Econophysics and Fractional Calculus: Einstein’s Evolution Equation, the Fractal Market Hypothesis, Trend Analysis and Future Price Prediction

Abstract

:1. Introduction

1.1. Focus and Context

1.2. Structure and Organisation

1.3. Original Contributions

2. Mathematical Preliminaries

2.1. Fourier Transformation and the Convolution Integral

2.2. The p- and Uniform-Norm

2.3. Fractional Integrals and Differentials

3. Einstein’s Evolution Equation

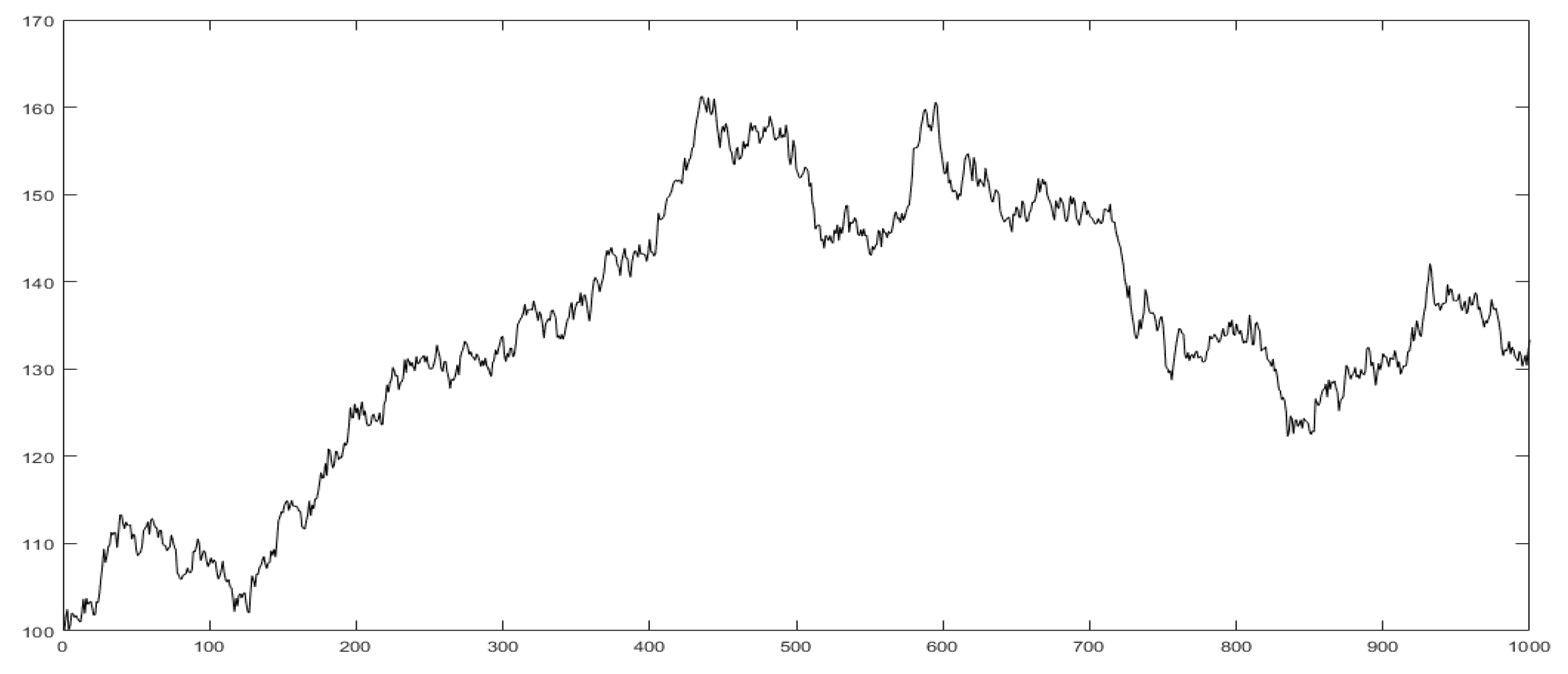

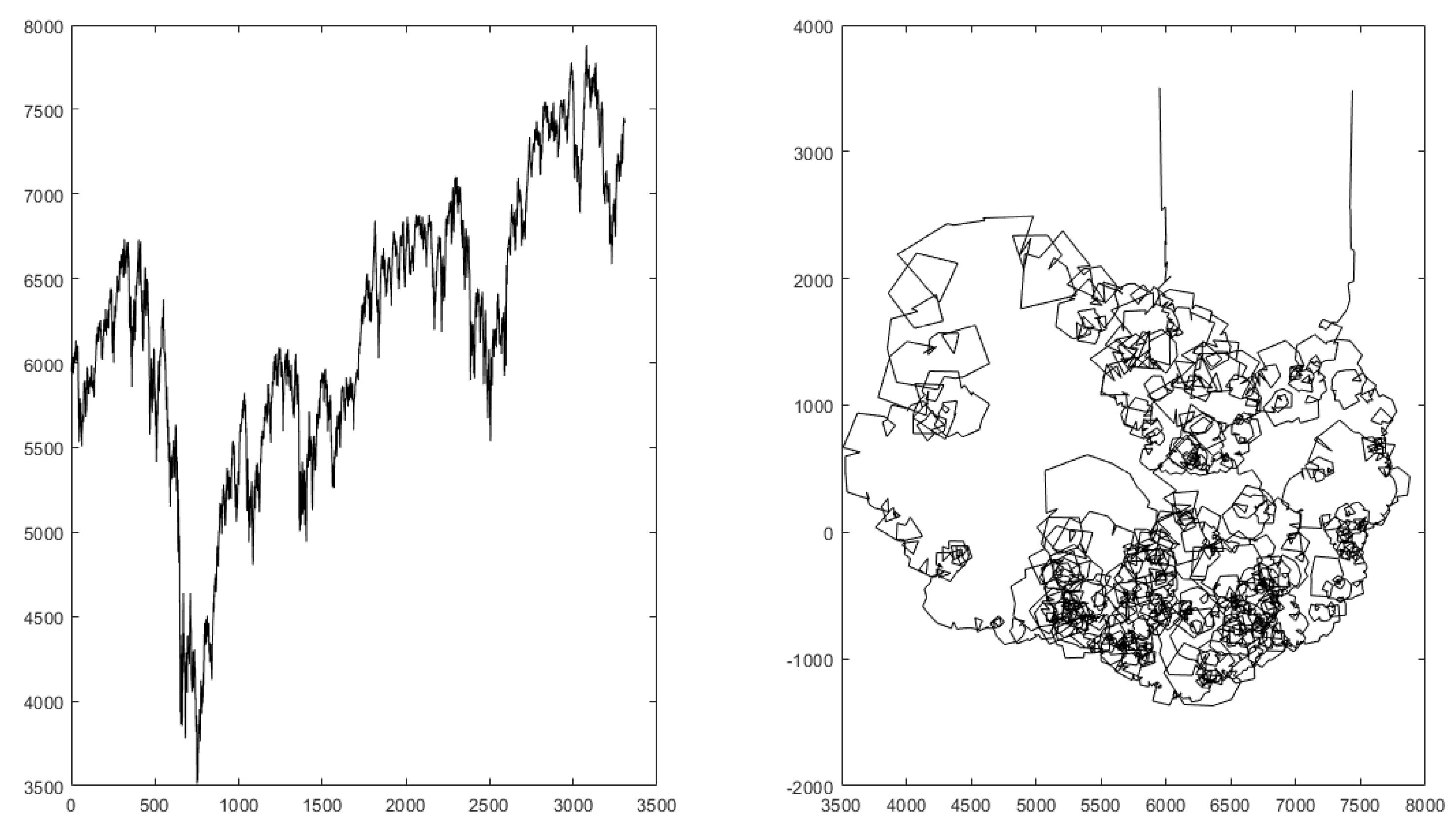

4. Financial Time Series Analysis

5. Einstein’s Evolution Equation and the Kolmogorov–Feller Equations

5.1. The Classical Kolmogorov–Feller Equation

5.2. The Generalised Kolmogorov–Feller Equation

5.3. Orthonormal Memory Functions

6. The Random Walk, the Efficient and the Fractal Market Hypotheses

6.1. The Random Walk Hypothesis

6.2. The Efficient Market Hypothesis

6.3. The Fractal Market Hypothesis

6.4. Principal Properties of Financial Signals

- financial signals are stochastic signals;

- they are non-stationary signals;

- their distributions (specifically the price differences) are non-Gaussian;

- they are often characterized by long term historical correlations;

- they have random repeating patterns at different scales—they are statistically self-affine (random fractals);

- they have instabilities at all scales—sometimes referred to a “Lévy flights”.

