1. Introduction

The economic sciences have always been concerned with economic growth and development. This fact can be observed in all schools of economic thought and also in numerous theories and growth models stated throughout history. In the context of the enlargement of the European Union, the issue of stimulating economic growth and reducing disparities between members has become a key issue that is needed to be addressed in order to ensure the proper development and functioning of the EU’s Single Market. As early as 1973, the British Commissioner for Regional Policy, George Thomson, emphasized the “need” for assistance to the poorer regions of the European Union (

Becker et al. 2018). Since then, the Regional Development Policies and the allocated Structural and Cohesion Funds have developed steadily.

From the last two multiannual financial perspectives, the Regional Development Policy has the second largest financial allocation after the Common Agricultural Policy. We can note that the resources allocated to regional development have increased significantly, and for the period of 2007–2013, the budget practically doubled compared to the previous year. For the period of 2021–2027, it has been estimated that the allocation will be around 500 billion Euros, being the largest allocation for the Regional Development Policy. This budget is justified by the fact that the functioning of the Single Market at the European Union level is affected by gaps between Member States, so mitigating these disparities is extremely important.

These resources are allocated for various measures: infrastructure development, research and development, innovation, stimulating business activity by encouraging investment, human resource development, streamlining public institutions and stimulating cooperation between economic agents.

The intensity of non-reimbursable financial aid differs depending on the degree of economic disparity, more precisely on the value of the GDP/capita ratio at the regional level compared to the EU average GDP/capita ratio. In this context, it should be noted that, for various reasons, planned allocations do not coincide with the actual figures of the absorption of those resources (

Aivazidou et al. 2020;

Santamarta et al. 2021;

European Comission 2015a,

2015b,

2017,

2018,

2020,

2021). This situation is valid in the case of Romania (

Antohi et al. 2020;

Pîrvu et al. 2018;

European Comission 2015a,

2015b,

2016), which has appreciable gaps.

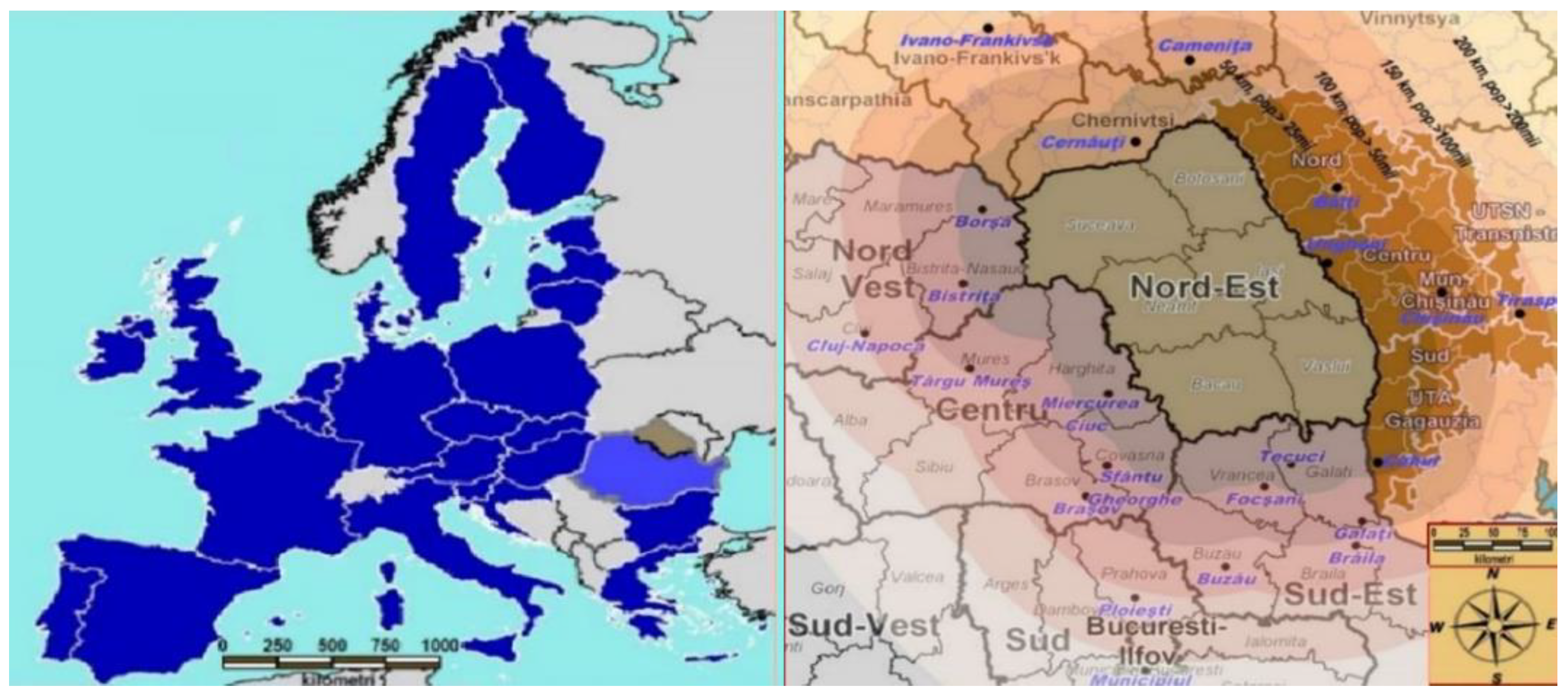

It is not difficult to observe that the component regions of Romania (eight in number) still have very different development characteristics. Prior to the pandemic crisis, according to EUROSTAT, Romania registered a GDP/inhabitant equivalent of 70%, expressed in euros, compared to the EU27 average. However, when addressing the situation at the regional level, it can be seen that (for the same indicator) there are extremes such as: the Bucharest Ilfov Development Region (160%) or the Northeast Development Region (NEDR) (44%) (

Figure 1).

At a theoretical level, the need for Structural Funds starts from the premise that market forces cannot correct economic imbalances due to the reduced mobility of factors of production. Mobility is restricted by language and cultural barriers between countries and regions (

Dumčiuvienė and Adomynienė 2014).

In the case of Romania, massive differences in the east and the west, including the huge gap that separates Bucharest from the rest of the country, can be mitigated in the future by attracting significant structural funds, considering the absorption capacity of each region and its influencing factors.

2. EU’s Regional Development Policy: Literary Review

Considering the growing importance given by the European Commission to the Regional Development Policy and implicitly to increasing allocations of Structural and Cohesion Funds, more and more researchers have tried through various methods and techniques to analyze and quantify the effects of these regional development instruments. The breadth of research efforts is comparable only to those related to agriculture, the environment or the sustainable economy (

Blanco et al. 2021;

Onofrei et al. 2020;

González and Piñeiro Antelo 2020;

Slätmo et al. 2019;

Bostan et al. 2009;

Bostan 2016).

