Predicting Volatility Based on Interval Regression Models

Abstract

1. Introduction

2. Literature Review

3. Model Specification

3.1. Interval Regression Models

3.1.1. Center and Range Method (CRM)

3.1.2. Parametrized Method

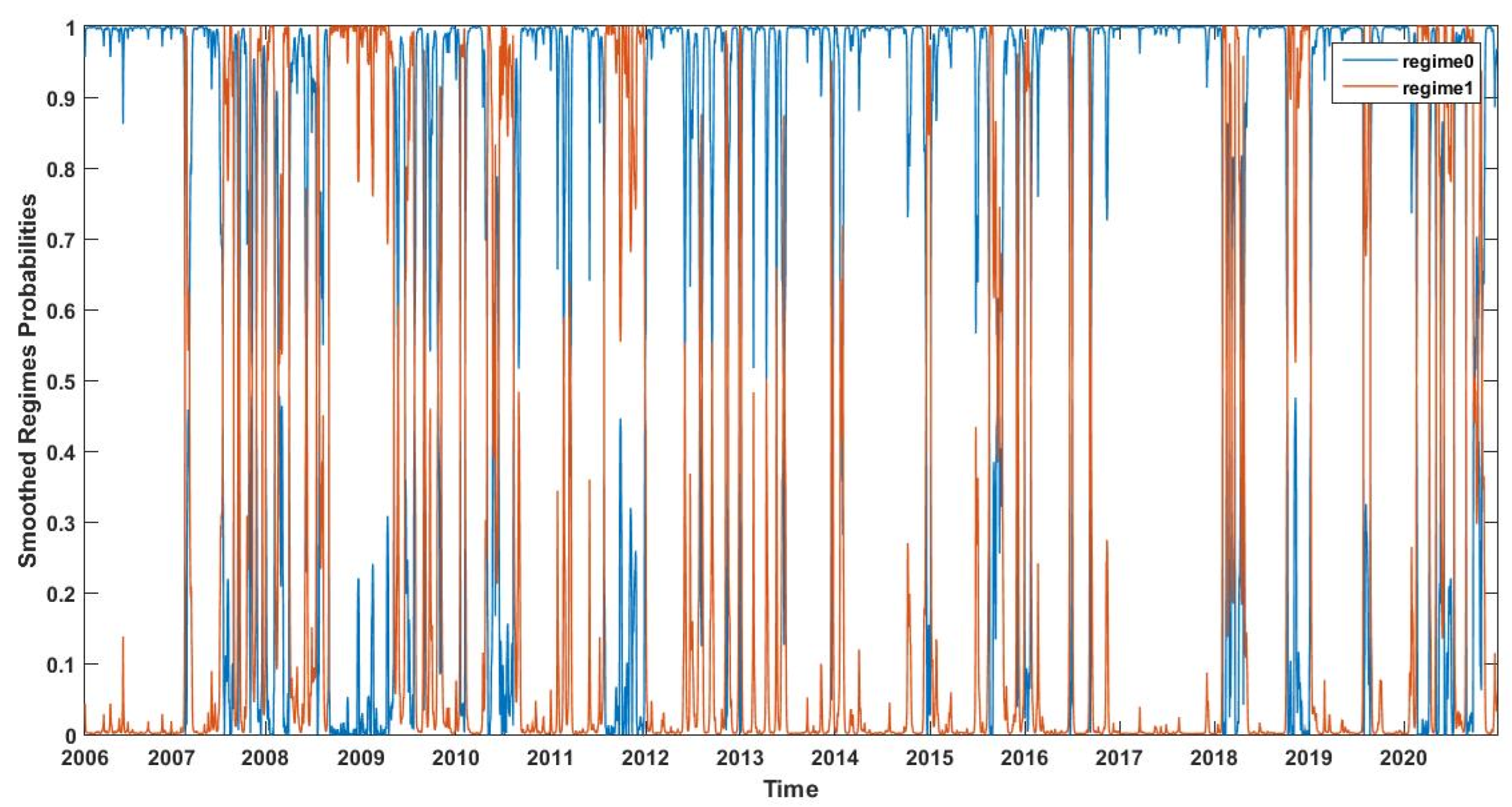

3.1.3. Interval Regression Models with Markov Regime Switching

3.2. ECARR Model

4. Data Description

5. In-Sample Results

5.1. In-Sample Fit

5.2. In-Sample Volatility Prediction

- (1)

- No matter which loss function is considered, all the eight interval regression models are marked with a “***”, which shows that these interval data-based models each provide significantly better in-sample volatility forecasts than the traditional point-data-based GARCH model.

