Does Heterogeneity in COVID-19 News Affect Asset Market? Monte-Carlo Simulation Based Wavelet Transform

Abstract

:1. Introduction

2. Literature Review

Literature Review Table

3. Data and Methodology

3.1. The Continuous Wavelet Transforms (CWT)

3.2. The Wavelet Coherence (WC)

4. Results

4.1. Continuous Wavelet Transforms Results

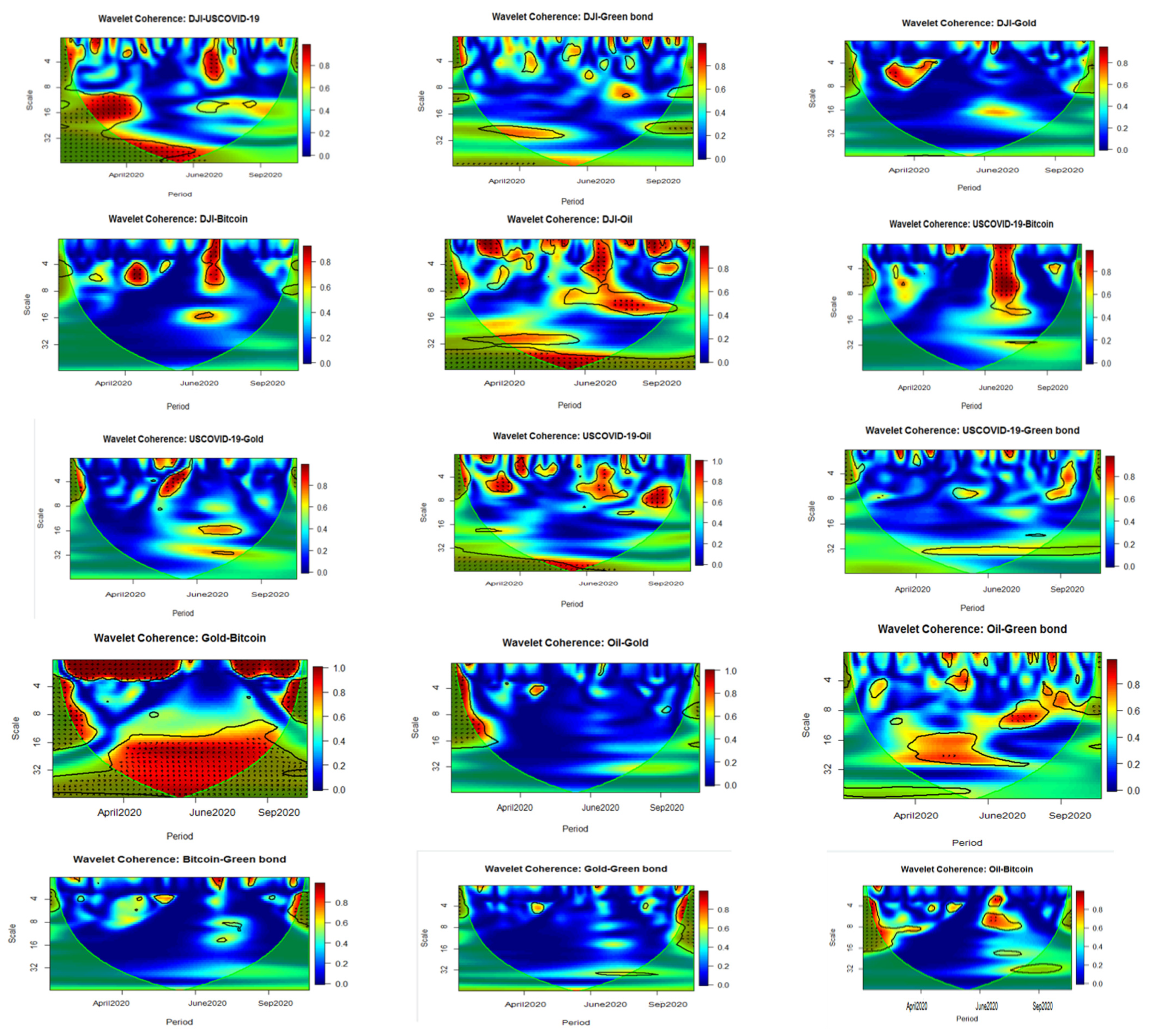

4.2. Wavelet Coherence

4.3. Robustness Test, the Wavelet-Based Granger Causality

5. Conclusions and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Ahinkorah, Bright Opoku, Edward Kwabena Ameyaw, John Elvis Hagan Jr., Abdul-Aziz Seidu, and Thomas Schack. 2020. Rising Above Misinformation or Fake News in Africa: Another Strategy to Control COVID-19 Spread. Frontiers in Communication 5: 2018–21. [Google Scholar] [CrossRef]

- Ahmed, Abdullahi D., and Rui Huo. 2020. Volatility transmissions across international oil market, commodity futures and stock markets: Empirical evidence from China. Energy Economics 93: 104741. [Google Scholar] [CrossRef]

- Atsalakis, George S., Elie Bouri, and Fotios Pasiouras. 2020. Natural disasters and economic growth: A quantile on quantile approach. Annals of Operations Research, 1–27. [Google Scholar] [CrossRef]

- Bal, Gnyana Ranjan, Amit Manglani, and Malabika Deo. 2018. Asymmetric volatility spillover between stock market and foreign exchange market: Instances from Indian market from pre-, during and post-subprime crisis periods. Global Business Review 19: 1567–79. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Brian M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Black, F. 1976. Studies of stock market volatility changes. Paper presented at the 1976 Business Meeting of the Business and Economics Statistics Section, Washington, DC, USA. [Google Scholar]

- Caporin, Massimiliano, Rangan Gupta, and Francesco Ravazzolo. 2021. Contagion between real estate and financial markets: A Bayesian quantile-on-quantile approach. The North American Journal of Economics and Finance 55: 101347. [Google Scholar] [CrossRef]

