Abstract

This paper examines the link between creative and innovative leadership and FinTech adoption through the transmission mechanisms of perceived ease of use (PEOU) and perceived usefulness (PU). This study used a questionnaire survey method to collect data from a sample of 721 employees working in the Indian financial services sector. The data were analyzed using structural equation modelling. The study results revealed a significant and positive influence of creative and innovative leadership, PEOU, and PU on FinTech adoption. Moreover, PEOU and PU mediated the link between creative and innovative leadership and FinTech adoption. This study proposes a new vision for managerial procedures to understand the critical aspects regarding FinTech adoption. The study advises that engineering managers should offer simple and user-friendly technology to enhance the adoption rate. Additionally, the results suggest the importance of creative and innovative leadership for competitively exploiting novel technologies. Given India’s digital revolution and huge market potential, the FinTech sector could prove a game-changer, especially in generating employment for the young and technologically qualified population. Tech-driven organizations could use the study findings strategically in this digital era.

1. Introduction

Today’s volatile business environments demand that organizations respond proactively in order to survive. Creativity and innovation are effective stimuli to sustain business volatility and remain competitive. Irrespective of the level of competition, a firm’s efficiency and success heavily depend on creativity and innovation (Slåtten and Mehmetoglu 2015). Moreover, creativity and innovation (Baker et al. 2016) spur superior corporate growth. Accordingly, researchers have identified and acknowledged many predictors of individuals’ creative and innovative behaviour. However, leadership behaviour appears to be the most influential predictor (Shin and Zhou 2003; Nusair et al. 2012; Jyoti and Dev 2015). Therefore, studying creativity and innovation from a leadership perspective becomes imperative.

The role of leadership becomes essential in encouraging creativity and innovation at the individual or group level or generating and implementing a new idea (Csikszentmihalyi 1997). Leadership produces a risk-tolerant environment wherein the organization accepts novel and practical tactics (Simmons and Sower 2012). As well as the successful adoption and implementation of innovation and technology, leaders help to draw out innovation from individuals’ creative thoughts (De Jong and Den Hartog 2007). Although researchers have acknowledged the trickle-down effect of leadership on employees’ creativity and innovation (Shin and Zhou 2003; Nusair et al. 2012; Jyoti and Dev 2015), relatively less is known about the relationship between creative and innovative leadership and technology adoption.

Technology forms the backbone of the success of modern businesses. Along with challenging the traditional financial services set-up (McWaters et al. 2015), technology, including financial technology (FinTech), has successfully enhanced the overall performance of organizations (Chen et al. 2021; Liu et al. 2021). Researchers have primarily examined the attributes affecting FinTech adoption from the perspectives of individual users/customers (Cheng et al. 2006; Tan and Leby Lau 2016; Leong et al. 2017). However, the research about the predictors driving organizations’ FinTech adoption needs to be more conclusive. The factors driving organizations’ FinTech adoption may be internal and external. For example, creative and innovative leadership (the internal perspective) may drive the organization to adopt novel tactics like FinTech.

On the other hand, engineering management (the external perspective) may also be crucial to determining the adoption of FinTech. From the standpoint of engineering management, product specifications become vital in enhancing product attractiveness. Similarly, Singh et al. (2020) have argued that perceived usefulness drives the intention to use FinTech services. Again, ease of use—another product specification—determines the customer’s willingness to use a tech product (Davis 1989; Esen and Erdogmus 2014).

The requirements imposed by customers can influence the engineering management process in terms of adding value to the technology, such as FinTech. These requirements are related to user–interface issues, such as ease of use and usefulness. Such factors have forced engineering managers and their respective staff to review production strategies to stimulate end-user acceptance. Accordingly, Opaluch and Tsao (1993) devised ten ways to improve a product’s ease of use. These methods include easy maintenance and ease of learning, which also comprise the essential requirements of FinTech users. Furthermore, Opaluch and Tsao (1993) remarked that product engineers and designers can maximize a technology’s end-user acceptance by focusing on its usefulness through the identification and validation of the product feature list, the negotiation of interface agreements and reaching a consensus on system requirements and, finally, building software or technology. Enhancing technology adoption and extending the customer base can influence FinTech design and priorities, thus justifying engineering efforts towards achieving user-friendly technology.

Accordingly, Rogers (1983) argued that potential users’ willingness to adopt and use a technology determines its success. The limited research has focused on a comprehensive model for highlighting the critical motivations for organizations to adopt FinTech. Accordingly, this study adopted well-established technology adoption theories to examine the relationship between FinTech adoption and its predictors, specifically creative and innovative leadership. We included age and gender as controls based on the prior technology adoption literature (Venkatesh and Morris 2000; Boonsiritomachai and Pitchayadejanant 2019).

Moreover, FinTech has received significant recognition due to its enhanced and efficient client experience, higher risk aversion, and inclusive growth potential (RBI Report 2018). FinTech has seen an enormous adoption rate, i.e., 87%, in developing countries like India, much higher than the global adoption rate of 64% (EY 2019). Moreover, the adoption and awareness of FinTech have significantly increased since 2015 (EY 2019). Regarding finance app downloads, India led the list of the top ten nations in the world in 2020 (EY 2021).

Moreover, innovative technologies like FinTech have brought a disruptive structural change to the financial service industry (McWaters et al. 2015). They have attracted both service (FinTech) providers and users due to their enhanced and efficient user experience. Given these attributes of financial technology, customer demand is significantly growing (see EY 2021). The PWC Report (2017) suggests that FinTech has achieved the easy delivery of financial services and high personalization and flexibility, which ensures a higher reach, efficiency, and profitability (EY 2016).

Because of the above advantages, FinTech has witnessed an enormous increase in user awareness and adoption (EY 2019). Accordingly, the two FinTech potential giant markets, India and China, witnessed an 87% adoption rate against a 64% global rate (EY 2019). Thus, the tremendous adoption rate renders India an apt example for examining the drivers of FinTech. Moreover, Ernst and Young’s (2017) FinTech adoption index claimed that 84% of users knew FinTech services in the 20 markets surveyed, including India. Therefore, this study uses the Indian financial services industry to study the hypothesized relationships. The main objective of this article is to investigate the influence of creative and innovative leadership on FinTech adoption in the financial services industry. The research will also analyze the influence of creative and innovative leadership on perceived ease of use and usefulness of FinTech adoption. A well-structured questionnaire was adopted to accomplish the study objectives. Referring to the statement of investigation above, the following research questions were formulated:

- Q1. Does creative and innovative leadership influence FinTech adoption in the financial services industry?

- Q2. Does creative and innovative leadership influence the perceived ease of use of FinTech?

- Q3. Does creative and innovative leadership influence the perceived usefulness of FinTech?

- Q4. Do the perceived ease of use and perceived usefulness of FinTech mediate the relationship between creative and innovative leadership and FinTech adoption?

The next section of this research study comprises a literature review concerning the effect of various prognosticators on FinTech adoption. The literature review provides the basis for the research framework and hypothesis formulation. It is followed by the section dealing with the methodology and descriptive statistics of the study sample and its variables. After that, the findings are discussed, followed by the implications, conclusion, limitations, and future research directions.

2. Literature Review and Hypothesis Development

FinTech refers to technological innovations concerning financial services (RBI Report 2018) and is an umbrella term representing the delivery and digital assessment (via media) of financial services (He et al. 2017). “FinTech is any technology-enabled financial innovation resulting in new business models, applications or processes or products, affecting financial markets and institutions and provisioning financial services” (Financial Stability Board 2017).

FinTech is an essential medium for measuring the developments in financial systems and institutions. It has offered novel applications for delivering services relating to payments, savings, borrowing, risk management, and financial guidance to make financial services accessible and convenient for customers (He et al. 2017) and, consequently, sought solutions to financial problems based on technology (Saal et al. 2017). Manyika et al. (2016) assert that the cost efficiency of FinTech pushes the acceptance of FinTech across sectors and firms, such as banking, investment, retail, and telecoms operators, among others (Gefen and Straub 2003; Birch and Irvine 2009; Gogus et al. 2012; Zhu et al. 2012; Alalwan et al. 2018; Boonsiritomachai and Pitchayadejanant 2019). Irrespective of the advantages, FinTech adoption is selective (Singh et al. 2020). This gap paves the way for exploring the prognosticators, unexplored transmission mechanisms, and boundary conditions that drive individuals and organizations to FinTech adoption. Accordingly, this study investigates the impact of innovative and creative leadership on FinTech adoption, which is believed to be the significant determinant of technological adoption.

Considering the existing literature using the TAM model for technology acceptance (Davis 1985; Davis et al. 1989; Yang et al. 2012; Kim et al. 2016), this study also uses the TAM model as a theoretical basis (Davis 1985; Davis et al. 1989) to investigate the relationship between innovative and creative leadership and FinTech adoption. Researchers (e.g., Davis et al. 1989; Adams et al. 1992; Gefen and Straub 2003; Sujana 2008) assert that TAM effectively predicts the acceptance of technology and information systems based on the internet, e-services, and online shopping. Again, this signifies the appropriateness of the TAM model for this study.

Further, this study investigates the relationship between innovative and creative leadership and FinTech adoption through the transmission mechanism of perceived ease of use (PEOU) and perceived usefulness (PU). The mediating mechanism of PEOU and PU in technology is chosen as these comprise the basic elements of TAM and influence favourable attitudes towards technology adoption and use (Davis 1985).