- (2)

- No matter which loss function is considered, CRM-H, CRM-MRS, CRM-H-MRS, PM-H, PM-MRS, and PM-H-MRS are always marked with at least a “#”, which shows that these six models provide significantly better in-sample volatility forecasts than the range-based ECARR model. Considering the fact that the CRM class models and the ECARR model utilize similar range information and the basic CRM model is inferior to the ECARR model, we conclude that incorporating the HAR structure, the Markov regime switching structure, or both, can more effectively use the range information in terms of volatility forecasting.

- (3)

- No matter which loss function is considered, CRM-H, CRM-H-MRS, PM-H, and PM-H-MRS are always marked with a “†††”, which shows that these four models provide significantly better in-sample volatility forecasts than their short memory comparatives, thus further confirms the importance of characterizing the long memory property. This result validates the conclusion of Corsi (2009) and Andersen et al. (2007)—that the HAR framework is effective.

- (4)

- No matter which loss function is considered, CRM-MRS, CRM-H-MRS, PM-MRS, and PM-H-MRS are always marked with a “‡‡‡”, which shows that these models provide significantly better in-sample volatility forecasts than their linear comparatives, which further confirms the value of incorporating the Markov regime switching structure. This result is consistent with the results of Ma et al. (2017), Raggi and Bordignon (2012), and Shi and Ho (2015)—that incorporating Markov regime switching leads to fitting accuracy gains.

- (5)

- No matter which loss function is considered, the average losses of the PM class models are all smaller than those of the corresponding CRM class models. Besides, the best model is always the PM-H-MRS model, which indicates that the PM structure makes better use of interval information relative to the CRM structure. This result is reasonable, as Souza et al. (2017) points out that CRM is a particular case of PM.

6. Out-of-Sample Results

7. Discussion

8. Conclusions and Outlook

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| MAE | 0.6211 *** | 0.5583 ***‡‡‡ | 0.4745 ***###††† | 0.4491 ***###†††‡‡‡ | 0.6260 *** | 0.5611 ***‡‡‡ | 0.5079 ***###††† | 0.4676 ***###†††‡‡‡ | 0.8569 | 0.5542 |

| MSE | 3.8894 *** | 3.9087 *** | 2.9392 ***###††† | 2.7847 ***###†††‡‡‡ | 3.9976 *** | 3.9960 ***‡ | 3.3186 ***###††† | 3.1888 ***###†††‡‡‡ | 4.8845 | 3.9152 |

| MAEln | 0.6403 *** | 0.5485 ***‡‡‡ | 0.4401 ***###††† | 0.4050 ***###†††‡‡‡ | 0.6461 *** | 0.5576 ***‡‡‡ | 0.4694 ***###††† | 0.4275 ***###†††‡‡‡ | 0.8282 | 0.5386 |

| MSEln | 0.6361 *** | 0.4728 ***‡‡‡ | 0.3141 ***###††† | 0.2619 ***###†††‡‡‡ | 0.6474 *** | 0.4857 ***‡‡‡ | 0.3514 ***###††† | 0.2886 ***###†††‡‡‡ | 1.0209 | 0.4636 |

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Full out-of-sample period. | ||||||||||

| MAE | 0.4542 *** | 0.4376 *** | 0.3896 ***###††† | 0.3248 ***###†††‡‡‡ | 0.4417 *** | 0.4477 *** | 0.3571 ***###††† | 0.3530 ***###†††‡ | 0.7133 | 0.4460 |

| MSE | 1.7055 *** | 1.6530 *** | 1.2876 ***##† | 1.0727 ***###†††‡‡ | 1.5703 *** | 1.7130 *** | 1.1830 ***##†† | 1.2146 ***###††† | 2.8588 | 1.8554 |

| MAEln | 0.6585 *** | 0.6346 *** | 0.5597 ***###††† | 0.4616 ***###†††‡‡‡ | 0.6405 *** | 0.6420 *** | 0.4871 ***###††† | 0.4890 ***#††† | 0.9227 | 0.6293 |

| MSEln | 0.6853 *** | 0.6216 ***‡ | 0.4978 ***###††† | 0.3478 ***###†††‡‡‡ | 0.6311 *** | 0.6313 *** | 0.3769 ***###††† | 0.3791 ***###††† | 1.2302 | 0.6367 |

| Panel B: H1 sub-period. | ||||||||||

| MAE | 0.7786 *** | 0.7590 *** | 0.6996 ***#††† | 0.5651 ***###†††‡‡‡ | 0.7836 *** | 0.7905 *** | 0.6289 ***##††† | 0.6245 ***###††† | 1.1403 | 0.7541 |

| MSE | 2.5712 *** | 2.0273 ***‡ | 2.2062 ***#† | 1.6450 ***###†††‡‡ | 2.2663 *** | 2.1755 *** | 2.0413 ***#†† | 1.9673 ***###††† | 3.9679 | 2.8114 |

