Abstract

This study aims to construct a mathematical model to determine the dimensions of an economic, social, and environmental project with the goal of sustainable management. By identifying the optimal weights, the synergy values for sustainable management can be maximized. Taking aesthetic medicine companies as examples, this study attempts to construct the index projects of the economic, social, and environmental dimensions of sustainable management in an uncertain environment. Linear relationships (a combination of fixed synergistic values and varying synergistic values) are used to calculate the import optimal weight under optimistic, normal, and pessimistic circumstances. This study helped companies to introduce triple bottom line (TBL) indices to plan their issues under sustainable management and development, thus, enabling the parent company to achieve the optimal weight for the project costs to put in its subsidiaries. Additionally, this study prioritizes the weight of the influence on the management of the aesthetic medicine industry according to the risk probabilities, to minimize the uncertainties of risk management in corporate management and reduce the possibility of direct and indirect cost losses caused by financial distress, functional fluctuations, and negative impact on the medical equipment market, thereby maximizing the estimated total project value under sustainable management. This study constructs an aesthetic medicine-specific mathematical model concept using the triple bottom line model as the basis for sustainable corporate management and proposes an approach to obtain sustainable weight in uncertain conditions. By doing so, companies can add various managerial methods for the same industry, and new ideas are provided to the academic community to discuss the development of decision-making assessment criteria for risk assessments in sustainable management.

1. Introduction

Any inappropriate management strategy of an enterprise may endanger society or the environment and directly threaten the economic gains of the enterprise or even its survival; this is especially true with regard to risk management under uncertain circumstances (). (), pointed out the five global risks that enterprises are most worried about when operating in their own countries in the next ten years are the economy, geopolitics, and environmental, social, and technological concerns. The requirements of the environment, the customers, and the supply chain change constantly, which adds fuel to the current market competition. Sustainable management and development is an important requirement for the management strategy or business model of any enterprise, as lacking a goal of sustainable development will result in weakened competitiveness and make long-term operation unlikely for an enterprise (). A sustainable management strategy enables a company to rise above its rivals and reposition itself in social and environmental aspects (). Additionally, from the perspective of sustainable management, in order to achieve sustainable development goals, it is necessary to make good use of the new concept of the three key dimensions of corporate strategies. The greatest challenge for sustainable management is to seek management value in project values according to the TBL indices regarding social, economic, and environmental dimensions (). Furthermore, an orientation towards social and environmental sustainability may help generate higher corporate confidence among key stakeholders, which identifies market demands according to economic, social, and environmental dimensions, thereby boosting and improving sustainable corporate performance () and creating opportunities for sustainable management.

Since 2019 and the onset of COVID-19, the world has faced increasing issues. The pandemic has brought about tremendous uncertainty and exerted an unimaginable influence on the economy, social development, business, risks, financial management, and financial markets (). Aesthetic medicine is a customized medical service industry (). Under an economic depression and an uncertain business environment, the aesthetic medicine industry has understood that sustainable development is the only way to enhance its competitive advantages. Furthermore, innovations in management strategies () are the key to the sustainable management, profit-making, and growth of aesthetic medicine enterprises. When pursuing sustainable management in the healthcare industry, the aesthetic medicine industry is becoming aware of the necessity of sustainable development and of consulting the TBL model according to the stage of its own development and growth. If suitable indices can be established in the social, economic, and environmental dimensions of the TBL model specific to the aesthetic medicine industry, it could allow enterprises to operate sustainably and obtain the maximum operating value, thus, increasing the opportunities for their sustainable development.

2. Literature Review

In 1987, the United Nations defined the concept of sustainable development as development that meets contemporary needs without compromising the future generation (). The 2002 Earth Summit Report pointed out it is crucial to harmonize the three core elements of sustainable development, namely, economic growth, social development, and environmental protection, as interconnected pillars (). () proposed the spirit of the TBL, and () pointed out that the sustainable management of enterprises must take into consideration the sustainable management performance from the economic, social, and environmental dimensions. Business managers are faced with tremendous pressure to compete in the various aspects of management strategies, management models, human resource management, research and development, the quality of services, and the establishment of brands, in which industries are expected to exhibit their values of sustainable management (). In order to adapt to the rapidly changing commercial environment, enterprises must maintain and improve their performance by continually improving their modes of management to the point of achieving the goal of sustainable management and development (). From the perspective of sustainable management for enterprises, to achieve the goal of sustainable development, enterprises must make good use of the new concepts concerning the three key dimensions mentioned in the enterprise management strategy. Many scholars have discussed the subject of sustainable management of enterprises from the perspective of TBL (; ; ; ; ). Table 1 summarizes the literature concerning the indexes related to sustainable development.

Table 1.

Literature concerning indices related to sustainable development.

