The Impact of COVID-19 on the Internationalization Performance of Family Businesses: Evidence from Portugal

Abstract

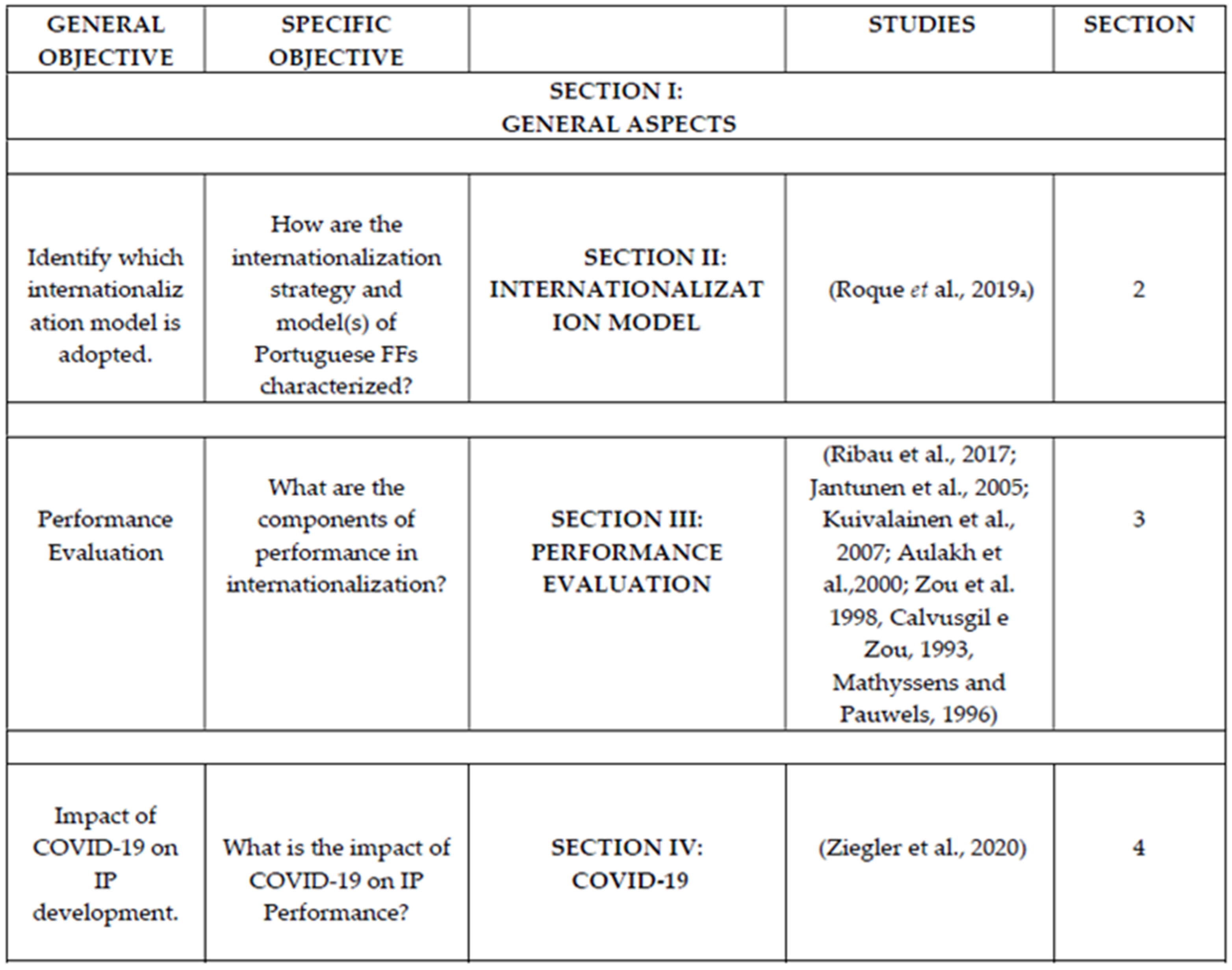

1. Introduction

2. Literature Review

2.1. Family Businesses

A family business is a company governed and/or managed with the intention of shaping and pursuing the vision of business maintenance by a dominant coalition controlled by members of the same family or a small number of families in such a way that it is sustainable across generations of family or families.