- Cepoi, Cosmin-Octavian. 2020. Asymmetric dependence between stock market returns and news during COVID-19 financial turmoil. Finance Research Letters 36: 101658. [Google Scholar] [CrossRef]

- Clapp, Christa, and Kamleshan Pillay. 2017. Green Bonds and Climate Finance. Climate Finance, 79–105. [Google Scholar] [CrossRef]

- Corbet, Shaen, Andrew Meegan, Charles Larkin, Brian Lucey, and Larisa Yarovaya. 2018. Exploring the dynamic relationships between cryptocurrencies and other financial assets. Economics Letters 165: 28–34. [Google Scholar] [CrossRef] [Green Version]

- Devpura, Neluka, and Paresh Kumar Narayan. 2020. Hourly Oil Price Volatility: The Role of COVID-19. Environmental Research Letters 1: 1–5. [Google Scholar] [CrossRef]

- Epstein, Paul R. 2001. West Nile virus and the climate. Journal of Urban Health 78: 367–71. [Google Scholar] [CrossRef] [Green Version]

- Flammer, Caroline. 2020. Green Bonds: Effectiveness and Implications for Public Policy. NBER Working Paper, No. w25950. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Forbes, Kristin J., and Roberto Rigobon. 2002. No contagion, only interdependence: Measuring stock market comovements. The Journal of Finance 57: 2223–61. [Google Scholar] [CrossRef]

- Gharib, Cheima, Salma Mefteh-Wali, and Sami Ben Jabeur. 2020. The bubble contagion effect of COVID-19 outbreak: Evidence from crude oil and gold markets. Finance Research Letters 38: 101703. [Google Scholar] [CrossRef]

- Hayes, Adam S. 2017. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics 34: 1308–21. [Google Scholar] [CrossRef]

- Hu, Chunyan, Xinheng Liu, Bin Pan, Bin Chen, and Xiaohua Xia. 2018. Asymmetric Impact of Oil Price Shock on Stock Market in China: A Combination Analysis Based on SVAR Model and NARDL Model. Emerging Markets Finance and Trade 54: 1693–705. [Google Scholar] [CrossRef]