| MAEln | 0.6379 *** | 0.6478 *** | 0.5474 ***#††† | 0.4431 ***###†††‡‡‡ | 0.6697 *** | 0.6660 *** | 0.4665 ***##††† | 0.4818 ***###††† | 0.8224 | 0.5871 |

| MSEln | 0.6451 *** | 0.6507 *** | 0.4707 ***###†† | 0.3209 ***###†††‡‡‡ | 0.6891 *** | 0.6803 *** | 0.3548 ***##††† | 0.3728 ***###††† | 0.9849 | 0.5625 |

| Panel C: H2 sub-period. | ||||||||||

| MAE | 0.6115 *** | 0.5819 *** | 0.5177 ***###††† | 0.4441 ***###†††‡‡‡ | 0.5906 *** | 0.6043 *** | 0.5101 ***###††† | 0.4967 ***###††† | 0.7883 | 0.6205 |

| MSE | 3.8096 *** | 3.6856 *** | 3.4946 ***##††† | 2.8792 ***###†††‡‡ | 3.7112 *** | 3.8202 *** | 3.3038 ***##††† | 3.2124 ***###††† | 4.2233 | 4.0737 |

| MAEln | 0.6513 *** | 0.5911 *** | 0.5104 ***###††† | 0.4302 ***###†††‡‡‡ | 0.6175 *** | 0.6257 *** | 0.4896 ***###††† | 0.4866 ***###††† | 0.8146 | 0.6487 |

| MSEln | 0.7200 *** | 0.6157 ***‡‡‡ | 0.4682 ***###††† | 0.3139 ***###†††‡‡‡ | 0.6375 *** | 0.6572 *** | 0.3968 ***###††† | 0.3855 ***###††† | 1.0545 | 0.7268 |

| Panel D: H3 sub-period. | ||||||||||

| MAE | 0.3628 *** | 0.3208 *** | 0.3258 ***###††† | 0.2473 ***###†††‡‡‡ | 0.3201 *** | 0.3221 *** | 0.2835 ***###††† | 0.2622 ***###††† | 0.6202 | 0.3840 |

| MSE | 0.5984 *** | 0.4115 *** | 0.4276 ***##††† | 0.2487 ***###†††‡‡‡ | 0.3931 *** | 0.4281 *** | 0.3266 ***###††† | 0.2998 ***###††† | 1.0264 | 0.6111 |

| MAEln | 0.6338 *** | 0.5850 *** | 0.5703 ***###††† | 0.4516 ***###†††‡‡‡ | 0.5820 *** | 0.5832 *** | 0.4775 ***###††† | 0.4603 ***###††† | 0.9377 | 0.6462 |

| MSEln | 0.6512 *** | 0.5536 ***‡‡ | 0.5056 ***###††† | 0.3147 ***###†††‡‡‡ | 0.5326 *** | 0.5435 *** | 0.3404 ***###††† | 0.3243 ***###††† | 1.2209 | 0.6635 |

| Panel E: H4 sub-period. | ||||||||||

| MAE | 2.8665 *** | 3.0472 *** | 2.2756 ***###††† | 2.1442 ***###††‡‡ | 2.7236 *** | 3.1251 *** | 2.2565 ***###††† | 2.3663 ***###††† | 6.2977 | 2.9261 |

| MSE | 29.971 *** | 35.8310 *** | 16.6850 ***###††† | 17.501 ***###††† | 29.659 *** | 36.921 *** | 16.6360 ***###††† | 19.654 ***###††† | 73.0520 | 34.2900 |

| MAEln | 0.6997 *** | 0.7011 *** | 0.5186 ***###††† | 0.5208 ***###††† | 0.6105 *** | 0.6894 *** | 0.4952 ***###††† | 0.5285 ***###††† | 1.1024 | 0.5779 |

| MSEln | 0.7348 *** | 0.7926 *** | 0.3789 ***###††† | 0.4322 ***###††† | 0.5964 *** | 0.7287 *** | 0.4076 ***###††† | 0.4376 ***###††† | 1.5677 | 0.5988 |

| Panel F: L sub-period. | ||||||||||

| MAE | 0.2600 *** | 0.2481 *** | 0.2148 ***###††† | 0.1825 ***###†††‡‡‡ | 0.2571 *** | 0.2490 *** | 0.1942 ***###††† | 0.1932 ***###†††‡ | 0.3877 | 0.2429 |

| MSE | 0.4178 | 0.3854 | 0.3330 ***###††† | 0.2591 ***###†††‡‡‡ | 0.3640 *** | 0.3801 ** | 0.2611 ***###††† | 0.2648 ***###††† | 0.3847 | 0.4158 |

