Understanding Consumer Preferences for Australian Sparkling Wine vs. French Champagne

Abstract

:1. Introduction

2. Materials and Methods

2.1. Chemical Analysis of French and Australian Sparkling Wines

2.1.1. Basic Wine Composition

2.1.2. Attenuated Total Reflectance Mid-Infrared Spectroscopy (ATR-MIR)

2.2. Sensory Analysis of French and Australian Sparkling Wines

2.2.1. Descriptive Analysis (DA)

2.2.2. Consumer Acceptance Testing

2.3. Ethical Statement

3. Results and Discussion

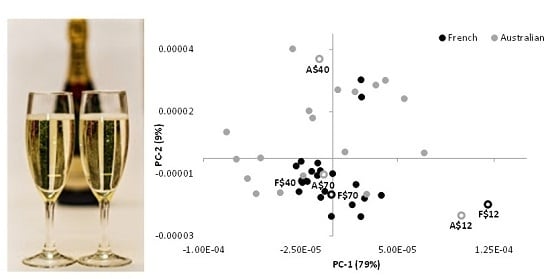

3.1. ATR-MIR Analysis of Sparkling Wines

3.2. Sensory Analysis of Selected Sparkling Wines

3.2.1. Sensory Profiles of Selected Sparkling Wines

3.2.2. Consumer Acceptance for Selected Sparkling Wines

4. Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Alexandre, H.; Guilloux-Benatier, M. Yeast autolysis in sparkling wine—A review. Aust. J. Grape Wine Res. 2006, 12, 119–127. [Google Scholar]

- Wine Australia 2014: Domestic Sales of Australian Wine by Winestyle. Available online: http://www.wineaustralia.com/en/Winefacts%20Landing/Domestic%20Market%20Intelligence/ABS%20Domestic%20Sales/Domestic%20Sales%20of%20Australian%20Wine%20by%20Winestyle.aspx?ec_trk=followlist&ec_trk_data=ABS+Domestic+Sales (accessed on 27 November 2015).

- Winetitles: Wine Industry Statistics. Available online: http://winetitles.com.au/statistics/wineries_numbers.asp (accessed on 27 November 2015).

- Verdonk, N.R.; Culbert, J.A.; Wilkinson, K.L. Sparkling wine: All that sparkles: Consumer perceptions of sparkling wine. Wine Vitic. J. 2015, 30, 71–73. [Google Scholar]

- Charters, S. Drinking Sparkling Wine: An Exploratory Investigation. Int. J. Wine Market. 2005, 17, 54–68. [Google Scholar]

- Bruwer, J.; Li, E.; Reid, M. Segmentation of the Australian wine market using a wine-related lifestyle approach. J. Wine Res. 2002, 13, 217–242. [Google Scholar]

- Felzensztein, C.; Hibbert, S.; Vong, G. Is the country of origin the fifth element in the marketing mix of imported wine? J. Food Prod. Market. 2004, 10, 73–84. [Google Scholar]

- Spawton, T. Why winemakers should know who consumes their wine and devise their marketing accordingly. Aust. Grapegrow. Winemak. 1991, 334, 33–37. [Google Scholar]

- Balestrini, P.; Gamble, P. Country-of-origin effects on Chinese wine consumers. Br. Food J. 2006, 108, 396–412. [Google Scholar] [CrossRef]

- Johnson, T.E.; Bastian, S.E.P. A preliminary study of the relationship between Australian wine consumers’ wine expertise and their wine purchasing and consumption behaviour. Aust. J. Grape Wine Res. 2007, 13, 186–197. [Google Scholar]

- Crump, A.M.; Johnson, T.E.; Bastian, S.E.P.; Bruwer, J.; Wilkinson, K.L. Consumers’ knowledge of and attitudes towards the role of oak in winemaking. Int. J. Wine Res. 2014, 6, 21–30. [Google Scholar]

