Recent Patterns of Economic Alignment in the European (Monetary) Union

Abstract

1. Introduction

2. Literature Review

3. Methodology and Data

4. Results

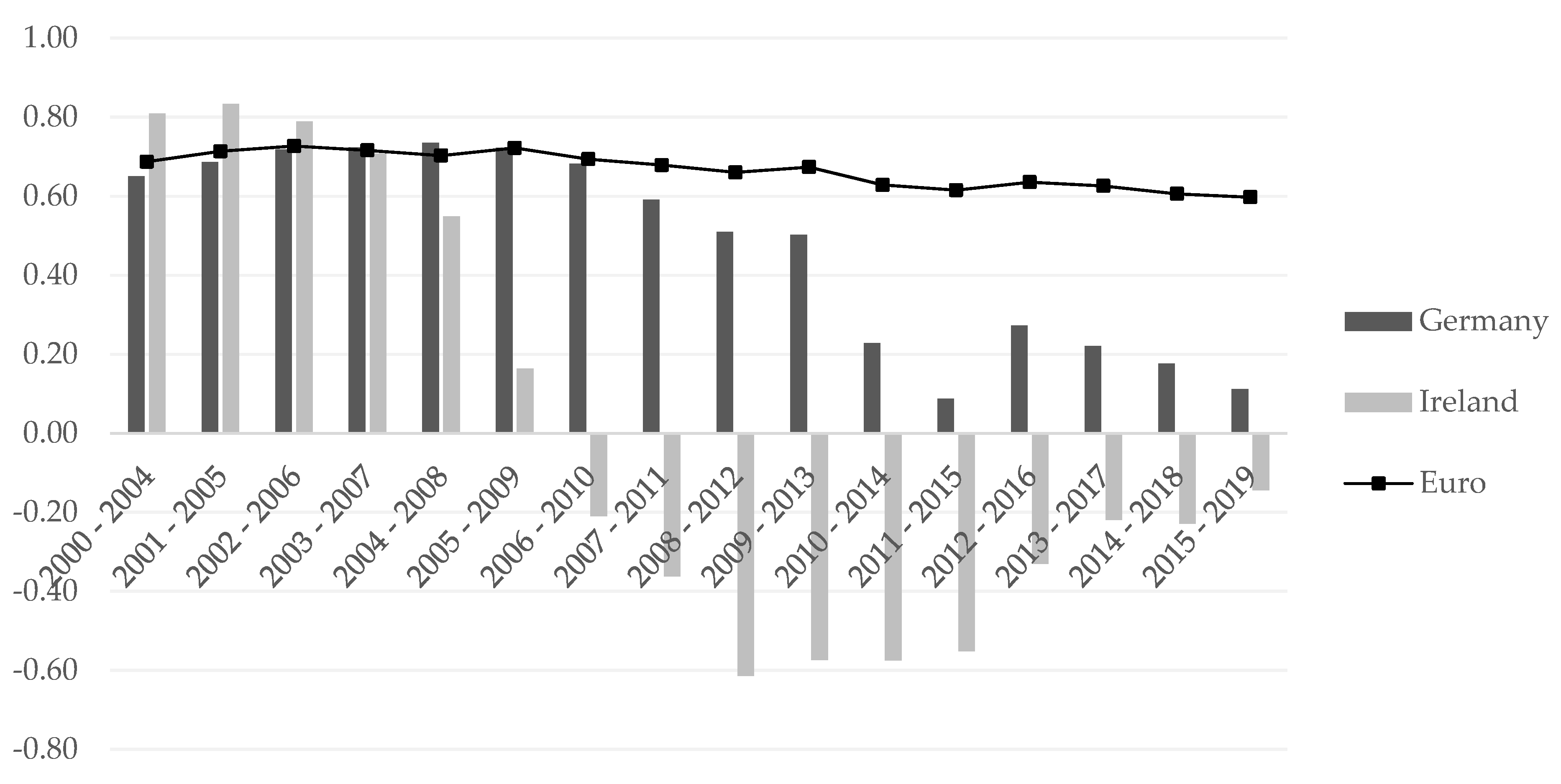

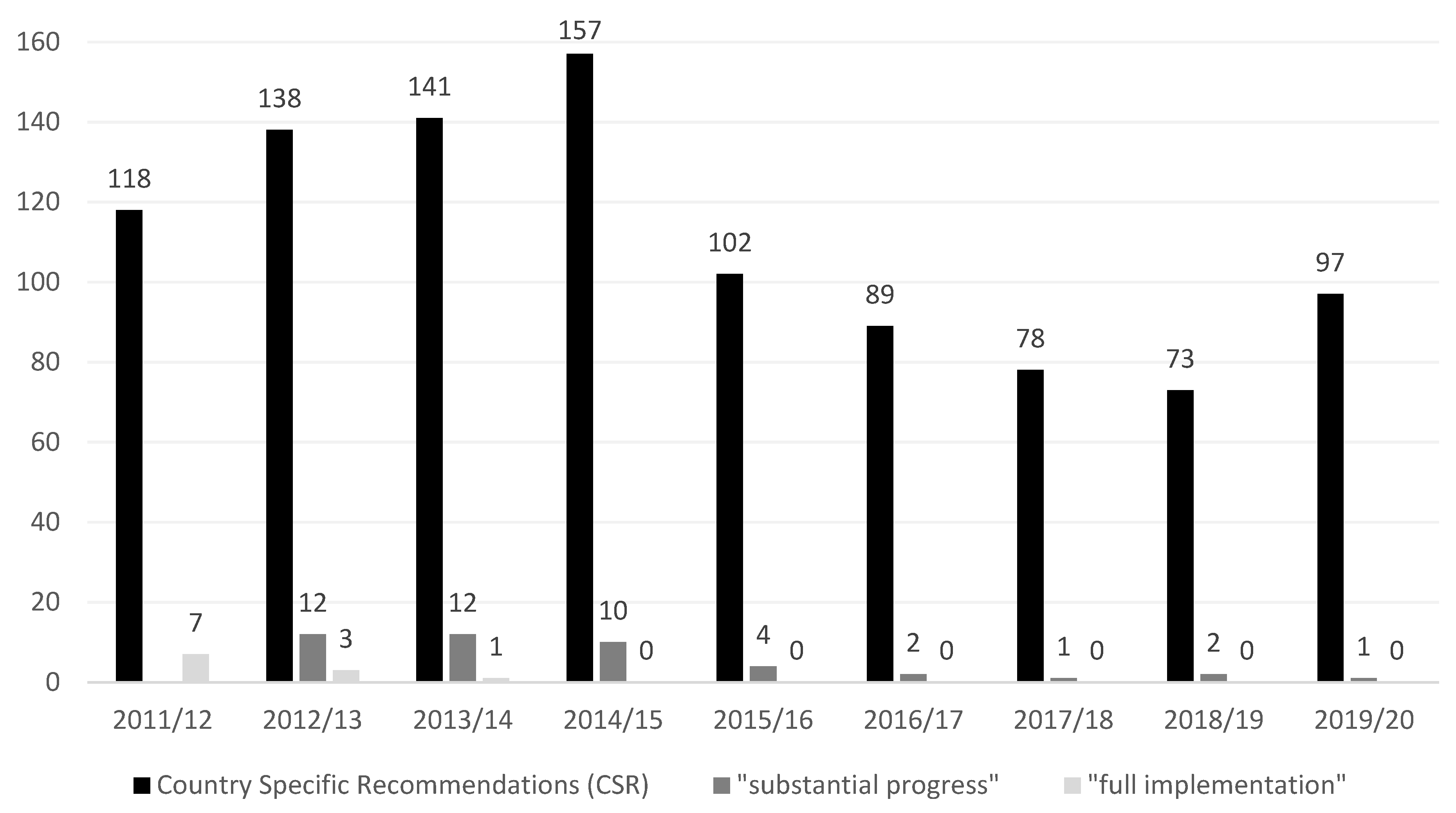

4.1. Real Integration

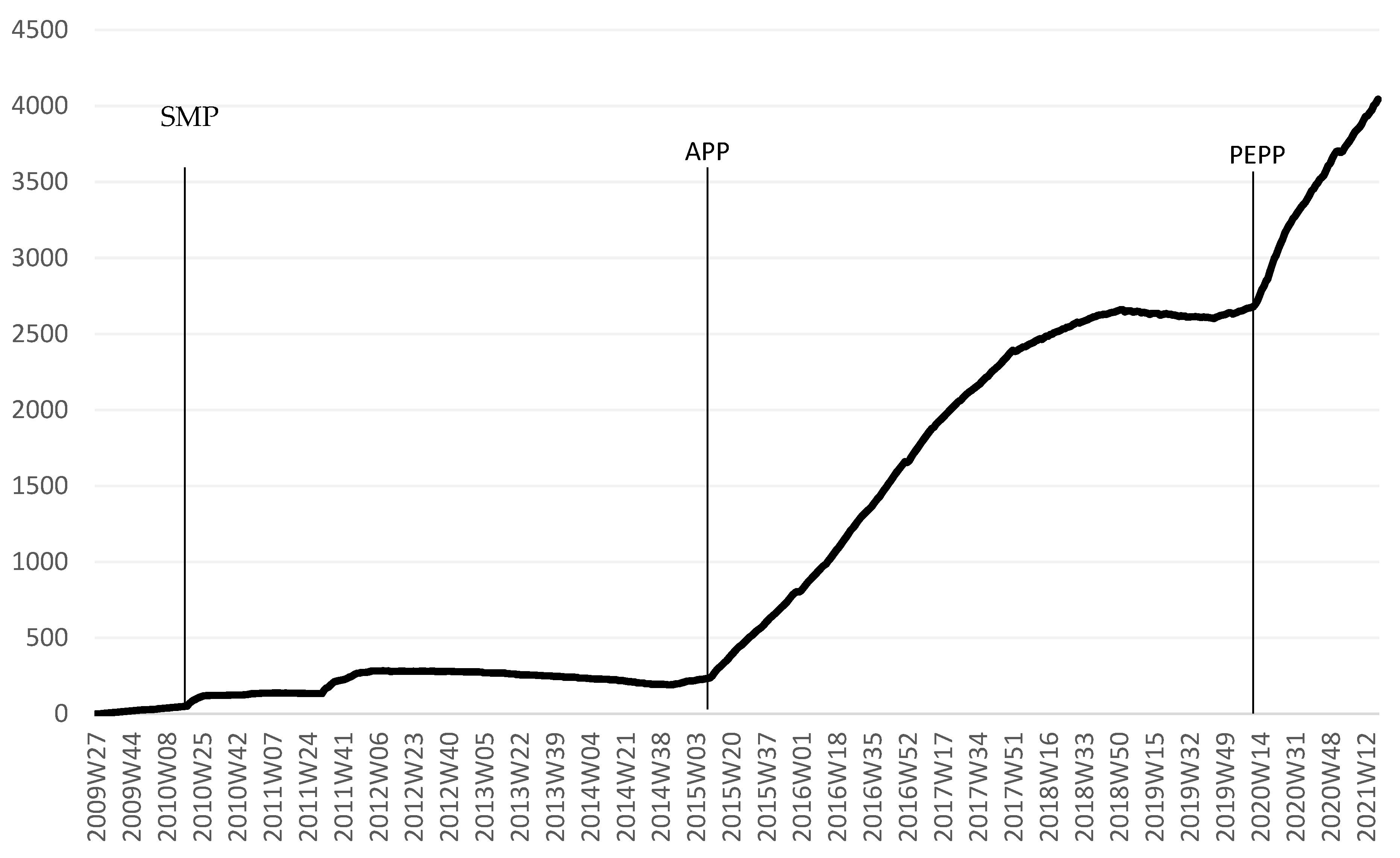

4.2. Nominal Integration

5. Business Cycle Alignment According to Instantaneous Quasi-Correlations

6. Policy Implications

- (1)

- Efforts to enhance structural adjustment of the member states,

- (2)

- European Central Bank (ECB) as lender of last resort,

- (3)

