Abstract

Corporate environment, society, and governance (ESG) management activities have recently been consolidated in the business ecosystem, and many firms are considering their employees’ recognition and job changes according to organizational ESG strategy. This study aims to verify the effects of ESG activity recognition of corporate employees on job performance by mediating change support behavior, innovative organization culture, and job crafting. This study designs a structural equation model with a hypotheses based on previous studies. A questionnaire survey was carried out targeting large Korean manufacturing companies, and an analysis of 329 response copies was performed. As a result, ESG activity recognition did not directly affect job crafting, but it affected job crafting with the mediation of innovative organizational culture and change support behavior. ESG activity recognition also positively affected job crafting and job performance by mediating change support behavior and an innovative organization culture. Hence, the research shows that an innovative culture and change support behavior within an organization should be considered to improve ESG management performance.

1. Introduction

Environment, society, and governance (ESG) activities are becoming a global hot topic, as they are recognized as a factor affecting a firm’s long-term value and sustainability through the minimization of disadvantages that firms may impose on the environment, society, and the maximization of governance utility. Because social, environmental, and economic factors are mutually connected, a sustainable state becomes difficult if any risk occurs in even one sector (Hassan and Mahrous 2019). Particularly, non-financial factors, such as the environment, society, and governance, have been reflected in investment decisions since 2006, so interest in ESG has been heightened (Galbreath 2013). Since the UN Principles for Responsible Investment (PRI) were established, ESG evaluation has been used as an essential criterion for selecting investment products centered on institutional investors. The world’s largest asset management company, Black Rock, can suspend investment in companies that do not make efforts to control carbon emissions and specifies that the values of highly sustainable companies are becoming higher than other companies in the investment decision. The US Government Accountability Office (US GAO) adopts each company’s ESG disclosure as one of the key items to evaluate US-listed companies.

As Capitalism 4.0 has been discussed since the financial crisis in 2008, the basis of corporate management and national policy has changed due to the advent of inclusive capitalism (Guillén 2020). With a catastrophe such as the COVID-19 pandemic and the climate change issue, ESG has rapidly spread as severe social problems and international crises emerge, and new values for corporate management become necessary. Based on the assertion of Cornell and Shapiro (2021), ESG is used as a critical factor for reliability construction and corporate value evaluation for firms’ various stakeholders, including shareholders, consumers, employees, and communities.

According to the Global Market Report (Korea Trade-Investment Promotion Agency 2021), global investors’ ESG investment in 2020 was USD 35.3 trillion, up 15%, compared with 2018. In major developed capital markets, including the US and Europe, socially responsible investment (SRI) financing in eco-friendly and moral companies is invigorated, and firms’ ESG activities are used as a vital investment indicator. Based on a March 2021 policy, Europe made ESG disclosures mandatory for financial firm trading within Europe by preempting the ESG global criteria.

Consequently, active ESG corporate activities are being strengthened, including establishing ESG commissions within the boards of directors, while companies’ ESG grade evaluations are being received globally. A typical example is that Apple, Google, Walmart, etc. participated in the ‘Renewable Energy 100’, in which 100% of the power required for corporate operations will be met by renewable energy, such as solar power and wind power, by 2050 (Hansen et al. 2019). Samsung Electronics constitutes a growing supply chain, responsible supply chain, and eco-friendly supply chain by segmenting the supply chain (Sachin and Rajesh 2022). ESG has been recognized as a factor for institutional investors to consider upon investment thus far, but its domain has recently been expanded to overall corporate management goals and activities.

When looking at existing ESG studies, there are many studies from a financial perspective insisting that ESG activities are closely related to a firm’s market and leadership, as well as an owner’s characteristics, risks, performance, and value (Gillan et al. 2021). Aouadi and Marsat (2018) empirically asserted that ESG is a factor significantly affecting corporate value and sustainability in the long term. Sassen et al. (2016) released an analysis result that ESG investment affects a firm’s value and has a ripple effect through various paths. An empirical study on the correlations between ESG evaluation and corporate value confirmed the effects of a firm’s ESG evaluation information and profit management on corporate value and the effects of parts of ESG evaluation information on corporate value (Leins 2020).

However, studies reflecting diverse academic and practical perspectives and investment-related financial evaluation indicators are necessary as interest in ESG management increases (Alsayegh et al. 2020). In a study by Janah and Sassi (2021) on the current status of ESG studies and future study directions, they insisted on a need for a quantitative study methodology and systematic literature review. Therefore, various studies on consumption, along with the market and non-financial perspectives of ESG activities, are emerging. Research on organizational change and employees’ recognition within firms according to ESG management has also been introduced (Parfitt 2020).

From the organizational activity aspect, Ben-Amar and Belgacem (2018) asserted that ESG management activities need efficient performance. Huang (2021) stressed the importance of recognizing the ESG activities of companies’ employees and their active participation. If a company implements ESG management activities, changes in culture, jobs, and processes within organizations occur, so changes in work recognition and attitude, as well as job change among internal organizational employees as management players, occur (Nekhili et al. 2021a). Consequently, priority should be placed on sharing a commitment to practice and measures with stakeholders and workers within a firm to lead ESG activities successfully (Cornell and Shapiro 2021).

By the global trend, Korean companies are interested in ESG management. However, their attention has been paid to responding to the company’s external environment rather than improving the company’s organizational members’ perceptions or changes in organizational activities for ESG activities. Accordingly, there are very few data dealing with the level of awareness of organizational members and the ESG status of the internal organization. However, ESG management cannot be achieved without clear awareness and job crafting of the members of the organization. In this respect, this study attempted to see the relationship between the ESG perception of corporate employees and the jobs and performance of members in the internal environment of the organization.

In these backgrounds, this study presents empirical results on the effects of employees’ recognition of the firm’s ESG management activities on the organizational employees’ job crafting or performance with the mediation of organizational culture and changes in support behavior. Finally, this article suggests specific implications on organizational change management and human resource management measures for ESG management activities (Parfitt 2020; Huang 2021; Nekhili et al. 2021b).

2. Materials and Methods

2.1. ESG Concept and Management Activities

ESG refers to environment, society, and governance, and it is defined as a concept including the factors in the environment, society, and governance that may affect the capability to execute a firm’s strategy and enhance corporate value (Jebe 2019). Full-swing ESG activities started as the UN Global Compact (UNGC) and UN Environmental Program Finance Initiative (UNET) were announced in 2004 and 2005, respectively (Ortas et al. 2015). In a report in the UN Principles for Responsible Investment in 2006 (Kotsantonis et al. 2016), ESG was presented as a pivotal factor to consider when investors decide on investments, namely as non-financial factors that may affect financial value, as shown in Table 1. ‘E’ (environment) refers to how companies affect the environment in the management process. Here, resources, energy, wastes, greenhouse gases, carbon emissions, and resource recycling are included. ‘S’ (society) is an item evaluating whether a company implements proper social responsibility well. Human rights, community contribution, labor, employment, and consumer safety and protection are included. ‘G’ (governance) refers to management transparency. This is an item judging whether the decision-making process, corporate structure, HR, and management policy are operated under a democratic procedure (Kotsantonis et al. 2016).

