Social Security Payments and Financialization: Lessons from the Greek Case

Abstract

:1. Introduction

2. Materials and Methods

2.1. Literature Review

2.2. Methodology

3. Results: Findings and Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Title | Label | Definition Sources |

|---|---|---|

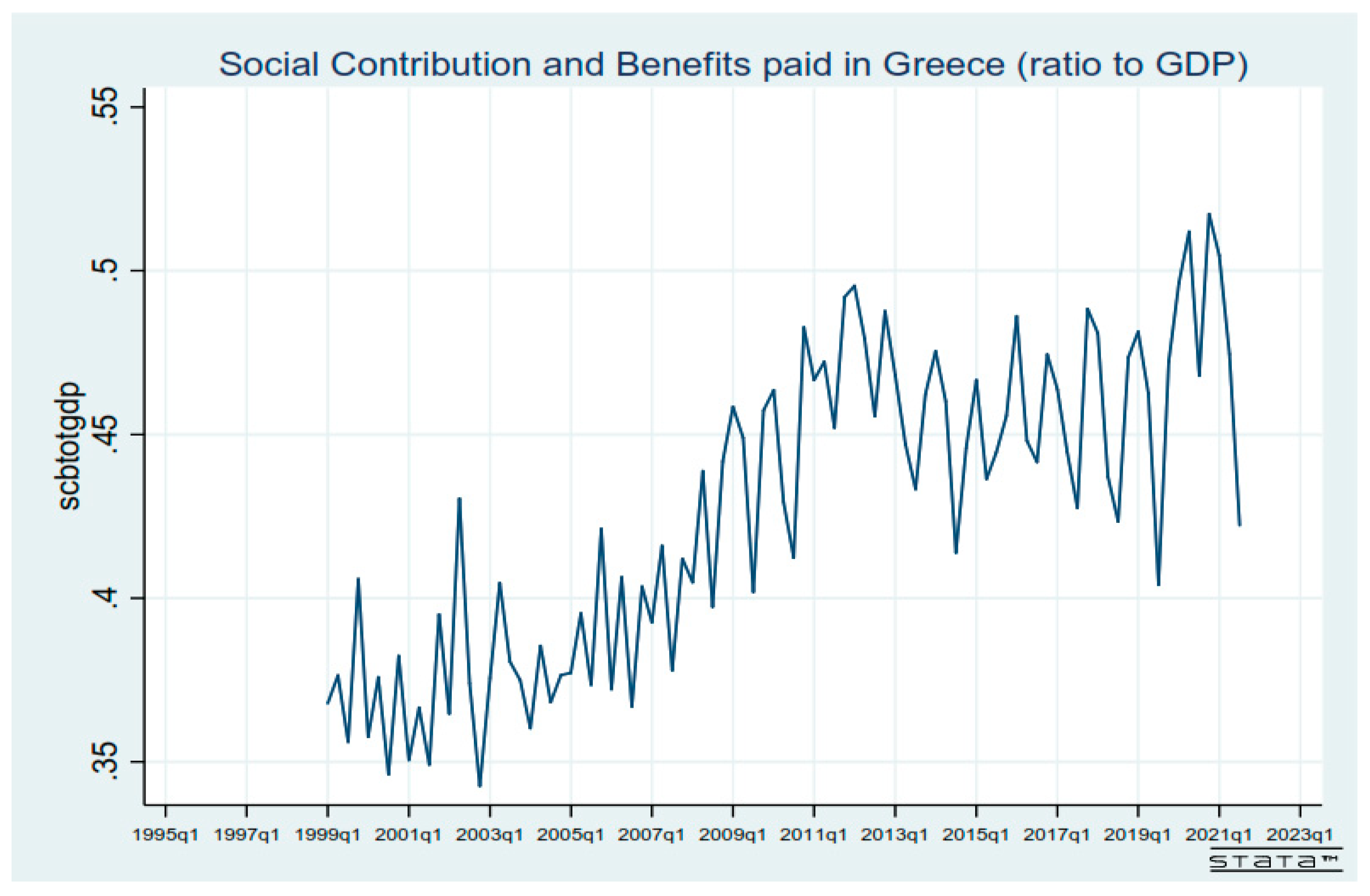

| Social Contributions and Benefits Paid (ratio to GDP). | scbtotgdp | Greece, Total Transactions (ESA 2010), Social Contributions and Benefits: Paid, Current Prices, Euro. REFINITIV/DATASTREAM/Eurostat 1. t = quarters (Q), timespan = 1995Q1–2021Q4, discontinued for all variables. GDP = Greece, Gross Domestic Product, Expenditure Approach, Gross Domestic Product, Quarterly Levels, Current Prices, Euro. This var. is used if GDP is not referred to constant 2010 prices or real GDP. REFINITIV/DATASTREAM/Quarterly National Accounts, copyright OECD, for GDP. |

| Gross Value Added | GVA | Greece, Gross Domestic Product, Output Approach, Gross Value Added (GVA) at Basic Prices, Quarterly Levels, Current Prices, Euro. REFINITIV/DATASTREAM/Quarterly National Accounts, copyright OECD. |

| “Financial and Insurance (+Real Estate) Activities” share in (total) Gross Value Added (GVA) of the country. | A1. fitotgva; A2. (firetotgva) | Greece, Gross Domestic Product, Output Approach, Financial and Insurance (+Real Estate) Activities, GVA as a ratio of the total GVA, at Basic Prices, Quarterly Levels, Current Prices, Euro. REFINITIV/DATASTREAM/Quarterly National Accounts, copyright OECD. |

| Monetary and Financial Institutions Assets (as a growth rate). | A3. mfifagr | Greece, Financial Balance Sheets, Consolidated Stocks (SNA2008), Financial Assets, Total, Monetary Financial Institutions, Current Prices, Euro. REFINITIV/DATASTREAM/Annual National Accounts, copyright OECD. |