Some theories have become standard for the acceptance of technological models. For example, the popular TAMs, such as the TAM 2 or revised TAM model (Venkatesh and Davis 2000) and the unified theory of technology acceptance and use of technology (UTAUT) (Venkatesh et al. 2003). However, TAM 2 and UTAUT found a basis in the theory of reasoned action (TRA) (Fishbein and Ajzen 1975) and the theory of planned behaviour (TPB) (Ajzen 1985, 1991). Thus, these studies further highlight the importance of PEOU and PU in technology concerning technology acceptance/adoption. These technology specifications demand attention from engineers for improved customer acceptance/adoption. Theories like the theory of reasoned action (Fishbein and Ajzen 1975) and planned behaviour (Ajzen 1985, 1991) help engineering managers and designers bridge the gap between customer needs and product specifications. Again, usability engineering can facilitate improved technology adoption through improved product specifications, such as ease of use and usefulness (e.g., Opaluch and Tsao 1993).

Moreover, the TAM model provides the basis for the adoption attributes of behaviour intention (innovative and creative leadership) to adopt FinTech services. Adding prognosticators, such as independent and mediating variables or, specifically, the predictive power of TAM, would enhance the practical implications of the present study (Venkatesh and Davis 1996; Ha and Stoel 2009). Therefore, this study uses TAM and UTAUT to explore the predictors of FinTech adoption through the mediating mechanism.

The TAM model explains how users adopt a technology by evaluating its PU and PEOU dimensions (Abu-Dalbouh 2013). In line with the TAM, researchers (e.g., Davis 1989; Doll et al. 2010; Susanto and Aljoza 2015) assert that PU and PEOU drive technology adoption. Renny et al. (2013) argued that internet acceptance mostly depends on TAM testing, considering its validity in predicting technological acceptance (Jahangir and Begum 2008). Regarding the weaker side of the TAM, Wallang (2018) posited the model’s low explanatory power.

UTAUT offers a candid representation of the drivers facilitating technology acceptance (Wallang 2018) and the comprehensive improvement of the TAM (Venkatesh et al. 2003). Researchers (e.g., Jackson et al. 2013) argued that the theory of planned behaviour is extended via UTAUT, which also acts as an effective instrument to predict technology adoption (Algharibi and Arvanitis 2011; Venkatesh et al. 2016). Thus, the TAM and UTAUT form the basis for the present research model.

2.1. Creative and Innovative Leadership and FinTech Adoption

Creativity implies producing novel ideas, and converting these ideas into actions means innovation (Mumford and Gustafson 1988). To ensure superior performance, organizations focus on creativity and innovation (Drazin et al. 1999). However, Van de Ven (1986, p. 592) asserted that the “foundation of innovative thoughts is creativity”, which signifies that innovation depends on creativity (Amabile et al. 1996; Madjar and Ortiz-Walters 2008). Accordingly, this study takes creativity to be the individual’s behaviour(s) in producing new and useful ideas/thoughts and innovation implies implementing creative ideas at the individual level.

The existing literature highlights the significant association between individuals’ creativity, innovation, and leadership theories. Generating and implementing novel thoughts in an organization highly depends on leadership (Mumford and Licuanan 2004). Furthermore, the extant literature signifies the role of leadership, specifically transformational and authentic leadership (Howell and Avolio 1993; Avolio and Gardner 2005; Sarros et al. 2008; Al-edenat 2018) and leader–member exchange (Mascareño et al. 2020), in catalyzing creativity and innovation. However, despite the researchers’ acknowledgement of leadership as the predictor of creative and innovative behaviour in individuals and employees, less is known about the creativity and innovation of leaders. Along with the creativity and innovation of the group/team members, those of the leadership are essential to business success. Hence, this study examined the impact of leaders’ creative and innovative behaviour on technology adoption, specifically FinTech adoption.

Researchers have asserted the significant role of leadership in technology adoption (e.g., Kristianto et al. 2012; Spencer et al. 2012; Liu et al. 2018). Additionally, leadership encourages ways to support innovative thinking (Gil et al. 2005). Technological innovations offer a plethora of affordable, secure, and convenient services, such as the services provided by FinTech (Leong et al. 2017). These technical specifications can prove to be a game-changer for an organization or an economy. For example, Manyika et al. (2016) argued that FinTech could contribute USD 3.7 trillion to emerging economies by 2025.

Similarly, technology is the main focus of the modern financial services industry. Leadership encourages technology adoption in the services sector, such as banking (Naicker and Van Der Merwe 2018). In support of this, Lee et al. (2013) asserted that leadership and imitation quicken technology adoption. Their study attests that leadership can influence employees’ attitudes towards adopting the technology. Von Solms and Langerman (2021) argued that a lack of good leadership could lower digital technology adoption in banks. Furthermore, Arifin (2015) argued that entrepreneurial leadership is a significant determinant of technology adoption. The existing literature asserts that technological leadership influences customers’ use of technology, specifically online banking services (Salem et al. 2019).

Similarly, leadership is the key driver of technology adoption in other sectors, such as small, owner-managed travel firms (Spencer et al. 2012) and SMEs (Jalil et al. 2022). Bach (2014) argued that innovative leaders are the fastest at utilizing ICT. In addition, leadership is a significant predictor of perceived ease of use and perceived usefulness (Schepers et al. 2005; Kuo and Lee 2011), eventually facilitating technology adoption (Aziz et al. 2020). Accordingly, we hypothesize:

H1.

Creative and innovative leadership significantly influences FinTech adoption.

H2.

Creative and innovative leadership significantly influences the perceived ease of use of FinTech.

H3.

Creative and innovative leadership significantly influences the perceived usefulness of FinTech.

2.2. Mediating Role of Perceived Ease of Use and Perceived Usefulness

Perceived ease of use (PEOU) implies one’s perception that operating technology requires less input (Davis et al. 1989) and the extent to which operating technology is easy or free from effort (Venkatesh and Davis 2000). The TAM model asserts that the perceived usefulness (PU) is the magnitude of the belief that technology enhances individual/organizational performance (Davis et al. 1989). Moreover, PEOU and PU have a bearing on individuals’ intentions to reuse technology (Davis 1993; Venkatesh and Davis 2000; Venkatesh et al. 2003; Amin 2007). These two constructs significantly influence technology adoption (Venkatesh and Morris 2000; Gefen et al. 2003; Chen and Barnes 2007; Gounaris and Koritos 2008; Tan et al. 2014). In support of this, Venkatesh et al. (2016) argued that the UTAUT model has been mainly used to explore only direct effects and indicated the need to explore the presence of mediating and moderating effects in this context. Again, the literature highlights areas for improvement in the UTAUT model regarding missing factors and the presence of only a few studies that examined the boundary conditions of technology acceptance models (Venkatesh et al. 2016; Wallang 2018).