COVID-19 has disrupted sustainable development goals, namely, society, the economy, and the environment (). Many enterprises, especially small and middle-sized enterprises, lack plans and strategies regarding sustainable management. The pandemic has resulted in the suspension of operations, lack of personnel, and supply chain disruptions. In the face of such problems, business management must not solely focus on the economic aspects of creating revenue or profit but should consider the extrinsic risk factors for society and the environment (). () wrote that responding to the market has long been the most basic strategy of enterprise management. The overall sustainable management values of an enterprise comprise social, financial, and environmental dimensions. The social dimension refers to the social benefits of the stakeholders in an enterprise, such as the employees, customers, manufacturers, and any other entities that may be affected by the business operations () the economic dimension refers to generating and maintaining long-term profits (), and the environmental dimension refers to minimizing the negative impact of business operations on the environment (). The greatest challenge for the sustainable management of an enterprise is to find management value in project values according to the TBL indices concerning the social, economic, and environmental dimensions (). An orientation towards social and environmental sustainability may help generate more confidence in the enterprises on the part of key stakeholders, while meeting market demand in the economic, social, and environmental dimensions, thus, stimulating the enterprise’s sustainable performance () and providing an opportunity for maintaining the sustainable management of the enterprise. More and more enterprises are including factors regarding sustainable development in their management strategies, and are establishing sustainable management policies to address those issues (). Of course, this argument also stands for healthcare enterprises. The above studies mostly focused on improving sustainable management values, while aesthetic medicine-related literature chiefly investigated medical disputes in crisis management, service quality, discussions on medical technology, strategic analysis, medical project management, and innovation. However, research on the sustainable management values of aesthetic medicine and exploration of aesthetic medicine sustainable management using the TBL model is relatively rare. To fill these gaps in existing literature, this study aimed to explore the new thinking on issues related to the sustainable operation of aesthetic medicine through the realization of the transformation of the knowledge ecosystem, in order to construct an aesthetic medicine-specific mathematical model ().

On the basis of literature regarding sustainable development and its relevant indexes, this study discussed which model the aesthetic medicine industry should adopt when implementing sustainable management, and which model suits the plans and strategies of the aesthetic medicine industry. It discussed the uncertain environment faced by business managers in the aesthetic medicine industry, especially at times when instability threatens the global economy. It analyzed literature relevant to the goals, including the Studies on the Project Value under an Enterprise of Aesthetic Medicine with Sustainability (), an Optimal Advertising Strategy in Aesthetic Medicine Budgets with Uncertain Income (), the Criteria of Optimal Training Cost Allocation for Sustainable Value in the Aesthetic Medicine Industry (), and the Modified Binomial Options Pricing Model and the Revised Replicating Portfolio Approach with the Concept of Sustainability Options (). According to the 2019 Taiwan and Asia Pacific Sustainability Reports Analysis, some regional hospitals in Taiwan announced their social responsibility and sustainability frameworks and targets, including the various indices regarding operations and management, happy workplace, medical services, environmental security management, medical quality and safety, talent cultivation, supply-chain systems, information security, and innovative management (). Based on the abovementioned literature and using the aesthetic medicine industry as an example, this study determined the dimensions of the TBL assessment model with regard to sustainable management in the aesthetic medicine industry, as well as their corresponding indices and functions, as shown in Table 2.

Table 2.

The dimensions of sustainable management in aesthetic medicine, with corresponding indices and functions.

(, ) studied ways to obtain the optimal ratio to achieve sustainability under uncertain circumstances in different TBL dimensions and came up with an overall sustainable synergy index for manufacturing enterprises. () focused on the relationship between the three factors of TBL, investigated the practice of sustainable management and marketing among customers, and concluded by means of finding the suitable ratio that the economic scale is the most important factor influencing sustainable marketing. () discussed sustainable supply chain projects, calculated the weight ratio by means of TBL, and selected effective models for suppliers in the supply chain. () studied and evaluated the sustainable development performance of the Brazilian electricity industry by calculating the weight ratios. ranked suppliers based on their sustainable development performance and proposed a way to select sustainable suppliers using ratios. From the above literature, it could be concluded that enterprises can use ratios to determine the most suitable total project value in each dimension when making sustainable business management decisions.

This study attempted to construct a generalized mathematical model of sustainable management value using indices regarding the three elements of the TBL model. After considering the synergistic value of sustainable management, this study determined the optimal ratio of the indices in the economic, social, and environmental dimensions, to fulfil the goal of maximizing project value.

The aesthetic medicine industry provides professional medical services; therefore, improving medical professionalism (), providing excellent medical technical services and enhancing the quality of employee services (), and providing medical expertise and proficiency, as well as transparent medical information, are all critical factors that could trigger medical disputes. According to (), functional training for medical teams can help improve medical companies’ sustainable management, reduce medical delays, and improve medical teamwork and patient safety. Therefore, functional training for employees and the time invested in such training will reduce medical disputes and increase the project values of the indices concerning the social dimension. According to (); (), an unstable global economy may increase the complexity of sustainable development factors in corporate finance. As a result, advertising may be considered a supporting tool for acquiring public wealth to achieve economic sustainability and growth, with the aim of improving a company’s economic development and investment attractiveness, as well as brand value. Therefore, the project value of social dimension indices in the aesthetic medicine TBL model focuses on the discussion of optimizing the advertising budget to increase earnings given uncertain revenue. Furthermore, the environment is the key to sustainable development, and sustainable development in the context of the environment involves the sustainable acquisition of natural resources (). Numerous studies have shown that an orientation toward environmentally sustainable development indirectly enhances a company’s competitiveness (). Regarding the green equipment for a product’s life cycle, sustainability and the environment are important elements for individuals and organizations in procurement, waste management, and energy-saving practices (). In the environmental dimension of aesthetic medicine’s sustainable development, green costs, supply chains, environmental protection in the product life cycle, and environmental pollution are all considerations related to sustainable capital, management costs, and sustainable development (). Therefore, given the uncertain environment, the project value of the environmental dimension indices in the aesthetic medicine TBL model lies in the green input instrument procurement project and the medical equipment procurement project.