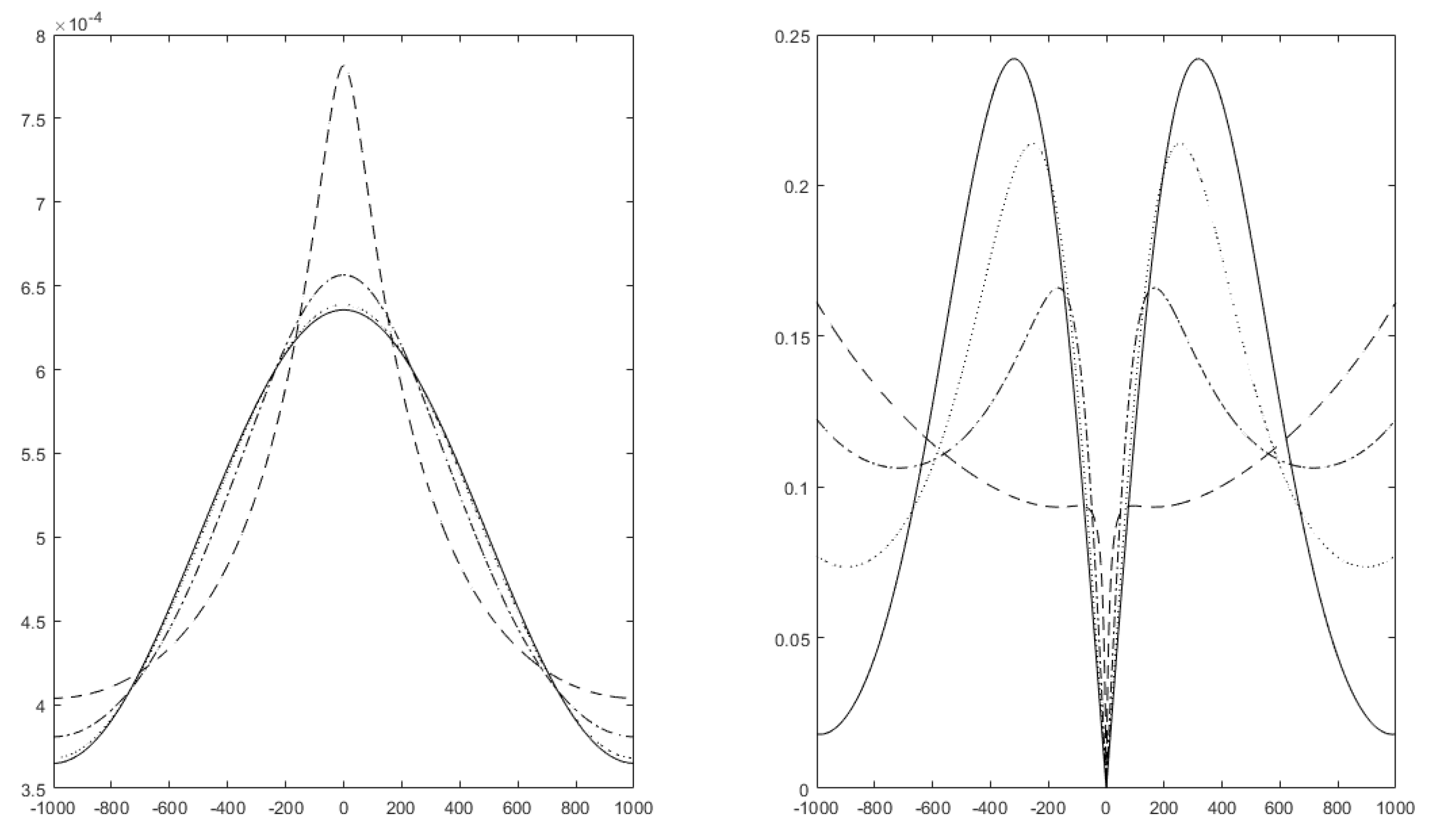

7. Density Function Distributions

7.1. Gaussian and Rayleigh Distributions

7.2. Lévy and Associated Distributions

8. The Lyapunov Exponent

9. The Evolution Equation, Volatility and Risk

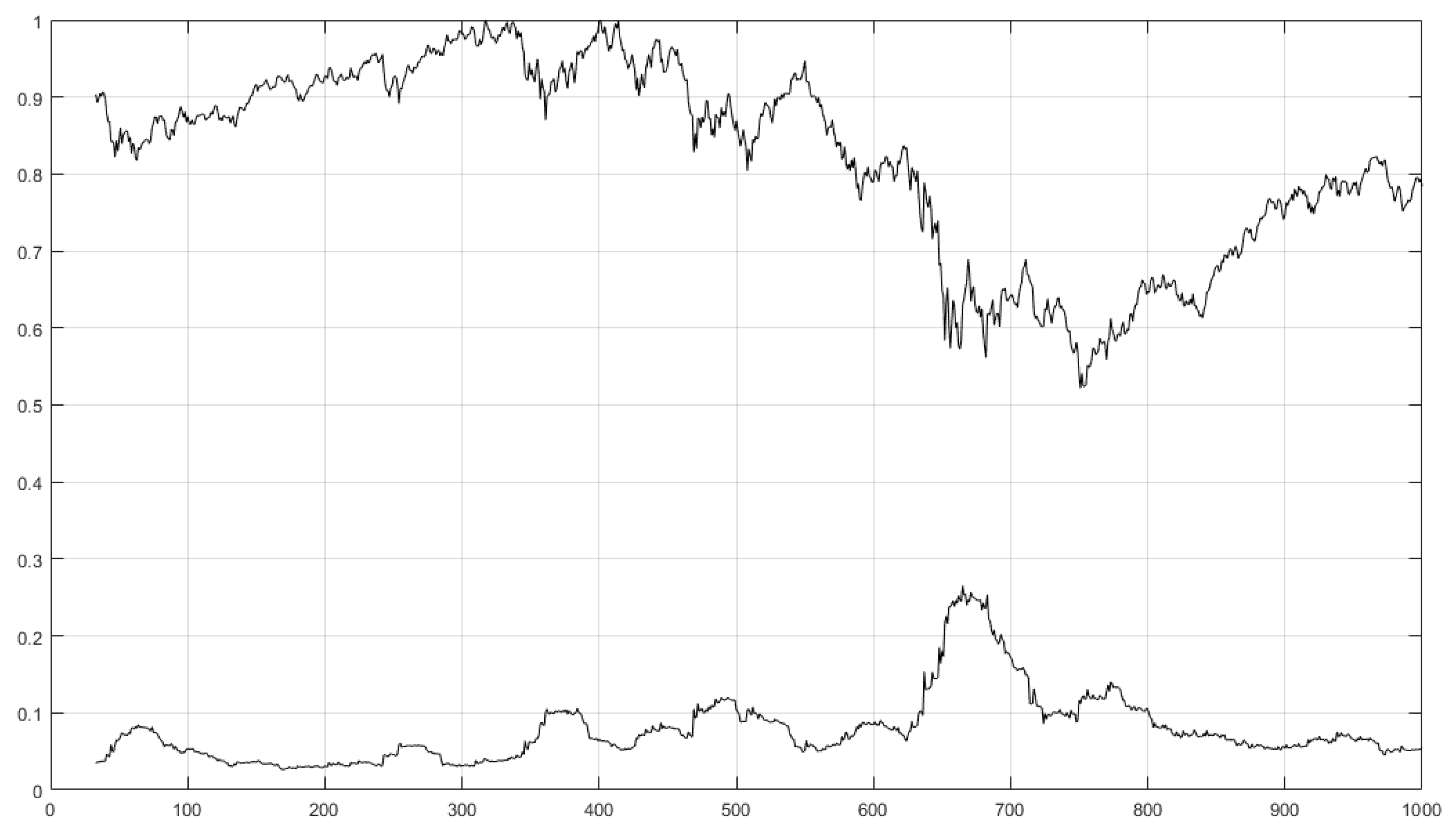

10. Trend Analysis Using the Lyapunov Exponent to Volatility Index Ratio

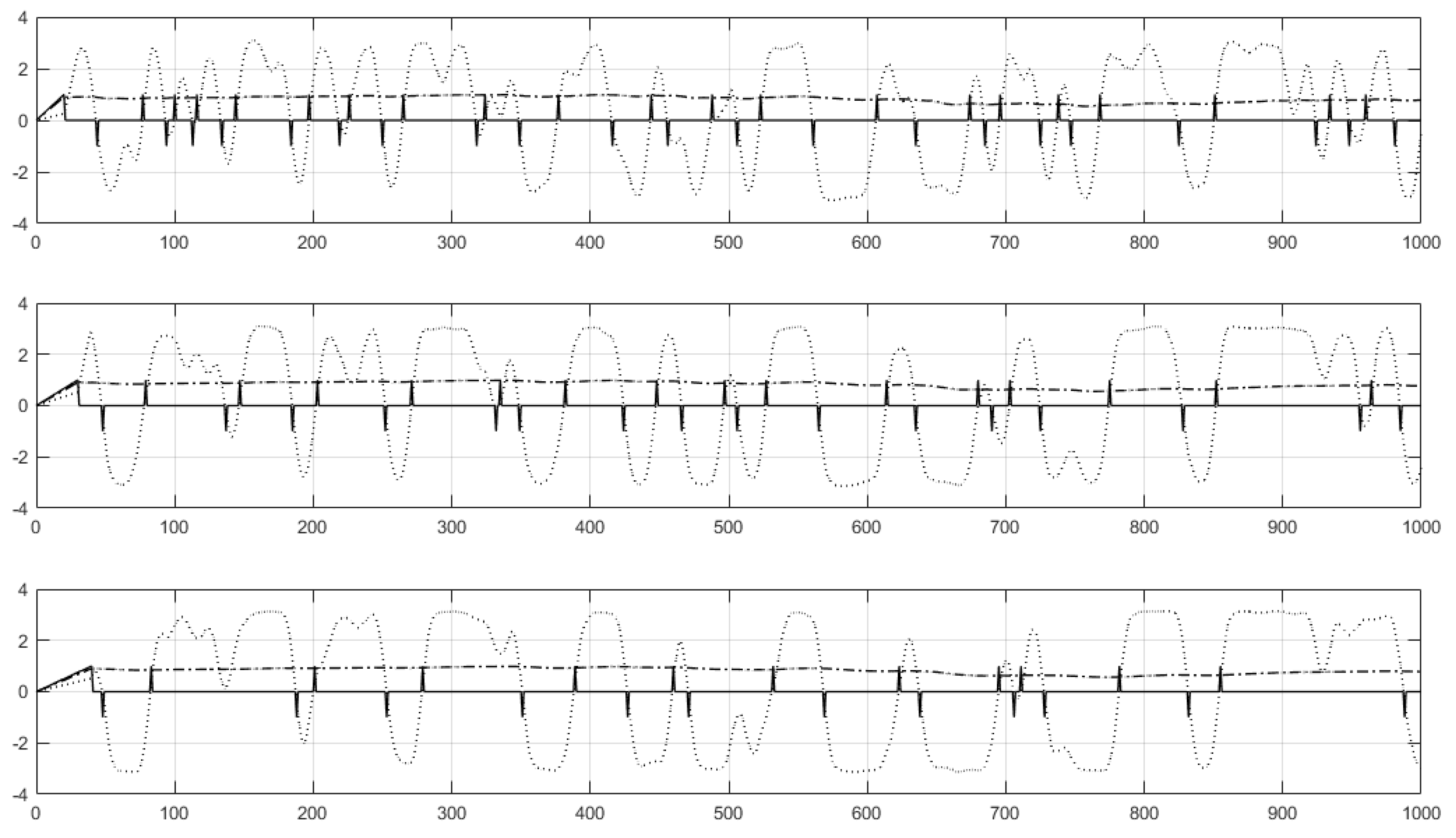