Table 1.

Major factors of ESG items.

The study of ESG can start from stakeholder theory, a theoretical basis asserted in a study by Moskowitz (1972). According to the theory, how corporate value can be affected by investors (not by shareholders) can be understood (Barnett and Salomon 2003). Namely, the ESG value gained attention in that socially responsible investment exerts better performance, rather than the traditional investment method emphasizing only management performance. The ESG studies thus far have focused on just investor-related earnings aspect performance, so ESG has been recognized as a factor to consider mainly by institutional investors (Cannas et al. 2022). However, the domain has recently been expanded to overall corporate management goals and activities.

According to Lewry et al. (2018), if a company does not consider environmental, social, and economic aspects, it may be at risk since it conducts unsustainable management. Rezaee and Tuo (2017) said goals could be achieved through performance created under non-financial performance, including ESG, to maximize corporate value. A study by Ben-Amar and Belgacem (2018) confirmed sustainability with activities such as environmental pollution prevention (environment), labor practices (society), and building the structure and diversity of a board of directors (governance). According to Zumente and Bistrova (2021), ESG has a core value that sustainability can be promoted if non-financial factors, including environmental protection, social problem solving, and governance improvement, as well as financial factors such as sales and operating profits, are considered. As such, the firm’s ESG activities are recognized as management activities that significantly affect the firm’s sustainability and long-term value by minimizing disadvantages that may be caused by the environment, society, and maximizing governance utility (Lokuwaduge et al. 2017).

The reason why ESG is gaining attention is that the problems of climate change and the environment, a firm’s sustainability, and partnership emerged, that the importance of value was applied by encompassing complex social problems in a business model, and that the creation of shared value (CSV) was carried out (Huang 2021). The ESG concept is a core factor of investment decisions, and studies on corporate management performance or effects on corporate value increased in terms of ESG. Aboud and Diab (2018) asserted that ESG, meaning environment, society, and corporate governance, which have become hot topics nowadays as non-financial factors, as well as financial factors used traditionally upon corporate value evaluation, should be used. Sassen et al. (2016) reported that if corporate ESG activities continue, the situation positively affects corporate performance in the long term, and ESG activities are connected to stakeholders’ satisfaction. Husted and de Sousa-Filho (2019) explained that ESG activities could more highly evaluate a firm’s premium and thus reduce the cost of equity capital. Pellegrini et al. (2019) emphasized that the reliability of the market is essential to maximizing the effects of ESG activities. Kim and Li (2021) found that governance significantly affects corporate performance.

According to a study by Shakil (2020), high ESG scores have significantly affected companies’ profitability enhancement. Recently, there have been many studies on the effects of the image and brand power of ESG-active companies on customers’ purchasing intentions and market competitiveness (Zhou et al. 2022; Park and Jang 2021). Due to the consolidation of ESG activities, changes are caused in various organizational activities, including corporate strategy, marketing, and HR, and studies on organizational culture, employees’ ESG recognition, and attitudes have recently been introduced (Bean 2013; Al-Batah 2019). As Gillan et al. (2021) asserted, ESG is placing itself as a comprehensive concept for companies to be equipped with in overall business management beyond recognizing that ESG is a firm’s social responsibility.

2.2. Organizational Change and Job Management for ESG Management

Margolis and Walsh (2003) insisted that a firm’s ESG activities should be in line with the expectations and desires of the firm’s diverse stakeholders, including internal employees and shareholders of the firm, communities, and government. A firm’s ESG activities need their support, and the ESG activities can succeed when the relationships with the stakeholders are positively maintained and their active participation is induced (Xu et al. 2022). From the institutional theory perspective, the organizational structure and operation mode are affected by the institutional environment to which the firm’s organization belongs (Cantino et al. 2017). In other words, corporate organizations can secure legitimacy by accepting and complying with the organizational structure and operation mode defined as desirable by the institutional environment where they belong (Drempetic et al. 2020).

2.2.1. ESG Activity Recognition

ESG activity recognition of employees within a company means the level to which the employees recognize corporate ESG strategy and commitment (Nekhili et al. 2021a). As recognition increases, ESG corporate activities can be executed better (Liu and Nemoto 2021). From this perspective, companies should be able to obtain legitimacy from internal organizational employees in ESG management execution and decision making. To this end, there is a need to induce employees’ explicit recognition of ESG and active participatory attitudes (Nekhili et al. 2021b).

2.2.2. Change Management and Organization Culture through ESG

From a change management perspective, organizational employees in the rapidly changing environment and organization reveal change recognition and behavior. Company employees carrying out jobs based on a clear and fundamental understanding of ESG are exposed to the environment that naturally accepts the change, and they implement innovative activities to make their changes in the environment (Mohammad and Wasiuzzaman 2021); that is, ESG management is connected to employees’ job management activities according to organizational change management and job changes, as ESG management is connected to an organization’s internal and external environment and resource operation change (Park and Jang 2021).

Rogiest et al. (2015) defined support behavior or commitment to change as meaning employees’ specific participation behavior. Specifically, organizational change support behavior consists of adaptation, cooperation, and diffusion, which means that change is accepted with the behavior, and the job is actively carried out. According to Bani-Melhem et al. (2018), employees’ innovative behaviors, such as job crafting by intrinsic job motivation and creative thinking techniques, positively affect job performance (Dos Santos and Pereira 2022). For ESG activities to positively affect performance creation, after employees are settled inside a company and connected to job performance, there is a need to strengthen innovative culture and change support behaviors that can actively accept the organization’s internal changes (Miralles-Quirós et al. 2019). As Bahadori et al. (2021) asserted, if innovative behavior such as job crafting for ESG activities is consolidated, it can directly affect corporate value improvement and continuous growth by successfully inducing ESG activities.

2.2.3. Job Crafting and ESG

Zhang and Parker (2019) defined job crafting as individuals having a relationship with people, conceptualizing their tasks, completing jobs, and regarding their jobs as meaningful. Debus et al. (2020) defined job crafting as a behavior of striking a balance between job demand and the job resources given to them within individuals’ capabilities and demands. Thun and Bakker (2018) defined job crafting as voluntary behavior in that an organization’s employees initiatively look for resources or challenging tasks and reduce demand.

Job crafting has three types of components: task boundaries, relational boundaries, and cognitive boundaries (Tims et al. 2021). First, task crafting means changing the type or number of involved activities in the course of performing the job, including changes in workflow, workload, work size, and work sequence, the adoption of a new handling method, and changes in combination and union. Second, relational crafting means forming relational boundaries among people required to perform work, including how frequently or how many relations will be made. Third, cognitive crafting means changing how people conduct their jobs, including changing work purpose and performance. Job crafting especially becomes a capability required for organization employees in the management environment to sensitively respond to corporate internal and external environments such as ESG by enhancing psychological well-being within the organization and flexibly adapting to job demand and resource changes (Piao et al. 2022; Alsayegh et al. 2020).

