Environmental Performance, Financial Constraints, and Tax Avoidance Practices: Insights from FTSE All-Share Companies

Abstract

1. Introduction

2. Literature Review, Theory, and Hypothesis Development

2.1. The Cash Flow Theory

2.2. Environmental Performance and Tax Avoidance

2.3. The Moderating Role of Financial Constraints

3. Research Design and Methodology

3.1. Data and Sample Collection

3.2. Variable Measurement

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variables

3.3. Regression Model

4. Empirical Results

4.1. Descriptive Statistics

4.1.1. Sample Distribution by Industry and Year

4.1.2. Correlation Matrix

4.1.3. Summary Statistics and Variance Inflation Factor Test

4.2. Environmental Performance and Tax Avoidance (Hypothesis 1)

4.3. The Moderating Role of Financial Constraints on the Relationship Between Environmental Performance and Tax Avoidance (Hypothesis 2)

4.4. Endogeneity and Robustness Tests

4.4.1. Introduction to Entropy Considerations

4.4.2. Entropy Balancing and Propensity Score Matching

4.4.3. Heckman Model

4.4.4. Instrumental Variable Approach

4.4.5. An Alternative Measure of Tax Avoidance

4.4.6. An Alternative Measure of Environmental Performance

5. Discussion and Conclusions

Some Limitations and Suggestions for Future Research

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Description | Source | |

|---|---|---|

| Dependent Variable: TBTD | Total book-tax difference—a proxy to represent tax avoidance | Refinitiv Eikon |

| Independent Variable: | ||

| EPILLAR | Environmental performance—measured as the environmental performance pillar score | Refinitiv Eikon |

| Control Variables: | ||

| ROA | Return on assets—measured as income after taxes for the fiscal period divided by the average total assets | Refinitiv Eikon |

| SIZE | Firm size—measured by the natural logarithm of total assets | Refinitiv Eikon |

| FCF | Free cash flow—measured by cash flow from operations divided by total sales | Refinitiv Eikon |

| LEV | Leverage—measured by total debt divided by total assets | Refinitiv Eikon |

| MTB | Market-to-book ratio—measured by company market capitalisation divided by book value capitalisation | Refinitiv Eikon |

| AIN | Asset/income ratio—measured by total assets divided by net income before taxes | Refinitiv Eikon |

| SG | Sales growth—measured as the sales from year t minus the sales from t − 1 divided by the sales from t – 1 | Refinitiv Eikon |

| LIQ | Liquidity—measured as current assets divided by current liabilities | Refinitiv Eikon |

| AGE | Firm age—measured by the natural logarithm of year t minus the date of incorporation plus 1 | Refinitiv Eikon |

| BIG4 | Big 4—a dummy variable to denote whether the auditor is affiliated with one of the BIG 4 auditor firms (1) or not (0) | Refinitiv Eikon |

| BODSIZE | Board size—measured by the natural logarithm of the number of board members | Refinitiv Eikon |

| BODIND | Board independence—measured by the proportion of independent directors on the board | Refinitiv Eikon |

| FFIN | Financial Opacity—A measure of firm-level financial transparency is determined by industry and year adjusted total scaled accruals, based on previous research by Bhattacharya et al. [71]. | Refinitiv Eikon |

| The main variable for this model is a scaled accrual, which is an absolute value calculated using the formula (ΔCA + ΔCL + ΔCASH − ΔSTD + DEP + ΔTP)/lag(TA), where ΔCA represents the change in total current assets, ΔCL represents the change in total current liabilities, ΔCASH represents the change in cash, ΔSTD represents the change in the current portion of long-term debt included in total current liabilities, DEP represents depreciation and amortisation expense, ΔTP represents the change in income taxes payable, and lag(TA) represents total assets at the end of the previous year. FFIN takes the value of 1 if a firm has a higher than industry year mean of ACCRUAL, and 0 otherwise. |

References

- House of Lords, 1st Report of Session 2013–14-Microsoft Word—Corporate Taxation Report Final Layout.doc. Available online: https://www.parliament.uk/globalassets/documents/lords-information-office/2015/hl-annual-report-2013-14.pdf (accessed on 24 December 2024).

- Garner, B.A.; Black, H.C. Black’s Law Dictionary, 9th ed.; West: St. Paul, MN, USA, 2009. [Google Scholar]

- Souguir, Z.; Lassoued, N.; Khanchel, I.; Bouzgarrou, H. Environmental performance and corporate tax avoidance: Green-washing policy or eco-responsibility? The moderating role of ownership structure. J. Clean. Prod. 2024, 434, 140152. [Google Scholar] [CrossRef]

- Rego, S.O. Tax-avoidance activities of U.S. multinational corporations. Contemp. Account. Res. 2003, 20, 805–833. [Google Scholar] [CrossRef]

- Dyreng, S.D.; Hanlon, M.; Maydew, E.L. Long-run corporate tax avoidance. Account. Rev. 2008, 83, 61–82. [Google Scholar] [CrossRef]

- Ying, T.; Wright, B.; Huang, W. Ownership structure and tax aggressiveness of Chinese listed companies. Int. J. Account. Inf. Manag. 2017, 25, 313–332. [Google Scholar] [CrossRef]

- Crocker, K.J.; Slemrod, J. Corporate tax evasion with agency costs. J. Public Econ. 2005, 89, 1593–1610. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Blouin, J.L.; Jagolinzer, A.D.; Larcker, D.F. Corporate governance incentives, and tax avoidance. J. Account. Econ. 2015, 60, 1–17. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Pinnuck, M.; Richardson, G.D. The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. Eur. Account. Rev. 2015, 24, 551–580. [Google Scholar] [CrossRef]

- Feng, C.; Zhu, X.; Gu, Y.; Liu, Y. Does the carbon emissions trading policy increase corporate tax avoidance? Evidence from China. Front. Energy Res. 2022, 9, 821219. [Google Scholar] [CrossRef]

- Khanchel, I.; Lassoued, N.; Bargaoui, I. Pollution Control Bonds and Environmental Performance in Energy Utility Firms: Is There an Incantation Effect? Int. J. Energy Sect. Manag. 2024, 18, 1066–1087. [Google Scholar] [CrossRef]