In the specialized literature, we can distinguish three approaches: firstly, there are purely theoretical approaches based exclusively on analyses of the existing literature and economic theory; secondly, there are approaches based exclusively on empirical analyses (they usually have an econometric component); and thirdly, there are mixed approaches. In this section, we will review the main aspects of the literature.

2.1. Theoretical Approaches

In his paper,

Wostner (

2008) pointed out that the number of macroeconomic studies on the impact of the Structural and Cohesion Funds is increasing, and the vast majority of them identify a positive impact conditioned by management practices and the institutional system in the Member State. Peter Wostner then discussed an analysis of the institutional system and the factors that may affect it. The author concluded that major changes are needed in the institutional system, even proposing the decentralization of institutions in the system of the absorption of European funds. In this way, he argued, operational programs can respond much better to the existing needs in that region, and, implicitly, the impact created by the implementation of these operational programs is much greater. Another advantage of this decentralization, the author argued, is the simplification of the institutional system, both vertically and horizontally.

Palevičienė and Dumčiuvienė (

2015) argued that the impact of the Structural Funds should not be quantified solely in terms of GDP growth. The authors identified a wide range of indicators from various fields (social, educational, labor market practices and demographics) which register favorable developments as a result of the absorption of the Structural and Cohesion Funds. In their paper,

Dumčiuvienė and Adomynienė (

2014) identified several aspects that diminish the effect of the absorption of structural funds, including long and complex administrative procedures and project objectives tending to copy program priorities disregarding the real needs of the community, thus minimizing long-term effects.

Reiner (

2003) admitted that the literature does not reach a unanimously agreed conclusion on the impact of the absorption of EU funds, but in his opinion, structural instruments have a positive impact on long-term economic growth. The positive impact of EU funds is, however, conditioned by a stable macroeconomic environment, microeconomic institutions and structures that support economic growth. Of these, the most important factors are: low inflation, responsible budgetary policies, a tax system aimed at supporting SMEs, efficient transport and communications infrastructure and well-trained human capital. All these things, explained

Reiner (

2003), contribute to the development of domestic economic agents and to the attraction of foreign direct investments, which are effects that are translated into long-term economic growth. Martin Reiner, in the above-mentioned research, pointed out some possible aspects that need to be addressed: elements of spatial concentration should be included in the Regional Development Policy, procedures need to be further simplified and much more serious coordination with national and regional policies is needed. All these measures can lead, in the author’s opinion, to a greater impact of EU funds on economic development (

Reiner 2003).

Similar to the views of Martin Reiner,

Barry et al. (

2011) concluded that the Structural Funds have a long-term impact, but this impact is not generated by financial aid to the business environment but by investment in infrastructure and human capital development. These factors have a direct effect on increasing productivity and profitability in the business environment.

Ederveen et al. (

2002) showed that the Structural Funds have a conditional effect. In this paper, the authors showed that the Structural Funds cannot explain the differences between the levels of economic growth of the beneficiary states. Moreover, only in states with an open institutional system does this financial aid make their effect felt. In the article, the institutional system was analyzed from the perspective of three factors: corruption, inflation and openness.

In the same paper, the authors emphasized that it is very difficult to analyze the absorption process and to quantify the impact of the absorption of the Structural Funds because they can be seen as income for the beneficiary state, but projects must be designed on certain predetermined priorities and must be co-financed. Thus, there are many other factors that influence the process, which makes its modeling almost impossible.

2.2. Empirical Approaches

In an attempt to assess the impact generated by the absorption of the Structural Funds,

Becker et al. (

2018) presented a particularly important contribution. In this research, the authors analyzed regions that have received support through Regional Development Policy Objective 1 (i.e., those regions that have a GDP/capita of less than 75% of the average EU) during several multiannual programs: 1989–1993, 1994–1999, 2000–2006 and 2007–2013. Bulgaria, Romania and Croatia were excluded from the research due to a lack of data. This analysis was performed at the macroeconomic level, and, among the variables considered, there were: the average annual increase in GDP/capita, the decrease in the average annual unemployment, the average annual value of total investments and the average annual value of public investments.

The analyses showed positive effects during all the analyzed periods, including in the years 2000–2006 and 2007–2013, periods that were affected by the economic and financial crisis. In countries strongly affected by cyclical phenomena, the effects of the absorption of the Structural and Cohesion Funds were lower but still present. In all the regions analyzed by this study, there were reductions in unemployment, but in the regions most severely affected by the economic and financial crisis, there were no favorable developments for income growth. An interesting aspect highlighted by this study shows that the effects of the structural funds were greater in the short term, and in the long term, there was no noticeable effect on GDP/capita. By default, if the region is no longer covered by Objective 1 (i.e., GDP/capita exceeds 75% of the EU average), there is a decline in that region. In view of these results (

Becker et al. 2018), the authors emphasized that supported investments should be targeted in the long term; otherwise, the impact of the absorbed funds is jeopardized.

Other research with important contributions in this field was the work published by

Jureviciene and Pileckaitė (

2013). This research was conducted at the microeconomic level and analyzed the way in which economic SMEs approach the opportunity of non-reimbursable financial aid offered through the Regional Development Policy. The research shows that the behavior of economic agencies is not exactly rational with respect to these grants. Specifically, SMEs prefer to implement secondary projects, which are not a priority, only to benefit from this financial aid; moreover, the costs tend to be higher if there is non-reimbursable financial aid. Moreover, in this research, the authors identified an indirect effect of the absorption of European funds, namely that there is a direct correlation between attracted European funds and foreign direct investment.

Varga and Veld (

2009) applied the QUEST III econometric model to quantify the potential impact of the Structural and Cohesion Funds allocated over the period of 2007–2013 to new EU members. Being an ex-ante evaluation model, there are certain margins of uncertainty that must be considered in the analysis of the results of this study. The QUEST III model is a newer model, from the DSGE class, being strongly anchored macroeconomically. This model is widely used in the evaluation of economic policies. The model incorporates public investment, quantifying the effects on productivity generated by infrastructure investments. The model allows for the quantification of the impacts that R&D incentive policies, specifically education policies, have on the simulation of economic growth and human capital.