2.2.4. Job Performance and ESG

Consequently, employees’ support and enthusiastic attitudes toward ESG management activities directly affect job performance, which means the degree of organizational effectiveness and goals (Rossi et al. 2021). Jalagat (2016) defined job performance as a desirable state of work for organizational employees to realize and the results of activities that an organization can objectively measure. ESG management can bring about overall corporate change and employees’ job competence, so specific job ability and performance should be administrated in ESG management strategy and implementation. From this aspect, there is a need to seek ESG management activities to induce the successful undertaking and achievement of organization employees who responded to job changes (Veenstra and Ellemers 2020).

3. Research Method

3.1. Research Model and Hypothesis

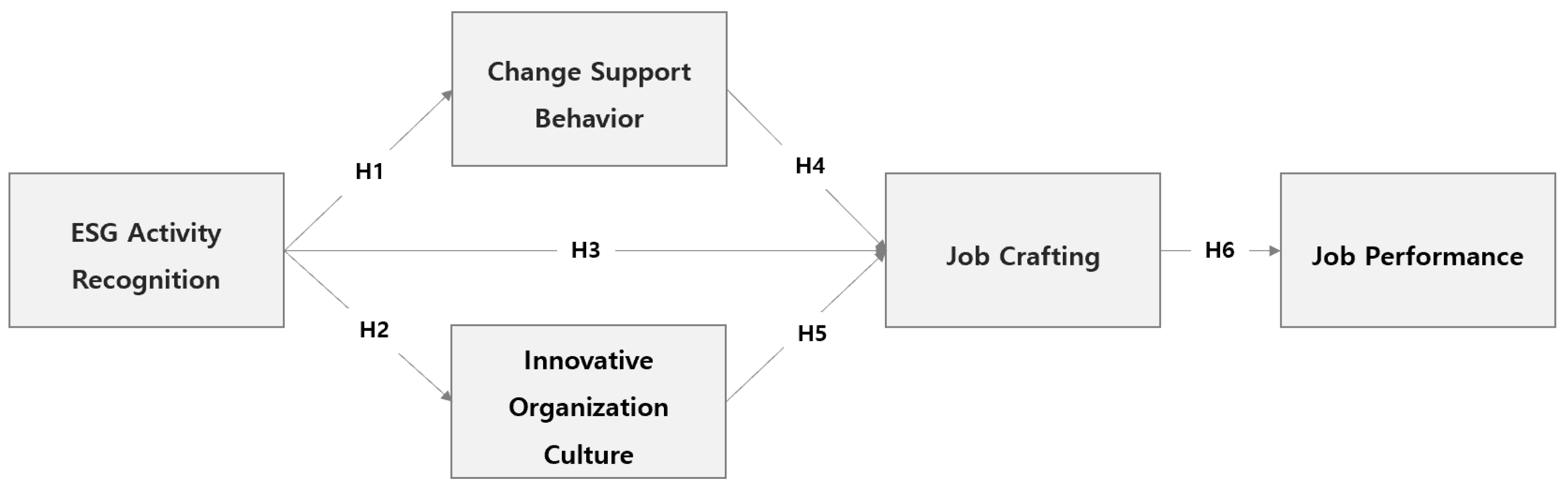

This study aims to determine the effects of manufacturing company employees’ ESG activity recognition on job performance by mediating change support behavior, innovative organization culture, and job crafting. ESG activity recognition based on three environmental, social, and governance variables was set as an independent variable. Change support behavior, innovative organization support, and job crafting were set as the parameters, and job performance was set as a dependent variable. This study designed hypotheses based on previous studies and formed a research model, which is shown in Figure 1.

Figure 1.

Research model.

3.1.1. ESG Activity Recognition and Change Support Behavior

Change support behavior is the behavior that organization employees accept and actively participate in and is defined as an essential factor for organizational change success (Oinas-Kukkonen 2013). The subject of change in a company is the organization employees. Successful organizational change cannot be expected without cooperation or consent, and a positive attitude toward organizational change can induce the employees’ cooperation (Robertson et al. 1993). For an organization experiencing ESG-centered business management activity change to perform change management successfully, the organizational employees’ positive attitudes and voluntary learning activities are required (Sroufe 2017). Concerning this, Shakil (2020) asserted that organization employees should recognize the ESG strategy and vision that a company pursues in order for the company to lead ESG management activities successfully. Zumente and Bistrova (2021) pointed out that change can be accepted, and a positive attitude and participation can be revealed only if a change in the new organization’s strategy and the system is recognized and learned. Based on the previous studies, the following hypothesis could be designed:

Hypothesis 1.

ESG activity recognition of employees within a company will have a positive (+) effect on change support behavior.

3.1.2. ESG Activity Recognition and Innovative Organization Culture

Innovation-oriented culture means an organizational culture that emphasizes using a new idea first or making something that did not exist to that point (Büschgens et al. 2013). Hogan and Coote (2014) explained that innovative organizational culture is a culture stressing innovation, creativity, growth, and dynamism, based on the hypothesis of change and that employees are motivated by the importance of work or ideal appeal, growth, and external legality. If ESG management activities are to be accepted as a new challenge or change, the employees must adapt to a new environment (Tan and Zhu 2022). ESG activity recognition can be connected to the need for innovative organizational culture and employees’ creative job performance demands. Zainullin and Zainullina (2021) reported that innovative organizational culture change occurs due to organizational process and system changes beyond individual employees’ job changes if a new management strategy or business is organized. As Al-Batah (2019) explained, ESG management activities affect the recognition and attitude of organizational employees, and innovative organizational culture is consolidated in pursuing new organizational change. The following hypothesis was designed based on the previous studies:

Hypothesis 2.

ESG activity recognition of employees within a company will have a positive (+) effect on innovative organizational culture.

3.1.3. ESG Activity Recognition and Job Crafting

Job crafting is a voluntary, proactive behavior exerted by organization employees for aligning their goals and desires with work experience through discretion, while job crafting means dynamic behavior improving the meaning of work and satisfaction (Zhang and Parker 2019). Therefore, company employees actively change their work characteristics and set job boundaries (Thun and Bakker 2018). Tims et al. (2021) emphasized the importance of job crafting in creating or initiating changes in a job, unlike when individuals passively respond to change. As asserted by Jalagat (2016), ESG management activities can succeed only if employees’ sympathy, support, and active participation are backed up, as with other management activities. Consequently, recognition of a new job by a new change and a playful attitude to perform can be critical factors in ESG activities (Veenstra and Ellemers 2020). The following hypothesis was presented based on the previous studies:

Hypothesis 3.

ESG activity recognition of employees within a company will have a positive (+) effect on job crafting.