- Desai, M.A.; Dharmapala, D. Corporate tax avoidance and firm value. Rev. Econ. Stat. 2009, 91, 537–546. [Google Scholar] [CrossRef]

- Wang, F.; Xu, S.; Sun, J.; Cullinan, C.P. Corporate tax avoidance: A literature review and research agenda. J. Econ. Surv. 2020, 34, 793–811. [Google Scholar] [CrossRef]

- Aguilera, R.V.; Rupp, D.E.; Williams, C.A.; Ganapathi, J. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manag. Rev. 2007, 32, 836–863. [Google Scholar] [CrossRef]

- Ntim, C.G.; Soobaroyen, T. Corporate governance and performance in socially responsible corporations: New empirical insights from a neo-institutional framework. Corp. Gov. Int. Rev. 2013, 21, 468–494. [Google Scholar] [CrossRef]

- Klassen, R.D.; Whybark, D.C. The impact of environmental technologies manufacturing performance. Acad. Manag. J. 1999, 42, 599–615. [Google Scholar] [CrossRef]

- Sarkis, J.; Cordeiro, J.J. An empirical evaluation of environmental efficiencies and firm performance: Pollution prevention versus end-of-pipe practice. Eur. J. Oper. Res. 2001, 135, 102–113. [Google Scholar] [CrossRef]

- Beck, T.; Lin, C.; Ma, Y. Why do firms evade taxes? The role of information sharing and financial sector outreach. J. Financ. 2014, 69, 763–817. [Google Scholar] [CrossRef]

- Dyreng, S.; Hanlon, M.; Maydew, E.L. The effects of executives on corporate tax avoidance. Account. Rev. 2010, 85, 1163–1189. [Google Scholar] [CrossRef]

- Na, K.; Yan, W. Languages and corporate tax avoidance. Rev. Account. Stud. 2022, 27, 148–184. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G. Is corporate social responsibility performance associated with tax avoidance? J. Bus. Ethics 2015, 127, 439–457. [Google Scholar] [CrossRef]

- Ilinitch, A.Y.; Soderstrom, N.S.; Thomas, T.E. Measuring Corporate Environmental Performance. J. Account. Public Policy 1998, 17, 383–408. [Google Scholar] [CrossRef]

- Hassel, L.; Nilsson, H.; Nyquist, S. The value relevance of environmental performance. Eur. Account. Rev. 2005, 14, 41–61. [Google Scholar] [CrossRef]

- Law, K.K.; Mills, L.F. Taxes and financial constraints: Evidence from linguistic cues. J. Account. Res. 2015, 53, 777–819. [Google Scholar] [CrossRef]

- Haque, T.; Pham, T.P.; Yang, J. Geopolitical risk, financial constraints, and tax avoidance. J. Int. Financ. Mark. Inst. Money 2023, 88, 101858. [Google Scholar] [CrossRef]

- Alm, J.; Liu, Y.; Zhang, K. Financial constraints and firm tax evasion. Int. Tax Public Financ. 2019, 26, 71–102. [Google Scholar] [CrossRef]

- Mkadmi, J.E.; Ben Ali, W. How does tax avoidance affect corporate social responsibility and financial ratio in emerging economies? J. Econ. Criminol. 2024, 5, 100070. [Google Scholar] [CrossRef]

- Felicia, J.; Yusnaini. The Influence of ESG (Environmental, Social, and Governance) on the Performance of Tax Payments in Technology Companies Listed on the IDX for the Period of 2017–2021. Daengku J. Humanit. Soc. Sci. Innov. 2023, 3, 640–647. [Google Scholar] [CrossRef]

- Lanis, R.; Richardson, G. Corporate social responsibility and tax aggressiveness: An empirical analysis. J. Account. Public Policy 2012, 31, 86–108. [Google Scholar] [CrossRef]

- Davies, A.K.; Guenther, D.A.; Krull, L.K.; Williams, B.M. Do Socially Responsible Firms Pay More Taxes? Account. Rev. 2016, 91, 47–68. [Google Scholar] [CrossRef]

- Gulzar, M.A.; Cherian, J.; Sial, M.S.; Bedulescu, A.; Thu, P.A.; Badulescu, D.; Khuong, N.V. Does corporate social responsibility influence corporate tax avoidance of Chinese listed companies? Sustainability 2018, 10, 4549. [Google Scholar] [CrossRef]

- Jiang, H.; Hu, W.; Jiang, P. Does ESG performance affect corporate tax avoidance? Evidence from China. Financ. Res. Lett. 2024, 61, 105056. [Google Scholar] [CrossRef]

- Laguir, I.; Staglianò, R.; Elbaz, J. Does corporate social responsibility affect corporate tax aggressiveness? J. Clean. Prod. 2015, 107, 662–675. [Google Scholar] [CrossRef]

- Abid, S.; Dammak, S. Corporate social responsibility and tax avoidance: The case of French companies. J. Financ. Rep. Account. 2022, 20, 618–638. [Google Scholar] [CrossRef]

- Edwards, A.; Schwab, C.; Shevlin, T. Financial Constraints and Cash Tax Savings. Account. Rev. 2016, 91, 859–881. [Google Scholar] [CrossRef]

- Penman, S. Financial Statement Analysis and Security Valuation, 5th ed.; McGraw-Hill Higher Education: New York, NY, USA, 2012. [Google Scholar]

- Sun, J.; Makosa, L.; Yang, J.; Yin, F.; Sitsha, L. Does corporate tax planning mitigate financial constraints? Evidence from China. Int. J. Financ. Econ. 2021, 26, 4874–4894. [Google Scholar] [CrossRef]

- Leong, C.K.; Yang, Y.C. Constraints on “doing good”: Financial constraints and corporate social responsibility. Financ. Res. Lett. 2021, 40, 101694. [Google Scholar] [CrossRef]

- Kabir, M.N.; Miah, M.D.; Rahman, S.; Alam, M.S.; Sarker, T. Financial Constraints and Environmental Innovations: Evidence from Global Data. 2024. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4848562 (accessed on 22 December 2024).