2.2. Internationalization in Family Businesses

2.3. The Internationalization Performance of Family Firms

2.4. Relationship between COVID-19 and Internationalization

3. Research Method

4. Research Findings

4.1. Sample Characteristics

4.2. Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Correction Statement

References

- Alawattage, Chandana, and Danture Wickramasinghe. 2007. Management Accounting Change: Approaches and Perspectives. London: Routledge. ISBN 9780415393317. [Google Scholar]

- Alpay, Güven, Muzaffer Bodur, Cengiz Yılmaz, Saadet Çetinkaya, and Laçin Arıkan. 2008. Performance implications of institutionalization process in family-owned businesses: Evidence from an emerging economy. Journal of World Business 43: 435–48. [Google Scholar] [CrossRef]

- Arosa, Blanca, Txomin Iturralde, and Amaia Maseda. 2010. Ownership structure and firm performance in non-listed firms: Evidence from Spain. Journal of Family Business Strategy 1: 88–96. [Google Scholar] [CrossRef]

- Arregle, Jean-Luc, Francesco Chirico, Liena Kano, Sumit K. Kundu, Antonio Majocchi, and William S. Schulze. 2021. Family firm internationalization: Past research and an agenda for the future. Journal of International Business Studies 52: 1159–98. [Google Scholar] [CrossRef]

- Astrachan, Joseph H., Sabine B. Klein, and Kosmas X. Smyrnios. 2002. The F-PEC Scale of family influence: A proposal for solving the definition problem. Family Business Review 15: 15–45. [Google Scholar] [CrossRef]

- Aulakh, Preet S., Masaaki Kotabe, and Hildy Teegen. 2000. Export strategies and performance of firms from emerging economies: Evidence from Brazil, Chile, and Mexico. Academy of Management Journal 43: 242–361. [Google Scholar] [CrossRef]

- Baños-Monroy, Veronica Ilián, Edgar Rogelio Ramirez-Solis, and Lucía Rodríguez-Aceves. 2015. Familiness and its Relationship with Performance in Mexican Family Firms. Academy of Strategic Management Journal 14: 1. [Google Scholar]

- Barney, Jay. 1991. Firm resources and sustained competitive advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Barth, Erling, Trygve Gulbrandsen, and Pål Schønea. 2005. Family ownership and productivity: The role of owner-management. Journal of Corporate Finance 11: 107–27. [Google Scholar] [CrossRef]

- Belitski, Maksim, Christina Guenther, Alexander S. Kritikos, and Roy Thurik. 2022. Economic effects of the COVID-19 pandemic on entrepreneurship and small businesses. Small Business Economics 58: 593–609. [Google Scholar] [CrossRef]

- Breton-Miller, Isabelle, Danny Miller, and Richard H. Lester. 2011. Stewardship or agency? A social embeddedness reconciliation of conduct and performance in public family businesses. Organization Science 22: 704–21. [Google Scholar] [CrossRef]

- Cadez, Simon, and Chris Guilding. 2008. An exploratory investigation of an integrated contingency model of strategic management accounting. Accounting, Organizations & Society 33: 836–63. [Google Scholar]

- Casillas, Jose, and Francisco Acedo. 2007. Evolution of the intellectual structure of family business literature: A bibliometric study of FBR. Family Business Review 20: 141–62. [Google Scholar] [CrossRef]

- Cavusgil, S. Tamer, and Shaoming Zou. 1994. Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. Journal of Marketing 58: 1–21. [Google Scholar] [CrossRef]

- Chenhall, Robert H. 2003. Management control systems design within its organizational context: Findings from contingency-based research and directions for the future. Accounting, Organizations and Society 28: 127–68. [Google Scholar] [CrossRef]

- Chrisman, James J., Jess H. Chua, and Pramodita Sharma. 2005. Trends and Directions in the Development of a Strategic Management Theory of the Family Firm. Entrepreneurship: Theory and Practice 29: 555–76. [Google Scholar] [CrossRef]

- Chrisman, James J., Jess H. Chua, and Shaker A. Zahra. 2003. Creating wealth in family firms through managing resources: Comments and extensions. Entrepreneurship Theory and Practice 27: 359–65. [Google Scholar] [CrossRef]

