Abstract

This paper examines equilibrium relationships and dynamic causality between economic growth, exports, and imports in Nepal using time-series data between 1965 and 2020. This research examines the impact of exports and imports on the economic growth of Nepal and documents empirical evidence in exports-led growth, imports-led growth, growth-led exports, and growth-led imports hypotheses in both the short and long run. The test results show no evidence favoring the exports-led growth and growth-led exports hypotheses in both the short and long run. However, the study finds evidence supporting the imports-led growth hypothesis in the short term and the growth-led imports hypothesis in the long term. Overall, this paper finds no evidence in favor of the notion that foreign trade supports the economic growth of Nepal in the long run. The research findings may have important implications for policymakers in Nepal. The paper contributes to trade and economic growth literature by investigating the relationship between exports, imports, capital, and gross domestic products in a small economy such as Nepal, where exports make a minimal and imports make an extensive contribution to gross domestic products by using cointegration and the vector error correction model.

1. Introduction

The role of foreign trade on economic growth has been a critical discussion among economists for decades. Classical economists view the relationship between foreign trade and economic growth optimistically. For instance, Smith (1977) see international trade as an essential element in creating an opportunity for a country through specialization, the division of labor, and surplus production efficiencies.

The impact of exports and imports on economic growth has been a topic of critical discussions and research among academicians and policymakers for decades. Most studies demonstrate the theoretical relation between trade and economic development, disagreeing with the magnitude of effects and causal direction (Bhagwati 1988; Edwards 1998). Most of the prior studies focus solely on the role of exports on economic growth and use bivariate causal models that ignore contributions of imports (Rahmaddi and Ichihashi 2011). Imports may play a crucial role in economic development in the long run since significant export growth is usually associated with rapid imports growth (Rodrik 1999). Empirical results on the link between exports and economic development may be spurious, resulting in misleading conclusions if the model excludes imports (Esfahani 1991; Riezman et al. 1996; Thangavelu and Rajaguru 2004). Moreover, the role of exports on economic growth analysis that excludes imports may suffer from omitted variable biases, leading to an overstatement of the dynamic relationship between exports and economic growth. Therefore, this study includes imports in our analysis to address the omitted variable bias problem in the study, which is ignored in most studies exploring the role of trade in economic growth.

Nepal, a small developing economy in South Asia, has been facing real challenges in its economic development amid its people’s high appreciation for economic growth. Nepal’s foreign trade was limited only to India and Tibet before 1951. With the advent of democracy in 1951, Nepal’s foreign trade expanded to other countries, namely the United States of America, Japan, Germany, France, Spain, Malaysia, Singapore, Thailand, and Bangladesh. During the fiscal year 2018/19, Nepal exported to 113 countries and imported from 149 countries (MoF 2019). Nepal had initially focused on the exports of agricultural goods in the 1980s, although its focus profoundly shifted to manufacturing products after the 1990s. However, Nepal’s exports volume has been decreasing steadily over time compared to the rapid growth of imports. As a result, Nepal’s imports and trade deficit have been increasing rapidly in recent decades. For example, exports were 52.78% of Nepal’s imports in 1965, whereas exports were only 6.64% of Nepal’s imports in 2020. Indeed, Nepal’s trade deficit was USD −9.98 billion in 2020, which was 29.32% of Nepal’s GDP in 2020. Thus, Nepal is unable to take advantage of globalization in foreign trade.

Most of the prior research focuses on large economies in which data is readily available. As Awokuse (2006) argues, as more data becomes available, the trend to study only one country using time-series data has increased. We believe that a smaller economy such as Nepal may have a higher reliance on foreign trade for its economic development. Nepal has been experiencing increasingly rapid imports-led growth in recent decades; therefore, it is worth examining the impact of exports and imports on Nepal’s economic growth jointly. Consequently, we believe Nepal is an ideal example of testing hypotheses for exports-led growth (ELG), growth-led exports (GLE), imports-led growth (ILG), and growth-led imports (GLI).

Nepal adopted liberalized economic policies, including privatization, liberalization of markets, and trade liberalization, starting around the mid-1980s. It gained momentum with the introduction of democracy in 1990. Nepal initiated a trade liberalization process on a unilateral and regional basis in the early 1990s (Gilbert 2008; Sapkota and Cockburn 2008) by introducing tariff reduction, duty drawbacks, and import licensing ease (Acharya et al. 2012). Nepal’s participation in the WTO since 23 April 2004 has further led to the creation of a new international trading system aiming to liberalize its market through further reduction of tariff and non-tariff barriers. The imbalance between exports and imports has widened rapidly, especially after 2005, abolishing Nepal’s quota system. Therefore, it is very relevant to analyze the impact of trade, specifically exports and imports, on Nepal’s economic development. Nepal provides an excellent example of an empirical study on exports, imports, and economic growth because of its significant dependence on imports.

The paper’s main objective is to empirically investigate the ELG, GLE, ILG, and GLI hypotheses using time-series data from Nepal. Therefore, motivated by the disparity in exports and imports growth and unbalanced rapid growth of imports in Nepal, this paper investigates the causality among exports, imports, capital, and economic growth using the time-series data from 1965 to 2020. Using the vector error correction model (VECM), we test the dynamic relationship among economic growth, exports, imports, and capital. The results do not favor the GLE and ELG hypotheses in both the short and long term. However, this study finds proof favoring the ILG in the short term and the GLI in the long term. Overall, this paper finds that foreign trade does not support the economic growth of Nepal in the long run.

This paper contributes to the existing literature in many ways. First, this study focuses on a small country experiencing rapid imports growth, employing the traditional neoclassical growth model by estimating the impact of both exports and imports on economic growth. Second, this study uses total merchandise imports, whereas most previous studies use total imports of goods and services in their analysis. As Islam (1998) points out, the imports of intermediate goods are more relevant to a country’s economic growth. Moreover, as Xu (1998) notes, empirical results using causality are sensitive to unit roots and lag. Therefore, we use the widely used methodology by specifying a causal model based on a vector error correction model. Finally, this study examines short-term and long-term dynamic relations among the relevant variables within an error-correction framework.

The remainder of this paper’s organization is as follows: Section 2 describes the role of exports and imports in the Nepalese economy and presents a review of past empirical research. A brief description of the data and the variables used in the study and research design are presented in Section 3. Section 4 contains the empirical results, and their interpretations, while the last part, Section 5, sums up the discussion with concluding remarks and policy implications.