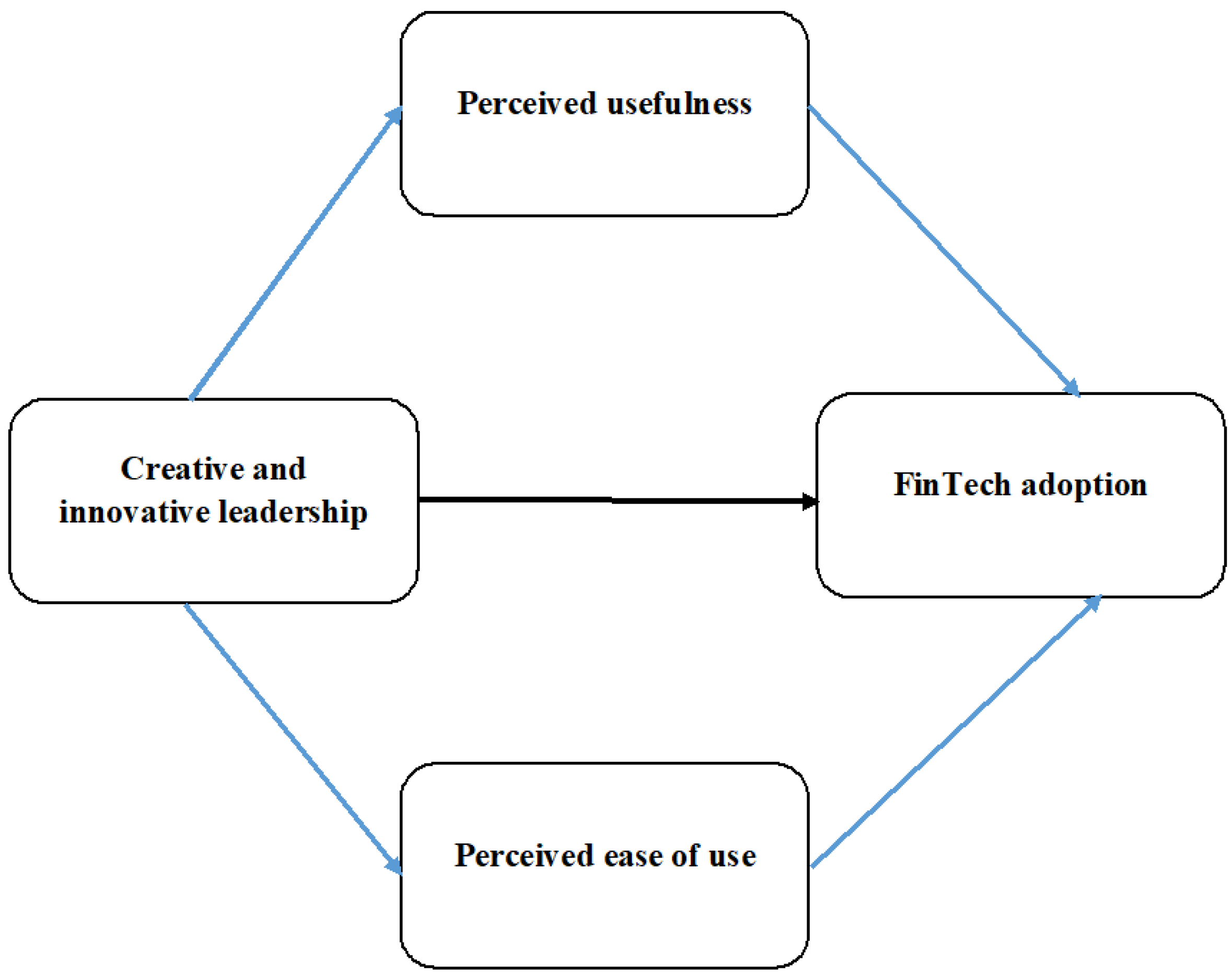

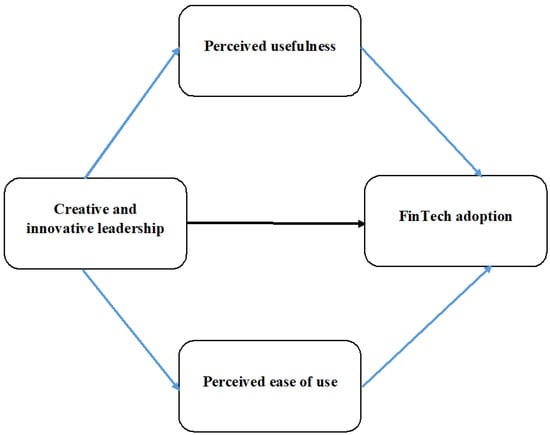

Davis (1989) asserted that PU and PEOU are central to technology adoption. Esen and Erdogmus (2014) also proposed that PU and PEOU act as a transmission mechanism in the connection between innovativeness and intention to use. Again, Schepers et al. (2005) suggested that leadership styles positively and indirectly impact technology usage through the mechanism of PU and PEOU, which, consequently, prompts technology adoption (Singh et al. 2020). Further, some studies have proposed the indirect effect of PEOU on technology usage (Schepers et al. 2005), behavioural intention to use (Terzis and Economides 2011; Chen and Aklikokou 2020; Huang and Teo 2020), and technology adoption (Calisir and Calisir 2004) through perceived usefulness. Moreover, PEOU significantly and positively facilitates the perceived usefulness of technology (Calisir and Calisir 2004; Susanto and Aljoza 2015; Abdullah and Ward 2016; Alalwan et al. 2018; Joo et al. 2018). Thus, PU and PEOU are significant mechanisms for facilitating the adoption of technological innovations, such as FinTech services (Jahangir and Begum 2008; Tan and Leby Lau 2016; Laukkanen 2017; Singh et al. 2020). Based on the above discussion, and the proposed study model (Figure 1), we hypothesize:

Figure 1.

The study model.

H4.

Perceived ease of use significantly influences FinTech adoption.

H5.

Perceived usefulness significantly influences FinTech adoption.

H6.

Creative and innovative leadership has a positive and significant indirect effect on FinTech adoption through perceived ease of use (PEOU) (H6a) and perceived usefulness (PU) (H6b) in the financial services industry.

H7.

Perceived ease of use significantly influences perceived usefulness in FinTech.

H8.

Perceived ease of use (PEOU) positively and indirectly affects FinTech adoption through perceived usefulness (PU) in the financial services industry.

In addition, this study involves controls such as age and gender. The existing literature asserts that individual decisions regarding technology adoption vary across age and gender. For example, social pressure less influences older people (Boonsiritomachai and Pitchayadejanant 2019; Tan and Leby Lau 2016), and females are more influenced by others’ opinions. Thus, these factors may influence the link between the prognosticators and FinTech adoption.

3. Methodology

3.1. Population and Sample

This study is cross-sectional and was conducted using a questionnaire survey. The data analysis was mainly based on structural equation modelling (SEM), which provides a graphical representation of the study relationships simultaneously via a two-step approach, including measurement and structural models (Anderson and Gerbing 1988). This study was conducted between October 2020 and September 2021. The Indian financial services sector comprises a variety of financial firms like banks, lenders, finance companies, investment houses, insurance companies, and real estate brokers. Given its wide acceptance in social sciences, we used convenience sampling, ensuring timely accessibility and availability, geographical proximity, and respondents’ willingness (Etikan et al. 2016). Convenience sampling was adopted due to the absence of an appropriate sampling frame, on account of which researchers gathered data that was only possible to obtain if it had been. The target population was employees working in different banks and insurance companies in North India. It was not easy to access such a diverse population of interest, so a snowball sampling technique was used to collect responses. The researchers mailed questionnaires to several contacts, who were close relatives of authors, across India, and they helped to organize and administer the survey process across many locations. Before the survey was conducted, participants were informed about the study’s intent. This study involved 757 respondents from different banks and insurance companies. Out of 757 questionnaires, 36 were excluded from the analysis as some were missing responses. Therefore, only 721 responses were fit for the data analysis.

3.2. Research Design

The survey questionnaire included two parts: the first collected respondents’ demographic information, and the second included the data about the study constructs. A detailed view of these two sections is presented below:

The first section gathered information regarding the participant’s age and gender. The second section involves:

- Creative and innovative leadership

This construct was measured using Khalili’s eight-item scale (Khalili 2017). A sample item from this scale is, “In this organization, leaders encourage employees to develop their ideas”.

- FinTech adoption

A four-item scale was adapted from Ryu (2018) to measure the FinTech adoption construct. A sample item from this scale is “I would prefer FinTech”.

- Perceived ease of use

A four-item scale adapted from Davis (1989) was used to assess the perceived ease of use construct. A sample item from this scale is, “I find it easy to get technology to do what I want to do”.

- Perceived usefulness

We adapted a four-item scale from Davis (1989) to measure the perceived usefulness construct. A sample item from this scale is “Using technology is useful in my job”.

This study used a 5-point Likert scale ranging from 1 = strongly disagree to 5 = strongly agree to record the respondents’ opinions regarding the study items.

We confirmed the study constructs using two pilot studies before the final data collection—each study included 31 respondents. An exploratory factor analysis (via SPSS 23.0) is followed by a confirmatory factor analysis (via AMOS 21.0) to study the relationships among the study variables. Additionally, the reliability and validity of the study constructs were confirmed using the average variance extracted, CR, and squared correlations.

3.3. Reliability and Validity

The reliability was assessed using composite reliability (CR) and convergent validity using average variance extracted (AVE) (Table 1). The result signifies reliability as the composite reliability estimates exceed 0.70 values, i.e., the minimum threshold (Zafiropoulos et al. 2012). This study prioritized CR values over Cronbach’s alpha to assess reliability, as the latter is subjected to biased results (Peterson and Kim 2013; Şimşek and Noyan 2013). Moreover, the CR has the edge over Cronbach’s alpha for assessing reliability. The results also indicate convergent validity, as the AVE values exceed the 0.50 level, i.e., the minimum threshold level (Fornell and Larcker 1981).

Table 1.

The average variance extracted (AVE), composite reliability (CR), and shared variance estimates.

To ensure the discriminant validity, we followed Fornell and Larcker’s (1981) recommendation that the AVE estimates of any two constructs exceed the shared variance estimate (squared correlations). The results show discriminant validity, as the AVE estimates for all the factors exceed their corresponding squared correlations (Table 1).

Therefore, the above results indicate the reliability and validity of the dataset.

4. The Descriptive Statistics of the Study Sample and Its Variables

4.1. Respondents Demographic Profile

Most respondents were male, i.e., 67%, followed by females, 33%. Regarding age, 68.09% of the respondents were under 40, followed by those above 40 (31.90%) (see Table 2).

Table 2.

The demographic information.

4.2. Exploratory and Confirmatory Factor Analysis

Exploratory factor analysis (EFA) used principal components with varimax rotation to explore the study constructs. The EFA results showed that all the items were loaded on their respective factors with loadings of more than 0.6. Furthermore, Ford et al. (1986) argued that factor loadings greater than 0.4 reduce subjectivity in data interpretation. Therefore, the EFA results signify the validity of the study constructs.

Further, we performed confirmatory factor analysis (CFA) to confirm the factor structure extracted from EFA. Higher model-fit values are essential for sound results (Moslehpour et al. 2018). The results show that all the fit indices satisfied the recommended threshold levels (see Table 3). Therefore, the proposed model of this study fits well with the empirical data.

Table 3.

The model-fit summary.