3.1.4. Change Support Behavior, Innovative Organization Culture, and Job Crafting

Traditional job design was a top-down mode by which an organization or a manager constituted and revised job details and delivered them to the employees (Oldham and Fried 2016). However, as an assertion that the mode scarcely motivates employees effectively and does not significantly affect organization performance, a bottom-up model in which employees redesign task units or boundaries is emphasized (Rai 2018). Amid personal change behaviors within an organization, job crafting voluntarily changing job boundaries can be a strategy to survive in a rapidly changing working environment. This is rated as a primary variable for inducing significant change in a whole organization (Burke and Litwin 1992).

Zhang and Parker (2019) insisted that change can be successfully led through job crafting activities while recognizing the importance of employees’ roles in the organizational change execution process. Hogan and Coote (2014) stressed that organizational employees’ interests and behaviors appear when an innovation-oriented organizational culture atmosphere is shaped, and their job crafting activities can be strengthened. Zainullin and Zainullina (2021) reported that commitment to positive innovation based on change support behavior for changing organizations is revealed in the employees’ voluntary job competence consolidation and job crafting behavior. Based on the previous studies, the following hypothesizes that ESG management activity employees’ changing support behaviors and innovative organization factors will have a positive (+) effect on job crafting:

Hypothesis 4.

Change management support of employees within a company will have a positive (+) effect on job crafting.

Hypothesis 5.

Innovative organization culture of employees within a company will have a positive (+) effect on job crafting.

3.1.5. Job Crafting and Job Performance

According to Tims et al. (2015), job performance means the outcomes of employees that are beneficial to an organization (Zhang and Liu 2021). Esmaeili et al. (2019) explained that one’s positive emotion or active attitude toward his or her job when experiencing a change of meaning for the job of organization employees has a significant effect on job performance improvement. Therefore, many previous studies (Veenstra and Ellemers 2020; Landi and Sciarelli 2018; Yoon et al. 2018) presented that job crafting has a positive (+) effect on job performance. Hypothesis 6, stating that job crafting will have a positive (+) effect on job performance in ESG activities, is presented as follows:

Hypothesis 6.

Job crafting of employees within a company will have a positive (+) effect on job performance.

3.2. Measurement Variable and Data Collection

A questionnaire survey was carried out to collect data to analyze the model, and the questions, as shown in Table 2, were set through previous studies, while the manipulative variables of the questionnaire components were defined. When looking at the manipulative definition of the variables applied for the questionnaire survey, a firm’s ESG activity recognition means the organizational employees’ recognition state to practice a business that can thrive within society with transparent governance. Job crafting means each firm’s work type changes according to ESG activity recognition. Innovative organizational culture means corporate employees’ ability to make innovative and new organizational changes absorbed by ESG management. Change support behavior means accepting and supporting the behavior of organization environment change and leadership change management according to ESG. Lastly, job performance means individual job evaluation results are affected by ESG management activities. The variables defined consisted of 39 questions: 12 questions for ESG activity recognition plus 3 questions each for change support behavior, innovative organization culture, job crafting, job performance, and others.

Table 2.

Variable definitions and measurement items.

3.3. Demographic Information of the Data

As shown in Table 3, this study conducted an online questionnaire survey targeting company employees with work experience related to ESG among Korean manufacturing companies through random sampling. The survey was conducted for 2 weeks between 15 and 21 March 2022. Except for 21 questionnaire response copies with errors, 329 response copies in total were collected and analyzed.

Table 3.

Demographic information of survey participants.

4. Results

4.1. Analysis Results of Reliability and Validity

As shown in Table 4, the measurement model’s reliability and convergent validity analysis results were good. Internal consistency reliability was verified based on a 0.7 and higher composite reliability index, and securing convergent validity was verified through the factor loading, Cronbach’s α, and composite reliability index values. In line with the criteria, the factor loading was good, being 0.645–0.900, and the internal reliability was between 0.868 and 0.920, so significance was secured. Because the t value was 8.0 and higher, statistical significance was confirmed. The average variance extracted (AVE) value was 0.491–0.710, and Cronbach’s α was 0.876–0.920, so convergent validity was secured. As a result of the analysis of the measurement model fit, χ2(df) was 293.311, and the χ2/degree of freedom was 1.898. The goodness of fit index (GFI) was 0.886, the adjusted goodness of fit index (AGFI) was 0.888, and the normal fit index (NFI) was 0.891. The comparative fit index (CFI) was 0.916, and the root mean square error of approximation (RMSEA) was 0.070, so the measurement model fit components were statistically significant.

Table 4.

Results of reliability and convergent validity tests.

According to the analysis of the AVE and CR values between the potential variables in this study, each potential variable’s square root of the AVE values was larger than the correlation coefficients between the potential variables. Therefore, discriminant validity was confirmed to be secured (Table 5).

Table 5.

Discriminant validity.

4.2. Analysis Results of the Structural Model

As a result of structural model fit analysis, χ2(p) was 278.521 (0.000), and χ2/degree of freedom was 1.784 (Table 6). The GFI was 0.897, NFI was 0.899, AGFI was 0.891, and RMSEA was 0.066, showing that the fit component values were significant. Although not affected by the samples, the comparative fit index (CH) indicated the model’s explanation power was 0.911, while the Tucker–Lewis index (TLI) showed the structural model’s explanation power to be 0.903, with both being above 0.9. Therefore, the basic model was found to be suitable.

Table 6.

Results of a hypothesis test.