2. Background and Literature Review

2.1. Background

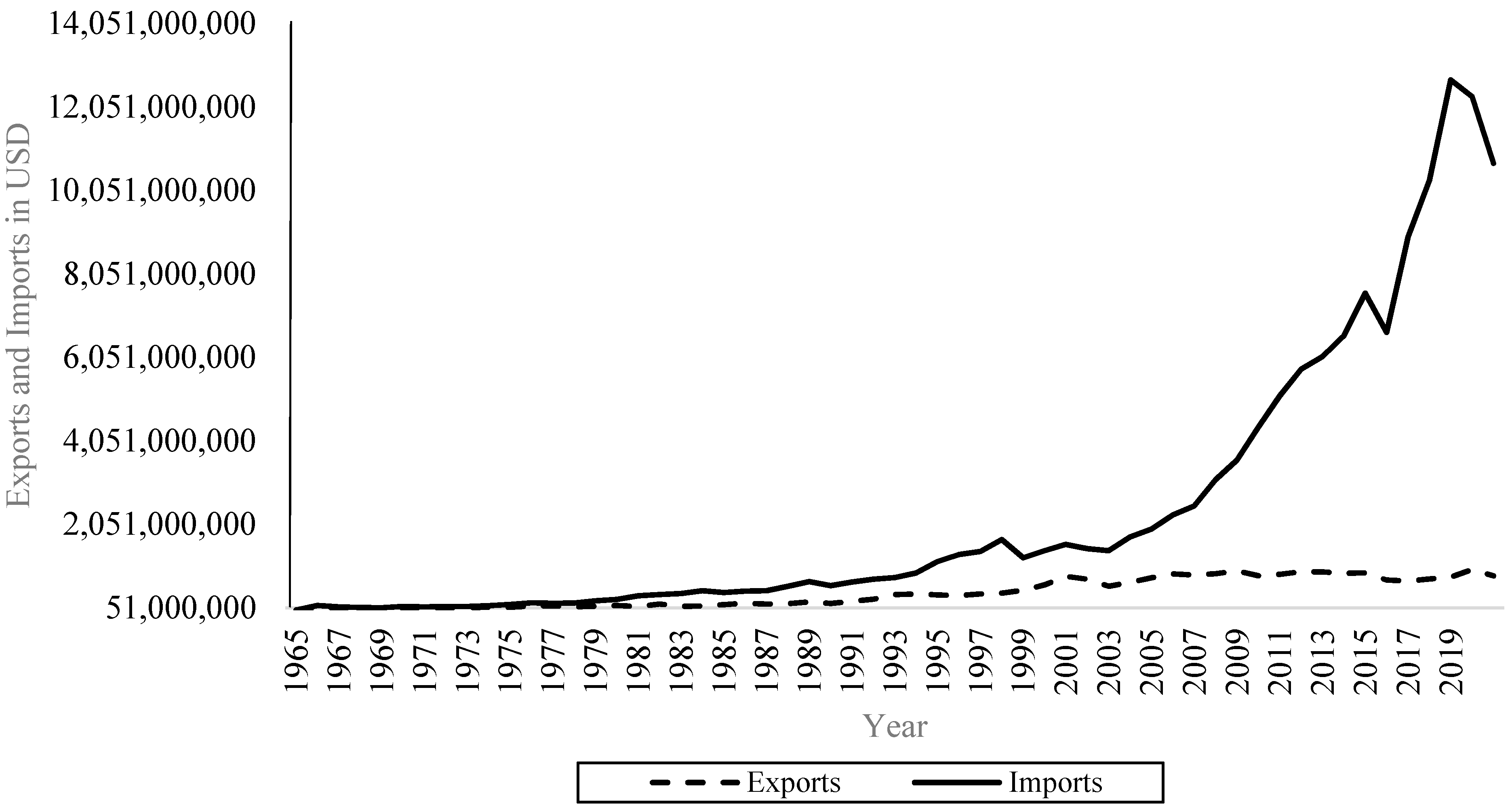

Nepal’s foreign trade has been dominated mainly by imports in recent decades. Figure 1 presents Nepal’s exports and imports graphically from 1965 to 2020. A close-up analysis of the Figure 1 shows that the imbalance between exports and imports in Nepal was minimal until 1990. However, the imbalance between exports and imports started widening after 1980, and the trade imbalance started expanding extensively after 1994. Nepal’s imbalance between exports and imports further widened after Nepal joined the WTO in 2004. In the past two decades, exports of Nepal have been stagnant or decreased, whereas imports growth has exploded in an unsustainable manner.

Figure 1.

Exports and imports of Nepal. This figure depicts exports and imports of Nepal from 1965 to 2020. The solid and dashed lines represent exports and imports, respectively. This graph is generated using data available through the World Bank.