- Huynh, Toan Luu Duc, Erik Hille, and Muhammad Ali Nasir. 2020. Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technological Forecasting and Social Change 159: 120188. [Google Scholar] [CrossRef]

- Iqbal, Najam, Muhammad Saqib Manzoor, and Muhammad Ishaq Bhatti. 2021. Asymmetry and Leverage with News Impact Curve Perspective in Australian Stock Returns’ Volatility during COVID-19. Journal of Risk and Financial Management 14: 314. [Google Scholar] [CrossRef]

- Iyke, Bernard Njindan. 2020. COVID-19: The reaction of US oil and gas producers to the pandemic. Environmental Research Letters 1: 1–7. [Google Scholar]

- Kang, Sang Hoon, Ron P. McIver, and Jose Arreola Hernandez. 2019. Co-movements between Bitcoin and Gold: A wavelet coherence analysis. Physica A: Statistical Mechanics and Its Applications 536: 120888. [Google Scholar] [CrossRef]

- Kisswani, Khalid M., and Mohammad I. Elian. 2017. Exploring the nexus between oil prices and sectoral stock prices: Nonlinear evidence from Kuwait stock exchange. Cogent Economics & Finance 5: 1–17. [Google Scholar] [CrossRef]

- Kumar, Anoop S., and Suvvari Anandarao. 2019. Volatility spillover in crypto-currency markets: Some evidences from GARCH and wavelet analysis. Physica A: Statistical Mechanics and Its Applications 524: 448–58. [Google Scholar] [CrossRef]

- Le, TN-Lan, Emmanuel Joel AikinsAbakahc, and Aviral Kumar Tiwari. 2021. Time and frequency domain connectedness and spill-over among fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technological Forecasting and Social Change 162: 120382. [Google Scholar] [CrossRef]

- Le Quéré, Corinne, Robert B. Jackson, Matthew W. Jones, Adam J. P. Smith, Sam Abernethy, Robbie M. Andrew, Anthony J. De-Gol, David R. Willis, Yuli Shan, Josep G. Canadell, and et al. 2020. Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nature Climate Change 10: 647–53. [Google Scholar] [CrossRef]

- Mensi, Walid, Besma Hkiri, Khamis H. Al-Yahyaee, and Sang Hoon Kang. 2018. Analyzing time–frequency co-movements across gold and oil prices with BRICS stock markets: A VaR based on wavelet approach. International Review of Economics & Finance 54: 74–102. [Google Scholar]

- Nguyen, Linh Hoang, and Brendan John Lambe. 2021. International tail risk connectedness: Network and determinants. Journal of International Financial Markets, Institutions & Money 72: 101332. [Google Scholar] [CrossRef]

- Niederhoffer, Victor. 2014. The Analysis of World Events and Stock Prices Author(s): Victor Niederhoffer the analysis of world events and stock prices. The Journal of Business 44: 193–219. [Google Scholar] [CrossRef]

- Pal, Debdatta, and Subrata K. Mitra. 2019. Oil price and automobile stock return co-movement: A wavelet coherence analysis. Economic Modelling 76: 172–81. [Google Scholar] [CrossRef]

- Peng, Xiaofan. 2020. Do precious metals act as hedges or safe havens for China’s financial markets? Finance Research Letters 37: 101353. [Google Scholar] [CrossRef]

- Peress, Joel. 2014. The media and the diffusion of information in financial markets: Evidence from newspaper strikes. The Journal of Finance 69: 2007–43. [Google Scholar] [CrossRef]

- Raza, Naveed, Jawad Shahzad, Aviral Tiwari, and Muhammad Shahbaz. 2016. Asymmetric impact of gold, oil prices and their volatilities on stock prices of emerging markets. Resources Policy 49: 290–31. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2018. Green bond and financial markets: Co-movement, diversification and price spillover effects. Energy Economics 74: 38–50. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Muhammad Zakaria, Mobeen Ur Rehman, Tanveer Ahmed, and Bashir Ahmed Fida. 2016a. Relationship Between FDI, Terrorism and Economic Growth in Pakistan: Pre and Post 9/11 Analysis. Social Indicators Research 127: 179–94. [Google Scholar] [CrossRef]

