An Introduction to Complex Networks in Climate Finance

Abstract

:1. Introduction

2. Background

2.1. Econophysics and Investor Networks

The advent of the computer age has incited an increasing interest in the fundamental properties of real networks. Due to the increased computational power, large data sets can now easily be stored and investigated, and this has had a profound impact in the empirical studies on large networks. A striking conclusion from this empirical work is that many real networks share fascinating features.

In our sample, the information on the equity holdings by US institutional investors allows to construct a network of relations. Stemming from the simple observation that often institutional blockholders share co-ownership relationships with other institutional investors, we interpret the blockholder as actor and the co-ownership link as a tie.

Our evidence indicates that, for maximum effect, coordinated engagements on (ESG) issues should preferably have a credible lead investor who is well suited geographically, linguistically, culturally and socially to influencing target companies.

2.2. Nonequilibrium Statistical Physics Meets Climate Finance

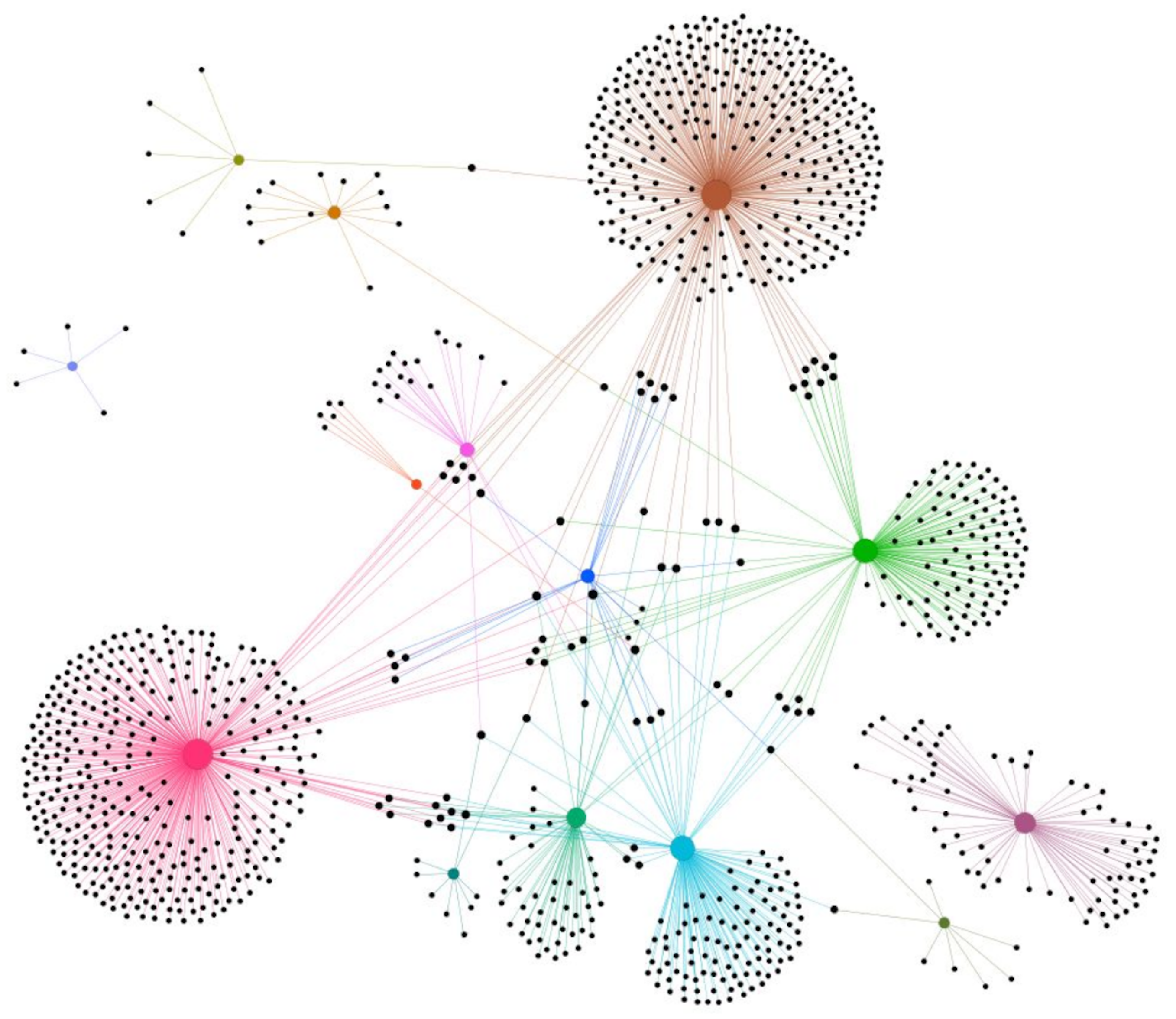

2.3. Investor Hubs Dominate the Market

2.4. Fit Get Richer, and Rich Get Richer

2.5. Community Detection

2.6. Centrality Measures

3. Empirical Evidence

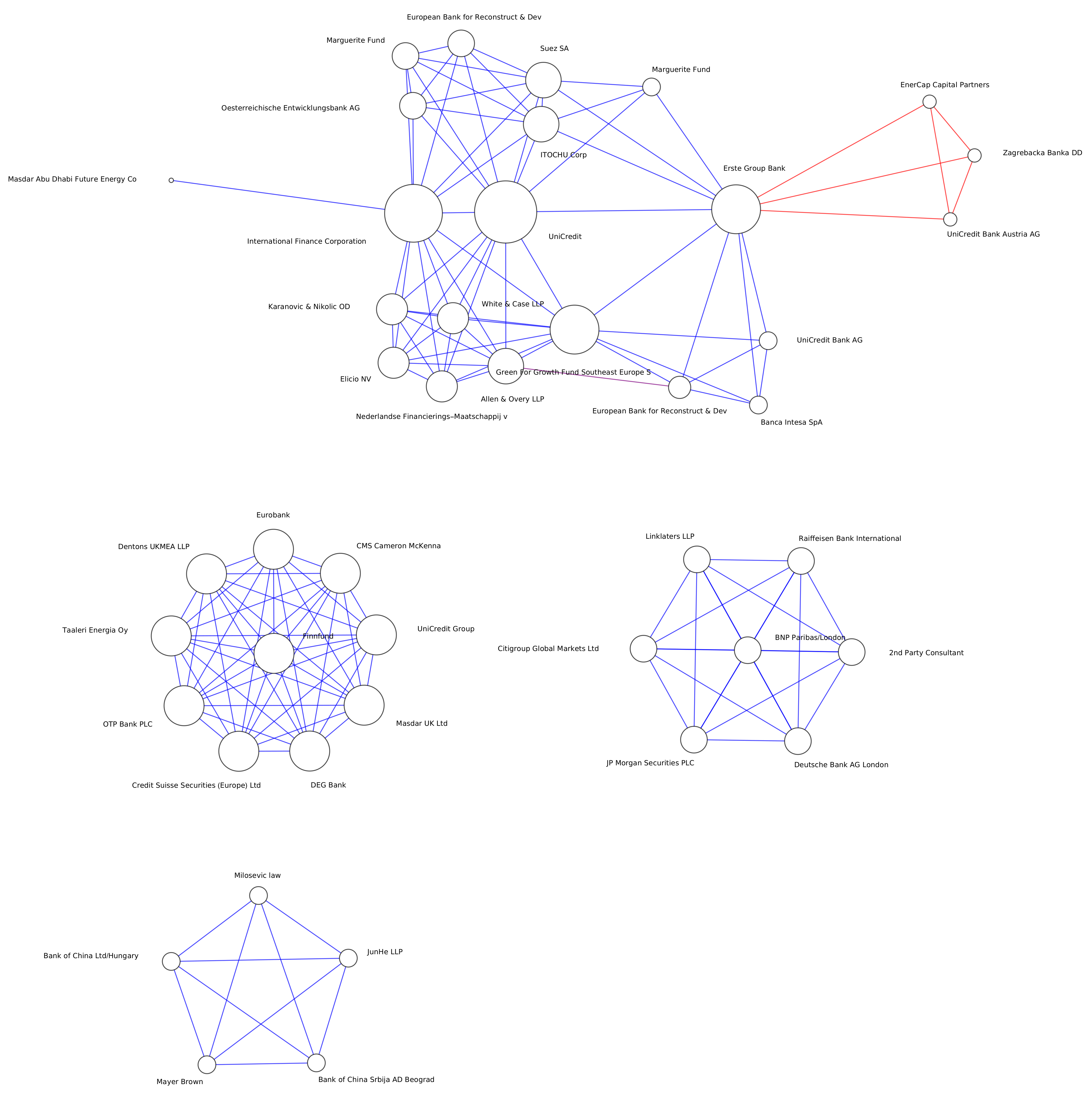

3.1. Wind Markets

3.2. Hydro Markets

3.3. Energy Efficiency Markets

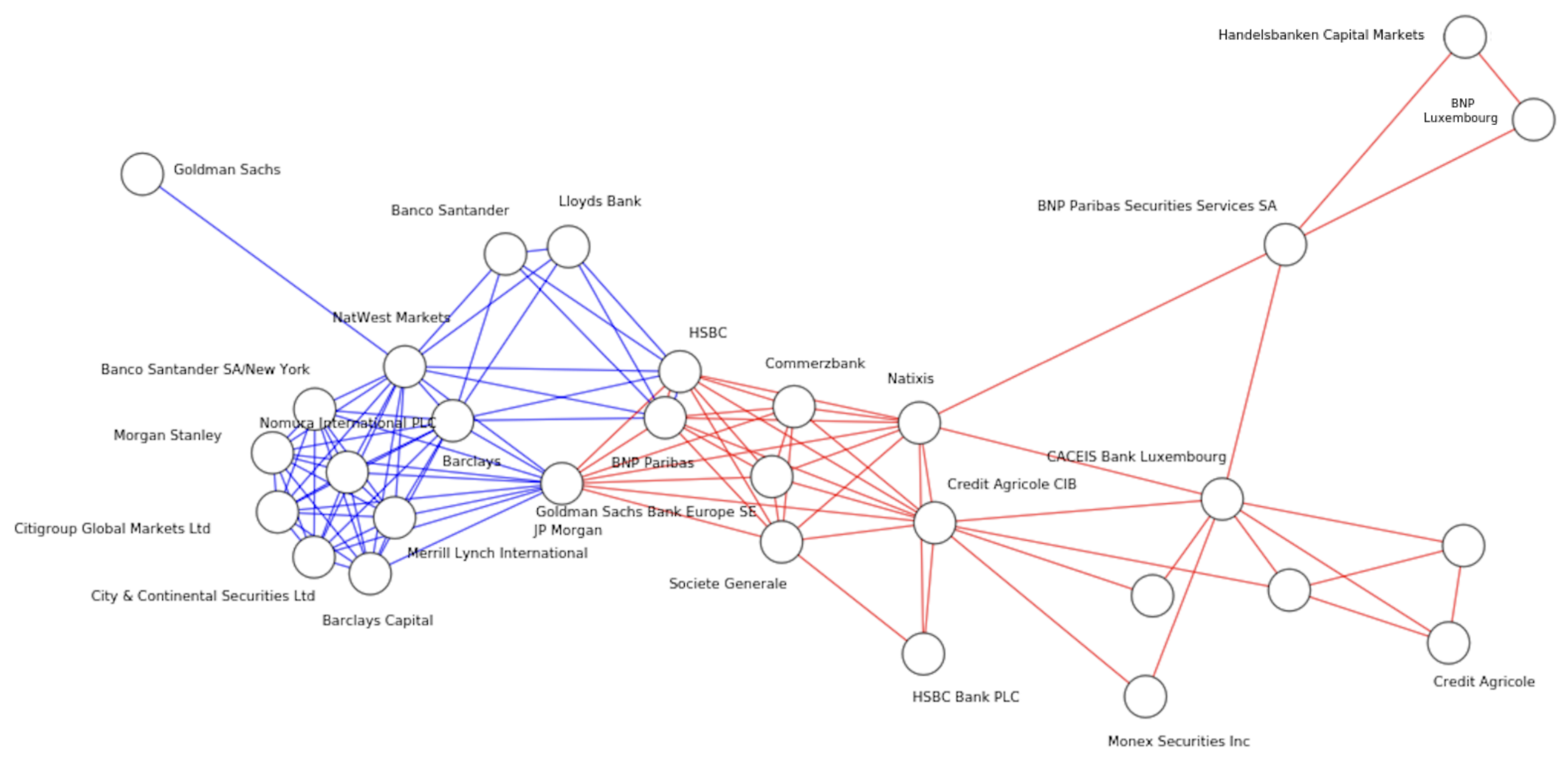

3.4. Green Bonds, Loans, and Networks of Underwriter Syndicates

- A hypergraph where V is the vertex set and E is the edge set, with and , and each edge e is simply a subset of V; see [39], Introduction.

- The vertices, which represent banks.