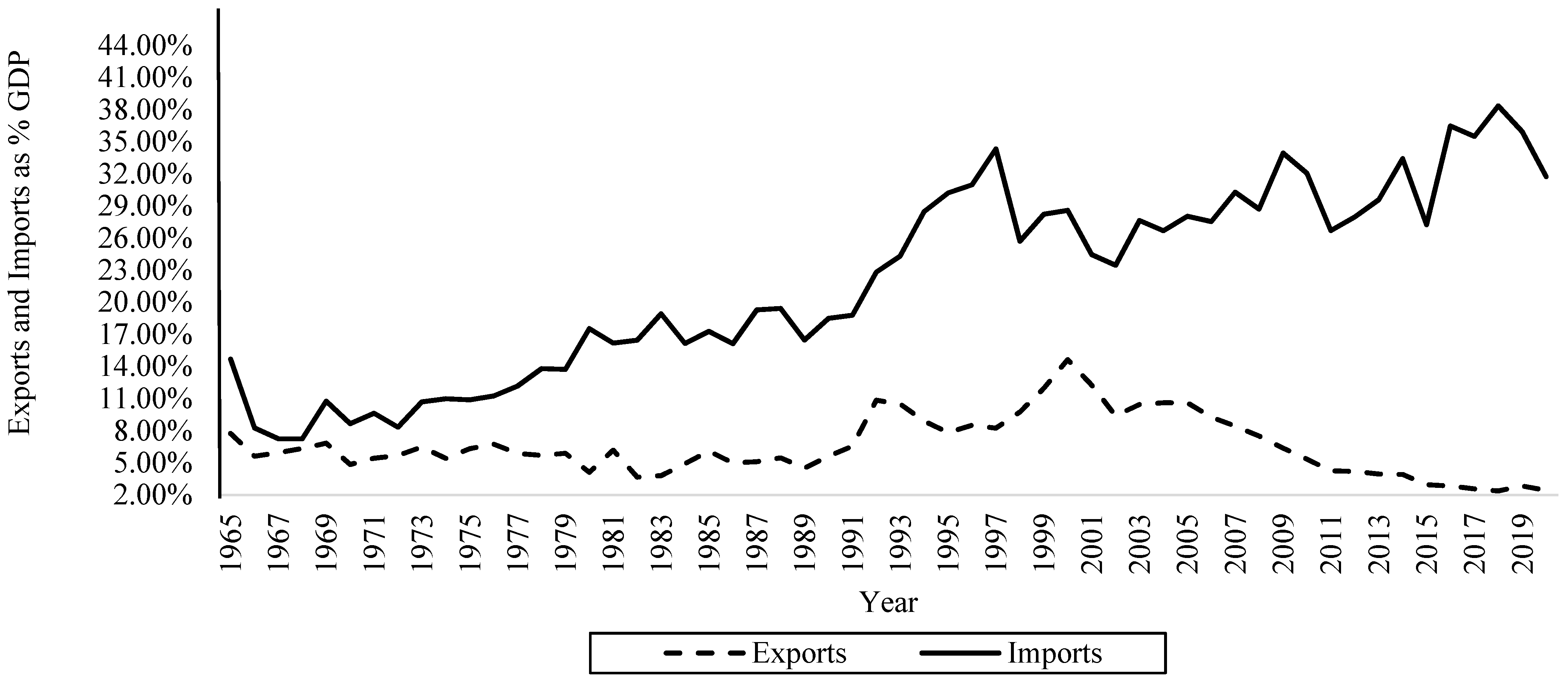

Nepal adopted an economic liberalization policy in the mid-1980s, which accelerated in the early 1990s immediately after the advent of democracy in 1990. With the advent of economic liberalization, Nepal privatized several government-owned enterprises. As Nepal implemented economic liberalization policies, the gap between exports and imports as a GDP ratio in the Nepalese economy started widening rapidly. The uptrend in imports continued even after adopting the liberalization policy. However, as shown in Figure 2, the contribution of exports to GDP started decreasing rapidly since the year 2000. As a result, the gap between exports and imports has become widespread, leading to Nepal’s large trade deficit.

Figure 2.

Percentage of exports and imports to GDP. This figure presents Nepal’s exports and imports as a percentage of GDP from 1965 to 2020. The solid and dashed lines represent exports and imports, respectively. This graph is generated using data available through the World Bank.

Figure 2 presents exports and imports as a percentage of the GDP from 1965 to 2020 in Nepal. The ratio of imports to GDP has continuously increased during the analysis period. However, the proportion of exports to GDP has exhibited a downward trend since 2000. During the analysis period, exports’ cumulative annual growth rate was 5.26%, compared to 9.24% of imports’ cumulative annual growth rate. The ratio of exports and imports to Nepal’s GDP was 6.11% and 17.29%, respectively, in 1985. The ratio of exports to GDP increased to 10.85% in 1992, whereas imports to GDP increased to 22.82%. The Figure 2 shows that the contribution of exports to GDP increased moderately during 1990 and 2000. The contribution of exports to Nepal’s GDP reached 14.64% in 2000, which was the highest contribution ever. Although the ratio of exports to GDP increased from 1990 to 2000, the gap between exports to GDP and the imports to GDP ratio started widening rapidly after 1992. Therefore, the trade liberalization policy initially seemed to be a primary source contributing to Nepal’s exports growth. After 2000, the contribution of exports to Nepal’s GDP started decreasing steadily, whereas the contribution of imports began increasing rapidly. In 2020, the contribution of exports to Nepal’s GDP was only 2.43%, whereas the contribution of imports was 31.75%. Indeed, the contribution of exports to the Nepalese economy in 2020 (2.43%) was less than its contribution in 1965 (7.76%). If the current trend continues, Nepal will be entirely reliant on imports soon. Therefore, given Nepal’s foreign trade statistics, Nepal is a great candidate for empirical analysis of the ELG, GLE, ILG, and GLI hypotheses.

2.2. Literature Review

The relation between trade and economic growth has been examined extensively using theoretical as well as empirical frameworks. Prior research has documented that open economies grow faster than closed economies (Edwards 1998; Rani and Kumar 2016). Financial openness is often associated with higher economic growth (Bekaert et al. 2011; Quinn and Toyoda 2008). Thus, trade stimulates economic growth (Awokuse 2007) through increased domestic output due to increased efficiency, better resource allocation, capacity utilization, and increased foreign currency reserve. Using data from Organization of the Petroleum Exporting Countries (OPEC) and middle-income economies, Tyler (1981) concluded that growth in manufacturing exports leads to technological advances, which increases absorptive capacity that results in economic development. Using Japanese, Korean, Turkish, and Yugoslavian data, Nishimizu and Robinson (1984) found that growth in exports raises total factor productivity by increasing completeness and economies of scale, while imports growth impedes growth in total factor productivity. A thriving export benefits a country through efficient resource allocation, higher capacity utilization, economies of scale, and increased technological innovation (Helpman and Krugman 1987). The literature on trade and economic growth can be organized into four main categories, namely, exports-led growth (ELG), growth-led exports (GLE), imports-led growth (ILG), and growth-led imports (GLI) hypotheses.

Most empirical research explores exports’ role in economic growth, also known as the export-led growth hypothesis. The ELG hypothesis is a development strategy that aims to grow productive capacity by focusing on foreign exports. The ELG hypothesis entails adopting policies to promote exports and acquire foreign currency reserves to import high-tech goods and services to achieve economic growth. Exports are likely to drive economic growth through increasing skilled labor and technology in the domestic market (Bhagwati 1988). Therefore, exports are viewed as a tool for economies of scale that lead to improved efficiencies and productivity in the long run.

Prior research on exports-led growth includes countries that are developed (Awokuse 2006; Jin and Yu 1996; Kónya 2006; Shan and Sun 1999); newly industrialized Asian (Awokuse 2005; Dhawan and Biswal 1999; Ghatak et al. 1997; Khalafalla and Webb 2001; Kwan et al. 1999; Siliverstovs and Herzer 2006); central and eastern European (Hagemejer and Mućk 2019); South American (Siliverstovs and Herzer 2006; Arteaga et al. 2020) including Mexico (Thornton 1996); African (Ahmad and Kwan 1991; Foster 2006); gulf (Al-Yousif 1997); and developing (Balassa 1978; Kavoussi 1984; Love and Chandra 2005; Vohra 2001). Thus, exports-led economic growth research is not only confined to developing economies but all countries. Similarly, the role of trade and economic growth is an ongoing research topic.