Varga and Veld (

2009) showed that the Structural and Cohesion Funds lead to a significant increase in government spending, especially in the field of public investment. This, according to the data provided by the QUEST III module, leads to an increase in productivity in the private sector, which gradually produces an increase in production in the private sector. Economic growth is also supported by investment in research and development, which involves the use of more patents/technologies, which requires an increasingly specialized workforce. The investments made in education and training respond to the need for specialized labor, while determining an increase in production. However, all these effects appear over time, according to the model data, with the effects of funds spent in 2007–2013 being fully felt only in 2020. Similar results were obtained by

Lolos (

2009), who, using a model of β-convergence equations using panel methods of estimation, demonstrated that, based on data from 1990 to 2005, in various regions of Greece, the absorption of EU funds led to economic regional growth, thus increasing wages and reducing unemployment.

In the short term, the absorption of the Structural Funds leads to increases in wages and interest rates and reductions in unemployment, all leading to increases in GDP but to a lesser extent than increases in the consumption of goods and services. In the long term, the effects on unemployment are reversible, mainly due to increases in demand for skilled labor.

Soukiazis and Antunes (

2006) analyzed the evolution of various regions of Portugal, classifying them into two broad categories: “coastal” and “inland”. The classification also considers the amount of funds allocated, with there being differences between the two categories. Through comparative analysis the authors observed that the regions that received more funds registered a higher convergence trend, but the value of GDP growth/capita attributed to the Structural and Cohesion Funds was a very small one (only 0.00007% for each additional Euro/capita received). The authors concluded that the Structural Funds are not used in the most productive way, with most of them being allocated to improve infrastructure or as direct revenue growth measures.

Slightly different approaches were taken by

Bachtler and Taylor (

2006), and they analyzed the impact of structural funds using the concept of “Added Value”, which includes both economic and non-economic benefits. The authors concluded that the Structural Funds have a significant positive impact in the regions covered by Regional Development Policy Objective 1 (regions with a GDP per capita below 75% of the community average), being an important catalyst for the regeneration and diversification of economic activities. Following the analyses, they were able to identify, at the level of certain regions, significant increases in GDP per capita, compared to the community average.

Bachtler and Taylor (

2006) even identified a number of factors that diminish the positive impact of the Structural Funds, the most important of which are: excessive bureaucracy represented by complex and costly documentation, restricted/fragmented eligible areas and a lack of convergence between national development projects and regional objectives and priorities of funding programs.

In a paper published in 2009,

Wostner and Šlander (

2009) examined the effectiveness of the Cohesion Policy and the extent to which it contributes to reducing disparities between beneficiary regions. The econometric analyses performed by them failed to directly quantify the efficiency of the absorption process, so an indirect approach was used. The modeling confirms that the Structural Funds contribute to increased investment in the beneficiary regions, but the final impact of non-reimbursable financial aid is strongly influenced by the efficiency of micro-management or project management, especially in the case of private funds. The authors pointed out that, at the macro level, the Regional Development Policy has the expected results, contributing to an increase in public investment in the target regions; however, for deeper analysis, an additional set of indicators should be developed. This is relatively problematic, given the very varied specificities of the beneficiary regions.

This variety is also the main limitation of the vast majority of econometric models.

2.3. Conclusions of the Literature Review

The conclusions of the specialized studies, both in the case of research carried out at the microeconomic level, and at the level of the macroeconomic ones, are varied, with the main aspects identified being:

Negative effects, such as slightly irrational behavior of SMEs with regard to non-reimbursable financial aid, sometimes implementing overestimated, oversized and inappropriate projects (

Jureviciene and Pileckaitė 2013).

By analyzing the existing literature, some essential aspects can be found:

The vast majority of studies are conducted at the macroeconomic level, and the literature is quite poor with respect to studies conducted at the microeconomic level. The few studies carried out at the microeconomic level are based on the application of questionnaires to economic operators who have received non-reimbursable financial assistance, to experts from institutions dealing with the management of European funds, or to consultants. A microeconomic approach, based on financial-accounting analysis, has not been achieved.

The vast majority of studies admit that, in the short term, a positive impact of the Structural and Cohesion Funds can be observed, but regarding the long-term effect, the literature is divided. Some studies admit that there is a notable but conditional long-term effect, and other studies do not identify any notable long-term effects.

The vast majority of studies suggest that infrastructure investments have a positive effect on supporting economic development, but regarding the effect of private investments co-financed by European funds, the discussion is polarized. Some authors, followers of the neoclassical model of economic growth, argue that granting non-reimbursable financial aid to investments of economic agents is an important way to encourage economic growth. The main argument of this opinion is the theory behind the neoclassical model of economic growth (capital accumulation). Other authors show that economic agents no longer behave rationally when the opportunity to obtain non-reimbursable financial aid is presented, with many of them agreeing to implement oversized, overestimated and questionable utility projects.

In these conditions, a study conducted at the microeconomic level, focused on the medium and long-term effects generated by the projects of economic agents, is essential to clarify the existing divergences among researchers in the field. The approach that is used in this paper is similar to that made by

Netrdová and Nosek (

2020) in their paper published in 2020, but we will focus on non-reimbursable funding and not on unemployment. The principles of analysis can be transferred, given that both subjects are complex phenomena, having multiple influencing factors.

In this research, we want to include aspects of spatial analysis, similar to those used by

Chłoń-Domińczak et al. (

2020) but aimed at the territorial distribution of projects and funds absorbed.

2.4. Spatial Dimension

The analysis made at the level of this article focuses on the NEDR of Romania (

Figure 2).

From the perspective of realized GDP, this is the poorest region of Romania and the fifth poorest region of the EU, achieving a GDP that represents 39% of the European Community average (according to EUROSTAT Newsrelease 34/2019).

Another reason for choosing this region was the disparities that exist in the counties that it comprises. In

Figure 3, it can be seen that, from the perspective of GDP per capita, we can distinguish three categories of counties: developed (Iasi), medium-developed (Suceava, Neamţ, Bacau) and poorly developed (Botoșani, Vaslui).

3. Research Methodology

To achieve the purpose of this research, namely to quantify the medium and long-term effects of the Structural and Cohesion Funds on the business environment in the NEDR, we aimed to build a representative sample of SMEs that had accessed and implemented projects with non-reimbursable financial assistance under the 2007–2013 programming period. For this, we used lists published by the Managing Authorities for the Regional Operational Program and the Sectoral Operational Program Increasing Economic Competitiveness (

Ministry of European Funds 2021,

https://beneficiar.fonduri-ue.ro:8080/proiecte/, accessed on 14 April 2022). From these lists, we selected the projects related to the Major Intervention Area 1.1 POSCCE and the Major Intervention Areas 4.1, 4.3 and 5.2 ROP. Within the four major areas, SMEs benefited from non-reimbursable financing (subsidies) for productive investments. From these databases, we selected only the private beneficiaries who had completed projects in the NEDR. We selected only these four instruments of intervention because these are the main programs for financing the business environment in Romania.