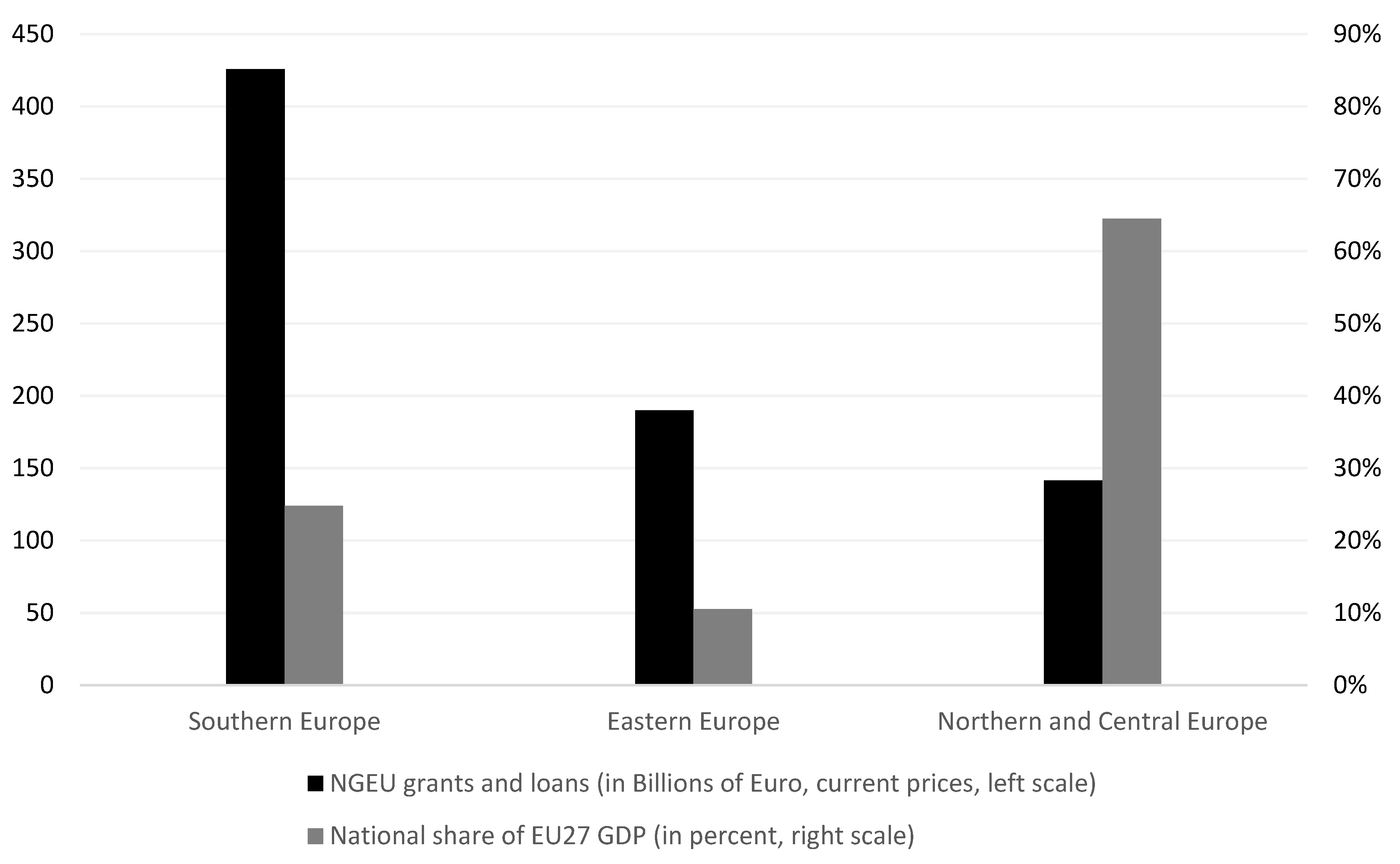

- Fiscal union with mutualisation of (public) debt.13

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Nominal integration in terms of prices and interest rates is less vital as a precondition for a well-functioning currency union and should rather be the consequence of real integration (Buiter 2004; De Grauwe and Schnabl 2005). |

| 2 | For a comprehensive literature review on the business cycle synchronization in the first years of the euro area, see De Haan et al. (2008). |

| 3 | Duarte and Gehringer (2020) show that stronger cyclical alignment could contribute to real convergence if average growth rates increased more in poorer than in richer countries. On the other hand, countries may converge to one another even if their business cycles were fully desynchronized, provided that, again, growth rates in poorer countries are on average higher than in richer countries over a longer time period. See also Belke et al. (2017) on the differences in the amplitude of business cycles in the euro area. |

| 4 | In developing their EU-Index, König and Ohr (2013) consider four different dimensions of integration, namely EU single market, EU homogeneity (convergence), EU symmetry and EU (legal and institutional) conformity. We focus on EU symmetry, since it constitutes a crucial economic precondition for an area forming a monetary union. |

| 5 | We use the Hodrick and Prescott (1981) decomposition, with lambda = 1600 to detrend our time series. There are arguments for and against using this detrending method (see Hamilton (2017) and Hodrick (2020) for the two opposite views). Whereas other methods, for instance, based on phase-average-trend method, or on Baxter-King, or Christiano-Fitzgerald filters were developed, the findings by Nilsson and Gyomai (2011) suggest that the Hodrick-Prescott filter outperforms the others. |

| 6 | EU refers to 27 EU members (EU-28 excluding Luxembourg, but including the UK). Euro includes 18 Euro countries. Euro core is the average across Austria, Belgium, Finland, France, Germany and the Netherlands and Euro periphery refers to Greece, Ireland, Italy, Portugal and Spain. EU non-euro includes EU member countries currently not participating in the euro-area, but formally obliged to once join the monetary union, namely, Bulgaria, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden. |

| 7 | All single-country correlation coefficients are available upon request. |

| 8 | We focus here on Southern euro area members, rather than on Euro periphery as before, given that Ireland managed to break the negative public debt spiral in the aftermath of the European sovereign debt crisis. |

| 9 | An explanation for this suggests the existence of country-specific factors, such as timing of seasonal sales, the size of discounts applied on sales articles, as well as differences in quality adjustment procedures (Álvarez et al. 2020). |

| 10 | This measure was used in recent business cycle literature, for instance, in Alter et al. (2018), Duval et al. (2016), Abiad et al. (2013) and Kalemli-Özcan et al. (2013). |

| 11 | Additionally, the measure is not bounded between −1 and 1, as the Pearson correlation is. |

| 12 | For brevity, we do not show the results for other indicators, but they are available upon request. |

| 13 |

References

- Abiad, Abdul Davide Furceri, Sebnem Kalemli-Ozcan, and Andrea Pescatori. 2013. Dancing Together? Spillovers, Common Shocks, and the Role of Financial and Trade Linkages. World Economic Outlook. Washington, DC: International Monetary Fund, pp. 81–111. [Google Scholar]

- Alcidi, Cinzia, and Daniel Gros. 2017. How to Strengthen the European Semester? CEPS Research Report No. 2017/15. Available online: https://www.ceps.eu/ceps-publications/how-strengthen-european-semester/ (accessed on 10 March 2021).

- Altavilla, Carlo. 2004. Do EMU Members Share the Same Business Cycle? Journal of Common Market Studies 42: 869–96. [Google Scholar] [CrossRef]

- Alter, Adrian, Jane Dokko, and Dulani Seneviratne. 2018. House Price Synchronicity, Banking Integration, and Global Financial Conditions. IMF Working Paper WP/18/250. Washington, DC: International Monetary Fund. [Google Scholar]

- Álvarez, Luis Julián, Maria Dolores Gadea, and Ana Gómez-Loscos. 2020. Inflation Comovements in Advanced Economies: Facts and Drivers. The World Economy 44: 485–509. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, and Gabriele Tondl. 2014. Does Integration and Economic Policy Coordination Promote Business Cycle Synchronization in the EU? Empirica 41: 541–75. [Google Scholar] [CrossRef][Green Version]

- Babetskii, Ian. 2005. Trade Integration and Synchronization of Shocks: Implications for EU Enlargement. Economics of Transition 13: 105–38. [Google Scholar] [CrossRef]

- Badinger, Harald. 2005. Growth Effects of Economic Integration: Evidence from the EU Member States. Review of World Economics 141: 50–78. [Google Scholar] [CrossRef]

- Balassa, Bela. 1961. The Theory of Economic Integration. Homewood: Irwin. [Google Scholar]

- Baldwin, Richard. 2006. In or Out: Does It Matter? An Evidence-Based Analysis of the Euro’s Trade Effects. London: Centre for Economic Policy Research (CERP). Available online: https://cepr.org/sites/default/files/geneva_reports/GenevaP178.pdf (accessed on 30 March 2021).

