Can Pension Funds Partially Manage Longevity Risk by Investing in a Longevity Megafund?

Abstract

:1. Introduction

2. Potential Size of Longevity Risk

2.1. Solutions Derived from Biology of Aging Are Reaching Clinics

2.2. Model of Longevity Risk

2.3. Implication for a Pension Fund in Terms of Needed Prudential Capital

2.4. Conclusion of This Section

3. Potential Rate of Return of a Longevity Megafund

3.1. Rate of Returns of Pharmaceutical Developments Today

3.2. Evolution of Biomedical Megafund Returns with Longevity: “Linkage 1”

3.3. Evolution of Longevity Megafund Returns with Longevity: “Linkage 2”

3.4. Evolution of Megafund Equity Returns with Longevity

4. In Which Cases Will a Pension Fund Benefit from Investing in a Megafund?

4.1. What Type of Retirement Systems Would Benefit from Investing in a Longevity Megafund?

- “Defined benefits” means that the pension benefits are defined and guaranteed by the pension fund. The fund is reponsible for the investments and bears the longevity risk. The capital may be handed over to an insurance company which will bear the longevity risk. The benefits are typically defined as a percentage of the pensionable salary, for example, 20% of the average salary over the last three years of work. Investing in a longevity megafund could be a way for defined benefit pension funds to partially hedge their longevity risk: in case of strong longevity improvements, investment returns should be greater so that the accumulated capital can pay benefits longer than the prospective life expectancy calculated at time of retirement.

- In defined contribution plans, employer and employees provide contributions during their working years. Often, employees make investment choices to build their capital for retirement. The amount of accumulated capital depends on how well investments perform. Often, the accumulated capital is transferred to an insurance company that pays annuities and bears the longevity risk. The risk can also be at the level of the pensioners in case of a lump sum, but they can also buy annuities. In recent decades, a shift has occurred from defined benefit plans to defined contribution plans in order to avoid the financial risk borne by the fund during the capital build up period.

- c.

- In pay-as-you-go pension plans, there is no, or very little, investment: the contributions from employers and employees directly pay the benefits to retired persons. In such a system, that is for example widely used in France, the lack of investment makes the longevity megafund of no use for the pay-as-you-go pension plan itself. However, retirees may ask an insurer to annuitize their wealth and the insurer would benefit from investing it in a longevity megafund.

- d.

- In conclusion, from a first qualitative perspective the equity part of a longevity megafund makes sense for defined benefit pension plans and for the investment of retirement capital by any stakeholder, but a priori not for the investment of contributions by defined contribution pension plans that bear the longevity risk, as it would be increased.

4.2. Impact of Investing in a Megafund on Needed Prudential Capital

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Choice of the Mortality Model

Appendix B. Investigation of the Current Rate of Return of Pharmaceutical Developments