For the SMEs included in the sample, we downloaded the financial statements for the period of 2005–2018 from the database of the Ministry of Public Finance, and based on these accounting data, we determined a series of indicators of profitability, productivity, financial stability and balance sheet position.

In order to have a basis for comparison, using the information provided by the Trade Register, we built another representative sample composed of SMEs that did not receive non-reimbursable financial aid. This second sample acted as a control group; it had a similar structure to the first sample (the structure was followed from the perspective of the field of activity and from the perspective of the size of the company; the size of each enterprise was determined on the basis of turnover, number of employees and total assets in accordance with EU legislation). Similarly, for the control group, the financial statements were downloaded, and the relevant financial indicators were calculated.

Using statistical tests, the results from the two groups of SMEs were compared, aiming to identify significant differences between them.

Based on the specific objectives assumed, the following hypotheses were constructed:

H1. The Structural and Cohesion Funds addressed to the business environment contribute to increases in the revenues of the beneficiary SMEs in the medium and long terms.

H2. The Structural and Cohesion Funds addressed to the business environment contribute to increases in the number of employees of the beneficiary SMEs in the medium and long terms.

H3. The Structural and Cohesion Funds contribute to increasing the productivity of beneficiary SMEs in the medium and long terms.

H4. The Structural and Cohesion Funds contribute to increasing the profitability indicators of beneficiary SMEs in the medium and long terms.

H5. The Structural and Cohesion Funds contribute to improving the indicators of asset stability of the beneficiary SMEs in the medium and long terms.

At the level of the NEDR, 629 SMEs were identified that benefited from non-reimbursable financial aid. Of these, the SMEs that had business interruptions, mergers or those that failed to complete the implementation of the project were eliminated, so in the analyzed group, there remained 578 SMEs that were included in the analysis. A control group was also set up for that comparison base, consisting of SMEs that did not receive non-reimbursable financial aid. With the help of the database of the National Office of Trade Register (RECOM online), we selected 660 SMEs. For their selection, random sampling was used, and on quotas, observance of the territorial distribution of the analyzed group was practically followed. In order to ensure the representativeness of the data, we verified that none of the SMEs in the control group were also included in the analyzed group, i.e., those that did not receive non-reimbursable financial aid. A total of 7 SMEs were identified that were in both groups, and the control group was eliminated, thus reaching 653 SMEs.

For the SMEs included in the control group, we downloaded the financial statements for the period of 2005–2018 from the database of the Ministry of Public Finance. Based on these accounting data, a series of indicators of profitability, productivity, financial stability and balance sheet position were determined, which were then compared with the values obtained for the first group. For data processing and statistical tests, we used the computer application SPSS version 20. Starting from the accounting data of the two groups of SMEs, we performed a comparative analysis of the main financial indicators at the level of several periods of time. The research analyzed the following representative indicators to describe the activity of a company: turnover, total assets, profitability rate, level of indebtedness, number of employees, and average labor productivity.

The six indicators were analyzed over several periods of time in an attempt to highlight the effects of grants in the short, medium and long terms. In the present research, we considered the short term as the first five years from the completion of the investment project, and what exceeded this period was classified in the medium and long terms. The last two were cumulated because, at the time of collecting the accounting data (December 2019–March 2020), only information until 2018 was available. Given that many projects were completed in 2009, the time horizon for the post-implementation period was for only nine years, and thus it was impossible to distinguish between medium-term and long-term effects.

At the level of the two groups, five time periods were analyzed:

Period 2005–2018: In the first phase, we analyzed the entire time horizon, looking for any representative differences between the averages of the two groups. This first analysis was indicative, and any difference identified at the level of this period was corroborated with the results identified at the level of the sub-periods;

Pre-implementation (2005–2008): For the analyzed group, the pre-implementation period was clearly delimited, from 2005 until the moment of signing the financing contract. From the available data, we identified the fact that the implementation for the vast majority of projects started in 2008, so for the control group, we considered the period 2005-2008 as a basis for comparison for the pre-implementation period;

Post-implementation (2009–2018): For the analyzed group, the post-implementation period was clearly delimited, from the year of project completion to 2018. For the control group, in order to ensure an equivalent period as a basis of comparison, we identified that the implementation for the vast majority of projects was completed during 2009, so for the control group, we considered the period 2009–2018 as a basis for comparison for the post-implementation period.

The post-implementation period was then broken down into: (i) the short-term post-implementation period, more precisely the first five years after the completion of the implementation, for which we took the period 2009–2013 as a basis for comparison for the control group; and the medium- and long-term post-implementation period, more precisely starting with the sixth year after the completion of the project’s implementation, for which we took the period 2014–2018 as a basis for comparison for the control group.

Another operation, which we performed to facilitate the application of statistical tests, was the elimination of extreme values. To ensure that we were working with normal data distributions, we proceeded to eliminate the extreme values using the inter-quartile method using a coefficient of 3.

4. Quantifying the Impacts of the Structural Funds

The first aspect that is analyzed is the territorial distribution of the projects, particularly the value engaged in financing contracts at the level of each county of the NEDR. In

Figure 4, it can be seen that, at the regional level, both the distribution of the number of contracted projects and the distribution of payments are correlated with the distribution of county GDP.

Thus, we noticed that more economically developed areas tended to attract a larger number of projects with non-reimbursable financing and implicitly larger volumes of European funds. However, beyond this quantitative observation, there is the question of the impacts that these funds have on the beneficiary regions.

The second aspect that we address in this chapter is the comparative analysis of the six relevant indicators previously identified at the level of the two groups of established SMEs. All the defined periods are analyzed successively, testing at each level whether the differences between the groups are statistically representative or not.

The first indicator is analyzed is turnover, with the aim of finding out if the non-reimbursable financial aid has any statistically representative influence on the incomes registered by the beneficiary enterprises. Turnover is one of the key indicators for any business, as it includes the total revenue from the sale of goods and products, the execution of works and the provision of services over a period of time. This indicator is sensitive to the field of activity; for example, SMEs operating in trade tend to register a higher value than SMEs operating in services or the production of goods. This should not influence the present analysis because trade is an area that is not financed through non-reimbursable funds. Implicitly in the analyzed group, there are no SMEs that have trade as main field of activity, and in the construction of the control group, we did not include SMEs with this field of activity, trying as much as possible to replicate the structure of the analyzed group.

As described in the methodology section, we analyzed the group of SMEs that received non-reimbursable financial aid compared to a control group of SMEs that did not benefit from this support instrument. The comparative analysis was performed at the level of several periods in order to be able to make a quantification in time of the effect that the structural funds addressed to the business environment had on the beneficiary SMEs.