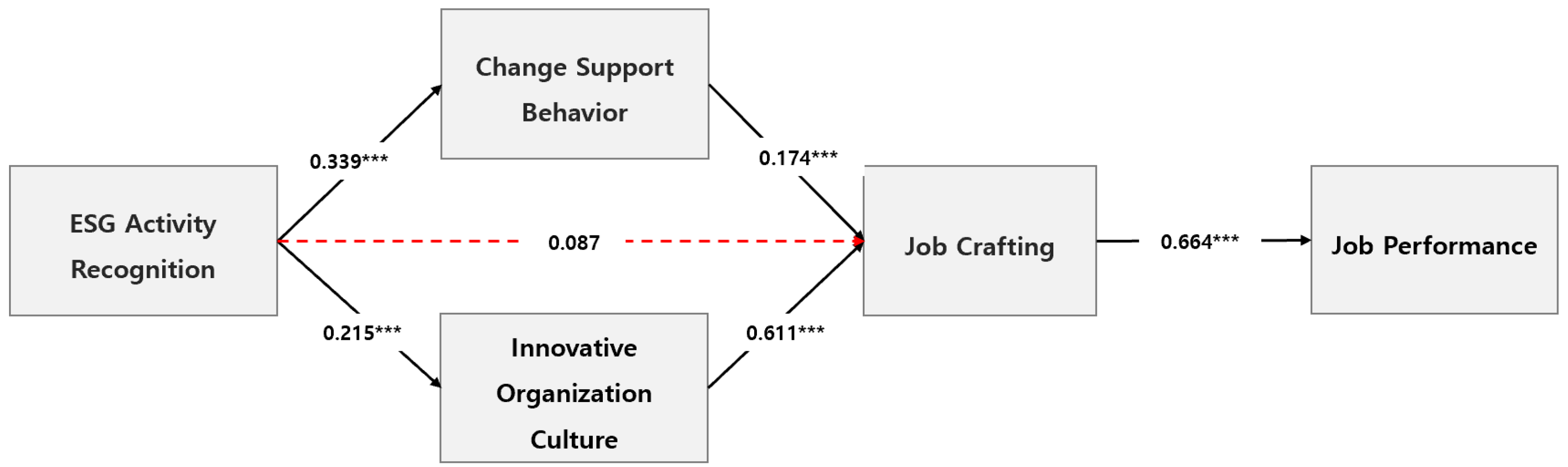

As shown in Table 6 and Figure 2, one out of the six hypotheses was rejected due to hypotheses verification through the structural equation model path analysis. Among the ESG activity recognition factors of Korean manufacturing company employees, change support behavior (5.386, p < 0.001) and innovative organization culture (3.432, p < 0.001) had a positive (+) effect. However, job crafting was rejected, and thus there was no effect. Meanwhile, change support behavior (3.274, p < 0.001) and innovative organizational culture (9.068, p < 0.001) had a positive (+) effect on job crafting. There was a positive effect (+) from the effect of job crafting (10.179, p < 0.001) on job performance. Thus, the hypotheses were adopted.

Figure 2.

Results of structural model analysis (*** p < 0.001).

5. Discussions

The corporate ecosystem and capital market are evolving into a responsible ecosystem emphasizing social responsibility, sustainability, and economic value creation (Halbritter and Dorfleitner 2015). While ESG management was centered on global corporations in the past, now is the era in which firms putting importance on social value in diverse fields emerges, and thus their survival becomes possible (Kotsantonis et al. 2016; Staszkiewicz and Karkowska 2021). This study examined the effects of each corporate employee’s ESG activity recognition on change support behavior, innovative organization culture, and job crafting. The study results drawn using the analysis results are as follows.

First, ESG activity recognition positively affected change support behavior and innovative organizational culture. The results support the study showing that organization employees’ change support behavior becomes a precondition for successful organizational change, as De Vries and Balazs (1999) pointed out. As Jaskyte (2004) asserted, if an organization attempts changes, innovative organizational culture should be shaped internally, and the employees’ active recognition and attitudes toward the changes must be in line with the fact that they are essential in shaping innovative organizational culture. As for ESG management, there is a trend that it is carried out in a top-down model of management activity centered on top management leadership. In such a case, if organizational employees’ sympathy or recognition is low, there is a limitation in bringing about organizational change and performance (Fatemi et al. 2018). From this aspect, ESG management activities taking into account change support behavior and organizational culture within the organization through ESG activity recognition should be emphasized. Through this, job crafting and job performance should be brought about.

Second, ESG activity recognition did not directly affect job crafting but affected job crafting by mediating change support behavior and innovative organizational culture. This finding shows that only ESG activity recognition is challenging for inducing ESG-related job crafting behavior. From the individual employee aspect, he or she conducts change support behavior, and innovative organizational culture is shaped from the organizational aspect. ESG activity recognition may affect job activities affected by the factors if the internal environment is devised. Onyeneke and Abe (2021) reported that organizational change affects employees’ direct behavior or attitudes and that mediation factors such as perceived value or capability consolidation should work. ESG management confirmed that only employees’ recognition could not induce immediate behavior (Friede et al. 2015). Consequently, ESG activities are essential for the environment where individual abilities can be freely exerted and for the process and behavior support by which employees’ challenges and creativity in new work are acknowledged.

Third, ESG activity recognition positively affected job performance by mediating change support behavior, innovative organization culture, and job crafting. This means that corporate employees’ activities and environment shaping are related to the firm’s change, innovation, and crafting based on ESG activity recognition and are connected to job performance. Thus, they can positively affect corporate performance and value creation. This result supports the study by Piderit (2000) explaining that positive emotions or an active attitude toward one’s job in the process of undergoing a meaningful change in an organization employee’s job significantly affects job performance improvement. ESG activities are essential to improve the firm’s financial and social value, but they can induce change and innovation inside the organization and affect the employees’ job management aspect (Chams et al. 2021). As the firm’s ESG performance becomes higher, the firm also becomes more robust against risks and can realize sustainable management (Weston and Nnadi 2021; Alsayegh et al. 2020). From the business perspective, the importance of the firm’s internal organization cognition expansion and the change management of an ESG management firm can be emphasized, because organizational employees’ ESG activity recognition can positively affect job performance beyond a firm’s need for future strategies.

6. Conclusions

6.1. Academic and Practical Implications

The academic and practical implications of this study are as follows. First, innovative organizational culture and change support behavior must be accompanied by ESG activity recognition to exert job crafting and job performance. An innovative organizational culture should allow each employee to initiate design jobs and challenge new work initiatives (Arik et al. 2022). Job crafting was presented as one of the methods to increase organizational performance through working environment changes (Roy and Mukherjee 2022). As such, all opportunities and autonomy should be guaranteed so that each employee can have various work experiences and learn organizational processes (Dan et al. 2017). The organizational support for each employee should be offered to redesign the job, reset relationships, and perform newly created tasks, including adding, expanding, reducing, and deleting, depending on one’s strengths, values, and interests. It is essential to shape organizational culture by respecting and acknowledging an individual’s redesigning of his or her job from the very start. If new management resources and activities are propelled due to the ESG era’s environment and need, stress and resistance to new work may occur. Therefore, management at the organizational level on change management should be executed.

Second, an implication of a firm’s direction to shape an environment where job crafting becomes possible by letting organizational employees recognize a corporate continuous management strategy via ESG management activities is included. In this study, ESG activity recognition alone cannot directly affect job crafting, which means that ESG performance is not connected to each performance yet; rather, it is discontinued. To propel corporate activities, a separate organization exists to do so, and the employee receives pressure on his or her performance from the separate organization and stress due to an excessive workload (Rai 2018). For job crafting, an environment where voluntary job crafting is formed should be offered so that employees can be committed to their jobs when they feel the change, feel that their jobs are essential and meaningful, and change the meanings of their jobs. A system of education and training as well as knowledge delivery, through which they can engage in job crafting, is necessary for letting them understand the need for ESG activities and naturally accepting the activities with sufficient time (Onyeneke and Abe 2021). ESG management has limitations to bringing about overall corporate change with just individuals’ job competence, so specific job coordination and execution ability should be considered through leaders’ bold organization reshuffling or strategy propulsion.