- Ma, Z.; Liang, D.; Yu, K.H.; Lee, Y. Most cited business ethics publications: Mapping the intellectual structure of business ethics studies in 2001–2008. Bus. Ethics 2012, 21, 286–297. [Google Scholar] [CrossRef]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Baden, D. A reconstruction of Carroll’s pyramid of corporate social responsibility for the 21st century. Int. J. Corp. Soc. Responsib. 2016, 1, 1–15. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organisational stakeholders. Bus. Horiz. 1991, 34, 39–48. Available online: https://link.gale.com/apps/doc/A11000639/AONE?u=anon~cf135a41&sid=googleScholar&xid=4b0a43c4 (accessed on 24 December 2024). [CrossRef]

- Rehman, I.U.; Shahzad, F.; Hanif, M.A.; Arshad, A.; Sergi, B.S. Financial constraints and carbon emissions: An empirical investigation. Soc. Responsib. J. 2024, 20, 761–782. [Google Scholar] [CrossRef]

- Huseynov, F.; Klamm, B.K. Tax avoidance, tax management and corporate social responsibility. J. Corp. Financ. 2012, 18, 804–827. [Google Scholar] [CrossRef]

- Jones, S.; Baker, M.; Ben, F.L. The relationship between CSR and tax avoidance: An international perspective. Aust. Tax Forum 2017, 32, 95–127. [Google Scholar]

- Kiesewetter, D.; Manthey, J. Tax avoidance, value creation and CSR—A European perspective. Corp. Gov. 2017, 17, 803–821. [Google Scholar] [CrossRef]

- Alsaadi, A. Financial-tax reporting conformity, tax avoidance and corporate social responsibility. J. Financ. Report. Account. 2020, 18, 639–659. [Google Scholar] [CrossRef]

- Muller, A.; Kolk, A. Responsible Tax as Corporate Social Responsibility: The Case of Multinational Enterprises and Effective Tax in India. Bus. Soc. 2015, 54, 435–463. [Google Scholar] [CrossRef]

- Zeng, T. Relationship between corporate social responsibility and tax avoidance: International evidence. Soc. Responsib. J. 2019, 15, 244–257. [Google Scholar] [CrossRef]

- Salhi, B.; Riguen, R.; Kachouri, M.; Jarboui, A. The mediating role of corporate social responsibility on the relationship be-tween governance and tax avoidance: UK common law versus French civil law. Soc. Responsib. J. 2020, 16, 1149–1168. [Google Scholar] [CrossRef]

- Ortas, E.; Gallego-Álvarez, I. Bridging the gap between corporate social responsibility performance and tax aggressiveness: The moderating role of national culture. Account. Audit. Account. 2020, 33, 825–855. [Google Scholar] [CrossRef]

- Feng, Z.; Wang, Y.; Wang, W. Corporate carbon reduction and tax avoidance: International evidence. J. Contemp. Account. Econ. 2024, 20, 100416. [Google Scholar] [CrossRef]

- Faulkender, M.; Wang, R. Corporate Financial Policy and the Value of Cash. J. Financ. 2006, 61, 1957–1990. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M.; Weisbach, M.S. The Cash Flow Sensitivity of Cash. J. Financ. 2004, 59, 1777–1804. [Google Scholar] [CrossRef]

- Ferdous, L.T.; Rana, T.; Yeboah, R. Decoding the impact of firm-level ESG performance on financial disclosure quality. Bus. Strategy Environ. 2024, 34, 162–186. [Google Scholar] [CrossRef]

- Albitar, K.; Al-Shaer, H.; Liu, Y.S. Corporate commitment to climate change: The effect of eco-innovation and climate governance. Res. Policy 2023, 52, 104697. [Google Scholar] [CrossRef]

- Bayar, O.; Huseynov, F.; Sardarli, S. Corporate Governance, Tax Avoidance, and Financial Constraints. Financ. Manag. 2018, 47, 651–677. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Alharbi, S.S.; Atawnah, N.; Ali, M.J.; Eshraghi, A. Gambling culture and earnings management: A novel perspective. Int. Rev. Econ. Financ. 2023, 86, 520–539. [Google Scholar] [CrossRef]

- Li, B.; Liu, Z.; Wang, R. When dedicated investors are distracted: The effect of institutional monitoring on corporate tax avoidance. J. Account. Public Policy 2021, 40, 106873. [Google Scholar] [CrossRef]

- Chung, S.G.; Goh, B.W.; Lee, J.; Shevlin, T. Corporate Tax Aggressiveness and Insider Trading. Contemp. Account. Res. 2019, 36, 230–258. [Google Scholar] [CrossRef]

- Amin, M.R.; Akindayomi, A.; Sarker, M.S.R.; Bhuyan, R. Climate policy uncertainty and corporate tax avoidance. Financ. Res. Lett. 2023, 58, 104581. [Google Scholar] [CrossRef]

- Delgado, F.J.; Fernández-Rodríguez, E.; García-Fernández, R.; Landajo, M.; Martínez-Arias, A. Tax avoidance and earnings management: A neural network approach for the largest European economies. Financ. Innov. 2023, 9, 19–25. [Google Scholar] [CrossRef]

- D’Amico, E.; Coluccia, D.; Fontana, S.; Solimene, S. Factors Influencing Corporate Environmental Disclosure. Bus. Strategy Environ. 2016, 25, 178–192. [Google Scholar] [CrossRef]

- Lucut Capras, I.; Achim, M.V.; Mara, E.R. Is tax avoidance one of the purposes of financial data manipulation? The case of Romania. J. Risk Financ. 2024, 25, 588–601. [Google Scholar] [CrossRef]

- Abdou, H.A.; Ellelly, N.N.; Elamer, A.A.; Hussainey, K.; Yazdifar, H. Corporate governance and earnings management nexus: Evidence from the UK and Egypt using neural networks. Int. J. Financ. Econ. 2021, 26, 6281–6311. [Google Scholar] [CrossRef]

- Thanasas, G.; Filiou, A.; Smaraidos, V. The impact of corporate governance on earnings management in emerging economies: The Greek evidence. Int. J. Comp. Manag. 2018, 1, 317. [Google Scholar] [CrossRef]

- Velte, P. Sustainable institutional investors, corporate sustainability performance, and corporate tax avoidance: Empirical evidence for the European capital market. Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2406–2418. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Bhattacharya, U.; Daouk, H.; Welker, M. The World Price of Earnings Opacity. Account. Rev. 2003, 78, 641–678. [Google Scholar] [CrossRef]

