Information Flow Analysis between EPU and Other Financial Time Series

Abstract

:1. Introduction

2. Methodology

2.1. Linear Causality

2.2. Nonlinear Causality

2.3. Effective Transfer Entropy (ETE)

3. An Improved Effective Transfer Entropy Method Based on a Sliding Window

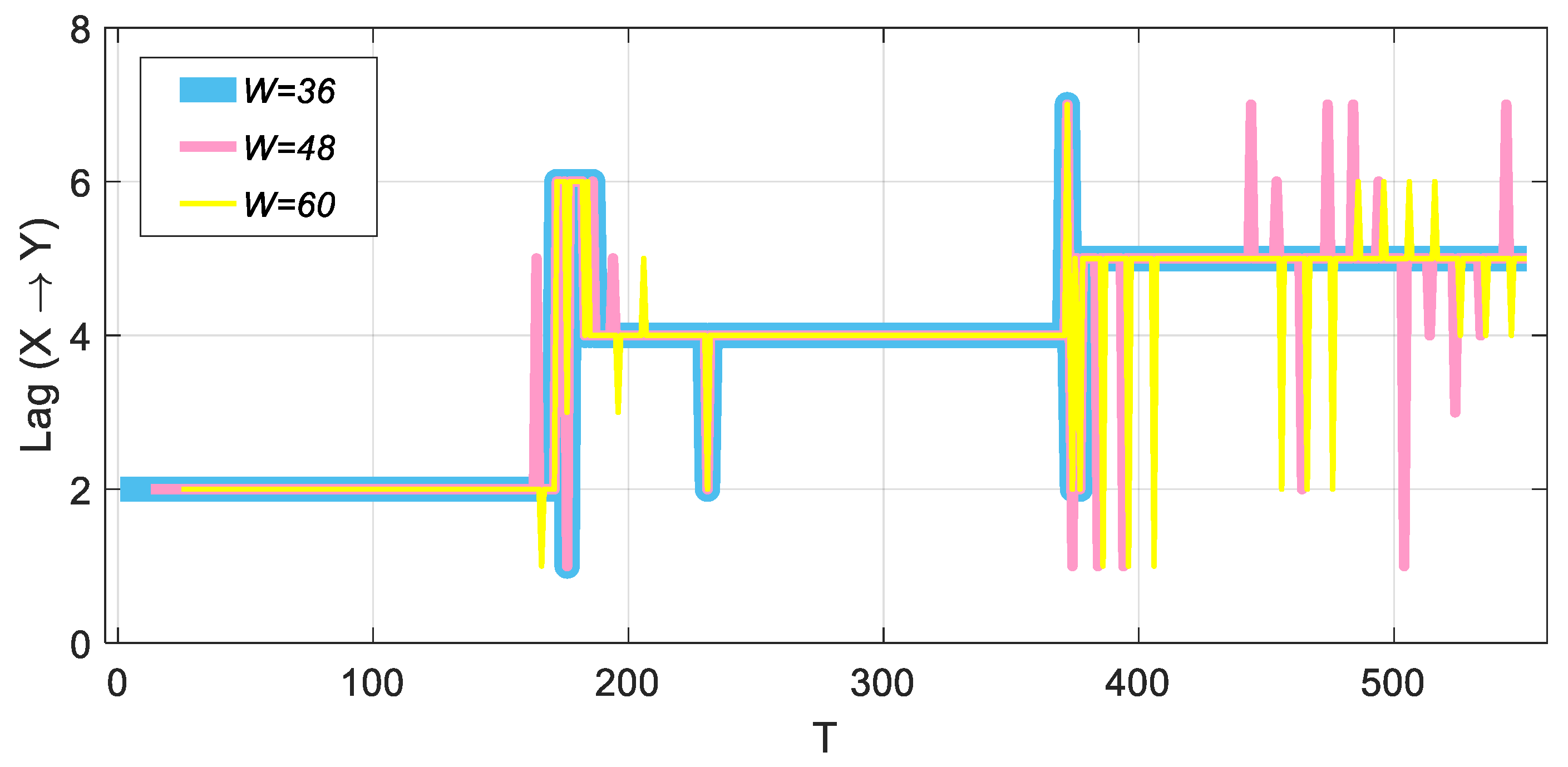

3.1. Improved Method Based on a Sliding Window and Comparison with the Traditional Linear Method

3.2. Sliding Window Length

3.3. Comparison with the Granger Causality Test

- (1)

- The maximum of the lag value p is set to a fixed number, such as 10.

