Abstract

The scarcity of female directors on Saudi boards is linked to cultural and social barriers deeply rooted in traditional masculine norms. Our study investigates the mediating role of ESG scores in the relationship between board gender diversity and firm value within the Saudi context. The Structural Equation Model (SEM) was utilized based on a sample of 54 Saudi-listed financial companies on (Tadawul) during 2021–2022. The study unveiled a negative correlation between female director presence and Saudi firm value. This association is attributed to the prevailing male-dominated Saudi societal norms, where boards with more female members may hesitate to prioritize performance-driven actions due to concerns about their perceived legitimacy within traditional gender roles. Conversely, a positive correlation was observed between female director presence and ESG scores, aligning with existing research highlighting the role of board gender diversity in improving sustainability performance. The sustainability framework prevails over the influence of gender diversity, fully integrating it within the broader context of sustainability to enhance the value of Saudi companies. Our results are consistent when considering alternative measures of firm value. Our findings offer valuable insights for investors assessing board gender diversity’s impact on company value and emphasize the role of gender diversity in enhancing sustainability. They suggest that greater female representation on boards is vital for ESG score improvement, promoting sustainable initiatives and overall firm value. This calls for policymakers to promote sustainability disclosures and establish guidelines for increased female board participation, considering the absence of mandatory quotas.

1. Introduction

A broad stream of research has consistently affirmed the positive impact of gender diversity in corporate boards on firm value (e.g., Salem et al. 2019; Issa and Fang 2019; Dwaikat et al. 2021). Similarly, Wahab et al. (2018) suggest that boardroom homogeneity has adverse effects on firms. In addition, the presence of women on boards is widely acknowledged as a pivotal factor contributing to enhanced corporate social performance (Byron and Post 2016; Pucheta-Martínez et al. 2018). This inclusivity also correlates with more substantial corporate social responsibility ratings (Bear et al. 2010) and greater transparency in disclosing social and environmental initiatives (Cabeza-García et al. 2018). Accordingly, increased female representation on corporate boards fosters more democratic, social, and environmentally conscious organizations, resulting in improved environmental, social, and governance (ESG) scoring (del Mar Fuentes-Fuentes et al. 2023) while concurrently enhancing company value and optimizing economic returns (Jiang et al. 2021).

Gender diversity on corporate boards has garnered growing interest in academic circles due to its significant impact on company performance and value, which holds relevance for a diverse range of stakeholders, including policymakers and practitioners (EmadEldeen et al. 2021; Brahma et al. 2021; Eliwa et al. 2023). This facet of corporate governance is essential because it enhances corporate governance systems and the formulation of strategic decisions in the boardroom (Ullah et al. 2019). Past research draws on diverse psychological, cultural, and social theories to substantiate the implications of gender diversity on firm values (Lu et al. 2022; Eliwa et al. 2023). Within this context, cultural factors and societal pressures prompt companies to prioritize gender diversity within their boards. Simultaneously, the regulatory landscape differs across countries, with some nations mandating the inclusion of at least one woman on corporate boards, while this issue remains relatively unaddressed in others (Karamahmutoğlu and Kuzey 2016; Issa and Fang 2019). For instance, Aladwey et al. (2022) highlighted that in 2019, the UK Corporate Governance Code recommended that UK companies expand female representation on their corporate boards. Also, Norway has stipulated that a minimum of 40% of directors on corporate boards must be female (Eliwa et al. 2023). Accordingly, due to variations in institutional contexts across countries, influenced by cultural norms and corporate governance regulations, the impact of board gender diversity on firm value and CSR performance is likely to differ (Issa and Fang 2019).

The concept of “masculinity” is a socially constructed ideology that societies use to define the behaviors and attributes expected of men. In many cultures, there is a prevailing belief, particularly among women, that men occupy a dominant societal position. Men are discouraged from yielding, compromising, or displaying emotions, often perceived as signs of weakness. In contrast, femininity is often seen as the polar opposite of masculinity, associated with qualities such as compromise, surrender, and emotional expression, which are considered feminine and, therefore, weaker. As a result, masculinity represents the dominant authority of men, giving them more power and agency than women. Some scholars have argued that societies tend to uphold dominant social roles for men, granting them authority over women and other gender identities perceived as feminine (Nahshal 2019). Consequently, masculinity shapes and defines relationships within the framework of dominance, alliances, and subordination. In this way, masculinity becomes a hindrance to the progress of women, as they are often confined to roles defined by masculinity, hindering societal evolution (Dobash and Dobash 2003; Margolis et al. 2009; Flammer 2015).

The impact of gender diversity on corporate performance remains an underexplored area in the Middle East and North Africa MENA region countries like Saudi Arabia, where women’s empowerment conditions are in a state of evolution, albeit at varying rates across countries due to the complex socioeconomic dynamics within the region (see, Al Hameli et al. 2023). The low number of female directors represented within the Saudi board (Chebbi and Ammer 2022), driven by cultural and social pressures, may contribute to such an end. Saudi Arabia is widely recognized as a patriarchal and masculine society. Men predominantly hold positions of power and exercise dominance over women, even in domains traditionally considered the domain of women. Men are expected to be the primary breadwinners, while women are traditionally assigned to manage the household, with men typically serving as the heads of their families (Mobaraki and Söderfeldt 2010). However, there are instances where men also take charge of household management. Women often find themselves in situations where they cannot express their opinions, perspectives, or emotions, and they may have limited mobility outside the boundaries of their homes. This dynamic has led to a significant power imbalance between men and women in Saudi society. Consequently, masculinity has a profound impact on the lack of empowerment of women in the Saudi workforce and has played a pivotal role in the virtual absence of women’s roles in the workplace.

Saudi Arabia is demonstrating rapid economic growth, positioning itself as a prominent emerging economy regionally in the Middle East and globally. After the new 2030 Vision announcement in April 2016, the Saudi government made substantive changes to increase women’s representation in top managerial positions and certain divisions traditionally restricted to men (Almathami et al. 2020). To enhance female representation in the public domain, women were appointed to governmental positions and granted participation rights in the constrained political processes unfolding within Saudi Arabia (Karolak 2023). The government has also imposed further reforms, such as enforcing Saudi job quotas more rigorously than ever and incorporating positive discrimination in hiring women; otherwise, punishment is implemented (Boshnak et al. 2023). Therefore, it is necessary to investigate traditional notions of masculinity as a substantial role in gender diversity and its relationship with ESC score and firm value.