- Chua, Jess H., James J. Chrisman, and Erick P. C. Chang. 2004. Are family firms born or made? An exploratory investigation. Family Business Review 17: 37–54. [Google Scholar] [CrossRef]

- Chua, Jess H., James J. Chrisman, and Pramodita Sharma. 1999. Defining the family business by behavior. Entrepreneurship: Theory and Practice 23: 19–39. [Google Scholar] [CrossRef]

- Clark, Timothy, Derek S. Pugh, and Geoff Mallory. 1997. The Process of Internationalization in the Operating Firm. International Business Review 6: 605–23. [Google Scholar] [CrossRef]

- Claver, Enrique, Laura Rienda, and Diego Quer. 2007. The internationalization process in family firms: Choice of market entry strategies. Journal General Management 3: 1–16. [Google Scholar]

- Conz, Elisa, Peter William Lamb, and Alfredo De Massis. 2020. Practising resilience in family firms: An investigation through phenomenography. Journal of Family Business Strategy 11: 100355. [Google Scholar] [CrossRef]

- Costa, Joana. 2022. Internationalization Strategies at a crossroads: Family Business market diffusion in the Post-COVID Era. Economies 10: 170. [Google Scholar] [CrossRef]

- Craig, Justin, and Clay Dibrell. 2006. The Natural environment, innovation, and firm performance: A comparative study. Family Business Review 19: 275–88. [Google Scholar] [CrossRef]

- Crespo, Nuno Fernandes, Vitor Corado Simões, and Margarida Fontes. 2020. Competitive strategies and international new ventures’ performance: Exploring the moderating effects of internationalization duration and preparation. Business Research Quarterly 23: 120–40. [Google Scholar]

- Dawson, Alexandra, and Donata Mussolino. 2014. Exploring what makes family firms different: Discrete or overlapping constructs in the literature? Journal of Family Business Strategy 5: 169–83. [Google Scholar] [CrossRef]

- Debellis, Francesco, Emanuela Rondi, Emmanuella Plakoyiannaki, and Alfredo De Massis. 2021. Riding the waves of family firm internationalization: A systematic literature review, integrative framework, and research agenda. Journal of World Business 56: 101144. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef]

- Donaldson, Lex. 2001. The Contingency Theory of Organizations. Foundations for Organizational Science. Thousand Oaks: SAGE Publications, Inc. [Google Scholar] [CrossRef]

- Donckels, Rik, and Erwin Fröhlich. 1991. Are family businesses really different? European experiences from Stratos. Family Business Review 4: 149–60. [Google Scholar] [CrossRef]

- Fernández, Zulima, and Maria Nieto. 2005. Internationalization Strategy of Small and Medium-Sized Family Businesses: Some Influential Factors. Family Business Review 18: 77–89. [Google Scholar] [CrossRef]

- Ford, Jeffrey D., and Deborah A. Schellenberg. 1982. Conceptual Issues of Linkage in the Assessment of Organizational Performance. Academy of Management Review 7: 49–58. [Google Scholar] [CrossRef]

- Frank, Hermann, Alexander Kessler, Thomas Rusch, and Daniela Weismeier-Sammer. 2017. Capturing the Familiness of Family Businesses: Development of the Family Influence Familiness Scale (FIFS). Entrepreneurship: Theory & Practice 41: 709–42. [Google Scholar]

- Frezatti, Fabio, Diogenes S. Bido, Daniel M. Mucci, and Franciele Beck. 2017. Life cycle stages and profile of Brazilian family firms. RAE-Revista de Administração de Empresas 57: 601–19. [Google Scholar] [CrossRef]

- Ginsberg, Ari, and Nenkat Venkatraman. 1985. Contingency Perspectives of Organizational Strategy: A Critical Review of the Empirical Research. The Academy of Management Review 10: 421–34. [Google Scholar] [CrossRef]

- Giovannini, Renato. 2010. Corporate governance, family ownership and performance. Journal of Management & Governance 14: 145–66. [Google Scholar]

- González, Maximiliano, Alexander Guzmán, Carlos Pombo, and María-Andrea Trujillo. 2012. Family firms and financial performance: The cost of growing. Emerging Markets Review 13: 626–49. [Google Scholar] [CrossRef]