4.3. Common Method Bias

The common method bias (CMB) was checked in SPSS using Harman’s single-factor test. An EFA with no rotation was also used (Verkijika and De Wet 2018) to complement Harman’s test. The results show that the highest variance explained by a single factor is less than 50% (Baabdullah et al. 2016), indicating no presence of common bias (Table 4).

Table 4.

Harman’s single-factor test results in EFA.

4.4. Hypothesis Testing

We tested the study’s proposed hypotheses using structural equation modelling (SEM). SEM is used as Tobbin (2010) asserts that it verifies the research model’s compatibility and evaluates causal relationships. The standardized betas (β) represent the path coefficients in the structural model (Saadé and Bahli 2005). Further, there were no multicollinearity issues, as the correlations between the independent variables were less than 0.8.

The results show that the model explains 51.09% of the variance in PEOU, 57.49% in PU, and 48.17% in FinTech adoption. The results supported the proposed relationships concerning H1, H2, H3, H4, H5, and H7 (Table 5).

Table 5.

Summary of the hypothesis testing.

The direct and indirect effects analysis was used to evaluate the mediation test. The significance of the mediating results was assessed following a two-tailed (BC) step-by-step bootstrap method. The results show significant indirect effects of creative and innovative leadership on FinTech adoption through (a) PEOU and (b) PU, supporting H6a and H6b (Table 6). Furthermore, PEOU significantly predicts FinTech adoption through PU, supporting hypothesis H8 (Table 6).

Table 6.

The mediation results.

Moreover, the magnitude of the predictors’ influence on FinTech adoption was assessed, controlling for age and gender. A multigroup analysis was used to explore the moderating effect of age. Using the FinTech adoption index (EY 2016), the respondents were divided into two groups, i.e., young or less than 40 years old (491) and older or more than 40 years old (230). The results show no significant difference between the young and older respondents (leaders) concerning FinTech adoption. This can be attributed to the fact that when a technology is user-friendly and easy to use, leaders encourage its adoption, irrespective of being young or older leaders.

Similarly, we used a multigroup analysis, i.e., males (n = 483) and females (n = 238), to examine the moderating role of gender. The results show no significant difference between male and female leaders concerning FinTech adoption. This could be due to the fact that FinTech services are utilitarian, wherein decision-making exclusively depends on prior knowledge and experience. Thus, the results highlight that age and gender do not influence the relationship between creative and innovative leadership and FinTech adoption.

5. Findings and Discussion

This study explored the FinTech adoption process through the perceived usefulness and ease of use transmission mechanisms. The study constructs were incorporated from the existing models. The constructs comprised creative and innovative leadership as the antecedents, perceived usefulness and ease of use as the intermediary variables and FinTech adoption as the outcome variable. Additionally, our results enrich the technology adoption theory by examining the direct influence of predictors (creative and innovative leadership, PEOU, and PU) on FinTech adoption. The addition of technological attributes, i.e., PEOU and PU, in the proposed model, enhances the robustness of the study’s implications, as individuals’ technology adoption is significantly influenced by responsiveness and security attributes (Parasuraman et al. 1985; Cronin and Taylor 1992; Barnes and Vidgen 2002).

Our results support H1, i.e., a significant positive relationship between creative and innovative leadership and FinTech adoption (β = 0.399; p < 0.001). This finding supports prior studies (Howell and Avolio 1993; Avolio and Gardner 2005; Sarros et al. 2008; Arifin 2015; Al-edenat 2018; Liu et al. 2018; Mascareño et al. 2020) and signifies that the more leaders are creative and innovative, the more compatible they are with technology adoption. Moreover, creative and innovative leaders’ passion for embedding novelty into company offerings pushes them to accept technological advancements. Further, H2, a significant and positive association between creative and innovative leadership and perceived ease of use, is also supported (β = 0.513; p < 0.001). This finding supports the existing literature (Kuo and Lee 2011; Aziz et al. 2020). It may be because leaders encouraging creativity and innovation create a team of quick learners who are also used to experimenting with new procedures and technologies (Schepers et al. 2005). Thus, with their know-how and experience with previous innovations, new technology, such as FinTech, appears more accessible. H3, a significant and positive relationship between creative and innovative leadership and FinTech adoption, is also supported (β = 0.357; p < 0.001). This finding also aligns with the literature (Schepers et al. 2005; Kuo and Lee 2011; Aziz et al. 2020). This indicates that the perception of FinTech being useful can be built when creative and innovative leaders clearly state its benefits, such as easy accessibility and the availability of financial services.

The study results show a significant and positive relationship between perceived ease of use and FinTech adoption (β = 0.338; p < 0.001), supporting hypothesis H4. This relationship indicates the user-friendly compatibility of FinTech in terms of compilation-free and easy-to-use technology. It also signifies that the more creative and innovative leaders perceive FinTech services to be, the more they would prefer FinTech adoption. The literature also asserts that adopting an information system depends on its technical capabilities and ease of use (Veeramootoo et al. 2018). This finding supports prior studies (Alryalat et al. 2013; Martins et al. 2014; Molina and Carter 2014; Alalwan et al. 2016, 2018; Baabdullah et al. 2016; Mensah and Mi 2018). Further, our results depict a significant and positive relationship between perceived usefulness and FinTech adoption (β = 0.317; p < 0.001), supporting H5. The benefits, such as easy accessibility, user-friendliness, time-saving, easy usage, and less confrontation with organizational bureaucracy, reflect the usefulness of FinTech. This finding suggests that creative and innovative leaders’ likelihood of adopting FinTech increases with their increased perception of FinTech benefits. This result supports the prior literature (Horst et al. 2007; Leong et al. 2011; Mou et al. 2017). This also highlights the importance of spreading the word regarding the benefits of technology to ensure its increased adoption (Baganzi and Lau 2017).

Moreover, the results show the significant and positive indirect influence of creative and innovative leadership on FinTech adoption through both the perceived ease of use (β = 0.193; p = 0.014) and perceived usefulness (β = 0.128; p = 0.003), supporting hypotheses H6a and H6b. PEOU and PU fully mediate the relationship between creative and innovative leadership and FinTech adoption. The leaders’ passion for and know-how around creative and innovative procedures and technologies, along with their openness to adopt new technologies, also influences their perception of the technology’s ease of use and usefulness. In line with this finding, Aziz et al. (2020) asserted a significant and positive association between leadership, perceived ease of use, usefulness, and technology acceptance in organizations. This further indicates that leaders’ perceptions regarding the usefulness and usage of technology, such as FinTech, depend on their compatibility with such innovative technology.

Hypothesis H7, a significant and positive relationship between PEOU and PU, is also supported (β = 0.436; p < 0.001). A lower complexity of FinTech services leads to a higher usefulness perception among users. This finding also supports the theory in the existing literature that PEOU improves PU (Gefen and Straub 2003; Calisir and Calisir 2004; Tobbin 2010; Susanto and Aljoza 2015; Abdullah and Ward 2016; Baabdullah et al. 2016; Alalwan et al. 2017; Joo et al. 2018). Additionally, the results show that PU acts as a transmission mechanism in the relationship between PEOU and FinTech adoption (β = 0.256; p = 0.006), supporting H8. This means that effortless FinTech means a higher adoption and higher usefulness perception. Furthermore, the literature also confirmed the indirect effect of PEOU on end-user satisfaction through perceived usefulness (see Calisir and Calisir 2004). Leaders, especially creative and innovative leaders, are easily acquainted with technological innovations that facilitate their apparent usefulness and will eventually increase their usage.

6. Implications

6.1. Theoretical Implications

This research study proposed and tested a FinTech adoption model in the Indian context. This study explores the relationship between creative and innovative leadership and FinTech adoption through the perceived usefulness and ease-of-use transmission mechanism. This study makes some commendable contributions to the TAM literature. Firstly, we unravel the black box of technology acceptance theories by providing empirical evidence for the links between creative and innovative leadership, PEOU, PU, and FinTech adoption in the Indian financial services industry. We confirmed the importance of considering creative and innovative leadership, PEOU, and PU, which is rare in existing technology adoption studies.

Moreover, our results advance the TAM and UTAUT models (Davis 1989; Venkatesh et al. 2003) to understand and explain the prognosticators of technology adoption, specifically FinTech adoption. Based on the study results, we demonstrated that organizations should focus on creative and innovative leadership to ensure FinTech adoption for superior performance, which supports the existing literature (Arifin 2015; Al-edenat 2018; Liu et al. 2018; Mascareño et al. 2020), thereby highlighting the creative and innovative leadership and FinTech adoption relationship. Thus, technology adoption models can be an effective medium for building leadership theory (Van Wart et al. 2017).

Secondly, the study results show a significant and positive association between creative and innovative leadership, PEOU, PU, and FinTech adoption, signifying the role of leadership, PEOU, and PU in FinTech adoption in the financial services sector in India. Additionally, this study suggests the importance of PEOU and PU not only as the main predictors of FinTech adoption but also as transmission mechanisms. Our results show that PEOU and PU significantly mediate creative and innovative leadership and FinTech adoption. The intellectual simulation phenomena back this finding well. In simple terms, when leadership is creative and innovation-centric, i.e., encouraging problem-solving from different viewpoints, the technology adoption level within the organization is enhanced (mediated by PEOU and PU). Additional analysis illustrates that PEOU and PU are essential predictors for enhancing technology adoption within organizations and are important transmission mechanisms for ensuring a superior link between creative and innovative leadership and FinTech adoption.

