Abstract

The renowned van der Waals (VDW) state equation quantifies the equilibrium relationship between the pressure P, volume V, and temperature of a real gas. We assign new variable interpretations adapted to the economic context: , representing price; , representing demand; and , representing income, to describe an economic state equilibrium. With this reinterpretation, the price elasticity of demand (PED) and the income elasticity of demand (YED) are non-constant factors and may exhibit a singularity of the cusp-catastrophe type. Within this economic framework, the counterpart of VDW liquid–gas phase transition illustrates a substitution mechanism where one product or service is replaced by an alternative substitute. The conceptual relevance of this reinterpretation is discussed qualitatively and quantitatively via several illustrations ranging from transport (carpooling), medical context (generic versus original medication), and empirical data drawn from the electricity market in Germany.

1. Prologue

In 2023, the van der Waals (VDW) equation, a cornerstone of thermodynamics, celebrated its 150th anniversary. Originating from the doctoral thesis of the Nobel laureate Johannes Diderik van der Waals in 1873, this equation extends the ideal gas equation () and offers profound insights into gas–liquid phase transitions and the underlying interplay of molecular forces. For an ideal gas at equilibrium, a decrease in volume corresponds to an increase in pressure, akin to dynamics observed in markets where price increases tend to dampen demand. As a modest tribute at the 150th anniversary occasion, we tentatively extend this economic analogy to real gas state equilibrium. To our surprise, the relevance of this a priori incongruous analogy has also been recently discussed by the late French astrophysicist François Roddier (1936–2023) in a paper entitled “L’équation de van der Waals appliquée à l’économie” [1].

2. Introduction

At thermostatic equilibrium, “the absolute pressure P exerted by a given mass of an ideal gas is inversely proportional to the volume V it occupies if the temperature and amount of gas remain unchanged within a closed system” [2]. Formally, this ideal gas equilibrium (IGE) is encapsulated in the state equation :

where is a proportionality constant. Equation (1) quantifies the interplay between the macro-variables P and V and the constant is proportional to the gas temperature T at the thermostatic equilibrium. We observe that in Equation (1), the P and V variables play a perfectly symmetric role. Ceteris paribus, one may view P as a V-dependent variable, namely, ; conversely, one may write . For a given (or equivalently T), the relation defines an isotherme line lying in the positive quadrant of the real plane .

The thermostatic equilibrium given by Equation (1) bears more than a passing resemblance to market equilibrium (i.e., market clearance), which correlates price with demand . Since the ideal gas equilibrium theory stated in Equation (1) has been very successively extended to the van der Waals (VDW) real gases, it looks natural to infer the potential relevance of the VDW equation in the economic context. This analogy has already motivated several previous discussions [3,4,5,6], and more particularly François Roddier’s recent work [1], which is closely related to the present paper. However, while in [1], the focus is on macro-economic aspects, here we discuss the micro-economic implications.

Depending on whether we consider the dependent or independent variables, we have dual interpretations:

- (i)

- When there is a price increase, equilibrium is maintained through a decrease in demand and vice versa. This is exemplified by sales, which help to sustain demand during price shifts.

- (ii)

- When there is an increase in demand, equilibrium is maintained by an increase in price and vice versa. This is exemplified by the scarcity of resources, which triggers competitive bidding.

Mirroring the gas equilibrium of Equation (1), the market equilibrium is assumed to follow a state relation . For fixed , the state equation defines iso-κ lines, and in the current context, these lines are situated in the positive quadrant of the Cartesian plane .

A couple of basic, relevant measures in economics are the elasticity factors:

Hence, the elasticity is a sensitivity factor that quantifies the relative variation of Y in response to a relative variation of X and vice versa for .