| Financial Openness (as a ratio to GDP) | A4. prtfieqligdp | Greece, Balance of Payments Standard Components (BPM6); Financial Account: Portfolio Investment, Equity and Investment Fund Shares, Assets or Liabilities; Euro. REFINITIV/DATASTREAM/IMF—International Financial Statistics. |

| Shareholder Value (growth rate of the ASE-relevant index) | B1. ftselcgr B2. m3outsgdp | Greece, FTSE/Athex (Athens Stock Exchange Market (ASE)) Large Capital. REFINITIV/DATASTREAM/Athens Stock Exchange Greece, Money Supply M3 Outstanding Amounts; million Euro. Ratio to GDP. REFINITIV/DATASTREAM/Bank of Greece |

| Public Debt (as a growth rate) | C1. pudbtgr | Greece, Public Debt, General Government, Long-Term, Total, Current Prices, not seas. adj., Euro. REFINITIV/DATASTREAM/World Bank QPSD. |

| Budget Balance (as a ratio to GDP or growth rates) | C2. primbubgdp C3. grosbubgdp | Greece, General Government, Discontinued, Budget Balance (Gross = grosbub, or Primary = primbub), Total, Cumulative, Current Prices, not seasonally adjusted (nsa), Euro. REFINITIV/DATASTREAM/Hellenic Republic Ministry of Economy and Finance. |

| Fiscal Space | C4. fspudbt. C5. fsgrosbub. | fspudbt = pudbtgdp/taxbase; fsgrosbub = grosbubgdp/taxbase. taxbase = tggrev/(5 years averaged GDP to capture eco. and pol. cycles). tggrev = Greece, Total General Government Revenue: Current Prices, Euro. REFINITIV/DATASTREAM/Eurostat for TGGREV. |

| Yield of 10-year government bond | D1. gr10ygby1 | Greece, Long-Term Government Bond Yields, 10-Year, Main (Including Benchmark), Yield 10-Year Government Bonds, nsa. REFINITIV/DATASTREAM/Main Economic Indicators, copyright OECD. |