Several researchers have found evidence in support of the ELG hypothesis. For instance, Balassa (1978) examined the relationship between exports and economic growth using data from 11 developing countries and found further evidence supporting the ELG hypothesis. Fajana (1979) documented exports as an important engine of economic growth in Nigeria. Onafowora et al. (1996) found evidence supporting the ELG for Kenya, Pakistan, Sri Lanka, Cameroon, Ivory Coast, Ghana, Madagascar, and Senegal from 1960 to 1991. Using data from Saudi Arabia, Kuwait, UAE, and Oman from 1973 to 1993, Al-Yousif (1997) found a positive and significant association between exports and economic growth. Using the bound testing approach for 44 countries, Bahmani-Oskooee and Oyolola (2007) found evidence supporting the ELG hypothesis in 60% of the countries included in the analysis. Using data from Sri Lanka, Islam (1998) found results consistent with the ELG hypothesis. Narayan et al. (2007) found evidence supporting the ELG in the long run for Fiji; however, only for the short run for Papua New Guinea. Rani and Kumar (2018) documented the long-run relationship between exports, imports, gross capital formation, and economic growth. Hagemejer and Mućk (2019) found that exports significantly improved economic development in Central and Eastern Europe from 1995 to 2014. In recent research, Arteaga et al. (2020) examined the relationship between exports to China and economic growth in Latin America. They found that exports to China enhanced economic growth in South American countries.

However, several studies documented mixed, weak, or no support for the ELG hypothesis. For instance, Jung and Marshall (1985) found weak support for the ELG hypothesis using the Granger causality test in 37 developing countries. They performed causality tests between exports and growth for 37 developing countries and shed substantial doubt on the legitimacy of the ELG hypothesis. Darrat (1986) found no relationship between exports and economic development for Hong Kong, South Korea, Singapore, and Taiwan. Similarly, Oxley (1993) did not find evidence supporting ELG in Portugal’s case. Dreger and Herzer (2013) found weak evidence for the ELG hypothesis. Khemka et al. (2017) found no support in favor of the ELG hypothesis. In contrast to Hye et al. (2013), in a recent study that excluded imports, Devkota and Panta (2019) found no evidence supporting the ELG hypothesis in Nepal.

Using data from 15 Asian countries between 1976 to 1991, Islam (1998) found cointegration between exports and growth only in 5 countries. Using Chinese data from 1979 to 2001, Mah (2005) found bidirectional causality between exports expansion and economic development. Awokuse (2007) found empirical evidence consistent with both the ELG and GLE hypotheses for Bulgaria. However, he found evidence supporting both the ELG and ILG hypotheses for the Czech Republic, and the results were consistent with the ILG hypothesis for Poland. Hye and Boubaker (2011) found evidence for both exports-led growth and imports-led growth for Tunisia. Zang and Baimbridge (2012) found evidence consistent with the ELG hypothesis in the case of Japan but a negative effect of economic growth on exports growth for South Korea. Using Latin American data, Kristjanpoller and Olson (2014) documented evidence supporting the ELG hypothesis for eight countries and evidence consistent with the ILG hypothesis for five countries. They found evidence supporting both the ELG and ILG hypotheses for one country but failed to find evidence supporting both the ELG and ILG for another country. Therefore, they argued that, in theory, ELG and ILG might not exist simultaneously in a country.

The growth-led exports hypothesis suggests that economic growth is a significant driver of exports growth. Ahmad and Harnhirun (1995) found the GLE hypothesis right for Malaysia, Philippines, Indonesia, and Singapore using data from 1967 through 1988. Arnade and Vasavada (1995) also found a similar conclusion for South Korea, Taiwan, North Korea, and Malaysia using the data from 1961 through 1987. Reppas and Christopoulos (2005) examined the relationship between exports and output growth for 22 less-developed Asian and African countries using data from 1969 to 1999. Their findings supported the GLE hypothesis but not the ELG.

The imports-led growth hypothesis suggests that imports are essential sources of economic growth. The imports-led growth hypothesis shows that imports can be a channel for long-run economic growth. Imports are likely to boost long-run economic growth through access to intermediate factors and foreign technology to domestic firms (Coe and Helpman 1995) and transfer of growth-enhancing R&D knowledge from developed to developing countries (Lawrence and Weinstein 1999; Mazumdar 2001). There was a significant shift in exports-led growth in the 1970s, and thus a new paradigm of imports-led growth became popular in economic literature.

Hanson (1982) was the leading proponent of the imports-led growth hypothesis. According to Hanson (1982), imports of capital goods and infrastructure development result in economic growth. There is extensive literature on the imports-led growth hypothesis as well. Hye et al. (2013) examined ELG, GLE, ILG, and GLI hypotheses for six South Asian economies except for the Maldives. They showed that the ELG hypothesis is relevant for all countries except Pakistan, and the ILG hypothesis is appropriate for all six South Asian countries. Hye et al. (2013) also documented that the GLE hypothesis is applicable for all countries except Bangladesh and Nepal, while the GLI model is relevant for all the nations. Kristjanpoller and Olson (2014) documented mixed results on the ELG and ILG using Latin American countries’ data. They concluded that, in theory, both the ELG and ILG do not exist simultaneously. Mishra et al. (2010), using Pacific Island nations, found results consistent with the ILG hypothesis. They found bidirectional causality between imports and economic growth.

Awokuse (2007) studied the impact of the expansion of exports and imports on the economic growth of three transition economies, namely Bulgaria, the Czech Republic, and Poland, and documented that trade stimulates economic growth. He found a bidirectional causal relationship between exports and growth in Bulgaria and causality from imports to economic growth in the Czech Republic and Poland. Awokuse (2008) found mixed results for the ELG, ILG, and GLE hypotheses in the case of Argentina, Colombia, and Peru. Mahadevan and Suardi (2008) found no evidence of cointegrating relations among South Korea’s economic growth and trade but found evidence supporting the ILG hypothesis for Japan. Narayan et al. (2007) found results consistent with the ELG and ILG for Fiji, but found exports and GDP cause imports in Papua New Guinea.

To conclude, prior research findings on ELG, GLE, ILG, and GLI are inconclusive. For instance, using Italian data from 1863 to 1913, Pistoresi and Rinaldi (2012) found strong evidence for ILG and GLE. However, they documented weak support for ELG and GLI for the period of 1951 to 2004. They also found weak support for ELG and GLI for Italy’s post World War II period. The empirical results on the relationship between exports and economic growth may be misleading (Awokuse 2008; Esfahani 1991; Riezman et al. 1996; Thangavelu and Rajaguru 2004) and may present spurious test results if we do not include imports on the model. For example, Riezman et al. (1996) examined the ELG hypothesis using 126 developing countries’ data and found spurious test results when imports were not included in the analysis. Therefore, while exploring the impact of trade on Nepal’s economic growth, this research includes both exports and imports, including the capital, in our empirical analysis.