For example, let us consider constant elasticity and the state equilibrium relation , with being two positive constants. In this case, for a fixed iso- line (i.e., ), the resulting elasticity reads

Note that by a suitable rescaling of X and Y, without loss of generality, we can express ; therefore, , which is the standard behavior in market equilibrium. For limited variation ranges of , the constant elasticity behavior given by Equation (3) is perfectly appropriate. However, for extended parameter ranges, it becomes imperative to generalize Equation (3) and allow elasticity to become state-dependent; this is developed in Section 3. In Section 4, economic variable interpretations—i.e., price elasticity of demand (PED) and income elasticity of demand (YED) —is exposed. Several illustrations are provided in Section 5. Concluding remarks are given in Section 6.

3. Non-Constant Elasticity—General Framework

Here, let us free ourselves from the sole market interpretation of the variables and develop a purely algebraic description directly inspired from the VDW thermostatic theory. Accordingly, we focus on state equations of the following types:

where stands for one (or possibly a set) of exogenous control parameter(s). The extra nonlinear contributions and are introduced to model non-constant elasticity responses.

Taking inspiration from the VDW generalization of the ideal gas equation, namely,

let us explore the modeling relevance offered by the class of state equations

where , , and .

With the specific choice in Equation (6), Equation (4) reads

Equations (6) and (7) follow straightforwardly from Equation (5) with the identifications , , and . In particular, in Equation (7), the parameter a quantifies the degree of inelasticity. For the iso- line to remain in the positive quadrant, we further impose ; the explicit derivation of this lower bound is postponed to the proof of Lemma 1 below. Due to the symmetric roles played by X and Y, we limit the analytical discussion to case (i) (the dual case (ii) follows identically from a substitution). Let us now introduce the rescaling defined as

Standard algebra shows that when plugging Equation (8) into Equation (7), we obtain a form that is independent of any parameters:

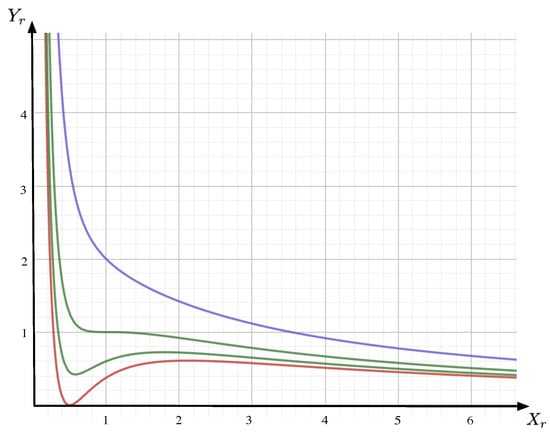

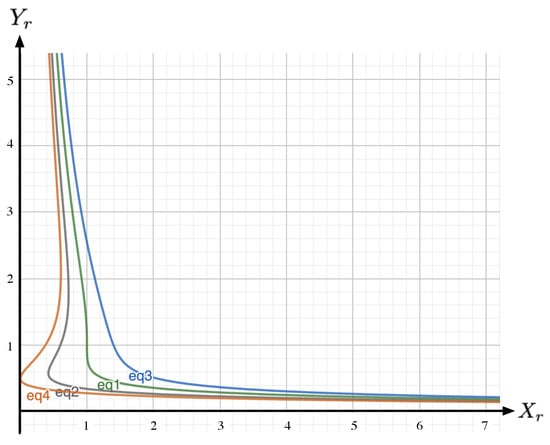

A selection of the iso- lines obtained from Equation (9) are drawn in Figure 1. Like for the VDW equation, the following features can be highlighted.

Figure 1.

Sketch of iso- lines (ordinate) as a function of (abscissa), as given by Equation (9). Here, the iso- lines are sketched for (red), (green, below), (green, above, in this case the iso- line exhibits a triple point at ), and (blue).

Lemma 1.

Equation (9) possesses the following properties:

- (i)

- On the iso- line with , the position defines an equilibrium triple point characterized by .

- (ii)

- For , all iso- lines remain in the positive quadrant.

Proof of Lemma 1.

