Propagation of International Supply-Chain Disruptions between Firms in a Country

Abstract

:1. Introduction

2. Material and Method

2.1. Supply-Chain Data

2.2. World Input-Output Table

2.3. Model

2.4. Simulation Procedures

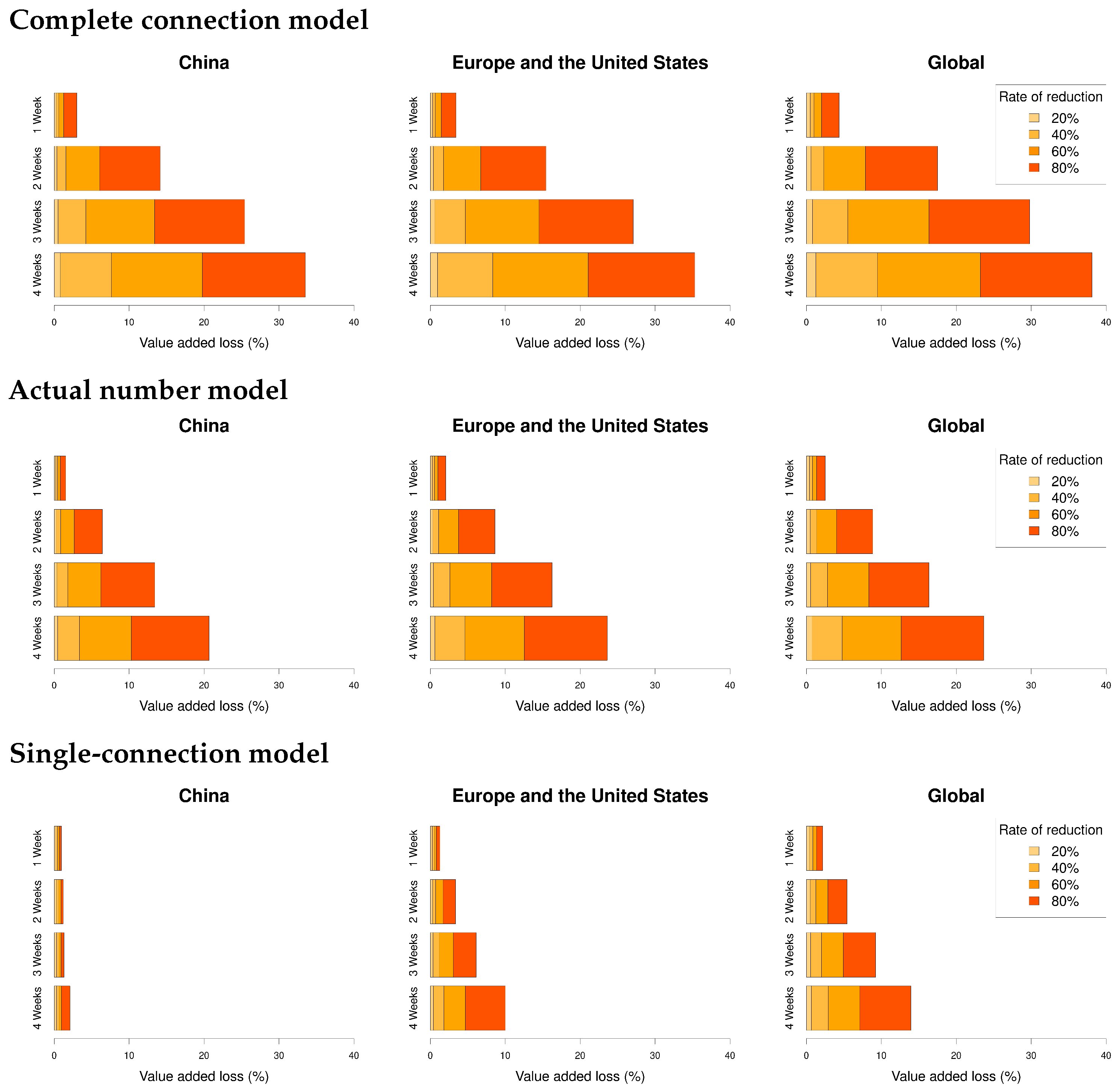

2.4.1. Complete Connection Model

2.4.2. Actual Number Model

2.4.3. Single-Connection Model

2.4.4. Scenarios

3. Results

4. Discussion and Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ayadi, Rym, Giorgia Giovannetti, Enrico Marvasi, Giulio Vannelli, and Chahir Zaki. 2021. Demand and Supply Exposure through Global Value Chains: Euro-Mediterranean Countries during COVID. The World Economy 113: 73–88. [Google Scholar]

- Baldwin, Richard, and Javier Lopez-Gonzalez. 2015. Supply-chain trade: A portrait of global patterns and several testable hypotheses. The World Economy 38: 1682–721. [Google Scholar] [CrossRef]

- Barabási, Albert-László. 2016. Network Science. Cambridge: Cambridge University Press. [Google Scholar]