3. Research Method and Model Formulation

3.1. Research Method

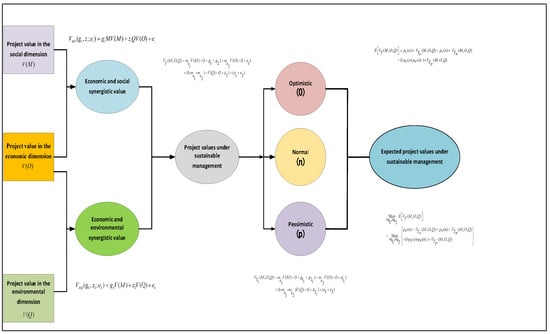

The aesthetic medicine industry also regards sustainable management as a long-term pursuit. Enterprise managers have realized that if the aesthetic medicine industry is to operate sustainably and remain unbeatable in the medical field, the management of aesthetic medicine enterprises has to be strengthened. After integrating human resource management, marketing software, and hardware equipment, the corresponding indexes of the economic, social, and environmental dimensions of the TBL model were introduced into subsidiaries. Projects should be proposed for each index to improve the sustainable management of the enterprise and find the optimal total project value for sustainable management. The relevant structure is shown in Figure 1. Through the value-added synergy in enterprise management can the enterprise value be improved, thus maximizing the goal of sustainable management and development in enterprises. This study used linear relationships (the fixed synergistic value, varying synergistic value, and combined synergistic value) to introduce the external environment in an attempt to evaluate the optimal ratio in the social, economic, and environmental dimensions under optimistic, normal, and pessimistic circumstances. It aimed to find the optimal weighting ratio between the synergistic value of the sustainable management project in the aesthetic medicine industry and the optimal resource input, thereby working as a defensive strategy to avoid risk and actively improve the synergistic value of sustainable management projects in the aesthetic medicine industry.

Figure 1.

Optimal evaluation structure of synergy value and weight in sustainable management projects.

3.2. Model Explanations

The main definitions in the model are, as follows:

Let the project value in the economic dimension under sustainable management be , and the weight of the assets to be invested in advertising be . Let the project value in the social dimension under sustainable management be , and the weight of the assets to be invested in functional training be . Let the project value in the environmental dimension under sustainable management be , and the weight of the assets to be invested in healthcare equipment be . With different investment amounts, the weight of the assets to be invested in advertising is , that of the assets to be invested in functional training is , and that of the assets to be invested in healthcare equipment is .

is the set weight reflecting the synergy value of the economic and social dimensions, and is the set weight reflecting the synergy value of the economic and environmental dimensions.

is the reaction coefficient reflecting the project value in the economic dimension and the economic and social synergy value , and , and are respectively the reaction coefficients reflecting the project value in the economic dimension and the economic and social synergy value under optimistic (o), normal (n), and pessimistic (p) circumstances. is the reaction coefficient reflecting the project value in the economic dimension and the economic and environmental synergy value , and , and are respectively the reaction coefficients reflecting the project value in the economic dimension and the economic and environmental synergy value under optimistic (o), normal (n), and pessimistic (p) circumstances.

is the reaction coefficient reflecting the project value in the social dimension and the economic and social synergy value , and , and are respectively the reaction coefficients reflecting the project value in the social dimension and the economic and social synergy value under optimistic (o), normal (n), and pessimistic (p) circumstances. is the reaction coefficient reflecting the project value in the environmental dimension and the economic and environmental synergy value , and , and are respectively the reaction coefficients reflecting the project value in the environmental dimension and the economic and environmental synergy value under optimistic (o), normal (n), and pessimistic (p) circumstances. The definitions of parameters are shown in Table 3.

Table 3.

Definitions of parameters.

Given , , , and the corresponding original project values in the economic, social, and environmental dimensions , and , the economic and social synergy value can be represented as:

The economic and environmental synergy value can be represented as:

The natural restrictive conditions are: , .

Based on the above definitions, the total project value under sustainable management can be defined as:

The total project model under sustainable management in optimistic (o), normal (n), and pessimistic (p) circumstances , , is:

The estimated total project value under sustainable development , in which the possibility of occurrence of optimistic circumstances , the possibility of occurrence of normal circumstances , and the possibility of occurrence of pessimistic circumstances can be represented as:

The objective function of this model was to determine the most suitable weight of the assets to be invested in advertising (), that of the assets to be invested in functional training (), and that to be invested in medical equipment when the estimated total project value under sustainable management reaches its maximum, which can be represented, as follows:

The restrictive conditions are , , and .

Within a given range of applicable total investment amounts, the weight of the assets to be invested in advertising (), that of the assets to be invested in functional training (), and that to be invested in medical equipment can be found where the estimated total project value under sustainable management reaches its maximum with different total investment amounts. This was taken as a basis for determining the most suitable weight of the assets to be invested in advertising (), that of the assets to be invested in functional training (), and that to be invested in medical equipment , within an applicable range of the total investment amounts.

4. Numerical Example

4.1. Introduction of Model Value Examples

An enterprise in the aesthetic medicine industry has initiated sustainable management projects with the help of the TBL indices in the economic, social, and environmental dimensions, to determine the partial project values under sustainable management. It constructed a mathematical model and introduced numerical examples to analyze and obtain the project values in all dimensions, including the advertising budget allocation in the economic dimension, the employee functional training investment in the social dimension, and the medical equipment green procurement in the environmental dimension. Based on the synergy values of projects in the TBL dimensions, the enterprise could determine the appropriate weights of project values and the total operation value for sustainable management in the aesthetic medicine industry. The data and figures of partial projects in the economic, social, and environmental dimensions of the TBL model in this study are calculated by referring to the internal data of individual aesthetic medicine companies. This study constructed a mathematical formula for each weight, as shown in Equations (1)–(6), and conducted a numerical simulation, as described below.