(i) is immediately verified by direct calculation. For (ii), one verifies that for , we have

which shows that at , the iso- line reaches its minimum and . For all , the minimum of the corresponding iso- line is positive, implying the iso- line to remain in the positive quadrant. This in turn implies that , as already expressed in Equation (7).

□

Proposition 1.

( and elasticities). For the state equilibrium given by Equation (9), and with the notation , we have the following:

- (i)

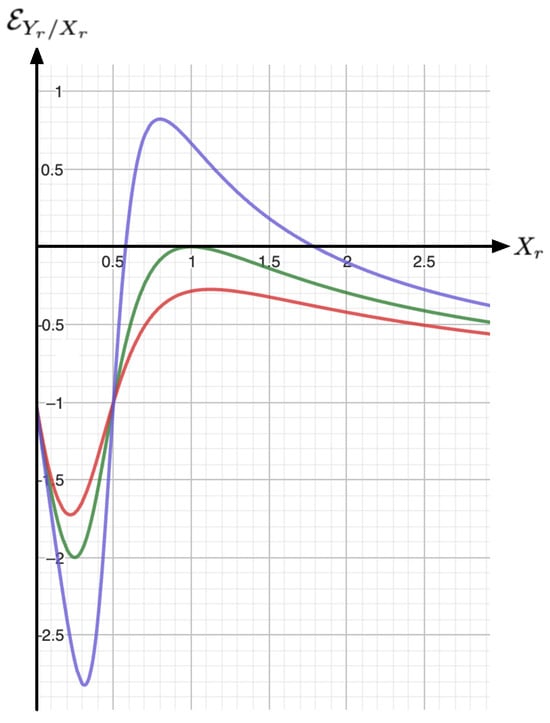

- On iso- lines, the corresponding elasticity reads (a selection of the elasticities obtained from Equation (10) are drawn in Figure 2):

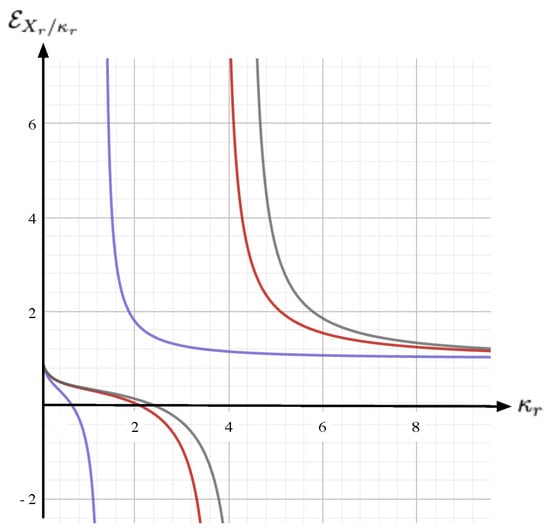

Figure 2. Sketch of the elasticity according to Equation (10) for (red), (green) and (orange). For , we systematically have . According to Lemma A1 (see Appendix A), we have and for .

Figure 2. Sketch of the elasticity according to Equation (10) for (red), (green) and (orange). For , we systematically have . According to Lemma A1 (see Appendix A), we have and for . - (ii)

- On iso- lines, the corresponding elasticity reads

Proof of Proposition 1.

(i) Fix an iso- line and take the logarithm of both sides of Equation (9). Then, perform the corresponding variations; we have

and, with the notation , the assertion follows.

- (ii) Fix an iso- line and take the logarithm of both sides of Equation (9). Then, perform the corresponding variations; we have

and the assertion follows.

□

Proposition 2.