- Battiston, Stefano, Domenico Delli Gatti, Mauro Gallegati, Bruce Greenwald, and Joseph E. Stiglitz. 2007. Credit chains and bankruptcy propagation in production networks. Journal of Economic Dynamics and Control 31: 2061–84. [Google Scholar] [CrossRef] [Green Version]

- Chongvilaivan, Aekapol. 2012. Thailand’s 2011 Flooding: Its Impact on Direct Exports and Global Supply Chains. Technical report, ARTNeT working paper series; Berlin: ARTNeT. [Google Scholar]

- Chowdhury, Priyabrata, Sanjoy Kumar Paul, Shahriar Kaisar, and Md. Abdul Moktadir. 2021. COVID-19 pandemic related supply chain studies: A systematic review. Transportation Research Part E: Logistics and Transportation Review 148: 102271. [Google Scholar] [CrossRef]

- Christopher, Martin. 2016. Logistics & Supply Chain Management. Upper Saddle River: Financial Times Press. [Google Scholar]

- Colon, Celian, Stephane Hallegatte, and Julie Rozenberg. 2019. Transportation and Supply Chain Resilience in the United Republic of Tanzania: Assessing the Supply-Chain Impacts of Disaster-Induced Transportation Disruptions. Washington, DC: World Bank. [Google Scholar]

- Coronavirus Resource Center. 2020. Coronavirus COVID-19 Global Cases by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University. Available online: http://coronavirus.jhu.edu/map.html (accessed on 21 April 2021).

- Dietzenbacher, Erik, Bart Los, Robert Stehrer, Marcel Timmer, and Gaaitzen de Vries. 2013. The construction of world input–output tables in the WIOD project. Economic Systems Research 25: 71–98. [Google Scholar] [CrossRef]

- Feenstra, Robert C. 1998. Integration of trade and disintegration of production in the global economy. Journal of Economic Perspectives 12: 31–50. [Google Scholar] [CrossRef] [Green Version]

- Fujiwara, Yoshi, and Hideaki Aoyama. 2010. Large-scale structure of a nation-wide production network. The European Physical Journal B 77: 565–80. [Google Scholar] [CrossRef]

- Gatti, Domenico Delli, Corrado Di Guilmi, Edoardo Gaffeo, Gianfranco Giulioni, Mauro Gallegati, and Antonio Palestrini. 2005. A new approach to business fluctuations: Heterogeneous interacting agents, scaling laws and financial fragility. Journal of Economic Behavior & Organization 56: 489–512. [Google Scholar]

- Gereffi, Gary, John Humphrey, and Timothy Sturgeon. 2005. The governance of global value chains. Review of International Political Economy 12: 78–104. [Google Scholar] [CrossRef]

- Guan, Dabo, Daoping Wang, Stephane Hallegatte, Steven J. Davis, Jingwen Huo, Shuping Li, Yangchun Bai, Tianyang Lei, Qianyu Xue, D’Maris Coffman, and et al. 2020. Global supply-chain effects of COVID-19 control measures. Nature Human Behaviour 4: 577–87. [Google Scholar] [CrossRef]

- Hallegatte, Stéphane. 2008. An adaptive regional input-output model and its application to the assessment of the economic cost of Katrina. Risk Analysis 28: 779–99. [Google Scholar] [CrossRef]

- Hallegatte, Stéphane. 2012. Modeling the Roles of Heterogeneity, Substitution, and Inventories in the Assessment of Natural Disaster Economic Costs. Washington, DC: The World Bank. [Google Scholar]

- Hallegatte, Stéphane. 2014 Modeling the role of inventories and heterogeneity in the assessment of the economic costs of natural disasters. Risk Analysis 34: 152–67. [CrossRef] [PubMed]

- Hallegatte, Stéphane, and Fanny Henriet. 2008. Assessing the Consequences of Natural Disasters on Production Networks: A Disaggregated Approach. FEEM Working Paper. No. 100.2008. Available online: https://ssrn.com/abstract=1318335 (accessed on 1 June 2020).

- Henriet, Fanny, Stéphane Hallegatte, and Lionel Tabourier. 2012. Firm-Network Characteristics and Economic Robustness to Natural Disasters. Journal of Economic Dynamics and Control 36: 150–67. [Google Scholar] [CrossRef] [Green Version]

- Hiroyasu, Inoue, and Todo Yasuyuki. 2020. The propagation of the economic impact through supply chains: The case of a mega-city lockdown against the spread of COVID-19. PLoS ONE 15: e0239251. [Google Scholar]

- Inoue, Hiroyasu, and Yasuyuki Todo. 2019a. Firm-level propagation of shocks through supply-chain networks. Nature Sustainability 2: 841–47. [Google Scholar] [CrossRef]

- Inoue, Hiroyasu, and Yasuyuki Todō. 2019b. Propagation of Negative Shocks through Firm Networks: Evidence from Simulation on Comprehensive Supply-Chain Data. PLoS ONE 14: 3. [Google Scholar] [CrossRef] [Green Version]