| MAEln | 0.6733 *** | 0.6509 *** | 0.5703 ***###††† | 0.4745 ***###†††‡‡‡ | 0.6540 *** | 0.6536 *** | 0.4966 ***###††† | 0.4997 ***###††† | 0.9648 | 0.6370 |

| MSEln | 0.7026 *** | 0.6282 *** | 0.5139 ***###††† | 0.3706 ***###†††‡‡‡ | 0.6426 *** | 0.6345 *** | 0.3919 ***###††† | 0.3958 ***###††† | 1.3365 | 0.6399 |

| 1 | The volatility forecasting performance gains from modeling the range based estimators have been demonstrated in numerous studies (Chou 2005; Chou et al. 2009; Brownlees and Gallo 2010), which confirm the merits of employing the daily price interval information to some extent. The most commonly used range model is the conditional autoregressive range (CARR) model with the disturbance term assumed to follow the exponential distribution with a unit mean (ECARR). |

| 2 | We also extended the CRM model by incorporating the HAR structure and the Markov regime switching structure in order to better analyze the advantages of the long memory and nonlinear extensions. The corresponding models are referred to as the CRM-H model, the CRM-MRS model, and the CRM-H-MRS model, respectively. |

| 3 | The predicted ranges are not negative for both the CRM model and the CRM-H model in our empirical experiments. |

| 4 | In order to guarantee the non-negativity of the predicted interval range, Souza et al. (2017) suggest using the Box-Cox transformation for the response variable. Our empirical results show that the predicted ranges are not negative even without the Box-Cox transformation. |

| 5 | In empirical applications of the Markov regime switching structure, two regimes are usually assumed; see Raggi and Bordignon (2012), Shi and Ho (2015) and Wang et al. (2016) for examples. |

| 6 | |

| 7 | Price data were amplified by a factor of 100. |

| 8 | A trader mistyped millions (m) as billions (b) while selling a stock, causing a sudden intraday plunge of the stock market. |

| 9 | We also used realized volatility calculated as the sum of squared intraday 10-minute logarithmic returns (Andersen and Bollerslev 1998) as the proxy for actual volatility. The high-frequency data were collected from PiTrading and span from 3 January 2006 to 15 May 2020. The corresponding results can be found in Appendix A, which hardly change the in-sample and out-of-sample conclusions. |

| 10 | The GARCH (1,1) specification was selected according to the AIC and BIC rules. |

References

- Andersen, Torben G., and Tim Bollerslev. 1998. Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review 39: 885–905. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Francis X. Diebold. 2007. Roughing it up: Including jump components in the measurement, modeling, and forecasting of return volatility. The Review of Economics and Statistics 89: 701–20. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., Peter Reinhard Hansen, Asger Lunde, and Neil Shephard. 2008. Designing realized kernels to measure the ex post variation of equity prices in the presence of noise. Social Science Electronic Publishing 76: 1481–536. [Google Scholar]

- Billard, Lynne, and Edwin Diday. 2000. Regression Analysis for Interval-Valued Data. Data Analysis, Classification, and Related Methods. Berlin/Heidelberg: Springer, pp. 369–74. [Google Scholar]

- Billard, Lynne, and Edwin Diday. 2002. Symbolic regression analysis. Studies in Classification Data Analysis & Knowledge Organization 37: 6317–28. [Google Scholar]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Brownlees, Christian T., and Giampiero M. Gallo. 2010. Comparison of volatility measures: A risk management perspective. Journal of Financial Econometrics 8: 29–56. [Google Scholar] [CrossRef]

- Chou, Ray Yeutien. 2005. Forecasting financial volatilities with extreme values: The conditional autoregressive range (CARR) model. Journal of Money, Credit and Banking 37: 561–82. [Google Scholar] [CrossRef]

- Chou, Ray Yeutien, Chun-Chou Wu, and Nathan Liu. 2009. Forecasting time-varying covariance with a range-based dynamic conditional correlation model. Review of Quantitative Finance & Accounting 33: 327–45. [Google Scholar]

- Corsi, Fulvio. 2009. A simple approximate long-memory model of realized volatility. Journal of Financial Econometrics 7: 174–96. [Google Scholar] [CrossRef]

- Diebold, Francis, and Robert Mariano. 1995. Comparing predictive accuracy. Journal of Business & Economic Statistics 13: 253–63. [Google Scholar]

- Fischer, Henning, Ángela Blanco-Fernández, and Peter Winker. 2016. Predicting stock return volatility: Can we benefit from regression models for return intervals? Journal of Forecasting 35: 113–46. [Google Scholar]