| Capital Flight (as a ratio to GDP) | D2. capflightgdp | Greece, Balance of Payments, Capital Flight, Net, (millions of Euros adj.) Current Prices, nsa. cflight (euro) = cflight-USD, EUR/USD spot exchange rate. REFINITIV/DATASTREAM/Oxford Economics. |

| Z(t) Statistic (The Model Contains Intercept and Trend) | |

|---|---|

| scbtotgdp | −8.315 *** |

| firetotgva | −6.203 *** |

| ftselcgr | −10.026 *** |

| m3outsgdp | −6.140 *** |

| capflightgdp | −13.073 *** |

| prtfieqligdp | −11.023 *** |

| mfifagr | −10.589 *** |

| pudbtgr | −8.095 *** |

| primbubgdp | −7.782 *** |

| gr10ygby1 | −6.386 *** |

| fitotgva | −5.738 *** |

| fspudbt | −7.691 *** |

| fsgrosbub | −6.644 *** |

References

- Aalbers, Manuel B. 2008. The Financialization of Home and Mortgage Markets. Competition and Change 12: 148–66. [Google Scholar] [CrossRef]

- Aalbers, Manuel B., Rodrigo Fernandez, and Gertjan Wijburg. 2020. The Financialization of the Real Estate. In The Routledge International Handbook of Financialization. Edited by Philip Mader, Daniel Mertens and Natascha van der Zwan. London and New York: Routledge, Taylor & Francis, pp. 200–12. [Google Scholar]

- Andersen, Hanne, and Brian Hepburn. 2020. Scientific Method. In The Stanford Encyclopedia of Philosophy, Winter 2020 ed. Edited by Edward N. Zalta. Available online: https://plato.stanford.edu/archives/win2020/entries/scientific-method (accessed on 27 September 2018).

- Baud, Celine, and Cédric Durand. 2012. Financialization, globalization and the making of profits by leading retailers. Socio-Economic Review 10: 241–66. [Google Scholar] [CrossRef] [Green Version]

- Becker, Joachim, Johannes Jager, Benhard Leubolt, and Rudy Weissenbacher. 2010. Peripheral Financialization and Vulnerability to Crisis: A Regulationist Perspective. Competition & Change 14: 225–47. [Google Scholar] [CrossRef]

- Berle, Adolf A., and Gardiner C. Means. 1932. The Modern Corporation and Private Property. New York: The Macmillan Company, OCLC Number/Unique Identifier: 1411248. Available online: https://www.worldcat.org/title/modern-corporation-and-private-property/oclc/1411248?page=citation (accessed on 25 July 2022).

- Besedovsky, Natalia. 2018. Financialization as calculative practice: The rise of structured finance and the cultural and calculative transformation of credit rating agencies. Socio-Economic Review 16: 61–84. [Google Scholar] [CrossRef]

- Bank of Greece (BoG). 2021. Governor’s Annual Report for the Year 2021. Available online: https://www.bankofgreece.gr/en/publications-and-research/publications/governors-annual-report (accessed on 19 September 2022).

- Borio, Claudio, and Philip Lowe. 2002. Asset Prices, Financial and Monetary Stability: Exploring the Nexus. BIS Working Papers No 114. Available online: https://www.bis.org/publ/work114.htm (accessed on 25 July 2022).

- Boyer, Robert. 2000. Is a Finance-led Growth Regime a Viable Alternative to Fordism? A Preliminary Analysis. Economy and Society 29: 111–45. [Google Scholar] [CrossRef]

- Boyer, Robert. 2005. From Shareholder Value to CEO Power: The Paradox of the 1990s. Competition and Change 9: 7–47. [Google Scholar] [CrossRef]

- Boyer, Robert. 2018. Do Globalization, Deregulation and Financialization Imply a Convergence of Contemporary Capitalisms? HAL Archives. Available online: https://halshs.archives-ouvertes.fr/halshs-01908095 (accessed on 25 July 2022).