- DeFond, M.L.; Hung, M. An empirical analysis of analysts’ cash flow forecasts. J. Account. Econ. 2003, 35, 73–100. [Google Scholar] [CrossRef]

- Leuz, C.; Nanda, D.; Wysocki, P.D. Earnings management and investor protection: An international comparison. J. Financ. Econ. 2003, 69, 505–527. [Google Scholar] [CrossRef]

- Elamer, A.A.; Boulhaga, M.; Ibrahim, B.A. Corporate tax avoidance and firm value: The moderating role of environmental, social, and governance (ESG) ratings. Bus. Strategy Environ. 2024, 33, 7446–7461. [Google Scholar] [CrossRef]

- Hanlon, M.; Heitzman, S. A review of tax research. J. Account. Econ. 2010, 50, 127–178. [Google Scholar] [CrossRef]

- Schauer, C.; Elsas, R.; Breitkopf, N. A new measure of financial constraints applicable to private and public firms. J. Bank. Financ. 2019, 101, 270–295. [Google Scholar] [CrossRef]

- Lee, C.; Wang, C. Firms’ cash reserve, financial constraint, and geopolitical risk. Pac. Basin Financ. J. 2021, 65, 101480. [Google Scholar] [CrossRef]

- Baker, M.; Stein, J.C.; Wurgler, J. When Does the Market Matter? Stock Prices and the Investment of Equity-Dependent Firms. Q. J. Econ. 2003, 118, 969–1005. [Google Scholar] [CrossRef]

- Hasan, I.; Hoi, C.K.S.; Wu, Q.; Zhang, H. Beauty is in the eye of the beholder: The effect of corporate tax avoidance on the cost of bank loans. J. Financ. Econ. 2014, 113, 109–130. [Google Scholar] [CrossRef]

- Panousi, V.; Papanikolaou, D. Investment, Idiosyncratic Risk, and Ownership. J. Financ. 2012, 67, 1113–1148. [Google Scholar] [CrossRef]

- Li, D. Financial Constraints, R&D Investment, and Stock Returns. Rev. Financ. Stud. 2011, 24, 2974–3007. [Google Scholar] [CrossRef]

- Duchin, R. Cash Holdings and Corporate Diversification. J. Financ. 2010, 65, 955–992. [Google Scholar] [CrossRef]

- Kaplan, S.N.; Zingales, L. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar] [CrossRef]

- Lamont, O.; Polk, C.; Saá-Requejo, J. Financial Constraints and Stock Returns. Rev. Financ. Stud. 2001, 14, 529–554. [Google Scholar] [CrossRef]

- Hainmueller, J. Entropy Balancing for Causal Effects: A Multivariate Reweighting Method to Produce Balanced Samples in Observational Studies. Political Anal. 2012, 20, 25–46. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 623–656. [Google Scholar] [CrossRef]

- Chen, C.; Huang, T.; Garg, M.; Khedmati, M. Governments as customers: Exploring the effects of government customers on supplier firms’ information quality. J. Bus. Financ. Account. 2021, 48, 1630–1667. [Google Scholar] [CrossRef]

- Khan, M.; Srinivasan, S.; Tan, L. Institutional Ownership and Corporate Tax Avoidance: New Evidence. Account. Rev. 2017, 92, 101–122. [Google Scholar] [CrossRef]

- Chyz, J.A.; Ching Leung, W.S.; Zhen Li, O.; Meng Rui, O. Labor unions and tax aggressiveness. J. Financ. Econ. 2013, 108, 675–698. [Google Scholar] [CrossRef]

- HM Revenue & Customs. Climate Change Levy. Available online: https://www.gov.uk/green-taxes-and-reliefs/climate-change-levy (accessed on 24 December 2024).

- Bigerna, S.; D’Errico, M.C.; Micheli, S.; Polinori, P. Environmental-economic efficiency for carbon neutrality: The role of eco-innovation, taxation, and globalization in OECD countries. Appl. Econ. 2024, 56, 3568–3581. [Google Scholar] [CrossRef]

- Gao, X.; Fan, M. Environmental taxes, eco-innovation, and environmental sustainability in EU member countries. Environ. Sci. Pollut. Res. 2023, 30, 101637–101652. [Google Scholar] [CrossRef]

- Bădîrcea, R.M.; Florea, N.M.; Manta, A.G.; Puiu, S.; Doran, M.D. Comparison between Romania and Sweden Based on Three Dimensions: Environmental Performance, Green Taxation and Economic Growth. Sustainability 2020, 12, 3817. [Google Scholar] [CrossRef]

- Bassetti, T.; Blasi, S.; Sedita, S.R. The management of sustainable development: A longitudinal analysis of the effects of environmental performance on economic performance. Bus. Strategy Environ. 2021, 30, 21–37. [Google Scholar] [CrossRef]

- Arsawan, I.W.E.; Hariyanti, N.K.D.; Azizah, A.; Suryantini, N.P.S.; Darmayanti, N.P.A. Internet of things towards environmental performance: A scientometrics and future research avenues. E3S Web Conf. 2024, 501, 01011. [Google Scholar] [CrossRef]

- Wang, M.C.; Chen, Z. The relationship among environmental performance, R&D expenditure, and corporate performance: Using simultaneous equations model. Qual. Quant. 2022, 56, 2675–2689. [Google Scholar] [CrossRef]

- Cozma, A.-C.; Achim, M.C.; Mare, C.; Coros, M.M. The Moderating Role of Tourism in the Impact of Financial Crime on Deforestation. J. Clean. Prod. 2025, 486, 144475. [Google Scholar] [CrossRef]