- Bilkey, W.J.; Nes, E. Country-of-origin effects on product evaluations. J. Int. Bus. Stud. 1982, 13, 89–99. [Google Scholar]

- Veale, R.; Quester, P. Do consumer expectations match experience? Predicting the influence of price and country of origin on perceptions of product quality. Int. Bus. Rev. 2009, 18, 134–144. [Google Scholar]

- Thode, S.; Maskulka, J. Place-based marketing strategies, brand equity and vineyard valuation. J. Prod. Brand Manag. 1998, 7, 379–399. [Google Scholar]

- Chaney, I.M. Promoting wine by country. Int. J. Wine Market. 2002, 14, 34–40. [Google Scholar]

- Charters, S. An ambivalent luxury: Images of Champagne in the Australian market. In Presented at Beccus Wine Conference: Fourth Interdisciplinary and International Wine Conference, Dijon, France, 7–9 July 2009.

- Brissonet, F.; Maujean, A. Identification of some foam-active compounds in Champagne base wines. Am. J. Enol. Vitic. 1991, 42, 97–102. [Google Scholar]

- De La Presa-Owens, C.; Schlich, P.; Davies, H.D.; Noble, A.C. Effect of Méthode Champenoise process on aroma flavour of four V. vinifera varieties. Am. J. Enol. Vitic. 1998, 49, 289–294. [Google Scholar]

- Vannier, A.; Bruna, O.X.; Feinberg, M.H. Application of sensory analysis to champagne wine characterisation and discrimination. Food Qual. Preference 1999, 10, 101–107. [Google Scholar]

- Chamkha, M.; Cathala, B.; Cheynier, V.; Douillard, R. Phenolic composition of Champagnes from Chardonnay and Pinot noir vintages. J. Agric. Food Chem. 2003, 51, 3179–3184. [Google Scholar] [CrossRef] [PubMed]

- Coelho, E.; Coimbra, M.A.; Nogueira, J.M.F.; Rocha, S.M. Quantification approach for assessment of sparkling wine volatiles from different soils, ripening stages, and varieties by stir bar sorptive extraction with liquid desorption. Anal. Chim. Acta 2009, 635, 214–221. [Google Scholar]

- Gallardo-Chacón, J.J.; Vichi, S.; López-Tamames, E.; Buxaderas, S. Changes in the sorption of diverse volatiles by Saccharomyces cerevisiae lees during sparkling wine aging. J. Agric. Food Chem. 2010, 58, 12426–12430. [Google Scholar]

- Torrens, J.; Riu-Aumatell, M.; Vichi, S.; Lopez-Tamames, E.; Buxaderas, S. Assessment of volatile and sensory profiles between base and sparkling wines. J. Agric. Food Chem. 2010, 58, 2455–2461. [Google Scholar]

- Martínez-Lapuente, L.; Guadalupe, Z.; Ayestarán, B.; Ortega-Heras, M.; Pérez-Magariño, S. Changes in polysaccharide composition during the sparkling winemaking and aging. J. Agric. Food Chem. 2013, 61, 12362–12373. [Google Scholar]

- Pérez-Magariño, S.; Martínez-Lapuente, L.; Bueno-Herrera, M.; Ortega-Heras, M.; Guadalupe, Z.; Ayestarán, B. Use of commercial dry yeast products rich in mannoproteins for white and rosé sparkling wine elaboration. J. Agric. Food Chem. 2015, 63, 5670–5681. [Google Scholar]

- Edelmann, A.; Diewok, J.; Schuster, K.C.; Lendl, B. Rapid method for the discrimination of red wine cultivars based on mid-infrared spectroscopy of phenolic wine extracts. J. Agric. Food Chem. 2001, 49, 1139–1145. [Google Scholar]

- Bevin, C.J.; Dambergs, R.G.; Fergusson, A.J.; Cozzolino, D. Varietal discrimination of Australian wines by means of mid-infrared spectroscopy and multivariate analysis. Anal. Chim. Acta 2008, 621, 19–23. [Google Scholar]