Thirdly, our results show that PEOU indirectly affects FinTech adoption through PU. To further elaborate on this finding, it may be asserted that the user’s perception of technology as applicable depends on the following three factors: firstly, the user’s acquaintance with novel technologies reduces the complexity of technological innovation or new technology (or they become easy to use) and they appear helpful to him/her, which eventually leads to higher technology adoption; secondly, the user-friendly characteristics of new technology increases usefulness perception among the users concerning new technology, thus ensuring higher technology adoption; and, thirdly, the accumulation of the first and second points, i.e., the user’s acquaintance with novel technologies and less complex technology (or easy-to-use technology) provides usefulness perception among users and, thus, higher adoption.

Furthermore, our study suggests that organizations should fully exploit proactive leaders, specifically creative and innovative leaders, to promote innovation within the organization via accepting and implementing novel technologies, which eventually will be reflected in the firm’s market offerings and, thus, bestow a competitive advantage and a superior performance.

6.2. Practical Implications

Our results also have some implications for managers and policymakers regarding technology (FinTech) providers and users, such as the Indian financial services industry. Additionally, this study provides insights into leaders’ fundamental priorities regarding FinTech adoption. The results of this study highlight the decisive role of PEOU and PU in FinTech adoption.

This study offers commendable implications for engineering management practice. For example, this study emphasizes that engineering managers should reduce the complexity of FinTech products to enhance the adoption rate by designing the products so that they become easy to use and valuable to users. Moreover, our study signifies that engineering managers need to focus on technology, specifically FinTech, specifications for stimulating tech adoption. Such specifications include the perceived ease of technology usage and usefulness, which become the primary facilitators for technology adoption (refer to hypotheses H6a, H6b, and H8 in Table 5). Furthermore, engineering managers should prioritize simplicity and added value in FinTech. The simplicity perspective can include enhancing the user-friendliness of technology, reducing time wastage, and enhancing transaction speeds (in the case of FinTech), which can be related to the added value perspective.

Additionally, if engineering managers in the FinTech industry ecosystem, including its sub-segments, such as Payments, Lending, Wealth Technology (WealthTech), Insurance Technology (InsurTech), Regulation Technology (RegTech), and Personal Finance Management, want to effectively tap into the needs of tech-savvy customers, they have several options. The first is to focus on customer evaluation while adopting the technology. For example, Abu-Dalbouh (2013) argued that TAM models unveil how customers evaluate technology while adopting it. Accordingly, researchers (e.g., Davis 1989; Doll et al. 2010; Abu-Dalbouh 2013; Susanto and Aljoza 2015) have proposed that customers’ black box focus is on PU and PEOU during technology evaluation and adoption. Therefore, if a company succeeds in incorporating these specifications into its offerings, it could create a competitive differential in the FinTech industry and stimulate the adoption rate of its offerings. The second is that technology providers can focus on enhancing their offerings’ general user interface (UI) to facilitate easy-to-use products. Accordingly, Opaluch and Tsao (1993) offered ten methods to improve usability engineering, benefiting project managers, system developers, and human factor engineers. These methods include knowing end-users, assigning a UI designer early on, and enumerating end-user tasks.

Furthermore, FinTech providers can raise awareness concerning its benefits and capabilities, facilitating its (FinTech’s) adoption. Awareness of a novel technology becomes essential as the user’s (organization or individual’s) information regarding how simple (easy to use) and valuable the technology is precedes its adoption. Accordingly, internal marketing campaigns should focus on positive word-of-mouth promotion to attain the required purpose(s). This means that facilitating FinTech adoption will require users to be conscious of its benefits and capabilities. Thus, the organizations/entities offering FinTech may influence organizations and individuals to take up its services by focusing on the user priorities highlighted in this study.

This study puts forth some practical implications from the user’s (financial services providers) perspective. Firstly, our study suggests that organizations, such as creative and innovative leaders, should focus on attaining and retaining quality talent. Such leaders act as strategic talent for an organization on many fronts, such as technology adoption or ensuring a competitive advantage (Pereira and Gomes 2012). Additionally, this demands that the organization produce creative leaders or employees to ensure a higher innovation capability. Investment in human resources is closely associated with the firm’s innovative capacity and superior financial performance (Renaud and Morin 2020), especially in the fourth industrial revolution era (Pastore et al. 2021). In support of this, our study also confirms the crucial role of creative and innovative leadership in adopting novel technologies, such as FinTech.

Additionally, adopting any technology by an organization is easy; however, the proper and fruitful utilization of that technology is more critical. In this respect, a leader’s creativity and innovation can benefit the organization. Such leaders not only enhance the productivity of the novel technology but also allow their subordinates to become acquainted with it, which leads to superior organizational performance.

Furthermore, this study explains that ease of use and usefulness should be the priorities when adopting any technology. The easy use of technology reduces human effort, enhancing its compatibility with employees/individuals. When all individuals are operating technology, productivity is enhanced. Furthermore, using technology leads to greater individual attention, thus ensuring higher productivity. Additionally, this study highlights that the ease of use of technology strongly drives its perceived usefulness, eventually facilitating a higher level of technology adoption.

Moreover, FinTech needs to be encouraged at both the government and private levels to help India attain the aim of financial inclusion, as FinTech has been seen as a promising factor in this arena. Moreover, it provides an attractive means to leave the clutches of poverty (Lagna and Ravishankar 2022).

To summarize, our study offers a candid view for organizations on how FinTech adoption can be enhanced through creative and innovative leadership, perceived ease of use, and perceived usefulness.

7. Conclusions

Though the research concerning technology adoption has received significant government/organizational funding (Agarwal and Chua 2020; Singh 2020; Yadav et al. 2020; Baporikar 2021), the exploration of its predictors is in the nascent stage (Shiau et al. 2020). This has led to higher research attention to unpacking technology adoption factors.

This study is the first to explore the role of creative and innovative leadership, perceived ease of use, and perceived usefulness in the research framework to investigate leaders’ FinTech adoption intention. The results suggest the addition of leadership, specifically creative and innovative leadership, to PEOU and PU (TAM variables) in predicting FinTech adoption in the Indian financial services sector. This study enriches the literature concerning TAM/technology acceptance theories by including the role of leadership in FinTech adoption. It also justifies to technology providers that leaders’ creativity and innovation, PEOU, and PU are decisive in FinTech adoption. Further, this study demands significant organizational investment towards employee development to facilitate creative and fruitful decisions (regarding technology adoption) to bestow a solid strategic position to a firm.

8. Limitations and Future Research Directions

Despite its significant contributions, this study is also associated with some limitations. Firstly, this study collected data from self-reported questionnaires, which are more prone to bias caused by respondents hiding their true feelings, thus limiting the quality and validity of the data (Fan et al. 2002). Future studies can focus on objective data to overcome this limitation. Secondly, this study focused on one sector, limiting the results’ generalizability. Moreover, the results associated with PEOU and PU might differ across contexts (Igbaria et al. 1997). Future studies could focus on different countries and sectors to make more assertive statements. Thirdly, given that the present study is based on TAM and UTAUT, including respondent characteristics, such as their computer self-efficacy, can provide candid results regarding technology adoption and use (Teo 2009, 2011).

Author Contributions

Conceptualization and Data Analysis, M.D.; Methodology and Validation, Z.u.H.; Writing, M.A.B.; Review and Editing, K.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Ethics Committee of Central University of Kashmir on 05-04-2023.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Correction Statement

Due to an error by the Editorial Office, the Institutional Review Board Statement and Informed Consent Statement were not included in the originally published version of this article. These have now been added accordingly.

References

- Abdullah, Fazil, and Rupert Ward. 2016. Developing a General Extended Technology Acceptance Model for E-Learning (GETAMEL) by analysing commonly used external factors. Computers in Human Behavior 56: 238–56. [Google Scholar] [CrossRef]

- Abu-Dalbouh, Hussain Mohammad. 2013. A questionnaire approach based on the technology acceptance model for mobile tracking on patient progress applications. Journal of Computer Science 9: 763–70. [Google Scholar] [CrossRef]

- Adams, Dennis A., R. Ryan Nelson, and Peter A. Todd. 1992. Perceived usefulness, ease of use, and usage of information technology: A replication. MIS Quarterly 16: 227–47. [Google Scholar] [CrossRef]

- Agarwal, Sumit, and Yeow Hwee Chua. 2020. FinTech and household finance: A review of the empirical literature. China Finance Review International 10: 361–76. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1985. From intentions to actions: A theory of planned behaviour. In Action Control: From Cognition to Behavior. SSSP Springer Series in Social Psychology; Berlin and Heidelberg: Springer, pp. 11–39. [Google Scholar]

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, and Nripendra P. Rana. 2017. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management 37: 99–110. [Google Scholar] [CrossRef]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, Nripendra P. Rana, and Michael D. Williams. 2016. Consumer adoption of mobile banking in Jordan: Examining the role of usefulness, ease of use, perceived risk and self-efficacy. Journal of Enterprise Information Management 29: 118–39. [Google Scholar] [CrossRef]

- Alalwan, Ali Abdallah, Yogesh K. Dwivedi, Nripendra P. Rana, and Raed Algharabat. 2018. Examining factors influencing jordanian customers’ intentions and adoption of internet banking: Extending utaut2 with risk. Journal of Retailing and Consumer Services 40: 125–38. [Google Scholar] [CrossRef]

- Al-edenat, Malek. 2018. Reinforcing innovation through transformational leadership: Mediating role of job satisfaction. Journal of Organizational Change Management 31: 810–38. [Google Scholar] [CrossRef]

- Algharibi, Amani J., and Theodoros N. Arvanitis. 2011. Adapting the Unified Theory of Acceptance and Use of Technology (UTAUT) as a Tool for Validating User Needs on the Implementation of e-Trial Software Systems. Paper presented at 25th BCS Conference on Human-Computer Interaction, Newcastle upon Tyne, UK, July 4–8; London: British Computer Society, pp. 526–30. Available online: https://dlnext.acm.org/doi/abs/10.5555/2305316.2305412 (accessed on 1 September 2023).