- Chizema, Amon. 2010. Early and Late Adoption of American-Style Executive Pay in Germany: Governance and Institutions. Journal of World Business 45: 9–18. [Google Scholar] [CrossRef]

- Davis, Aeron, and Catherine Walsh. 2017. Distinguishing Financialization from Neoliberalism. Theory, Culture & Society 34: 27–51. [Google Scholar] [CrossRef] [Green Version]

- Davis, Gerald F., Kristina A. Diekmann, and Catherine H. Tinsley. 1994. The Decline and Fall of the Conglomerate Firm in the 1980s: The De-Institutionalization of an Organizational Form. American Sociological Review 59: 547–70. [Google Scholar] [CrossRef]

- De Grauwe, Paul. 2020. Economics of Monetary Union. Oxford: OUP. Available online: https://global.oup.com/academic/product/economics-of-monetary-union-9780192849779?lang=en&cc=ae (accessed on 7 September 2020).

- Deutschmann, Christoph. 2011. Limits to Financialization: Sociologial Analyses of the Financial Crisis. European Journal of Sociology 52: 347–89. [Google Scholar] [CrossRef]

- Deutschmann, Christoph. 2020. The Socio-Economic Background of Financialization. In The Routledge International Handbook of Financialization. Edited by Philip Mader, Daniel Mertens and Natascha van der Zwan. London: Taylor and Francis, pp. 31–42. [Google Scholar]

- Dobbin, Frank, and Rirk Zorn. 2005. Corporate Malfeasance and the Myth of Shareholder Value. In Political Power and Social Theory. Edited by Diane E. Davis. Amsterdam: Elsevier, vol. 17, pp. 179–98. [Google Scholar]

- Dumenil, Gerard, and Domique Levy. 2004. Capital Resurgent: Roots of the Neoliberal Revolution. Cambridge: Harvard University Press. [Google Scholar]

- Epstein, Gerald A., ed. 2005. Introduction: Financialization and the world economy. In Financialication and the World Economy. Cheltenham: Edward Elgar, pp. 3–16. [Google Scholar]

- Epstein, Gerald A., and Arjun Jayadev. 2005. The Rise of Rentier Incomes in OECD Countries: Financialization, Central Bank Policy and Labor Solidarity. In Financialization and the World Economy. Edited by Gerald A. Epstein. Cheltenham: Edward Elgar, pp. 46–74. [Google Scholar]

- Erturk, Ismail, Julie Froud, Sukhdev Johal, Adam Leaver, and Karel Williams, eds. 2008. Financialization at Work Key Texts and Commentary. New York: Routledge. ISBN 9780415417310. [Google Scholar]

- ESA. 2010. European System of Accounts. Maastricht: European Union, European Commission, Eurostat. Available online: https://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/ks-02-13-269 (accessed on 7 September 2020).

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of Ownership and Control. The Journal of Law & Economics 26: 301–25. Available online: http://www.jstor.org/stable/725104 (accessed on 25 July 2022).

- Froud, Julie, Colin Haslam, Sukhdev Johal, and Karel Williams. 2000. Shareholder value and financialization: Consultancy promises, management moves. Economy and Society 29: 80–110. [Google Scholar] [CrossRef]

- Goel, Rajeev K., James E. Payne, and Rati Ram. 2008. R&D expenditures and U.S. economic growth: A disaggregated approach. Journal of Policy Modeling 30: 237–50. [Google Scholar] [CrossRef]

- Hajilee, Massomeh, Donna Y. Stringer, and Linda A. Hayes. 2021. On the link between the shadow economy and stock market progress: An asymmetry analysis. The Quarterly Review of Economics and Finance 80: 303–16. [Google Scholar] [CrossRef]

- Hassler, Uwe, and Juergen Wolters. 2005. Autoregressive Distributed Lag Models and Cointegration. No 2005/22, Discussion Papers. Berlin: Free University Berlin, School of Business & Economics. [Google Scholar]

- Hassler, Uwe, and Juergen Wolters. 2006. Autoregressive distributed lag models and cointegration. AStA Advances in Statistical Analysis 90: 59–74. [Google Scholar]

- International Monetary Fund (IMF). 2022. Country Report No. 22/173, Greece. 2022 Article IV Consultation—Press Release; Staff Report; and Statement by the Executive Director for Greece. Available online: https://www.imf.org/en/Publications/CR/Issues/2022/06/16/Greece-2022-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-519669 (accessed on 19 September 2022).