- Gössling, Stefan, Daniel Scott, and C. Michael Hall. 2020. Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism 29: 1–20. [Google Scholar] [CrossRef]

- Grant, Robert M. 1991. The resource-based theory of competitive advantage: Implications for strategy formulation. California Management Review 33: 114–35. [Google Scholar] [CrossRef]

- Grant, Robert M. 1987. Multinationality and Performance among British Manufacturing Companies. Journal of International Business Studies 18: 79–89. [Google Scholar] [CrossRef]

- Graves, Chris, and Jill Thomas. 2004. Internationalization of the family business: A longitudinal perspective. International Journal of Globalization and Small Business 1: 7–27. [Google Scholar] [CrossRef]

- Graves, Chris, and Jill Thomas. 2006. Internationalization of Australian family businesses: A managerial capabilities perspective. Family Business Review 19: 207–24. [Google Scholar] [CrossRef]

- Graves, Chris, and Jill Thomas. 2008. Determinants of the internationalization pathways of family firms: An examination of family influence. Family Business Review 21: 151–67. [Google Scholar] [CrossRef]

- Greenwood, Royston, Oliver Christine, Roy Suddaby, and Kerstin Sahlin-Andersson. 2008. Handbook of Organization Institutionalism. London: Sage Publications. [Google Scholar]

- Hilal, Adriana, and Carlos Hemais. 2003. The internationalization process from the Nordic School perspective: Empirical evidence in Brazilian companies. Journal of Contemporary Management 7: 109–24. [Google Scholar]

- Hoque, Zahirul, and Wendy James. 2000. Linking Balanced Scorecard Measures to Size and Market Factors: Impact on Organizational Performance. Journal of Management Accounting Research 12: 1–17. [Google Scholar] [CrossRef]

- Ivanova, Yordanka, Nikolay Dentchev, and Kiril Todorov. 2015. Family Business Internationalization in the New Millennium: Achievements and Avenues for Future Research? International Review of Entrepreneurship 13: 299–332. [Google Scholar]

- Jantunen, Ari, Kaisu Puumalainen, Sami Saarenketo, and Kalevi Kyläheiko. 2005. Entrepreneurial orientation, dynamic capabilities and international performance. Journal of International Entrepreneurship 3: 223–43. [Google Scholar] [CrossRef]

- Jensen, Michael, and William Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Johanson, Jan, and Fin Wiedersheim-Paul. 1975. The internationalization of the firm. Four Swedish cases. Journal of Management Studies 12: 305–22. [Google Scholar]

- Johanson, Jan, and Jan-Erik Vahlne. 1977. The internationalization process of the firm: A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies 8: 23–32. [Google Scholar] [CrossRef]

- Kampouri, Katerina, Emmanuella Plakoyiannaki, and Tanja Leppäaho. 2017. Family business internationalization and networks: Emerging pathways. Journal of Business and Industrial Marketing 32: 357–70. [Google Scholar] [CrossRef]

- Klein, Sabine B. 2000. Family businesses in Germany: Significance and structure. Family Business Review 13: 157–82. [Google Scholar] [CrossRef]

- Kontinen, Tanja, and Arto Ojala. 2010. The internationalization of family businesses: A review of extant research. Journal of Family Business Strategy 1: 97–107. [Google Scholar] [CrossRef]

- Kuivalainen, Olli, Sanna Sundqvist, and Per Servais. 2007. Firms’ degree of born-globalness, international entrepreneurial orientation and export performance. Journal of World Business 42: 253–67. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-de-Silanes, and Andrei Shleifer. 1999. Corporate ownership around the world. Journal of Finance 54: 471–517. [Google Scholar] [CrossRef]

- Lee, Jim. 2006. Family firm performance: Further evidence. Family Business Review 19: 103–14. [Google Scholar] [CrossRef]

- Lindow, Corinna M., Stephan Stubner, and Torsten Wulf. 2010. Strategic Fit within Family Firms: The Role of Family Influence and the Effect on Performance. Journal of Family Business Strategy 1: 167–78. [Google Scholar] [CrossRef]

- Macedo, M., and A. Lehmann. 2010. Strategies for Internationalization of Companies in the Northern Region of Portugal. Master’s thesis, University of Porto, Porto, Portugal. [Google Scholar]