- The hyperedges (i.e., higher-order edges representing groups of investors and an investment rather than simply pairs of investors). which represent project financing by the corresponding banking syndicate. The amount of money invested is large enough in many cases to require large syndicates of banks to underwrite the risk.

4. Final Words and Open Avenues of Research

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ladyman, J.; Lambert, J.; Wiesner, K. What is a complex system? Eur. J. Philos. Sci. 2012, 3, 33–67. [Google Scholar] [CrossRef]

- Mantegna, R. Hierarchical structure in financial markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Hall, S.; Foxon, T.J.; Bolton, R. Investing in low-carbon transitions: Energy finance as an adaptive market. Clim. Policy 2015, 17, 280–298. [Google Scholar] [CrossRef]

- Schweitzer, F.; Fagiolo, G.; Sornette, D.; Vega-Redondo, F.; Vespignani, A.; White, D.R. Economic Networks: The New Challenges. Science 2009, 325, 422–425. [Google Scholar] [CrossRef] [PubMed]

- Foster, J. From simplistic to complex systems in economics. Camb. J. Econ. 2005, 29, 873–892. [Google Scholar] [CrossRef]

- Gross, T.; Sayama, H. (Eds.) Adaptive Networks; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar] [CrossRef]

- Ameli, N.; Kothari, S.; Livan, G.; Caldarelli, G. The Hidden Structure of Energy Efficiency Finance. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Larosa, F.; Rickman, J.; Ameli, N. Finding the right partners? Examining inequalities in the global investment landscape of hydropower. Glob. Environ. Chang. 2022, 74, 102518. [Google Scholar] [CrossRef]

- Rickman, J.; Larosa, F.; Ameli, N. The internal dynamics of fast-growing wind finance markets. J. Clean. Prod. 2022, 375, 134129. [Google Scholar] [CrossRef]

- Barthelemy, M. Spatial networks. Phys. Rep. 2011, 499, 1–101. [Google Scholar] [CrossRef]

- Grimmett, G. Probability on Graphs; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Pearson, K. The Life, Letters and Labours of Francis Galton; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar] [CrossRef]

- May, R.M. Will a Large Complex System be Stable? Nature 1972, 238, 413–414. [Google Scholar] [CrossRef]

- Rickles, D. Econophysics and the Complexity of Financial Markets. In Philosophy of Complex Systems; Handbook of the Philosophy of Science; Hooker, C., Ed.; North-Holland: Amsterdam, The Netherlands, 2011; Volume 10, pp. 531–565. [Google Scholar] [CrossRef]

- Kutner, R.; Ausloos, M.; Grech, D.; Matteo, T.D.; Schinckus, C.; Stanley, H.E. Econophysics and sociophysics: Their milestones and challenges. Phys. A Stat. Mech. Its Appl. 2019, 516, 240–253. [Google Scholar] [CrossRef]

- Van der Hofstad, R. Random Graphs and Complex Networks; Cambridge University Press: Cambridge, UK, 2016. [Google Scholar] [CrossRef]

- Aguiar, M.; Bick, C.; Dias, A. Network Dynamics with Higher-Order Interactions: Coupled Cell Hypernetworks for Identical Cells and Synchrony. arXiv 2022, arXiv:2201.09379. [Google Scholar] [CrossRef]

- Bajo, E.; Croci, E.; Marinelli, N. Institutional investor networks and firm value. J. Bus. Res. 2020, 112, 65–80. [Google Scholar] [CrossRef]

- Fracassi, C. Corporate Finance Policies and Social Networks. Manag. Sci. 2012, 63, 2397–2419. [Google Scholar] [CrossRef]

- Crane, A.D.; Koch, A.; Michenaud, S. Institutional investor cliques and governance. J. Financ. Econ. 2019, 133, 175–197. [Google Scholar] [CrossRef]

- Dordi, T.; Gehricke, S.A.; Naef, A.; Weber, O. Ten financial actors can accelerate a transition away from fossil fuels. Environ. Innov. Soc. Transitions 2022, 44, 60–78. [Google Scholar] [CrossRef]

- Galaz, V.; Crona, B.; Dauriach, A.; Scholtens, B.; Steffen, W. Finance and the Earth system – Exploring the links between financial actors and non-linear changes in the climate system. Glob. Environ. Chang. 2018, 53, 296–302. [Google Scholar] [CrossRef]