- Beck, Krzysztof. 2019. What Drives Business Cycle Synchronization? BMA Results from the European Union. Baltic Journal of Economics 19: 248–75. [Google Scholar] [CrossRef]

- Belke, Ansgar. 2013. Finance Access of SMEs: What Role for the ECB? Ruhr Economic Papers No. 430. Bochum: Ruhr-Universität Bochum (RUB). Available online: https://www.rwi-essen.de/media/content/pages/publikationen/ruhr-economic-papers/REP_13_430.pdf (accessed on 17 February 2021).

- Belke, Ansgar, Clemens Domnick, and Daniel Gros. 2017. Business Cycle Synchronization in the EMU: Core vs. Periphery. Open Economies Review 28: 863–92. [Google Scholar] [CrossRef]

- Bolea, Lucía, Rosa Duarte, and Julio Sánchez Chóliz. 2018. From Convergence to Divergence? Some New Insights into the Evolution of the European Union. Structural Change and Economic Dynamics 47: 82–95. [Google Scholar] [CrossRef]

- Buiter, Willelm. 2004. To Purgatory and Beyond: When and How Should the Accession Countries from Central and Eastern Europe Become Full Members of EMU? CEPR Discussion Paper Series 4342. London: Centre for Economic Policy Research (CERP). Available online: https://repec.cepr.org/repec/cpr/ceprdp/DP4342.pdf (accessed on 21 April 2021).

- Buiter, Willem, and Ebrahim Rahbari. 2012a. Looking into the Deep Pockets of the ECB. Citi Global Economics View. February 27. Available online: http://blogs.ft.com/money-supply/files/2012/02/citi-Looking-into-the-Deep-Pockets-of-the-ECB.pdf (accessed on 19 February 2021).

- Buiter, Willem, and Ebrahim Rahbari. 2012b. The ECB as Lender of Last Resort for Sovereigns in the Euro Area. Journal of Common Market Studies 50: 6–35. [Google Scholar] [CrossRef]

- Bulmer, Simon. 2007. History and Institutions. In The Economics of the European Union. Edited by Michael Artis, Mike Artis and Frederick Nixson. Oxford: Oxford University Press, pp. 5–34. [Google Scholar]

- Camacho, Maximo, Angela Caro, and German Lopez-Buenache. 2020. The Two-Speed Europe in Business Cycle Synchronization. Empirical Economics 59: 1069–84. [Google Scholar] [CrossRef]

- Campos, Nauro, Jarko Fidrmuc, and Iikka Korhonen. 2019. Business Cycle Synchronization and Currency Unions: A Review of the Econometric Evidence Using Meta-Analysis. International Review of Financial Analysis 61: 274–83. [Google Scholar] [CrossRef]

- Carney, Mark. 2017. [De]Globalisation and Inflation. Speech Given at the 2017 IMF Michel Camdessus Central Banking Lecture. Available online: https://www.bankofengland.co.uk/-/media/boe/files/speech/2017/de-globalisation-and-inflation.pdf (accessed on 21 April 2021).

- Cecchini, Paolo, Michael Catinat, and Alexis Jacquemin. 1988. The Benefits of a Single Market. Aldershot: Wildwood House. [Google Scholar]

- Clarida, Richard, Jordi Gali, and Mark Gertler. 1999. The Science of Monetary Policy: A New Keynesian Perspective. Journal of Economic Literature 37: 1661–707. [Google Scholar] [CrossRef]

- Darvas, Zsolt, and György Szapáry. 2008. Business Cycle Synchronization in the Enlarged EU. Open Economies Review 19: 1–19. [Google Scholar] [CrossRef]

- De Grauwe, Paul. 2018. Economics of Monetary Union, 10th ed. New York: Oxford University Press. [Google Scholar]

- De Grauwe, Paul, and Gunther Schnabl. 2005. Nominal versus Real Convergence—EMU Entry Scenarios for the New Member States. Kyklos 4: 537–55. [Google Scholar] [CrossRef]

- De Grauwe, Paul, and Yuemei Ji. 2016. Synchronisation in Business Cycles: An Endogenous Explanation. London: VoxEU. Available online: https://voxeu.org/article/synchronisation-business-cycles (accessed on 19 April 2021).

- De Haan, Jakob, Robert Inklaar, and Olaf Sleijpen. 2002. Have Business Cycles Become More Synchronized? Journal of Common Market Studies 40: 23–42. [Google Scholar] [CrossRef]

- De Haan, Jakob, Robert Inklaar, and Richard Jong-A-Pin. 2008. Will Business Cycles in the Euro Area Converge? A Critical Survey of Empirical Research. Journal of Economic Surveys 22: 234–73. [Google Scholar] [CrossRef]

- Degiannakis, Stavros, David Duffy, and George Filis. 2014. Business Cycle Synchronization in EU: A Time-Varying Approach. Scottish Journal of Political Economy 61: 348–70. [Google Scholar] [CrossRef]

- Diaz del Hoyo, Juan Luis, Ettore Dorrucci, Frigyes Ferdinand Heinz, and Sona Muzikarova. 2017. Real Convergence in the Euro Area: A Long-Term Perspective. ECB Occasional Paper No. 203. Available online: https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op203.en.pdf (accessed on 25 March 2021).

- Dickerson, Andrew, Heather Gibson, and Euclid Tsakalotos. 1998. Business Cycle Correspondence in the European Union. Empirica 25: 49–75. [Google Scholar] [CrossRef]

- Duarte, Pablo, and Agnieszka Gehringer. 2020. Disintegration versus Divergence: The EMU Experience. Macroeconomics 05/11/2020. Köln: Flossbach von Storch Research Institute. Available online: https://www.flossbachvonstorch-researchinstitute.com/fileadmin/user_upload/RI/Studien/files/20201105-disintegration-versus-divergence.pdf (accessed on 19 March 2021).

- Duval, Romain, Kevin Cheng, Kum Hwa Oh, Richa Saraf, and Dulani Seneviratne. 2014. Trade Integration and Business Cycle Synchronization: A Reappraisal with Focus on Asia. IMF Working Paper WP/14/32. Washington, DC: International Monetary Fund. Available online: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Trade-Integration-and-Business-Cycle-Synchronization-A-Reappraisal-with-Focus-on-Asia-41460 (accessed on 15 March 2021).

- Duval, Romain, Nan Li, Richa Saraf, and Dulani Seneviratne. 2016. Value-Added Trade and Business Cycle Synchronization. Journal of International Economics 99: 251–62. [Google Scholar] [CrossRef]

- Eichengreen, Barry. 1991. Is Europe an Optimum Currency Area? NBER Working Paper No. 3579. Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/system/files/working_papers/w3579/w3579.pdf (accessed on 21 January 2021).

- Eijffinger, S., and L. Hoogduin. 2018. ECB: Quo Vadis? Intereconomics 3: 170–73. [Google Scholar] [CrossRef][Green Version]

- Engel, Charles, and John Rogers. 1996. How Wide is the Border? American Economic Review 86: 1113–25. [Google Scholar]

- European Commission. 1985. Completing the Internal Market. White Paper from the Commission to the European Council (Milan, 28–29 June 1985), COM(85) 310. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:51985DC0310&from=EN (accessed on 10 February 2021).