- González-Rivera, Gloria, and Wei Lin. 2013. Constrained regression for interval-valued data. Journal of Business & Economic Statistics 31: 473–90. [Google Scholar]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57: 357–84. [Google Scholar] [CrossRef]

- Hansen, Peter R., Asger Lunde, and James M. Nason. 2011. The model confidence set. Econometrica 79: 453–97. [Google Scholar] [CrossRef]

- Klaassen, Franc. 2002. Improving Garch volatility forecasts with regime-switching Garch. Empirical Economics 27: 363–94. [Google Scholar] [CrossRef]

- Lima Neto, Eufrásio A., and Francisco de A. T. De Carvalho. 2008. Centre and range method to fitting a linear regression model on symbolic interval data. Computational Statistics & Data Analysis 52: 1500–15. [Google Scholar]

- Lima Neto, Eufrásio A., and Francisco de A. T. De Carvalho. 2010. Constrained linear regression models for symbolic interval-valued variables. Computational Statistics & Data Analysis 54: 333–47. [Google Scholar]

- Ma, Feng, Mohamed Ismail M. Wahab, Dengshi Huang, and Weiju Xu. 2017. Forecasting the realized volatility of the oil futures market: A regime switching approach. Energy Economics 67: 136–45. [Google Scholar] [CrossRef]

- Mincer, Jacob A., and Victor Zarnowitz. 1969. The evaluation of economic forecasts. In Economic Forecasts and Expectations: Analysis of Forecasting Behavior and Performance. Cambridge: NBER, pp. 3–46. [Google Scholar]

- Parkinson, Michael. 1980. The extreme value method for estimating the variance of the rate of return. The Journal of Business 53: 61–65. [Google Scholar] [CrossRef]

- Perlin, Marcelo. 2015. MS_Regress—The Matlab Package for Markov Regime Switching Models. Available online: https://ssrn.com/abstract=1714016 (accessed on 20 October 2022).

- Raggi, Davide, and Silvano Bordignon. 2012. Long memory and nonlinearities in realized volatility: A markov switching approach. Computational Statistics & Data Analysis 56: 3730–42. [Google Scholar]

- Ross, Gordon J., Dimitris K. Tasoulis, and Niall M. Adams. 2011. Nonparametric monitoring of data streams for changes in location and scale. Technometrics 53: 379–89. [Google Scholar] [CrossRef]

- Shi, Yanlin, and Kin-Yip Ho. 2015. Long memory and regime switching: A simulation study on the Markov regime-switching ARFIMA model. Journal of Banking & Finance 61: 189–204. [Google Scholar]

- Souza, Leandro C., Renata M. C. R. Souza, Getúlio J. A. Amaral, and Telmo M. Silva Filho. 2017. A parametrized approach for linear regression of interval data. Knowledge-Based Systems 131: 149–59. [Google Scholar] [CrossRef]

- Sun, Yuying, Ai Han, Yongmiao Hong, and Shouyang Wang. 2018. Threshold autoregressive models for interval-valued time series data. Journal of Econometrics 206: 414–46. [Google Scholar] [CrossRef]

- Taylor, Stephen John. 1982. Financial returns modelled by the product of two stochastic processes-a study of the daily sugar prices 1961–75. Time Series Analysis: Theory and Practice 1: 203–26. [Google Scholar]

- Wang, Yudong, Feng Ma, Yu Wei, and Chongfeng Wu. 2016. Forecasting realized volatility in a changing world: A dynamic model averaging approach. Journal of Banking & Finance 64: 136–49. [Google Scholar]

