Mental Time Travel and Retirement Savings †

Abstract

:1. Introduction

2. The Lifecycle Model and Pension Adequacy in the Real World

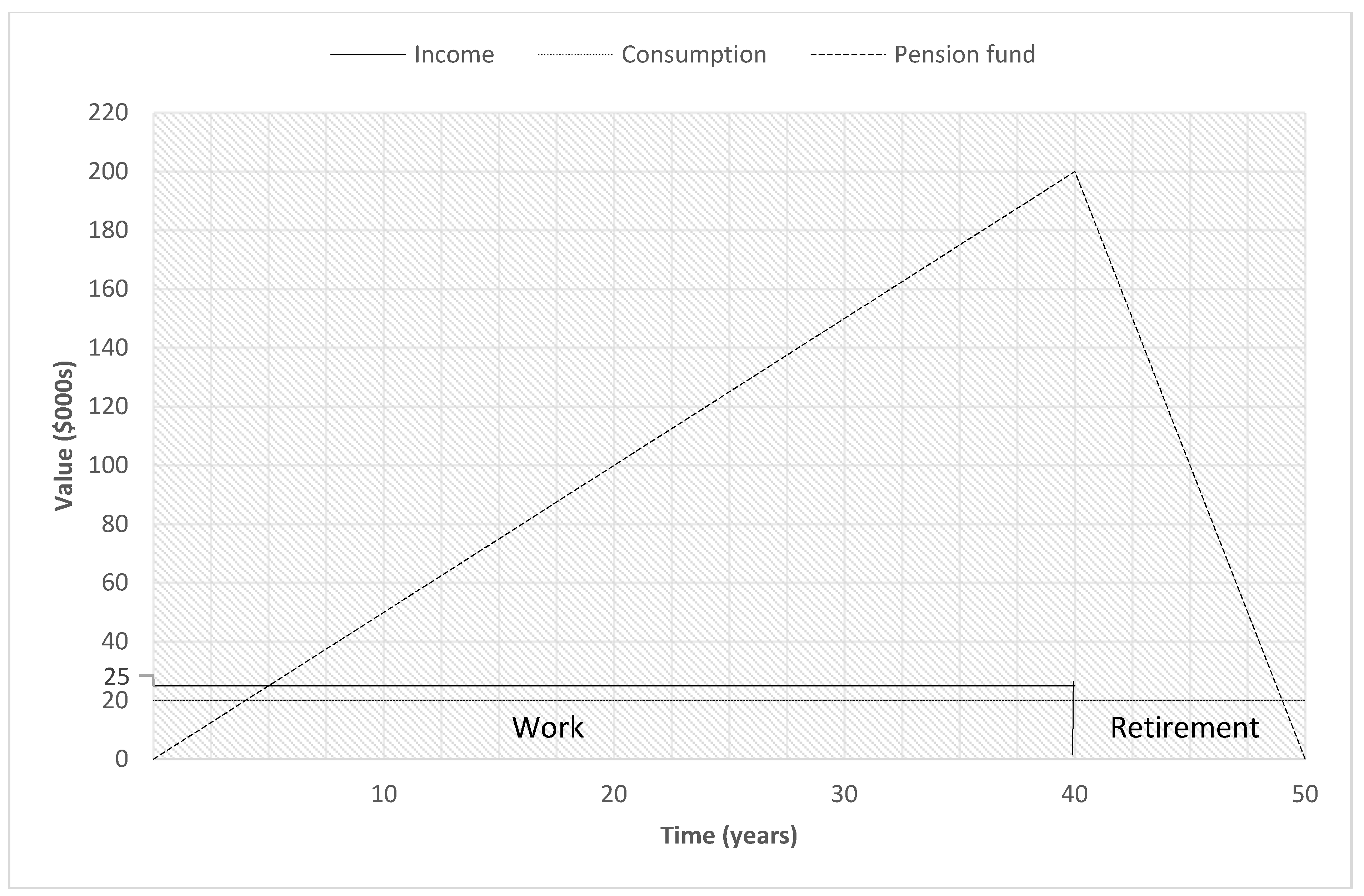

2.1. The Lifecycle Model

2.2. Pension Adequacy in the Real World

- Poverty protection, the ability to prevent and mitigate the risk of poverty in old age, noting that pensions account for four fifths of older households’ income;

- Income maintenance, the capacity to replace income earned before retirement and hence limit the financial impact of retirement, thereby maintaining standards of living; and

- Pension/retirement duration. This has two aspects, both of which measure adequacy. First, is whether individuals can afford to spend a reasonable share of their lives in retirement. Second, adequacy changes over the time spent in retirement, reflecting changes in income levels, household composition, health and the need for long-term care.