(Cusp catastrophe singularity). (i) Under the change of variables:

Equation (9) reduces to the cubic relation:

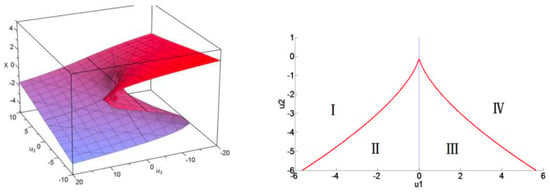

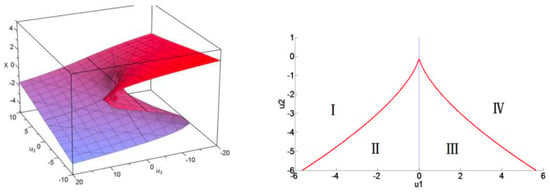

(ii) For , the cubic equation of Equation (13) admits one, respectively three, real solutions. The limiting case describes a cusp catastrophe singularity, as sketched in Figure 3.

Figure 3.

On the left panel [7], the position corresponds to a triple point singularity. On the right panel, the red line is determined by . This shows the projection of the sheet fold on the plane and corresponds to a cusp catastrophe. For example, the couple of points and lies on the red curve. In the region , we have ; here, the relation of Equation (9) is one-to-one, yielding . For , the relation is surjective in regions II and III, where and . In regions I and IV, we have and .

Proof of Proposition 2.

(i) is verified by direct calculation and (ii) is the direct consequence of the Cardan classical theory for cubic equations. □

An additional list of properties of Equation (9) can be found in Appendix A.

4. Price Elasticity of Demand (PED) and Income Elasticity of Demand (YED)

For a comprehensive description of the economic equilibrium state equation given by Equation (9), with being the demand (or the inverse demand) and being the price, it is mandatory to assign an ad-hoc meaning to (i.e., the temperature in the nominal VDW model). The yet missing variable in the economic modeling context is a budget (or income) variable; therefore, it is natural to assign to this complementary dimension. Summarizing, from Section 3, one concludes that the state equilibrium binding the price , the demand , and the budget are geometrically encapsulated within a sheet immersed within the 3D space (see Figure 3). According to Equation (13), this sheet possesses a fold singularity located at the triple point . From this description, a couple of elasticity factors can be naturally defined:

- (i)

- (ii)

- YED-elasticity. For iso-price lines (i.e., fixed price ), the YED-elasticity is the income elasticity of demand; it is given by Equation (11). As shown in Figure 4, the YED factor enables to distinguish between the normal goods, for which , and the inferior goods, which correspond to situations where .

Figure 4. The YED (ordinate) as a function of (abscissa), according to Equation (11), for (gray), (red), and (blue). For large price , we have , showing that at high price we systematically have a normal good behavior, namely, ; for intermediate , there exists a -dependent range where , which is the signature of an inferior good behavior; for low , the normal behavior is recovered.

Figure 4. The YED (ordinate) as a function of (abscissa), according to Equation (11), for (gray), (red), and (blue). For large price , we have , showing that at high price we systematically have a normal good behavior, namely, ; for intermediate , there exists a -dependent range where , which is the signature of an inferior good behavior; for low , the normal behavior is recovered.

Substitution Phenomena and Maxwell-Type Plateau of Prices

Let us now focus on a usual economic state equilibrium where an increase in demand triggers an increase in prices. In this situation, the corresponding price elasticity of demand will be positive definite (a practical illustration for this is the German electricity market, which is further discussed in Section 5.3). To qualitatively recover the typical VDW behavior of Equation (9), let us interpret as the inverse demand (i.e., rather than the demand itself) while keeping to represent the price. With this inverse demand convention and since , the corresponding price elasticity of the inverse demand becomes systematically negative for , as sketched in Figure 1 (the state equilibrium description, in terms of the inverse demand rather than the demand itself, is actually adopted in applications as in [8]). For however, within a -dependent range of the inverse demand . Hence, this would describe a range of economic equilibriums in which increases in the demand generate increases in the price that do not reflect the actual reality. Inspired directly from the VDW liquid–gas phase transition, instead of following the z-shape iso-budget line, we describe the state equilibrium by constructing, for each iso-budget line with , a price plateau at a -constant level . In the VDW case, extra physical considerations fix the position of the plateau level by using the renowned Maxwell construction:

where denotes the intersection abscissa of the horizontal line with the iso-budget line , and and are the abscissa of extrema of the same iso-budget line. While the Maxwell construction given in Equation (14) also arises in economic contexts (see, for example, Figure 2 in [9], with related explanations), a more rigorous justification yet remains open in general. The important feature is the necessity to construct a plateau for iso-budget lines with . This plateau behavior in the economic context effectively models a substitution mechanism during which a nominal product (or service) is, due to a demand modification, progressively replaced by an available substitute. The actual position on the plateau itself informs on the relative proportion of the nominal product with respect to its substitute. This stands in full analogy with the VDW context where the plateau describes the liquid and gas mixture of phases.

5. Illustrations

Far from exhaustive, yet aimed at sparking imagination, we now present a few examples where the VDW equation of state provides insightful modeling perspectives in an economic context.

5.1. Transportation Context—Carpooling Substitution

In the context of transportation, specifically regarding a carpooling commuting policy, let us consider the variables as follows: represents the transportation price, signifies the inverse transportation demand, and denotes the per-capita budget. Given these definitions, we can describe the qualitative stylized behavior as follows:

- (a)

- Wealthy commuters are characterized by . We assume that these individuals consistently choose to travel alone in their private cars. In this case, an increase in transport demand (which is represented by a decrease in , the inverse transportation demand) leads to an equilibrium state through an increase in , the transportation price, as governed by Equation (9). In the context of the nominal VDW equation, this state of equilibrium can be analogized to a condition of high temperature.

- (b)

- For ordinary commuters, characterized by , the high cost of transportation is a significant burden. These individuals are, thus, more inclined to embrace a carpooling policy as a more economical but also environmentally friendly option. This shift towards carpooling helps stabilize both transportation prices and the ecological footprint, creating a scenario corresponding to the plateau phase in the VDW equation for real gases. Within the transportation context, a substitution is struck between individual commuting and carpooling. As the demand for transportation increases (indicated by a decrease in ), there is a corresponding rise in the proportion of commuters opting for carpooling. This dynamic is represented by a movement to the right on the plateau, where the transportation price remains constant despite the changing demand. This analogy extends to the nominal VDW model for real gases, where the position on the VDW plateau indicates the ratio of liquid to gas in a mixture. Similarly, in the transportation model, the position on the plateau reflects the balance between individual commuting and carpooling, illustrating how economic and environmental considerations can lead to a stable equilibrium in commuter behaviors.

- (c)

- When all opportunities for carpooling have been fully utilized and the demand for transportation continues to rise, the scenario leads to a sharp increase in transportation prices. This situation in the transportation context mirrors the behavior observed in the liquid phase of the VDW state equation for real gases. In the VDW model, once the gas is compressed to a point where it becomes liquid (which represents the end of the plateau phase), any further reduction in volume (or, analogously, any further increase in demand in the transportation context) results in a significant increase in pressure (or prices in the transportation scenario). This is because the liquid phase is much less compressible than the gas phase, just as the transportation system becomes much less flexible once carpooling capacities are maximized.

Extending the carpooling analogy to incorporate a multi-agent or microscopic perspective, like for the ideal gas concept, provides a nuanced view of individual decision-making in the context of commuting. In the VDW context, phase transitions between gas and liquid states are influenced by intermolecular attractive forces. Drawing a parallel to carpooling, ecological incentives to share rides can be viewed as analogous to these attractive forces, encouraging individuals to pool together in a single vehicle. Envisioning an “ideal gas” of commuters, where each commuter shares common socioeconomic characteristics, allows for an exploration of the individual decision to commute alone or to carpool. This decision-making process involves balancing personal wealth against ecological consciousness. In this analogy, , representing the average wealth or economic capacity of commuters, plays a role similar to temperature in the VDW context. At high values of (analogous to high temperatures), individualistic tendencies outweigh ecological considerations, leading to a preference for traveling alone. This scenario aligns with the gas phase in the VDW model, where high temperatures mitigate the effects of attractive forces, preventing the formation of a liquid phase or, in our analogy, a cohesive carpooling group (the VDW plateau). Conversely, for , mirroring lower temperatures in the VDW framework, the conditions become favorable for the emergence of a substitution plateau. This plateau represents a phase where individual and pooled commuting behaviors coexist and interchange. In this extended analogy, the parameter b reflects the limitation on how many commuters can realistically share a single vehicle, which corresponds to the volume exclusion principle in the VDW equation. The parameter a quantifies the strength of the ecological incentives or social pressures that encourage carpooling, analogous to the attractive forces between molecules in the VDW context.