Appendix C. List of Figures, Tables, and Variables in the Article

| Theme | Figure | Name |

|---|---|---|

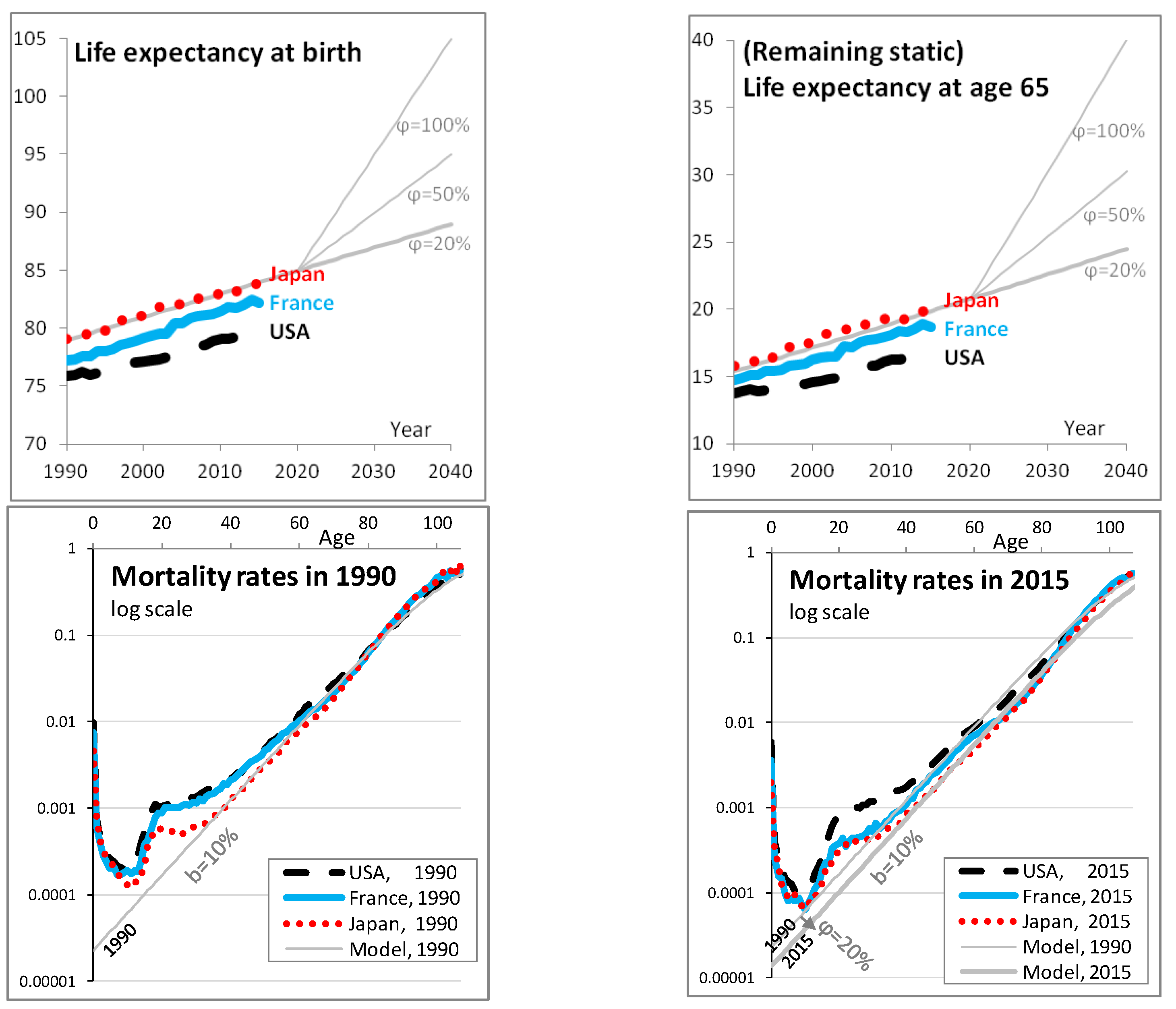

| Longevity model | 1 | Characteristics of the chosen longevity model |

| A1 | Historical mortality rates, for three countries and as modeled | |

| A2 | Static life expectancy at birth and at age 65, for three countries and as modeled | |

| developments | A3 | Estimated gain per successful drug development based on Royalty Pharma sales |