- (2)

- Calculating the total AIC of Equations (16) and (17) by traversing the p-value from 1 to 10, we obtain the corresponding p of a minimum . The experimental results show that the optimal is 5.

- (3)

- Equations (16) and (17) are estimated using OLS with .

- (4)

- and are calculated according to Equation (18). The results show and (at the confidence level).

- (5)

- If , we conclude that can Granger cause significantly.

- (6)

- The window is moved forward by a one-month step, and steps (1)–(5) are repeated.

4. Data Description

5. Empirical Results

5.1. EPU and Exports/Imports

5.2. EPU and Exchange Rate

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Hume, D. A Treatise of Human Nature; Penguin Group: London, UK, 1739. [Google Scholar]

- Judea, P. Causality: Models, Reasoning and Inference; Cambridge University Press: New York, NY, USA, 2009. [Google Scholar]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Barnett, L.; Barrett, A.B.; Seth, A.K. Granger Causality and Transfer Entropy Are Equivalent for Gaussian Variables. Phys. Rev. Lett. 2009, 103, 238701. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Duan, P.; Chen, T.; Shah, S.L.; Yang, F. Methods for root cause diagnosis of plant-wide oscillations. AIChE J. 2014, 60, 2019–2034. [Google Scholar] [CrossRef]

- Lindner, B.; Auret, L.; Bauer, M.; Groenewald, J.W. The Comparative analysis of Granger causality and transfer entropy to present a decision flow for the application of oscillation diagnosis. J. Process Control 2019, 79, 72–84. [Google Scholar] [CrossRef]

- Kwon, O.; Yang, J.-S. Information Flow between Stock Indices. Europhys. Lett. 2008, 82, 68003. [Google Scholar] [CrossRef] [Green Version]

- Marschinski, R.; Kantz, H. Analysing the information flow between financial time series. Eur. Phys. J. B-Condens. Matter Complex Syst. 2002, 30, 275–281. [Google Scholar] [CrossRef]

- Tungsong, S.; Caccioli, F.; Aste, T. Relation between regional uncertainty spillovers in the global banking system. J. Netw. Theory Financ. 2018, 4, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. Measuring Financial Asset Return and Volatility Spillovers, with Application to Global Equity Markets. Econ. J. 2009, 119, 158–171. [Google Scholar] [CrossRef] [Green Version]

- Kyrtsou, C.; Kugiumtzis, D.; Papana, A. Further insights on the relationship between SP500, VIX and volume: A new asymmetric causality test. Eur. J. Financ. 2019, 25, 1402–1419. [Google Scholar] [CrossRef]

- Dimpfl, T.; Peter, F.J. Group transfer entropy with an application to cryptocurrencies. Phys. A 2019, 516, 543–551. [Google Scholar] [CrossRef]

- Garcia-Medina, A.; Sandoval, L.; Banuelos, E.U.; Martinez-Arguello, A.M. Correlations and flow of information between the New York Times and stock markets. Phys. A 2018, 502, 403–415. [Google Scholar] [CrossRef] [Green Version]

- Han, L.; Qi, M.; Yin, L. Macroeconomic policy uncertainty shocks on the Chinese economy: A GVAR analysis. Appl. Econ. 2016, 51, 4907–4921. [Google Scholar] [CrossRef]

- Fontaine, I.; Didier, L.; Razafindravaosolonirina, J. Foreign policy uncertainty shocks and US macroeconomic activity: Evidence from China. Econ. Lett. 2017, 155, 121–125. [Google Scholar] [CrossRef]

- Li, X.M.; Peng, L. US economic policy uncertainty and co-movements between Chinese and US stock markets. Econ. Modell 2017, 61, 27–39. [Google Scholar] [CrossRef]

- Liow, K.H.; Liao, W.C.; Huang, Y. Dynamics of international spillovers and interaction: Evidence from financial market stress and economic policy uncertainty. Econ. Modell 2018, 68, 96–116. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Kim, W.J.; Sarafrazi, S. Source of fluctuations in islamic, U.S., EU, and Asia equity markets: The roles of economic uncertainty, interest rates, and stock indexes. Emerg. Mark. Financ. Trade 2016, 52, 1195–1209. [Google Scholar] [CrossRef]