3. Data and Methodology

3.1. Data

This study is based on yearly time-series data for Nepal from 1965 to 2020. The data were obtained from the World Development indicators 2020 (World Bank 2021). Following Hye et al. (2013) and Awokuse (2007), this article defines the gross domestic product as a proxy for economic growth (G), merchandise exports (X), and merchandise imports (M) as explanatory variables. Introducing additional variables in the equation may turn the estimated coefficient of economic growth previously significant to insignificant (Dodaro 1993). Therefore, this study also includes gross capital formation as a proxy for capital (C) in our analysis to ensure that our results are not driven by omitted variable bias. All the variables are converted to real value using the GDP deflator. Following prior literature (Bahmani-Oskooee and Economidou 2009; Hye et al. 2013), all variables used in this study are transformed into natural logarithmic scales before the empirical analysis.

3.2. Methodology

Following prior studies (e.g., Awokuse 2007; Hye et al. 2013), this study hypothesizes that trade plays a vital role in the economic growth of a country. Therefore, the ELG, GLE, ILG, and GLE hypotheses are tested in the case of Nepal. We expect that both exports and imports are vital in Nepal’s economic growth. Particularly, this research hypothesizes that ELG and ILG are valid for Nepal in both the short and long terms.

To investigate the relationship between our variables of interest, we first tested each variable’s stationarity. This research conducted the Augmented Dickey-Fuller (Dickey and Fuller 1979) and Phillip–Perron (Phillips and Perron 1988) unit root tests to test the stationarity of the variables of interest. After establishing each variable’s stationarity, we determined the lag lengths of the vector autoregressive system. Next, we employed Johansen (1988, 1991, 1992) and Johansen and Juselius’s (1990) maximum likelihood cointegration technique to test the long-run equilibrium relationship among the GDP, exports, imports, and capital. This technique determines the number of cointegrating vectors and is based on Granger (1981) ECM representation. Finally, we determined the direction of both long- and short-run Granger causality among our variables of interest. The VECM is useful to detect the short- and long-term Granger causality when the variables are cointegrated (Ratanapakorn and Sharma 2007). Therefore, we estimated the following VECM model for each of the variables of interest to find the short and long-term Granger casualty:

where ETCt−1 is the error correction term obtained from the cointegrating vector, γ, δ, and ω are the parameters to be estimated, n is the lag length, ε is the error term. The error terms are assumed to be a stationary random process with zero mean and constant variance. Similarly, the models for X terms can be rewritten as shown in Equation (1).

4. Empirical Results

4.1. Unit Root Tests

First, this study examines the time-series properties of the data using the Augmented Dickey-Fuller (Dickey and Fuller 1979) and Phillip–Perron (Phillips and Perron 1988) unit root tests. Both unit root test techniques test the null hypothesis of non-stationarity in the data. Table 1 presents the results of the ADF and Phillip–Perron unit root tests for levels and the first differences. The results suggest that the variables are non-stationary in their levels but stationary in their first differences. In other words, the time series used for the study are integrated of order 1 or I(1). Therefore, the results imply the possibility of cointegrating relationships in our variables.

Table 1.

Unit Root Test Results.

4.2. The Johansen’s Multivariate Cointegration Test

Once we determined the order of integration, we explored the existence of a long-run relationship between the series. Based on final prediction error (FPE), Akaike’s information criteria (AIC), Hannan–Quinn information criterion (HQC), and the Schwarz information criterion (SBIC), we determined the lag length of one. Using a lag length of one, we employed the Johansen (Søren Johansen 1988, 1991; 1988; Søren Johansen and Juselius 1990) maximum likelihood cointegration technique to test the short- and long-run equilibrium relationship between exports, imports, capital, and the GDP.

Table 2 provides the results for the Johansen cointegration test using an optimal lag length of one. Results from both the -trace and -max tests indicate that the variables in the system are cointegrated. As shown in Table 2, both -Trace (64.97 > 61.21) and -Max (46.46 > 35.68) statistics are statistically significant at a 1% significance level. Thus, this research found that both the test statistics identify one cointegrating relationship between the GDP, capital, exports, and imports.

Table 2.

Johansen Cointegration Test Results.

4.3. Vector Error Correction Model (VECM) and Causality

The Vector Error Correction Model (VECM) is useful for detecting the short- and long-run Granger causality when variables are cointegrated (Ratanapakorn and Sharma 2007). The VECM also distinguishes between the short- and long-term Granger causality as it captures both short-run dynamics between time series and long-run equilibrium relationships (Masih and Masih 1996). The lagged error correction term(s) in the VECM captures the long-term cointegrating relationship(s). In contrast, the joint significance of the differenced explanatory variables’ coefficients capture the short-run Granger causality.

Using Equation (1), we tested the long-run causality through the statistical significance of each of the error correction terms (ECT) using t-tests and the short-run Granger causality through the significance of the lags of each explanatory variable using Wald χ2 tests. A variable Xt is said to cause another variable Yt in the Granger sense if the one step ahead forecast of Yt in the regression model improves the quality of the model and or forecasts by considering the historical values of Xt (Osińska 2011). Table 3 presents the results for both the long-run and short-run Granger causalities quantitatively in Panel A and qualitatively in Panel B.

Table 3.

VECM and Granger Causality Test Results.

Considering the GDP equation in Panel A of Table 3, statistically significant Wald test statistic (χ2 test statistic = 7.73, p-value < 0.01) for ∆M indicate that imports Granger cause the GDP in the short run. However, statistically insignificant Wald χ2 test statistics for ∆X and ∆C suggest that exports and capital do not Granger cause the GDP in the short term. Similarly, the statistically insignificant t-statistic of the ETC indicates that, in the long term, none of the variables Granger cause the economic growth. Considering the exports equation, statistically insignificant t-statistics for the ETC and Wald χ2 test statistics for GDP, imports, and capital suggest that none of the variables Granger cause exports in both short and long term.

Considering the imports equation in Panel A of Table 3, a statistically significant Wald χ2 test statistic (χ2 test statistic = 3.34, p-value < 0.10) for exports but insignificant test statistics for GDP and capital indicate that only exports Granger cause imports, but the GDP and capital do not Granger cause imports in the short term. The results show that the -statistic of the ETC corresponding to the target variable, ∆M, is positive (t-stat = 15.86, p-value < 0.01) and statistically significant at a 1% level of significance. Therefore, we concluded that there are long-run Granger causalities from ∆G, ∆X, ∆C to ∆M. Turning to the capital equation, we found imports (χ2 test statistic = 11.33, p-value < 0.01) Granger cause the capital in the short run, but the GDP and exports do not Granger cause the capital in the long term.