10.1. Pre- and Post-Filtering

10.1.1. Pre-Filtering

10.1.2. Post-Filtering

10.2. Zero-Crossings Analysis

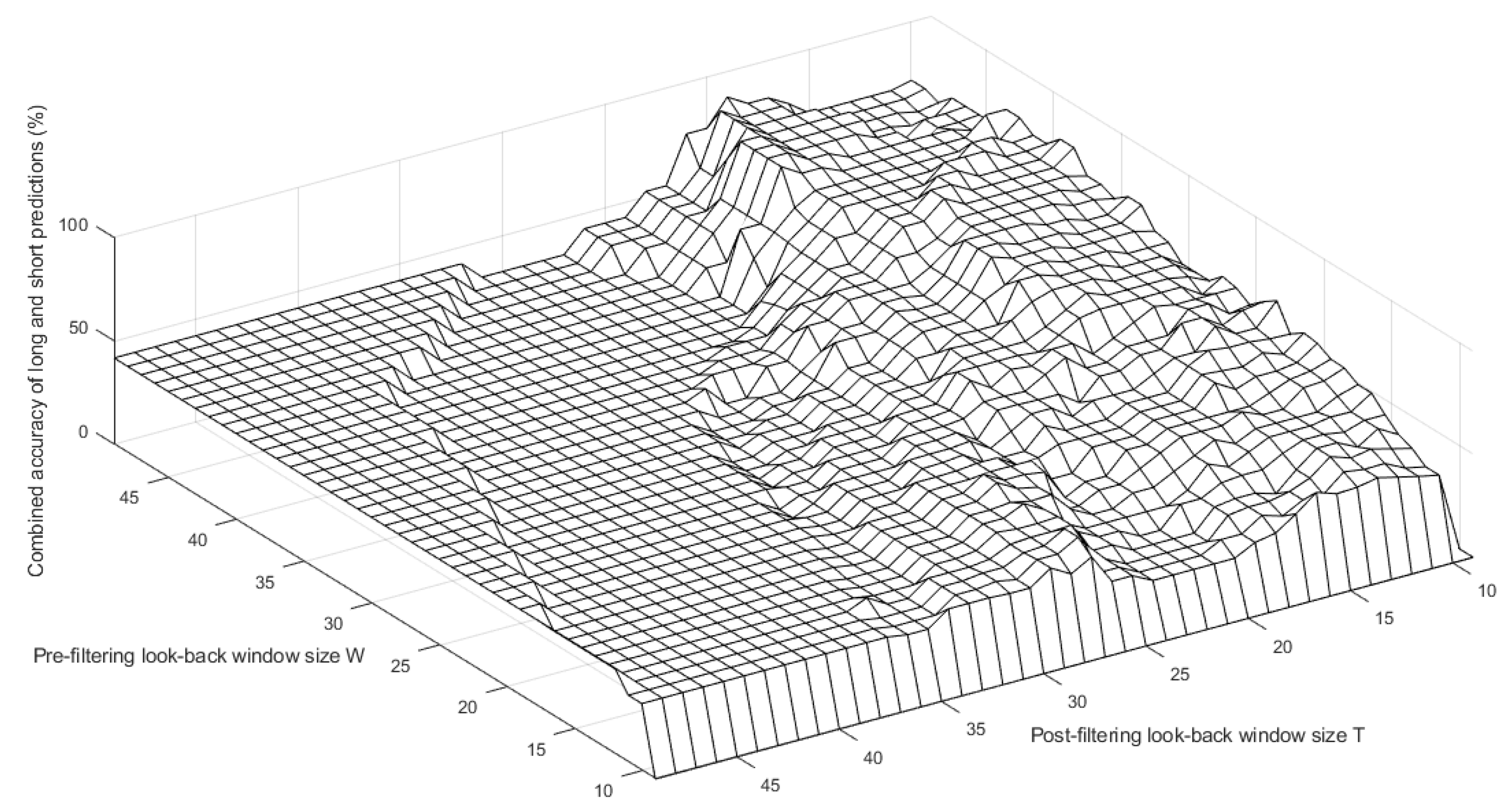

10.3. Back-Testing Evaluator

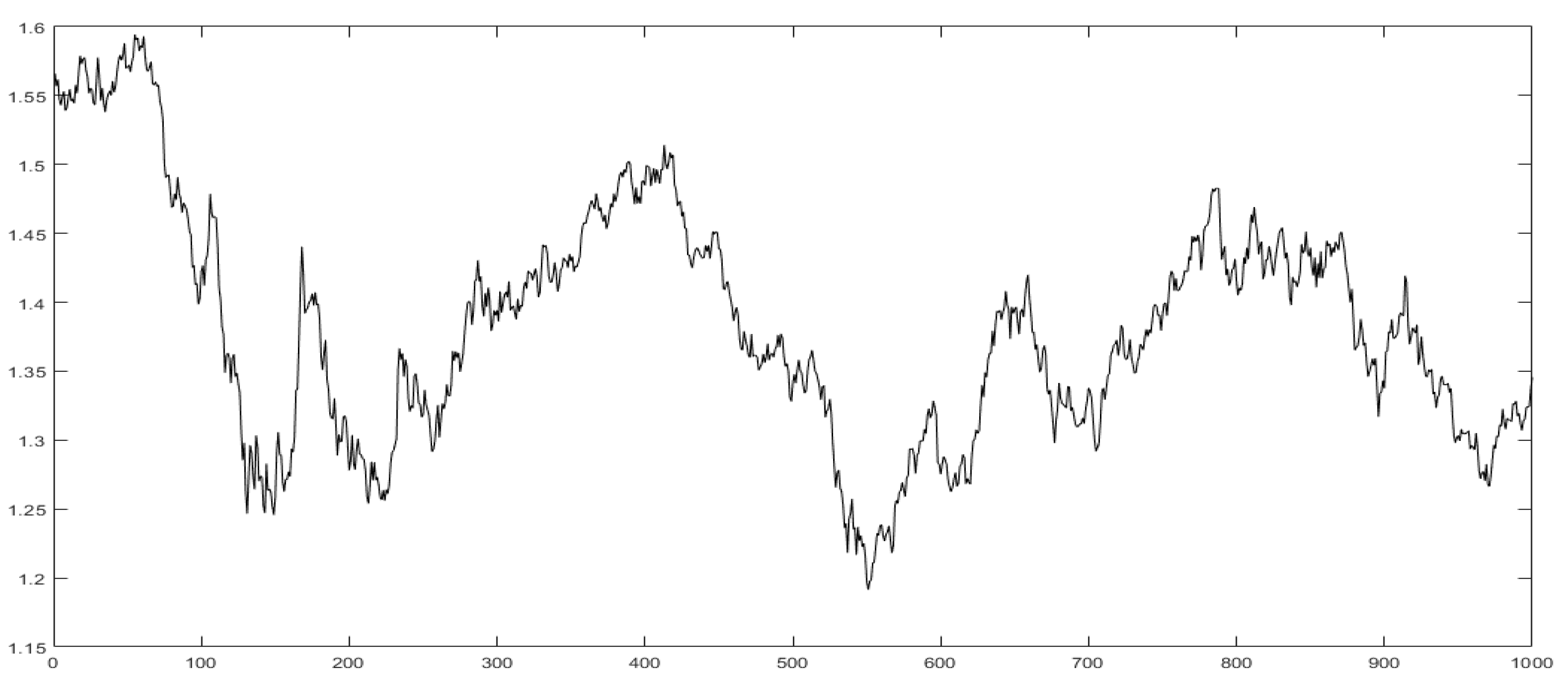

10.4. Example Results

11. Price Prediction Using Evolutionary Computing

11.1. Evolutionary Computing

11.2. Eureqa

11.3. Application to Financial Forecasting

11.4. An Example Result

11.5. Discussion

12. Derivations of the Diffusion Equation from the Evolution Equation

12.1. Einstein’s Derivation for

12.2. Einstein’s Derivation for

12.3. PDF Dependent Derivation of the Diffusion Equation

12.4. Generalisation

12.5. Green’s Function Solution

12.6. The Black–Scholes Model

13. The Fractional Diffusion Equation

13.1. Continuity Equation

13.2. Time-Independent Analysis

13.3. Time-Dependent Analysis

13.4. Green’s Function for the Fractional Diffusion Equation

13.5. Asymptotic Solution

13.6. Discussion: Impulse Response Functions for Classical and Fractional Diffusion

- Classical Diffusion

- Fractional Diffusion

14. Solution to the GKFE for an Orthonormal Memory Function

15. Time Varying Lévy- and -Indices

- L(m)=Lyapunov(s,T,1);%Compute the Lyapunov Exponent.