- Alryalat, Mohammad, Yogesh Dwivedi, Michael Williams, and Nripendra Rana. 2013. Examining Role of Usefulness, Ease of Use and Social Influence on Jordanian Citizen’s Intention to Adopt e-Government. UK Academy for Information Systems Conference Proceedings. p. 4. Available online: https://aisel.aisnet.org/ukais2013/4 (accessed on 1 September 2023).

- Amabile, Teresa M., Regina Conti, Heather Coon, Jeffrey Lazenby, and Michael Herron. 1996. Assessing the work environment for creativity. Academy of Management Journal 39: 1154–84. [Google Scholar] [CrossRef]

- Amin, Hanudin. 2007. An analysis of mobile credit card usage intentions. Information Management and Computer Security 15: 260–69. [Google Scholar] [CrossRef]

- Anderson, James C., and David W. Gerbing. 1988. Structural equation modeling in practice: A review and recommended two-step approach. Psychological Bulletin 103: 411–23. [Google Scholar] [CrossRef]

- Arifin, Zainal. 2015. The effect of dynamic capability to technology adoption and its determinant factors for improving firm’s performance; toward a conceptual model. Procedia-Social and Behavioral Sciences 207: 786–96. [Google Scholar] [CrossRef]

- Avolio, Bruce J., and William L. Gardner. 2005. Authentic leadership development: Getting to the root of positive forms of leadership. The Leadership Quarterly 16: 315–38. [Google Scholar] [CrossRef]

- Aziz, Faiq, A. Md Rami, Fazilah Razali, and Nomahaza Mahadi. 2020. The influence of leadership style towards technology acceptance in organization. International Journal of Advanced Science and Technology 29: 218–25. [Google Scholar]

- Baabdullah, A., O. Nasseef, and A. Alalwan. 2016. Consumer adoption of mobile government in the Kingdom of Saudi Arabia: The role of usefulness, ease of use, perceived risk and innovativeness. Paper presented at Conference on e-Business, e-Services and e-Society, Swansea, UK, September 13–15; Cham: Springer, pp. 267–79. [Google Scholar]

- Bach, Mirjana Pejic. 2014. Exploring information and communications technology adoption in enterprises and its impact on innovation performance of European countries. Ekonomický časopis 62: 335–62. [Google Scholar]

- Baganzi, Ronald, and Antonio K. W. Lau. 2017. Examining trust and risk in mobile money acceptance in Uganda. Sustainability 9: 2233. [Google Scholar] [CrossRef]

- Baker, William E., Amir Grinstein, and Nukhet Harmancioglu. 2016. Whose innovation performance benefits more from external networks: Entrepreneurial or conservative firms? Journal of Product Innovation Management 33: 104–20. [Google Scholar] [CrossRef]

- Baporikar, Neeta. 2021. FinTech Challenges and Outlook in India. In Innovative Strategies for Implementing FinTech in Banking. Hershey: IGI Global, pp. 136–53. [Google Scholar]

- Barnes, Stuart J., and Richard T. Vidgen. 2002. An integrative approach to the assessment of e-commerce quality. Journal of Electronic Commerce Research 3: 114–27. [Google Scholar]

- Birch, Anthony, and Valerie Irvine. 2009. Preservice teachers’ acceptance of ICT integration in the classroom: Applying the UTAUT model. Educational Media International 46: 295–315. [Google Scholar] [CrossRef]

- Blunch, Niels J. 2012. Introduction to Structural Equation Modeling Using IBM SPSS Statistics and AMOS. Newcastle upon Tyne: Sage. [Google Scholar]

- Boonsiritomachai, Waranpong, and Krittipat Pitchayadejanant. 2019. Determinants affecting mobile banking adoption by generation Y based on the Unified Theory of Acceptance and Use of Technology Model modified by the Technology Acceptance Model concept. Kasetsart Journal of Social Sciences 40: 349–58. [Google Scholar] [CrossRef]

- Calisir, Fethi, and Ferah Calisir. 2004. The relation of interface usability characteristics, perceived usefulness, and perceived ease of use to end-user satisfaction with enterprise resource planning (erp) systems. Computers in Human Behavior 20: 505–15. [Google Scholar] [CrossRef]

- Carmines, Edward G., John P. McIver, George W. Bohrnstedt, and Edward F. Borgatta. 1981. Analyzing models with unobserved variables. In Social Measurement: Current Issues. Edited by George W. Bohrnstedt and Edgar F. Borgatta. Beverly Hills: Sage, pp. 65–115. [Google Scholar]

- Chen, Lijun, and Apetogbo Komlan Aklikokou. 2020. Determinants of E-government adoption: Testing the mediating effects of perceived usefulness and perceived ease of use. International Journal of Public Administration 43: 850–65. [Google Scholar] [CrossRef]

- Chen, Xihui, Xuyuan You, and Victor Chang. 2021. FinTech and commercial banks’ performance in China: A leap forward or survival of the fittest? Technological Forecasting and Social Change 166: 120645. [Google Scholar] [CrossRef]

- Chen, Yu-Hui, and Stuart Barnes. 2007. Initial trust and online buyer behaviour. Industrial Management and Data Systems 107: 21–36. [Google Scholar] [CrossRef]

- Cheng, TC Edwin, David YC Lam, and Andy CL Yeung. 2006. Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems 42: 1558–72. [Google Scholar] [CrossRef]

- Cronin, J. Joseph, Jr., and Steven A. Taylor. 1992. Measuring service quality: A reexamination and extension. Journal of Marketing 56: 55–68. [Google Scholar] [CrossRef]

- Csikszentmihalyi, Mihaly. 1997. Flow and the Psychology of Discovery and Invention. New York: HarperPerennial, p. 39. [Google Scholar]

- Davis, Fred D. 1985. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Doctoral dissertation, Massachusetts Institute of Technology, Cambridge, MA, USA. [Google Scholar]

- Davis, Fred D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef]

- Davis, Fred D. 1993. User acceptance of information technology: System characteristics, user perceptions and behavioral impacts. International Journal of Man-Machine Studies 38: 475–87. [Google Scholar] [CrossRef]

- Davis, Fred D., Richard P. Bagozzi, and Paul R. Warshaw. 1989. User acceptance of computer technology: A comparison of two theoretical models. Management Science 35: 982–1003. [Google Scholar] [CrossRef]

- De Jong, Jeroen PJ, and Deanne N. Den Hartog. 2007. How leaders influence employees’ innovative behaviour. European Journal of Innovation Management 10: 41–64. [Google Scholar] [CrossRef]

- Doll, William J., Anthony Hendrickson, and Xiaodong Deng. 2010. Using Davis’s perceived usefulness and ease-of-use instruments for decision making: A confirmatory and multigroup invariance analysis. Decision Sciences 29: 839–69. [Google Scholar] [CrossRef]

- Drazin, Robert, Mary Ann Glynn, and Robert K. Kazanjian. 1999. Multilevel theorizing about creativity in organizations: A sensemaking perspective. Academy of Management Review 24: 286–307. [Google Scholar] [CrossRef]

- Ernst and Young. 2017. EY FinTech Adoption Index: FinTech Services Poised for Mainstream Adoption in the US with 1 in 3 Digitally Active Consumers Using FinTech. Press Release. June 28. Available online: https://www.ey.com/us/en/newsroom/news-releases/news-ey-FinTech-adoption-index (accessed on 21 January 2022).

- Esen, Murat, and Nihat Erdogmus. 2014. Effects of technology readiness on technology acceptance in e-HRM: Mediating role of perceived usefulness. The Journal of Knowledge Economy and Knowledge Management 9: 7–21. [Google Scholar]

- Etikan, Ilker, Sulaiman Abubakar Musa, and Rukayya Sunusi Alkassim. 2016. Comparison of convenience sampling and purposive sampling. American Journal of Theoretical and Applied Statistics 5: 1–4. [Google Scholar] [CrossRef]

- EY. 2016. EY FinTech Adoption Index 2016. EY, pp. 1–44. Available online: https://www.ey.com/gl/en/%20industries/financial-services/ey-FinTech-adoption-index (accessed on 17 January 2022).

- EY. 2019. EY FinTech Adoption Index 2019. EY, pp. 1–44. Available online: https://www.ey.com/en_gl/%20ey-global-FinTech-adoption-index (accessed on 3 January 2022).