| Criteria | Number of Firm-Years |

|---|---|

| Refinitiv Eikon | 1243 |

| Less: | |

| Utility Firms (SIC codes 6000-6999) | 44 |

| Financial Firms (SIC codes 4000-4999) | 186 |

| Others (SIC codes between 4000-4999 and 6000-6999) | 9 |

| Final sample | 1004 |

| A: | ||||

| l | Year | Freq. | Percent | Cum. |

| 1 | 2014 | 80 | 7.97 | 7.97 |

| 2 | 2015 | 96 | 9.56 | 17.53 |

| 3 | 2016 | 97 | 9.66 | 27.19 |

| 4 | 2017 | 102 | 10.16 | 37.35 |

| 5 | 2018 | 106 | 10.56 | 47.91 |

| 6 | 2019 | 116 | 11.55 | 59.46 |

| 7 | 2020 | 129 | 12.85 | 72.31 |

| 8 | 2021 | 137 | 13.65 | 85.96 |

| 9 | 2022 | 141 | 14.04 | 100.00 |

| Total | 1004 | 100.00 | ||

| B: | ||||

| k | Industry Sector | Freq. | Percent | Cum. |

| 1 | Consumer Nondurables | 78 | 7.77 | 7.77 |

| 2 | Consumer Durables | 7 | 0.70 | 8.47 |

| 3 | Manufacturing | 149 | 14.84 | 23.31 |

| 4 | Oil, Gas, and Coal Extraction and Products | 48 | 4.78 | 28.09 |

| 5 | Chemicals and Allied Products | 23 | 2.29 | 30.38 |

| 6 | Business Equipment | 104 | 10.36 | 40.74 |

| 7 | Telephone and Television Transmission | 16 | 1.59 | 42.33 |

| 8 | Whole sales, Retail, and Some Services | 234 | 23.31 | 65.64 |

| 9 | Healthcare, Medical Equipment, and Drugs | 34 | 3.39 | 69.02 |

| 10 | Other | 311 | 30.98 | 100.00 |

| Total | 1004 | 100.00 | ||

| m | Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TBTD | 1.000 | |||||||||||||||

| 1 | EPILLAR | 0.100 *** | 1.000 | |||||||||||||

| 2 | ROA | 0.174 *** | −0.115 *** | 1.000 | ||||||||||||

| 3 | SIZE | −0.046 | 0.596 *** | −0.148 *** | 1.000 | |||||||||||

| 4 | FCF | −0.076 ** | −0.310 *** | 0.287 *** | −0.387 *** | 1.000 | ||||||||||

| 5 | LEV | 0.008 | 0.183 *** | −0.222 *** | 0.139 *** | −0.265 *** | 1.000 | |||||||||

| 6 | MTB | −0.062 ** | −0.206 *** | 0.607 *** | −0.323 *** | 0.471 *** | −0.064 ** | 1.000 | ||||||||

| 7 | AIN | 0.096 *** | −0.122 *** | 0.035 | −0.200 *** | 0.107 *** | −0.052 * | 0.049 | 1.000 | |||||||

| 8 | SG | 0.047 | −0.023 | 0.152 *** | −0.080 ** | 0.082 *** | 0.004 | 0.047 | 0.051 * | 1.000 | ||||||

| 9 | LIQ | −0.018 | −0.159 *** | 0.171 *** | −0.280 *** | 0.190 *** | −0.227 *** | 0.145 *** | 0.012 | 0.114 *** | 1.000 | |||||

| 10 | AGE | 0.054 * | 0.043 | −0.044 | 0.142 *** | −0.155 *** | −0.222 *** | −0.220 *** | 0.022 | −0.097 *** | 0.024 | 1.000 | ||||

| 11 | BODSIZE | −0.039 | 0.495 *** | −0.158 *** | 0.587 *** | −0.281 *** | 0.218 *** | −0.145 *** | −0.195 *** | −0.035 | −0.106 *** | −0.048 | 1.000 | |||

| 12 | BODIND | −0.012 | 0.374 *** | −0.090 *** | 0.375 *** | −0.239 *** | 0.080 ** | −0.180 *** | −0.066 ** | −0.034 | −0.104 *** | 0.174 *** | 0.312 *** | 1.000 | ||

| 13 | BIG4 | −0.058 * | −0.038 | 0.079 ** | −0.060 * | −0.003 | −0.009 | 0.104*** | 0.042 | −0.005 | −0.045 | 0.114 *** | −0.058 * | −0.051 * | 1.000 | |

| 14 | FFIN | 0.005 | 0.008 | −0.016 | 0.009 | 0.048 | −0.039 | 0.005 | −0.005 | −0.015 | −0.064 ** | −0.058 * | 0.033 | −0.025 | 0.025 | 1.000 |