- Kaltenbrunner, Annina. 2010. International Financialization and Depreciation: The Brazilian Real in the International Financial Crisis. Competition & Change 14: 296–323. [Google Scholar]

- Karwowski, Ewa, and Engelbert Stockhammer. 2017. Financialisation in emerging economies: A systematic overview and comparison with Anglo-Saxon economies. Economic and Political Studies 5: 60–86. [Google Scholar] [CrossRef] [Green Version]

- Konings, Martijn. 2008. The Institutional Foundations of U.S. Structural Power in International Finance: From the Re-Emergence of Global Finance to the Monetarist Turn. Review of International Political Economy 15: 35–61. [Google Scholar] [CrossRef]

- Kotz, David M. 2010. Financialization and Neoliberalism. In Relations of Global Power: Neoliberal Order and Disorder. Edited by Gary Teeple and Stephen McBride. Toronto: University of Toronto Press, pp. 1–18. [Google Scholar]

- Krippner, Greta R. 2005. The financialization of the American economy. Socio-Economic Review 3: 173–208. [Google Scholar] [CrossRef]

- Krippner, Greta R. 2012. Capitalizing on Crisis: The Political Origins of the Rise of Finance. Harvard: Harvard University Press. [Google Scholar]

- Kuhn, Thomas S. 1962. The Structure of Scientific Revolutions. Chicago: University of Chicago Press. [Google Scholar]

- Langley, Paul. 2004. In the Eye of the “Perfect Storm”: The Final Salary Pensions Crisis and Financialisation of Anglo-American Capitalism. New Political Economy 9: 539–58. [Google Scholar] [CrossRef]

- Lazonick, William, and Mary O’Sullivan. 2000. Maximizing Shareholder Value. A New Ideology for Corporate Governance. Economy and Society 29: 13–35. [Google Scholar] [CrossRef]

- Mader, Philip, Daniel Mertens, and Natascha van der Zwan. 2020. The Routledge International Handbook of Financialization. New York: Taylor & Francis. Available online: https://bookshelf.vitalsource.com/books/9781351390361 (accessed on 3 September 2020).

- Magdoff, Harry, and Paul M. Sweezy. 1987. Stagnation and the Financial Explosion. New York: Monthly Review Press. [Google Scholar]

- Martin, Randy. 2002. Financialization of Daily Life. Philadelphia: Temple University Press. [Google Scholar]

- Organization for Economic Cooperation and Progress (OECD). 2022. Economic Surveys: Greece. Available online: https://www.oecd.org/economy/greece-economic-snapshot/ (accessed on 19 September 2022).

- Orhangazi, Özgür. 2008. Financialisation and Capital Accumulation in the Non-financial Corporate Sector: A Theoretical and Empirical Investigation on the US Economy: 1973–2003. Cambridge Journal of Economics 32: 863–86. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, Hashem M., and Yongcheol Shin. 1999. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Edited by S. Strom. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Pesaran, Hashem M., Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Economics 16: 289–326. [Google Scholar] [CrossRef]

- Popper, Karl. 1959. The Logic of Scientific Discovery. New York: Routledge. ISBN 0-41527843-0. [Google Scholar]

- Stockhammer, Engelbert. 2004. Financialisation and the slowdown of accumulation. Cambridge Journal of Economics 28: 719–41. [Google Scholar] [CrossRef]

- Stockhammer, Engelbert. 2012. Financialization, Income Distribution and the Crisis. Investigacio’n Economica 71: 39–70. Available online: https://www.scielo.org.mx/scielo.php?pid=S0185-16672012000100003&script=sci_abstract&tlng=en (accessed on 25 July 2022). [CrossRef]

- Stockhammer, Engelbert, and Karsten Kohler. 2020. Financialization and Demand regimes in Advanced Economies. In The Routledge International Handbook of Financialization. Edited by Philip Mader, Daniel Mertens and Natascha van der Zwan. London: Taylor and Francis, pp. 149–60. [Google Scholar]