Third, a firm’s ESG activities are a process of making an intangible value into a business model by simultaneously pursuing economic and social values (Büschgens et al. 2013). Therefore, the role of each organizational member in the center of numerous stakeholders is essential (Cornell and Shapiro 2021). Each firm should offer the system and framework of creative, innovative organizational culture, create a corporate performance that all employees can sympathize with and support, and create a sustainable corporate image. In addition to performance, diversities in organizational culture should be shaped, ranging from a transparent governance system affecting the members internally and the communication channel composition of the MZ generation to the leader’s ethics and responsible management through industrial security and a differentiated welfare system. Within the framework, an employee needs to carry out his or her job performance, and thus the firm and its members should shape a new business model.

6.2. Research Limitations and Future Plans

This study examined organizational change and organizational employees’ job changes through ESG activities, which have recently become a hot topic in manufacturing companies worldwide beyond effects or an evaluation scale according to the external environment. This study has a meaning in that it proved the relationship of each variable between organizational members’ recognition, job crafting, and performance aspects.

Nonetheless, this study has the following limitations. First, this study targeted only Korean companies performing ESG activities. Therefore, generalization of the results is limited. Previous articles also dealt with single-country data analysis, such as the case of China examined by Deng and Cheng (2019) and the Australian case examined by Lokuwaduge et al. (2017) in the study of ESG. In a further study, there is a need to perform a study based on global samples targeting more countries. Additionally, a comparative analysis of ESG activities by countries, continents, and corporate characteristics can be carried out.

Second, this study delved into the relationship between change support behavior, innovative organizational culture, and job crafting according to ESG activity recognition. However, there is a need to consider diverse variables affecting organization members’ job activities, including attitudes and capabilities, depending on ESG strategies and management activities. A study examining the variables of the factors affecting the work activities of ESG company employees can be performed in the future.

Third, this study was conducted by targeting employees within large companies leading ESG activities. As ESG activities are an essential issue for small- and medium-sized businesses and large corporations, a further study may need to expand the study participants and involve a comparative study targeting various corporate groups.

Lastly, this study was carried out as a cross-sectional study collecting data at a specific time. Thus, there is a limitation in reflecting the level of corporate ESG activities. Consequently, there is a need to perform a longitudinal analysis of various parameters in addition to innovative organizational culture and change support behavior that repeatedly examines several points in time to seek a clearer answer to the factors affecting job crafting in terms of the ESG environment’s continuous change, as recognized by the organizational members.

Author Contributions

Conceptualization, M.J.; methodology, M.J.; software, M.J.; validation, B.K.; formal analysis, M.J.; investigation, M.J.; resources, M.J.; data curation, M.J.; writing—original draft preparation, M.J. and B.K.; writing—review and editing, B.K.; visualization, B.K.; supervision, B.K.; project administration, B.K.; funding acquisition, M.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aboud, Ahmed, and Ahmed Diab. 2018. The impact of social, environmental and corporate governance disclosures on firm value: Evidence from Egypt. Journal of Accounting in Emerging Economies 8: 442–58. [Google Scholar] [CrossRef] [Green Version]

- Al-Batah, Mohammad Subhi. 2019. Automatic diagnosis system for heart disorder using ESG peak recognition with ranked features selection. International Journal of Circuits, Systems and Signal Processing 13: 391–98. [Google Scholar]

- Alsayegh, Maha Faisal, Rashidah Abdul Rahman, and Saeid Homayoun. 2020. Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12: 3910. [Google Scholar] [CrossRef]

- Aouadi, Amal, and Sylvain Marsat. 2018. Do ESG controversies matter for firm value? Evidence from international data. Journal of Business Ethics 151: 1027–47. [Google Scholar] [CrossRef]

- Arik, Ben Dor, Jingling Guan, Adam Kelleher, Adam Lauretig, Ryan Preclaw, and Xiaming Zeng. 2022. ESG and alternative data: Capturing corporates’ sustainability-related activities with job postings. The Journal of Financial Data Science 4: 130–44. [Google Scholar]

- Bahadori, Negar, Turhan Kaymak, and Mehdi Seraj. 2021. Environmental, social, and governance factors in emerging markets: The impact on firm performance. Business Strategy & Development 4: 411–22. [Google Scholar]

- Bani-Melhem, Shaker, Rachid Zeffane, and Mohamed Albaity. 2018. Determinants of employees’ innovative behavior. International Journal of Contemporary Hospitality Management 30: 1601–20. [Google Scholar] [CrossRef]

- Barnett, Michael L., and Robert M. Salomon. 2003. Throwing a curve at socially responsible investing research: A new pitch at an old debate. Organization & Environment 16: 381–89. [Google Scholar]

- Bean, LuAnn. 2013. ESG reporting: What is treasury’s new role? Journal of Corporate Accounting & Finance 25: 33–37. [Google Scholar]

- Ben-Amar, Walid, and Ines Belgacem. 2018. Do socially responsible firms provide more readable disclosures in annual reports? Corporate Social Responsibility and Environmental Management 25: 1009–18. [Google Scholar] [CrossRef]

- Burke, W. Warner, and George H. Litwin. 1992. A causal model of organizational performance and change. Journal of Management 18: 523–45. [Google Scholar] [CrossRef]

- Büschgens, Thorsten, Andreas Bausch, and David B. Balkin. 2013. Organizational culture and innovation: A meta-analytic review. Journal of Product Innovation Management 30: 763–81. [Google Scholar] [CrossRef]

- Cannas, Claudia, Maurizio Dallocchio, and Laura Pellegrini. 2022. Environmental, social, and governance issues: An empirical literature review around the world. Climate Change Adaptation, Governance and New Issues of Value, 107–24. [Google Scholar] [CrossRef]

- Cantino, Valter, Alain Devalle, and Simona Fiandrino. 2017. ESG sustainability and financial capital structure: Where they stand nowadays. International Journal of Business and Social Science 8: 116–26. [Google Scholar]

- Chams, Nour, Josep García-Blandón, and Khaled Hassan. 2021. Role reversal! Financial performance as an antecedent of ESG: The moderating effect of total quality management. Sustainability 13: 7026. [Google Scholar] [CrossRef]

- Cornell, Bradford, and Alan C. Shapiro. 2021. Corporate stakeholders, corporate valuation and ESG. European Financial Management 27: 196–207. [Google Scholar] [CrossRef]

- Dan, Hanson, Tom Lyons, Jennifer Bender, Bruno Bertocci, and Bobby Lamy. 2017. Analysts’ roundtable on integrating ESG into investment decision-making. Journal of Applied Corporate Finance 29: 44–55. [Google Scholar]

- De Vries, Manfred F. R. Kets, and Katharina Balazs. 1999. Transforming the mind-set of the organization: A clinical perspective. Administration & Society 30: 640–75. [Google Scholar]

- Debus, Maike E., Christian Gross, and Martin Kleinmann. 2020. The power of doing: How job crafting transmits the beneficial impact of autonomy among overqualified employees. Journal of Business and Psychology 35: 317–31. [Google Scholar] [CrossRef]

- Deng, Xiang, and Xiang Cheng. 2019. Can ESG indices improve the enterprises’ stock market performance? An empirical study from China. Sustainability 11: 4765. [Google Scholar] [CrossRef] [Green Version]