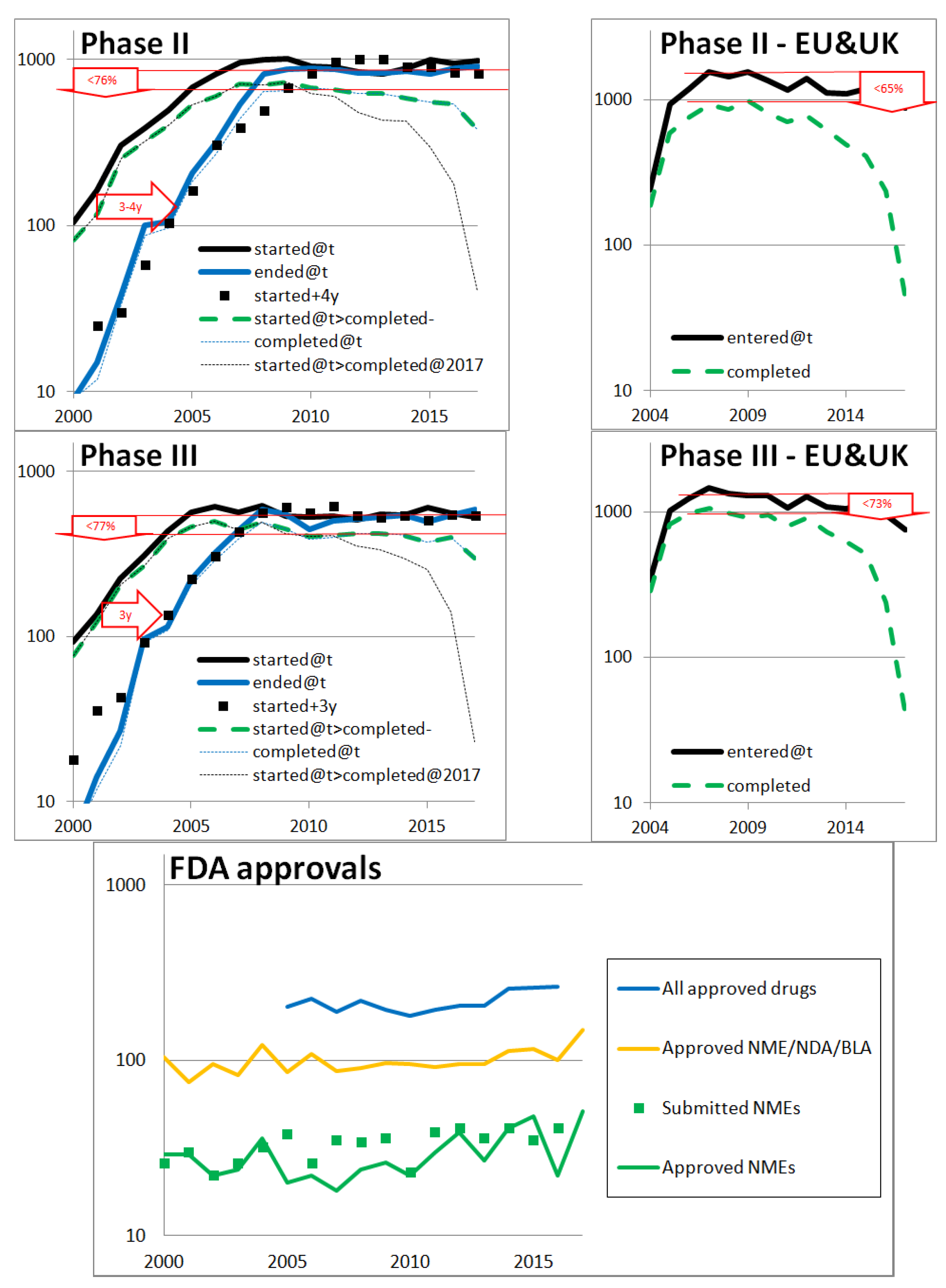

| pharmaceutical | A4 | Pharmaceutical drug development indicators based on open data: clinicaltrials.gov, clinicaltrialsregister.eu, Drugs@FDA and accessdata.fda.gov |

| Returns of | 3 | Megafund annualized return r as a function of longevity trend φ |

| 4 | Annualized equity return i as a function of longevity trend φ | |

| Pension fund needed capital | 2 | Needed prudential capital depending on the future longevity trend (or lack of) expressed as a proportion of the initial wealth |

| 5 | Needed prudential capital, expressed as a proportion of the initial wealth, depending on the future longevity trend and on investments in a longevity megafund |

| Theme | Table | Name |

|---|---|---|

| Pension fund needed capital | 1 | Contributions by age tranche |

| 2 | Needed prudential capital, expressed as a proportion of the initial wealth, depending on investments in a megafund |

| Theme | Variable | Name | Definition |

|---|---|---|---|

| Longevity model | Level of longevity | Equation (1) | |

| Ageing rate | Equation (1) | ||

| Age in years | Equation (1) | ||

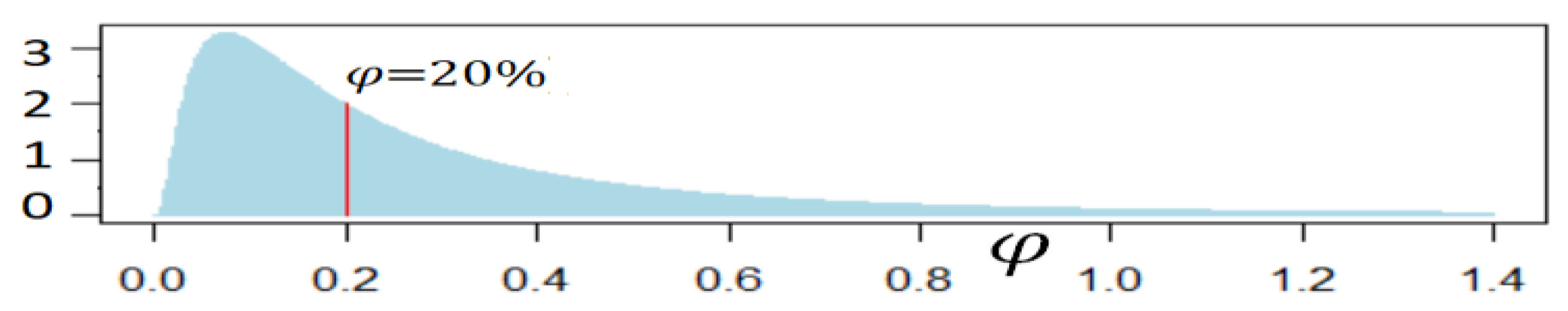

| Longevity trend | Equation (1) | ||

| Year (t = 0 corresponds to 2020) | Equation (1) | ||

| Annual mortality rate at age x and time t | Equation (1) | ||

| Standard deviation of potential longevity trends | Equation (2) | ||

| Prospective life expectancy at age x and time t | Equation (A1) | ||

| Static life expectancy at age x and time t | Equation (A2) | ||

| initial investment | Equation (12) | ||

| gain ten years later | Equation (12) | ||

| probability of success | Equation (12) | ||

| Returns of pharmaceutical developments | 10-year return | Equation (12) | |

| annualized return | Equations (12) and (16) | ||

| evolution of with longevity | Equations (14) and (15) | ||

| parameter to ajust the expected level of | Equation (14) | ||

| correlation between and longevity | Equation (15) | ||

| residual performance of the megafund | Equation (14) | ||

| I | annualized return of the equity tranche | Equation (17) | |

| equity percentage of investments in the megafund | Equation (17) | ||

| Pension fund needed capital | number of persons aged x at time t | Equation (3) | |