- V(m)=Volatility(s,T);%Compute the Volatility.

- R(m)=L(m)/V(m);%Compute the Lyapunov to Volatility Ratio (LVR).

- A(m)=Alpha(s,T);%Compute the Alpha Index.

- V(m)=Volatility(s,T);%Compute the Volatility.

- R(m)=A(m)/V(m);%Compute the Alpha-To-Volatility Ratio (AVR).

16. Summary, Conclusions and Open Questions

- the Lyapunov Exponent;

- the Volatility;

- the Lévy Index.

16.1. Summary

- predicting the entry points in time for making, holding or withdrawing an investment;

- assessing the position in time when application of EC can be expected to yield optimally accurate short term price predictions.

16.2. Conclusions

16.3. Open Questions

- Given that the critical step in deriving the IRF (from which can be computed) is the asymptotic condition , what are the consequences of developing a numerical algorithm to compute when this condition is negated?

- What is the impact of the LVR and AVR in terms of their possible inclusion into machine learning algorithms that use sets of more conventional financial indices and other statistical metrics for forecasting?

- In regard to E, the PDFs considered in this work are the delta function, Gaussian function and Lévy distribution which provide models associated with the random walk, efficient and fractal hypothesis, respectively. An investigation into the models for and metrics thereof, associated with the application of different PDF (including non-symmetric distributions), is therefore warranted.

- Similarly, what is the effect of introducing different memory functions into the generalised Kolmogorov–Feller equation, i.e., E in all but name, expressed in terms of memory function , and, further, is it possible to develop an inverse solution in which a financial signal can be used to derive a estimate of for a known distribution .

- What is the relationship/connectivity (or otherwise) between fractional and Itô calculus in regard to E?

16.4. Final Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Abbreviations

| AVR | Alpha-to-Volatility Ratio |

| CF | Characteristic Function |

| CGI | Computer Generated Imagery |

| DC | Direct Current |

| EC | Evolutionary Computing |

| E | Einstein’s Evolution Equation |

| FDE | Fractional Diffusion Equation |

| FFT | Fast Fourier Transform |

| FMH | Fractal Market Hypothesis |

| FPE | Fractional Poisson Equation |

| GKFE | Generalised Kolmogorov–Feller Equation |

| IRF | Impulse Response Function |

| KFE | Kolmogorov–Feller Equation |

| LSM | Least Squares Method |

| LVR | Lyapunov-to-Volatility Ratio |

| MFP | Mean Free Path |

| Probability Density Function | |

| PSDF | Power Spectral Density Function |

Appendix A. Prototype MATLAB Functions

Appendix A.1. Software Development and Usage

- Redistributions of source code must retain the above copyright notice, this list of conditions and the following disclaimer.

- Redistributions in binary form must reproduce the above copyright notice, this list of conditions and the following disclaimer in the documentation and/or other materials provided with the distribution.

- Neither the name of the organisation nor the names of its contributors may be used to endorse or promote products derived from this software without specific prior written permission.

Appendix A.2. Function Lyapunov

Appendix A.3. Function Volatility

Appendix A.4. Function Movav

Appendix A.5. Function Evaluator

Appendix A.6. Function Backtester

Appendix A.7. Function Levy

Appendix A.8. Function Alpha

Appendix B. Relationship between the Lévy Index and the Fractal Dimension

References

- Einstein, A. On the Motion of Small Particles Suspended in Liquids at Rest Required by the Molecular-Kinetic Theory of Heat. Annalen der Physik 1905, 17, 549–560. [Google Scholar] [CrossRef]

- Navarro, L. Gibbs, Einstein and the Foundations of Statistical Mechanics. Arch. Hist. Exact Sci. 1998, 53, 147–180. [Google Scholar] [CrossRef]

- Tindel, S.; Tudor, C.A.; Viens, F. Stochastic Evolution Equations with Fractional Brownian Motion. Probab. Theory Relat. Fields 2003, 127, 186–204. [Google Scholar] [CrossRef]

- Peters, E.E. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics; Wiley Finance; Wiley: Hoboken, NJ, USA, 1994; ISBN-13 978-0471585244. [Google Scholar]

- Blackledge, J.M. The Fractal Market Hypothesis: Applications to Financial Forecasting; Lecture Notes Series 4; Centre for Advanced Studies; Polish Academy of Sciences: Warsaw, Poland, 2010; ISBN 978-83-61993-01-8. [Google Scholar]

- Blackledge, J.M.; Lamphiere, M.; Murphy, K.; Overton, S. Financial Forecasting using the Kolmogorov-Feller Equation. In AENG Transactions on Engineering Technologies: Special Volume of the World Congress on Engineering 2012; Lecture Notes in Electrical Engineering; Yang, G.-C., Ao, S.-L., Gelman, L., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; Volume 229, ISBN 978-94-007-6190-2. [Google Scholar]

- Blackledge, J.M.; Lamphiere, M.; Murphy, K.; Overton, S. Stochastic Volatility Analysis using the Generalised Kolmogorov-Feller Equation. In Proceedings of the International Conference of Financial Engineering, World Congress on Engineering (WCE2012), London, UK, 4–6 July 2012; pp. 453–458. [Google Scholar]

- Blackledge, J.M. A New Forex Currency Exchange Indicator. In European Success Stories in Industrial Mathematics; Springer: Berlin/Heidelberg, Germany, 2011; p. 131. ISBN 978-3-642-23847-5. [Google Scholar]