- Mahoney, Joseph T., and J. Rajendran Pandian. 1992. The resource-based view within the conversation of strategic management. Strategic Management Journal 13: 363–80. [Google Scholar] [CrossRef]

- Major, Maria, J. Pinto, and Celia Vicente. 2011. Study of Change in Management Control Practices in Portugal. Portuguese Journal of Accounting and Management 10: 9–42. [Google Scholar]

- Marletta, Davide, and Tiziano Vescovi. 2019. Internationalization of Family Business: The Prosecco Family Firms Case. Journal of Applied Business and Economics 22: 121–29. [Google Scholar]

- Martínez-Romero, María J., Rubén Martínez-Alonso, and M. Pilar Casado-Belmonte. 2020. The influence of socioemotional wealth on firm financial performance: Evidence from small and medium privately held family businesses. International Journal of Entrepreneurship and Small Business 40: 7–31. [Google Scholar] [CrossRef]

- Matthyssens, Paul, and Pieter Pauwels. 1996. Assessing export performance measurement. Advances in International Marketing 8: 85–114. [Google Scholar]

- McConaughy, Daniel, Charles Matthews, and Anne Fialko. 2001. Founding family controlled firms: Performance, risk, and value. Journal of Small Business Management 39: 31–50. [Google Scholar] [CrossRef]

- Meneses, Raquel, Ricardo Coutinho, and Jose Pinho. 2014. The impact of succession on family business internationalization: The successors’ perspective. Journal of Family Business Management 4: 24–45. [Google Scholar] [CrossRef]

- Merino, Fernando, Joaquin Monreal-Pérez, and Gregorio Sánchez-Marín. 2015. Family SMEs’ Internationalization: Disentangling the Influence of Familiness on Spanish Firms’ Export Activity. Journal of Small Business Management 53: 1164. [Google Scholar] [CrossRef]

- Miller, Danny, and Isabelle Le Breton-Miller. 2006. Family governance and firm performance: Agency, stewardship, and capabilities. Family Business Review 19: 73–87. [Google Scholar] [CrossRef]

- Miller, Danny, and Isabelle Le Breton-Miller. 2014. Deconstructing socioemotional wealth. Entrepreneurship Theory and Practice 38: 713–20. [Google Scholar] [CrossRef]

- Miller, Danny, Isabelle Le Breton-Miller, R. Lester, and Albert A. Cannella, Jr. 2007. Are family firms really superior performers? Journal of Corporate Finance 13: 829–58. [Google Scholar] [CrossRef]

- Miroshnychenko, Ivan, Giorgio Vocalelli, Alfredo De Massis, Stefano Grassi, and Francesco Ravazzolo. 2023. The COVID-19 pandemic and family business performance. Small Business Economics. [Google Scholar] [CrossRef]

- Mitter, Christine, Christine Duller, Birgit Feldbauer-Durstmüller, and Sascha Kraus. 2014. Internationalization of family firms: The effect of ownership and governance. Review of Managerial Science 8: 1–28. [Google Scholar] [CrossRef]

- Novas, Jorge C. 2009. Management Accounting and Intellectual Capital: Integrating Elements and Contributions to the Strategic Management of Organizations. Ph.D. thesis, University of Évora, Évora, Portugal. [Google Scholar]

- Novas, Jorge C., Maria Alves, and António Sousa. 2017. The role of management accounting systems in the development of intellectual capita. Journal of Intellectual Capital 18: 286–315. [Google Scholar] [CrossRef]

- O’Boyle, Ernest H., Jeffrey Pollack, and Matthew W. Rutherford. 2012. Exploring the relation between family involvement and firms’ financial performance: A meta-analysis of main and moderator effects. Journal of Business Venturing 27: 1–18. [Google Scholar] [CrossRef]

- Otley, David. 1980. The contingency theory of management accounting: Achievement and progress. Accounting Organizations and Society 5: 413–28. [Google Scholar] [CrossRef]

- Oyadomari, Jose. 2008. Use of Management Control Systems and Performance: A Study of Brazilian Companies from the Perspective of the RBV. Ph.D. thesis, Graduate Program in Accounting, University of São Paulo, São Paulo, Brazil. [Google Scholar]