| accumulated capital for the group of persons aged x at t | Equations (6) and (7) | ||

| i1, i2, i3 | expected annual return of contributions by age tranche | Table 1, Equation (4) | |

| σ1, σ2, σ3 | standard deviation of the annual returns by age tranche | Table 1, Equation (4) | |

| ik,t | annual return of contributions by age tranche and year | Table 1, Equation (5) | |

| initial wealth of the pension fund | Equation (8) | ||

| annual benefit paid to the workers who retire at time t | Equation (9) | ||

| needed prudential capital for a given scenario | Equation (10) | ||

| K | needed prudential capital | Equation (11) | |

| p1, p2, p3 | percentage of investments in the equity tranche by age tranche | Section 4.2 |

References

- Antolin, Pablo, and Jessica Mosher. 2014. Mortality Assumptions and Longevity Risk. Paris: OECD, Working Party on Private Pensions. [Google Scholar]

- Arias, Elizabeth, Melonie Heron, and Betzaida Tejada-Vera. 2013. United States Life Tables Eliminating Certain Causes of Death, 1999–2001. National Vital Statistics Reports 61: 1–128. [Google Scholar] [PubMed]

- Ayyadevara, Srinivas, Ramani Alla, John Thaden, and Robert Joseph Shmookler Reis. 2008. Remarkable longevity and stress resistance of nematode PI3K-null mutants. Aging Cell 7: 13–22. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Barardo, Diogo, Daniel Thornton, Harikrishnan Thoppil, Michael Walsh, Samim Sharifi, Susana Ferreira, Andreja Anžič, Maria Fernandes, Patrick Monteiro, Tjaša Grum, and et al. 2017. The DrugAge database of aging-related drugs. Aging Cell 16: 594–97. [Google Scholar] [CrossRef] [PubMed]

- Bartke, Andrzej, Michael Bonkowski, and Michal Masternak. 2008. How diet interacts with longevity genes—Review. Hormones 7: 17–23. [Google Scholar] [CrossRef] [PubMed]

- Ben-Haim, Moshe Shay, Yariv Kanfi, Sarah J Mitchell, Noam Maoz, Kelli L Vaughan, Ninette Amariglio, Batia Lerrer, Rafael de Cabo, Gideon Rechavi, and Haim Y Cohen. 2017. Breaking the Ceiling of Human Maximal Lifespan. The Journals of Gerontology. Series A, Biological Sciences and Medical Sciences. [Google Scholar] [CrossRef] [PubMed]

- Boissel, François-Henri. 2013. The cancer megafund: mathematical modeling needed to gauge risk. Nature Biotechnology 31: 494. [Google Scholar] [CrossRef] [PubMed]

- Bongaarts, John. 2005. Long-Range Trends in Adult Mortality: Models and projection methods. Demography 42: 23–49. [Google Scholar] [CrossRef] [PubMed]

- Broadbent, John, Michael Palumbo, and Elizabeth Woodman. 2006. The Shift from Defined Benefit to Defined Contribution Pension Plans–Implications for Asset Allocation and Risk Management; Sydney: Reserve Bank of Australia, Washington: Board of Governors of the Federal Reserve System, Ottawa: Bank of Canada, pp. 1–54.

- Carbonnier, Gilles, Pavel Chakraborty, Emmanuel Dalle Mulle, and Cartografare il presente. 2013. Asian and African Development Trajectories—Revisiting Facts and Figures. International Development Policy. Working papers. Geneva: Graduate Institute of International and Development Studies. [Google Scholar] [CrossRef]

- Casquillas, Guilhem Velvé. 2016. Human Longevity: The Giants. Available online: LongLongLife.org (accessed on 28 April 2018).

- De Magalhães, João Pedro, Michael Stevens, and Daniel Thornton. 2017. The business of anti-aging science. Trends in Biotechnology 35: 1062–73. [Google Scholar] [CrossRef] [PubMed]

- Debonneuil, Edouard. 2015. Modèle Paramétrique de Mortalité en Fonction de L’âge, Pour des Applications à des Portefeuilles de Retraite. Actuarial Memorandum, ISFA. Available online: http://www.ressources-actuarielles.net (accessed on 28 April 2018).