- van der Zwan, Natascha. 2014. Making sense of financialization. Socio-Economic Review 1: 99–129. [Google Scholar] [CrossRef]

- Varoufakis, Yanis. 2011. The Global Minotaur: America, the True Origins of the Financial Crisis and the Future of the World Economy. London: Economic Controversies. [Google Scholar]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| scbtotgdp | 91 | 0.4268 | 0.0459 | 0.3426 | 0.5174 |

| firetotgva | 109 | 0.1880 | 0.0346 | 0.1406 | 0.2573 |

| ftselcgr | 99 | −0.0024 | 0.1663 | −0.4279 | 0.4030 |

| m3outsgdp | 108 | 3.7618 | 0.5502 | 2.6755 | 5.2945 |

| capflightgdp | 108 | −0.0085 | 0.0449 | −0.2484 | 0.2124 |

| prtfieqligdp | 91 | 0.0094 | 0.0294 | −0.0392 | 0.1596 |

| mfifagr | 90 | 0.0102 | 0.0760 | −0.1275 | 0.2133 |

| pudbtgr | 87 | 0.0079 | 0.0346 | −0.2001 | 0.0991 |

| primbubgdp | 94 | 0.0172 | 0.0778 | −0.2959 | 0.1370 |

| gr10ygby1 | 100 | 0.0662 | 0.0467 | 0.0070 | 0.2540 |

| fitotgva | 109 | 0.0461 | 0.0059 | 0.0338 | 0.0625 |

| fspudbt | 88 | 3.0521 | 0.9506 | 1.8317 | 5.3373 |

| fsgrosbub | 80 | −0.2981 | 0.2872 | −1.5446 | 0.0258 |

| Scbtotgdp | Firetotgva | Ftselcgr | M3outsgdp | Capflightgdp | Prtfieqligdp | Mfifagr | Pudbtgr | Primbubgdp | Gr10ygby1 | Fitotgva | Fspudbt | Fsgrosbub | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| scbtotgdp | 1 | ||||||||||||

| firetotgva | 0.83 * | 1 | |||||||||||

| ftselcgr | −0.04 | -0.12 | 1 | ||||||||||

| m3outsgdp | 0.69 * | 0.62 * | −0.07 | 1 | |||||||||

| capflightgdp | 0.08 | 0.06 | 0.19 | 0.02 | 1 | ||||||||

| prtfieqligdp | −0.11 | −0.04 | 0.12 | −0.11 | 0.11 | 1 | |||||||

| mfifagr | 0.15 | 0.16 | −0.09 | 0.32 * | 0.06 | −0.12 | 1 | ||||||

| pudbtgr | 0.11 | 0.1 | −0.13 | 0.18 | −0.06 | −0.06 | 0.08 | 1 | |||||

| primbubgdp | −0.32 * | −0.2 | 0.06 | −0.47 * | −0.06 | 0.1 | −0.02 | −0.26 * | 1 | ||||

| gr10ygby1 | 0.30 * | 0.42 * | −0.11 | −0.05 | 0.1 | −0.1 | −0.07 | 0.01 | −0.24 * | 1 | |||

| fitotgva | 0.43 * | 0.56 * | 0.03 | 0.23 * | 0.06 | 0.05 | 0.28 * | 0.04 | 0.08 | −0.12 | 1 | ||

| fspudbt | 0.76 * | 0.90 * | −0.04 | 0.68 * | 0.09 | −0.09 | 0.1 | 0.13 | −0.07 | 0.33 * | 0.41 * | 1 | |

| fsgrosbub | −0.1 | 0.05 | −0.06 | −0.16 | −0.22 * | 0.17 | 0.18 | −0.23 | 0.69 * | −0.37 * | 0.35 * | 0.03 | 1 |

| Model 1 | Model 2 | |

|---|---|---|

| ARDL (4,0,4,1,1,4), 2000q1–2021q3, financialization of the Greek economy and FIf | ARDL (4,0,4,1,1,3), 2000q4–2021q3, financialization of the Greek economy and FIf | |