- European Commission. 1990. One Market, One Money: An Evaluation of the Potential Benefits and Costs of Forming an Economic and Monetary Union. European Economy 44. Brussels: Commission for the European Communities. [Google Scholar]

- Filipovski, Vladimir, Predrag Trpeski, and Jane Bogoev. 2018. Business Cycle Synchronization of a Small Open EU-Candidate Country’s Economy with the EU Economy. Panoeconomicus 65: 609–31. [Google Scholar] [CrossRef]

- Frankel, Jeffrey, and Andrew Rose. 1997. Is EMU More Justifiable Ex Post than Ex Ante. European Economic Review 41: 753–60. [Google Scholar] [CrossRef]

- Frankel, Jeffrey, and Andrew Rose. 1998. The Endogeneity of the Optimum Currency Area Criteria. Economic Journal 108: 1009–25. [Google Scholar] [CrossRef]

- Franks, Jeffrey, Bergljot Barkbu, Rodolphe Blavy, William Oman, and Hanni Schoelermann. 2018. Economic Convergence in the Euro Area: Coming Together or Drifting Apart? IMF Working Paper WP/18/10. Washington, DC: International Monetary Fund. Available online: https://www.imf.org/en/Publications/WP/Issues/2018/01/23/Economic-Convergence-in-the-Euro-Area-Coming-Together-or-Drifting-Apart-45575 (accessed on 11 February 2021).

- Gächter, Martin, and Alexandra Riedl. 2014. One Money, One Cycle? The EMU Experience. Journal of Macroeconomics 42: 141–55. [Google Scholar] [CrossRef]

- Gächter, Martin, Alexandra Riedl, and Doris Ritzberger-Grünwald. 2012. Business Cycle Synchronization in the Euro Area and the Impact of the Financial Crisis. Monetary Policy and the Economy 2: 33–60. [Google Scholar]

- Gehringer, Agnieszka. 2013. Growth, Productivity and Capital Accumulation: The Effects of Financial Liberalization in the Case of European Integration. International Review of Economics & Finance 25: 291–309. [Google Scholar]

- German Council of Economic Experts (GCEE). 2018. Setting the Right Course for Economic Policy. Annual Report 2018/19. Wiesbaden: German Council of Economic Experts, chp. 4. Available online: https://www.sachverstaendigenrat-wirtschaft.de/en/publications/annual-reports/previous-annual-reports/annual-report-201819.html (accessed on 16 March 2021).

- German Council of Economic Experts (GCEE). 2021. Stellungnahme zum Entwurf des Deutschen Aufbau- und Resilienzplans von Dezember 2020. Available online: https://www.sachverstaendigenrat-wirtschaft.de/themen/produktivitaet/produktivitaetsausschuss/stellungnahme-zum-deutschen-aufbau-und-resilienzplan-darp-veroeffentlicht-2404.html (accessed on 16 March 2021).

- Gouveia, Sofia, and Leonida Correia. 2008. Business Cycle Synchronisation in the Euro Area: The Case of Small Countries. International Economics and Economic Policy 5: 103–21. [Google Scholar] [CrossRef]

- Guerini, Mattia, Duc Thi Luu, and Mauro Napoletano. 2019. Synchronization Patterns in the European Union. GREDEG Working Paper No. 2019-30. Available online: https://halshs.archives-ouvertes.fr/halshs-02375416/document (accessed on 16 March 2021).

- Hamilton, James. 2017. Why You Should Never Use the Hodrick-Prescott Filter. NBER Working Paper No. 23429. Cambridge: National Bureau of Economic Research. Available online: https://direct.mit.edu/rest/article/100/5/831/58479/Why-You-Should-Never-Use-the-Hodrick-Prescott (accessed on 15 March 2021).

- Herzog, B. 2020. Corona-Bonds und EU-Verschuldung: Zukunftsvision oder Europäische Naivität? Zeitschrift für Wirtschaftspolitik 69: 148–65. [Google Scholar] [CrossRef]

- Hodrick, Robert. 2020. An Exploitation of Trend-Cycle Decomposition Methodologies in Simulated Data. NBER Working Paper No. 26450. Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/papers/w26750 (accessed on 15 March 2021).

- Hodrick, Robert, and Edward Prescott. 1981. Postwar US Business Cycles: An Empirical Investigation. Discussion Paper No. 451. Evanston: Northwestern University, Center for Mathematical Studies in Economics and Management Science. [Google Scholar]

- Issing, Otmar. 2011. Moral Hazard Will Result from ECB Bond Buying. Financial Times, November 30. [Google Scholar]

- Kalamov, Zarko, and Klaas Staal. 2020. The Pitfalls and Possibilities of Coronabonds. LSE European Politics and Policy Blog, Available at LSE European Politics and Policy (EUROPP) Blog: The Pitfalls and Possibilities of Coronabonds. Available online: https://blogs.lse.ac.uk/europpblog/2020/04/20/the-pitfalls-and-possibilities-of-coronabonds/ (accessed on 12 March 2021).

- Kalemli-Özcan, Sebnem, Elias Papaioannou, and Fabrizio Perri. 2013. Global Banks and Crisis Transmission. Journal of International Economics 89: 495–510. [Google Scholar] [CrossRef]

- Kenen, Peter. 1969. The Theory of Optimum Currency Areas: An Eclectic View. In Monetary Problems in the International Economy. Edited by Robert Mundell and Alexander Swoboda. Chicago: University of Chicago Press. [Google Scholar]

- König, Jörg. 2020. EU-Stabilität nach Corona: Subsidiarität und Solidarität. Auf den Punkt 3. Berlin: Stiftung Marktwirtschaft. [Google Scholar]

- König, Jörg, and Renate Ohr. 2013. Different Efforts in European Economic Integration: Implications of the EU Index. Journal of Common Market Studies 51: 1074–90. [Google Scholar] [CrossRef]

- Konstantakopoulou, Ioanna, and Mike Tsionas. 2011. The Business Cycle in Eurozone Economies (1960 to 2009). Applied Finanancial Economics 21: 1495–513. [Google Scholar] [CrossRef]

- Kreis, Kronberger. 2016. Dismantling the Boundaries of the ECB’s Monetary Policy Mandate: The CJEU’s OMT Judgement and Its Consequences. Kronberger Kreis Studien 61. Berlin: Stiftung Marktwirtschaft. [Google Scholar]

- Krugman, Paul. 1979. Increasing Returns, Monopolistic Competition, and International Trade. Journal of International Economics 9: 469–79. [Google Scholar] [CrossRef]

- Krugman, Paul. 1991a. Increasing Returns and Economic Geography. Journal of Political Economy 99: 183–99. [Google Scholar] [CrossRef]

- Krugman, Paul. 1991b. Geography and Trade. Cambridge: MIT Press. [Google Scholar]

- Krugman, Paul, Maurice Obstfeld, and Marc Melitz. 2018. International Economics: Theory and Policy. Harlow: Pearson Education Limited. [Google Scholar]

- Lehwald, Sybille. 2013. Has the Euro Changed Business Cycle Synchronization? Evidence from the Core and the Periphery. Empirica 40: 655–84. [Google Scholar] [CrossRef]

- McCarthy, Mary, and Bent Sørensen. 2006. Comments on the Paper: Trends and Cycles in the Euro Area: How Much Heterogeneity and Should We Worry about It? ECB Working Paper No. 595. Frankfurt: European Central Bank. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp595.pdf (accessed on 10 May 2021).