The total assets represent the total means of production that an SME owns and can use in carrying out its activities, implicitly, in generating future cash flows. This indicator includes fixed and mobile assets represented by buildings, technical installations and any other technical equipment or software that is used in several production cycles, and current assets are represented by raw materials, finished products, other consumables and the last component of total assets, which is represented by expenses in advance. This indicator is important in economic–financial analysis, along with turnover and the number of staff, which are key indicators in determining the size of an enterprise. Another indicator that we analyzed in this research is the rate of return. This synthesis indicator was determined by relating the value of the net result to the value of total assets. Similar to the previous indicators, we analyzed the relative evolution index.

As they are indicators based on a company’s net results, we expected to see notable differences between the two groups, given that most funding programs require certain minimum returns for selected projects. Another indicator that describes the financial stability of an enterprise and that can be affected by the Structural Funds received is the degree of indebtedness. This indicator shows to what extent a company uses loans to finance investment and operating activities. As it results from the stated hypotheses, we wanted to see if there are differences at the level of this indicator and if these differences are statistically representative. In order to ensure increased comparability, we analyzed the evolution of the index with a mobile base. We practically analyzed the average rhythm of evolution of this indicator at the level of several periods of time.

The last category of indicators that we analyzed is the one related to human resources and how they are used. The evolution of the average number of employees is a key indicator regarding business analysis, being used in assessing the size of a company, along with turnover and total assets. Given that several funding programs encouraged the creation of new jobs, we expected there to be notable differences between the two groups at the level of this indicator. Moreover, we wanted to see even if there were differences in the monitoring period, i.e., if the companies receiving non-reimbursable funds maintained their commitments even after the end of the monitoring period.

The last indicator that analyzed in this paper is average labor productivity. Its value was determined by comparing the annual turnover to the average number of employees registered in that year. As a summary indicator, it allowed us to assess the efficiency with which human resources are used in SMEs. The evolution of this indicator is influenced by the evolution of its determinants (turnover and average number of employees), and, given the fact that for the two determinants we expected differences between groups, we anticipated to see variations in this indicator as well.

The results of the comparative analysis are centralized in

Table 1. Comparisons of the averages for the six indicators determined at the level of the two groups of enterprises were performed with the help of an independent sample t-test, whose results indicate whether or not the difference is statistically representative. The analysis was conducted first on the entire period (2005–2018), and then it was broken down into three: pre-implementation, post-implementation short term and post-implementation medium-long term.

The first observation is that at the level of the post-implementation period. In the medium and long terms, from the comparative analysis, it results that there are representative differences in five of the six analyzed indicators (

Table 1).

Of the five indicators that show statistically significant differences, we found that two of them show relatively small differences, which are below 5% (number of employees, 2.31%, and average labor productivity, 3.87%), two of the indicators show average differences, which are between 5% and 10% (total assets, 7.42%, and level of indebtedness, 6.50%), and only one of the indicators shows a large difference of over 10% (rate of return, 15.98%).

At the level of the short-term effect, there are also significant differences in the case of five indicators out of the six analyzed indicators. Of the five indicators that show statistically significant differences, we found that four of them show average differences, between 5% and 10% (turnover, 8.34%; rate of return, 9.97%; level of indebtedness, 7.84%; and average labor productivity, 9.37%), and one of the indicators shows a large difference of over 10% (Number of employees, 12.37%).

At the level of the pre-implementation period, the situation is slightly different, as only three of the six indicators show statistically representative differences. In the case of two indicators, we identified differences of average intensity between 5% and 10% (total assets, 7.51%, and average labor productivity, 7.18%), and in the case of the third, we identified a larger difference of over 15% (rate of return, 17.04%).

5. Conclusions, Limitations and Future Research Perspectives

5.1. Conclusions

In order to be able to confirm or refute the stated hypotheses, we analyzed the evolution of the representative indicators at the level of the different defined periods. The verification of the hypotheses must imply that, at the level of the pre-implementation period, there are no statistically representative differences; at the level of the post-implementation period, there are statistically representative differences; or at the level of the pre-implementation period, there are statistically representative differences. However, at the level of the post-implementation period, we noticed a significantly larger difference.

H1. The Structural and Cohesion Funds for the business environment contribute to increasing the revenues of beneficiary SMEs in the medium and long terms.

For testing hypothesis H1, the representative indicator is turnover, so for the pre-implementation period, we found that the difference between groups is unrepresentative. In the short post-implementation period, the difference is representative, and SMEs that received non-reimbursable financial aid register an average annual increase of 8.33%, higher than the SMEs in the control group. In the case of the medium- and long-term post-implementation period, the difference between the average indices of evolution of the two groups is statistically unrepresentative. Thus, the hypothesis is refuted, as the Structural and Cohesion Funds have an effect on the revenues of SMEs, but this effect is noticeable only in the short term.

H2. The Structural and Cohesion Funds for the business environment contribute to increasing the number of employees of beneficiary SMEs in the medium and long terms.

To validate the hypothesis H2, we analyzed the evolution of the number of employees. At the level of the pre-implementation period, the difference between the groups is not statistically representative. In the short-term post-implementation period, there is a representative difference, as the SMEs in the analyzed group register an average annual growth of 12.37% higher than those from the control group, whereas in the medium and long term post-implementation period, the difference between the groups is still statistically representative but has a much lower value of only 2.31%. Thus, we conclude that the hypothesis is confirmed, as the changes observed in the average number of employees can be attributed to non-reimbursable financial aid. From the analysis, we found that the effect is much more intense in the short term but is also observable in the medium and long terms.

H3. The Structural and Cohesion Funds contribute to increasing the productivity of beneficiary SMEs in the medium and long terms.

Analyzing the evolution of average labor productivity, we found that, at the level of the pre-implementation period, there is a representative difference of 7.18%, and at the level of the post-implementation period, in the short term, statistically representative difference of 9.37% was observed. At the level of the post-implementation period, in the medium and long terms, the difference is also a representative one but with a much lower value of 3.87%. Given that in all three periods the analyzed group shows a lower average annual increase in labor productivity than the control group and the fact that the difference between the groups is the lowest in the last period, we can conclude that hypothesis H3 is confirmed. In the medium and long terms, the Structural Funds helped to reduce the gap between the groups of SMEs that were analyzed.

H4. The Structural and Cohesion Funds contribute to increasing the profitability indicators of beneficiary SMEs in the medium and long terms.