| D.scbtotgdp | ||

| Panel A. Long-Run Relationship | ||

| dfiretotgva | 0.873(0.12) | --- |

| mfifagr | --- | −0.101(0.087) * |

| ftselcgr | −0.160(0.001) *** | −0.0860(0.001) *** |

| m3outsgdp | 0.0154(0.087) * | 0.0240(0.000) *** |

| capflightgdp | 0.426(0.015) ** | 0.373(0.000) *** |

| prtfieqligdp | ||

| q1 | −0.0365(0.000) *** | −0.0278(0.000) *** |

| q2 | 0.0183(0.016) ** | 0.0115(0.075) * |

| q3 | −0.0259(0.000) *** | −0.0234(0.000) *** |

| d2013q1 | −0.032(0.000) *** | |

| d2011q2 | --- | 0.033(0.000) *** |

| Time Trend | 0.000794(0.000) *** | 0.00102(0.000) *** |

| Constant | 0.0537(0.060) * | 0.115(0.000) *** |

| Panel B. Short-Run Relationship | ||

| LD.scbtotgdp | ||

| L2D.scbtotgdp | −0.394(0.000) *** | −0.258(0.000) *** |

| L3D.scbtotgdp | ||

| D.ftselcgr | 0.0750(0.000) *** | 0.0726(0.000) *** |

| LD.ftselcgr | 0.0747(0.000) *** | 0.0714(0.000) *** |

| L2D.ftselcgr | 0.0397(0.000) *** | 0.0456(0.000) *** |

| L3D.ftselcgr | 0.0293(0.000) *** | 0.0326(0.000) *** |

| D.m3outsgdp | 0.0307(0.024) ** | 0.0554(0.000) *** |

| D.capflightgdp | −0.191(0.000) *** | −0.252(0.000) *** |

| D.prtfieqligdp | ||

| LD.prtfieqligdp | ||

| L2D.prtfieqligdp | −0.191(0.001) *** | |

| L3D.prtfieqligdp | 0.108(0.075) * | --- |

| Panel C. Diagnostic Statistics | ||

| PSS (2001) bounds test | F = 8.129 ***; t = −4.761 ** (rej. H0 at 5%) | F = 10.81 ***; t = −6.39 *** (rej. H0 at 1%) |

| Adjustment EC Term: L.scbtotgdp | −0.535(0.000) *** | −0.931(0.000) *** |

| Ramsey RESET F-test | 2.48(0.070) | 1.87(0.146) |

| Breusch-Godfrey LM test for AR | 0.566(0.452) | 0.824(0.364) |

| Breusch-Pagan/Cook-Weisberg test | 0.50(0.480) | 1.17(0.279) |

| Mean VIF | 5.68 | 6.71 |

| Observations | 87 | 84 |

| Adj R-squared | 0.8297 | 0.8533 |

| Model 3 | Model 4 | |

| ARDL (1,3,0,3,4), 2001q2–2018q4, Financialization of the State | ARDL (1,3,1,0), 2001q1–2018q4, Financialization of the State | |