- Dakhlaoui, I.; Aloui, C. The interactive relationship between the US economic policy uncertainty and BRIC stock markets. Int. Econ. 2016, 146, 141–157. [Google Scholar] [CrossRef]

- Arouri, M.; Estay, C.; Rault, C.; Roubaud, D. Economic policy uncertainty and stock markets: Long-run evidence from the US. Financ. Res. Lett. 2016, 18, 136–141. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Antonakakis, N.; Gupta, R.; Andre, C. Dynamic co-movements between economic policy uncertainty and housing market returns. J. Real Estate Portf. Manag. 2015, 21, 53–60. [Google Scholar]

- Sarwar, G.; Khan, W. The effect of US stock market uncertainty on emerging market returns. Emerg. Mark. Financ. Trade 2017, 53, 1796–1811. [Google Scholar] [CrossRef]

- Tsai, I.C. The source of global stock market risk: A viewpoint of economic policy uncertainty. Econ. Modell 2017, 60, 122–131. [Google Scholar] [CrossRef]

- Li, X.; Balcilar, M.; Gupta, R.; Chang, T. The causal relationship between economic policy uncertainty and stock returns in China and India: Evidence from a bootstrap rolling window approach. Emerg. Mark. Financ. Trade 2016, 52, 674–689. [Google Scholar] [CrossRef] [Green Version]

- Yao, C.Z.; Liu, C.; Ju, W.J. Multifractal analysis of the WTI crude oil market, US stock market and EPU. Physica A 2020, 2, 124096. [Google Scholar] [CrossRef]

- Wisniewski, T.P.; Lambe, B.J. Does economic policy uncertainty drive CDS spreads? Int. Rev. Financ. Anal. 2015, 42, 447–458. [Google Scholar] [CrossRef] [Green Version]

- Aastveit, K.A.; Natvik, G.J.; Sola, S. Economic uncertainty and the influence of monetary policy. J. Int. Money Financ. 2017, 76, 50–67. [Google Scholar] [CrossRef]

- Caggiano, G.; Castelnuovo, E.; Figueres, J.M. Economic policy uncertainty and unemployment in the United States: A nonlinear approach. Econ. Lett. 2017, 151, 31–34. [Google Scholar] [CrossRef] [Green Version]

- Kido, Y. On the link between the US economic policy uncertainty and exchange rates. Econ. Lett. 2016, 144, 49–52. [Google Scholar] [CrossRef]

- Beckmann, J.; Czudaj, R. Exchange rate expectations and economic policy uncertainty. Eur. J. Political Econ. 2017, 47, 148–162. [Google Scholar] [CrossRef]

- Geweke, J.F. Measures of Conditional Linear Dependence and Feedback between Time Series. J. Am. Stat. Assoc. 1984, 79, 907–915. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef] [Green Version]

- Keskin, Z.; Aste, T. Information-theoretic measures for non-linear causality detection: Application to social media sentiment and cryptocurrency prices. arXiv 2019, arXiv:1906.05740v2. [Google Scholar]

- Wiener, N. The theory of prediction. Mod. Math. Eng. 1956, 1, 125–139. [Google Scholar]

- Akaike, H. Fitting autoregressive models for regression. Ann. Inst. Statist. Math 1969, 21, 243–247. [Google Scholar] [CrossRef]

- Podobnik, B.; Stanley, H.E. Detrended crosscorrelation analysis: A new method for analyzing two nonstationary time series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [Green Version]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring Economic Policy Uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Huang, Y.; Luk, P. Measuring Economic Policy Uncertainty in China. Hong Kong Baptist Univ. Work. Pap. 2018, 59, 101367. [Google Scholar] [CrossRef]

- Zhang, D.; Lei, L.; Ji, Q.; Kutan, A.M. Economic policy uncertainty in the US and China and their impact on the global markets. Econ. Model. 2019, 79, 47–56. [Google Scholar] [CrossRef]

- Balcilar, M.; Gupta, R.; Kyei, C.; Wohar, M.E. Does economic policy uncertainty predict exchange rate returns and volatility? Evidence from a nonparametric causality-in-quantiles test. Open Econ. Rev. 2016, 27, 229–250. [Google Scholar] [CrossRef] [Green Version]