- McKinnon, Ronald. 1963. Optimum Currency Areas. American Economic Review 53: 717–25. [Google Scholar]

- Miles, William, and Chu-Ping Vijverberg. 2018. Did the Euro Common Currency Increase or Decrease Business Cycle Synchronization for its Member Countries? Economica 85: 558–80. [Google Scholar] [CrossRef]

- Morgan, Donald, Bertrand Rime, and Philip Strahan. 2004. Bank Integration and State Business Cycles. Quarterly Journal of Economics 119: 1555–85. [Google Scholar] [CrossRef]

- Müller, Claudia, and Herbert Buscher. 1999. The Impact of Monetary Instruments on Shock Absorption in EU-Countries. ZEW Discussion Papers No. 99–15. Mannheim: ZEW. Available online: https://ftp.zew.de/pub/zew-docs/dp/dp1599.pdf (accessed on 10 May 2021).

- Mundell, Robert. 1961. A Theory of Optimum Currency Areas. American Economic Review 51: 567–665. [Google Scholar]

- Nikolov, Plamen. 2016. Cross-Border Risk Sharing after Asymmetric Shocks: Evidence from the Euro Area and the United States. Quarterly Report on the Euro Area (QREA), Directorate General Economic and Financial Affairs (DG ECFIN). Brussels: European Commission, vol. 15, pp. 7–18. [Google Scholar]

- Nilsson, Ronny, and Gyorgy Gyomai. 2011. Cycle Extraction: A Comparison of the Phase-Average Trend Method, the Hodrick-Prescott and Christiano-Fitzgerald Filters. OECD Statistics Working Papers No. 2011/04. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Notaro, Giovanni. 2011. Notaro, Giovanni 2011. European Integration and Productivity: Exploring the Early Effects of Completing the Internal Market. Journal of Common Market Studies 49: 845–69. [Google Scholar] [CrossRef]

- Oman, William. 2019. The Synchronization of Business Cycles and Financial Cycles in the Euro Area. International Journal of Central Banking 15: 327–62. [Google Scholar]

- Papageorgiou, Theofanis, Panayotis Michaelides, and John Milios. 2010. Business Cycles Synchronization and Clustering in Europe (1960–2009). Journal of Economics and Business 62: 419–70. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 1985. The Optimal Degree of Commitment to an Intermediate Monetary Target. The Quarterly Journal of Economics 100: 1169–89. [Google Scholar] [CrossRef]

- Rose, Andrew. 2000. One Money, One Market: The Effect of Common Currencies on Trade. Economic Policy 15: 7–45. [Google Scholar] [CrossRef]

- Rose, A., and T. Stanley. 2005. A Meta-Analysis of the Effects of Common Currencies on International Trade. Journal of Economic Surveys 19: 347–65. [Google Scholar] [CrossRef]

- Taylor, John. 1993. Discretion versus Policy Rules in Practice. Carnegie-Rochester Conference Series on Public Policy 39: 195–214. [Google Scholar] [CrossRef]

- Viner, Jacob. 1950. The Customs Union Issue. New York: Carnegie Endowment for International Peace. [Google Scholar]

- Weidman, Jens. 2021. Insolvency Figures will Rise Significantly. Augsburger Allgemeine, February 12. [Google Scholar]

- Wyplosz, Charles. 2012. The ECB’s Trillion Euro Bet. VoxEU. February 13. Available online: http://voxeu.org/index.php?q=node/7617 (accessed on 16 April 2021).

- Zamani, Zahra, and Seyed Komail Tayebi. 2013. Synchronized Cycles during the Process of Economic Transition in Asia. Isfahan: University of Isfahan. [Google Scholar]

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.20 | 0.23 | 0.38 | 0.30 | 0.14 |

| 2001–2005 | 0.22 | 0.22 | 0.32 | 0.28 | 0.16 |

| 2002–2006 | 0.34 | 0.41 | 0.47 | 0.47 | 0.28 |

| 2003–2007 | 0.35 | 0.39 | 0.47 | 0.43 | 0.28 |

| 2004–2008 | 0.60 | 0.59 | 0.74 | 0.60 | 0.56 |

| 2005–2009 | 0.72 | 0.74 | 0.86 | 0.68 | 0.66 |

| 2006–2010 | 0.71 | 0.73 | 0.86 | 0.65 | 0.65 |

| 2007–2011 | 0.70 | 0.71 | 0.87 | 0.61 | 0.64 |

| 2008–2012 | 0.68 | 0.70 | 0.87 | 0.60 | 0.64 |

| 2009–2013 | 0.68 | 0.70 | 0.89 | 0.57 | 0.60 |

| 2010–2014 | 0.45 | 0.49 | 0.70 | 0.39 | 0.39 |

| 2011–2015 | 0.36 | 0.35 | 0.49 | 0.33 | 0.34 |

| 2012–2016 | 0.33 | 0.33 | 0.41 | 0.39 | 0.33 |

| 2013–2017 | 0.24 | 0.29 | 0.38 | 0.19 | 0.13 |

| 2014–2018 | 0.23 | 0.24 | 0.26 | 0.14 | 0.19 |

| 2015–2019 | 0.26 | 0.25 | 0.28 | 0.17 | 0.29 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.24 | 0.26 | 0.38 | 0.19 | 0.08 |

| 2001–2005 | 0.19 | 0.25 | 0.30 | 0.30 | −0.02 |

| 2002–2006 | 0.17 | 0.25 | 0.18 | 0.47 | −0.02 |

| 2003–2007 | 0.19 | 0.25 | 0.08 | 0.43 | 0.07 |

| 2004–2008 | 0.58 | 0.56 | 0.57 | 0.57 | 0.58 |

| 2005–2009 | 0.55 | 0.52 | 0.56 | 0.48 | 0.56 |

| 2006–2010 | 0.60 | 0.56 | 0.62 | 0.52 | 0.61 |

| 2007–2011 | 0.61 | 0.57 | 0.67 | 0.50 | 0.65 |

| 2008–2012 | 0.60 | 0.56 | 0.68 | 0.48 | 0.64 |

| 2009–2013 | 0.39 | 0.39 | 0.43 | 0.38 | 0.38 |

| 2010–2014 | 0.38 | 0.39 | 0.33 | 0.49 | 0.35 |

| 2011–2015 | 0.28 | 0.35 | 0.20 | 0.53 | 0.16 |

| 2012–2016 | 0.22 | 0.31 | 0.14 | 0.45 | 0.02 |

| 2013–2017 | 0.18 | 0.24 | 0.00 | 0.36 | 0.02 |

| 2014–2018 | 0.17 | 0.21 | -0.05 | 0.32 | 0.04 |

| 2015–2019 | 0.28 | 0.29 | 0.11 | 0.40 | 0.19 |

| EU Average | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.63 | 0.69 | 0.83 | 0.74 | 0.56 |