| Mean | Std. | Skewness | Kurtosis | LB(1) | LB(5) | LB(10) | ADF | |

|---|---|---|---|---|---|---|---|---|

| 0.6083 | 0.8598 | 2.9065 | 22.0742 | 0.0000 | 0.0000 | 0.0000 | 0.0004 | |

| −0.6438 | 1.0327 | −3.3192 | 21.2520 | 0.0000 | 0.0000 | 0.0000 | 0.0001 | |

| −0.0178 | 0.7906 | −0.9177 | 15.4844 | 0.0074 | 0.0002 | 0.0000 | 0.0000 | |

| 1.2521 | 1.0542 | 3.3366 | 17.7260 | 0.0000 | 0.0000 | 0.0000 | 0.0015 |

| CRM | CRM-H | PM | PM-H | ECARR | |

|---|---|---|---|---|---|

| 0.3427 *** | 0.0438 ** | 0.3625 *** | 0.0544 ** | ||

| 0.7262 *** | −0.1356 *** | ||||

| 1.2100 *** | |||||

| −0.1094 *** | |||||

| −0.7681 *** | 0.1451 *** | ||||

| 0.6492 *** | −0.2597 *** | ||||

| −1.3238 *** | |||||

| 0.9289 *** | |||||

| 0.0672 | |||||

| 0.1230 *** | |||||

| 0.0372 | |||||

| 0.7024 *** | |||||

| 0.2666 ** | |||||

| 0.5272 | 0.7466 | 0.5349 | 0.7754 | 0.5879 |

| CRM-MRS | CRM-H-MRS | PM-MRS | PM-H-MRS | |

|---|---|---|---|---|

| 0.5317 *** | 0.0520 *** | 0.5374 *** | 0.0746 *** | |

| 0.9318 *** | 0.2123 *** | 0.9192 *** | 0.2203 *** | |

| 0.3472 *** | −0.2620 *** | |||

| 0.6085 *** | −0.0798 ** | |||

| 1.2986 *** | ||||

| 1.1185 *** | ||||

| −0.1039 *** | ||||

| −0.1199 ** | ||||

| −0.4052 *** | 0.2510 *** | |||

| −0.6486 *** | 0.1073 *** | |||

| 0.2727 *** | −0.3464 *** | |||

| 0.5422 *** | −0.2261 *** | |||

| −1.3963 *** | ||||

| −1.2384 *** | ||||

| 1.0249 *** | ||||

| 0.8391 *** | ||||

| 0.1205 ** | ||||

| 0.0412 | ||||

| 0.0990 ** | ||||

| 0.1061 | ||||

| 0.1230 *** | 0.0888 *** | 0.1157 *** | 0.0733 *** | |

| 1.2249 *** | 0.8803 *** | 1.1694 *** | 0.7063 *** | |

| 0.9600 *** | 0.9800 *** | 0.9600 *** | 0.9700 *** | |

| 0.9100 *** | 0.9300 *** | 0.9200 *** | 0.9200 *** | |

| 0.5273 | 0.8136 | 0.5350 | 0.8475 |

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| MAE | 0.6346 *** | 0.5433 ***#‡‡‡ | 0.4610 ***###††† | 0.2926 ***###†††‡‡‡ | 0.6430 *** | 0.5462 ***#‡‡‡ | 0.4862 ***###††† | 0.3318 ***###†††‡‡‡ | 0.9510 | 0.5858 |

| MSE | 3.5208 *** | 3.2902 ***#‡‡‡ | 1.9506 ***###††† | 0.9738 ***###†††‡‡‡ | 3.6315 *** | 3.3531 ***#‡‡‡ | 2.1627 ***##††† | 1.3780 ***###†††‡‡‡ | 4.9652 | 3.1760 |

| MAEln | 0.8047 *** | 0.6758 ***#‡‡‡ | 0.5474 ***###††† | 0.4284 ***###†††‡‡‡ | 0.8103 *** | 0.6840 ***#‡‡‡ | 0.5722 ***###††† | 0.4604 ***###†††‡‡‡ | 1.0600 | 0.7160 |

| MSEln | 0.9776 *** | 0.7135 ***#‡‡‡ | 0.4660 ***###††† | 0.3245 ***###†††‡‡‡ | 0.9930 *** | 0.7316 ***#‡‡‡ | 0.5149 ***###††† | 0.3684 ***###†††‡‡‡ | 1.6494 | 0.7857 |

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| MAE | 0.0000 | 0.0000 | 0.0052 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| MSE | 0.0493 | 0.0493 | 0.0493 | 1.0000 | 0.0493 | 0.0493 | 0.0493 | 0.0493 | 0.0493 | 0.0493 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Full out-of-sample period. | ||||||||||

| MAE | 0.4578 *** | 0.4407 *** | 0.3944 ***###††† | 0.3141 ***###†††‡‡‡ | 0.4394 *** | 0.4475 *** | 0.3444 ***###††† | 0.3350 ***###†††‡ | 0.7694 | 0.4448 |

| MSE | 1.0832 *** | 1.0348 *** | 0.9117 ***##† | 0.5919 ***###†††‡‡ | 0.9892 *** | 1.0813 *** | 0.7238 ***##†† | 0.7039 ***###††† | 2.7245 | 1.2453 |

| MAEln | 0.8281 *** | 0.8118 *** | 0.7100 ***###††† | 0.5580 ***###†††‡‡‡ | 0.8090 *** | 0.8148 *** | 0.5822 ***###††† | 0.5809 ***#††† | 1.1298 | 0.7817 |

| MSEln | 1.0473 *** | 0.9901 *** | 0.7837 ***###††† | 0.4842 ***###†††‡‡‡ | 0.9980 *** | 1.0050 *** | 0.5337 ***###††† | 0.5314 ***###††† | 1.8499 | 0.9575 |