In order to be able to quantify the influence that the structural funds have on the profitability of the beneficiary SMEs, we proceeded to analyze profitability rates. Thus, at the level of the pre-implementation period, we found that there is a representative difference of 17.04% between the two groups of SMEs that were analyzed. At the level of the post-implementation period, in the short term, there is a representative difference of 9.97%, and at the level of the period post-implementation, in the medium and long terms, there is also a representative difference of 15.89%. Essentially, we found that the differences in the pre-implementation and post-implementation period, in the medium and long terms, are approximately identical, which leads us to refute hypothesis H4.

H5. The Structural and Cohesion Funds contribute to improving the indicators of asset stability of beneficiary SMEs in the medium and long terms.

In order to be able to validate hypothesis H5, we analyzed the evolution of the total assets and that of the degree of indebtedness, both indicators being representative for the patrimonial stability of an enterprise. At the level of the pre-implementation period, for the total assets, there is a representative difference of 7.51%. At the level of the post-implementation period, in the short term, the difference is unrepresentative, and at the level of the post-implementation period, in the medium and long terms, there is a representative difference of 7.43%. Given that the differences are comparable in size, we can conclude that non-reimbursable financial aid does not have a significant effect on total assets. For the degree of indebtedness, at the level of the pre-implementation period, it was found that there is a statistically unrepresentative difference. At the level of the post-implementation period, in the short term, there is a representative difference of 7.84%, and at the level of the post-implementation period, in the medium and long terms, we identified a representative difference of 6.50%. We can conclude, thus, that the Structural and Cohesion Funds have an effect only on some indicators of patrimonial stability, which implies that the hypothesis is partially accepted.

Following the analysis, we found that the medium and long-term effects of the structural funds addressed to the business environment are limited to indicators related to human resources and certain indicators of asset stability. The fact that SMEs that have benefited from non-reimbursable financial aid tend to use human resources more efficiently both quantitatively and qualitatively leads us to the conclusion that the Structural Funds have a positive effect on the medium and long term economic development of the beneficiary region.

More efficient use of human resources leads to reduced unemployment and increased incomes of the population, which leads to increased consumption.

The fact that at the level of income and profitability indicators of the analyzed SMEs we identified statistically representative differences only in the short term, may suggest average quality of the selected and implemented projects. This can be attributed both to the management of SMEs that have not opted for the optimal business plan (either oversized or overestimated) and to the authorities that manage the Structural Funds, because in the evaluation phase, the projector should have signaled those deficiencies and corrected them.

Referring to the literature mentioned in the first part of this paper, we can appreciate, based on an empirical analysis of the process, that the Structural and Cohesion Funds have a positive effect on the economic development of the beneficiary region, and they are much stronger in the short term than they are in the long term. There are factors that can potentiate this effect; for example, the quality of the projects implemented can ensure a stronger and long-term effect. However, this quality is conditional, on one hand, as a result of the efficiency of the authorities involved in the process of managing European funds, and on the other hand as a result of the behavior of economic operators intending to access these support instruments.

We can clearly state that EU Funds have a positive impact on economic development, but it is a conditional one. Thus, this paper supports the studies that argued in favor of the conditioned effects in which the conditioning factors are the efficiency of the institutional absorption system. The conclusions of this paper also support the ideas related to the concept of the absorption capacity of a region, which is determined by certain factors, as the allocation of resources over this capacity is inefficient.

5.2. Limitations and Future Research Perspectives

A first limitation that we must remember is the influence of the management staff. Changes in economic indicators that characterize SMEs may be attributed, to some extent, as a result of better management of them and not necessarily as the effect of using EU funds. This is a factor with a notable influence on financial statements, but the influence of managerial skills is very difficult to quantify. However, considering the fact that in the present analysis we are talking, in general, about SMEs, we can consider that the influence of managerial skills at the level of the analyzed entities is constant. We can make this presumption because the management of small and medium-sized SMEs is usually provided by partners and, consequently, changes relatively rarely.

A second notable limitation is the volume of available data. In order to be able to fully study the long-term effects of the Structural Funds, the time horizon must be increased. This is also a future research direction, as when there is more data, the research can be resumed, pursuing time horizons of up to 15 years. This type of approach also presents a series of risks, because at such a time horizon, the possibility of disturbing factors is high.

Another limitation that is worth noting is that the analysis focuses only on SME enterprises. The decision to analyze only this category of enterprises was due to their special importance in the national economy but also due to their peculiarities. The process of regional development is a complex phenomenon, and thus, in future research, we will focus on other categories of enterprises from the Northeast Region. In particular, we will use additional analysis techniques such as quantitative interviews or surveys. Another aspect that we will pursue in future research is a sectoral analysis to see if there are representative differences between the manufacturing sector and the service sector in regard to the impacts of EU funds.

Author Contributions

Conceptualization, I.B., A.-A.M., C.-V.H., P.S. and I.C.; methodology, I.B., A.-A.M., C.-V.H., P.S. and I.C.; software, I.B., A.-A.M., C.-V.H., P.S. and I.C.; validation, I.B., A.-A.M., C.-V.H., P.S. and I.C.; formal analysis, I.B., A.-A.M., C.-V.H., P.S. and I.C.; investigation, I.B., A.-A.M., C.-V.H., P.S. and I.C.; resources, I.B., A.-A.M., C.-V.H., P.S. and I.C.; data curation, I.B., A.-A.M., C.-V.H., P.S. and I.C.; writing—original draft preparation, I.B., A.-A.M., C.-V.H., P.S. and I.C.; writing—review and editing, I.B., A.-A.M., C.-V.H., P.S. and I.C.; visualization, I.B., A.-A.M., C.-V.H., P.S. and I.C.; supervision, I.B., A.-A.M., C.-V.H., P.S. and I.C.; project administration, I.B., A.-A.M., C.-V.H., P.S. and I.C.; funding acquisition, I.B., A.-A.M., C.-V.H., P.S. and I.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data generated or analyzed during this study are included in this article.

Acknowledgments

This work was carried out within the project POCU 125040, entitled “Development of the tertiary university education to support the economic growth—PROGRESSIO”, co-financed by the European Social Fund under the Human Capital Operational Program 2014–2020.

Conflicts of Interest

The authors declare no conflict of interest.

References

- ADRNE. 2020. Planul de Dezvoltare Regionala Nord-Est 2021–2027. p. 7. Available online: https://adrnordest.ro/storage/2021/02/PDR-NE-2021-2027-dec.-2020.pdf (accessed on 14 April 2022).