- Pedersen, Torben. 2000. The internationalisation process of Danish firms. Gradual learning or discrete rational choices? Journal of Transnational Management Development 5: 75–89. [Google Scholar] [CrossRef]

- Pereira, Carla, Bruno Veloso, Natercia Durão, and Fernando Moreira. 2022. The influence of technological innovations on international business strategy before and during COVID-19 pandemic. Procedia Computer Science 196: 44–5. [Google Scholar] [CrossRef] [PubMed]

- Pillemer, David B. 1991. One- versus Two-Tailed Hypothesis Tests in Contemporary Educational Research. Educational Researcher 20: 13. [Google Scholar] [CrossRef]

- Pires, Rui, and Maria-Ceu Alves. 2022. The Impact of Environmental Uncertainty on Accounting Information Relevance and Performance: A Contingency Approach. Economies 10: 211. [Google Scholar] [CrossRef]

- Pires, Rui, Maria-Ceu Alves, and Catarina Fernandes. 2023. The Usefulness of Accounting Information and Management Accounting Practices under Environmental Uncertainty. Journal of Risk and Financial Management 16: 102. [Google Scholar] [CrossRef]

- Powell, K. Skylar. 2014. From M–P to MA–P: Multinationality alignment and performance. Journal of International Business Studies 45: 211–26. [Google Scholar] [CrossRef]

- Pukall, Thilo J., and Andrea Calabrò. 2014. The internationalization of family firms: A critical review and integrative model. Family Business Review 27: 105–25. [Google Scholar] [CrossRef]

- Rantanen, Nora, and Iiro Jussila. 2011. F-CPO: A collective psychological ownership approach to capturing realized family influence on business. Journal of Family Business Strategy 2: 139–50. [Google Scholar] [CrossRef]

- Reid, Gavin C., and Julia A. Smith. 2000. The impact of contingencies on information system development. Management Accounting Research 11: 427–50. [Google Scholar] [CrossRef]

- Ribau, Claudia. 2016. Internationalization among SME’s of Plastics Industry. Ph.D. thesis, University of Beira Interior, Covilhã, Portugal. [Google Scholar]

- Ribau, Claudia, Antonio Moreira, and Mario Raposo. 2017. SMEs innovation capabilities and export performance: An entrepreneurial orientation view. Journal of Business Economics and Management 18: 920–34. [Google Scholar] [CrossRef]

- Roque, Ana F. M., Maria-Ceu Alves, and Mario Raposo. 2019a. Internationalization Strategies Revisited: Main Models and Approaches. IBIMA Business Review 2019: 681383. [Google Scholar]

- Roque, Ana F. M., Maria-Ceu Alves, and Mario Raposo. 2019b. The Use of Management Accounting and Control Systems in the Internationalization Strategy: A Process Approach. IBIMA Business Review 2019: 437064. [Google Scholar] [CrossRef]

- Roque, Ana F. M., Mario Raposo, and Maria-Ceu Alves. 2018. ‘Management accounting and control systems and strategy: A theoretical framework for future researches’, Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional Expansion to Global Growth. Paper presented at 32nd International Business Information Management Association Conference (IBIMA), Seville, Spain, November 15–16. [Google Scholar]

- Schulze, William, Michael Lubatkin, and Richard Dino. 2003. Toward a theory of agency and altruism in family firms. Journal of Business Venturing 18: 473–90. [Google Scholar] [CrossRef]

- Shanker, Melissa C., and Joseph H. Astrachan. 1996. Myths and realities: Family businesses’ contribution to the US economy: A framework for assessing family business statistics. Family Business Review 9: 107–23. [Google Scholar] [CrossRef]

- Sirmon, David G., and Michael A. Hitt. 2003. Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice 27: 339–58. [Google Scholar] [CrossRef]

- Škerlavaj, Miha, Mojca Indihar Štemberger, Rok Škrinjar, and Vlado Dimovski. 2007. Organizational learning culture-the missing link between business process change and organizational performance. International Journal of Production Economics 106: 346–67. [Google Scholar] [CrossRef]

- Smith, Malcolm. 2005. Performance Measurement & Management: A Strategic Approach to Management Accounting. Thousand Oaks: SAGE Publications Ltd. [Google Scholar]