- Inoue, Hiroyasu, Yohsuke Murase, and Yasuyuki Todo. 2021a. Do Economic Effects of the “Anti-COVID-19” Lockdowns in Different Regions Interact through Supply Chains? PLoS ONE 16: e0255031. [Google Scholar] [CrossRef]

- Inoue, Hiroyasu, Yohsuke Murase, and Yasuyuki Todo. 2021b. Lockdowns need geographic coordination because of propagation of economic effects through supply chains. Social Science Research Network. [Google Scholar] [CrossRef]

- Kimura, Fukunari, and Mitsuyo Ando. 2005. Two-dimensional fragmentation in East Asia: Conceptual framework and empirics. International Review of Economics & Finance 14: 317–48. [Google Scholar]

- MIC. 2013. Japan Standard Industrial Classification (Revision 13). Available online: https://www.soumu.go.jp/english/dgpp_ss/seido/sangyo/index13.htm (accessed on 1 June 2020).

- Ministry of Economy, Trade and Industry. 2011. White Paper on International Economy and Trade. Tokyo: METI Tokyo. [Google Scholar]

- Ministry of Finance. 2021. Trade Statistics of Japan. Available online: https://www.customs.go.jp/toukei/info/index_e.htm (accessed on 10 June 2021).

- Ministry of Internal Affairs and Communications, the Cabinet Office, the Financial Services Agency, the Ministry of Finance, the Ministry of Education, Culture, Sports, Science and Technology, the Ministry of Health, Labour and Welfare, the Ministry of Agriculture, Forestry and Fisheries, the Ministry of Economy, Trade and Industry, the Ministry of Land, Infrastructure, Transport and Tourism, and the Ministry of Environment, Japan. 2015. Input-Output Tables for Japan. Available online: https://www.soumu.go.jp/english/dgpp_ss/data/io/index.htm (accessed on 1 June 2020).

- Ministry of Trade, Enterprise and Industry. 2019. Preliminary Report of 2019 (26th) Basic Survey of Japanese Business Structure and Activities (Definite Reports). Available online: https://www.meti.go.jp/english/statistics/tyo/kikatu/2019_26th.html (accessed on 7 April 2021).

- Otto, Christian, Sven N. Willner, Leonie Wenz, Katja Frieler, and Anders Levermann. 2017. Modeling loss-propagation in the global supply network: The dynamic agent-based model acclimate. Journal of Economic Dynamics and Control 83: 232–69. [Google Scholar] [CrossRef] [Green Version]

- Paul, Sanjoy Kumar, and Priyabrata Chowdhury. 2020. A production recovery plan in manufacturing supply chains for a high-demand item during COVID-19. International Journal of Physical Distribution & Logistics Management 51: 104–25. [Google Scholar]

- Statistics Division, Department of Economic and Social Affairs, United Nations. n.d. International Standard Industrial Classification. Available online: https://unstats.un.org/unsd/classifications/Econ/ISIC.cshtml (accessed on 7 April 2021).

- Thomas, Douglas, and Jennifer Helgeson. 2021. The effect of natural/human-made hazards on business establishments and their supply chains. International Journal of Disaster Risk Reduction 59: 102257. [Google Scholar] [CrossRef]

- Timmer, Marcel P., Erik Dietzenbacher, Bart Los, Robert Stehrer, and Gaaitzen J. de Vries. 2015. An illustrated user guide to the world input–output database: The case of global automotive production. Review of International Economics 23: 575–605. [Google Scholar] [CrossRef]

- Weisbuch, Gérard, and Stefano Battiston. 2007. From production networks to geographical economics. Journal of Economic Behavior & Organization 64: 448–69. [Google Scholar]

- World Bank. 2020. World Development Report 2020. Washington, DC: World Bank Publications. [Google Scholar]

- Ye, Linghe, and Masato Abe. 2012. The Impacts of Natural Disasters on Global Supply Chains. ARTNeT working paper series; Bangkok: Asia-Pacific Research and Training Network on Trade (ARTNeT). [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Inoue, H. Propagation of International Supply-Chain Disruptions between Firms in a Country. J. Risk Financial Manag. 2021, 14, 461. https://doi.org/10.3390/jrfm14100461

Inoue H. Propagation of International Supply-Chain Disruptions between Firms in a Country. Journal of Risk and Financial Management. 2021; 14(10):461. https://doi.org/10.3390/jrfm14100461

Chicago/Turabian StyleInoue, Hiroyasu. 2021. "Propagation of International Supply-Chain Disruptions between Firms in a Country" Journal of Risk and Financial Management 14, no. 10: 461. https://doi.org/10.3390/jrfm14100461

APA StyleInoue, H. (2021). Propagation of International Supply-Chain Disruptions between Firms in a Country. Journal of Risk and Financial Management, 14(10), 461. https://doi.org/10.3390/jrfm14100461