A Study of Private Equity Rounds of Entrepreneurial Finance in EU: Are Buyout Funds Uninvited Guests for Startup Ecosystems?

Abstract

:1. Introduction

2. Literature Review

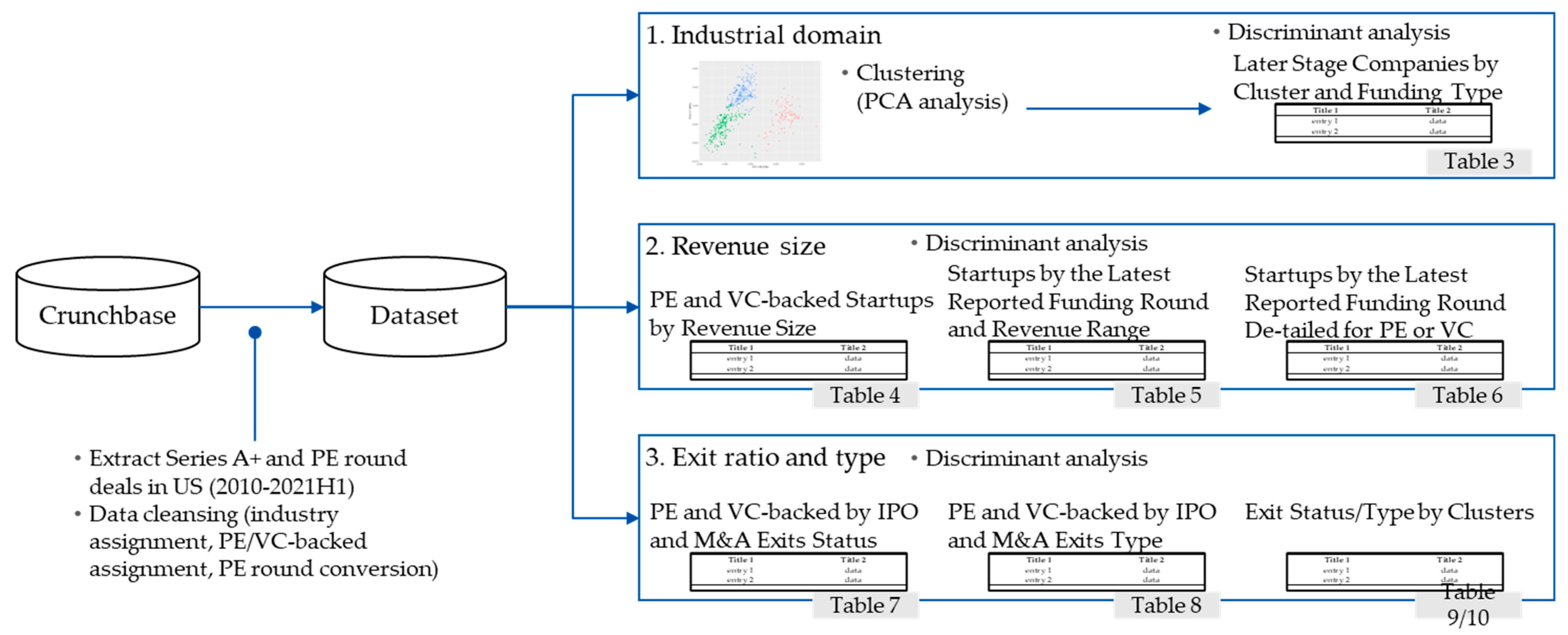

3. Materials and Methods

3.1. Hypothesis Development

3.2. Data

- Series A and Series B rounds: Funding rounds for early-stage startups. The range is on average between $1 M–$30 M. Aimed at product development.

- Series C rounds and onwards: Funding rounds for later-stage startups. The range is usually $10 M or more. Aimed for scaling and market penetration.

- Private Equity rounds (PE rounds): Later-stage funding rounds led by a private equity firm or a hedge fund. The range is typically upwards of $50 M.