The qualitative summary of the test results is presented in Panel B of Table 3. The results of short- and long-run Granger causality tests suggest one bidirectional (feedback) relationship between imports and GDP. Thus, the causal relationship runs from the GDP to imports in the long run and imports to GDP in the short and long run. Therefore, the VECM test results support the GLI hypothesis in the long run and the ILG hypothesis in the short run in the case of Nepal, which is consistent with Hye et al. (2013). However, we did not find evidence in favor of the ILG hypothesis in the long run, whereas Hye et al. (2013) found evidence consistent with the ILG hypothesis in the long run. We also tested the long- and short-term relationship between exports and economic growth. However, the test results showed no evidence favoring the ELG and GLE hypotheses in both the short and long run. In contrast, using the ARDL approach, Hye et al. (2013) found results consistent with the ELG and GLE hypotheses in the long term but not in the short term for Nepal.

This research also used the GDP per capita as the measure of economic growth to test the robustness of the analysis. The untabulated test results were still consistent with our main findings. In a nutshell, the empirical findings suggest that excluding imports in the previous studies that document exports as an engine of growth may be misleading in the context of heavily import-dependent countries such as Nepal. Imports represent most of Nepal’s foreign trade. Therefore, testing the GLE, ELG, GLI, and ILG hypotheses using Nepal’s data may shed light on the role of foreign trade, mainly imports for a small, heavily imports-dependent country such as Nepal.

The test results are robust. The LM tests for residual autocorrelation indicate that our VECM model is free from autocorrelation. The Jarque–Bera test was conducted to test the normality of residuals. The untabulated test results indicate that the residuals are normally distributed in all models. The stability test for the model also did not find any issue with the model. Therefore, our test results are robust.

5. Conclusions

This research employs widely used econometric methodologies such as the ADF and Phillip–Perron unit root tests, Johansen’s cointegration test, and the VECM to test the ELG, GLE, ILG, and GLI hypotheses using Nepal’s data from 1965 to 2020. The ADF and Phillip–Perron unit test results suggest that the time-series data for the GDP, capital, exports, and imports are nonstationary at their levels but stationary at their first differences. Johansen’s cointegration test results show a cointegrating relationship between Nepal’s GDP, exports, imports, and capital.

This paper documents no evidence supporting the ELG and GLE hypotheses in both short and long terms, contrary to previous research findings of Hye et al. (2013). The research also documents the causality from growth to imports in the long term but not in the short term, supporting the GLI hypothesis in the long term. Similarly, this study also finds causality running from imports to growth in the short term but not in the long term, supporting only the ILG hypothesis in the short run. Overall, our findings do not support the notion of trade-led growth in the long run for Nepal, whereas prior studies using a different sample found that imports play as much of a role as exports in stimulating economic growth (e.g., Awokuse 2007). The paper contributes to the literature by using a nonclassical growth framework and multivariable VECM approaches to explore the role of exports and imports in economic growth in a country where imports are substantial relative to exports. The paper also contributes to the literature by documenting that the ELG and GLE hypotheses may not be applicable in a country where the contribution of exports to the GDP is minimal, and the imbalance between exports and imports is extensive.

Our study results may have important implications for national policymakers to design macroeconomic and trade policies to establish a long-run equilibrium between exports and imports. The research results indicate an indispensable need to implement a short- and long-term strategy to address the problems of foreign trade in Nepal. A long-term equilibrium can be sustained between exports and imports by carefully analyzing trade and industry policies, including exports and imports policies, before implementing them. The government must prioritize diversifying exports to achieve economic growth through industrialization. The government should also develop imports substitution industries and promote industrial production. If the government implements policies to import capital goods and improve its production capacity, Nepal can enhance exports and reduce imports to improve the excessive trade imbalance.

This research has some limitations. Mainly, this study does not explore the GLE, ELG, ILG, and GLI hypotheses at a sectoral level. Similarly, this research is based on data from a single country. Therefore, future research could contribute to the existing literature on the role of trade on economic growth by investigating the role of trade using data from multiple countries with similar characteristics, including major economic sectors.

Author Contributions

Conceptualization, H.P.; methodology, H.P. and M.L.D.; software, H.P.; validation, H.P., M.L.D., and D.B.; formal analysis, H.P. and M.L.D.; investigation, H.P. and D.B.; resources, D.B.; data curation, H.P.; writing—original draft preparation, H.P.; writing—review and editing, H.P., M.L.D. and D.B.; visualization, H.P.; supervision, H.P.; project administration, H.P.; funding acquisition, H.P. All authors have read and agreed to the published version of the manuscript.

Funding

The authors do not obtain any internal and external funding to complete this project.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The authors primarily use World Development Indicators (WDI) data which is publicly available through the World Bank.

Acknowledgments

We would like to thank the anonymous referee for valuable comments and suggestions and Arpita Panta for reviewing the paper extensively and correcting errors. The views expressed herein belong to the authors. We did not receive any funding for this research. We also want to thank the editor for support during the paper revision process.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Acharya, Sanjaya, Hölscher Jens, and Cristiano Perugini. 2012. Trade liberalisation and inequalities in Nepal: A CGE analysis. Economic Modelling 29: 2543–57. [Google Scholar] [CrossRef]

- Ahmad, Jaleel, and Andy C. C. Kwan. 1991. Causality between exports and economic growth: Empirical evidence from Africa. Economics Letters 37: 243–48. [Google Scholar] [CrossRef]

- Ahmad, Jaleel, and Somchai Harnhirun. 1995. Unit roots and cointegration in estimating causality between exports and economic growth: Empirical evidence from the ASEAN countries. Economics Letters 49: 329–34. [Google Scholar] [CrossRef]

- Al-Yousif, Yousif Khalifa. 1997. Exports and economic growth: Some empirical evidence from the Arab Gulf countries. Applied Economics 29: 693–97. [Google Scholar] [CrossRef]

- Arnade, Carlos, and Utpal Vasavada. 1995. Causality Between Productivity and Exports in Agriculture: Evidence from Asia and Latin America. Journal of Agricultural Economics 46: 174–86. [Google Scholar] [CrossRef]

- Arteaga, Julio César, Mónica Liseth Cardozo, and Márcia Jucá T. Diniz. 2020. Exports to China and economic growth in Latin America, unequal effects within the region. International Economics 164: 1–17. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2005. Exports, Economic Growth and Causality in Korea. Applied Economics Letters 12: 693–96. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2006. Export-led growth and the Japanese economy: Evidence from VAR and directed acyclic graphs. Applied Economics 38: 593–602. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2007. Causality between exports, imports, and economic growth: Evidence from transition economies. Economics Letters 94: 389–95. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2008. Trade openness and economic growth: Is growth export-led or import-led? Applied Economics 40: 161–73. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Claire Economidou. 2009. Export Led Growth vs. Growth Led Exports: LDCs Experience. The Journal of Developing Areas 42: 179–212. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Maharouf Oyolola. 2007. Export growth and output growth: An application of bounds testing approach. Journal of Economics and Finance 31: 1–11. [Google Scholar] [CrossRef]