- Shahzad, Syed Jawad Hussain, Ronald Ravinesh Kumar, Sajid Ali, and Saba Ameer. 2016b. Interdependence between Greece and other European stock markets: A comparison of wavelet and VMD copula, and the portfolio implications. Physica A: Statistical Mechanics and its Applications 457: 8–33. [Google Scholar] [CrossRef] [Green Version]

- Shahzad, Syed Jawad Hussain, Muhammad Abubakr Naeem, Zhe Peng, and Elie Bouri. 2021. Asymmetric volatility spillover among Chinese sectors during COVID-19. International Review of Financial Analysis 75: 101754. [Google Scholar] [CrossRef]

- Tang, Dragon Yongjun, and Yupu Zhang. 2020. Do shareholders benefit from green bonds? Journal of Corporate Finance 61: 1–18. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Gilbert P. Compo. 1998. A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef] [Green Version]

- Wang, Lin, and Ali M. Kutan. 2013. The impact of natural disasters on stock markets: Evidence from Japan and the US. Comparative Economic Studies 55: 672–86. [Google Scholar] [CrossRef]

- Zhu, Sha, Qiuhong Liu, Yan Wang, Yu Wei, and Guiwu Wei. 2019. Which fear index matters for predicting US stock market volatilities: Text-counts or option based measurement? Physica A: Statistical Mechanics and Its Applications 536: 122567. [Google Scholar] [CrossRef]

| Research Studies | Sample Countries | Data | Aims/Objective | Key Conclusions |

|---|---|---|---|---|

| Atsalakis et al. (2020) | 100 countries | 1979–2010 | The paper tries to explore the nature of relationship between economic growth and natural disaster. | The result reveals that some time natural disasters have positive relationship with economic growth depending on quantile |

| Ahinkorah et al. (2020) | January–February, 2020 | The study investigate fake new (bandwagon) of corona virus because the today is information era. | We have found several misinformations (fake news) exist between individual and business as well. | |

| Iyke (2020) | United States | 21 January–5 May 2020 | In the present study, the author wanted to examine the response of oil and gas producer by changing the condition of pandemic and applied descriptive statistics. | The study finding told us that 28 percent and 27 percent variation in oil and gas return is explained by pandemic. |

| Devpura and Narayan (2020) | Global database | July 2019–June 2020 (hourly data) | The recent paper explores the role of novel covid-19 for predicting the volatility of oil prices using descriptive statistics and graphs. | The paper results shows that by increasing death and infected patient of covid-19 led sharp increase in the volatility of oil price. |

| Cepoi (2020) | Italy, USA, Spain, Germany, UK and France | 3 February–17 April 2020 | The underlying article examines the role of covid-19 news impact on equity market of different countries by analysing panel quantile regression. | The results depict that asymmetric dependence persist between covid-19 news and equity market of underlying countries. |

| Ahmed and Huo (2020) | China | 2012–2017 | This paper investigate the dynamic relationship between Chinese stock market, commodity market and global oil prices. | The result shows that unidirectional spillover exist from oil to stock market. |

| Zhu et al. (2019) | United States | 1990–April 2019 | The main objective of this paper is to search out the role of fear while determining equity market volatility by using the Grach Midas model. | The conclusion of the paper reveals that VIX contribute more than emv index while predicting about the U.S. financial market volatility. |

| Pal and Mitra (2019) | United States and world index | 1996–2017 | The study investigated relationship between automobile sector returns and oil prices | The results confirm that oil price has both short and long term movement with automobile equity sector returns. |

| Kang et al. (2019) | Global database | 2012–2015 | The study tried to investigate the degree of movement (association) between gold and bitcoin by using wavelet coherency. | The results show that Bitcoin price has greater degree of co-movements with the traditional asset class (gold). |