Accordingly, the implications mentioned above of the Saudi 2030 vision, accompanied by the contemporary economic reforms in Saudi Arabia, would enhance female participation and empowerment and would contribute to reshaping the cultural context in Saudi Arabia from masculine-dominated to a notion of board diversity and equality. While this initiative anticipates bolstering Saudi Arabia’s economic well-being through heightened female workforce participation, empirical research to assess the efficacy and achievement of Vision 2030’s objectives in enhancing women’s involvement needs to be improved (Almathami et al. 2020). In addition, Almubarak et al. (2023) issued a call for research papers that explore the interplay between corporate governance variables and the dynamics of ESG in conjunction with various factors, encompassing the benefits of sustainable management and gender diversity considerations. Thus, the study sheds light on an unexplored area within the relevant literature: the examination of board gender diversity in Saudi Arabia and its potential impact on corporate performance. Accordingly, it is interesting to gain deeper insights into gender diversity in the ever-changing cultural and social environment. Thus, our paper aims to study the effect of board gender diversity on firm value in Saudi Arabia and how the ESG scoring would mediate such an effect subject to the reshaped cultural dimension. The aim of our paper is to test the mediating effect of ESG scoring as a proxy for the sustainability performance on the relationship between gender diversity and firm value, taking into account the cultural dimension of Saudi Arabia. Utilizing structural equation modeling (SEM), a well-established inferential framework for mediation analyses, we examine a sample of 54 Saudi financial companies listed on the Saudi Stock Exchange (Tadawul) from 2021 to 2022, resulting in 108 firm-year observations.

The findings unveil a negative association between female directors’ presence and Saudi firms’ value. This relationship can be attributed to Saudi Arabia’s predominantly male-dominated society, where a corporate board with a higher proportion of female members may be less willing to adhere to the notion of thinking that prioritizes objective and performance-oriented attitudes and actions that might diminish their perceived legitimacy. Accordingly, the prevalence of traditional masculinity in society may dampen the positive influence of board diversity on a company’s performance. Furthermore, the findings suggest a correlation between the participation of female directors on Saudi corporate boards and enhancements in companies’ ESG scores, serving as a proxy for their sustainable performance and disclosure. This finding is consistent with a substantial body of research that underscores the crucial role of board gender diversity in improving a company’s sustainability performance. Notably, ESG acts as a comprehensive mediator, effectively channeling the intended impact of board gender diversity in promoting the value of Saudi companies. In essence, the sustainability framework takes precedence, outweighing the influence of board gender diversity in enhancing a company’s value, as gender diversity is fully integrated within the sustainability context.

Our paper contributes to the pertinent literature in many aspects as follows: First, it sheds light on one of the uncharted areas in the pertinent literature, the board gender diversity in Saudi Arabia and its implications on the value of Saudi firms. Second, although the cultural and social barriers to women’s participation in Saudi boards still matter, our paper provides empirical evidence that the potential of female directors in enhancing Saudi firms’ value is fully mediated within sustainability initiatives. Thus, our study emphasizes that diverse cultural contexts influence the expected positive outcomes of gender diversity within corporate boards, which, in turn, contributes to the realization of firm value. Third, it underscores the notion that the pathways to attaining sustainability goals also facilitate the promotion of gender equality and diversity in a fast-moving Saudi business environment.

The remaining sections of the paper proceed as follows. In Section 2, we delve into the institutional context, review the relevant literature, and outline the development of hypotheses. Section 3 provides an overview of the methodology, including details about the sample, data, and models utilized. Proceeding to Section 4, we present descriptive statistics and the primary findings of our study. Section 5 is dedicated to additional tests conducted in our research. Finally, Section 6 offers our conclusions, implications, and recommendations for future research directions.

2. Background, Literature Review, and Hypotheses Development

2.1. Gender Diversity and ESG Score in Saudi Arabia

A growing emphasis on gender diversity has also had regulatory implications. Governments and regulators are paying increasing attention to female participation in businesses; depending on where they operate, companies may face even more regulatory pressure to address gender diversity at the board level and beyond (S&P Global 2020). For example, in U.S., California’s law requiring certain publicly traded companies to include women on their boards will more than double the total number of female-held board seats in the state. Other U.S. state governments, including New Jersey, Illinois, and Massachusetts, have taken efforts to introduce similar legislation related to gender diversity on boards of directors (S&P Global 2020).

In the Saudi context, amid global requests to enhance environmental, social, and governance investments, the Saudi government in Saudi Arabia wants an improved approach that combines ESG demand with today’s challenging economic reality1 The GDP in Saudi Arabia has historically been heavily influenced by oil exports. Nevertheless, due to the volatility and instability in oil prices during the past decade, Crown Prince Mohammed bin Salman, acting on behalf of the Saudi government, introduced the Saudi Vision 2030 framework on 25 April 2016 (Boshnak et al. 2023). The Saudi Vision of 20302 prioritizes the adoption of essential fiscal amendments that enhance Saudi Arabia’s economic sustainability in the long run. In 2021, the Saudi Stock Exchange3 announced ESG disclosure standards, which will assist listed businesses and potential corporations intending to go public with their ESG reporting and promote awareness in the local market. According to the ESG Disclosure Guidelines released by the Saudi exchange4, the sustainable growth is the pivot of the Vision 2030, and its underlying principles enhance the formulation and execution of Vision 2030 that are in alignment with the chief tenets of ESG practices. This alignment justifies the reason behind the Saudi exchange’s empowerment toward ESC discourse in the capital market. In addition, in 20185, the Saudi Stock Exchange entered a partnership with the UN Sustainable Stock Exchanges Initiative. This collaboration aimed to enhance the ESG awareness initiatives and promote sustainable investment practices.

Furthermore, as noted by Nahshal (2019), one of the fundamental goals embedded in Vision 2030 is the enhancement of women’s empowerment in Saudi Arabia. In 2019, Saudi Arabia achieved a remarkable surge in its ranking in the World Bank Group’s Women, Business, and the Law report6. This upswing surpassed that of all other countries when compared to its 2018 ranking. Additionally, the International Finance Corporation (IFC) released a report in 2022 on gender equality in corporate leadership among G20 nations7, revealing an increase in the percentage of women holding board seats in Saudi Arabia in 2022. This substantial progress can be attributed to Saudi Arabia’s adoption of an extensive range of measures aimed at expanding women’s roles in society and granting them unprecedented economic freedoms (Karolak 2023).

Consequently, women’s contributions in Saudi Arabia are now not only expected but also acknowledged. However, a persisting challenge that necessitates cultural adjustments for resolution is the entrenched perceptions of gender roles in a predominantly male-dominated field (Chebbi and Ammer 2022). Despite the persisting issues related to masculinity in the country, Saudi female empowerment is gradually reshaping societal norms and challenging the status quo. This evolving landscape is indicative of a growing movement toward achieving genuine gender equality (Nahshal 2019).

2.2. Hypothesis Development

Table 1 summarizes the previous research related to our main variables as follows.

Table 1.

A summary of the prior research.

2.2.1. The Relationship between Gender Diversity and Firm Value

Board gender diversity has emerged as a pivotal component within corporate governance. Its significance lies in its capacity to enhance the corporate governance system and influence the strategic decisions formulated in the boardroom. Women occupying senior management positions, particularly on boards, contribute a unique set of experiences and perspectives that fortify the governance function of the board. This, in turn, can bolster decision-making processes and yield positive impacts on corporate value.