5.2. Medical Context—Generic and Original Medication

Consider the scenario where two treatments, A (an original medication) and B (a generic version), are available for a specific disease. Both treatments contain the same active molecules, but they may have different excipients, with B being more cost-effective. Despite this, patients tend to prefer A due to its established reputation and the perceived added value of its excipients.

Here again, an analogy with the VDW state equation may help understand patient preferences and economic dynamics in healthcare. Let represent the cost to cure the illness and the inverse demand for treatment, which inversely correlates with the spread of the illness. The parameter measures the available healthcare budget. For high healthcare budgets (), patients predominantly choose the more expensive treatment A, analogous to the single gas phase in the VDW state equation where there is little to no compression of particles, representing the minimal economic pressure to switch to a more cost-effective option. As the budget constraint tightens (), a portion of the patient population shifts to the generic treatment B. This shift creates a substitution equilibrium, similar to the liquid–gas equilibrium in the VDW model, where there is a balance between the original and generic treatments. During this phase, the overall cost of treatment stabilizes, in line with the constant pressure observed on the VDW plateau during a phase transition. Once the entire patient population has switched to the generic option B (analogous to the complete transition to the liquid phase in the VDW model), any further increase in demand (conversely, a further decrease in the inverse demand ) necessitates finding new, potentially costly alternatives. This could involve developing new supply chains or treatments, leading to a sharp increase in . This phase mirrors the incompressibility of the liquid phase in the VDW equation, where further compression (or increased demand in our context) leads to a significant rise in pressure (or cost).

5.3. Electricity Demand—Actual Data Fitting

To explore the possibility of applying a state equation similar to Equation (9) (or equivalently Equation (7)) for data fitting purposes, we draw inspiration from study [8], which focuses on the electricity demand market.

In their study, the authors successfully employ a cubic polynomial equation to fit actual market data within a specified range. The price-and-demand equation they propose is as follows:

Here, Y represents the price and X represents the demand. The coefficients are determined through data fitting (see Figure 2 in [8]), effectively capturing the relationship between price and demand in the electricity market. Inspired by this approach, we can consider applying the VDW state equation, Equation (7), to a similar data fitting exercise. Considering the cubic polynomial applied in [8] and the nonlinear properties of the VDW equation, this method could provide a robust framework for modeling the intricate relationships between variables such as price and demand across different markets. The critical step involves meticulously gathering and examining data, followed by adjusting the equation’s coefficients to achieve the best fit. Ultimately, this process would lead to insightful interpretations of market dynamics.

Refer to Figure 2 in [8], particularly the shaded area. The inverse electricity demand at the center of this shaded area is approximately located at 30,000. At this point, the corresponding price is roughly . Therefore, the slope of the straight line (the slope of the blue curve in Figure 2 of [8]) is approximately given by

From Equation (16), we observe a very small slope. Within a VDW modeling framework, this strongly indicates that the iso-line described by Equation (16) is closely aligned with the critical VDW isotherm. Consequently, we can approximately equate the values and to those at the VDW critical point, facilitating direct model calibration. The corresponding VDW parameters a, b, and the variable can then be directly identified using Equation (8), namely (for clarity, note that we use the conversion ):

Based on the parameters obtained from Equation (17), it is straightforward to formulate a cubic equation model that replicates the identical triple point. The model is expressed as follows:

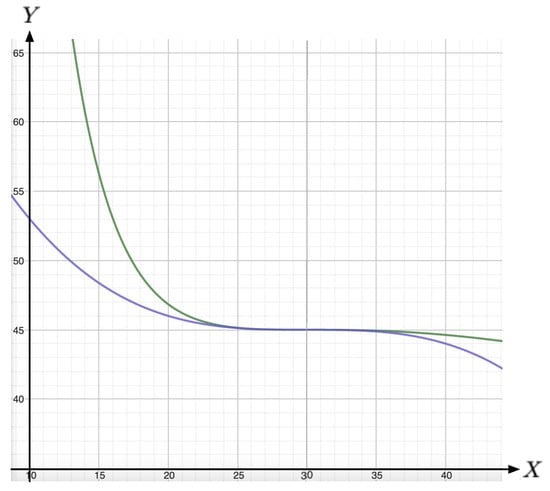

The couple of inverse demand curves and are drawn in Figure 5.

Figure 5.

Fitting of the cubic polynomial (blue) and VDW (green) curves at the quasi-plateau level . From Figure 2 in [8], one qualitatively estimates that we are close to a plateau (i.e., close to the VDW triple point). Assume that we are at the critical level with the triple point at demand level GWh, as observed in Figure 2 in [8]. We draw the corresponding price-and-demand state equations Equation (18) with price Y in [EUR/MWh] as ordinate and demand X in [GWh = 1000 MWh] as abscissa. There is virtually no usable distinctions between the two curves in the range considered in [8]. However, the VDW curve appears to be steeper away from the plateau, which matches the actual monitoring displayed (with black dots) in Figure 2 of [8].

Remark 1.

It is important to note that the cubic polynomial relation in Equation (18) has a limited range of applicability. This is because it predicts negative prices for large values of inverse demand X, which is not realistic. In contrast, the VDW model maintains positive prices for all values of X, making it a more robust framework for pricing. Additionally, the elasticity behavior in the VDW model remains coherent across the entire range of inverse demands X, unlike the cubic model, which further highlights the VDW model’s superior capacity for modeling.

5.4. Giffen and Veblen Behaviors—Luxury and Inferior Goods

Let us assume here that the input variable is the price, and with each price increase, the equilibrium imposes a drop in demand. Accordingly, the adapted modeling can be described by line (ii) of Equation (7), where is the price, denotes the demand, and stands for the income, namely the average available budget (here, and contrary to Section 4, the variable is the demand itself and not the inverse demand). From Equation (7), a few corresponding iso-budget lines for a selection of are derived in Figure 6.

Figure 6.

Iso-budget lines, as given by line (ii) of Equation (7) for (blue), (green), (gray), and (red, corresponding as before to the lower bound). The abscissa stands for the demand and the ordinates for the price . For , a Z-shape behavior emerges. This corresponds to the economically counter-intuitive response where a reduction in the price induces a reduction in the demand.

With line (ii) of Equation (7), the corresponding elasticity is given by Equation (10), with an exchange of the variables, and we have

We again observe a singularity at . For , the resulting elasticity is systematically negative, thus describing a standard behavior. For however, the iso-budget lines exhibit Z-shaped curves. As in Section 4, a (here, vertical) plateau can also be constructed. However, it is worth pointing out that, in this case, the Z-shape itself offers a natural modeling framework for the so-called Veblen and/or Giffen behaviors (see, among others, [10,11]). Veblen/Giffen effects are induced by the absence of economic substitution alternatives. Hence, the full Z-shape behavior is needed here instead of a VDW-type plateau. The Veblen effect is observed in luxury markets, where the prestige associated with luxury goods means that a decrease in price can lead to reduced demand, as the goods lose some of their prestige value. On the other hand, the Giffen effect pertains to certain inferior goods, such as staple foods like rice and bread. In this scenario, a price increase paradoxically boosts demand because, for consumers with limited budgets, the alternatives become prohibitively expensive. For example, a typical consumer might balance their daily food intake between bread and meat. With a reduced budget (i.e., ), they may no longer be able to afford meat, compelling them to consume more bread to meet their dietary needs.