3.3. Method

4. Results

4.1. Industrial Domain

4.2. Revenue Size

4.3. Exit Ratio and Type

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Administrative Services |

| Advertising |

| Agriculture and Farming |

| Apps |

| Artificial Intelligence |

| Biotechnology |

| Clothing and Apparel |

| Commerce and Shopping |

| Community and Lifestyle |

| Consumer Electronics |

| Consumer Goods |

| Content and Publishing |

| Data and Analytics |

| Design |

| Education |

| Energy |

| Events |

| Financial Services |

| Food and Beverage |

| Gaming |

| Government and Military |

| Hardware |

| Health Care |

| Information Technology |

| Internet Services |

| Lending and Investments |

| Manufacturing |

| Media and Entertainment |

| Messaging and Telecommunications |

| Mobile |

| Music and Audio |

| Natural Resources |

| Navigation and Mapping |

| Other |

| Payments |

| Platforms |

| Privacy and Security |

| Professional Services |

| Real Estate |

| Sales and Marketing |

| Science and Engineering |

| Software |

| Sports |

| Sustainability |

| Transportation |

| Travel and Tourism |

| Video |

References

- Alexy, Oliver T., Joern H. Block, Philipp Sandner, and Anne L. J. Ter Wal. 2012. Social Capital of Venture Capitalists and Startup Funding. Small Business Economics 39: 835–51. [Google Scholar] [CrossRef] [Green Version]

- Amor, Salma Ben, and Maher Kooli. 2020. Do M&A Exits Have the Same Effect on Venture Capital Reputation than IPO Exits? Journal of Banking and Finance 111: 105704. [Google Scholar] [CrossRef]

- Bertoni, Fabio, María Alejandra Ferrer, and José Martí. 2013. The Different Roles Played by Venture Capital and Private Equity Investors on the Investment Activity of Their Portfolio Firms. Small Business Economics 40: 607–33. [Google Scholar] [CrossRef]

- Block, Joern, Christian Fisch, Silvio Vismara, and René Andres. 2019. Private Equity Investment Criteria: An Experimental Conjoint Analysis of Venture Capital, Business Angels, and Family Offices. Journal of Corporate Finance 58: 329–52. [Google Scholar] [CrossRef]

- Buchner, Axel, Abdulkadir Mohamed, and Niklas Wagner. 2019. Are Venture Capital and Buyout Backed IPOs Any Different? Journal of International Financial Markets, Institutions and Money 60: 39–49. [Google Scholar] [CrossRef]

- Crunchbase. 2021a. Glossary of Funding Types. Available online: https://support.crunchbase.com/hc/en-us/articles/115010458467-Glossary-of-Funding-Types (accessed on 30 December 2021).

- Crunchbase. 2021b. What Industries Are Included in Crunchbase? Available online: https://support.crunchbase.com/hc/en-us/articles/360043146954-What-Industries-are-included-in-Crunchbase- (accessed on 30 December 2021).

- Crunchbase News. 2021. European Startups Got A Bigger Share of Record Global VC Invested in H1 2021. Available online: https://news.crunchbase.com/news/european-vc-funding-h1-2021/ (accessed on 30 December 2021).

- Cumming, Douglas, and Sofia Johan. 2017. The Problems with and Promise of Entrepreneurial Finance. Strategic Entrepreneurship Journal 11: 357–70. [Google Scholar] [CrossRef]

- Cumming, Douglas, Donald S. Siegel, and Mike Wright. 2007. Private Equity, Leveraged Buyouts and Governance. Journal of Corporate Finance 13: 439–60. [Google Scholar] [CrossRef]

- Cumming, Douglas, Jochen Christian Werth, and Yelin Zhang. 2019. Governance in Entrepreneurial Ecosystems: Venture Capitalists vs. Technology Parks. Small Business Economics 52: 455–84. [Google Scholar] [CrossRef] [Green Version]

- Da Rin, Marco, Thomas Hellmann, and Manju Puri. 2013. A Survey of Venture Capital Research. Handbook of the Economics of Finance 2: 573–648. [Google Scholar] [CrossRef] [Green Version]

- Dahiya, Sandeep, and Korok Ray. 2012. Staged Investments in Entrepreneurial Financing. Journal of Corporate Finance 18: 1193–216. [Google Scholar] [CrossRef]

- European VC Valuations Report Q2. 2021. PitchBook. Available online: https://pitchbook.com/news/reports/q2-2021-european-vc-valuations-report (accessed on 30 December 2021).