- Dimson, E.; Karakaş, O.; Li, X. Coordinated Engagements. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Yang, A.; Uysal, N.; Taylor, M. Unleashing the Power of Networks: Shareholder Activism, Sustainable Development and Corporate Environmental Policy. Bus. Strategy Environ. 2017, 27, 712–727. [Google Scholar] [CrossRef]

- Chung, F.; Lu, L.; Dewey, T.G.; Galas, D.J. Duplication Models for Biological Networks. J. Comput. Biol. 2003, 10, 677–687. [Google Scholar] [CrossRef]

- Seyed-allaei, H.; Bianconi, G.; Marsili, M. Scale-free networks with an exponent less than two. Phys. Rev. E 2006, 73, 046113. [Google Scholar] [CrossRef]

- Bianconi, G.; Barabási, A.L. Competition and multiscaling in evolving networks. Europhys. Lett. (EPL) 2001, 54, 436–442. [Google Scholar] [CrossRef]

- Pham, T.; Sheridan, P.; Shimodaira, H. Joint estimation of preferential attachment and node fitness in growing complex networks. Sci. Rep. 2016, 6, 32558. [Google Scholar] [CrossRef]

- Newman, M.E.J.; Girvan, M. Finding and evaluating community structure in networks. Phys. Rev. E 2004, 69, 026113. [Google Scholar] [CrossRef] [PubMed]

- Lindblom, T.; Mavruk, T.; Sjögren, S. East or west, home is best: The birthplace bias of individual investors. J. Bank. Financ. 2018, 92, 323–339. [Google Scholar] [CrossRef]

- Murphy, A.H. The Finley Affair: A Signal Event in the History of Forecast Verification. Weather Forecast. 1996, 11, 3–20. [Google Scholar] [CrossRef]

- IEA. World Energy Outlook; IEA: Paris, France, 2022. [Google Scholar]

- Barabasi, L.; Albert, R. Emergence of Scaling in Random Networks. Science 1999, 286, 509–512. [Google Scholar] [CrossRef] [PubMed]

- Inoue, M.; Pham, T.; Shimodaira, H. Joint estimation of non-parametric transitivity and preferential attachment functions in scientific co-authorship networks. J. Inf. 2020, 14, 101042. [Google Scholar] [CrossRef]

- Clegg, R.G.; Parker, B.; Rio, M. Likelihood-based assessment of dynamic networks. J. Complex Netw. 2016, 4, 517–533. [Google Scholar] [CrossRef]

- Egli, F.; Steffen, B.; Schmidt, T.S. A dynamic analysis of financing conditions for renewable energy technologies. Nat. Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

- nobelprize.org. Press Release. Nobel Prize Outreach AB 2023. Available online: https://www.nobelprize.org/prizes/physics/2014/press-release/ (accessed on 31 March 2023).

- Wikipedia. Project Finance. 2023. Available online: https://en.wikipedia.org/wiki/Project_finance (accessed on 9 April 2023).

- Chen, H.; Frieze, A. Coloring bipartite hypergraphs. In Integer Programming and Combinatorial Optimization; Springer: Berlin/Heidelberg, Germany, 1996; pp. 345–358. [Google Scholar] [CrossRef]

- Berge, C. Hypergraphs: Combinatorics of Finite Sets; North-Holland: Amsterdam, The Netherlands, 1989; Volume 43. [Google Scholar]

- Beckenbach, I.L. Matchings and Flows in Hypergraphs. Ph.D. Dissertation, Freien Universität Berlin, Berlin, Germany, 2019. [Google Scholar]

- Kartun-Giles, A.P.; Bianconi, G. Beyond the clustering coefficient: A topological analysis of node neighbourhoods in complex networks. Chaos Solitons Fractals X 2019, 1, 100004. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kartun-Giles, A.P.; Ameli, N. An Introduction to Complex Networks in Climate Finance. Entropy 2023, 25, 1371. https://doi.org/10.3390/e25101371

Kartun-Giles AP, Ameli N. An Introduction to Complex Networks in Climate Finance. Entropy. 2023; 25(10):1371. https://doi.org/10.3390/e25101371

Chicago/Turabian StyleKartun-Giles, Alexander P., and Nadia Ameli. 2023. "An Introduction to Complex Networks in Climate Finance" Entropy 25, no. 10: 1371. https://doi.org/10.3390/e25101371

APA StyleKartun-Giles, A. P., & Ameli, N. (2023). An Introduction to Complex Networks in Climate Finance. Entropy, 25(10), 1371. https://doi.org/10.3390/e25101371