- EY. 2021. EY FinTech Adoption Index 2021. EY, p. 5. Available online: https://www.appannie.com/en/insights/market-data/the-2021-asean-FinTech-adoption-index-staying-competitive-with-mobile-first-banking/ (accessed on 6 January 2022).

- Fan, Xitao, Brent C. Miller, Mathew Christensen, Kyung-Eun Park, Harold D. Grotevant, Manfred van Dulmen, Nora Dunbar, and Bruce Bayley. 2002. Questionnaire and interview inconsistencies exaggerated differences between adopted and non-adopted adolescents in a national sample. Adoption Quarterly 6: 7–72. [Google Scholar] [CrossRef]

- Financial Stability Board. 2017. Financial Stability Implications from FinTech: Supervisory and Regulatory Issues That Merit Authorities’ Attention, Basel, June. Available online: https://www.fsb.org/%20wp-content/uploads/R270617.pdf (accessed on 22 January 2022).

- Fishbein, Martin, and Icek Ajzen. 1975. Belief, Attitude, Intention and Behavior: An Introduction to Theory and Research. Redwood City: Addison-Wesley, pp. 181–202. [Google Scholar]

- Ford, J. Kevin, Robert C. MacCallum, and Marianne Tait. 1986. The application of exploratory factor analysis in applied psychology: A critical review and analysis. Personnel Psychology 39: 291–314. [Google Scholar] [CrossRef]

- Fornell, Claes, and David F. Larcker. 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research 18: 39–50. [Google Scholar] [CrossRef]

- Gefen, David, and Detmar Straub. 2003. Managing user trust in B2C e-services. e-Service 2: 7–24. [Google Scholar] [CrossRef]

- Gefen, David, Elena Karahanna, and Detmar W. Straub. 2003. Trust and TAM in online shopping: An integrated model. MIS Quarterly 27: 51–90. [Google Scholar] [CrossRef]

- Gil, Francisco, Ramon Rico, Carlos M. Alcover, and Angel Barrasa. 2005. Change-oriented leadership, satisfaction and performance in work groups: Effects of team climate and group potency. Journal of Managerial Psychology 20: 312–28. [Google Scholar] [CrossRef]

- Gogus, Aytac, Nicolae Nistor, Richard W. Riley, and Thomas Lerche. 2012. Educational technology acceptance across cultures: A validation of the unified theory of acceptance and use of technology in the context of Turkish national culture. Turkish Online Journal of Educational Technology-TOJET 11: 394–408. [Google Scholar]

- Gounaris, Spiros, and Christos Koritos. 2008. Investigating the drivers of internet banking adoption decision: A comparison of three alternative frameworks. International Journal of Bank Marketing 26: 282–304. [Google Scholar] [CrossRef]

- Ha, Sejin, and Leslie Stoel. 2009. Consumer e-shopping acceptance: Antecedents in a technology acceptance model. Journal of Business Research 62: 565–71. [Google Scholar] [CrossRef]

- Hair, Joseph F., W. C. Black, B. J. Babin, and R. E. Anderson. 2010. Multivariate Data Analysis, 7th ed. Upper Saddle River: Person Education. [Google Scholar]

- He, Dong, Ross B. Leckow, Vikram Haksar, Tommaso Mancini Griffoli, Nigel Jenkinson, Mikari Kashima, Tanai Khiaonarong, Celine Rochon, and Hervé Tourpe. 2017. FinTech and Financial Services: Initial Considerations. International Monetary Fund. Available online: https://www.imf.org/external/error.htm?URL=https://www.imf.org/%e2%88%bc/media/Files/Publications/SDN/2017/sdn1705 (accessed on 21 January 2022).

- Horst, Mark, Margôt Kuttschreuter, and Jan M. Gutteling. 2007. Perceived usefulness, personal experiences, risk perception and trust as determinants of adoption of e-government services in The Netherlands. Computers in Human Behavior 23: 1838–52. [Google Scholar] [CrossRef]

- Howell, Jane M., and Bruce J. Avolio. 1993. Transformational leadership, transactional leadership, locus of control, and support for innovation: Key predictors of consolidated-business-unit performance. Journal of Applied Psychology 78: 891–902. [Google Scholar] [CrossRef]

- Huang, Fang, and Timothy Teo. 2020. Influence of teacher-perceived organisational culture and school policy on Chinese teachers’ intention to use technology: An extension of technology acceptance model. Educational Technology Research and Development 68: 1547–67. [Google Scholar] [CrossRef]

- Igbaria, Magid, Nancy Zinatelli, Paul Cragg, and Angele LM Cavaye. 1997. Personal computing acceptance factors in small firms: A structural equation model. MIS Quarterly 21: 279–302. [Google Scholar] [CrossRef]

- Jackson, Joyce D., Y. Yi Mun, and Jae S. Park. 2013. An empirical test of three mediation models for the relationship between personal innovativeness and user acceptance of technology. Information and Management 50: 154–61. [Google Scholar] [CrossRef]

- Jahangir, Nadim, and Noorjahan Begum. 2008. The role of perceived usefulness, perceived ease of use, security and privacy, and customer attitude to engender customer adaptation in the context of electronic banking. African Journal of Business Management 2: 32–40. [Google Scholar]

- Jalil, Muhammad Farhan, Azlan Ali, and Rashidah Kamarulzaman. 2022. Does innovation capability improve SME performance in Malaysia? The mediating effect of technology adoption. The International Journal of Entrepreneurship and Innovation 23: 253–67. [Google Scholar] [CrossRef]

- Joo, Young Ju, Hyo-Jeong So, and Nam Hee Kim. 2018. Examination of relationships among students’ self-determination, technology acceptance, satisfaction, and continuance intention to use K-MOOCs. Computers and Education 122: 260–72. [Google Scholar] [CrossRef]

- Jyoti, Jeevan, and Manisha Dev. 2015. The impact of transformational leadership on employee creativity: The role of learning orientation. Journal of Asia Business Studies 9: 78–98. [Google Scholar] [CrossRef]

- Khalili, Ashkan. 2017. Creative and innovative leadership: Measurement development and validation. Management Research Review 40: 1117–38. [Google Scholar] [CrossRef]

- Kim, Yonghee, Jeongil Choi, Y-J. Park, and Jiyoung Yeon. 2016. The adoption of mobile payment services for ‘FinTech’. International Journal of Applied Engineering Research 11: 1058–61. [Google Scholar]

- Kristianto, Yohanes, Mian Ajmal, Richard Addo Tenkorang, and Matloub Hussain. 2012. A study of technology adoption in manufacturing firms. Journal of Manufacturing Technology Management 23: 198–211. [Google Scholar] [CrossRef]

- Kuo, Ren-Zong, and Gwo-Guang Lee. 2011. Knowledge management system adoption: Exploring the effects of empowering leadership, task-technology fit and compatibility. Behaviour and Information Technology 30: 113–29. [Google Scholar] [CrossRef]

- Lagna, Andrea, and M. N. Ravishankar. 2022. Making the world a better place with FinTech research. Information Systems Journal 32: 61–102. [Google Scholar] [CrossRef]

- Laukkanen, Tommi. 2017. Mobile banking. International Journal of Bank Marketing 35: 1042–43. [Google Scholar] [CrossRef]

- Lee, Sang-Gun, Silvana Trimi, and Changsoo Kim. 2013. Innovation and imitation effects’ dynamics in technology adoption. Industrial Management and Data Systems 113: 772–99. [Google Scholar] [CrossRef]

- Leong, Carmen, Barney Tan, Xiao Xiao, Felix Ter Chian Tan, and Yuan Sun. 2017. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. International Journal of Information Management 37: 92–97. [Google Scholar] [CrossRef]

- Leong, Lai-Ying, Keng-Boon Ooi, Alain Yee-Loong Chong, and Binshan Lin. 2011. Influence of individual characteristics, perceived usefulness and ease of use on mobile entertainment adoption. International Journal of Mobile Communications 9: 359–82. [Google Scholar] [CrossRef]

- Liu, Cheol, David Ready, Alexandru Roman, Montgomery Van Wart, XiaoHu Wang, Alma McCarthy, and Soonhee Kim. 2018. E-leadership: An empirical study of organizational leaders’ virtual communication adoption. Leadership and Organization Development Journal 39: 826–43. [Google Scholar] [CrossRef]

- Liu, Yadong, Sharjeel Saleem, Rizwan Shabbir, Malik Shahzad Shabbir, Adil Irshad, and Shahbaz Khan. 2021. The relationship between corporate social responsibility and financial performance: A moderate role of FinTech technology. Environmental Science and Pollution Research 28: 20174–87. [Google Scholar] [CrossRef] [PubMed]

- Madjar, Nora, and Rowena Ortiz-Walters. 2008. Customers as contributors and reliable evaluators of creativity in the service industry. Journal of Organizational Behavior: The International Journal of Industrial, Occupational and Organizational Psychology and Behavior 29: 949–66. [Google Scholar] [CrossRef]

- Manyika, James, Susan Lund, Marc Singer, Olivia White, and Chris Berry. 2016. Digital Finance for All: Powering Inclusive Growth in Emerging Economies. McKinsey Report. Chicago: McKinsey Global Institute. [Google Scholar]

- Martins, Carolina, Tiago Oliveira, and Aleš Popovic. 2014. Understanding the internet banking adoption: A unified theory of acceptance and use of technology and perceived risk application. International Journal of Information Management 34: 1–13. [Google Scholar] [CrossRef]

- Mascareño, Jesús, Eric Rietzschel, and Barbara Wisse. 2020. Leader-member exchange (lmx) and innovation: A test of competing hypotheses. Creativity and Innovation Management 29: 495–511. [Google Scholar] [CrossRef]

- McWaters, R. Jesse, Giancarlo Bruno, Abel Lee, and Matthew Blake. 2015. The Future of Financial Services-How Disruptive Innovations Are Reshaping the Way Financial Services Are Structured, Provisioned and Consumed. World Economic Forum, pp. 1–178. Available online: https://www.weforum.org/reports/%20future-financial-services-2015 (accessed on 8 December 2015).