- Liu, L.; Cozzolino, D.; Cynkar, W.U.; Gishen, M.; Colby, C.B. Geographic classification of Spanish and Australian Tempranillo red wines by visible and near-infrared spectroscopy combined with multivariate analysis. J. Agric. Food Chem. 2006, 54, 6754–6759. [Google Scholar]

- Cozzolino, D.; Cynkar, W.U.; Shah, N.; Smith, P.A. Can spectroscopy geographically classify Sauvignon Blanc wines from Australia and New Zealand? Food Chem. 2011, 126, 673–678. [Google Scholar]

- Riovanto, R.; Cynkar, W.U.; Berzaghi, P.; Cozzolino, D. Discrimination between Shiraz wines from different Australian regions: The role of spectroscopy and chemometrics. J. Agric. Food Chem. 2011, 59, 10356–10360. [Google Scholar]

- Culbert, J.; Cozzolino, D.; Ristic, R.; Wilkinson, K. Classification of sparkling wine style and quality by MIR spectroscopy. Molecules 2015, 20, 8341–8356. [Google Scholar]

- Iland, P.G.; Bruer, N.; Edwards, G.; Weeks, S.; Wilkes, E. Chemical Analysis of Grapes and Wine: Techniques and Concepts; Patrick Iland Wine Promotions: Adelaide, Australia, 2004. [Google Scholar]

- Iland, P.; Gago, P. Australian Wine: From the Vine to the Glass; Patrick Iland Wine Promotions: Adelaide, Australia, 1997. [Google Scholar]

- Charters, S.; Velikova, N.; Ritchie, C.; Fountain, J.; Thach, L.; Dodd, T.H.; Fish, N.; Herbst, F.; Terblanche, N. Generation Y and sparkling wines: A cross-cultural perspective. Int. J. Wine Bus. Res. 2011, 23, 161–175. [Google Scholar]

- Hoffman, C.A. When consumers buy wine, what factors decide the final purchase? Aust. N. Z. Wine Ind. J. 2004, 19, 82–91. [Google Scholar]

- Bruwer, J.; Saliba, A.; Miller, B. Consumer behaviour and sensory preference differences: Implications for wine product marketing. J. Consum. Mark. 2011, 28, 5–18. [Google Scholar] [CrossRef]

- Lange, C.; Martin, C.; Chabanet, C.; Combris, P.; Issanchou, S. Impact of the information provided to consumers on their willingness to pay for Champagne: Comparison with hedonic scores. Food Qual. Preference 2002, 13, 597–608. [Google Scholar]

- Combris, P.; Lange, C.; Issanchou, S. Assessing the effect of information on the reservation price for Champagne: What are consumers actually paying for? J. Wine Econ. 2006, 1, 75–88. [Google Scholar] [CrossRef]

- Vignes, A.; Gergaud, O. Twilight of the idols in the market for Champagne: Dissonance or consonance in consumer preferences? J. Wine Res. 2007, 18, 147–162. [Google Scholar]

- Cordell, V.V. Effects of consumer preferences for foreign sourced products. J. Int. Bus. Stud. 1992, 23, 251–296. [Google Scholar] [CrossRef]

| Aroma Attribute | Descriptors | Reference Standard a |

|---|---|---|

| Citrus b | Lemon, grapefruit, lime, orange, mandarin | Grapefruit 4.5 g + lemon 3.0 g + lime 2.0 g + orange 3.0 g |

| Stone fruit b | Apricot, nectarine, peach, white peach | Dried peach and apricot mixture 8.3 g + fresh nectarine 4.2 g + fresh peach 3.8 g + fresh apricot 3.0 g |

