain based financial case analysis and its implications. Asia Pac. J. Innov. Entrep. 2017, 11, 312–321. [Google Scholar] [CrossRef]

- Ølnes, S.; Ubacht, J.; Janssen, M. Blockchain in government: Benefits and implications of distributed ledger technology for information sharing. Gov. Inf. Q. 2017, 34, 355–364. [Google Scholar] [CrossRef] [Green Version]

- Batubara, F.R.; Ubacht, J.; Janssen, M. Challenges of blockchain technology adoption for e-government: A systematic literature review. In Proceedings of the 19th Annual International Conference on Digital Government Research: Governance in the Data Age, Delft, The Netherlands, 30 May–1 June 2018; 2018; pp. 1–9. [Google Scholar]

- Nugent, T.; Upton, D.; Cimpoesu, M. Improving data transparency in clinical trials using blockchain smart contracts. F1000Research 2016, 5, 2541. [Google Scholar] [CrossRef] [Green Version]

- Adams, W.M.; Brockington, D.; Dyson, J.; Vira, B. Managing tragedies: Understanding conflict over common pool resources. Science 2003, 302, 1915–1916. [Google Scholar] [CrossRef] [Green Version]

- Böhme, R.; Christin, N.; Edelman, B.; Moore, T. Bitcoin: Economics, technology, and governance. J. Econ. Perspect. 2015, 29, 213–238. [Google Scholar] [CrossRef] [Green Version]

- Serrano, O.L.; de Diego, S.D.D.; Seco, I.; Larrucea, X. Semi-real-time Hash Comparison for Detecting Intrusions Using Blockchain. In Proceedings of the International Conference on Model and Data Engineering, Touluse, France, 28–31 October 2019; Springer: Cham, Switzerland, 2019; pp. 165–179. [Google Scholar]

- Ryu, J.H.; Sharma, P.K.; Jo, J.H.; Park, J.H. A blockchain-based decentralized efficient investigation framework for IoT digital forensics. J. Supercomput. 2019, 75, 4372–4387. [Google Scholar] [CrossRef]

- Ferdous, M.S.; Chowdhury, F.; Alassafi, M.O. In search of self-sovereign identity leveraging blockchain technology. IEEE Access 2019, 7, 103059–103079. [Google Scholar] [CrossRef]

- Ter Hofstede, A.H.; Van der Aalst, W.M.; Adams, M.; Russell, N. (Eds.) Modern Business Process Automation: YAWL and Its Support Environment; Springer Science & Business Media: Berlin, Germany, 2009; p. 492. [Google Scholar]

- De Diego, S.; Gonçalves, C.; Lage, O.; Manshell, J.; Kontoulis, M.; Moustakidis, S.; Guerra, B.; Liapis, A. Blockchain-Based Threat Registry Platform. In Proceedings of the 2019 IEEE 10th Annual Information Technology, Electronics and Mobile Communication Conference (IEMCON), Vancouver, BC, Canada, 17–19 October 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 892–898. [Google Scholar]

- Ferrer, E.C. The blockchain: A new framework for robotic swarm systems. In Proceedings of the Future Technologies Conference, Vancouver, BC, Canada, 15–16 November 2018; Springer: Cham, Switzerland, 2018; pp. 1037–1058. [Google Scholar]

- Van der Aalst, W.M.; Bichler, M.; Heinzl, A. Robotic process automation. Bus. Inf. Syst. Eng. 2018, 60, 269–272. [Google Scholar] [CrossRef] [Green Version]

- Szabo, N. Smart Contracts; 1994; Unpublished manuscript. [Google Scholar]

- Szabo, N. Smart contracts: Building blocks for digital markets. EXTROPY J. Transhumanist Thought 1996, 16, 18–20. [Google Scholar]

- Subramanian, H. Decentralized blockchain-based electronic marketplaces. Commun. ACM 2017, 61, 78–84. [Google Scholar] [CrossRef]

- Van Leeuwen, G.; AlSkaif, T.; Gibescu, M.; van Sark, W. An integrated blockchain-based energy management platform with bilateral trading for microgrid communities. Appl. Energy 2020, 263, 114613. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; Demartini, C.; Pranteda, C.; Santamaría, V. Blockchain and smart contracts for insurance: Is the technology mature enough? Future Internet 2018, 10, 20. [Google Scholar] [CrossRef] [Green Version]

- Pazaitis, A.; De Filippi, P.; Kostakis, V. Blockchain and value systems in the sharing economy: The illustrative case of Backfeed. Technol. Forecast. Soc. Change 2017, 125, 105–115. [Google Scholar] [CrossRef]

- Allen, C. The path to self-sovereign identity. Life Alacrity. 2016. Available online: http://www.lifewithalacrity.com/2016/04/the-path-to-self-soverereign-identity.html (accessed on 17 December 2021).