3. Financial Investment Valuation as Mental Time Travel

3.1. Projection Methods

3.1.1. Exponential Projection

3.1.2. Hyperbolic Projection

3.1.3. Linear Projection—Exponential Growth Bias

3.2. Discounting Methods

3.2.1. Exponential Discounting

3.2.2. Hyperbolic Discounting

3.2.3. Linear Discounting

3.3. Symmetry and Asymmetry

4. A Mental Time Travel “Retirement Savings” Thought Investment—The Impact of Exponential Growth Bias and Present Bias

5. Empirical Evidence of the Biases and Their Effect on Retirement Savings—And Implications

5.1. Empirical Evidence

- Only 8% displayed neither bias;

- 12% projected accurately, but were present biased;

- 32% projected linearly, and a further 39% underestimated the effects of compound interest;

- Of those who were not present biased, 14% projected linearly and a further 17% underestimated EG, a total of 31%;

- 9% overestimated exponential growth, of whom 4% had no present bias; and

- 57% were present biased.

5.2. Implications of the Empirical Evidence and the MTT Framework

6. Mitigating the Biases

- Improved financial education, especially in schools (Lusardi and Mitchell 2011, 2014);

- Generic financial guidance—the UK, for example, has introduced a free national guidance service called the Money and Pension Service (MAPS);14

- The provision of online retirement income projections or pension calculators, such as that provided by Money Helper in the UK (which is a subsidiary of MAPS);15

- Computer-based decision aids and support systems (Arnott 2006);

- Independent financial advice (Stango and Zinman 2009);

- Tutorials on useful rules of thumb, such as the Rule of 72.16

- “You’re already on your way to having a retirement income”. Building confidence by emphasizing what they have, including the State pension and any existing pension pots.

- “Start from today and plan forwards”. Helping people work from what they know, to understand the gap they need to close.

- “There are steps you can take”. Breaking it down into manageable and meaningful actions and showing the difference each step could make to a retirement income.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | We cite here only the original LCM studies, although we recognize that there have been many extensions of the LCM since then, including allowances for income risk, liquidity constraints, bequests, family formation and dissolution, each of which can influence retirement savings. |

| 2 | When the interest rate is zero, we can simply sum up the annual earnings over the 40 years of the working life. |

| 3 | https://www.worldbank.org/en/topic/pensions (accessed on 2 December 2021). |

| 4 | We use the formula (1 + r)T to define the exponential projection function for a T-year investment horizon. Figure 2 assumes that r = 6%. |

| 5 | We use the formula (1 + αT)γ/α, where γ and α are constants, to define the T-year hyperbolic projection function (Loewenstein and Prelec 1992; Laibson 1998). Figure 2 assumes γ = 1 and α = 4. |

| 6 | We use the formula (1 + rT) to define the linear projection function for a T-year investment horizon (i.e., simple interest is applied). Figure 2 assumes that r = 6%. |

| 7 | We use the formula (1 + r)−T to define the T-year exponential discount function. Figure 2 assumes that r = 6%. |

| 8 | We use the formula (1 + αT)−γ/α to define the T-year hyperbolic discount function (Loewenstein and Prelec 1992; Laibson 1998). Figure 2 assumes that γ = 1 and α = 4. |

| 9 | We use the formula −r(T − t) to define the T-year linear discount function, so the discounted value of the year-40 value of $3.40 will follow the linear path $3.40-r(T − t), for t = T, T − 1, T − 2,…, 1, 0 from year-40 back to the current date. Figure 2 assumes that r = 6%. |

| 10 | It is not the only explanation, of course, since as one of the referees for this paper pointed out “simply observing that many old people are in poverty is not a proof of lack of saving: many people are lifetime poor, and their consumption is unfortunately low before and after retirement”. |

| 11 | To confirm this possibility, Levy and Tasoff (2016) found that 33% of their US sample reported total pension savings below the sum of contributions, while 26% of their sample failed to provide the correct answer to the question “what is the value of $100 investment at the end of one year when the interest rate is 4%?”. |

| 12 | We look to other studies, such as that of Goda et al. (2019), for evidence that biases in valuation influence decision making. |

| 13 | For those not living in extreme poverty. |

| 14 | https://maps.org.uk (accessed on 2 December 2021). Note that guidance differs from advice—and this is an important distinction in a UK financial regulatory context. |

| 15 | https://www.moneyhelper.org.uk/en/pensions-and-retirement/pensions-basics/pension-calculator (accessed on 2 December 2021). |