A body of previous research has established a strong relationship between the presence of women on corporate boards and enhanced business value. Notably, studies conducted by Salem et al. (2019), Issa and Fang (2019), and Dwaikat et al. (2021) have all demonstrated the capacity of female board directors to elevate a company’s overall value. Agyemang-Mintah and Schadewitz (2019) further noted that financial institutions benefit from the presence of female directors by witnessing an increase in their value. Additionally, Noguera (2020) emphasized the positive correlation between female directors and the value of real estate investment trusts, highlighting women’s potential to serve as skilled director candidates who enhance market awareness within the industry. Moreover, women directors have been found to elevate board performance through their problem-solving acumen and creativity, ultimately contributing to increased business value (Terjesen et al. 2015). In a similar vein, Bagh et al. (2023) revealed a positive association between board diversity and company value. This connection is attributed to the diverse and distinct characteristics of board members, which facilitate the formulation of high-quality decisions.

As mentioned earlier, Saudi’s Vision 2030 opens the door for female participation and empowerment. As argued by Nahshal (2019), this embraced vision has led to what can be described as a “Golden Age” for women in Saudi Arabia, ushering in a significant wave of cultural transformation, especially regarding traditional gender roles. This notion of thinking marks a significant departure from traditional norms where gender segregation hindered women from realizing their full potential, and their empowerment was viewed as unnecessary to achieve economic development (Karolak 2023). Accordingly, based on the context of Saudi Arabia, we hypothesize the following:

H1:

There is a positive association between board gender diversity and firm values.

2.2.2. The Relationship between Gender Diversity and ESG Score

As social and environmental issues become more pressing, ESG and sustainable investment have become important. Furthermore, gender diversity is a social quality that investors value, and it is a metric businesses are eager to promote. Investors are becoming more aware of the need to resolve environmental, social, and governance (ESG) issues, putting pressure on public companies to perform well in all three areas. As a result, investors are urging firms to diversify their boards of directors and to perform gender diversity and equality audits to determine how they will respond to ESG risks and opportunities (S&P Global 2020). As a result, gender diversity has become an essential aspect of the ESG’s identity (Burdon 2023). Gender diversity serves to reinforce and promote ESG investing and companies who make an effort to do so. As expected, companies that have previously adopted gender diversity have experienced numerous advantages. Gender diversity, for example, is a significant feature for integrating enterprises into ESG funds. Aside from that, rating agencies evaluate gender diversity while evaluating their “S” score. When a company performs well in all three categories (environmental, social, and governance), it has a significantly better chance of being included in ESG-focused investing strategies (Burdon 2023).

Prior research has increasingly centered on the interconnection between corporate governance and sustainability. In this context, corporate governance and ESG disclosure are inherently intertwined, reflecting a company’s engagement with its internal and external socio-political environment. Notably, gender diversity within corporate boards has emerged as a pivotal aspect of corporate governance, providing valuable resources such as personal networks, knowledge, and ethical principles that can contribute to the firm’s social and environmental performance (Cabeza-García et al. 2018).

As a result, the presence of women on corporate boards has been associated with elevated levels of corporate social performance (Byron and Post 2016; Pucheta-Martínez et al. 2018), more substantial corporate social responsibility ratings (Bear et al. 2010), and increased disclosure of social and environmental practices (Cabeza-García et al. 2018). Including more women on corporate boards fosters greater democratic, socially engaged, and ecologically responsible corporate practices, thereby improving social and environmental standards. Moreover, Aladwey et al. (2022) observed that female directors exhibit higher levels of responsibility, which can motivate companies to disclose information related to their social and environmental initiatives. This view is supported by Rao and Tilt (2016), Yasser et al. (2017), and Harjoto and Laksmana (2018), which underscores the influential role of female directors in shaping social and environmental reporting. Furthermore, Pucheta-Martínez et al. (2018) discovered a positive correlation between external women directors (independent and institutional) and CSR disclosure.

Subject to the Saudi context, Karolak (2023) argued that to increase women’s participation in the public sphere, women were appointed to governmental positions and granted opportunities to engage in the limited political processes in Saudi Arabia. Accordingly, in light of the evidence indicating that the inclusion of female directors on corporate boards enhances social and environmental disclosure, our research proposes the following hypothesis:

H2:

There is a positive association between gender diversity and ESG score.

2.2.3. The Relationship between Gender Diversity and Firm Value: The Mediating Effect of ESG Disclosure

The benefits of a company’s commitment to social and environmental responsibility contribute to its competitive advantage, ultimately enhancing its performance and value (Donaldson and Preston 1995; Margolis et al. 2009; Flammer 2015). Companies prioritizing sustainability disclosure can increase their value and maximize economic returns (Alodat et al. 2023). Furthermore, firms with greater gender diversity on their boards tend to be more engaged in reporting on social and environmental issues (Aladwey et al. 2022). Altering the composition of corporate boards by increasing female representation can enhance board performance because diverse boards often bring a more comprehensive perspective. However, the impact of gender diversity on corporate boards and its connection to firm value can vary significantly depending on the context and country (Alhosani and Nobanee 2023).

In the context of Hofstede’s cultural dimensions, the “masculinity-femininity” dimension can influence board gender diversity, firm performance, and value. This cultural dimension may either support or resist board diversity. For instance, masculinity in organizational culture emphasizes achievement, assertiveness, and material rewards for success. In nations characterized by a pronounced masculinity within their organizational culture, corporate boards often exhibit more significant gender differentiation, with a predominant emphasis on objectives among board members (Kabir et al. 2023). In contrast, a more feminine culture promotes gender equality, and board members tend to be more compromising and collaborative. In such cultures, women on boards often focus on non-monetary contributions and foster cooperative relationships, emphasizing relationships over objectives (Luckerath-Rovers 2013).

Due to variations in institutional contexts across countries driven by cultural differences (Post and Byron 2015), the mediating role of the ESG score in the relationship between gender diversity and firm value can be expected to differ based on the specific country and its context. Some scholars argue that appointing women directors to the board has multiple positive effects on firm-related outcomes and values, primarily in terms of improving the ESG score and promoting ethical behavior (Pucheta-Martínez et al. 2018; Escamilla-Solano et al. 2023). However, other authors suggest that gender diversity does not significantly affect firm-related outcomes, including the ESG score (Ahern and Dittmar 2012; Matsa and Miller 2013). Given these inconsistent findings, we hypothesize that the ESG score mediates the relationship between gender diversity and firm value in the context of Saudi Arabia. This hypothesis can be formulated as follows:

H3:

ESG disclosure mediates the relationship between gender diversity and firm value.