- Blackledge, J.M.; Murphy, K. Forex Trading Using MetaTrader4 with the Fractal Market Hypothesis, Risk Management Trends; Giancarlo, N., Ed.; InTech Publishing: London, UK, 2011; pp. 129–146. ISBN 978-953-307-154-1. [Google Scholar]

- Blackledge, J.M. Application of the Fractal Market Hypothesis for Modelling Macroeconomic Time Series. ISAST Trans. Electron. Signal Process. 2008, 2, 89–110. [Google Scholar]

- Blackledge, J.M. Application of the Fractional Diffusion Equation for Predicting Market Behaviour. IAENG Int. J. Appl. Math. 2010, 40, 130–158. [Google Scholar]

- Blackledge, J.M.; Rebow, M. Economic Risk Assessment using the Fractal Market Hypothesis. In Proceedings of the 5th International Conference on Internet Monitoring and Protection, Valencia, Spain, 22–26 May 2010; pp. 41–47. [Google Scholar]

- Blackledge, J.M.; Murphy, K. Forex Trading using MetaTrader 4 with the Fractal Market Hypothesis. In Proceedings of the Third International Conference on Resource Intensive Applications and Services, INTENSIVE 2011, Venice, Italy, 22–27 May 2011; pp. 1–9, ISBN 978-1-61208-006-2. [Google Scholar]

- Blackledge, J.M.; Murphy, K. Predicting Currency Pair Trends using the Fractal Market Hypothesis. In Proceedings of the IET ISSC2011, Dublin, Ireland, 23–24 June 2011. [Google Scholar]

- The Fourier Transform, Tables of Important Fourier Transforms. Wikipedia. 2019. Available online: https://en.wikipedia.org/wiki/Fourier_transform (accessed on 23 July 2019).

- Podlubny, I. Geometric and Physical Interpretation of Fractional Integration and Fractional Differentiation. Fract. Calc. Appl. Anal. 2002, 5, 367–386. [Google Scholar]

- Tavassoli, M.H.; Tavassoli, A.; Ostad Rahimi, M.R. The Geometric and Physical Interpretation of Fractional Order Derivatives of Polynomial Functions. Differ. Geom.-Syst. 2013, 15, 93–104. [Google Scholar]

- Butera, S.; Di Paola, M. A Physically based Connection Between Fractional Calculus and Fractal Geometry. Ann. Phys. 2014, 350, 146–158. [Google Scholar] [CrossRef]

- Kiryakova, V. Generalised Fractional Calculus and Applications; Longman: Harlow, UK, 1994. [Google Scholar]

- Zheng, Z.; Zhao, W.; Dai, H. A New Definition of Fractional Derivative. Int. J. Non-Linear Mech. 2019, 108, 1–6. [Google Scholar] [CrossRef]

- Hermann, R. Fractional Calculus: An Introduction for Physicists; World Scientific: Singapore, 2014. [Google Scholar]

- Zhou, Y. Basic Theory of Fractional Differential Equations; World Scientific: Singapore, 2014. [Google Scholar]

- Investing.com. 2019. Available online: https://uk.investing.com/indices/uk-100-historical-data (accessed on 2 August 2019).

- Investopedia. 2019. Available online: https://www.investopedia.com (accessed on 24 July 2019).

- Kolmogorov, A.N. On Analytic Methods in Probability Theory. In Selected Works of A.N. Kolmogorov, Volume II: Probability Theory and Mathematical Statistics; Shiryaev, A.N., Ed.; Kluwer: Dordrecht, The Netherlands, 1992; pp. 61–108, (Original: Uber die Analytischen Methoden in der Wahrscheinlichkeitsrechnung. Math. Ann. 1931, 104, pp. 415–458). [Google Scholar]

- Feller, W. On Boundaries and Lateral Conditions for the Kolmogorov Differential Equations. Ann. Math. 1957, 65, 527–570. [Google Scholar] [CrossRef]

- Bachelier, L. Théorie de la spéculation. Annales Scientifiques de l’École Normale Supérieure 1900, 3, 21–86. [Google Scholar] [CrossRef]

- Working, H. A Random-Difference Series for Use in the Analysis of Time Series. J. Am. Stat. Assoc. 1934, 29, 11–24. [Google Scholar] [CrossRef]

- Kendall, M.G.; Bradford Hill, A. The Analysis of Economic Time-Series-Part I: Prices. J. R. Stat. Soc. Ser. A 1953, 116, 11–34. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Lo, A.W.; Mackinlay, A.C. The Econometrics of Financial Markets; Princeton University Press: Princeton, NJ, USA, 1996. [Google Scholar]

- Sewell, M. History of the Efficient Market Hypothesis, Research Not RN/11/04. UCL Department of Computer Science. 2011. Available online: http://www.cs.ucl.ac.uk/fileadmin/UCL-CS/images/Research_Student_Information/RN_11_04.pdf (accessed on 6 July 2019).

- Investopedia. 2019. Available online: https://www.investopedia.com/terms/b/blackscholes.asp (accessed on 25 July 2019).

- Elliott, R.N. The Wave Principle. Amazon. 2012. Available online: https://www.amazon.co.uk/Wave-Principle-Ralph-Nelson-Elliott/dp/1607964961 (accessed on 28 July 2019).

- Frost, A.J.; Prechter, R.R. Amazon 2017. Available online: https://www.amazon.co.uk/Elliott-Wave-Principle-Market-Behavior/dp/1616040815 (accessed on 28 July 2019).

- WolframAlpha Computational Intelligence. 2019. Available online: https://www.wolframalpha.com/input/?i=Fourier+transform (accessed on 28 July 2019).