- European Venture Report Q1. 2021. PitchBook. Available online: https://pitchbook.com/news/reports/q1-2021-european-venture-report (accessed on 30 December 2021).

- Ferrary, Michel, and Mark Granovetter. 2009. The Role of Venture Capital Firms in Silicon Valley’s Complex Innovation Network. Economy and Society 38: 326–59. [Google Scholar] [CrossRef] [Green Version]

- Gao, Xiaohui, Jay R. Ritter, and Zhongyan Zhu. 2013. Where Have All the IPOs Gone? Journal of Financial and Quantitative Analysis 48: 1663–92. [Google Scholar] [CrossRef] [Green Version]

- Gompers, Paul A., Will Gornall, Steven N. Kaplan, and Ilya A. Strebulaev. 2020. How Do Venture Capitalists Make Decisions? Journal of Financial Economics 135: 169–90. [Google Scholar] [CrossRef]

- Groh, Alexander Peter, Heinrich Von Liechtenstein, and Karsten Lieser. 2010. The European Venture Capital and Private Equity Country Attractiveness Indices. Journal of Corporate Finance 16: 205–24. [Google Scholar] [CrossRef]

- Guler, Isin, and Mauro F. Guillén. 2010. Institutions and the Internationalization of US Venture Capital Firms. Journal of International Business Studies 41: 185–205. [Google Scholar] [CrossRef] [Green Version]

- Harris, Robert S., Tim Jenkinson, Steven N. Kaplan, and Ruediger Stucke. 2020. Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Ingham, Alexander, and Leah Kodner. 2017. PrivCo versus Crunchbase. Journal of Business and Finance Librarianship 22: 250–52. [Google Scholar] [CrossRef]

- Kaplan, Steven N., and Per Strömberg. 2009. Leveraged Buyouts and Private Equity. Journal of Economic Perspectives 23: 121–46. [Google Scholar] [CrossRef] [Green Version]

- Kupor, Scott. 2019. Secrets of Sand Hill Road: Venture Capital and How to Get It. Portfolio. Available online: https://a16z.com/book/secrets-of-sand-hill-road/ (accessed on 30 December 2021).

- Lee, Peggy M., and Sunil Wahal. 2004. Grandstanding, Certification and the Underpricing of Venture Capital-Backed IPOs. Journal of Financial Economics 73: 375–407. [Google Scholar] [CrossRef]

- Metrick, Andrew, and Ayako Yasuda. 2010. The Economics of Private Equity Funds. Review of Financial Studies 23: 2303–41. [Google Scholar] [CrossRef] [Green Version]

- Metrick, Andrew, and Ayako Yasuda. 2011. Venture Capital and Other Private Equity: A Survey. European Financial Management 17: 619–54. [Google Scholar] [CrossRef] [Green Version]

- Mollick, Ethan. 2014. The Dynamics of Crowdfunding: An Exploratory Study. Journal of Business Venturing 29: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Paglia, John K., and Maretno A. Harjoto. 2014. The Effects of Private Equity and Venture Capital on Sales and Employment Growth in Small and Medium-Sized Businesses. Journal of Banking and Finance 47: 177–97. [Google Scholar] [CrossRef]

- Robinson, David T., and Berk A. Sensoy. 2012. Private Equity in the 21st Century: Cash Flows, Liquidity, Contract Terms, and Performance from 1984–2010. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Tian, Xuan. 2011. The Causes and Consequences of Venture Capital Stage Financing. Journal of Financial Economics 101: 132–59. [Google Scholar] [CrossRef]