| A | |||||||

| m | Sum | Mean | StDev | Min | Median | Max | |

| TBTD | 1004 | −0.007 | 0.018 | −0.092 | −0.005 | 0.068 | |

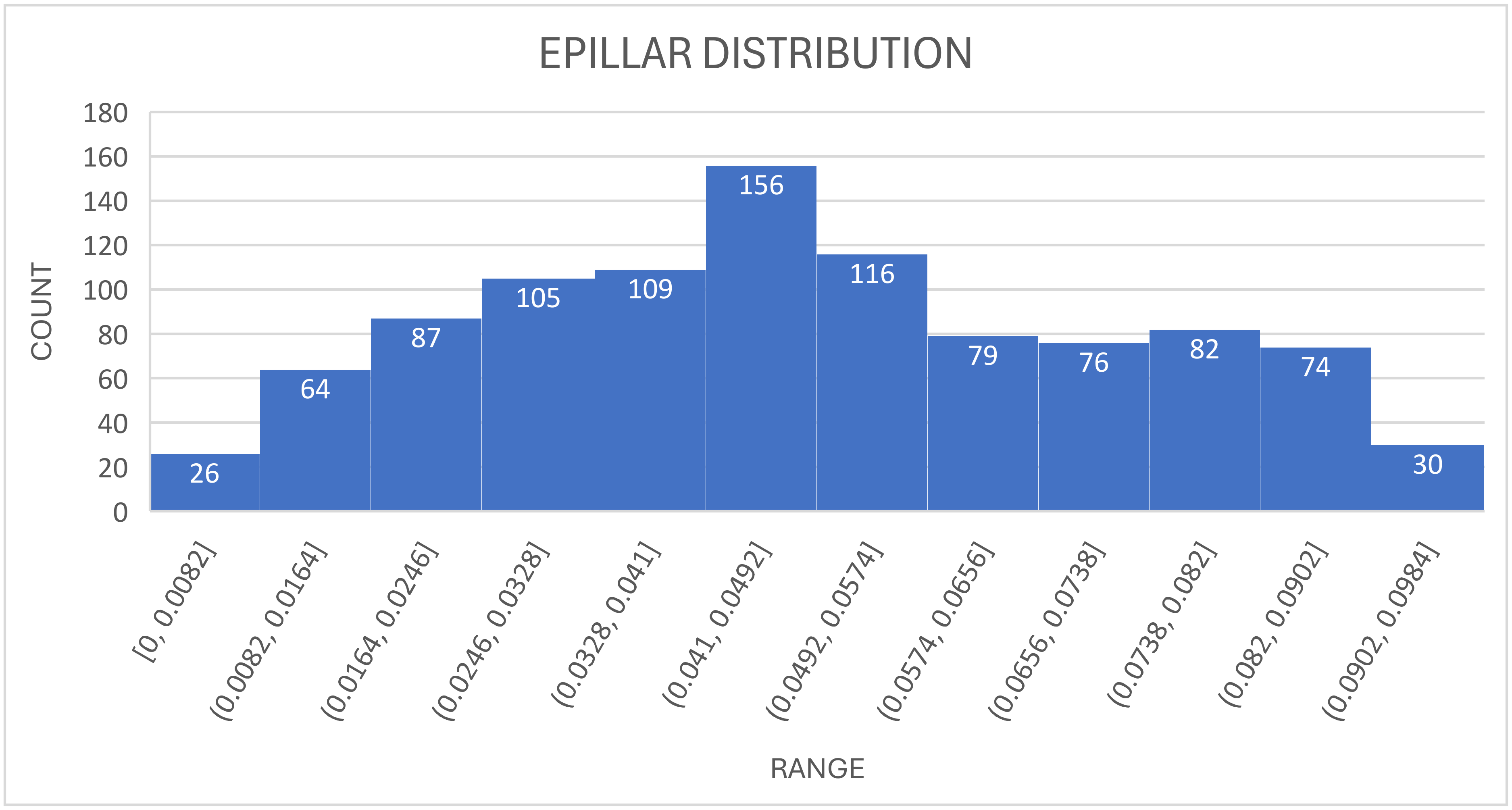

| 1 | EPILLAR | 1004 | 0.484 | 0.233 | 0.000 | 0.463 | 0.958 |

| 2 | ROA | 1004 | 0.065 | 0.101 | −0.248 | 0.054 | 0.448 |

| 3 | SIZE | 1004 | 21.242 | 1.642 | 16.835 | 20.990 | 25.512 |

| 4 | FCF | 1004 | 0.084 | 0.087 | 0.000 | 0.060 | 0.460 |

| 5 | LEV | 1004 | 0.214 | 0.158 | 0.000 | 0.210 | 0.770 |

| 6 | MTB | 1004 | 2.014 | 2.202 | 0.235 | 1.311 | 12.875 |

| 7 | AIN | 1004 | 0.150 | 0.636 | −2.727 | 0.062 | 4.391 |

| 8 | SG | 1004 | 0.093 | 0.272 | −0.552 | 0.060 | 1.874 |

| 9 | LIQ | 1004 | 1.571 | 1.088 | 0.242 | 1.320 | 8.112 |

| 10 | AGE | 1004 | 3.115 | 1.008 | 0.000 | 3.040 | 4.930 |

| 11 | BODSIZE | 1004 | 8.840 | 2.266 | 3.000 | 8.000 | 17.000 |

| 12 | BODIND | 1004 | 0.617 | 0.138 | 0.000 | 0.625 | 0.867 |

| 13 | BIG4 | 1004 | 0.649 | 0.477 | 0.000 | 1.000 | 1.000 |

| 14 | FFIN | 1004 | 0.700 | 0.458 | 0.000 | 1.000 | 1.000 |

| B | |||||||

| VIF | 1/VIF | ||||||

| SIZE | 2.310 | 0.434 | |||||

| MTB | 2.140 | 0.467 | |||||

| ROA | 1.790 | 0.559 | |||||

| BODSIZE | 1.760 | 0.568 | |||||

| EPILLAR | 1.710 | 0.584 | |||||

| FCF | 1.540 | 0.647 | |||||

| LEV | 1.290 | 0.774 | |||||

| BODIND | 1.260 | 0.791 | |||||

| AGE | 1.230 | 0.810 | |||||

| LIQ | 1.190 | 0.843 | |||||

| SG | 1.060 | 0.943 | |||||

| AIN | 1.060 | 0.943 | |||||

| BIG4 | 1.050 | 0.953 | |||||

| FFIN | 1.020 | 0.982 | |||||

| Mean VIF | 1.460 | ||||||

| m | Dependent Variable: TBTD | |||

|---|---|---|---|---|

| (2) | (3) | (4) | ||

| 1 | EPILLAR | 0.078 *** (3.192) | 0.160 *** (5.328) | 0.154 *** (4.958) |

| 2 | ROA | 0.067 *** (9.354) | 0.067 *** (3.901) | |

| 3 | SIZE | −0.003 *** (−5.147) | −0.002 *** (−3.514) | |

| 4 | FCF | −0.014 * (−1.851) | −0.014 (−0.844) | |

| 5 | LEV | 0.006 * (1.653) | 0.007 (0.931) | |

| 6 | MTB | −0.002 *** (−6.164) | −0.002 *** (−4.352) | |

| 7 | AIN | 0.002 *** (2.838) | 0.002 ** (2.975) | |

| 8 | SG | 0.000 (0.037) | 0.003 ** (2.514) | |

| 9 | LIQ | −0.001 * (−1.806) | −0.001 * (−1.965) | |

| 10 | AGE | 0.001 * (1.740) | 0.001 ** (2.299) | |

| 11 | BODSIZE | 0.000 (0.219) | −0.000 (−0.280) | |

| 12 | BODIND | −0.007 (−1.642) | −0.007 (−1.143) | |

| 13 | BIG4 | −0.003 *** (−2.673) | −0.003 (−1.792) | |

| 14 | FFIN | 0.001 (0.618) | 0.001 (0.876) | |

| Constant | −0.011 *** (−8.278) | 0.043 *** (4.360) | 0.027 ** (2.705) | |

| Number of Observations | 1004 | 1004 | 1004 | |

| Adjusted R-squared | 0.009 | 0.123 | 0.158 | |

| Year Fixed Effect | NO | NO | YES | |

| Industry Sector Fixed Effect | NO | NO | YES | |

| Cluster by Industry | NO | NO | YES | |

| Dependent Variable: TBTD | ||||||

|---|---|---|---|---|---|---|

| Financial Constraints: | High Sales | Low Sales | High WW Score | Low WW Score | High KZ | Low KZ |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| EPILLAR | 0.088 *** (3.937) | 0.219 *** (3.569) | 0.246 *** (3.469) | 0.074 ** (3.325) | 0.178 * (1.954) | 0.133 * (2.027) |