- Debonneuil, Edouard, Lise He, Jessica Mosher, and Nathalie Weiss. 2011. Longevity Risk: Setting the Scene. London: Risk books. [Google Scholar]

- Debonneuil, Edouard, Frédéric Planchet, and Stéphane Loisel. 2017. Do actuaries believe in longevity deceleration? Insurance: Mathematics and Economics 31: 373–93. [Google Scholar] [CrossRef]

- Devlin, Nancy. 2003. Does NICE Have a Cost Effectiveness Threshold and What Other Factors Influence Its Decisions? A Discrete Choice Analysis. Report No. 03/01. London: Department of Economics, City University London. [Google Scholar]

- DiMasi, Joseph A., Ronald W. Hansen, and Henry G. Grabowski. 2003. The price of innovation: New estimates of drug development costs. Journal of Health Economics 22: 151–85. [Google Scholar] [CrossRef]

- DiMasi, Joseph A., Henry G. Grabowski, and Ronald W. Hansen. 2016. Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics 47: 20–33. [Google Scholar] [PubMed] [Green Version]

- Drugs@FDA. 2018. Available online: http://www.fda.gov/drugsatfda (accessed on 28 April 2018).

- Dublin, Louis Israel. 1928. Health and Wealth. A Survey of the Economics of World Health. New York: Harper, p. 361. [Google Scholar]

- El Karoui, Nicole, Caroline Hillairet, and Mohamed Mrad. 2014. Affine long-term yield curves: An application of the Ramsey rule with progressive utility. Journal of Financial Engineering, 1. [Google Scholar] [CrossRef]

- Fagnan, David E., Austin A. Gromatzky, Roger M. Stein, Jose-Maria Fernandez, and Andrew W. Lo. 2014. Financing drug discovery for orphan diseases. Drug Discovery Today 19: 533–38. [Google Scholar] [CrossRef] [PubMed]

- Fagnan, David E., N NoraYang, John C McKew, and Andrew W. Lo. 2015. Financing translation: Analysis of the NCATS rare-diseases portfolio. Science Translational Medicine 7: 276ps3. [Google Scholar] [CrossRef] [PubMed]

- Fahy, Gregory M. 2003. Apparent induction of partial thymic regeneration in a normal human subject: A case report. Journal of Anti-Aging Medicine 6: 219–27. [Google Scholar] [CrossRef] [PubMed]

- Fernandez, Jose-Maria, Roger M. Stein, and Andrew W. Lo. 2012. Commercializing biomedical research through securitization techniques. Nature Biotechnology 30: 964–75. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Gavrilov, Leonid A., Vyacheslav N. Krut’ko, and Natalia S. Gavrilova. 2017. The future of human longevity. Gerontology 63: 524–26. [Google Scholar] [CrossRef] [PubMed]

- Guibert, Quentin, Frédéric Planchet, and Michaël Schwarzinger. 2017. Mesure de l’espérance de vie sans dépendance en France. Forthcoming. [Google Scholar]

- Heligman, Larry, and John H. Pollard. 1980. The age pattern of mortality. Journal of the Institute of Actuaries 107: 49–82. [Google Scholar] [CrossRef]

- House of Commons Work, Pensions Committee. 2016. Defined Benefit Pension Schemes. Sixth Report of Session 2016–17. London: House of Commons Work and Pensions Committee. [Google Scholar]

- Howard, David H., Peter B. Bach, Ernst R. Berndt, and Rena M. Conti. 2015. Pricing in the market for anticancer drugs. Journal of Economic Perspectives 29: 139–62. [Google Scholar] [CrossRef] [PubMed]

- Hull, John. 2016. Funding Long Shots. In Rotman School of Management Working paper No. 2773108. Toronto: Rotman School of Management, University of Toronto. [Google Scholar] [CrossRef]

- Kantor, Elizabeth D., Colin D. Rehm, Jennifer S. Haas, Andrew T. Chan, and Edward L. Giovannucc. 2015. Trends in prescription drug use among adults in the United States from 1999–2012. JAMA 314: 1818–30. [Google Scholar] [CrossRef] [PubMed]

- Kenyon, Cynthia J. 2010. The genetics of ageing. Nature 464: 504–12. [Google Scholar] [CrossRef] [PubMed]

- Lazonick, William, Matt Hopkins, Ken Jacobson, Mustafa Sakinc, and Oner Tulum. 2017. US Pharma’s Financialized Business Model. Institute for New Economic Thinking Working Paper Series No. 60; New York: Institute for New Economic. [Google Scholar]