| Mensi et al. (2018) | BRICS countries | 1997–2016 | The study analysed the comvement between oil, gold and equity market of different currencies. | The results show that no evidence of comovement between equity market and gold while oil comovement is found after the analysis. |

| Shahzad et al. (2018) | Global data | 2000–2016 | The study investigate the asymmetric spillover among oil and agriculture commodities | There is asymmetric spillover from oil to agriculture commodities that intensify especially during financial turmoil period. |

| Reboredo (2018) | United States, and global | 2014–2017 | The study investigated relationship between conventional bonds and green bonds. | The conclusion depicts that positive association present between these two financial assets. |

| Kisswani and Elian (2017) | Kuwait | 2012–2015 | The study examines the non-linear relationship between oil price and Kuwait sectoral stocks by using daily data by applying NARDL. | The result depicts that asymmetrically short term effects between some sectors and oil price but there are no long term effects. |

| Hayes (2017) | Australia | 1980–2003 | The study aims to investigate the relationship between natural events and stock market. | The estimates show that natural events have no significant impact on Australian equity market. |

| Raza et al. (2016) | 10 emerging markets | 2008–2015 | The study investigates the dynamic spillover relationship between oil, gold & their volatilities on the equity market by using NARDL. | Oil and Gold price has a negative effect on the equity market in both the long and short run. |

| Wang and Kutan (2013) | United States, Japan | 1982–2002 | The study examines the effect of natural disaster on equity market especially using insurance sector. | The results show that insignificant prevail in case of equity market, while significant relationship exist between insurance sector and natural disaster. |

| Forbes and Rigobon (2002) | 78 countries | 1960–1990 | The paper analyse the type of relationship between natural disaster and long term growth. | The result of study proves that high frequency of natural disasters reduce the long term growth of different countries |