- Dos Santos, Murillo Caldeira, and Fabio Henrique Pereira. 2022. ESG performance scoring method to support responsible investments in port operations. Case Studies on Transport Policy 10: 664–73. [Google Scholar] [CrossRef]

- Drempetic, Samuel, Christian Klein, and Bernhard Zwergel. 2020. The influence of firm size on the ESG score: Corporate sustainability ratings under review. Journal of Business Ethics 167: 333–60. [Google Scholar] [CrossRef]

- Esmaeili, Homa Khorasani, Jihad Mohammad, and Iraj Soltani. 2019. The relationship between job crafting and job performance: Empirical evidence from the automobile industry. International Journal of Business Innovation and Research 19: 109–24. [Google Scholar] [CrossRef]

- Fatemi, Ali, Martin Glaum, and Stefanie Kaiser. 2018. ESG performance and firm value: The moderating role of disclosure. Global Finance Journal 38: 45–64. [Google Scholar] [CrossRef]

- Friede, Gunnar, Timo Busch, and Alexander Bassen. 2015. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment 5: 210–33. [Google Scholar]

- Galbreath, Jeremy. 2013. ESG in focus: The Australian evidence. Journal of Business Ethics 118: 529–41. [Google Scholar] [CrossRef]

- Gillan, Stuart L., Andrew Koch, and Laura T. Starks. 2021. Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance 66: 101889. [Google Scholar] [CrossRef]

- Guillén, Arturo. 2020. Coronavirus crisis or a new stage of the global crisis of capitalism? Agrarian South: Journal of Political Economy 9: 356–67. [Google Scholar] [CrossRef]

- Halbritter, Gerhard, and Gregor Dorfleitner. 2015. The wages of social responsibility—Where are they? A critical review of ESG investing. Review of Financial Economics 26: 25–35. [Google Scholar] [CrossRef]

- Hansen, Kenneth, Christian Breyer, and Henrik Lund. 2019. Status and perspectives on 100% renewable energy systems. Energy 175: 471–80. [Google Scholar] [CrossRef]

- Hassan, Salah, and Abeer A. Mahrous. 2019. Nation branding: The strategic imperative for sustainable market competitiveness. Journal of Humanities and Applied Social Sciences 1: 146–58. [Google Scholar] [CrossRef]

- Hogan, Suellen J., and Leonard V. Coote. 2014. Organizational culture, innovation, and performance: A test of Schein’s model. Journal of Business Research 67: 1609–21. [Google Scholar] [CrossRef]

- Huang, Danny Zhao-Xiang. 2021. Environmental, social and governance factors and assessing firm value: Valuation, signalling and stakeholder perspectives. Accounting & Finance 62: 1983–2010. [Google Scholar]

- Husted, Bryan W., and José Milton de Sousa-Filho. 2019. Board structure and environmental, social, and governance disclosure in Latin America. Journal of Business Research 102: 220–27. [Google Scholar] [CrossRef]

- Jalagat, Revenio. 2016. Job performance, job satisfaction, and motivation: A critical review of their relationship. International Journal of Advances in Management and Economics 5: 36–42. [Google Scholar]

- Janah, Oussama Oualaid, and Hassan Sassi. 2021. The ESG impact on corporate financial performance in developing countries: A systematic literature review. International Journal of Accounting, Finance, Auditing, Management and Economics 2: 391–410. [Google Scholar]

- Jaskyte, Kristina. 2004. Transformational leadership, organizational culture, and innovativeness in nonprofit organizations. Nonprofit Management and Leadership 15: 153–68. [Google Scholar] [CrossRef]

- Jebe, Ruth. 2019. The convergence of financial and ESG materiality: Taking sustainability mainstream. American Business Law Journal 56: 645–702. [Google Scholar] [CrossRef]

- Kim, Sang, and Zhichuan Li. 2021. Understanding the impact of ESG practices in corporate finance. Sustainability 13: 3746. [Google Scholar] [CrossRef]

- Korea Trade-Investment Promotion Agency. 2021. Global Market Report 21-026. Seoul: Korea Trade-Investment Promotion Agency (KOTRA). [Google Scholar]

- Kotsantonis, Sakis, Chris Pinney, and George Serafeim. 2016. ESG integration in investment management: Myths and realities. Journal of Applied Corporate Finance 28: 10–16. [Google Scholar]

- Landi, Giovanni, and Mauro Sciarelli. 2018. Towards a more ethical market: The impact of ESG rating on corporate financial performance. Social Responsibility Journal 15: 11–27. [Google Scholar] [CrossRef]

- Leins, Stefan. 2020. Responsible investment’: ESG and the post-crisis ethical order. Economy and Society 49: 71–91. [Google Scholar] [CrossRef]

- Lewry, Andy, James Fisher, and Matt Holden. 2018. The value of sustainability. Journal of Building Survey, Appraisal & Valuation 7: 13–18. [Google Scholar]

- Liu, Lian, and Naoko Nemoto. 2021. Environmental, social and governance (ESG) evaluation and organizational attractiveness to prospective employees: Evidence from Japan. Journal of Accounting and Finance 21: 14–29. [Google Scholar]

- Lokuwaduge, Chitra, Sriyani De Silva, and Kumudini Heenetigala. 2017. Integrating environmental, social and governance (ESG) disclosure for a sustainable development: An Australian study. Business Strategy and the Environment 26: 438–50. [Google Scholar] [CrossRef]

- Margolis, Joshua D., and James P. Walsh. 2003. Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly 48: 268–305. [Google Scholar] [CrossRef] [Green Version]

- Miralles-Quirós, María Mar, José Luis Miralles-Quirós, and Jesús Redondo Hernández. 2019. ESG performance and shareholder value creation in the banking industry: International differences. Sustainability 11: 1404. [Google Scholar] [CrossRef] [Green Version]

- Mohammad, Wan Masliza Wan, and Shaista Wasiuzzaman. 2021. Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Cleaner Environmental Systems 2: 100015. [Google Scholar] [CrossRef]

- Moskowitz, Howard R. 1972. Perceptual changes in taste mixtures. Perception & Psychophysics 11: 257–62. [Google Scholar]

- Nekhili, Mehdi, Amal Boukadhaba, and Haithem Nagati. 2021b. The ESG–financial performance relationship: Does the type of employee board representation matter? Corporate Governance: An International Review 29: 134–61. [Google Scholar] [CrossRef]

- Nekhili, Mehdi, Amal Boukadhaba, Haithem Nagati, and Tawhid Chtioui. 2021a. ESG performance and market value: The moderating role of employee board representation. The International Journal of Human Resource Management 32: 3061–87. [Google Scholar] [CrossRef]

- Oinas-Kukkonen, Harri. 2013. A foundation for the study of behavior change support systems. Personal and Ubiquitous Computing 17: 1223–35. [Google Scholar] [CrossRef]