- Zucker, Lynne G., Michael R. Darby, and Jeff S. Armstrong. 2002. Commercializing Knowledge: University Science, Knowledge Capture, and Firm Performance in Biotechnology. Management Science 48: 138–53. [Google Scholar] [CrossRef] [Green Version]

| Category | Papers | Findings and Contributions of the Paper |

|---|---|---|

| Conceptual and theoretical study on commonalities | Metrick and Yasuda (2011) | Report the commonalities of PE and VC as financial intermediaries. |

| Empirical and comparative studies on the performance | Harris et al. (2020) Paglia and Harjoto (2014) Buchner et al. (2019) | Report similarities in performance persistence. Reports differences in growth impact on portfolio companies. Report differences in IPO underpricing and post-IPO operating performance. |

| Experimental study on the behavioral level differences | Block et al. (2019) | Report behavioral differences of fund managers in their investment angles. |

| Variable | Details |

|---|---|

| Exit | Binary. True for companies that have IPO or been acquired True: 461 False: 902 |

| Later Stage Funding | Either VC or PE: VC: 172 PE: 1191 |

| Number of funding rounds | The number of reported funding rounds Min: 1; Mean: 1.58; Median: 1; Max:11 |

| Last round | Any of the VC rounds (Series A to J) or PE Series C: 120 Series D: 39 Series E: 13 Series F: 2 Series G, H: 1 PE: 1187 |

| Last funding year | The year when the last funding round took place Min: 2011; Mean:2015; Median: 2015; Max: 2021 |

| Founded year | The year the company was founded Min: 1703; Mean: 1992: Median: 2001; Max: 2020 |

| Made acquisitions | Binary. True for companies that have acquired other companies True: 269 False: 1094 |

| Number of founders | The number of founders of the company Min: 1; Mean: 1.6; Median: 1; Max: 6 |

| Number of employees | Any of 4 categories: 1 to 100: 670 101 to 500: 395 501 to 5000: 210 5000+: 32 No data: 38 |

| Revenue range | Any of four categories: Less than $1 M: 110 $1 M to $10 M: 269 $10 M to $100 M: 224 $100 M+: 72 No data: 688 |

| Total Funding | Total funding in Millions of US Dollars accumulated until the day of data retrieval Min: 1200 USD; Median: 25.97 M USD; Mean: 80.57 M USD; Max: 1913 M USD; No data: 1097 |

| Industry Groups | One or more of the 47 Industry Groups |

| Cluster | Main Industry Groups of Companies in the Cluster | PE-Backed Startups | VC-Backed Startups |

|---|---|---|---|

| 1 | Manufacturing; Science_and_Engineering; Consumer_Goods; Hardware; Transportation | 288 (24.5%) | 11 (6.3%) |

| 2 | Software; Information_Technology; Hardware; Internet_Services; Professional_Services | 267 (22.7%) | 67 (39.0%) |

| 3 | Health_Care; Food_and_Beverage; Commerce_and_Shopping; Transportation; Financial_Services | 622 (52.8%) | 94 (54.7%) |