- Lee, Ronald D., and Lawrence R. Carter. 1992. Modeling and forecasting U.S. mortality. Journal of the American Statistical Association 87: 659–71. [Google Scholar] [CrossRef]

- Light, Donald W., and Rebecca Warburton. 2011. Demythologizing the high costs of pharmaceutical research. BioSocieties 6: 34–50. [Google Scholar] [CrossRef]

- Lo, Andrew W. 2015. Can Financial Engineering Cure Cancer? San Bruno: YouTube. Video. [Google Scholar]

- Lo, Andrew W., and Sourya V. Naraharisetti. 2014. New Financing Methods in the Biopharma Industry: A Case Study of Royalty Pharma, INC. Journal of Investment Management 12: 4–19. [Google Scholar] [CrossRef]

- Lo, Andrew W., Carloe Ho, Jayna Cummings, and Kenneth S. Kosik. 2014. Parallel discovery of Alzheimer’s therapeutics. Science Translational Medicine 6: 241cm5. [Google Scholar] [CrossRef] [PubMed]

- MacMinn, Richard D., and Nan Zhu. 2017. Hedging Longevity Risk in Life Settlements Using Biomedical Research-Backed Obligations. Journal of Risk and Insurance 84: 439–58. [Google Scholar] [CrossRef]

- Marko, Nicholas F. 2013. The cancer megafund: determinants of success. Nature Biotechnoloy 31: 492–94. [Google Scholar] [CrossRef] [PubMed]

- Martin, George M., Kelly LaMarco, Evelyn Strauss, and Katrina Kelner. 2003. Research on aging: The end of the beginning. Science 299: 1339–41. [Google Scholar] [CrossRef] [PubMed]

- Martin, Linda, Melissa Hutchens, Conrad Hawkins, and Alaina Radnov. 2017. How much do clinical trials cost? Nature Reviews Drug Discovery 16: 381–90. [Google Scholar] [CrossRef] [PubMed]

- Mellon, Jim, and Al Chalabi. 2017. Juvenescence: Investing in the Age of Longevity. Hampshire: Harriman House Limited. [Google Scholar]

- Mendelsohn, Andrew R., James W. Larrick, and Jennifer L. Lei. 2017. Rejuvenation by Partial Reprogramming of the Epigenome. Rejuvenation Research 20: 146–50. [Google Scholar] [CrossRef] [PubMed]

- Mir, Tanveer Ahmad, and Makoto Nakamura. 2017. Three-Dimensional Bioprinting: Toward the Era of Manufacturing Human Organs as Spare Parts for Healthcare and Medicine. Tissue Engineering Part B: Reviews 23: 245–56. [Google Scholar] [CrossRef] [PubMed]

- Moskalev, Alexey, Vladimir Anisimov, Aleksander Aliper, Artem Artemov, Khusru Asadullah, Daniel Belsky, Ancha Baranova, Aubrey de Grey, Vishwa Deep Dixit, Edouard Debonneuil, and et al. 2017. A review of the biomedical innovations for healthy longevity. Aging (Albany NY) 9: 7–25. [Google Scholar] [CrossRef] [Green Version]

- Mosteiro, Lluc, Cristina Pantoja, Noelia Alcazar, Rosa M. Marión, Dafni Chondronasiou, Miguel Rovira, Pablo J. Fernandez-Marcos, Maribel Muñoz-Martin, Carmen Blanco-Aparicio, Joaquin Pastor, and et al. 2016. Tissue damage and senescence provide critical signals for cellular reprogramming in vivo. Science, 354. [Google Scholar] [CrossRef] [PubMed]

- Murphy, Kevin M., and Robert H. Topel. 2006. The value of health and longevity. Journal of political Economy 114: 871–904. [Google Scholar] [CrossRef]

- Neumann, Peter J., Joshua T. Cohen, and Milton C. Weinstein. 2014. Updating cost-effectiveness—The curious resilience of the $50,000-per-QALY threshold. New England Journal of Medicine 371: 796–97. [Google Scholar] [CrossRef] [PubMed]

- Ocampo, Alejandro, Pradeep Reddy, Paloma Martinez-Redondo, Aida Platero-Luengo, Fumiyuki Hatanaka, Tomoaki Hishida, Mo Li, David Lam, Masakazu Kurita, Ergin Beyret, and et al. 2016. In Vivo Amelioration of Age-Associated Hallmarks by Partial Reprogramming. Cell 167: 1719–33. [Google Scholar] [CrossRef] [PubMed]

- OECD. 2017. Health at a Glance: OECD Indicators. Paris: OECD Publishing, Available online: http://dx.doi.org/10.1787/health_glance-2017-en (accessed on 28 April 2018).