- Balassa, Bela. 1978. Exports and economic growth: Further evidence. Journal of Development Economics 5: 181–89. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2011. Financial Openness and Productivity. World Development 39: 1–19. [Google Scholar] [CrossRef] [Green Version]

- Bhagwati, Jagdish N. 1988. Protectionism. Cambridge: The MIT Press. [Google Scholar]

- Coe, David T., and Elhanan Helpman. 1995. International R&D spillovers. European Economic Review 39: 859–87. [Google Scholar]

- Darrat, Ali F. 1986. Trade and Development: The Asian Experience. Cato Journal 6: 695–99. [Google Scholar]

- Devkota, Mitra Lal, and Humnath Panta. 2019. Are Exports, Imports, and Exchange Rates Cointegrated? Empirical Evidence from Nepal. International Journal of Economics and Financial Issues 9: 273–76. [Google Scholar] [CrossRef]

- Dhawan, Urvashi, and Bagala Biswal. 1999. Re-examining Export-Led Growth Hypothesis: A Multivariate Cointegration Analysis for India. Applied Economics 31: 525–30. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dodaro, Santo. 1993. Exports and Growth: A Reconsideration of Causality. The Journal of Developing Areas 27: 227–44. [Google Scholar]

- Dreger, Christian, and Dierk Herzer. 2013. A further examination of the export-led growth hypothesis. Empirical Economics 45: 39–60. [Google Scholar] [CrossRef] [Green Version]

- Edwards, Sebastian. 1998. Openness, Productivity and Growth: What Do We Really Know? The Economic Journal 108: 383–98. [Google Scholar] [CrossRef] [Green Version]

- Esfahani, Hadi Salehi. 1991. Exports, imports, and economic growth in semi-industrialized countries. Journal of Development Economics 35: 93–116. [Google Scholar] [CrossRef] [Green Version]

- Fajana, Olufemi. 1979. Trade and growth: The Nigerian experience. World Development 7: 73–78. [Google Scholar] [CrossRef]

- Foster, Neil. 2006. Exports, Growth and Threshold Effects in Africa. Journal of Development Studies 42: 1056–74. [Google Scholar] [CrossRef]

- Ghatak, Subrata, Chris Milner, and Utku Utkulu. 1997. Exports, Export Composition and Growth: Cointegration and Causality Evidence for Malaysia. Applied Economics 29: 213–23. [Google Scholar] [CrossRef]

- Gilbert, John. 2008. Agricultural trade reform and poverty in the Asia-Pacific region: A survey and some new results. Asia-Pacific Development Journal 15: 1–34. [Google Scholar]

- Granger, Clive W. J. 1981. Some properties of time series data and their use in econometric model specification. Journal of Econometrics 16: 121–30. [Google Scholar] [CrossRef]

- Hagemejer, Jan, and Jakub Mućk. 2019. Export-led growth and its determinants: Evidence from Central and Eastern European countries. The World Economy 42: 1994–2025. [Google Scholar] [CrossRef]

- Hanson, Philip. 1982. The end of import-led growth? Some observations on Soviet, Polish, and Hungarian experience in the 1970s. Journal of Comparative Economics 6: 130–47. [Google Scholar] [CrossRef]

- Helpman, Elhanan, and Paul R. Krugman. 1987. Market Structure and Foreign Trade. Reprint ed. Cambridge: The MIT Press. [Google Scholar]

- Hye, Qazi Muhammad Adnan, and Houda Ben Haj Boubaker. 2011. Exports, Imports and Economic Growth: An Empirical Analysis of Tunisia. IUP Journal of Monetary Economics 9: 6–21. [Google Scholar]

- Hye, Qazi Muhammad Adnan, Shahida Wizarat, and Wee-Yeap Lau. 2013. Trade-led growth hypothesis: An empirical analysis of South Asian countries. Economic Modelling 35: 654–60. [Google Scholar] [CrossRef]

- Islam, Muhammed N. 1998. Export expansion and economic growth: Testing for cointegration and causality. Applied Economics 30: 415–25. [Google Scholar] [CrossRef]

- Jin, Jang C., and Eden S. H. Yu. 1996. Export-Led Growth and the US Economy: Another Look. Applied Economics Letters 3: 341–44. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Johansen, Søren. 1991. Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 59: 1551–80. [Google Scholar] [CrossRef]

- Johansen, Søren. 1992. Determination of Cointegration Rank in the Presence of a Linear Trend. Oxford Bulletin of Economics and Statistics 54: 383–397. [Google Scholar] [CrossRef]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on Cointegration—With Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Jung, Woo S., and Peyton J. Marshall. 1985. Exports, growth and causality in developing countries. Journal of Development Economics 18: 1–12. [Google Scholar] [CrossRef]

- Kavoussi, Rostam M. 1984. Export expansion and economic growth: Further empirical evidence. Journal of Development Economics 14: 241–50. [Google Scholar] [CrossRef]

- Khalafalla, Khalid Yousif, and Alan J. Webb. 2001. Export-Led Growth and Structural Change: Evidence from Malaysia. Applied Economics 33: 1703–15. [Google Scholar] [CrossRef]

- Khemka, Abhinav, Temesgen Kifle, and Bryan Morgan. 2017. Export-Led Growth in India: A Bounds Testing Approach. The Journal of Developing Areas 52: 1–14. [Google Scholar] [CrossRef]

- Kónya, László. 2006. Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Economic Modelling 23: 978–92. [Google Scholar] [CrossRef]

- Kristjanpoller, Werner, and Josephine E. Olson. 2014. Economic Growth in Latin American Countries: Is It Based on Export-Led or Import-Led Growth? Emerging Markets Finance and Trade 50: 6–20. [Google Scholar]

- Kwan, Andy C. C., John A. Cotsomitis, and Benjamin K. C. Kwok. 1999. Exports, Economic Growth and Structural Invariance: Evidence from Some Asian NICs. Applied Economics 31: 493–98. [Google Scholar] [CrossRef]

- Lawrence, Robert Z., and David Weinstein. 1999. Trade and Growth: Import-Led or Export-Led? Evidence from Japan and Korea. NBER Working Paper No. 7264. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Love, Jim, and Ramesh Chandra. 2005. Testing export-led growth in South Asia. Journal of Economic Studies 32: 132–45. [Google Scholar] [CrossRef]