- Smyrnios, Kosmas, George Tanewski, and Claudio Romanom. 1998. Development of a measure of the characteristics of family business. Family Business Review 11: 49–60. [Google Scholar] [CrossRef]

- Tsao, Chiung-Wen, Miao-Ju Wang, Chia-Mei Lu, Shyh-Jer Chen, and Yi-Hsien Wang. 2018. Internationalization propensity in family-controlled public firms in emerging markets: The effects of family ownership, governance, and top management team heterogeneity. Journal of Small Business Strategy 28: 28–37. [Google Scholar]

- Zahra, Shaker A. 2003. International expansion of US manufacturing family businesses: The effect of ownership and involvement. Journal of Business Venturing 18: 495–512. [Google Scholar] [CrossRef]

- Zellweger, Thomas, Robert Nason, and Mattias Nordqvist. 2011. From longevity of firms to transgenerational entrepreneurship of families: Introducing family entrepreneurial orientation. Family Business Review 25: 136–55. [Google Scholar] [CrossRef]

- Zeng, Saixing, X. M. Xie, C. M. Tam, and T. W. Wan. 2009. Relationships between business factors and performance in internationalization. Management Decision 47: 308–29. [Google Scholar] [CrossRef]

- Zhou, Chao. 2018. Internationalization and performance: Evidence from Chinese firms. Chinese Management Studies 12: 19–34. [Google Scholar] [CrossRef]

- Ziegler, Tania, Bryan Zheng Zhang, Ana Carvajal, Mary Emma Barton, Herman Smit, Karsten Wenzlaff, Harish Natarajan, Felipe Ferri de Camargo Paes, Krishnamurthy Suresh, Hannah Forbes, and et al. 2020. The Global COVID-19 FinTech Market Rapid Assessment Study. In The Global COVID-19 FinTech Market Rapid Assessment Report. Cambridge: University of Cambridge, World Bank Group and the World Economic Forum. Available online: https://ssrn.com/abstract=3770789 (accessed on 15 May 2020).

- Zou, Shaoming, Charles R. Taylor, and Gregory E. Osland. 1998. The EXPERF scale: A cross-national generalized export performance measure. Journal of International Marketing 6: 37–57. [Google Scholar] [CrossRef]

| Model | Features |

|---|---|

| U-Model | - Exports and direct investment (Hilal and Hemais 2003). - First, they expand to countries that are psychologically closer (Johanson and Wiedersheim-Paul 1975). - Gradual and incremental expansion (Johanson and Vahlne 1977). - External aspects such as competitive conditions and market potential are ignored (Pedersen 2000). - They focus on specific market knowledge (Clark et al. 1997). - Process developed by the Chain of Establishment (Johanson and Wiedersheim-Paul 1975): (i) Stage of sporadic exports; (ii) Export stage through an agent; (iii) Setting up a commercial subsidiary; (iv) Stage of setting up a production unit. |