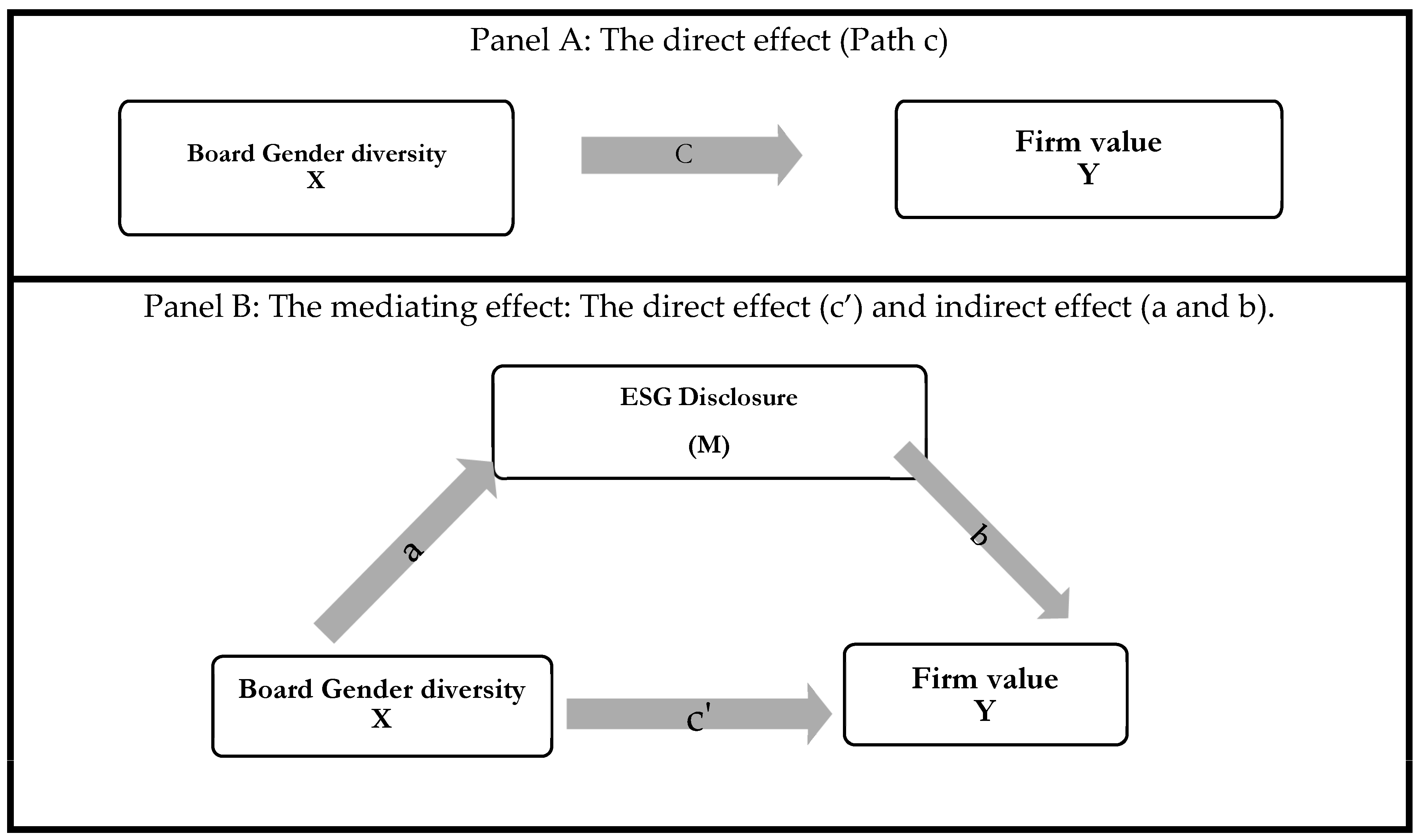

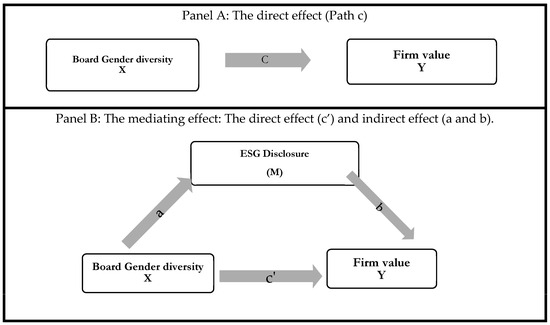

Figure 1 depicts the impact of BGD on FV, as indicated by path (c’), mediated through the role of ESG, represented by paths (a) and (b). As illustrated in Panel A, Figure 1, path (c) signifies the direct influence of BGD on FV. The inclusion of mediating variables leads to the breakdown of the total effect (c) of BGD on FV into a direct effect (c’) and an indirect effect (ab), as presented in Panel B, Figure 1.

Figure 1.

Board gender diversity and firm value: the mediating effect of ESG disclosure.

3. Methodology

3.1. Sample and Data

To assess the mediating impact of ESG discourse on the relationship between gender diversity and firm value, we conducted our analysis using a sample comprising financial Saudi companies listed on the Saudi Stock Exchange (Tadawul). Our sample comprises a diverse range of financial Saudi-listed firms across various sectors, including banks, diversified financials, REITs, and insurance. Furthermore, the dataset encompasses data for the years 2021 and 2022, representing the most recent available information. As argued by Shen et al. (2020) and Sultana et al. (2022), the global COVID-19 pandemic substantially dampened economic activities worldwide. Accordingly, we could not extend our analysis to a broader timeframe preceding the mentioned period due to the evident impact of the COVID-19 pandemic on financial data. The sampling process and categorization of firms based on their respective industrial sectors are presented in Table 2. After the exclusion of companies with no or insufficient data about the variables under investigation, our final sample consisted of 54 companies with 108 company-year observations.

Table 2.

The sample: selection process and industry sectors.

Data about the variables under investigation were collected from different sources. We manually collected the data regarding the financial variables from the Saudi Stock Exchange’ Tadawul’ website. In addition, the ESG score was obtained from the Refinitiv Thomson Reuters Database. Finally, data for gender diversity were manually collected from companies’ annual reports, governance reports, and official websites. Following Gonçalves et al. (2022), all continuous variables were winsorized at 1% to reduce the influence of outliers.

3.2. Measurement of Variables

Table 3 shows the definition of the main variables utilized. The independent variable in our study pertains to gender diversity (BGD), represented as a binary dummy variable. Specifically, it takes the value of one if the board of directors includes at least one female director and zero otherwise (Chebbi and Ammer 2022). As for our dependent variable, firm value (FV), it is operationalized as the market-to-book value ratio (Bravo 2017; Abdi et al. 2022; Ben Fatma and Chouaibi 2021). This ratio is calculated by dividing the market capitalization of equity by its book value. According to Abdi et al. (2022) and Ben Fatma and Chouaibi (2021), a ratio of less than one signifies that the market price of equity falls below the book value, which may imply financial distress for companies. Conversely, when the ratio exceeds one, the market price surpasses the book value of a company’s assets, suggesting sustained profitability and strong financial performance (Abdi et al. 2022; Ben Fatma and Chouaibi 2021).