| Frequency Domains | Dependent Variables | Independent Variables | |||||

|---|---|---|---|---|---|---|---|

| US-Stock | USCOVID-19 | Oil | Gold | Bitcoin | Green Bond | ||

| D1 | US-stock | 0.4304 | 0.0296 | 0.2771 | 0.003 | 0.6729 | |

| USCOVID-19 | 0.4722 | 0.5671 | 0.3001 | 0.0048 | 0.1806 | ||

| Oil | 0.4108 | 0.9915 | 0.037 | 0.6005 | |||

| Gold | 0.7005 | 0.8305 | 0.0651 | 0.0061 | 0.0822 | ||

| Bitcoin | 0.4303 | 0.0000 | 0.7843 | 0.8988 | 0.5779 | ||

| Green bond | 0.4943 | 0.5517 | 0.4741 | 0.4875 | 0.3819 | ||

| D2 | US-stock | 0.3549 | 0.0492 | 0.5003 | 0.4139 | 0.7453 | |

| USCOVID-19 | 0.578 | 0.8974 | 0.3612 | 0.4884 | 0.9751 | ||

| Oil | 0.7605 | 0.8442 | 0.9206 | 0.6042 | |||

| Gold | 0.8536 | 0.2776 | 0.9428 | 0.4469 | 0.5731 | ||

| Bitcoin | 0.6893 | 0.000483 | 0.8562 | 0.003182 | 0.9939 | ||

| Green bond | 0.7194 | 0.9408 | 0.0415 | 0.9066 | 0.9415 | ||

| D3 | US-stock | 0.2011 | 0.3709 | 0.7042 | 0.4205 | 0.62377 | |

| USCOVID-19 | 0.1263 | 0.7069 | 0.001236 | 0.5408 | 0.6917 | ||

| Oil | 0.4219 | 0.8177 | 0.9494 | 0.6652 | 0.7142 | ||

| Gold | 0.7635 | 0.19081 | 0.8005 | 0.0001 | 0.5300 | ||

| Bitcoin | 0.4258 | 0.0066 | 0.9055 | 0.0000 | 0.9091 | ||

| Green bond | 0.09077 | 0.3214 | 0.0149 | 0.2463 | 0.5761 | ||

| D4 | US-stock | 0.0917 | 0.5281 | 026938 | 0.71903 | 0.4872 | |

| USCOVID-19 | 0.0009 | 0.0232 | 0.0035 | 0.0000 | 0.0365 | ||

| Oil | 0.0000 | 0.0035 | 0.7524 | 0.7546 | 0.6708 | ||

| Gold | 0.6285 | 0.0097 | 0.7533 | 0.0000 | 0.7627 | ||

| Bitcoin | 0.6193 | 0.0134 | 0.9536 | 0.0080 | 0.7322 | ||

| Green bond | 0.1921 | 0.0010 | 0.0968 | 0.8955 | 0.7378 | ||

| D5 | US-stock | 0.0000 | 0.0000 | 0.0000 | 0.000 | 0.000 | |

| USCOVID-19 | 0.0000 | 0.0000 | 0.6938 | 0.0000 | 0.000 | ||

| Oil | 0.0000 | 0.0000 | 0.06072 | 0.0623 | 0.000 | ||

| Gold | 0.04434 | 0.6156 | 0.1962 | 0.0764 | 0.1879 | ||

| Bitcoin | 0.7579 | 0.6284 | 0.9495 | 0.000 | 0.9998 | ||

| Green bond | 0.0000 | 0.0000 | 0.000 | 0.0007 | 0.0363 | ||

| D6 | US-stock | 0.9208 | 0.2016 | 0.003 | 0.029 | 0.7872 | |

| USCOVID-19 | 0.0000 | 0.000 | 0.0000 | 0.0000 | 0.0006 | ||

| Oil | 0.4189 | 0.000 | 0.0000 | 0.000 | |||

| Gold | 0.0000 | 0.007951 | 0.04875 | 0.0000 | 0.000346 | ||

| Bitcoin | 0.1040 | 0.02219 | 0.1337 | 0.0000 | 0.01189 | ||

| Green bond | 0.0000 | 0.01585 | 0.000 | 0.0000 | 0.0000 | ||

| Original | US-stock | 0.0497 | 0.6002 | 0.0000 | 0.0000 | 0.3944 | |

| US COVID-19 | 0.0000 | 0.0495 | 0.3887 | 0.5840 | 0.7563 | ||

| Oil | 0.0000 | 0.0065 | 0.8930 | 0.3819 | 0.0403 | ||

| Gold | 0.5139 | 0.7230 | 0.2754 | 0.0093 | 0.5937 | ||

| Bitcoin | 0.4702 | 0.0760 | 0.1859 | 0.0493 | 0.4062 | ||

| Green bond | 0.7364 | 0.0805 | 0.0021 | 0.7931 | 0.3825 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Siddique, A.; Kayani, G.M.; Ashfaq, S. Does Heterogeneity in COVID-19 News Affect Asset Market? Monte-Carlo Simulation Based Wavelet Transform. J. Risk Financial Manag. 2021, 14, 463. https://doi.org/10.3390/jrfm14100463

Siddique A, Kayani GM, Ashfaq S. Does Heterogeneity in COVID-19 News Affect Asset Market? Monte-Carlo Simulation Based Wavelet Transform. Journal of Risk and Financial Management. 2021; 14(10):463. https://doi.org/10.3390/jrfm14100463

Chicago/Turabian StyleSiddique, Asima, Ghulam Mujtaba Kayani, and Saira Ashfaq. 2021. "Does Heterogeneity in COVID-19 News Affect Asset Market? Monte-Carlo Simulation Based Wavelet Transform" Journal of Risk and Financial Management 14, no. 10: 463. https://doi.org/10.3390/jrfm14100463

APA StyleSiddique, A., Kayani, G. M., & Ashfaq, S. (2021). Does Heterogeneity in COVID-19 News Affect Asset Market? Monte-Carlo Simulation Based Wavelet Transform. Journal of Risk and Financial Management, 14(10), 463. https://doi.org/10.3390/jrfm14100463