| 16 | The Rule of 72 shows the number of years it takes to double the value of an investment that grows with compound interest (Years to Double = 72/Interest Rate) and is reasonably accurate for interest rates in the range 6–10% (https://www.investopedia.com/terms/r/ruleof72.asp (accessed on 2 December 2021). |

| 17 | Above the poverty threshold. |

| 18 | http://www.shlomobenartzi.com/save-more-tomorrow (accessed on 2 December 2021). |

| 19 | |

| 20 | https://www.nestpensions.org.uk (accessed on 2 December 2021). |

| 21 | Invesco et al. (2021) suggests this could be 20% in the UK. |

| 22 | Since it improves immediate welfare or utility. |

| 23 | Furthermore, as helpfully pointed out by one of the reviewers of this paper, “there may be circumstances where growth and discount rates differ for understandable reasons such as when individuals have a normal (e.g., 6%) return on investments but face interest rates of, say, 15% or more on credit card debt or payday loans”. |

| 24 | We discuss some of these issues in more detail in Blake and Pickles (2021). |

References

- Ainslie, George. 2005. Precis of breakdown of will. Behavioral and Brain Sciences 28: 635–73. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ando, Albert K., and Franco Modigliani. 1963. The life cycle hypothesis of saving: Aggregate implications and tests. American Economic Review 53: 55–84. [Google Scholar]

- Angeletos, George-Marios, David Laibson, Andrea Repetto, Jeremy Tobacman, and Stephen Weinberg. 2001. The hyperbolic consumption model: Calibration, simulation, and empirical evaluation. Journal of Economic Perspectives 15: 47–68. [Google Scholar] [CrossRef] [Green Version]

- Arnott, David R. 2006. Cognitive biases and decision support systems development: A design science approach. Information Systems Journal 16: 55–78. [Google Scholar] [CrossRef]

- Berns, Gregory S., David I. Laibson, and George Loewenstein. 2007. Intertemporal choice: Toward an integrative framework. Trends in Cognitive Sciences 11: 482–88. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Blake, David, and John Pickles. 2021. Mental time travel and the valuation of financial investments. Review of Behavioral Finance. [Google Scholar] [CrossRef]

- Eisenstein, Eric M., and Stephen J. Hoch. 2007. Intuitive Compounding: Framing, Temporal Perspective, and Expertise. Working Paper. Ithaca: Cornell University. [Google Scholar]

- European Union. 2021. Pension Adequacy Report 2021: Current and Future Income Adequacy in Old Age in the EU. Joint Report Prepared by the Social Protection Committee (SPC) and the European Commission (DG EMPL). Available online: https://op.europa.eu/en/publication-detail/-/publication/4ee6cadd-cd83-11eb-ac72-01aa75ed71a1 (accessed on 2 December 2021).

- Frederick, Shane, George Loewenstein, and Ted O’Donoghue. 2002. Time discounting and time preference: A critical review. Journal of Economic Literature 40: 351–491. [Google Scholar] [CrossRef]

- Frederick, Shane. 2003. Time preference and personal identity. In Time and Decision: Economic and Psychological Perspectives on Intertemporal Choice. Edited by George Loewenstein, Daniel Read and Roy F. Baumeister. New York: Russell Sage, pp. 89–113. [Google Scholar]

- Frederick, Shane. 2006. Valuing future life and future lives: a framework for understanding discounting. Journal of Economic Psychology 27: 667–80. [Google Scholar] [CrossRef]

- Goda, Gopi S., Matthew R. Levy, Colleen F. Manchester, Aaron Sojourner, and Joshua Tasoff. 2014. What will my account really be worth? Experimental evidence on how retirement income projections affect saving. Journal of Public Economics 119: 80–92. [Google Scholar] [CrossRef]

- Goda, Gopi S., Matthew R. Levy, Colleen F. Manchester, Aaron Sojourner, and Joshua Tasoff. 2019. Predicting retirement savings using survey measures of exponential growth bias and present bias. Economic Inquiry 57: 1636–58. [Google Scholar] [CrossRef]

- Hershfield, Hal E. 2011. Future self-continuity: How conceptions of the future self transform intertemporal choice. Annals of the New York Academy of Sciences 1235: 30–43. [Google Scholar] [CrossRef] [Green Version]

- Hershfield, Hal E., M. Tess Garton, Kacey Ballard, Gregory R. Samanez-Larkin, and Brian Knutson. 2009. Don’t stop thinking about tomorrow: Individual differences in future self-continuity account for saving. Judgment and Decision Making 4: 280–86. [Google Scholar]

- Invesco, Maslansky, Matthew Blakstad, Annick Kuipers, Jo Phillips, and Nest Insight. 2021. Small Steps to a Better Future. Available online: https://www.nestinsight.org.uk/wp-content/uploads/2021/10/Small-steps-to-a-better-future.pdf (accessed on 2 December 2021).