| 2001–2005 | 0.65 | 0.71 | 0.84 | 0.74 | 0.57 |

| 2002–2006 | 0.66 | 0.73 | 0.84 | 0.76 | 0.57 |

| 2003–2007 | 0.65 | 0.72 | 0.85 | 0.74 | 0.59 |

| 2004–2008 | 0.64 | 0.70 | 0.85 | 0.70 | 0.61 |

| 2005–2009 | 0.69 | 0.72 | 0.86 | 0.67 | 0.73 |

| 2006–2010 | 0.68 | 0.69 | 0.85 | 0.61 | 0.74 |

| 2007–2011 | 0.67 | 0.68 | 0.83 | 0.56 | 0.73 |

| 2008–2012 | 0.67 | 0.66 | 0.80 | 0.51 | 0.73 |

| 2009–2013 | 0.69 | 0.67 | 0.80 | 0.54 | 0.73 |

| 2010–2014 | 0.66 | 0.63 | 0.75 | 0.53 | 0.68 |

| 2011–2015 | 0.66 | 0.62 | 0.73 | 0.52 | 0.69 |

| 2012–2016 | 0.68 | 0.64 | 0.76 | 0.55 | 0.69 |

| 2013–2017 | 0.68 | 0.63 | 0.76 | 0.53 | 0.68 |

| 2014–2018 | 0.67 | 0.61 | 0.76 | 0.49 | 0.69 |

| 2015–2019 | 0.65 | 0.60 | 0.73 | 0.47 | 0.64 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.06 | 0.12 | 0.04 | 0.29 | −0.06 |

| 2001–2005 | 0.03 | 0.11 | 0.02 | 0.28 | −0.11 |

| 2002–2006 | 0.22 | 0.25 | 0.19 | 0.24 | 0.22 |

| 2003–2007 | 0.33 | 0.31 | 0.15 | 0.31 | 0.38 |

| 2004–2008 | 0.32 | 0.24 | 0.13 | 0.27 | 0.40 |

| 2005–2009 | 0.60 | 0.56 | 0.56 | 0.55 | 0.64 |

| 2006–2010 | 0.63 | 0.59 | 0.57 | 0.59 | 0.66 |

| 2007–2011 | 0.61 | 0.56 | 0.53 | 0.57 | 0.66 |

| 2008–2012 | 0.58 | 0.53 | 0.52 | 0.56 | 0.63 |

| 2009–2013 | 0.63 | 0.62 | 0.65 | 0.62 | 0.61 |

| 2010–2014 | 0.30 | 0.33 | 0.37 | 0.39 | 0.23 |

| 2011–2015 | 0.24 | 0.27 | 0.32 | 0.34 | 0.17 |

| 2012–2016 | 0.15 | 0.19 | 0.21 | 0.35 | 0.09 |

| 2013–2017 | 0.12 | 0.15 | 0.02 | 0.39 | 0.09 |

| 2014–2018 | 0.08 | 0.11 | −0.06 | 0.27 | −0.01 |

| 2015–2019 | 0.15 | 0.09 | −0.02 | 0.20 | 0.11 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.10 | 0.16 | 0.34 | 0.09 | −0.03 |

| 2001–2005 | 0.04 | 0.12 | 0.28 | 0.01 | −0.05 |

| 2002–2006 | 0.22 | 0.25 | 0.34 | 0.15 | 0.22 |

| 2003–2007 | 0.31 | 0.28 | 0.36 | 0.15 | 0.37 |

| 2004–2008 | 0.32 | 0.31 | 0.34 | 0.23 | 0.31 |

| 2005–2009 | 0.51 | 0.49 | 0.53 | 0.45 | 0.51 |

| 2006–2010 | 0.51 | 0.51 | 0.56 | 0.45 | 0.48 |

| 2007–2011 | 0.49 | 0.48 | 0.51 | 0.43 | 0.47 |

| 2008–2012 | 0.43 | 0.43 | 0.47 | 0.37 | 0.39 |

| 2009–2013 | 0.47 | 0.45 | 0.47 | 0.45 | 0.48 |

| 2010–2014 | 0.17 | 0.20 | 0.23 | 0.26 | 0.11 |

| 2011–2015 | 0.11 | 0.09 | 0.08 | 0.21 | 0.14 |

| 2012–2016 | 0.06 | 0.04 | 0.02 | 0.14 | 0.10 |

| 2013–2017 | 0.04 | 0.06 | 0.04 | 0.04 | 0.01 |

| 2014–2018 | 0.03 | 0.07 | 0.06 | −0.01 | −0.04 |

| 2015–2019 | 0.01 | 0.05 | 0.08 | −0.13 | −0.09 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.26 | 0.12 | 0.22 | 0.10 | 0.37 |

| 2001–2005 | 0.26 | 0.10 | 0.25 | 0.13 | 0.39 |

| 2002–2006 | 0.38 | 0.33 | 0.43 | 0.41 | 0.35 |

| 2003–2007 | 0.56 | 0.58 | 0.63 | 0.71 | 0.47 |

| 2004–2008 | 0.52 | 0.53 | 0.61 | 0.61 | 0.47 |

| 2005–2009 | 0.70 | 0.71 | 0.77 | 0.75 | 0.62 |

| 2006–2010 | 0.70 | 0.71 | 0.82 | 0.68 | 0.63 |

| 2007–2011 | 0.70 | 0.69 | 0.84 | 0.68 | 0.68 |

| 2008–2012 | 0.60 | 0.57 | 0.80 | 0.51 | 0.60 |

| 2009–2013 | 0.49 | 0.48 | 0.73 | 0.36 | 0.42 |

| 2010–2014 | 0.30 | 0.31 | 0.56 | 0.20 | 0.20 |

| 2011–2015 | 0.04 | −0.04 | 0.06 | −0.26 | 0.07 |

| 2012–2016 | −0.02 | −0.07 | 0.01 | −0.26 | −0.04 |

| 2013–2017 | 0.19 | 0.06 | 0.23 | −0.17 | 0.24 |

| 2014–2018 | 0.39 | 0.37 | 0.61 | 0.19 | 0.33 |

| 2015–2019 | 0.55 | 0.56 | 0.72 | 0.46 | 0.47 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.44 | 0.46 | 0.40 | 0.55 | 0.38 |