Table 3.

Definition of variables.

Our paper employed the ESG score as the mediating variable to assess a company’s sustainability and disclosure performance. The ESG score, sourced from the Refinitiv Thomson Reuters Database, is depicted on a scale ranging from 0% to 100%. As illustrated in Table 4, this scoring system encompasses four tiers—A, B, C, and D—reflecting the quality of sustainability performance and disclosure.

Table 4.

The categories of ESG based on Refinitiv Thomson Reuters Database8.

We employed two sets of control variables in our study. The first set comprises corporate governance variables: board independence (BI) and board size (BS). Board independence (BI) is determined as the percentage of independent directors on the board (Aladwey and Diab 2023). Consistent with Kiharo and Kariuki (2018), board independence is argued to have a positive association with firm value. Independent directors are considered more adept at overseeing management actions that enhance the transparency of financial reporting and thus enhance a firms’ value (Kiharo and Kariuki 2018). Additionally, board size (BS) is calculated as the natural logarithm of the number of board members (Ben Fatma and Chouaibi 2021; Aladwey and Diab 2023). Following the rationale proposed by Noja et al. (2021), we predict a positive relationship between board size and firm value in the context of financial sectors.

The firm-specific variables, our second set of control variables, encompass company size (FS), age (AGE), and leverage (LEV). Firm size (FS) is computed as the natural logarithm of total assets (Aladwey 2021). Firm age (AGE) is calculated as the natural logarithm of the number of years a company has been in the market since its incorporation (Martínez-Ferrero et al. 2020; Fayyaz et al. 2023; Alodat et al. 2023). Finally, following Biswas et al. (2023), the leverage (LEV) is computed as total liabilities divided by total assets. Ben Fatma and Chouaibi (2021) argue that in the context of financial institutions, there is a non-significant association between firm value and leverage.

3.3. Model

In order to test the mediating effect of ESG disclosure on the relationship between gender diversity and firm value, we utilize two approaches. First, we follow Baron and Kenny’s (1986) approach to mediation—the variable functions as a mediator when it satisfies the following criteria. First, the independent variable should significantly affect the mediator, “path a.” Second, the dependent variable should significantly explain the change in the mediator variable, “path b.” Third, upon controlling the results in both paths a and b, the alluded significant relationship between the independent and dependent variables becomes non-significant. Accordingly, the powerful demonstration of mediation happens in “path c”: the direct relationship between the independent and dependent variables decreases after controlling the effect of mediators Baron and Kenny (1986).

In our paper, we have three variables. The firm value represents the independent variable or Y; gender diversity is the dependent variable or X; and the ESG disclosure is the mediating variable or M. Following Salhi et al. (2020) and Alodat et al. (2023), we operationalized the mediation effect into four steps as follows.

Step one: Identify the relationship between Y and X.

Step two: Identify the relationship between M and X.

Step three: Identify how M affects the alluded relationship between Y and X.

Step four: Indicate if M fully mediates the X and Y relationship in the case that the direct effect of X on Y is diminished upon controlling M (path c’).

Second, in line with Salhi et al. (2020) and Abu-Bader and Jones (2021), Sobel tests were employed to examine whether a third variable (M) mediates the relationship between the independent variable (X) and the dependent variable (Y). Consistent with Jarboui et al. (2020) and Alodat et al. (2023), the complete mediation model was confirmed when the significance of X diminished after accounting for M, while partial mediation was established if X remained significant even after controlling for M.

Structural equation modelling (SEM), in contrast to traditional regression analysis, is a robust inference framework for mediation analyses capable of handling concurrent indirect and direct effects and acknowledging the mediator’s dual role as both a cause and an effect (Gunzler et al. 2013). Accordingly, similar to Salhi et al. (2020) and Moussa et al. (2023), we employed SEM to explore the direct and indirect associations between board gender diversity and firm value in econometric models 1 to 3, where steps three and four were integrated into model three as follows:

FVit = β0 + β1 BGDit + β2 BIit + β3 BSit + β4 FSit + β5 AGEit + β6 LEVit + FIRM and YEAR Fixed effect + εit

ESGit = β0 + β1 BGDit + β2 BIit + β3 BSit + β4 FSit + β5 AGEit + β6 LEVit + FIRM and YEAR Fixed effect + εit

FVit = β0 + β1 BGDit + β2 ESGit + β3 BIit + β4 BSit + β5 FSit + β6 AGEit + β7 LEVit + FIRM and YEAR Fixed effect + εit

4. Analysis and Results

4.1. Descriptive Analysis

Table 5 shows the descriptive statistics for the utilized continuous variables (mean, standard deviations, minimum, median, and maximum values. The FV, or the market-to-book ratio, spans a wide range from 0 to 4.45, with an average value of 1.25., revealing a diverse landscape within the financial sector of Saudi Arabia. Some companies are traded at or below their book value, while others command a premium, with the market valuing them substantially higher than their book value. The mean value of ESG is 12.69, with a standard deviation of 20.72, signifying significant variations in the disclosed ESG information across the sample. Consequently, ESG scores within the Saudi financial sector span a broad spectrum. The scale spans from 0, denoting companies with insufficient evidence of sustainable practices and disclosure, to a high ESG score of 73, signifying companies demonstrating relatively robust sustainable performance and highly transparent sustainability disclosure. On average, the percentage of independent directors within the Saudi boards is 40, and the number of board members is around three directors. Additionally, the mean size of Saudi financial listed companies is 20, and the average age is two years. Within the list of financial companies in Saudi Arabia, the leverage ratios exhibit significant variation, ranging from notably low levels (0.21) in some cases to exceptionally high levels (11.6) in others.

Table 5.

Descriptive statistics for continuous variables.

Table 6 provides statistical insights into gender diversity and ESG scores in Saudi Arabia, with a breakdown by industry sector. By the ESG score tiers detailed in Table 4, it is notable that no companies within the Saudi financial sector are categorized as “A,” signifying a high level of excellence in sustainable performance and disclosure, as indicated in Table 6. Within the financial sector, the banking sector leads with 19 percent of companies adhering to sustainability standards, surpassing other financial sectors. In contrast, the diversified financial and REITS sectors exhibit relatively lower percentages, with 2% and 4% of companies acknowledged by Refinitiv Thomson Reuters for their commitment to sustainability practices. Table 6 demonstrates the percentage of female directors on the boards of various financial sectors. The diversified financial sector stands out with the highest representation of female directors at 60 percent, while the insurance sector records the lowest percentage with only 8 percent.

Table 6.

Summary statistics for gender diversity and ESG scores in KSA subject to industry sector.