- Olshansky, S. Jay, Bruce A. Carnes, and Christine Cassel. 1990. In Search of Methuselah: Estimating the Upper Limits to Human Longevity. Science 250: 634–40. [Google Scholar] [CrossRef] [PubMed]

- Phalippou, Ludovic. 2010. Investing in Private Equity Funds: A Survey. Charlottesville: The Research Foundation of CFA Institute. [Google Scholar]

- Pifferi, Fabien, Jérémy Terrien, Julia Marchal, Alexandre Dal-Pan, Fathia Djelti, Isabelle Hardy, Sabine Chahory, Nathalie Cordonnier, Loïc Desquilbet, Murielle Hurion, and et al. 2018. Caloric restriction increases lifespan but affects brain integrity in grey mouse lemur primates. Communications Biology 1: 30. [Google Scholar] [CrossRef]

- Pratt, Chelsea. 2016. 5 Private Longevity Stocks to Watch: From Calico to Genescient. Investing News. December 22. Available online: https://investingnews.com/daily/life-science-investing/longevity-investing/top-longevity-stocks-alkahest-calico-elysium-health-navitor/ (accessed on 28 April 2018).

- Ravnic, Dino J., Ashley N. Leberfinger, Srinivas V. Koduru, Monika Hospodiuk, Kazim K. Moncal, Pallab Datta, Madhuri Dey, Elias Rizk, and Ibrahim T. Ozbolat. 2017. Transplantation of Bioprinted Tissues and Organs: Technical and Clinical Challenges and Future Perspectives. Annals of Surgery 266: 48–58. [Google Scholar] [CrossRef] [PubMed]

- Roman, Pablo, and Alberto Ruiz-Cantero. 2017. Polypathology, an emerging phenomenon and a challenge for healthcare systems. Revista Clinica Espanola 217: 229–37. [Google Scholar] [CrossRef] [PubMed]

- Scannell, Jack W., Alex Blanckley, Helen Boldon, and Brian Warrington. 2012. Diagnosing the decline in pharmaceutical R&D efficiency. Nature Reviews Drug Discovery 11: 191–200. [Google Scholar] [PubMed]

- Sertkaya, Aylin, Hui-Hsing Wong, Amber Jessup, and Trinidad Beleche. 2016. Key cost drivers of pharmaceutical clinical trials in the United States. Clinical Trials 13: 117–26. [Google Scholar] [CrossRef] [PubMed]

- Stein, Roger M. 2016. A Simple Hedge for Longevity Risk and Reimbursement Risk Using Research-Backed Obligations. MIT Sloan Research Paper No. 5165-16. Cambridge: MIT Sloan School of Management. [Google Scholar]

- Stewart, Jeffrey J., Peter N. Allison, and Ronald S. Johnson. 2001. Putting a price on biotechnology. Nature Biotechnology 19: 813–17. [Google Scholar] [CrossRef] [PubMed]

- Swedish Agency for Growth Policy Analysis. 2017. Towards a Swedish Megafund for Life Science Innovation; Tillväxtanalysis 2017/089. Östersund: Swedish Agency for Growth Policy Analysis.

- Tenenbaum, Jay M. 2013. The cancer megafund: A catalyst for disruptive innovation. Nature Biotechnology 31: 491–92. [Google Scholar] [CrossRef] [PubMed]

- Tengs, Tammy O., Miriam E. Adams, Joseph S. Pliskin, Dana Gelb Safran, Joanna E. Siegel, Milton C. Weinstein, and John D. Graham. 1995. Five-hundred life-saving interventions and their cost-effectiveness. Risk Analysis 15: 369–90. [Google Scholar] [CrossRef] [PubMed]

- Thiem, Ulrich, Timo Hinrichs, Christiane A Müller, Stefanie Holt-Noreiks, Alexander Nagl, Claudio Bucchi, Ulrike Trampisch, Anna Moschny, Petra Platen, Erika Penner, and et al. 2011. Prerequisites for a new health care model for elderly people with multiple morbidities: Results and conclusions from 3 years of research in the PRISCUS consortium. Zeitschrift Fur Gerontologie Und Geriatrie 44: 101–12. [Google Scholar] [CrossRef] [PubMed]

- Thiers, Fabio A., Anthony J. Sinskey, and Ernst R. Berndt. 2008. Trends in the Globalization of Clinical Trials. Cambridge: MIT. [Google Scholar]

- Thomas, David W., Justin Burns, John Audette, Adam Carrol, Corey Dow-Hygelund, and Michael Hay. 2016. Clinical Development Success Rates 2006–2015. San Diego: Biomedtracker. [Google Scholar]

- Transparency Market Research. 2014. Anti-Aging Market (Anti-Wrinkle Products, Hair Color, Hair Restoration Treatment, Breast Augmentation and Radio Frequency devices)—Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2013–2019. Albany: Transparency Market Research. [Google Scholar]

- US Department of Labor. 2016. Types of Retirement Plans. Available online: https://www.dol.gov/general/topic/retirement/typesofplans (accessed on 28 April 2018).