In the economic dimension, regarding the budget allocation weight of an enterprise’s investment cost in advertising , it was found that the aesthetic medicine industry is faced with advertising risk assessment when investing in advertising. When the advertising investment cost and other parameters take different values, different optimal allocation weights can be found; for example, let the enterprise’s investment cost in advertising be US$0.267 million, US$0.333 million, and US$0.4 million.

When the enterprise’s investment cost in advertising equals US$0.4 million, its advertising revenue will be US$0.683 million. Deducting the advertising investment cost of = US$0.4 million results in a net advertising revenue of US$0.283 million.

When the enterprise’s investment cost in advertising equals US$0.267 million, its advertising revenue equals US$0.862 million. By deducting the advertising investment cost of = US$0.267, the net advertising revenue is US$0.954 million.

The above advertising budget allocation and net advertising revenue indicate that the advertising revenue is not proportional to the advertising investment cost, meaning the net advertising revenue becomes less when the enterprise places more investment in advertising. Therefore, the maximum advertising revenue of US$0.862 million with an advertising investment cost of US$0.267 million constitutes the project value in the economic dimension .

In the social dimension, regarding the time investment in functional training, from the perspective of the partial net income of the enterprise’s TBL project specific to aesthetic medicine, it was found that the maximum revenue is obtained when the investment ratio of functional training time : ranges between 50%:50% and 70%:30%, and training time ranges from 60 to 100 h, with the time investment cost of the training being .

When the investment ratio of functional training time : is 50%:50% and training time reaches 60 h, the time investment cost of the training amounts to US$0.045 million, rendering a net income of US$1.367 million for the enterprise.

When the investment ratio of the functional training time : is 70%:30% and training time reaches 100 h, the time investment cost of the training amounts to US$0.139 million, rendering a net income of US$1.279 million for the enterprise.

As can be seen from the above, in comparison, the partial net income of US$1.347 million with the investment ratio of functional training time : at 50%:50% constitutes the project value in the social dimension , which generates the maximum partial net income when the enterprise makes time investments in functional training.

Regarding the additional cost of sustainable capital investments in medical equipment procurement in the environmental dimension of sustainable management, this study used a modified binomial options pricing model based on the real options theory and a modified replicating portfolio approach to construct the models and give numerical examples. The sensitivity analysis showed that the aesthetic medicine industry should introduce new equipment on a timely basis to improve competitiveness and increase revenue.

When sustainable capital investment is introduced to the aesthetic medicine industry along with the traditional equipment investment , the revenue to be generated in an optimistic environment after phase one can be raised to US$0.7 million, which is an increase of US$0.033 million. Meanwhile, when sustainable capital is invested, the generated net present value rises to US$2.28 million, which is an increase of US$0.131 million. Compared with investing in new equipment without sustainable capital, an investment with sustainable capital could generate a net present value of US$0.521 million, which is an increase of US$0.131 million.

As can be seen from the above, as the net present value of the medical equipment procurement of the aesthetic medicine industry in the environmental dimension is higher with sustainable capital than without, the best situation is when the initial value of the sustainable option and the initial value of the sustainable option under the replicating portfolio approach raise the value from US$0.389 million to US$0.415 million, which is an increase of US$0.026 million. Therefore, US$0.389 million constitutes the project value in the environmental dimension regarding the enterprise’s procurement of medical equipment.

The data and figures in this study are based on the internal data of the aesthetic medicine case company and mathematical model assumptions. Referring to the data and model assumptions in Table 4 and Table 5, this study constructed the fixed coefficients and ratios of the synergistic value of each project and set the risk probabilities. Analysis was performed using Polymath software, as follows.

Table 4.

Basic parameters. Currency: US$ Unit: million dollars.

Table 5.

Risk probabilities of project synergy values in optimistic, normal, and pessimistic circumstances.

4.2. Sensitivity Analysis

Faced with an uncertain healthcare environment and fierce horizontal competition, managers in the aesthetic medicine industry intend to attract new customers and create more revenue by building brand reputations and increasing their exposure through investment in advertising. Investment in advertising is an annual expenditure and constitutes a relatively high weight in the whole project.

Medical equipment procurement is an important procedure in the aesthetic medicine industry, as it is a means of creating profit and enhancing competitiveness. Although procurements result in relatively high expenditures, it is not an annual necessity, thus, the investment weight is lower in comparison.

Meanwhile, employee functional training incurs human resource investment costs for the purposes of improving the quality of medical services, reducing loss, and building a reputation. An enterprise can reduce employee turnover by organizing education programs and training continually. Having senior employees equipped with advanced skills and rich experience can enhance the quality of medical services and reduce mistakes. By studying new technologies and acquiring new skills, doctors with specialized medical skills can increase enterprises’ specialization and differentiation, thus, bringing in more revenues; therefore, the investment weight in this respect lies in the middle.

The investment weight for projects of the economic, social, and environmental dimensions :

According to Table 6, when the investment weight for the project of the economic, social, and environmental dimensions has a ratio of 40%:40%:20%, respectively, the project value is US$5.143 million; when the project value has a probability of 60%:20%:20%, the corresponding project value becomes US$5.82 million. Given the above project value weight and risk probability, the project value has increased.

Table 6.

Sensitivity analysis of weight for project value. Currency: US$ Unit: million dollars.