4.2. Correlation Matrix

Table 7 shows the statistical results of the Pearson correlation and multicollinearity. The Pearson correlation matrix is typically used to illustrate the correlation between continuous variables when they exhibit a normal distribution pattern (Schober et al. 2018). In line with the guidelines of Schober et al. (2018), correlation coefficients below 0.40 indicate weak or no correlations among variables, which is the case for the correlation coefficients of all the continuous variables presented in Table 7, Panel A. Subsequently, according to Chebbi and Ammer (2022), the VIF values that are below the critical threshold of 10 imply the absence of multicollinearity concerns. As observed in Table 7, Panel B, we can conclude that our variables have no multicollinearity problem.

Table 7.

Pearson correlation and multicollinearity statistics.

4.3. Primary Findings of SEM

Table 8 displays the fixed effect regression results. Similar to Chebbi and Ammer (2022) and Alodat et al. (2023), in order to mitigate the influence of unaccounted variables and potential biases, we incorporated fixed effects regression in our models. As presented in Table 8, the results of the Hausman tests are statistically significant, suggesting the superiority of the fixed effect model for our analysis. Wooldridge (2013) and Brüderl and Ludwig (2015) state that fixed effects regression can lead to biased estimates when independent variables exhibit substantial variation across different firms. However, if there is consistency within the same firm over time, the firm-specific heterogeneity may not disrupt the estimation process, thereby enabling the fixed effect model to yield unbiased estimates (Brüderl and Ludwig 2015; Nasr and Ntim 2018).

Table 8.

Results of the main regression analysis for the mediation.

4.3.1. Estimating the Direct Relationship between Board Gender Diversity and Firm Value

Step one involves discerning the correlation between board gender diversity (X) and firm value (Y). Contrary to our expectation, the findings of Table 8, Model 1, indicate a negative relationship between board gender diversity (BGD) and firm value (FV) at a 10% significance level, as evidenced by a p-value of 0.058 and β1 of −0.122. Accordingly, H1 is not supported. This finding is in congruence with Anh and Khanh (2017), Naghavi et al. (2021), and Kabir et al. (2023), which have also reported a negative association.

In contrast to the prevailing literature, which predominantly supports a positive association, our findings seem a better fit within the specific context of Saudi Arabia. This is especially pertinent given the limited involvement of female directors on the boards within the Saudi financial sector, as indicated in Table 4. Thompson (2019) highlights the widespread recognition of socio-cultural norms shaping accepted societal norms in Saudi Arabia. Nahshal (2019) further emphasizes the prevalence of a masculine cultural norm in Saudi Arabia, which is influenced by factors like upbringing, socialization, and parenting, which leads to distinct roles for men and women. Consequently, Saudi Arabia is commonly characterized as a masculine state where women face restrictions in various areas (Al-Rasheed 2013; Nahshal 2019).

Hofstede’s cultural dimensions, precisely the “masculinity-femininity” dimension, are recognized to notably influence firm performance (Kabir et al. 2023). In general, masculine societies tend to be more competitive and goal-oriented than feminine cultures, where a greater emphasis is placed on nurturing interpersonal relationships and fostering socially oriented objectives (Naghavi et al. 2021; Kabir et al. 2023). Therefore, in a highly masculine society, a board of directors with a higher proportion of female members may be less inclined toward conforming to norms emphasizing assertive and performance-based corporate actions, potentially reducing their targeted legitimacy (Naghavi et al. 2021). In essence, this suggests that the prevalence of masculinity in society may reduce the positive impact of board diversity on a company’s performance.

Regarding the control variables, Table 8 reports that BI is positively associated with FV at a significance level of 1% where p-value = 0.000 and β2 = 1.035. This result aligns with the findings of Kabir et al. (2023). In essence, the higher the proportion of independent directors on the boards of Saudi financial companies, the greater the value of these companies. This aligns with the expectations outlined by Singh et al. (2017) and Kapoor and Goel (2019), who anticipate that independent directors will diligently oversee management actions, mitigate bias, and act in ways that enhance the value of their companies. Table 8 also indicates a negative association between BS and FV at a significance threshold of 5% (where p-value = 0.05 and β3 = −0.509). Consistently, Kumar and Singh (2013) and Nguyen et al. (2016) assume that firms with large board sizes are expected to demonstrate lower operating performance while incurring higher operating costs. For firm-specific variables, Table 8 indicates a positive association between FS and FV at a significance level of 1% (p-value = 0.00 and β4 = 0.246). Conversely, non-significant associations are reported between FS and either AGE or LEV.

4.3.2. Estimating the Relationship between Board Gender Diversity and ESG Disclosure

In the second step, the examination tested the association between board gender diversity (X) and ESG disclosure (M). The results presented in Table 8, corresponding to Model 2, support the argument outlined in H2. Specifically, at a significance level of 1%, a positive association between BGD and ESG is evident, supported by a p-value of 0.001 and a coefficient (β1) of 0.222. This implies that the presence of female directors on Saudi corporate boards is linked to the advancement of companies’ ESG performance and communication. This finding aligns with a considerable body of research that emphasizes the pivotal role of board gender diversity in enhancing companies’ sustainable performance, as demonstrated in studies such as Yasser et al. (2017), Cabeza-García et al. (2018), Fernández-Gago et al. (2018), Harjoto and Laksmana (2018), Pucheta-Martínez et al. (2018), Aladwey et al. (2022), Khatri (2023), and numerous others. Additionally, Ebaid (2022), based on a sample of 67 Saudi-listed companies for 2014–2019, reveals that the ratio of female directors on the board positively correlates with the extent of CSR disclosure. However, this correlation is statistically nonsignificant. Similarly, Chebbi and Ammer (2022), drawing from a sample of 38 Saudi companies from 2015 to 2021, reported a positive but nonsignificant association between BGD and ESG. Chebbi and Ammer (2022) contend that a plausible explanation for the nonsignificant association is the constrained presence of female directors on the corporate boards within the sample they utilized.

Table 8 also provides insights into the relationship between ESG and control variables. Based on a significance threshold of 1%, the results reveal a positive and significant relationship between BS and ESG, as indicated by a p-value of 0.005 and a coefficient (β3) of 0.695. This finding suggests that more directors on Saudi boards are associated with a higher propensity to engage in sustainability activities and initiatives. This is consistent with the perspective presented by Aladwey et al. (2022) from an agency theory standpoint, which suggests that larger corporate boards enhance their capacity to oversee management, improve transparency, and disclose non-financial information while reducing information asymmetry. In addition, Table 8 also reveals a positive effect of AGE on ESG at a significance level of 1%, with a p-value = 0.005 and a coefficient (β5) of 0.968. Hence, it can be observed that older Saudi companies are more receptive to sustainable practices and demonstrate greater willingness to pursue sustainable objectives compared to younger companies. This aligns with a similar observation by Fitranita et al. (2023).