- Chen, L.; Du, Z.; Hu, Z. Impact of economic policy uncertainty on exchange rate volatility of China. Financ. Res. Lett. 2020, 32, 101266. [Google Scholar] [CrossRef]

| Lag | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| F | 0.5664 | 4.0797 | 2.9568 | 2.2895 | 6.6669 | 5.8331 | 4.9915 | 5.0310 | 4.4082 | 3.9662 |

| p-value | 0.4520 | 0.0174 | 0.0319 | 0.0586 | 4.76 × 10−6 * | 6.48 × 10−6 * | 1.68 × 10−5 * | 4.75 × 10−6 * | 1.38 × 10−5 * | 3 × 10−5 * |

| Category-Specific Policy Term Sets | Related Terms | 1985:1-2014:12 Overall Average |

|---|---|---|

| Economic Policy Uncertainty | 100.0 | |

| Fiscal Policy | Anything covered by Taxes or Government Spending & Other | 46.1 |

| -Taxes | Taxes, tax, taxation, taxed | 40.3 |

| -Government Spending & Other | Government spending, federal budget, budget battle, balanced budget, defense spending, military spending, entitlement spending, fiscal stimulus, budget deficit, federal debt, national debt, etc. | 17.1 |

| Monetary Policy | Federal reserve, the Fed, money supply, open market operations, quantitative easing, monetary policy, Fed funds rate, overnight lending rate, Bernanke, Volcker, central bank, interest rates, Fed chairman, Fed chair, discount window, European Central Bank, ECB, etc. | 28.1 |

| Healthcare | Health care, Medicaid, Medicare, health insurance, malpractice tort reform, malpractice reform, prescription drugs, drug policy, food and drug administration, etc. | 17.3 |

| National Security | National security, war, military conflict, terrorism, terror, 9/11, defense spending, military spending, police action, armed forces, base closure, military procurement, etc. | 23.8 |

| Regulation | Anything covered by financial regulation and truth in lending, union rights, card check, collective bargaining law, national labor relations board, minimum wage, living wage, right to work, closed shop, etc. | 17.4 |

| -Financial Regulation | Banking (or bank) supervision, Glass-Steagall, tarp, thrift supervision, Dodd-frank, financial reform, commodity futures trading commission, CFTC, house financial services committee, Volcker rule, etc. | 3.3 |

| Sovereign Debt & Currency Crises | Sovereign debt, currency crisis, currency devaluation, currency revaluation, euro crisis, Eurozone 51 crisis, exchange rate, European debt, Asian financial crisis, Russian crisis, etc. | 1.6 |

| Entitlement Programs | Entitlement program, entitlement spending, government entitlements, social security, Medicaid, government welfare, welfare reform, unemployment insurance, unemployment benefits, food stamps, EITC, etc. | 12.4 |

| Trade Policy | Import tariffs, import duty, import barrier, government subsidies, government subsidy, WTO, World Trade Organization, trade treaty, trade agreement, trade policy, etc. | 3.8 |

| IM | EX | CN EPU | US EPU | Exchange Rate CNY/USD | |

|---|---|---|---|---|---|

| Count | 173 | 173 | 173 | 173 | 170 |

| Mean | 33,273.0705 | 7938.5202 | 130.4408 | 124.9687 | 6.8104 |

| Std | 8143.0326 | 2582.7937 | 33.8313 | 48.2120 | 0.6087 |

| Min | 16,184.9000 | 2609.3000 | 52.1958 | 44.7828 | 6.0540 |

| Max | 52,202.3000 | 13,630.3000 | 238.3172 | 284.1359 | 8.2765 |

| Skewness | −0.0292 | −0.1197 | 0.1333 | 0.8279 | 0.9972 |

| Kurtosis | −0.8894 | −0.7930 | 0.2282 | 0.5363 | −0.0514 |

| Jarque-Bera | 5.7268 | 4.9460 | 0.8876 | 21.837055 * | 28.1910 * |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yao, C.-Z. Information Flow Analysis between EPU and Other Financial Time Series. Entropy 2020, 22, 683. https://doi.org/10.3390/e22060683

Yao C-Z. Information Flow Analysis between EPU and Other Financial Time Series. Entropy. 2020; 22(6):683. https://doi.org/10.3390/e22060683

Chicago/Turabian StyleYao, Can-Zhong. 2020. "Information Flow Analysis between EPU and Other Financial Time Series" Entropy 22, no. 6: 683. https://doi.org/10.3390/e22060683

APA StyleYao, C.-Z. (2020). Information Flow Analysis between EPU and Other Financial Time Series. Entropy, 22(6), 683. https://doi.org/10.3390/e22060683