| 2001–2005 | 0.45 | 0.47 | 0.39 | 0.57 | 0.37 |

| 2002–2006 | 0.41 | 0.43 | 0.32 | 0.50 | 0.32 |

| 2003–2007 | 0.46 | 0.48 | 0.39 | 0.59 | 0.43 |

| 2004–2008 | 0.60 | 0.63 | 0.59 | 0.76 | 0.58 |

| 2005–2009 | 0.61 | 0.63 | 0.61 | 0.80 | 0.63 |

| 2006–2010 | 0.61 | 0.63 | 0.64 | 0.80 | 0.63 |

| 2007–2011 | 0.62 | 0.63 | 0.66 | 0.78 | 0.65 |

| 2008–2012 | 0.62 | 0.62 | 0.69 | 0.73 | 0.64 |

| 2009–2013 | 0.49 | 0.48 | 0.57 | 0.58 | 0.55 |

| 2010–2014 | 0.54 | 0.54 | 0.61 | 0.56 | 0.56 |

| 2011–2015 | 0.59 | 0.62 | 0.60 | 0.63 | 0.61 |

| 2012–2016 | 0.58 | 0.60 | 0.53 | 0.63 | 0.53 |

| 2013–2017 | 0.55 | 0.57 | 0.37 | 0.66 | 0.44 |

| 2014–2018 | 0.62 | 0.64 | 0.42 | 0.74 | 0.54 |

| 2015–2019 | 0.61 | 0.64 | 0.41 | 0.75 | 0.54 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2000–2004 | 0.13 | 0.12 | −0.10 | 0.61 | 0.08 |

| 2001–2005 | 0.18 | 0.17 | −0.10 | 0.70 | 0.09 |

| 2002–2006 | 0.19 | 0.20 | −0.11 | 0.64 | 0.13 |

| 2003–2007 | 0.22 | 0.23 | −0.06 | 0.60 | 0.13 |

| 2004–2008 | 0.23 | 0.23 | −0.04 | 0.60 | 0.04 |

| 2005–2009 | 0.18 | 0.21 | −0.04 | 0.63 | 0.01 |

| 2006–2010 | 0.18 | 0.21 | −0.01 | 0.57 | −0.02 |

| 2007–2011 | 0.14 | 0.17 | −0.07 | 0.51 | −0.06 |

| 2008–2012 | 0.10 | 0.14 | −0.08 | 0.42 | −0.04 |

| 2009–2013 | 0.11 | 0.14 | −0.11 | 0.41 | 0.10 |

| 2010–2014 | 0.19 | 0.18 | −0.10 | 0.31 | 0.19 |

| 2011–2015 | 0.23 | 0.22 | −0.16 | 0.38 | 0.25 |

| 2012–2016 | 0.27 | 0.27 | −0.16 | 0.44 | 0.37 |

| 2013–2017 | 0.38 | 0.40 | −0.02 | 0.59 | 0.42 |

| 2014–2018 | 0.43 | 0.46 | 0.01 | 0.64 | 0.47 |

| 2015–2019 | 0.51 | 0.55 | 0.18 | 0.67 | 0.45 |

| EU | Euro | Euro Core | Euro Periphery | Euro Periphery ex. Greece | EU Non-Euro | |

|---|---|---|---|---|---|---|

| 2000–2004 | 0.63 | 0.71 | 0.99 | 0.96 | 0.99 | 0.50 |

| 2001–2005 | 0.68 | 0.79 | 1.00 | 0.98 | 0.99 | 0.47 |

| 2002–2006 | 0.65 | 0.75 | 0.99 | 0.97 | 0.98 | 0.46 |

| 2003–2007 | 0.60 | 0.68 | 0.99 | 0.78 | 0.91 | 0.38 |

| 2004–2008 | 0.59 | 0.64 | 0.97 | 0.61 | 0.80 | 0.42 |

| 2005–2009 | 0.57 | 0.61 | 0.94 | 0.57 | 0.72 | 0.49 |

| 2006–2010 | 0.51 | 0.58 | 0.88 | 0.59 | 0.69 | 0.34 |

| 2007–2011 | 0.42 | 0.52 | 0.61 | 0.72 | 0.76 | 0.20 |

| 2008–2012 | 0.35 | 0.42 | 0.32 | 0.71 | 0.74 | 0.21 |

| 2009–2013 | 0.35 | 0.40 | 0.28 | 0.69 | 0.73 | 0.23 |

| 2010–2014 | 0.46 | 0.47 | 0.36 | 0.73 | 0.77 | 0.48 |

| 2011–2015 | 0.53 | 0.51 | 0.42 | 0.74 | 0.80 | 0.59 |

| 2012–2016 | 0.54 | 0.55 | 0.44 | 0.74 | 0.85 | 0.52 |

| 2013–2017 | 0.62 | 0.63 | 0.84 | 0.59 | 0.82 | 0.62 |

| 2014–2018 | 0.70 | 0.71 | 0.89 | 0.71 | 0.88 | 0.68 |

| 2015–2019 | 0.71 | 0.73 | 0.94 | 0.65 | 0.86 | 0.68 |

| EU | Euro | Euro Core | Euro Periphery | EU Non-Euro | |

|---|---|---|---|---|---|

| 2004 | 0.00 | −0.02 | 0.00 | 0.01 | 0.02 |

| 2005 | 0.06 | 0.05 | 0.02 | 0.00 | 0.04 |

| 2006 | 0.22 | 0.36 | 0.23 | 0.30 | 0.20 |

| 2007 | 0.26 | 0.20 | 0.16 | 0.15 | 0.18 |

| 2008 | 1.16 | 1.10 | 0.94 | 0.90 | 1.20 |

| 2009 | 2.66 | 3.33 | 2.74 | 1.89 | 2.23 |

| 2010 | 0.21 | 0.27 | 0.38 | 0.00 | 0.18 |

| 2011 | 0.07 | 0.08 | 0.13 | 0.01 | 0.09 |

| 2012 | 0.16 | 0.15 | 0.14 | 0.18 | 0.19 |

| 2013 | 0.04 | 0.07 | 0.07 | 0.14 | 0.00 |

| 2014 | 0.00 | −0.01 | −0.02 | −0.02 | 0.00 |

| 2015 | 0.01 | −0.02 | −0.03 | −0.07 | 0.01 |

| 2016 | 0.05 | 0.04 | 0.04 | 0.00 | 0.03 |

| 2017 | 0.09 | 0.10 | 0.12 | −0.01 | 0.09 |

| 2018 | 0.06 | 0.05 | 0.03 | 0.05 | 0.07 |

| 2019 | 0.11 | 0.05 | 0.05 | 0.03 | 0.16 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gehringer, A.; König, J. Recent Patterns of Economic Alignment in the European (Monetary) Union. J. Risk Financial Manag. 2021, 14, 362. https://doi.org/10.3390/jrfm14080362

Gehringer A, König J. Recent Patterns of Economic Alignment in the European (Monetary) Union. Journal of Risk and Financial Management. 2021; 14(8):362. https://doi.org/10.3390/jrfm14080362

Chicago/Turabian StyleGehringer, Agnieszka, and Jörg König. 2021. "Recent Patterns of Economic Alignment in the European (Monetary) Union" Journal of Risk and Financial Management 14, no. 8: 362. https://doi.org/10.3390/jrfm14080362

APA StyleGehringer, A., & König, J. (2021). Recent Patterns of Economic Alignment in the European (Monetary) Union. Journal of Risk and Financial Management, 14(8), 362. https://doi.org/10.3390/jrfm14080362