| Tropical fruit | Pineapple, melon, lychee, banana, passionfruit | Rock melon 5.8 g (pulp + seeds) + lychee 2.3 g + lychee juice 1 mL + pineapple 5.6 g + pineapple juice 1 mL + passionfruit 3.0 g |

| Pome fruit b | Apple, pear | Apple 6.0 g + pear 6.0 g |

| Floral | Rose, perfume, blossom, honeysuckle | Rose water ½ tablespoon + two jasmine flower petals + two rose flower petals + rose flower stamen 0.3 g |

| Confection | Turkish delight, bubble gum, musk, sherbet, strawberries and cream | Lollies 3.5 g (half each of yellow, green and red ‘snakes’, cut into small pieces) + Turkish delight (¼ of a Cadbury’s square) |

| Savoury/meaty | Savoury, meaty, vegemite, soy | Cooked bacon pieces 2.0 g + a quarter of one smoked almond |

| Mushroom/earthy | Mushroom, earthy | Mushroom 2.0 g + earth 0.2 g |

| Honey | Honey | Honey 1.35 g |

| Yeasty | Dough | Dried yeast 0.1 g |

| Toasty | Biscuit, bread, brioche, buttery, popcorn | Toasted bread 1.5 g + a quarter of a milk coffee biscuit |

| Vanilla/caramel | Vanilla, caramel, coconut, spice/clove | Coconut (fine desiccated) 0.4 g + vanillin 0.05 g |

| Aged/developed | Nutty, kerosene, developed, Muscat/port, acetaldehyde | 20 mL of aged sparkling white wine with a notable kerosene character |

| pH | TA (g/L) | Residual Sugar (g/L) | Alcohol (% abv) | Total Phenolics (au) | |||

|---|---|---|---|---|---|---|---|

| French | All (n = 24) | Range | 3.0–3.4 | 6.3–9.7 | 2.2–13.4 | 10.8–12.9 | 1.2–5.6 |

| Mean | 3.1 | 7.6 | 10.2 | 12.4 | 3.0 | ||

| F$12 | 3.4 | 6.3 | 13.4 | 10.8 | 4.3 | ||

| F$40 | 3.1 | 7.5 | 11.3 | 12.4 | 1.5 | ||

| F$70 | 3.0 | 8.0 | 11.4 | 12.3 | 3.5 | ||

| Australian | All (n = 21) | Range | 3.0–3.4 | 6.1–9.6 | 0.5–13.1 | 11.2–13.0 | 0.3–4.9 |

| Mean | 3.2 | 7.9 | 9.0 | 12.3 | 2.3 | ||

| A$12 | 3.3 | 6.1 | 11.6 | 11.4 | 3.0 | ||

| A$40 | 3.3 | 8.9 | 8.2 | 12.7 | 2.6 | ||

| A$70 | 3.2 | 7.7 | 10.7 | 12.7 | 2.7 |

| Total Sample (n = 95) | Cluster 1 (n = 27, 28.4%) | Cluster 2 (n = 25, 26.3%) | Cluster 3 (n = 43, 45.3%) | ||

|---|---|---|---|---|---|

| Gender | Female | 64.2 | 74.1 | 68.0 | 55.8 |

| Male | 35.8 | 25.9 | 32.0 | 44.2 | |

| Age | <25 | 29.5 | 40.7 | 16.0 | 30.2 |

| 25 to 39 | 28.4 | 33.3 | 20.0 | 30.2 | |

| 40 to 54 | 24.2 | 3.7 | 40.0 | 27.9 | |

| ≥55 | 17.9 | 22.2 | 24.0 | 11.6 | |

| Education | High school or trade | 35.8 | 48.1 | 28.0 | 32.6 |

| Bachelor’s degree | 33.7 | 37.0 | 28.0 | 34.9 | |

| Postgraduate degree | 30.5 | 14.8 | 44.0 | 32.6 | |

| Household income | ≤$50,000 | 34.0 | 25.9 | 28.0 | 33.2 |

| $50,001–$100,000 | 30.9 | 37.0 | 32.0 | 25.6 | |

| $100,001–$150,000 | 19.1 | 29.6 | 20.0 | 11.6 | |

| ≥$150,001 | 15.9 | 7.4 | 20.0 | 18.6 |

| Sample | Hedonic Ratings a | Expected Price ($/750 mL Bottle) | |||||

|---|---|---|---|---|---|---|---|

| Total Sample (n = 95) | Cluster 1 (n = 27) | Cluster 2 (n = 25) | Cluster 3 (n = 43) | p | Based on Tasting | Based on Front Label | |