4.3.3. Estimating the Mediating Effect of ESG Disclosure on the Relationship between Board Gender Diversity and Firm Value

Steps three and four involved estimating the indirect relationship between board gender diversity (X) and firm value (Y), specifically focusing on the mediating effect of ESG disclosure (M). Upon incorporating ESG into Model 3, the association between BGD and FV becomes non-significant, as reported in Table 8, Model 3, contrasting with the significant relationship presented in Table 8, Model 1. In addition, at a 1% significance level, Table 8, Model 3 highlights a significant and positive association between ESG and FV, supported by a p-value of 0.002 and a β2’s coefficient of 0.016. These results all together indicate that ESG fully mediates the relationship between BGD and FV, confirming the fulfillment of H3. Moreover, we illustrate the mediation effect using the Sobel z-test. The outcomes presented in Table 8 indicate that ESG serves as a significant mediator in the relationship between BGD and FV, where the p-values of Sobel of 0.002, Aroian of 0.025, and Goodman of 0.019 are all significant, falling below the 5% significance threshold. Accordingly, ESG functions to offset the effect of BGD on FV. In addition, the entire mediation entails that the collaboration of ESG and BGD contributes to the enhancement of FV.

As per the Sustainable Development Report (2023), the Sustainable Development Goals (SDGs) advocate for governments to promote gender equality and establish it as a critical agenda within the framework of sustainable development goals. Accordingly, ESG plays a prominent role in enhancing Saudi companies’ values in the KSA context. Accordingly, this finding aligns with the core principles of Vision 2030. As previously mentioned, Vision 2030 strongly emphasizes sustainable growth, and its guiding principles closely resonate with ESG practices. Moreover, ESG acts as a complete mediator, effectively channeling the intended impact of BGD in enhancing the value of Saudi companies. Simply put, the sustainable concept takes precedence, outweighing the influence of BGD in enhancing a company’s value because gender diversity is fully integrated within the sustainability framework.

Similarly, Filho et al. (2022) argue that gender-related matters, particularly gender equality, can be viewed as overarching concerns within the realm of sustainability, contributing to the achievement of sustainable development goals, even though the precise mechanisms for their inclusion may not always be evident. Similarly, Alarcón and Cole (2019) assert that the pathways to achieving sustainability goals also serve as a means to promote gender equality and diversity. It is worth noting that the vice versa would not happen. As evidence, Ahern and Dittmar (2012) and Matsa and Miller (2013) contend that the significant gender imbalance on boards may not necessarily lead to swift changes in organizational ESG activities.

5. Robustness Check

Similar to Salhi et al. (2020) and Alodat et al. (2023), in order to assess the robustness of our main findings, we re-conducted the main analysis to determine whether the mediating role of ESG holds if we substitute the measure of our dependent variable: firm value. Accordingly, we re-estimated the main analysis using FV-SP as an indicator of firm value. Following D’Amato and Falivena (2020), FV-SP was measured as the annual growth rate of the stock price for firmi in yeart, and calculated as follows:

where:

FV-SPit = [(Pit − Pit−1)/Pit−1] × 100

Pit represents the stock price of firmi in yeart.

Pit−1 represents the stock price of firmi in the previous yeart−1.

Data for the stock price were manually collected from the Saudi stock exchange (Tadawul). The outcomes displayed in Table 9 show a similarity to the findings reported earlier in Table 8.

Table 9.

Additional test: the alternate measure of firm value.

6. Conclusions

Our paper aims to explore the mediating effect of ESG disclosure on the relationship between gender diversity and firm value, taking into account the cultural context. Based on a sample of Saudi-listed financial companies from 2021 to 2022, the results show a negative and significant association between gender diversity and firm value. Upon introducing the ESG score as a mediator variable, the results indicate that ESG fully mediates the relationship between gender diversity and firm value in Saudi financial companies.

Our findings uncover a significant revelation: there exists a negative relationship between corporate gender diversity and firm value, particularly within the context of Saudi Arabia. This observation diverges from the prevailing literature, which predominantly advocates for a positive association. A possible justification is that diverse cultural contexts imply distinct proportions of women required on corporate boards to realize firms’ values. It appears that the results may be aligned with the cultural dynamics of Saudi Arabia, where traditional notions of masculinity play a substantial role. Notably, the low representation of female directors on corporate boards within the Saudi financial sector underscores the intricate interplay between gender diversity and cultural dimensions. When involving the ESG score as a mediating variable, our results indicate that ESG fully mediates the relationship between gender diversity and firm value in Saudi financial companies. The sustainable notion dismisses the effect of BGD on promoting a firm’s value because gender diversity is fully embedded within sustainability’s purview. This suggests that cultural dimensions, such as masculinity, may intersect with ESG considerations to shape the financial landscape in this unique context. Our results are robust for alternate measures of firm value.

The findings of our paper have several implications for investors, policymakers, and regulators. First, our findings offer valuable insights for investors seeking to assess the influence of board gender diversity on a company’s overall value. Second, the findings highlight the significance of gender diversity in the realm of sustainability, indicating that enhancing female representation on corporate boards is a crucial strategy for firms aiming to improve their ESG scores. Furthermore, this encouragement motivates firms to actively participate in sustainability initiatives actively, recognizing their positive impact on overall firm value. Consequently, it serves as a compelling prompt for policymakers to recognize the importance of fostering sustainability disclosures among Saudi companies, even though such disclosures remain voluntary. Additionally, these findings advocate for regulators and policymakers to establish rules that facilitate increased female participation on corporate boards, particularly in light of the absence of mandatory minimum requirements for female representation.

Gender diversity has become a fundamental component of Saudi Arabia’s Vision 2030, and it is anticipated that fostering gender diversity will play a pivotal role in achieving the objectives of this vision. The persistence of the cultural dimension of a predominantly masculine society in Saudi Arabia may present obstacles to realizing the potential benefits of gender diversity on corporate performance. Within the sustainability framework, there may be a mediating effect of gender diversity on firm value. Specifically, sustainable performance entails the promotion of higher female representation on boards. This notion of sustainability could enhance the value of Saudi firms and contribute to the transformation of the cultural landscape in Saudi Arabia, shifting it from one dominated by traditional masculinity to a more inclusive and diverse notion of corporate governance and equality. Thus, the progression of Saudi companies toward achieving the goals of Vision 2030 encompasses a dedication to sustainable practices, wherein gender diversity on Saudi boards plays a crucial role. This commitment is essential to realizing the positive impacts of gender diversity on the value of Saudi firms.