- Mah, Jai S. 2005. Export expansion, economic growth and causality in China. Applied Economics Letters 12: 105–7. [Google Scholar] [CrossRef]

- Mahadevan, Renuka, and Sandy Suardi. 2008. A dynamic analysis of the impact of uncertainty on import- and/or export-led growth: The experience of Japan and the Asian Tigers. Japan and the World Economy 20: 155–74. [Google Scholar] [CrossRef]

- Masih, Abul M. M., and Rumi Masih. 1996. Empirical tests to discern the dynamic causal chain in macroeconomic activity: New evidence from Thailand and Malaysia based on a multivariate cointegration/vector error-correction modeling approach. Journal of Policy Modeling 18: 531–60. [Google Scholar] [CrossRef]

- Mazumdar, Joy. 2001. Imported machinery and growth in LDCs. Journal of Development Economics 65: 209–24. [Google Scholar] [CrossRef]

- Mishra, Vinod, Susan Sunila Sharma, and Russell Smyth. 2010. Is economic development in the Pacific island countries export led. Pacific Economic Bulletin 25: 46–63. [Google Scholar]

- MoF. 2019. Annual Foreign Trade Statistics. 207576 (201819). Kathmandu: Ministry of Finance, Department of Customs. [Google Scholar]

- Narayan, Paresh Kumar, Seema Narayan, Biman Chand Prasad, and Arti Prasad. 2007. Export-led growth hypothesis: Evidence from Papua New Guinea and Fiji. Journal of Economic Studies 34: 341–51. [Google Scholar] [CrossRef]

- Nishimizu, Mieko, and Sherman Robinson. 1984. Trade policies and productivity change in semi-industrialized countries. Journal of Development Economics 16: 177–206. [Google Scholar] [CrossRef]

- Onafowora, Olugbenga A., Oluwole Owoye, and Akorlie A. Nyatepe-Coo. 1996. Trade policy, export performance and economic growth: Evidence from sub-Saharan Africa. The Journal of International Trade and Economic Development 5: 341–60. [Google Scholar] [CrossRef]

- Osińska, Magdalena. 2011. On the Interpretation of Causality in Granger’s Sense. Dynamic Econometric Models 11: 129–40. [Google Scholar] [CrossRef]

- Oxley, Les. 1993. Cointegration, causality and export-led growth in Portugal, 1865–1985. Economics Letters 43: 163–66. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Pistoresi, Barbara, and Alberto Rinaldi. 2012. Exports, imports and growth: New evidence on Italy: 1863–2004. Explorations in Economic History 49: 241–54. [Google Scholar] [CrossRef]

- Quinn, Dennis P., and A. Maria Toyoda. 2008. Does Capital Account Liberalization Lead to Growth? The Review of Financial Studies 21: 1403–49. [Google Scholar] [CrossRef] [Green Version]

- Rahmaddi, Rudy, and Masaru Ichihashi. 2011. Exports and economic growth in Indonesia: A causality approach based on multi-variate error correction model. Journal of International Development and Cooperation 17: 53–73. [Google Scholar]

- Rani, Ritu, and Naresh Kumar. 2016. Does Fiscal Deficit Affect Interest Rate in India? An Empirical Investigation. Jindal Journal of Business Research 5: 87–103. [Google Scholar] [CrossRef]

- Rani, Ritu, and Naresh Kumar. 2018. Is There an Export- or Import-led Growth in BRICS Countries? An Empirical Investigation. Jindal Journal of Business Research 7: 13–23. [Google Scholar] [CrossRef] [Green Version]

- Ratanapakorn, Orawan, and Subhash C. Sharma. 2007. Dynamic analysis between the US stock returns and the macroeconomic variables. Applied Financial Economics 17: 369–77. [Google Scholar] [CrossRef]

- Reppas, Panayiotis A., and Dimitris K. Christopoulos. 2005. The export-output growth nexus: Evidence from African and Asian countries. Journal of Policy Modeling 27: 929–40. [Google Scholar] [CrossRef]

- Riezman, Raymond G., Charles H. Whiteman, and Peter M. Summers. 1996. The engine of growth or its handmaiden? Empirical Economics 21: 77–110. [Google Scholar] [CrossRef]

- Rodrik, Dani. 1999. The New Global Economy and Developing Countries: Making Openness Work. Washington, DC: Overseas Development Council, Policy Essay No. 24. Baltimore, The Johns Hopkins University Press, x-168p. [Google Scholar]

- Sapkota, Prakash Raj, and John Cockburn. 2008. Trade Liberalization and Poverty in Nepal: An Applied General Equilibrium Analysis. PEP Working Paper Series 2008-13. Available online: https://ssrn.com/abstract=3171512 (accessed on 9 December 2021).

- Shan, Jordan, and Fiona Sun. 1999. Export-led growth and the US economy: Some further testing. Applied Economics Letters 6: 169–72. [Google Scholar] [CrossRef]

- Siliverstovs, Boriss, and Dierk Herzer. 2006. Export-led growth hypothesis: Evidence for Chile. Applied Economics Letters 13: 319–24. [Google Scholar] [CrossRef]

- Smith, Adam. 1977. An Inquiry into the Nature and Causes of the Wealth of Nations. Edited by Edwin Cannan and George J. Stigler. Chicago: University of Chicago Press. [Google Scholar]

- Thangavelu, Shandre Mugan, and Gulasekaran Rajaguru. 2004. Is there an export or import-led productivity growth in rapidly developing Asian countries? A multivariate VAR analysis. Applied Economics 36: 1083–93. [Google Scholar] [CrossRef]

- Thornton, John. 1996. Cointegration, causality and export-led growth in Mexico, 1895–992. Economics Letters 50: 413–16. [Google Scholar] [CrossRef]

- Tyler, William G. 1981. Growth and export expansion in developing countries: Some empirical evidence. Journal of Development Economics 9: 121–30. [Google Scholar] [CrossRef]

- Vohra, Rubina. 2001. Export and economic growth: Further time series evidence from less-developed countries. International Advances in Economic Research 7: 345–50. [Google Scholar] [CrossRef]

- World Bank. 2021. World Development Indicators. Washington, DC: World Bank. [Google Scholar]

- Xu, Zhenhui. 1998. Export and Income Growth in Japan and Taiwan. Review of International Economics 6: 220–33. [Google Scholar] [CrossRef]

- Zang, Wenyu, and Mark Baimbridge. 2012. Exports, imports and economic growth in South Korea and Japan: A tale of two economies. Applied Economics 44: 361–72. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).