6. Conclusions and Perspectives

The Van der Waals (VDW) state equilibrium equation, with its minimal reliance on exogenous parameters, offers a comprehensive and unifying framework for analyzing both substitution effects in economics and the peculiar phenomena of Giffen and Veblen behaviors. In general, the VDW model, with its capability to accommodate non-constant elasticity curves, emerges as a compelling and natural alternative to the commonly used cubic and exponential models for quantitative fitting. Furthermore, the VDW theory, characterized by its depiction of a cusp catastrophe singularity, is well-suited for capturing market equilibria, involving key variables such as price, demand, and budget. Drawing on approaches from physics, VDW modeling bridges micro- and macro-economic models and perspectives through the possibility of a mean-field description of multi-agent systems. In this context, the VDW intermolecular attractive forces manifest a propensity among agents to adopt common consensual behaviors, as seen for example in carpooling practices. With over 150 years of successes in thermostatics, the VDW state equation may now be poised for a new cross-disciplinary life—a potential that was already highlighted by the late François Roddier [1].

Author Contributions

Conceptualization, M.-O.H., O.G. and F.H.; Methodology, M.-O.H., O.G. and F.H.; Writing—original draft, M.-O.H., O.G. and F.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

Author Fariba Hashemi was employed by the company Salus Partners. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Appendix A

In this section, we describe additional analytical properties that follow from Equation (9).

Corollary A1.

(i) For , we have , and defines a one-to-one relation leading to .

- (ii)

- For , we have , and defines a surjective relation allowing within a region , where are the respective abscissae of the -extrema.

Proof of Corollary A1.

This corollary is an immediate consequence of Proposition 2. □

Lemma A1.

Miscellaneous properties of the elasticities and .

- (i)

- (ii)

- for all .

- (iii)

- (iv)

- .

- (v)

- elasticity at the triple point:

- (vi)

- for .

- (vii)

- for all .

References

- Roddier, F. L’équation de van der waals appliquée à l’économie. Res-Systematica 2017, 16, 2. [Google Scholar]

- Levine, I. Physical Chemistry; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Gumjudpai, B. Towards equation of state for a market: A thermodynamical paradigm of economics. J. Phys. Conf. Ser. Siam Phys. Congr. 2018, 1144, 012181. [Google Scholar] [CrossRef]

- Jammernegg, W.; Fischer, E.O. Economic applications and statistical analysis of the cusp catastrophe model. Z. Oper. Res. 1986, 30, B45–B58. [Google Scholar] [CrossRef]

- Rashkovskiy, S. Economic thermodynamics. Phys. A Stat. Mech. Its Appl. 2017, 582, 126261. [Google Scholar] [CrossRef]

- Saslow, W.M. An economic analogy to thermodynamics. Am. J. Phys. 1999, 67, 1239–1247. [Google Scholar] [CrossRef]

- Huang, Q.; Liu, Z.; Zhoua, Y.; Zhang, D.; Wang, F. Study on mechanisms of CO2 bleve based on the cusp-catastrophe model. Energy Procedia 2014, 61, 1343–1347. [Google Scholar] [CrossRef]

- Wan, Y.; Kober, T.; Densing, M. Nonlinear inverse demand curves in electricity market modeling. Energy Econ. 2022, 107, 105809. [Google Scholar] [CrossRef]

- Guimaraes, B.; Sheedy, K.D. Sales and monetary policy. Am. Econ. Rev. 2011, 101, 844–876. [Google Scholar] [CrossRef]

- Dougan, W.R. Giffen goods and the law of demand. J. Political Econ. 1982, 90, 809–815. [Google Scholar] [CrossRef]

- Philbois, G.; Block, W.E. The z curve: Supply and demand for giffen goods. MISES Interdiscip. J. Philos. Law Econ. 2018, 6, 503–508. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).