| Controls | YES | YES | YES | YES | YES | YES |

| Constant | 0.008 (0.364) | 0.078 ** (3.185) | 0.049 * (2.210) | 0.024 (0.988) | 0.029 (1.781) | 0.019 ** (2.927) |

| Number of Observations | 501 | 503 | 502 | 502 | 502 | 502 |

| Adjusted R-squared | 0.114 | 0.225 | 0.159 | 0.314 | 0.145 | 0.223 |

| Year Fixed Effect | YES | YES | YES | YES | YES | YES |

| Industry Sector Fixed Effect | YES | YES | YES | YES | YES | YES |

| Cluster by Industry | YES | YES | YES | YES | YES | YES |

| Permutation tests for coeff. | p-value < 0.000 | p-value < 0.000 | p-value = 0.300 | |||

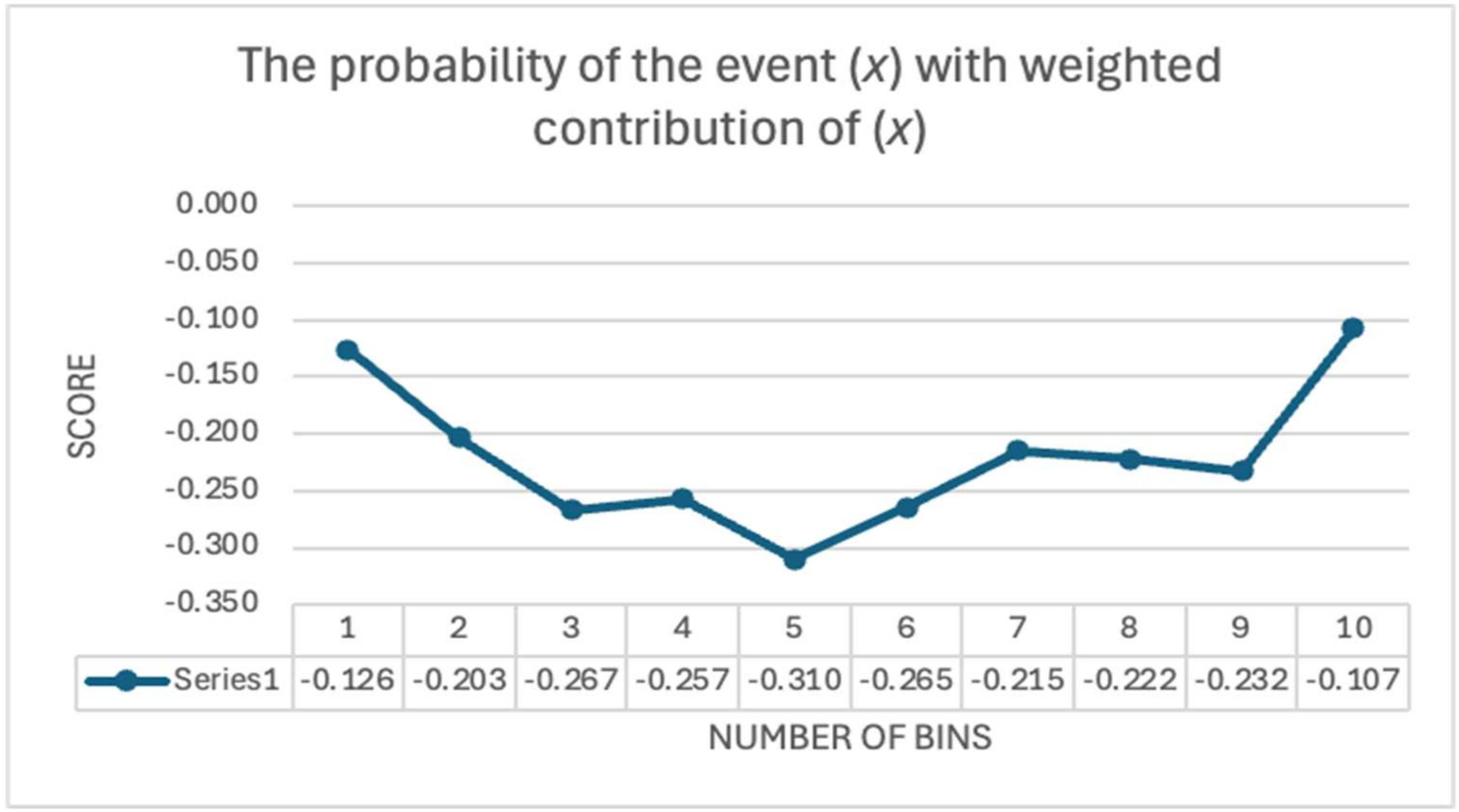

| A | ||||

| x | NEPILLAR | EntropyEPILLAR | ||

| 0 | ||||

| 1 | 39 | 0.038845 | −3.248186 | 0.126175 |

| 2 | 81 | 0.080677 | −2.517298 | 0.203089 |

| 3 | 132 | 0.131474 | −2.028945 | 0.266754 |

| 4 | 123 | 0.12251 | −2.099563 | 0.257217 |

| 5 | 183 | 0.182271 | −1.702261 | 0.310273 |

| 6 | 130 | 0.129482 | −2.044213 | 0.264689 |

| 7 | 89 | 0.088645 | −2.423111 | 0.214798 |

| 8 | 94 | 0.093625 | −2.368453 | 0.221748 |

| 9 | 102 | 0.101594 | −2.286774 | 0.232322 |

| 10 | 31 | 0.030876 | −3.47776 | 0.107381 |

| Sum | 2.204444 | |||

| B | ||||

| Variable | High Intensity | Low Intensity | High Intensity | Low Intensity |

| Before Balancing | After Balancing | |||

| ROA | 0.057 | 0.074 | 0.057 | 0.057 |

| SIZE | 21.940 | 20.540 | 21.940 | 21.940 |

| FCF | 0.066 | 0.103 | 0.066 | 0.066 |

| LEV | 0.238 | 0.191 | 0.238 | 0.238 |

| MTB | 1.665 | 2.362 | 1.665 | 1.665 |

| AIN | 0.091 | 0.209 | 0.091 | 0.091 |

| SG | 0.097 | 0.089 | 0.097 | 0.097 |

| LIQ | 1.478 | 1.664 | 1.478 | 1.478 |

| AGE | 3.162 | 3.069 | 3.162 | 3.162 |

| BODSIZE | 9.733 | 7.946 | 9.733 | 9.733 |

| BODIND | 0.656 | 0.579 | 0.656 | 0.656 |

| BIG4 | 0.618 | 0.681 | 0.618 | 0.618 |

| FFIN | 0.703 | 0.697 | 0.703 | 0.703 |

| C | ||||

| Variable | High Intensity | Low Intensity | Difference in Mean | |

| (Treated) | (Control) | Diff | t-value | |

| ROA | 0.060 | 0.055 | −0.005 | −0.497 |

| SIZE | 21.028 | 21.009 | −0.019 | −0.154 |

| FCF | 0.088 | 0.082 | −0.006 | −0.811 |

| LEV | 0.226 | 0.227 | 0.001 | 0.092 |

| MTB | 1.931 | 1.961 | 0.030 | 0.164 |

| AIN | 0.138 | 0.125 | −0.014 | −0.232 |

| SG | 0.097 | 0.096 | −0.001 | −0.016 |

| LIQ | 1.623 | 1.622 | −0.001 | −0.015 |

| AGE | 3.214 | 3.166 | −0.048 | −0.524 |

| BODSIZE | 8.700 | 8.708 | 0.008 | 0.046 |

| BODIND | 0.616 | 0.612 | −0.004 | −0.337 |

| BIG4 | 0.648 | 0.657 | 0.009 | 0.194 |

| FFIN | 0.700 | 0.670 | −0.030 | −0.697 |

| D | ||||

| VARIABLES | Entropy Balancing | PSM | ||

| EPILLAR | 0.175 *** (4.608) | 0.127 ** (2.685) | ||

| Controls | YES | YES | ||

| Constant | 0.027 * (2.126) | 0.013 (0.637) | ||

| Observations | 1004 | 392 | ||

| Adjusted R-squared | 0.165 | 0.170 | ||

| Year Fixed Effect | YES | YES | ||

| Industry Sector Fixed Effect | YES | YES | ||

| Cluster by Industry | YES | YES | ||