- Goldreich, O.; Oren, Y. Definitions and properties of zero-knowledge proof systems. J. Cryptol. 1994, 7, 1–32. [Google Scholar] [CrossRef]

- Jarke, M. Data Sovereignty and Data Space Ecosystems. Bus. Inf. Syst. Eng. 2019, 61, 549–550. [Google Scholar] [CrossRef] [Green Version]

- Harris, D.; Khan, L.; Paul, R.; Thuraisingham, B. Standards for secure data sharing across organizations. Comput. Stand. Interfaces 2007, 29, 86–96. [Google Scholar] [CrossRef]

- Naehrig, M.; Lauter, K.; Vaikuntanathan, V. Can homomorphic encryption be practical? In Proceedings of the 3rd ACM Workshop on Cloud Computing Security Workshop, Chicago, IL, USA, 21 October 2011; pp. 113–124. [Google Scholar]

- Park, Y.H.; Kim, Y.; Shim, J. Blockchain-Based Privacy-Preserving System for Genomic Data Management Using Local Differential Privacy. Electronics 2021, 10, 3019. [Google Scholar] [CrossRef]

- Peng, Z.; Xu, J.; Chu, X.; Gao, S.; Yao, Y.; Gu, R.; Tang, Y. Vfchain: Enabling verifiable and auditable federated learning via blockchain systems. IEEE Trans. Netw. Sci. Eng. 2021, 9, 173–186. [Google Scholar] [CrossRef]

- Du, W.; Atallah, M.J. Secure multi-party computation problems and their applications: A review and open problems. In Proceedings of the 2001 Workshop on New Security Paradigms, Cloudcroft, NM, USA, 10–13 September 2001; pp. 13–22. [Google Scholar] [CrossRef]

- Peng, Z.; Xu, C.; Wang, H.; Huang, J.; Xu, J.; Chu, X. P2B-Trace: Privacy-Preserving Blockchain-based Contact Tracing to Combat Pandemics. In Proceedings of the 2021 International Conference on Management of Data, Xi’an, China, 20–25 June 2021; pp. 2389–2393. [Google Scholar]

- Lage, O. Blockchain: From Industry 4.0 to the Machine Economy. In Computer Security Threats; IntechOpen: London, UK, 2019. [Google Scholar]

- Chen, Y. Blockchain tokens and the potential democratization of entrepreneurship and innovation. Bus. Horiz. 2018, 61, 567–575. [Google Scholar] [CrossRef]

- Attaran, M.; Gunasekaran, A. Applications of Blockchain Technology in Business: Challenges and Opportunities; Springer Nature: Berlin, Germany, 2019. [Google Scholar]

- Lee, J.Y. A decentralized token economy: How blockchain and cryptocurrency can revolutionize business. Bus. Horiz. 2019, 62, 773–784. [Google Scholar] [CrossRef]

- Morstyn, T.; Farrell, N.; Darby, S.J.; McCulloch, M.D. Using peer-to-peer energy-trading platforms to incentivize prosumers to form federated power plants. Nat. Energy 2018, 3, 94–101. [Google Scholar] [CrossRef]

- Ziberna, A.; Kejzar, N.; Golob, P. A comparison of different approaches to hierarchical clustering of ordinal data. Metodoloski Zv. 2004, 1, 57. [Google Scholar] [CrossRef]

- Forina, M.; Armanino, C.; Raggio, V. Clustering with dendrograms on interpretation variables. Anal. Chim. Acta 2002, 454, 13–19. [Google Scholar] [CrossRef]

- Norta, A. Designing a smart-contract application layer for transacting decentralized autonomous organizations. In Proceedings of the International Conference on Advances in Computing and Data Sciences, Ghaziabad, India, 11–12 November 2016; pp. 595–604. [Google Scholar]

- Hughes, L.; Dwivedi, Y.K.; Misra, S.K.; Rana, N.P.; Raghavan, V.; Akella, V. Blockchain research, practice and policy: Applications, benefits, limitations, emerging research themes and research agenda. Int. J. Inf. Manag. 2019, 49, 114–129. [Google Scholar] [CrossRef]