The risk probability of the project of the economic, social, and environmental dimensions in optimistic, normal, and pessimistic circumstances:

According to the results of sensitivity analysis in Table 7, after the estimated total project value is calculated, when its risk probability in optimistic, normal, and pessimistic circumstances, , is 20%:60%:20%, the estimated total project value is US$5.183 million; when is 60%:20%:20%, the estimated total project value becomes US$5.867 million.

Table 7.

Risk probabilities of the estimated project synergy values in optimistic, normal, and pessimistic circumstances. Currency: US$ Unit: million dollars.

According to Table 8, taking sustainable management as the goal and the risk probability of economic benefits in optimistic, normal, and pessimistic circumstances, the optimal estimated total project value has a risk probability of 60%:20%:20%.

Table 8.

Optimal risk probability for the estimated total project value. Currency: US$ Unit: million dollars.

According to sensitivity analysis in Table 9, the estimated total project value is US$5.529 million when its weight has a ratio of 40%:40%:20%, and becomes US$5.867 million when the ratio is 60%:20%:20%. The project value is US$12.683 million when its weight has a ratio of 40%:40%:20%, and becomes US$13.283 million when the ratio is 60%:20%:20%.

Table 9.

Sensitivity analysis to estimate the proportion of total project value weight ratio. Currency: US$ Unit: million dollars.

According to Table 10, the optimal project value under the sustainable management of the aesthetic medicine industry has an estimated value of US$13.283 million. The estimated total project value generates the maximum synergy value with a weight of 60%:20%:20% under the invested resource weight ratio . Its objective function is the maximum estimated total project value , with an estimated total project value of US$5.867 million.

Table 10.

Weight for the maximized estimated total project value. Currency: US$ Unit: million dollars.

After inputting the numerical examples into a practical mathematical model, this study obtained the sensitivity analysis results, as shown in Table 6 and Table 10. The results show that, in order to pursue sustainable operation, the aesthetic medicine enterprise established an index topic project on the economic, social, and environmental aspects of the TBL model project. In addition, it has invested an advertising budget in the economic dimension project, functional training costs in the social dimension index project, and medical equipment procurement expenses in the environmental dimension index project. Within the framework of the TBL index projects of the aesthetic medicine enterprise, this study found the synergy values, the total value under sustainable development, and the respective optimal investment weights under optimistic, normal, and pessimistic risk probabilities for maximizing the synergy values under sustainable management in uncertain circumstances.

5. Conclusions

This study could help enterprises determine the respective synergy values and the optimal weights to maximize the total value for projects pursuing sustainable management under uncertain circumstances in the aesthetic medicine industry by means of a three-dimensional mathematical model. The model could minimize the uncertainties in risk management encountered in enterprise operations, and reduce financial predicaments and the probability of losses in direct and indirect costs, as caused by negative impacts from changes in functions and the medical equipment market ().

5.1. Academic Implications

Sustainable development has become a key factor leading to long-term success in enterprise operation, and innovations in the business management model constitute a promising approach to improving and ensuring enterprise sustainability. Business management models can mainly be studied from the perspectives of the statement, capture, creation, and delivery of project values in the social, economic, and environmental dimensions. (). Scholars have supported that practising enterprise risk management can lower the costs related to business operation while enhancing competitive advantages and providing outstanding performance (). For the purpose of sustainable operation, enterprises should focus on the sustainability of their businesses and implement enterprise policies based on financial performance, social performance, and environmental performance. (; ). Of course, these arguments also stand for healthcare enterprises. Therefore, this study discussed project value in the context of sustainable management in the aesthetic medicine industry, introduced the theoretical background of the triple bottom line (TBL) model in enterprise sustainable management, constructed a research framework, and proposed research methods to provide academia with a new way of thinking about establishing principles for assessing decisions with regard to sustainable management in the aesthetic medicine industry.

5.2. Managerial Implications

This study provides a number of clear managerial implications. The mathematical model of this study is a tool for measuring project value and performance, as well as for avoiding the risks concerning sustainable management. Creating synergy values in the economic, social, and environmental dimensions of the TBL is the ultimate goal of enterprises in their pursuit of a project value model based on sustainable development and management (). Utilizing the weights of various forms of project values under sustainable management in an enterprise may contribute to increasing the sustainable management project value, such as investment in advertising (the economic dimension), investment in functional training (the social dimension), and the expenditures incurred from procuring medical instruments (the environmental dimension) as the enterprise pursues sustainable management in an uncertain operating environment. By applying sustainable management business models, enterprises can add different management methods in the same industry, thus, creating synergy value (). This paper provides an extensive explanation of how to use mathematical models as a distinct tool for enterprise decision-makers to conduct assessments and carry out necessary reformations.

5.3. Contributions

The novelty of this article lies in its attempt to construct a generalized mathematical model for sustainable management value using the indices of the three elements of the TBL model. This article also puts efforts into helping the aesthetic medicine industry pursue sustainable management decisions in the medical industry from the perspective of the synergistic value of sustainable management. Firstly, the analytical method of this study could make the theoretical framework of economics or financial decisions more clear, organized, and logical. Secondly, the feasibility and applicability of model construction could present the changes between the variables and linear relationships through sensitivity analysis. In addition, this study contributes to existing literature; for example, this study used linear relationships (the fixed synergistic value and the varying synergistic value combined) in an attempt to calculate the optimal ratio in the social, economic, and environmental dimensions under optimistic, normal, and pessimistic circumstances, and determined the optimal ratio of project value and resource input under sustainable management.