| Dependent Variable: TBTD | ||

|---|---|---|

| First Stage | Second Stage | |

| IND_AVG | 0.439 *** (4.592) | - |

| EPILLAR | - | 0.154 *** (4.892) |

| Controls | YES | YES |

| Constant | −10.795 *** (−6.840) | 0.025 (0.837) |

| Observations | 1004 | 1004 |

| Year Fixed Effect | YES | YES |

| Industry Sector Fixed Effect | YES | YES |

| Cluster by Industry | YES | YES |

| Adjusted R-squared | 0.261 | 0.157 |

| Dependent Variable: TBTD | ||

|---|---|---|

| First Stage | Second Stage | |

| IND_AVG | 0.007 *** (5.58) | - |

| EPILLAR | - | 0.513 * (1.820) |

| Controls | YES | YES |

| Observations | 1004 | 1004 |

| Year Fixed Effect | YES | YES |

| Industry Sector Fixed Effect | YES | YES |

| Cluster by Industry | YES | YES |

| Cragg-Donald Wald F statistics | 20.950 | 20.951 |

| 15% Maximal IV size | 8.960 | - |

| Kleibergen–Paap rk F statistics | 29.120 | 29.117 |

| Dependent Variable: | CURRENT_ETR | GAAP_ETR | TBTD |

|---|---|---|---|

| EPILLAR | −0.020 *** (−3.645) | −0.015 *** (−3.291) | 0.154 *** (4.958) |

| Controls | YES | YES | YES |

| Constant | −0.007 ** (−2.371) | −0.003 (−1.163) | 0.027 ** (2.705) |

| Observations | 1001 | 1004 | 1004 |

| Adjusted R-squared | 0.146 | 0.068 | 0.158 |

| Year Fixed Effect | YES | YES | YES |

| Industry Sector Fixed Effect | YES | YES | YES |

| Cluster by Industry Sectors | YES | YES | YES |

| Dependent Variable: TBTD | |||

|---|---|---|---|

| (4) | (9) | (10) | |

| EPILLAR | 0.154 *** (4.958) | - | - |

| ECO_INNOVATION | - | 0.079 ** (2.487) | - |

| RND_INTENS | 0.053 * (1.909) | ||

| Controls | YES | YES | YES |

| Constant | 0.027 ** (2.705) | 0.020 ** (2.595) | 0.008 (0.691) |

| Observations | 1004 | 1004 | 1004 |

| Adjusted R-squared | 0.158 | 0.150 | 0.142 |

| Year Fixed Effect | YES | YES | YES |

| Industry Sector Fixed Effect | YES | YES | YES |

| Cluster by Industry | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sastroredjo, P.E.; Ausloos, M.; Khrennikova, P. Environmental Performance, Financial Constraints, and Tax Avoidance Practices: Insights from FTSE All-Share Companies. Entropy 2025, 27, 89. https://doi.org/10.3390/e27010089

Sastroredjo PE, Ausloos M, Khrennikova P. Environmental Performance, Financial Constraints, and Tax Avoidance Practices: Insights from FTSE All-Share Companies. Entropy. 2025; 27(1):89. https://doi.org/10.3390/e27010089

Chicago/Turabian StyleSastroredjo, Probowo Erawan, Marcel Ausloos, and Polina Khrennikova. 2025. "Environmental Performance, Financial Constraints, and Tax Avoidance Practices: Insights from FTSE All-Share Companies" Entropy 27, no. 1: 89. https://doi.org/10.3390/e27010089

APA StyleSastroredjo, P. E., Ausloos, M., & Khrennikova, P. (2025). Environmental Performance, Financial Constraints, and Tax Avoidance Practices: Insights from FTSE All-Share Companies. Entropy, 27(1), 89. https://doi.org/10.3390/e27010089