- Laibson, David I. 1998. Life-cycle consumption and hyperbolic discount functions. European Economic Review 42: 861–71. [Google Scholar] [CrossRef]

- Laibson, David I. 2003. Intertemporal decision making. In Encyclopedia of Cognitive Science. London: Nature Publishing Group. [Google Scholar]

- Levy, Matthew, and Joshua Tasoff. 2016. Exponential-growth bias and lifecycle consumption. Journal of the European Economic Association 14: 545–83. [Google Scholar] [CrossRef] [Green Version]

- Loewenstein, George, and Drazen Prelec. 1992. Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics 107: 573–97. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2011. Financial literacy around the world: An overview. Journal of Pension Economics and Finance 10: 497–508. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2014. The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature 52: 5–44. [Google Scholar] [CrossRef] [Green Version]

- Mitchell, Olivia S., and Stephen P. Utkus. 2004. Lessons from behavioral finance for retirement plan design. In Pension Design and Structure: New Lessons from Behavioral Finance. Edited by Olivia S. Mitchell and Stephen P. Utkus. Oxford: Oxford University Press. [Google Scholar]

- Modigliani, Franco, and Albert K. Ando. 1957. Tests of the life cycle hypothesis of savings: Comments and suggestions. Bulletin of the Oxford University of Statistics 19: 99–124. [Google Scholar] [CrossRef]

- Munnell, Alicia H., Anthony Webb, and Luke Delorme. 2006. A new national retirement risk index. In Issue in Brief 48. Newton: Center for Retirement Research, Boston College. [Google Scholar]

- O’Donoghue, Ted, and Matthew Rabin. 1999. Doing it now or later. American Economic Review 89: 103–24. [Google Scholar] [CrossRef] [Green Version]

- Parfit, Derek. 1971. Personal identity. The Philosophical Review 80: 3–27. [Google Scholar] [CrossRef]

- Parfit, Derek. 1982. Personal identity and rationality. Synthese 53: 227–41. [Google Scholar] [CrossRef]

- Parfit, Derek. 1984. Reasons and Persons. Oxford: Oxford University Press. [Google Scholar]

- Read, Daniel, Shane Frederick, and Marc Scholten. 2013. DRIFT: An analysis of outcome framing in intertemporal choice. Journal of Experimental Psychology: Learning, Memory, and Cognition 39: 573–88. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Song, Changcheng. 2020. Financial illiteracy and pension contributions: A field experiment on compound interest in China. Review of Financial Studies 33: 916–49. [Google Scholar]

- Stango, Victor, and Jonathan Zinman. 2009. Exponential growth bias and household finance. Journal of Finance 64: 2807–49. [Google Scholar] [CrossRef]

- Strotz, Robert H. 1956. Myopia and inconsistency in dynamic utility maximization. Review of Economic Studies 23: 165–80. [Google Scholar] [CrossRef]

- Thaler, Richard H. 1981. Some empirical evidence on dynamic inconsistency. Economics Letters 8: 201–07. [Google Scholar] [CrossRef]

- Thaler, Richard H., and Shlomo Benartzi. 2004. Save More Tomorrow: Using behavioral economics to increase employee saving. Journal of Political Economy 112: 164. [Google Scholar] [CrossRef]

- Timmers, Han, and Willem A. Wagenaar. 1977. Inverse statistics and misperception of exponential growth. Perception and Psychophysics 11: 558–62. [Google Scholar] [CrossRef] [Green Version]

| Exponential Growth Bias | |||||

|---|---|---|---|---|---|

| Most Biased (Linear) | Some Bias (Underestimate EG) | No Bias (Accurate) | Some Bias (Overestimate EG) | ||

| Present bias | Not biased | 14 | 17 | 8 | 4 |

| Biased | 18 | 22 | 12 | 5 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Blake, D.; Pickles, J. Mental Time Travel and Retirement Savings . J. Risk Financial Manag. 2021, 14, 581. https://doi.org/10.3390/jrfm14120581

Blake D, Pickles J. Mental Time Travel and Retirement Savings . Journal of Risk and Financial Management. 2021; 14(12):581. https://doi.org/10.3390/jrfm14120581

Chicago/Turabian StyleBlake, David, and John Pickles. 2021. "Mental Time Travel and Retirement Savings " Journal of Risk and Financial Management 14, no. 12: 581. https://doi.org/10.3390/jrfm14120581