By adopting the management’s perspective, this study investigated the social dimension in corporate management regarding the improvement of digital transition issues through increased investment in financial and human resources, storage enhancement of medical records, and environmental uncertainty reduction to lower medical losses when establishing a professional brand (). Through emails, blogs, internal management systems, and supporting tools used for sharing knowledge and managing customer relationships in advertising and marketing, and with representatives’ active interactions with customers, media has become more influential in aesthetic medicine companies’ marketing strategies (). To boost revenue and improve companies’ sustainable development, the results of this paper can provide academic research and discussion on the self-funded medical industry.

5.4. Research Limitations

There are many factors influencing the sustainable management of enterprises, and they cover a wide range of issues. The aesthetic medicine industry is a part of the healthcare industry. It serves consumers who wish to improve their appearance with the help of medical technologies or instruments. Regulatory restrictions regarding medical services, advertising, and marketing, as well as the introduction and procurement of medical equipment, abound in this industry. Likewise, the capital invested in the TBL dimensions varies according to the different ways of management, the environment, regulations, social customs, and probabilities.

This model discussed the synergy project values in the management of the case enterprise. The mathematical model was mainly constructed using data from this particular enterprise. Therefore, this article could only discuss the aesthetic medicine medical institution and the cases of two subsidiaries with different types of management. It discussed how the parent enterprise should establish relevant index projects in the social, economic, and environmental dimensions for the two subsidiaries with different management types in its current pursuit of sustainable development, and calculated the estimated project value for the parent enterprise based on academic literature and the capital investment weights given by the owner according to the management model of the enterprise.

Author Contributions

Conceptualization, H.-T.Y., T.T.L., and S.-Y.H.; Data curation, H.-T.Y.; Investigation, H.-T.Y. and T.T.L.; Methodology, T.T.L.; Writing—original draft, H.-T.Y. and S.-Y.H.; Writing—review & editing, H.-T.Y., T.T.L. and S.-Y.H.; Funding Acquisition, T.T.L. All authors have read and agreed to the published version of the manuscript.

Funding

The authors would like to thank the Ministry of Science and Technology of the Republic of China, Taiwan for financially supporting this research under Contract No. MOST 109-2410-H-259-021.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdullah, Zalinawati, Ahmad Ismail Mohd Anuar, Wan Maziah Wan Ab Razak, Hamdan Haslenna, and Nurul Aini Aziz. 2018. The triple bottom line (TBL) studies towards sustainability marketing. Advances in Economics, Business and Management Research 46: 300–6. [Google Scholar] [CrossRef][Green Version]

- Aquilani, Barbara, Michela Piccarozzi, Tindara Abbate, and Anna Codini. 2020. The role of open innovation and value co-creation in the challenging transition from industry 4.0 to society 5.0: Toward a theoretical framework. Sustainability 12: 8943. [Google Scholar] [CrossRef]

- Bansal, Pratimal. 2005. Evolving sustainability: A longitudinal study of corporate sustainable development. Strategic Management Journal 26: 197–218. [Google Scholar] [CrossRef]

- Barbosa, Marileide, Juan Arturo Castañeda-Ayarza, and Denise Helena Lombardo Ferreira. 2020. Sustainable strategic management (GES): Sustainability in small business. Journal of Cleaner Production 258: 120880. [Google Scholar] [CrossRef]

- Baumgartner, Rupert J., and Romana Rauter. 2017. Strategic perspectives of corporate sustainability management to develop a sustainable organization. Journal of Cleaner Production 140: 81–92. [Google Scholar] [CrossRef]

- Brandenburg, Marcus, and Tobias Rebs. 2015. Sustainable supply chain management: A modeling perspective. Annals of Operations Research 229: 213–52. [Google Scholar] [CrossRef]

- Castagna, Francesco, Piera Centobelli, Roberto Cerchione, Emilio Esposito, Eugenio Oropallo, and Renato Passaro. 2020. Customer knowledge management in SMEs facing digital transformation. Sustainability 12: 3899. [Google Scholar] [CrossRef]

- Cerchione, Roberto, Piera Centobelli, Emanuela Riccio, Stefano Abbate, and Eugenio Oropallo. 2022. Blockchain’s coming to hospital to digitalize healthcare services: Designing a distributed electronic health record ecosystem. Technovation, 102480, in press. [Google Scholar] [CrossRef]

- Chang, Chia-Lin, and Michael McAleer. 2020. Alternative global health security indexes for risk analysis of COVID-19. International Journal of Environmental Research and Public Health 17: 3161. [Google Scholar] [CrossRef]

- CSRone Sustainability Report Platform. 2019. 2019 Taiwan and Asia Pacific Sustainability Report Analysis. Available online: https://www.csronereporting.com/report/show/3148 (accessed on 26 January 2021).

- Danso, Albert, Samuel Adomako, Theophilus Lartey, Joseph Amankwah-Amoah, and Diana Owusu-Yirenkyi. 2019. Stakeholder integration, environmental sustainability orientation and financial performance. Journal of Business Research 119: 652–62. [Google Scholar] [CrossRef]

- Dragomir, Voicu D. 2020. Theoretical aspects of environmental strategy. In Corporate Environmental Strategy. Cham: Springer, pp. 1–31. [Google Scholar] [CrossRef]

- Elkington, John. 1997. The triple bottom line. Environmental Management: Readings and Cases 2: 49–66. Available online: https://books.google.com.tw/books?hl=zh-TW&lr=&id=hRJGrsGnMXcC&oi=fnd&pg=PA49&ots=0fpzGLOyfF&sig=N_WVQAu2KBCANC3BeBHoWYBDQYs&redir_esc=y#v=onepage&q&f=false (accessed on 15 January 2020).