- Blackledge, J.M.; Rani, T.R. Stochastic Modelling for Lévy Distributed Systems. Math. Aeterna 2017, 7, 193–210. [Google Scholar]

- Blackledge, J.M. Digital Signal Processing, 2nd ed.; Horwood Publishing: Cambridge, UK, 2006; p. 418. ISBN 1-904275-26-5. Available online: https://arrow.dit.ie/engschelebk/4/ (accessed on 19 June 2019).

- Bryant, P.; Brown, R.; Abarbanel, H. Lyapunov Exponents From Observed Time Series. Phys. Rev. Lett. 1990, 65, 1523–1526. [Google Scholar] [CrossRef]

- Brown, R.; Bryant, P.; Abarbanel, H. Computing the Lyapunov Spectrum of a Dynamical System From an Observed Time Series. Phys. Rev. A 1991, 43, 2787–2806. [Google Scholar] [CrossRef]

- Abarbanel, H.; Brown, R.; Kennel, M.B. Local Lyapunov Exponents Computed from Observed Data. J. Nonlinear Sci. 1992, 2, 343–365. [Google Scholar] [CrossRef]

- Eiben, A.E.; Schoenauer, M. Evolutionary Computing. Inf. Process. Lett. 2002, 82, 1–6. [Google Scholar] [CrossRef]

- Fogel, L.J.; Owens, A.J.; Walsh, M.J. Artificial Intelligence through Simulated Evolution; Wiley: Hoboken, NJ, USA, 1966. [Google Scholar]

- Holland, J.H. Adaptation in Natural and Artificial Systems: An Introductory Analysis with Applications to Biology, Control, and Artificial Intelligence; University of Michigan Press: Ann Arbor, MI, USA, 1975. [Google Scholar]

- Rechenberg, I. Evolutionsstrategien, Simulationsmethoden in der Medizin und Biologie; Springer: Berlin/Heidelberg, Germany, 1978; pp. 83–114. [Google Scholar]

- Eiben, A.E.; Smith, J.E. Introduction to Evolutionary Computing; Springer: Berlin/Heidelberg, Germany, 2003. [Google Scholar]

- Schmidt, M.; Lipson, H. Eureqa. 2014. Available online: www.nutonian.com (accessed on 23 August 2019).

- Schmidt, M.; Lipson, H. Distilling Free-form Natural Laws from Experimental Data. Science. 2009. Available online: https://science.sciencemag.org/content/324/5923/81 (accessed on 24 August 2019).

- Dubcakova, R. Eureqa: Software Review. Genet. Program. Evolvable Mach. 2011, 12, 173–178. [Google Scholar] [CrossRef]

- Ehrenberg, R. Software Scientist: With a Little Data, Eureqa Generates Fundamental Laws of Nature’. Sci. News 2012, 181, 20–21. [Google Scholar] [CrossRef]

- Abbott, R. Equity Markets and Computational Intelligence. In Proceedings of the 2010 UK Workshop on Computational Intelligence (UKCI), Colchester, UK, 8–10 September 2010; pp. 1–6. [Google Scholar]

- Walsh, P. An Econophysics Approach to the Trading of Energy Commodities. Ph.D. Thesis, Technological University Dublin, Dublin, Ireland, 2018. [Google Scholar]

- Wheelwright, S.C.; Makridakis, S.G. Forecasting Nethods for Management; Wiley: Hoboken, NJ, USA, 1973. [Google Scholar]

- Evans, G.; Blackledge, J.M.; Yardley, P. Analytic Solutions to Partial Differential Equations; Springer: Berlin/Heidelberg, Germany, 1999. [Google Scholar]

- Crack, T.F. Basic Black-Scholes: Option Pricing and Trading; Amazon: Seattle, WA, USA, 2017; ISBN-13 978-0994138682. [Google Scholar]

| Kolmogorov–Feller Equation (KFE) | ← | Taylor Series Analysis | → | Generalised KFE |

| ↑ | ↓ | |||

| Lyapunov Exponent () | ← | E | Volatility () | |

| ↓ | ||||

| Gaussian Distribution with CF | ← | Probability Density Function | → | Lévy Distribution with CF |

| ↓ | ↓ | |||

| Classical Diffusion Equation | Fractional Diffusion Equation | |||

| ↕ | ↕ | |||

| Classical Calculus | ↔ | Memory Function | ↔ | Fractional Calculus |

| ↕ | ↕ | |||

| Efficient Market Hypothesis | Fractal Market Hypothesis | |||

| ↓ | ↓ | |||

| Time Series Model | → | Financial Trend Analysis based on time variations in , & | ← | Time Series Model |

| ↓ | ||||

| Evolutionary Computing | ||||

| ↓ | ||||

| Future Price Prediction |

| Day | 09/09/2009 | 10/09/2009 | 11/09/2009 |

|---|---|---|---|

| 31 | 32 | 33 | |

| Predicted price value | 5022.9 | 5066.6 | 5087.4 |

| Actual price value | 5138.0 | 5108.9 | 5154.6 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Blackledge, J.; Kearney, D.; Lamphiere, M.; Rani, R.; Walsh, P. Econophysics and Fractional Calculus: Einstein’s Evolution Equation, the Fractal Market Hypothesis, Trend Analysis and Future Price Prediction. Mathematics 2019, 7, 1057. https://doi.org/10.3390/math7111057

Blackledge J, Kearney D, Lamphiere M, Rani R, Walsh P. Econophysics and Fractional Calculus: Einstein’s Evolution Equation, the Fractal Market Hypothesis, Trend Analysis and Future Price Prediction. Mathematics. 2019; 7(11):1057. https://doi.org/10.3390/math7111057

Chicago/Turabian StyleBlackledge, Jonathan, Derek Kearney, Marc Lamphiere, Raja Rani, and Paddy Walsh. 2019. "Econophysics and Fractional Calculus: Einstein’s Evolution Equation, the Fractal Market Hypothesis, Trend Analysis and Future Price Prediction" Mathematics 7, no. 11: 1057. https://doi.org/10.3390/math7111057