| Panel B: H1 sub-period. | ||||||||||

| MAE | 0.7547 *** | 0.7585 *** | 0.6407 ***#††† | 0.4877 ***###†††‡‡‡ | 0.7535 *** | 0.7822 *** | 0.5420 ***##††† | 0.5346 ***###††† | 1.1754 | 0.6925 |

| MSE | 1.8688 *** | 1.7588 ***‡ | 1.5841 ***#† | 0.9288 ***###††‡‡ | 1.8201 *** | 1.8966 *** | 1.2836 ***#†† | 1.2240 ***###††† | 3.9420 | 2.2081 |

| MAEln | 0.7868 *** | 0.8092 *** | 0.6766 ***#††† | 0.5078 ***###†††‡‡‡ | 0.8080 *** | 0.8224 *** | 0.53055 ***##††† | 0.5256 ***###††† | 1.0105 | 0.7047 |

| MSEln | 0.9531 *** | 0.9980 *** | 0.7015 ***###†† | 0.4033 ***###†††‡‡‡ | 1.0086 *** | 1.0385 *** | 0.4478 ***###††† | 0.4443 ***###††† | 1.5191 | 0.7870 |

| Panel C: H2 sub-period. | ||||||||||

| MAE | 0.4821 *** | 0.4509 *** | 0.4281 ***###††† | 0.3559 ***###†††‡‡‡ | 0.4507 *** | 0.4585 *** | 0.3981 ***###††† | 0.3905 ***###††† | 0.7171 | 0.4937 |

| MSE | 0.9644 *** | 0.8744 *** | 0.7929 ***##††† | 0.5299 ***###†††‡‡ | 0.8773 *** | 0.9295 *** | 0.7548 ***##††† | 0.6857 ***###††† | 1.4771 | 1.0939 |

| MAEln | 0.7625 ** | 0.7013 *** | 0.6415 ***###††† | 0.5354 ***###†††‡‡‡ | 0.7049 *** | 0.7136 *** | 0.5688 ***###††† | 0.5644 ***###††† | 0.9877 | 0.7505 |

| MSEln | 0.8890 *** | 0.7550 ***‡‡‡ | 0.6763 ***###††† | 0.4560 ***###†††‡‡‡ | 0.7778 *** | 0.7880 *** | 0.5357 ***###††† | 0.5155 ***###††† | 1.5428 | 0.9418 |

| Panel D: H3 sub-period. | ||||||||||

| MAE | 0.4517 *** | 0.4213 *** | 0.4185 ***###††† | 0.3324 ***###†††‡‡‡ | 0.4237 *** | 0.4227 *** | 0.3622 ***###††† | 0.3493 ***###††† | 0.7137 | 0.4779 |

| MSE | 0.9477 *** | 0.8485 *** | 0.7849 ***##††† | 0.4976 ***###†††‡‡‡ | 0.8371 *** | 0.8633 *** | 0.5659 ***###††† | 0.5606 ***###††† | 1.3721 | 0.9845 |

| MAEln | 0.7989 *** | 0.7593 *** | 0.7210 ***###††† | 0.5771 ***###†††‡‡‡ | 0.7662 *** | 0.7583 *** | 0.6021 ***###††† | 0.5924 ***###††† | 1.1476 | 0.8114 |

| MSEln | 0.9694 *** | 0.8813 ***‡‡ | 0.7992 ***###††† | 0.4856 ***###†††‡‡‡ | 0.8924 *** | 0.8717 *** | 0.5376 ***###††† | 0.5169 ***###††† | 1.8383 | 1.0162 |

| Panel E: H4 sub-period. | ||||||||||

| MAE | 0.9988 *** | 0.9321 *** | 0.9200 ***###††† | 0.7768 ***###†††‡‡‡ | 0.8584 *** | 0.9553 *** | 0.8691 ***###††† | 0.8124 ***###††† | 2.3968 | 1.0891 |

| MSE | 5.2374 *** | 5.3011 *** | 4.6711 ***###††† | 3.2575 ***###†††‡‡‡ | 4.5530 *** | 5.4872 *** | 3.7452 ***###††† | 3.7163 ***###††† | 20.3539 | 6.4517 |

| MAEln | 0.8391 *** | 0.7765 *** | 0.6996 ***###††† | 0.5952 ***###†††‡‡‡ | 0.7213 *** | 0.7747 *** | 0.6181 ***###††† | 0.6177 ***###††† | 1.1591 | 0.7820 |

| MSEln | 1.0916 *** | 0.9097 *** | 0.8172 ***###††† | 0.5581 ***###†††‡‡‡ | 0.8105 *** | 0.8995 *** | 0.5843 ***###††† | 0.5899 ***###††† | 1.8618 | 1.0365 |