- Filser, Matthias, Sascha Kraus, Matthias Breier, Ioanna Nenova, and Kaisu Puumalainen. 2021. Business model innovation: Identifying foundations and trajectories. Business Strategy and the Environment 30: 891–907. [Google Scholar] [CrossRef]

- Garbie, Ibrahim H. 2015. Sustainability optimization in manufacturing enterprises. Procedia CIRP 26: 504–9. [Google Scholar] [CrossRef][Green Version]

- Garg, Ruchi, Rahul Batra, and Anirudh Banerji. 2020. Low cost, quality treatment and excellent hospitality makes India the best destination for medical tourism. International Journal of Innovative Research in Medical Science 5: 10–15. [Google Scholar] [CrossRef]

- Glogau, Richaed, Brian Biesman, and Michael Kane. 2015. Assessment of botulinum toxin aesthetic outcomes: Clinical study vs real-world practice. JAMA Dermatology 151: 1177–78. [Google Scholar] [CrossRef]

- Gopalakrishnan, Kavitha, Yahaya Y. Yusuf, Ahmed Musa, Tijjani Abubakar, and Hafsat M. Ambursa. 2012. Sustainable supply chain management: A case study of British Aerospace (BAe) Systems. International Journal of Production Economics 140: 193–203. [Google Scholar] [CrossRef]

- Govindan, Kannan, Khodaverdi Roohollah, and Ahmad Jafarian. 2013. A fuzzy multi-criteria approach for measuring sustainability performance of a supplier based on triple bottom line approach. Journal of Cleaner Production 47: 345–54. [Google Scholar] [CrossRef]

- Hanaysha, Jalal, and Haim Hilman. 2015. Advertising and country of origin as key success factors for creating sustainable brand equity. Journal of Asian Business Strategy 5: 141–52. [Google Scholar] [CrossRef]

- Hassini, Elkafi, Chirag Surti, and Cory Searcy. 2012. A literature review and a case study of sustainable supply chains with a focus on metrics. International Journal of Production Economics 140: 69–82. [Google Scholar] [CrossRef]

- Hendiani, Sepehr, Amin Mahmoudi, and Huchang Liao. 2020a. A multi-stage multi-criteria hierarchical decision-making approach for sustainable supplier selection. Applied Soft Computing 94: 106456. [Google Scholar] [CrossRef]

- Hendiani, Sepehr, Huchang Liao, Morteza Bagherpour, Manuela Tvaronavičienė, Audrius Banaitis, and Jurgita Antucheviciene. 2020b. Analyzing the status of sustainable development in the manufacturing sector using multi-expert multi-criteria fuzzy decision-making and integrated triple bottom lines. International Journal of Environmental Research and Public Health 17: 3800. [Google Scholar] [CrossRef] [PubMed]

- Hermundsdottir, Fanny, Dag Håkon Haneberg, and Arild Aspelund. 2022. Analyzing the impact of COVID-19 on environmental innovations in manufacturing firms. Technology in Society 68: 101918. [Google Scholar] [CrossRef] [PubMed]

- Joyce, Alexandre, and Raymond L. Paquin. 2016. The triple layered business model canvas: A tool to design more sustainable business models. Journal of Cleaner Production 135: 1474–86. [Google Scholar] [CrossRef]

- Kang, Sungmin, and Youn Kue Na. 2020. Effects of strategy characteristics for sustainable competitive advantage in sharing economy businesses on creating shared value and performance. Sustainability 12: 1397. [Google Scholar] [CrossRef]

- Kleindorfer, Paul R., Kalyan Singhal, and Luk N. Van Wassenhove. 2005. Sustainable operations management. Production and Operations Management 14: 482–92. [Google Scholar] [CrossRef]

- Klimek, Dariusz, and Elżbieta Jędrych. 2020. A model for the sustainable management of enterprise capital. Sustainability 13: 183. [Google Scholar] [CrossRef]

- Kraus, Sascha, Janina Burtscher, Thomas Niemand, Roig-Tierno Norat, and Pasl Syrjä. 2017. Configurational paths to social performance in SMEs: The interplay of innovation, sustainability, resources and achievement motivation. Sustainability 9: 1828. [Google Scholar] [CrossRef]

- Krause, Timothy A., and Yiuman Tse. 2016. Risk management and firm value: Recent theory and evidence. International Journal of Accounting and Information Management 24: 56–81. [Google Scholar] [CrossRef]

- Kuo, Tsai-Chi, and Shana Smith. 2018. A systematic review of technologies involving eco-innovation for enterprises moving towards sustainability. Journal of Cleaner Production 192: 207–20. [Google Scholar] [CrossRef]

- Lin, Tyrone T., and Hui-Tzu Yen. 2020. The criteria of optimal training cost allocation for sustainable value in aesthetic medicine industry. Journal of Risk and Financial Management 13: 149. [Google Scholar] [CrossRef]

- Lin, Tyrone T., Hui-Tzu Yen, and Shu-Yen Hsu. 2020. The modified binomial options pricing model and the revised replicating portfolio approach with the concept of sustainability options. International Journal of Financial Engineering 7: 2050013. [Google Scholar] [CrossRef]

- Majid, Izaidin Abdul, and Wei-Loon Koe. 2012. Sustainable entrepreneurship (SE): A revised model based on triple bottom line (TBL). International Journal of Academic Research in Business and Social Sciences 2: 293–310. Available online: https://www.researchgate.net/profile/Izaidin-Majid/publication/268188411_Sustainable_Entrepreneurship_SE_A_Revised_Model_Based_on_Triple_Bottom_Line_TBL/links/551535b80cf2f7d80a328399/Sustainable-Entrepreneurship-SE-A-Revised-Model-Based-on-Triple-Bottom-Line-TBL.pdf (accessed on 5 May 2022).