| D.scbtotgdp | ||

| Panel A. Long-Run Relationship | ||

| pudbtgr | 0.416(0.0336) ** | --- |

| primbubgdp | --- | |

| dgr10ygby | 0.0091(0.001) *** | --- |

| fitotgva | −2.638(0.000) *** | --- |

| fspudbt | --- | 0.0125(0.030) ** |

| fsgrosbub | --- | −0.0641(0.000) *** |

| mfifagr | --- | 0.134(0.086) * |

| q1 | ||

| q2 | 0.0268(0.008) *** | |

| q3 | −0.0382(0.000) *** | −0.0217(0.061) * |

| Time Trend | 0.0016(0.000) *** | 0.0011(0.000) *** |

| Constant | 0.118(0.000) *** | 0.107(0.000) *** |

| Panel B. Short-Run Relationship | ||

| LD.scbtotgdp | --- | |

| D.pudbtgr | −0.383(0.008) *** | --- |

| LD.pudbtgr | −0.215(0.055) * | --- |

| L2D.pudbtgr | −0.140(0.048) *** | --- |

| D.dgr10ygby | --- | |

| L2D.dgr10ygby | −0.00381(0.029) ** | --- |

| D.fitotgva | 3.351(0.000) *** | --- |

| LD.fitotgva | --- | |

| L2D.fitotgva | --- | |

| L3D.fitotgva | 1.277(0.026) ** | --- |

| D.fspudbt | --- | |

| LD.fspudbt | --- | −0.0265(0.000) *** |

| L2D.fspudbt | --- | |

| D.fsgrosbub | --- | 0.0276(0.094) * |

| Panel C. Diagnostic Statistics | ||

| PSS (2001) bounds test | F = 8.841 ***; t = −6.535 ** (rej. H0 at 1%) | F = 13.57 ***; t = −6.87 *** (rej. H0 at 1%) |

| Adjustment EC Term: L.scbtotgdp | −0.794(0.000) *** | −0.86(0.000) *** |

| Ramsey RESET F-test | 0.91(0.445) | 1.81(0.156) |

| Breusch-Godfrey LM test for AR | 0.329(0.566) | 0.000(0.995) |

| Breusch-Pagan/Cook-Weisberg test | 0.69(0.405) | 0.44(0.509) |

| Mean VIF | 6.41 | 5.41 |

| Observations | 71 | 72 |

| Adj R-squared | 0.7896 | 0.7262 |

| Null Hypotheses and Findings | Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|---|

| A1 | dfiretotgva does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause dfiretotgva dfiretotgva → scbtotgdp | 11.24 ** 3.57 | |||

| A2 | mfifagr does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause mfifagr mfifagr → scbtotgdp | 10.03 ** 6.66 | |||

| B1 | ftselcgr does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause ftselcgr ftselcgr ↔ scbtotgdp | 11.33 ** 11.04 ** | |||

| B2 | dgr10ygby does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause dgr10ygby dgr10ygby ↔ scbtotgdp | 16.9 *** 11.3 ** | |||

| B3d | mfifagr does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause mfifagr mfifagr ↔ scbtotgdp | 8.2 * 12.3 ** | |||

| C1d | ftselcgr does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause ftselcgr ftselcgr ← scbtotgdp | 6.15 14.6 *** | |||

| C2 | m3outsgdp does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause m3outsgdp m3outsgdp ← scbtotgdp | 4.28 16.1 *** | |||

| C3 | primbubgdp does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause primbubgdp primbubgdp ← scbtotgdp | 3.64 13.2 *** | |||

| C4 | fspudbt does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause fspudbt fspudbt ← scbtotgdp | 5.6 7.9 * | |||

| C5 | fsgrosbub does not Granger-cause scbtotgdp scbtotgdp does not Granger-cause fsgrosbub fsgrosbub ← scbtotgdp | 5.7 13.2 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kyriakopoulos, D.; Yfantopoulos, J.; Stamatopoulos, T.V. Social Security Payments and Financialization: Lessons from the Greek Case. J. Risk Financial Manag. 2022, 15, 615. https://doi.org/10.3390/jrfm15120615

Kyriakopoulos D, Yfantopoulos J, Stamatopoulos TV. Social Security Payments and Financialization: Lessons from the Greek Case. Journal of Risk and Financial Management. 2022; 15(12):615. https://doi.org/10.3390/jrfm15120615

Chicago/Turabian StyleKyriakopoulos, Dionysios, John Yfantopoulos, and Theodoros V. Stamatopoulos. 2022. "Social Security Payments and Financialization: Lessons from the Greek Case" Journal of Risk and Financial Management 15, no. 12: 615. https://doi.org/10.3390/jrfm15120615

APA StyleKyriakopoulos, D., Yfantopoulos, J., & Stamatopoulos, T. V. (2022). Social Security Payments and Financialization: Lessons from the Greek Case. Journal of Risk and Financial Management, 15(12), 615. https://doi.org/10.3390/jrfm15120615