- Wu, H.; Peng, Z.; Guo, S.; Yang, Y.; Xiao, B. VQL: Efficient and Verifiable Cloud Query Services for Blockchain Systems. IEEE Trans. Parallel Distrib. Syst. 2021, 33, 1393–1406. [Google Scholar] [CrossRef]

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

| Source | Research Objective(s) |

|---|---|

| Seebacher et al. [10] | Systematic literature review of blockchain applicability. |

| Tama et al. [11] | Identification of the main areas of potential applicability of blockchain technology. |

| Hawlitschek et al. [12] | Evaluation of blockchain from the perspective of its potential application in the shared economy. |

| Casino et al. [13] | Systematic literature review of blockchain applicability. Elaborate on a taxonomy of blockchain-based applications in several sectors. |

| Laroiya et al. [14] | Overview of the different uses and applications of blockchain technology. |

| Perera et al. [15] | Identification of potential applications, characteristics, and adoption drivers of blockchain in the construction industry. |

| Ko et al. [16] | Identification of potential blockchain applications in the manufacturing industry. |

| Size | Dec. of Processes | Dec. of Buss. Models | Trac. of Assets | Trac. of Processes | Trans. of Processes | Shared Asset Mgmt. | Trust and Integrity | Autom. of Processes | Smart Contracts | Digital Identity | Sovereignty Data | Machine Economy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Micro | 14.96 | 9.16 | 4.60 | 9.92 | 2.12 | 4.28 | 16.96 | - | 5.81 | 12.11 | 9.50 | 10.58 |

| Small | 8.11 | 2.44 | 8.03 | 13.00 | 4.11 | 8.04 | 21.53 | - | 5.34 | 13.11 | 8.11 | 8.17 |

| Med. | 8.50 | 1.49 | 6.36 | 15.33 | 3.23 | 12.04 | 17.32 | 5.91 | 5.53 | 9.61 | 6.42 | 8.25 |

| Large | 15.14 | 2.45 | 6.45 | 7.23 | 1.89 | 5.22 | 21.51 | 11.03 | 1.13 | 14.32 | 4.20 | 9.42 |

| Sector | Dec. of Processes | Dec. of Buss. Models | Trac. of Assets | Trac. of Processes | Trans. of Processes | Shared Asset Mgmt. | Trust and Integrity | Autom. of Processes | Smart Contracts | Digital Identity | Sovereignty Data | Machine Economy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cons. | - | - | 10.78 | 22.21 | 10.78 | 22.21 | 22.21 | 6.51 | - | 5.31 | - | - |

| eGov | 9.93 | - | - | 24.34 | 5.26 | 24.34 | 13.98 | 1.75 | - | 16.04 | 4.35 | - |

| Energ. | 3.74 | 4.23 | 15.42 | 15.38 | 1.68 | 13.77 | 15.79 | 10.77 | 3.82 | - | - | 15.42 |

| Finan. | 0.69 | 1.38 | 0.69 | 22.14 | 8.46 | 22.83 | 10.49 | 22.14 | 11.18 | - | - | - |

| Ind4.0 | 4.08 | 0.90 | 4.31 | 4.66 | 0.79 | 10.79 | 20.90 | 10.57 | 1.83 | 6.44 | 15.84 | 18.89 |

| Health | 13.53 | 5.89 | 5.90 | 12.39 | - | 17.88 | 17.88 | 5.19 | - | 12.69 | 8.64 | - |

| Mobil. | 11.20 | 6.81 | 7.99 | 7.99 | 3.60 | 14.80 | 14.80 | 14.80 | - | 11.20 | - | 6.81 |

| ICT | 9.03 | 1.94 | 2.25 | 7.35 | 0.33 | 4.34 | 17.64 | 10.29 | 3.48 | 19.23 | 11.75 | 12.36 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lage, O.; Saiz-Santos, M.; Zarzuelo, J.M. Real Business Applications and Investments in Blockchain Technology. Electronics 2022, 11, 438. https://doi.org/10.3390/electronics11030438

Lage O, Saiz-Santos M, Zarzuelo JM. Real Business Applications and Investments in Blockchain Technology. Electronics. 2022; 11(3):438. https://doi.org/10.3390/electronics11030438

Chicago/Turabian StyleLage, Oscar, María Saiz-Santos, and José Manuel Zarzuelo. 2022. "Real Business Applications and Investments in Blockchain Technology" Electronics 11, no. 3: 438. https://doi.org/10.3390/electronics11030438