- Aivazidou, Eirini, Giovanni Cunico, and Edoardo Mollona. 2018. Deliverable 6.1: Report on Causal Qualitative Model. Perception and Evaluation of Regional and Cohesion Policies by Europeans and Identification with the Values of Europe. Bologna: PERCEIVE Grant Agreement No. 693529. [Google Scholar] [CrossRef]

- Aivazidou, Eirini, Giovanni Cunico, and Edoardo Mollona. 2020. Beyond the EU Structural Funds’ Absorption Rate: How Do Regions Really Perform? Economies 8: 55. [Google Scholar] [CrossRef]

- Antohi, Valentin-Marian, Monica L. Zlati, Romeo Victor Ionescu, Mihaela Neculita, Raluca Rusu, and Aurelian Constantin. 2020. Attracting European Funds in the Romanian Economy and Leverage Points for Securing their Sustainable Management: A Critical Auditing Analysis. Sustainability 12: 5458. [Google Scholar] [CrossRef]

- Bachtler, John, and Sandra Taylor. 2006. The Added Value of the Structural Funds: A Regional Perspective, Glasgow: IQ-Net Special Report, European Policies Research Centre; Mairate, A. The ‘‘added value’’ of European Union Cohesion policy’. Regional Studies 40: 167–77. [Google Scholar]

- Barry, Frank, John Bradley, and Aoife Hannan. 2011. The Single Market, The Structural Funds and Ireland’s Recent Economic Growth. Journal of Common Market Studies 39: 537–52. [Google Scholar] [CrossRef]

- Becker, Sascha O., Peter H. Egger, and Maximilian Von Ehrlich. 2018. Effects of EU Regional Policy: 1989–2013. Regional Science and Urban Economics 69: 143–52. [Google Scholar] [CrossRef]

- Blanco, Miguel, Marcos Ferasso, and Lydia Bares. 2021. The Regional Efficiency in the Use of European Agricultural Funds in Spain: Growth and Employment Analyses. Agronomy 11: 1109. [Google Scholar] [CrossRef]

- Bostan, Ionel. 2016. Pro sustainable development: The influence of the law of entropy on economic systems. Environmental Engineering & Management Journal (EEMJ) 15: 2429–32. [Google Scholar]

- Bostan, Ionel, Aurel Burciu, Petru Condrea, and Gheorghe Durac. 2009. Involvement of legal responsibility for severe acts of pollution and noncompliance. Environmental Engineering & Management Journal (EEMJ) 8: 469–73. [Google Scholar]

- Bostan, Ionel, Cristina Mihaela Lazar, Nicoleta Asalos, Irena Munteanu, and Gabriela Maria Horga. 2019. The three-dimensional impact of the absorption effects of Euro-pean funds on the competitiveness of the SMEs from the Danube Delta. Industrial Crops and Products 132: 460–67. [Google Scholar] [CrossRef]

- Chłoń-Domińczak, Agnieszka, Anna Fiedukowicz, and Robert Olszewski. 2020. Geographical and Economic Factors Affecting the Spatial Distribution of Micro, Small, and Medium Enterprises: An Empirical Study of The Kujawsko-Pomorskie Region in Poland. ISPRS International Journal of Geo-Information 9: 426. [Google Scholar] [CrossRef]

- Dall’erba, Sandy, Rachel Guillain, and Julie Le Gallo. 2009. Impact of Structural Funds on Regional Growth: How to Reconsider a 9 Year-Old Black Box. Region et Developpement 30: 77–100. [Google Scholar]

- Dumčiuvienė, Daiva, and Indrė Adomynienė. 2014. The Evaluation of European Union Structural Support. Procedia Social and Behavioral Sciences 156: 382–87. [Google Scholar] [CrossRef][Green Version]

- Ederveen, Sjef, Henri L.F. de Groot, and Richard Nahuis. 2002. Fertile Soil for Structural Funds? A Panel Data Analysis of the Conditional Effectiveness of European Cohesion Policy. Tinbergen Institute Working Paper 59: 17–42. [Google Scholar] [CrossRef]

- European Comission. 2015a. Country Profile—Key Indicators: Romania. Directorate-General Regional and Urban Policy. Available online: https://ec.europa.eu/regional_policy/en/information/publications/factsheets/2015/country-profile-key-indicators-romania (accessed on 14 April 2022).

- European Comission. 2015b. Guide to Cost-Benefit Analysis of Investment Projects Economic Appraisal Tool for Cohesion Policy 2014–2020. Brussels: Directorate-General for Regional and Urban Policy. Available online: https://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/cba_guide.pdf (accessed on 9 April 2022).

- European Comission. 2016. European Structural and Investment Funds: Country Factsheet—Romania. Brussels: European Comission. Available online: https://ec.europa.eu/regional_policy/en/information/publications/factsheets/2016/european-structural-and-investment-funds-country-factsheet-romania (accessed on 12 April 2022).

- European Comission. 2017. Guidance on Sampling Methods for Audit Authorities—Programming Periods 2007–2013 and 2014–2020. Brussels: European Comission. Available online: https://ec.europa.eu/regional_policy/en/information/publications/guidelines/2017/guidance-on-sampling-methods-for-audit-authorities-programming-periods-2007-2013-and-2014-2020 (accessed on 9 April 2022).

- European Comission. 2018. Analysis of ERDF Support for Inclusive Growth in the 2014–2020 Programming Period. Final Report. Luxembourg: Publications Office of the European Union. Available online: https://ec.europa.eu/regional_policy/en/information/publications/studies/2018/analysis-of-erdf-support-for-inclusive-growth-in-the-2014-2020-programming-period (accessed on 3 April 2022).

- European Comission. 2020. European Structural and Investment Funds 2014–2020. Report from the Commission to the European Par-Liament, the Council, the European Economic and Social Committee and the Committee of the Regions. Brussels: European Comission. Available online: https://op.europa.eu/en/publication-detail/-/publication/5714920a-a809-11eb-9585-01aa75ed71a1/language-en (accessed on 8 April 2022).

- European Comission. 2021. Analysis of the Budgetary Implementation of the European Structural and Investment Funds in 2020. Luxembourg: Publications Office of the European Union. Available online: https://op.europa.eu/en/publication-detail/-/publication/196e166e-b91c-11eb-8aca-01aa75ed71a1 (accessed on 4 April 2022).

- Eurostat. 2021. Your Key to European Statistics. Available online: https://ec.europa.eu/eurostat/web/main/data/database (accessed on 14 April 2022).