- Mitchell, Robert W, Ben Wooliscroft, and James Higham. 2010. Sustainable market orientation: A new approach to managing marketing strategy. Journal of Macromarketing 30: 160–70. [Google Scholar] [CrossRef]

- Montabon, Frank, Robert Sroufe, and Ram Narasimhan. 2007. An examination of corporate reporting, environmental management practices and firm performance. Journal of Operations Management 25: 998–1014. [Google Scholar] [CrossRef]

- Musina, Nuriya Z., Vitaly V. Omelyanovskiy, and A. V. Krasheninnikova. 2016. Early health technologies assessment-new approach to improving the efficiency of the medical technology development process. Farmakoekonomika. Modern Pharmacoeconomic and Pharmacoepidemiology 9: 53–59. [Google Scholar] [CrossRef]

- Nosratabadi, Saeed, Amir Mosavi, Shamshirband Shahaboddin, Edmundas Kazimieras Zavadskas, Andry Rakotonirainy, and Kwok Wing Chau. 2019. Sustainable business models: A review. Sustainability 11: 1663. [Google Scholar] [CrossRef]

- Paape, Leen, and Roland F. Speklè. 2012. The adoption and design of enterprise risk management practices: An empirical study. European Accounting Review 21: 533–64. [Google Scholar] [CrossRef]

- Pugna, Irina Bogdana, Adriana Duțescu, and Oana Georgiana Stănilă. 2019. Corporate attitudes towards big data and its impact on performance management: A qualitative study. Sustainability 11: 684. [Google Scholar] [CrossRef]

- Risks of Doing Business. 2019. Available online: http://reports.weforum.org/global-risks-report-2020/survey-results/global-risks-of-highest-concern-for-doing-business-2020/ (accessed on 26 January 2021).

- Sartori, Simone, Sjors Witjes, and Lucila M. S. Campos. 2017. Sustainability performance for Brazilian electricity power industry: An assessment integrating social, economic and environmental issues. Energy Policy 111: 41–51. [Google Scholar] [CrossRef]

- Searcy, Cory. 2016. Measuring enterprise sustainability. Business Strategy and the Environment 25: 120–33. [Google Scholar] [CrossRef]

- Szegedi, Zoltan, Monika Gabriel, and Ilona Papp. 2017. Green supply chain awareness in the Hungarian automotive industry. Polish Journal of Management Studies 16: 259–68. [Google Scholar] [CrossRef]

- Thorp, H. Holden. 2020. The costs of secrecy. In Science. American Association for the Advancement of Science 367: 959. [Google Scholar] [CrossRef] [PubMed]

- United Nations. 1987. Report of the World Commission on Environment and Development (General Assembly Resolution 42/187). Available online: http://www.un.org/documents/ga/res/42/ares42-187.h (accessed on 6 April 2017).

- United Nations. 2002. Report of the World Summit on Sustainable Development (A/CONF.199/20). New York: United Nations, p. 128. [Google Scholar]

- Vanclay, Frank. 2004. The triple bottom line and impact assessment: How do TBL, EIA, SIA, SEA and EMS relate to each other? Journal of Environmental Assessment Policy and Management 6: 265–88. [Google Scholar] [CrossRef]

- Vlasova, Marina, Anna Pimenova, Svetlana Kuzmina, and Natalia Morozova. 2016. Tools for company’s sustainable economic growth. Procedia Engineering 165: 1118–24. [Google Scholar] [CrossRef]

- Wiesner, Retha, Doren Chadee, and Peter Best. 2018. Managing change toward environmental sustainability: A conceptual model in small and medium enterprises. Organization & Environment 31: 152–77. [Google Scholar] [CrossRef]

- Wilson, Elisa D., and Alicia C. Garcia. 2011. ‘Going green’ in food services: Can health care adopt environmentally friendly practices? Canadian Journal of Dietetic Practice and Research 72: 43–47. [Google Scholar] [CrossRef]

- Wolf, Francis A., Lawrence W. Way, and Lygia Stewart. 2010. The efficacy of medical team training: Improved team performance and decreased operating room delays: A detailed analysis of 4863 cases. Annals of Surgery 252: 477–85. [Google Scholar] [CrossRef]

- Yang, Miying, Stephen Evans, Doroteya Vladimirova, and P. Rana. 2017. Value uncaptured perspective for sustainable business model innovation. Journal of Cleaner Productio 140: 1794–804. [Google Scholar] [CrossRef]

- Yen, Hui Tzu, and Tyrone T. Lin. 2021. An optimal advertising strategy in aesthetic medicine budgets with uncertain income. International Journal of Healthcare Management 14: 700–9. [Google Scholar] [CrossRef]

- Yen, Hui Tzu. 2021. Studies on the Project Value under an Enterprise of Aesthetic Medicine with Sustainability. Unpublished Doctoral dissertation, National Dong Hwa University, Hualien, Taiwan. [Google Scholar]

- Zurheide, Sebastian, and Kathrin Fischer. 2015. Revenue management methods for the liner shipping industry. Flexible Services and Manufacturing Journal 27: 200–23. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).