| Revenue Range | PE-Backed Startups | VC-Backed Startups |

|---|---|---|

| Less than $1 M | 103 (19.4%) | 7 (4.9%) |

| $1–10 M | 182 (34.2%) | 87 (60.8%) |

| $10–100 M | 179 (33.6%) | 45 (31.5%) |

| $100 M+ | 68 (12.8%) | 4 (2.8%) |

| Revenue Range | Round C | Round D | Round E+ |

|---|---|---|---|

| Less than $1 M | 108 (17.3%) | 2 (5.7%) | 0 (0%) |

| $1 M to $10 M | 246 (39.3%) | 17 (48.6%) | 6 (42.9%) |

| $10 M to $100 M | 202 (32.3%) | 16 (45.7%) | 6 (42.9%) |

| $100 M+ | 70 (11.1%) | 0 (0%) | 2 (14.2%) |

| Revenue Range | Round C | Round D | Round E+ | |||

|---|---|---|---|---|---|---|

| PE-Backed | VC-Backed | PE-Backed | VC-Backed | PE-Backed | VC-Backed | |

| Less than $1 M | 103 (19.4%) | 5 (5.3%) | 0 | 2 (5.7%) | 0 | 0 |

| $1 M to $10 M | 182 (34.2%) | 64 (68.1%) | 0 | 17 (48.6%) | 0 | 6 (42.9%) |

| $10 M to $100 M | 179 (33.6%) | 23 (24.5%) | 0 | 16 (45.7%) | 0 | 6 (42.9%) |

| $100 M+ | 68(12.8%) | 2 (2.1%) | 0 | 0 | 0 | 2 (14.2%) |

| Exit Status | PE-Backed Startups | VC-Backed Startups | Total |

|---|---|---|---|

| Not exited | 809 (67.9%) | 93 (54.1%) | 902 |

| Exited | 382 (32.1%) | 79 (45.9%) | 461 |

| Total | 1191 | 172 | 1363 |

| Exit Type | PE-Backed Startups | VC-Backed Startups | Total |

|---|---|---|---|

| Exit with IPO | 14 (3.7%) | 12 (15.2%) | 26 |

| Exit with MA | 368 (96.3%) | 67 (84.8%) | 435 |

| Total | 382 | 79 | 461 |

| Cluster | Main Industry Groups of Companies in the Cluster | Exit | Not Exit |

|---|---|---|---|

| 1 | Manufacturing; Science_and_Engineering; Consumer_Goods; Hardware; Transportation | 74 (16.2%) | 225 (25.2%) |

| 2 | Software; Information_Technology; Hardware; Internet_Services; Professional_Services | 142 (32.1%) | 192 (21.5%) |

| 3 | Health_Care; Food_and_Beverage; Commerce_and_Shopping; Transportation; Financial_Services | 241 (52.7%) | 475 (53.3%) |

| Cluster | Main Industry Groups of Companies in the Cluster | IPO | M&A |

|---|---|---|---|

| 1 | Manufacturing; Science_and_Engineering; Consumer_Goods; Hardware; Transportation | 5 (19.3%) | 69 (16.0%) |

| 2 | Software; Information_Technology; Hardware; Internet_Services; Professional_Services | 1 (3.8%) | 141 (32.7%) |

| 3 | Health_Care; Food_and_Beverage; Commerce_and_Shopping; Transportation; Financial_Services | 20 (76.9%) | 221 (5.13%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miyamoto, H.; Mejia, C.; Kajikawa, Y. A Study of Private Equity Rounds of Entrepreneurial Finance in EU: Are Buyout Funds Uninvited Guests for Startup Ecosystems? J. Risk Financial Manag. 2022, 15, 236. https://doi.org/10.3390/jrfm15060236

Miyamoto H, Mejia C, Kajikawa Y. A Study of Private Equity Rounds of Entrepreneurial Finance in EU: Are Buyout Funds Uninvited Guests for Startup Ecosystems? Journal of Risk and Financial Management. 2022; 15(6):236. https://doi.org/10.3390/jrfm15060236

Chicago/Turabian StyleMiyamoto, Hiroyuki, Cristian Mejia, and Yuya Kajikawa. 2022. "A Study of Private Equity Rounds of Entrepreneurial Finance in EU: Are Buyout Funds Uninvited Guests for Startup Ecosystems?" Journal of Risk and Financial Management 15, no. 6: 236. https://doi.org/10.3390/jrfm15060236

APA StyleMiyamoto, H., Mejia, C., & Kajikawa, Y. (2022). A Study of Private Equity Rounds of Entrepreneurial Finance in EU: Are Buyout Funds Uninvited Guests for Startup Ecosystems? Journal of Risk and Financial Management, 15(6), 236. https://doi.org/10.3390/jrfm15060236