| Panel F: L sub-periods. | ||||||||||

| MAE | 0.2730 *** | 0.2627 *** | 0.2182 ***###††† | 0.1727 ***###†††‡‡‡ | 0.2720 *** | 0.2628 *** | 0.1838 ***###††† | 0.1814 ***###†††‡ | 0.4152 | 0.2451 |

| MSE | 0.2611 *** | 0.2406 *** | 0.1843 ***###††† | 0.1220 ***###†††‡‡‡ | 0.2427 *** | 0.2436 *** | 0.1290 ***###††† | 0.1278 ***###††† | 0.3412 | 0.2520 |

| MAEln | 0.8612 *** | 0.8534 *** | 0.7312 ***###††† | 0.5676 ***###†††‡‡‡ | 0.8537 *** | 0.8532 *** | 0.5907 ***###††† | 0.5936 ***###††† | 1.1850 | 0.8041 |

| MSEln | 1.1250 *** | 1.0737 *** | 0.8203 ***###††† | 0.5056 ***###†††‡‡‡ | 1.0930 *** | 1.0883 *** | 0.5543 ***###††† | 0.5602 ***###††† | 2.0181 | 0.9888 |

| PM | PM-MRS | PM-H | PM-H-MRS | CRM | CRM-MRS | CRM-H | CRM-H-MRS | GARCH | ECARR | |

|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Full out-of-sample period. | ||||||||||

| MAE | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0033 | 0.0033 | 0.0000 | 0.0000 |

| MSE | 0.0246 | 0.0498 | 0.0498 | 1.0000 | 0.0246 | 0.0498 | 0.1106 | 0.1106 | 0.0246 | 0.0498 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0002 | 0.0002 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Panel B: H1 sub-period. | ||||||||||

| MAE | 0.0000 | 0.0000 | 0.0001 | 1.0000 | 0.0000 | 0.0000 | 0.1167 | 0.1167 | 0.0000 | 0.0042 |

| MSE | 0.0166 | 0.0166 | 0.0166 | 1.0000 | 0.0166 | 0.0166 | 0.1929 | 0.1929 | 0.0166 | 0.1206 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.2108 | 0.2108 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Panel C: H2 sub-period. | ||||||||||

| MAE | 0.0024 | 0.0024 | 0.0024 | 1.0000 | 0.0024 | 0.0024 | 0.1199 | 0.1199 | 0.0009 | 0.0024 |

| MSE | 0.0878 | 0.0982 | 0.1222 | 1.0000 | 0.0982 | 0.0982 | 0.1728 | 0.1454 | 0.0878 | 0.0982 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.1585 | 0.1585 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0004 | 0.0004 | 0.0439 | 0.0439 | 0.0000 | 0.0000 |

| Panel D: H3 sub-period. | ||||||||||

| MAE | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0005 | 0.1258 | 0.0000 | 0.0000 |

| MSE | 0.0631 | 0.0631 | 0.0631 | 1.0000 | 0.0631 | 0.0631 | 0.2932 | 0.2932 | 0.0529 | 0.0631 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.1322 | 0.1322 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0218 | 0.1078 | 0.0000 | 0.0000 |

| Panel E: H4 sub-period. | ||||||||||

| MAE | 0.0457 | 0.1069 | 0.1695 | 1.0000 | 0.2595 | 0.1695 | 0.2595 | 0.2595 | 0.0457 | 0.1069 |

| MSE | 0.4565 | 0.5787 | 0.5787 | 1.0000 | 0.5787 | 0.5787 | 0.5787 | 0.5787 | 0.4565 | 0.5787 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.2193 | 0.2193 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.4519 | 0.4519 | 0.0000 | 0.0000 |

| Panel F: L sub-period. | ||||||||||

| MAE | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| MSE | 0.1132 | 0.1132 | 0.1132 | 1.0000 | 0.1132 | 0.1931 | 0.3550 | 0.3550 | 0.0058 | 0.1931 |

| MAEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| MSEln | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qu, H.; He, M. Predicting Volatility Based on Interval Regression Models. J. Risk Financial Manag. 2022, 15, 564. https://doi.org/10.3390/jrfm15120564

Qu H, He M. Predicting Volatility Based on Interval Regression Models. Journal of Risk and Financial Management. 2022; 15(12):564. https://doi.org/10.3390/jrfm15120564

Chicago/Turabian StyleQu, Hui, and Mengying He. 2022. "Predicting Volatility Based on Interval Regression Models" Journal of Risk and Financial Management 15, no. 12: 564. https://doi.org/10.3390/jrfm15120564

APA StyleQu, H., & He, M. (2022). Predicting Volatility Based on Interval Regression Models. Journal of Risk and Financial Management, 15(12), 564. https://doi.org/10.3390/jrfm15120564