- Oldham, Greg R., and Yitzhak Fried. 2016. Job design research and theory: Past, present and future. Organizational Behavior and Human Decision Processes 136: 20–35. [Google Scholar] [CrossRef]

- Onyeneke, Gechinti Bede, and Tomokazu Abe. 2021. The effect of change leadership on employee attitudinal support for planned organizational change. Journal of Organizational Change Management 34: 403–15. [Google Scholar] [CrossRef]

- Ortas, Eduardo, Igor Álvarez, and Ainhoa Garayar. 2015. The environmental, social, governance, and financial performance effects on companies that adopt the United Nations Global Compact. Sustainability 7: 1932–56. [Google Scholar] [CrossRef] [Green Version]

- Parfitt, Claire. 2020. ESG integration treats ethics as risk, but whose ethics and whose risk? Responsible investment in the context of precarity and risk-shifting. Critical Sociology 46: 573–87. [Google Scholar] [CrossRef]

- Park, So Ra, and Jae Young Jang. 2021. The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies 9: 48. [Google Scholar] [CrossRef]

- Pellegrini, Carlo Bellavite, Raul Caruso, and Niketa Mehmeti. 2019. The impact of ESG scores on cost of equity and firm’s profitability. New Challenges in Corporate Govenrnace, Theory and Practice 3–4: 38–40. [Google Scholar]

- Piao, Xiangdan, Jun Xie, and Shunsuke Managi. 2022. Environmental, social, and corporate governance activities with employee psychological well-being improvement. BMC Public Health 22: 22. [Google Scholar] [CrossRef]

- Piderit, Sandy Kristin. 2000. Rethinking resistance and recognizing ambivalence: A multidimensional view of attitudes toward an organizational change. Academy of Management Review 25: 783–94. [Google Scholar] [CrossRef]

- Rai, Alka. 2018. Job crafting intervention: Fostering individual job redesign for sustainable organisation. Industrial and Commercial Training 50: 200–8. [Google Scholar] [CrossRef]

- Rezaee, Zabihollah, and Ling Tuo. 2017. Voluntary disclosure of non-financial information and its association with sustainability performance. Advances in Accounting 39: 47–59. [Google Scholar] [CrossRef]

- Robertson, Peter J., Darryl R. Roberts, and Jerry I. Porras. 1993. Dynamics of planned organizational change: Assessing empirical support for a theoretical model. Academy of Management Journal 36: 619–34. [Google Scholar]

- Rogiest, Sofie, Jesse Segers, and Arjen van Witteloostuijn. 2015. Climate, communication and participation impacting commitment to change. Journal of Organizational Change Management 28: 1094–106. [Google Scholar] [CrossRef]

- Rossi, Matteo, Jamel Chouaibi, Salim Chouaibi, Wafa Jillani, and Yamina Chouaibi. 2021. Does a board characteristic moderate the relationship between CSR practices and financial performance? Evidence from European ESG firms. Journal of Risk and Financial Management 14: 354. [Google Scholar] [CrossRef]

- Roy, Abhijit, and Paramita Mukherjee. 2022. Does national culture influence corporate ESG disclosures? Evidence from cross-country study. Vision. [Google Scholar] [CrossRef]

- Sachin, Nikunj, and R. Rajesh. 2022. An empirical study of supply chain sustainability with financial performances of Indian firms. Environment, Development and Sustainability 24: 6577–601. [Google Scholar] [CrossRef]

- Sassen, Remmer, Anne-Kathrin Hinze, and Inga Hardeck. 2016. Impact of ESG factors on firm risk in Europe. Journal of Business Economics 86: 867–904. [Google Scholar] [CrossRef]

- Shakil, Mohammad Hassan. 2020. Environmental, social and governance performance and stock price volatility: A moderating role of firm size. Journal of Public Affairs, e2574. [Google Scholar] [CrossRef]

- Sroufe, Robert. 2017. Integration and organizational change towards sustainability. Journal of Cleaner Production 162: 315–29. [Google Scholar] [CrossRef]

- Staszkiewicz, Piotr, and Renata Karkowska. 2021. Audit fee and banks’ communication sentiment. Economic Research-Ekonomska Istraživanja 35: 1618–38. [Google Scholar] [CrossRef]

- Tan, Yafei, and Zhaohui Zhu. 2022. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technology in Society 68: 101906. [Google Scholar] [CrossRef]

- Thun, Sylvi, and Arnold B. Bakker. 2018. Empowering leadership and job crafting: The role of employee optimism. Stress and Health 34: 573–81. [Google Scholar] [CrossRef]

- Tims, Maria, Arnold B. Bakker, and Daantje Derks. 2015. Job crafting and job performance: A longitudinal study. European Journal of Work and Organizational Psychology 24: 914–28. [Google Scholar] [CrossRef]

- Tims, Maria, Melissa Twemlow, and Christine Yin Man Fong. 2021. A state-of-the-art overview of job-crafting research: Current trends and future research directions. Career Development International 27: 54–78. [Google Scholar] [CrossRef]

- Veenstra, Esmee M., and Naomi Ellemers. 2020. ESG indicators as organizational performance goals: Do rating agencies encourage a holistic approach? Sustainability 12: 10228. [Google Scholar] [CrossRef]

- Weston, Piers, and Matthias Nnadi. 2021. Evaluation of strategic and financial variables of corporate sustainability and ESG policies on corporate finance performance. Journal of Sustainable Finance & Investment, 1–17. [Google Scholar] [CrossRef]

- Xu, Jingshi, Xue Li, and Soonkyoo Choe. 2022. The effect of green innovation on corporate ESG performance: Evidence from Chinese listed enterprises. Asia-Pacific Journal of Business 13: 1–17. [Google Scholar] [CrossRef]

- Yoon, Bohyun, Jeong Hwan Lee, and Ryan Byun. 2018. Does ESG performance enhance firm value? Evidence from Korea. Sustainability 10: 3635. [Google Scholar] [CrossRef] [Green Version]

- Zainullin, Sergei, and Olga Zainullina. 2021. Scientific review digitalization of corporate culture as a factor influencing ESG investment in the energy sector. International Review 1–2: 130–36. [Google Scholar] [CrossRef]

- Zhang, Chunyu, and Liping Liu. 2021. The effect of job crafting to job performance. Knowledge Management Research & Practice 19: 253–62. [Google Scholar]

- Zhang, Fangfang, and Sharon K. Parker. 2019. Reorienting job crafting research: A hierarchical structure of job crafting concepts and integrative review. Journal of Organizational Behavior 40: 126–46. [Google Scholar] [CrossRef]

- Zhou, Guangyou, Lian Liu, and Sumei Luo. 2022. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Business Strategy and the Environment, 1–17. [Google Scholar] [CrossRef]

- Zumente, Ilze, and Jūlija Bistrova. 2021. ESG importance for long-term shareholder value creation: Literature vs. practice. Journal of Open Innovation: Technology, Market, and Complexity 7: 127. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).