| N | % | ||

|---|---|---|---|

| Role in the company | CEO | 37 | 29.1% |

| Accountant | 33 | 26.0% | |

| External market manager | 57 | 44.9% | |

| Uptime | Up to 10 years | 1 | 0.8% |

| 11 to 20 years | 4 | 3.4% | |

| 21 to 50 years old | 75 | 63.0% | |

| 51 to 100 years | 32 | 26.9% | |

| More than 100 years | 7 | 5.9% | |

| Activity time (years), Mean ± SD [Min–Max] | 52.4 ± 28.8 [10–178] | ||

| Location region | Alentejo | 4 | 3.2% |

| Algarve | 2 | 1.6% | |

| Center | 46 | 36.5% | |

| Lisbon and Tagus Valley | 23 | 18.3% | |

| North | 50 | 39.7% | |

| Autonomous Region of Madeira | 1 | 0.8% | |

| Economic Activity | Agriculture and forestry | 15 | 12.1% |

| Fishing | 1 | 0.8% | |

| Extractive industry | 5 | 4.0% | |

| Manufacturing | 72 | 58.1% | |

| Trade | 28 | 22.6% | |

| Services | 3 | 2.4% | |

| No. of people working for the company | <50 | 56 | 44.1% |

| 50–99 | 47 | 37.0% | |

| 100–249 | 16 | 12.6% | |

| 250–499 | 7 | 5.5% | |

| >500 | 1 | 0.8% | |

| Turnover last available year (thousands of EUR) | <300,000 | 1 | 0.8% |

| 300,000–500,000 | 37 | 29.4% | |

| 500,000–1,000,000 | 54 | 42.9% | |

| 1,000,000–1,500,000 | 27 | 21.4% | |

| >1,500,000 | 7 | 5.6% | |

| Generational level of the company | 1º | 20 | 15.7% |

| 2º | 89 | 70.1% | |

| 3º | 15 | 11.8% | |

| 4º | 3 | 2.4% | |

| The company belongs to an economic group | No | 124 | 97.6% |

| Yes | 3 | 2.4% | |

| Year in which the company started exporting and/or began your internationalization process | Until 1974 | 24 | 18.9% |

| From 1975 to 1990 | 49 | 38.6% | |

| From 1991 to 2000 | 40 | 31.5% | |

| From 2001 to 2010 | 13 | 10.2% | |

| After 2010 | 1 | 0.8% | |

| How many countries it currently exports to | 1–2 | 40 | 31.5% |

| 3–5 | 69 | 54.3% | |

| 6–10 | 17 | 13.4% | |

| >10 | 1 | 0.8% | |

| The proportion of exports in turnover in the first three years of activity | Less than 10% of sales | 4 | 4.0% |

| From 10% to 25% of sales | 51 | 50.5% | |

| From 26% to 50% of sales | 16 | 15.8% | |

| From 51% to 80% of sales | 3 | 3.0% | |

| More than 80% of sales | 27 | 26.7% | |

| Test Value = 3 | ||||||

|---|---|---|---|---|---|---|

| t | df | Sig. (2-Tailed) | Mean Difference | 95% Confidence Interval | ||

| Lower | Upper | |||||

| Total volume of transactions | −33,764 | 126 | 0.000 | −1.504 | −1.59 | −1.42 |

| Number of new international clients | −31,852 | 126 | 0.000 | −1.370 | −1.46 | −1.28 |

| Retaining or renewing existing customers | −31,813 | 126 | 0.000 | −1.362 | −1.45 | −1.28 |

| Contractual disputes with clients or partners | −31,751 | 126 | 0.000 | −1.339 | −1.42 | −1.26 |

| Late payments | −31,852 | 126 | 0.000 | −1.370 | −1.46 | −1.28 |

| Significant variations in market performance | −32,263 | 126 | 0.000 | −1.417 | −1.50 | −1.33 |

| N | Mean | Std Deviation | Std. Error Mean | |

|---|---|---|---|---|

| Total volume of transactions | 127 | 1.50 | 0.502 | 0.045 |

| Number of new international clients | 127 | 1.63 | 0.485 | 0.043 |

| Retaining or renewing existing customers | 127 | 1.64 | 0.483 | 0.043 |

| Contractual disputes with clients or partners | 127 | 1.66 | 0.475 | 0.042 |

| Late payments | 127 | 1.63 | 0.485 | 0.043 |

| Significant variations in market performance | 127 | 1.58 | 0.495 | 0.044 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Roque, A.; Alves, M.-C. The Impact of COVID-19 on the Internationalization Performance of Family Businesses: Evidence from Portugal. J. Risk Financial Manag. 2023, 16, 511. https://doi.org/10.3390/jrfm16120511

Roque A, Alves M-C. The Impact of COVID-19 on the Internationalization Performance of Family Businesses: Evidence from Portugal. Journal of Risk and Financial Management. 2023; 16(12):511. https://doi.org/10.3390/jrfm16120511

Chicago/Turabian StyleRoque, Ana, and Maria-Ceu Alves. 2023. "The Impact of COVID-19 on the Internationalization Performance of Family Businesses: Evidence from Portugal" Journal of Risk and Financial Management 16, no. 12: 511. https://doi.org/10.3390/jrfm16120511

APA StyleRoque, A., & Alves, M.-C. (2023). The Impact of COVID-19 on the Internationalization Performance of Family Businesses: Evidence from Portugal. Journal of Risk and Financial Management, 16(12), 511. https://doi.org/10.3390/jrfm16120511