| F$12 | 5.6 ± 0.2 ab | 6.0 a | 4.2 b | 6.1 a | <0.001 | $21–$30 | $61–$70 |

| F$40 | 5.8 ± 0.2 ab | 5.0 | 3.8 | 7.3 | ns | $21–$30 | $51–$60 |

| F$70 | 5.3 ± 0.2 b | 2.9 b | 6.7 a | 5.9 a | <0.001 | $21–$30 | $61–$70 |

| A$12 | 6.3 ± 0.2 a | 5.8 b | 5.6 b | 6.8 a | 0.05 | $21–$30 | $21–$30 |

| A$40 | 5.7 ± 0.2 ab | 5.9 | 5.3 | 5.8 | ns | $21–$30 | $41–$50 |

| A$70 | 5.8 ± 0.2 ab | 4.1 b | 5.9 a | 6.5 a | 0.01 | $21–$30 | $51–$60 |

| French Origin | Australian Origin | Unknown Origin | ||||

|---|---|---|---|---|---|---|

| No. of Consumers | Hedonic Ratings a | No. of Consumers | Hedonic Ratings a | No. of Consumers | Hedonic Ratings a | |

| F$12 | 26 (27%) | 6.7 ± 0.4 | 49 (52%) | 5.0 ± 0.3 | 20 (21%) | 5.6 ± 0.6 |

| F$40 | 31 (32%) | 6.8 ± 0.4 | 32 (34%) | 5.5 ± 0.3 | 32 (34%) | 5.0 ± 0.4 |

| F$70 | 21 (22%) | 4.9 ± 0.5 | 36 (38%) | 5.8 ± 0.4 | 38 (40%) | 4.9 ± 0.4 |

| A$12 | 23 (24%) | 7.4 ± 0.3 | 47 (50%) | 5.8 ± 0.3 | 25 (26%) | 6.0 ± 0.3 |

| A$40 | 26 (27%) | 7.4 ± 0.3 | 46 (49%) | 5.8 ± 0.2 | 23 (24%) | 5.7 ± 0.4 |

| A$70 | 27 (28%) | 6.0 ± 0.4 | 50 (53%) | 5.6 ± 0.3 | 18 (19%) | 6.0 ± 0.5 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Culbert, J.; Verdonk, N.; Ristic, R.; Olarte Mantilla, S.; Lane, M.; Pearce, K.; Cozzolino, D.; Wilkinson, K. Understanding Consumer Preferences for Australian Sparkling Wine vs. French Champagne. Beverages 2016, 2, 19. https://doi.org/10.3390/beverages2030019

Culbert J, Verdonk N, Ristic R, Olarte Mantilla S, Lane M, Pearce K, Cozzolino D, Wilkinson K. Understanding Consumer Preferences for Australian Sparkling Wine vs. French Champagne. Beverages. 2016; 2(3):19. https://doi.org/10.3390/beverages2030019

Chicago/Turabian StyleCulbert, Julie, Naomi Verdonk, Renata Ristic, Sandra Olarte Mantilla, Melissa Lane, Karma Pearce, Daniel Cozzolino, and Kerry Wilkinson. 2016. "Understanding Consumer Preferences for Australian Sparkling Wine vs. French Champagne" Beverages 2, no. 3: 19. https://doi.org/10.3390/beverages2030019