- Mensah, Isaac Kofi, and Jianing Mi. 2018. An empirical investigation of the impact of demographic factors on e-government services adoption. International Journal of E-Services and Mobile Applications 10: 17–35. [Google Scholar] [CrossRef]

- Molina, Cayetano Medina, and Lemuria Carter. 2014. A cross-cultural comparison of electronic government adoption in Spain and the USA. International Journal of Electronic Government Research 10: 43–59. [Google Scholar]

- Moslehpour, Massoud, Van Kien Pham, Wing-Keung Wong, and İsmail Bilgiçli. 2018. e-Purchase intention of taiwanese consumers: Sustainable mediation of perceived usefulness and perceived ease of use. Sustainability 10: 234. [Google Scholar] [CrossRef]

- Mou, Jian, Dong-Hee Shin, and Jason Cohen. 2017. Understanding trust and perceived usefulness in the consumer acceptance of an e-service: A longitudinal investigation. Behaviour and Information Technology 36: 125–39. [Google Scholar] [CrossRef]

- Mumford, Michael D., and Brian Licuanan. 2004. Leading for innovation: Conclusions, issues, and directions. The Leadership Quarterly 15: 163–71. [Google Scholar] [CrossRef]

- Mumford, Michael D., and Sigrid B. Gustafson. 1988. Creativity syndrome: Integration, application, and innovation. Psychological Bulletin 103: 27. [Google Scholar] [CrossRef]

- Naicker, Visvanathan, and Derrick Barry Van Der Merwe. 2018. Managers’ perception of mobile technology adoption in the Life Insurance industry. Information Technology and People 31: 507–26. [Google Scholar] [CrossRef]

- Nusair, Naim, Raed Ababneh, and Yun Kyung Bae. 2012. The impact of transformational leadership style on innovation as perceived by public employees in Jordan. International Journal of Commerce and Management 22: 182–201. [Google Scholar] [CrossRef]

- Opaluch, Robert E., and Yao-Chung Tsao. 1993. Ten ways to improve usability engineering—Designing user interfaces for ease of use. ATandT Technical Journal 72: 75–88. [Google Scholar] [CrossRef]

- Parasuraman, Anantharanthan, Valarie A. Zeithaml, and Leonard L. Berry. 1985. A conceptual model of service quality and its implications for future research. Journal of Marketing 49: 41–50. [Google Scholar] [CrossRef]

- Pastore, Francesco, Claudio Quintano, and Antonella Rocca. 2021. Some young people have all the luck! The duration dependence of the school-to-work transition in Europe. Labour Economics 70: 101982. [Google Scholar] [CrossRef]

- Pereira, Carmen M. M., and Jorge F. S. Gomes. 2012. The strength of human resource practices and transformational leadership: Impact on organisational performance. The International Journal of Human Resource Management 23: 4301–18. [Google Scholar] [CrossRef]

- Peterson, Robert A., and Yeolib Kim. 2013. On the relationship between coefficient alpha and composite reliability. Journal of Applied Psychology 98: 194. [Google Scholar] [CrossRef]

- PWC Report. 2017. FinTech Trends Report. Available online: https://www.pwc.in/assets/pdfs/publications/2017/FinTech-india-report-2017.pdf (accessed on 23 January 2022).

- RBI Report. 2018. FinTech and Digital Banking, 2017 (Published in 2018), RBI. Available online: www.rbi.org.in (accessed on 25 February 2018).

- Renaud, Stéphane, and Lucie Morin. 2020. The impact of training on firm outcomes: Longitudinal evidence from Canada. International Journal of Manpower 41: 117–31. [Google Scholar] [CrossRef]

- Renny, Suryo Guritno, and Hotniar Siringoringo. 2013. Peer review: Perceived usefulness, ease of use, and attitude towards online shopping usefulness towards online airlines ticket purchase. Procedia-Social and Behavioral Sciences 81: 212–16. [Google Scholar] [CrossRef]

- Rogers, Everett M. 1983. Diffusion of Innovations, 3rd ed. New York: Free Press. [Google Scholar]

- Ryu, Hyun-Sun. 2018. Understanding benefit and risk framework of FinTech adoption: Comparison of early adopters and late adopters. Paper presented at the 51st Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, January 3–6; pp. 3864–73. [Google Scholar]

- Saadé, Raafat, and Bouchaib Bahli. 2005. The impact of cognitive absorption on perceived usefulness and perceived ease of use in on-line learning: An extension of the technology acceptance model. Information and Management 42: 317–27. [Google Scholar] [CrossRef]

- Saal, Matthew, Susan Starnes, and Thomas Rehermann. 2017. Digital Financial Services: Challenges and Opportunities for Emerging Market Banks. 42 vols. EM Compass Note. Washington, DC: World Bank Group. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/750421502949470705/%20digital-financial-services-challenges-and-opportunities-for-emerging-market-banks (accessed on 21 January 2022).

- Salem, Mohammed Z., Samir Baidoun, and Grace Walsh. 2019. Factors affecting Palestinian customers’ use of online banking services. International Journal of Bank Marketing 37: 426–51. [Google Scholar] [CrossRef]

- Sarros, James C., Brian K. Cooper, and Joseph C. Santora. 2008. Building a climate for innovation through transformational leadership and organizational culture. Journal of Leadership and Organizational Studies 15: 145–58. [Google Scholar] [CrossRef]

- Schepers, Jeroen, Martin Wetzels, and Ko de Ruyter. 2005. Leadership styles in technology acceptance: Do followers practice what leaders preach? Managing Service Quality: An International Journal 15: 496–508. [Google Scholar] [CrossRef]

- Shiau, Wen-Lung, Ye Yuan, Xiaodie Pu, Soumya Ray, and Charlie C. Chen. 2020. Understanding FinTech continuance: Perspectives from self-efficacy and ECT-IS theories. Industrial Management and Data Systems 120: 1659–89. [Google Scholar] [CrossRef]

- Shin, Shung Jae, and Jing Zhou. 2003. Transformational leadership, conservation, and creativity: Evidence from Korea. Academy of Management Journal 46: 703–14. [Google Scholar] [CrossRef]

- Simmons, Aneika L., and Victor E. Sower. 2012. Leadership sagacity and its relationship with individual creative performance and innovation. European Journal of Innovation Management 15: 298–309. [Google Scholar] [CrossRef]

- Şimşek, Gülhayat Gölbaşi, and Fatma Noyan. 2013. McDonald’s ωt, Cronbach’s α, and generalized θ for composite reliability of common factors structures. Communications in Statistics-Simulation and Computation 42: 2008–25. [Google Scholar] [CrossRef]

- Singh, Shubhangi, Marshal M. Sahni, and Raj K. Kovid. 2020. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Management Decision 58: 1675–97. [Google Scholar] [CrossRef]

- Singh, Tejinder. 2020. FinTech adoption: A critical appraisal of the strategies of Paytm in India. IUP Journal of Management Research 19: 7–17. [Google Scholar]

- Slåtten, Terje, and Mehmet Mehmetoglu. 2015. The effects of transformational leadership and perceived creativity on innovation behavior in the hospitality industry. Journal of Human Resources in Hospitality and Tourism 14: 195–219. [Google Scholar] [CrossRef]

- Spencer, Andrew J., Dimitrios Buhalis, and Miguel Moital. 2012. A hierarchical model of technology adoption for small owner-managed travel firms: An organizational decision-making and leadership perspective. Tourism Management 33: 1195–208. [Google Scholar] [CrossRef]

- Sujana, Adapa. 2008. Adoption of internet shopping: Cultural considerations in India and Australia. Journal of Internet Banking and Commerce 13: 1–17. [Google Scholar]

- Susanto, Tony Dwi, and Mohammad Aljoza. 2015. Individual acceptance of e-government services in a developing country: Dimensions of perceived usefulness and perceived ease of use and the importance of trust and social influence. The third information systems international conference. Procedia Computer Science 72: 622–29. [Google Scholar] [CrossRef]

- Tan, C., J. Zhang, and Y. Zeng. 2014. Influence factors of customer online shopping: Study based on UTAUT model. Modernization of Management 3: 28–30. [Google Scholar]

- Tan, Evon, and Jasmine Leby Lau. 2016. Behavioural intention to adopt mobile banking among the millennial generation. Young Consumers 17: 18–31. [Google Scholar] [CrossRef]

- Teo, Timothy. 2009. Modelling technology acceptance in education: A study of pre-service teachers. Computers and Education 52: 302–12. [Google Scholar] [CrossRef]