- Farole, Thomas, Andrés Rodriguez-Pose, and Michael Storper. 2011. Cohesion Policy in the European Union: Growth, Geography, Institutions. JCMS: Journal of Common Market Studies 49: 1089–111. [Google Scholar] [CrossRef]

- González, Rubén C. Lois, and María de los Ángeles Piñeiro Antelo. 2020. Fishing Tourism as an Opportunity for Sustainable Rural Development—The Case of Galicia, Spain. Land 9: 437. [Google Scholar] [CrossRef]

- Horvat, Andrej. 2005. Why Does Nobody Care about the Absorption? Some Aspects Regarding Administrative Absorption Capacity for the EU Structural Funds in the Czech Republic, Estonia, Hungary, Slovakia and Slovenia before Accession. WIFO Working Papers 2005, No. 258. Vienna: Austrian Institute of Economic Research (WIFO). Available online: https://www.wifo.ac.at/jart/prj3/wifo/resources/person_dokument/person_dokument.jart?publikationsid=25750&mime_type=application/pdf (accessed on 14 April 2022).

- Horvat, Andrej, and Maier Gunther. 2004. Regional development, Absorption problems and the EU Structural Funds. Paper presented at 44th Congress of the European Regional Science Association: “Regions and Fiscal Federalism”, Porto, Portugal, August 25–29; Louvain-la-Neuve: European Regional Science Association (ERSA). Available online: https://www.econstor.eu/bitstream/10419/117224/1/ERSA2004_591.pdf (accessed on 15 April 2022).

- Jureviciene, Jurevičienė, and Jūratė Pileckaitė. 2013. The Impact of EU Structural Fund Support and Problems of its Absorption. Business, Management and Education 11: 1–18. [Google Scholar] [CrossRef]

- Lolos, Sarantis E. G. 2009. The effect of EU structural funds on regional growth: Assessing the evidence from Greece, 1990–2005. Economic Change and Restructuring 42: 211–28. [Google Scholar] [CrossRef]

- Martin, Ferry, and Irene McMaster. 2018. Assessing Integrated Territorial and Urban Strategies: Challenges, Emerging Approaches and Options for the Future. European Structural & Investment Funds Journal 6: 58–67. [Google Scholar]

- Ministry of European Funds. 2021. Proiecte [achiziții beneficiari privați]. Available online: https://beneficiar.fonduri-ue.ro:8080/proiecte (accessed on 14 April 2022).

- Netrdová, Pavlína, and Vojtěch Nosek. 2020. Spatial Dimension of Unemployment: Space-Time Analysis Using Real-Time Accessibility in Czechia. ISPRS International Journal of Geo-Information 9: 401. [Google Scholar] [CrossRef]

- Onofrei, Mihaela, Ionel Bostan, Florin Oprea, Gigel Paraschiv, and Cristina Mihaela Lazăr. 2020. The Implication of Fiscal Principles and Rules on Promoting Sustainable Public Finances in the EU Countries. Sustainability 12: 2772. [Google Scholar] [CrossRef]

- Palevičienė, Aistė, and Daiva Dumčiuvienė. 2015. Socio-Economic Diversity of European Regions: Finding the Impact for Regional Perfor-mance. Procedia Economics and Finance 23: 1096–101. [Google Scholar] [CrossRef]

- Pîrvu, Ramona, Roxana Bădîrcea, Alina Manta, and Mihaela Lupăncescu. 2018. The Effects of the Cohesion Policy on the Sustainable Development of the Development Regions in Romania. Sustainability 10: 2577. [Google Scholar] [CrossRef]

- Reiner, Martin. 2003. The Impact of the EU’s Structural and Cohesion Funds on Real Convergence in the EU. Paper presented at NBP Conference: Potential Output and Barriers to Growth, Zalesie Górne, Poland, November 27–28; Available online: https://www.nbp.pl/konferencje/zalesie/pdf/martin.pdf (accessed on 1 March 2022).

- Santamarta, Juan C., Dolores Storch de Gracia, Ángeles Huerta Carrascosa, Margarita Martínez-Núñez, Celia de las Heras García, and Noelia Cruz-Pérez. 2021. Characterisation of Impact Funds and Their Potential in the Context of the 2030 Agenda. Sustainability 13: 6476. [Google Scholar] [CrossRef]

- Slätmo, Elin, Kjell Nilsson, and Eeva Turunen. 2019. Implementing Green Infrastructure in Spatial Planning in Europe. Land 8: 62. [Google Scholar] [CrossRef]

- Soukiazis, Elias, and Micaela Antunes. 2006. Two Speed Regional Convergence in Portugal and the Importance of Structural Funds on Growth. Ekonomia. Cyprus Economic Society and University of Cyprus 9: 222–41. [Google Scholar]

- Storper, Michael. 2011. Justice, efficiency and economic geography: Should places help one another to develop? European Urban and Regional Studies 18: 3–21. [Google Scholar] [CrossRef]

- Tătulescu, Alina, and Alexandru Pătruţi. 2014. Structural Funds and Economic Crises: Romania’s Absorption Paradox. Procedia Economics and Finance 16: 64–72. [Google Scholar] [CrossRef]

- Tobias, Chilla, and Franziska Sielker. 2016. Measuring the Added-Value of the EUSDR—Challenges and opportunities. In Input Paper for DG Regio and Danube Strategy Point. Brussels: European Commission. Available online: http://www.danuberegion.eu/attachments/article/616586/Chilla_Sielker_Discussion%20paper_EUSDR.p (accessed on 16 April 2022).

- Varga, Janos, and Jan in’t Veld. 2009. A Model-Based Assessment of the Macroeconomic Impact of EU Structural Funds on the New Member States. European Economy Economic Papers. No. 371. Available online: https://ec.europa.eu/economy_finance/publications/pages/publication14342_en.pdf (accessed on 17 April 2022).

- Wostner, Peter. 2008. The Micro-Efficiency of EU Cohesion Policy. European Policy—Research Paper No. 64. Glasgow: European Policies Research Center. Available online: https://www.eprc-strath.eu/public/dam/jcr:655472ad-0a95-4f8e-8954-63b7875d29e2/EPRP%2064.pdf (accessed on 20 April 2022).

- Wostner, Peter, and Sonja Šlander. 2009. The Effectiveness of EU Cohesion Policy Revisited: Are EU Funds Really Additional? Research Paper, No. 69. Glasgow: European Policies Research Center. Available online: https://www.eprc-strath.eu/uploads/eprc/documents/PDF_files/EPRP_69_The_Effectiveness_of_EU_Cohesion_Policy_Revisited.pdf (accessed on 20 April 2022).

- Zaman, Gheorghe, and Anca Cristea. 2011. EU Structural Funds Absorption in Romania: Obstacles and Issues. Romanian Journal of Economics 32: 41. [Google Scholar]

- Zaman, Gheorghe, and George Georgescu. 2009. Structural Funds absorption: A New Challenge for Romania? Romanian Journal of Economic Forecasting 6: 136–54. [Google Scholar]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).