- Vallin, Jacques, and France Meslé. 2010. Espérance de vie: Peut-on gagner trois mois par an indéfiniment? Population & Sociétés. No. 473. Available online: http://alexandre.cor-retraites.fr/IMG/pdf/doc-2305.pdf (accessed on 28 April 2018).

- Vaupel, James W. 2010. Biodemography of human ageing. Nature 464: 536–42. [Google Scholar] [CrossRef] [PubMed]

- Vijg, Jan, and Eric Le Bourg. 2017. Aging and the inevitable limit to human life span. Gerontology 63: 432–34. [Google Scholar] [CrossRef] [PubMed]

- Wong, Chi Heem, Kien Wei Siah, and Andrew W. Lo. 2018. Estimate of clinical trial success rates and related parameters. Biostatistics. [Google Scholar] [CrossRef] [PubMed]

- Yang, Xianjin, Edouard Debonneuil, Alex Zhavoronkov, and Bud Mishra. 2016. Cancer megafunds with in silico and in vitro validation: Accelerating cancer drug discovery via financial engineering without financial crisis. Oncotarget 7: 57671–78. [Google Scholar] [CrossRef] [PubMed]

- Zhavoronkov, Alexander, Edouard Debonneuil, Nawazish Mirza, and Igor Artyuhov. 2012. Evaluating the impact of recent advances in biomedical sciences and the possible mortality decreases on the future of health care and Social Security in the United States. Pensions 17: 241–51. [Google Scholar] [CrossRef]

- Zion Market Research. 2017. Anti-Aging Market (Baby Boomer, Generation X and Generation Y), by Product (Botox, Anti-Wrinkle Products, Anti-Stretch Mark Products, and Others), by Services (Anti-Pigmentation Therapy, Anti-Adult Acne Therapy, Breast Augmentation, Liposuction, Chemical Peel, Hair Restoration Treatment, and Others), by Device (Microdermabrasion, Laser Aesthetics, Anti-Cellulite Treatment and Anti-Aging Radio Frequency Devices): Global Industry Perspective, Comprehensive Analysis, Size, Share, Growth, Segment, Trends and Forecast, 2015–2021. Pune: Zion Market Research. [Google Scholar]

| 1 | The 50% correlation is not critical for the model as longevity risk is the main risk; setting the correlation to 0% did not materially affect results |

| Age | Salary | Individual Annual Contribution | Annual Investment Return Rate | |

|---|---|---|---|---|

| 20 to 34 | 30,000 | 3000 | i1 = 5% | σ1 = 4% |

| 35 to 49 | 45,000 | 4500 | i2 = 4% | σ2 = 3% |

| 50 to 64 | 60,000 | 6000 | i3 = 2% | σ3 = 1% |

| 85% VaR | 90% VaR | 95% VaR | ||||

|---|---|---|---|---|---|---|

| No megafund | 1.4 | 2.8 | 8.5 | |||

| Longevity megafund that has 25% equity | 0.3 | 0.6 | 0.6 | 1.4 | 2.4 | 4.6 |

| Biomedical megafund that has 25% equity | 0.1 | 0.6 | 0.5 | 1.4 | 3.3 | 5.1 |

| Longevity megafund that has 50% equity | 0.3 | 0.8 | 0.9 | 1.6 | 3.1 | 4.9 |

| Biomedical megafund that has 50% equity | 0.3 | 0.7 | 0.9 | 1.6 | 4.0 | 5.8 |

| Longevity megafund that has 100% equity | 0.5 | 0.9 | 1.2 | 1.8 | 3.9 | 5.4 |

| Biomedical megafund that has 100% equity | 0.5 | 0.9 | 1.2 | 1.9 | 4.6 | 6.4 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Debonneuil, E.; Eyraud-Loisel, A.; Planchet, F. Can Pension Funds Partially Manage Longevity Risk by Investing in a Longevity Megafund? Risks 2018, 6, 67. https://doi.org/10.3390/risks6030067

Debonneuil E, Eyraud-Loisel A, Planchet F. Can Pension Funds Partially Manage Longevity Risk by Investing in a Longevity Megafund? Risks. 2018; 6(3):67. https://doi.org/10.3390/risks6030067

Chicago/Turabian StyleDebonneuil, Edouard, Anne Eyraud-Loisel, and Frédéric Planchet. 2018. "Can Pension Funds Partially Manage Longevity Risk by Investing in a Longevity Megafund?" Risks 6, no. 3: 67. https://doi.org/10.3390/risks6030067