The limitations of our paper could open new avenues for future research. The study explores how a cultural dimension, namely masculinity–femininity, influences the mediating effect of the ESG score on the relationship between gender diversity and firm value. Further research into the intricate dynamics of cultural influences on corporate performance, such as “individualism-collectivism,” “uncertainty avoidance,” and “power distance,” is warranted to gain a deeper understanding of these complex relationships within Saudi Arabia. In addition, our study examines the mediating effect of ESG score over two years, 2021 and 2022. Other researchers could conduct a longitudinal panel study on the effect of gender diversity on the firm value for the period from 2016, the year of the inception of Saudi Vision, to 2030, the year at which the vision is accomplished. In addition, it is anticipated that the participation of female directors on Saudi boards will increase after 2030. Consequently, it would be intriguing for other researchers to explore the impact of achieving a critical mass of female directors on the corporate performance of Saudi companies. Furthermore, subject to data availability, our sample only covers the financial sector in Saudi Arabia. It could be interesting if other researchers expand the sample size to include Saudi-listed non-financial companies to address any difference in findings.

Author Contributions

Conceptualization, L.M.A.A. and R.A.A.; Methodology, L.M.A.A.; Formal analysis, L.M.A.A.; Data curation, L.M.A.A.; Writing; Review, L.M.A.A. and R.A.A.; Editing, L.M.A.A. and R.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-RG23102).

Data Availability Statement

Data is unavailable due to privacy or ethical restrictions.

Acknowledgments

This work was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number IMSIU-RG23102).

Conflicts of Interest

The authors declare no conflict of interest.

Notes

References

- Abdi, Yaghoub, Xiaoni Li, and Xavier Càmara-Turull. 2022. Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environment, Development and Sustainability 24: 5052–79. [Google Scholar] [CrossRef]

- Abu-Bader, Soleman, and Tiffanie Victoria Jones. 2021. Statistical Mediation Analysis Using the Sobel Test and Hayes SPSS Process Macro. International Journal of Quantitative and Qualitative Research Methods 9: 42–61. [Google Scholar]

- Agyemang-Mintah, Peter, and Hannu Schadewitz. 2019. Gender diversity and firm value: Evidence from UK financial institutions. International Journal of Accounting & Information Management, Emerald Group Publishing Limited 27: 2–26. [Google Scholar]

- Ahern, Kenneth R., and Amy K. Dittmar. 2012. The changing of the boards: The impact on firm valuation of mandated female board representation. The Quarterly Journal of Economics 127: 137–97. [Google Scholar] [CrossRef]

- Aladwey, Laila Mohamed Alshawadfy. 2021. The effect of equity ownership structure on non-conditional conservatism: An empirical study based on listed companies in Egypt. Journal of Financial Reporting and Accounting 19: 742–71. [Google Scholar] [CrossRef]

- Aladwey, Laila, Adel Elgharbawy, and Mona Ganna. 2022. Attributes of corporate boards and assurance of corporate social responsibility reporting: Evidence from the UK. Corporate Governance: The International Journal of Business in Society 22: 748–80. [Google Scholar] [CrossRef]

- Aladwey, Laila, and Ahmed Diab. 2023. The determinants and effects of the early adoption of IFRS 15: Evidence from a developing country. Cogent Business & Management 10: 2167544. [Google Scholar]

- Alarcón, Daniela Moreno, and Stroma Cole. 2019. No sustainability for tourism without gender equality. Journal of Sustainable Tourism 27: 903–19. [Google Scholar] [CrossRef]

- Al Hameli, Afra, Charilaos Mertzanis, and Ilias Kampouris. 2023. Women’s empowerment conditions, institutions and firm performance in the MENA region. Accounting Forum 3: 1–30. [Google Scholar] [CrossRef]

- Alhosani, Noora Hasan Ismail, and Haitham Nobanee. 2023. Board gender diversity and corporate social responsibility: A bibliometric analysis. Heliyon 9: e12734. [Google Scholar] [CrossRef] [PubMed]

- Almathami, Rafiah, Catheryn Khoo-Lattimore, and Elaine Chiao Ling Yang. 2020. Exploring the challenges for women working in the event and festival sector in the Kingdom of Saudi Arabia. Tourism Recreation Research 1: 47–61. [Google Scholar] [CrossRef]

- Almubarak, Wadhaah Ibrahim, Kaouther Chebbi, and Mohammed Abdullah Ammer. 2023. Unveiling the Connection among ESG, Earnings Management, and Financial Distress: Insights from an Emerging Market. Sustainability 15: 12348. [Google Scholar] [CrossRef]

- Alodat, Ahmad Yuosef, Zalailah Salleh, Haitham Nobanee, and Hafiza Aishah Hashim. 2023. Board gender diversity and firm performance: The mediating role of sustainability disclosure. Corporate Social Responsibility and Environmental Management 30: 2053–65. [Google Scholar] [CrossRef]

- Al-Rasheed, Madawi A. 2013. A Most Masculine State: Gender, Politics and Religion in Saudi Arabia. Cambridge: Cambridge University Press. [Google Scholar]

- Anh, Vo Thi Thuy, and Nha Khanh. 2017. Impact of Board Gender Diversity on Firm Value: International Evidence. Journal of Economics and Development 19: 65–76. [Google Scholar]

- Bagh, Tanveer, Muhammad Asif Khan, Natanya Meyer, and Hammad Riaz. 2023. Impact of boardroom diversity on corporate financial performance. Humanities and Social Sciences Communications 10: 222. [Google Scholar] [CrossRef]

- Baron, Reuben M., and David A. Kenny. 1986. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51: 1173–1182. [Google Scholar] [CrossRef]

- Bear, Stephen, Noushi Rahman, and Corinne Post. 2010. The Impact of Board Diversity and Gender Composition on Corporate Social Responsibility and Firm Reputation. Journal of Business Ethics 97: 207–21. [Google Scholar] [CrossRef]

- Ben Fatma, Hanen, and Jamel Chouaibi. 2021. Corporate governance and firm value: A study on European financial institutions. International Journal of Productivity and Performance Management 72: 1392–418. [Google Scholar] [CrossRef]

- Biswas, Pallab Kumar, Larelle Chapple, Helen Roberts, and Kevin Stainback. 2023. Board Gender Diversity and Women in Senior Management. Journal of Business Ethics 182: 177–98. [Google Scholar] [CrossRef]

- Boshnak, Helmi A., Mohammad Alsharif, and Majed Alharthi. 2023. Corporate governance mechanisms and firm performance in Saudi Arabia before and during the COVID-19 outbreak. Cogent Business & Management 10: 2195990. [Google Scholar]

- Brahma, Sanjukta, Chioma Nwafor, and Agyenim Boateng. 2021. Board gender diversity and firm performance: The UK evidence. International Journal of Finance and Economics 26: 5704–19. [Google Scholar] [CrossRef]

- Bravo, Francisco. 2017. Are risk disclosures an effective tool to increase firm value. Managerial and Decision Economics 38: 1116–24. [Google Scholar] [CrossRef]

- Brüderl, Josef, and Volker Ludwig. 2015. Fixed-Effects Panel Regression. In The SAGE Handbook of Regression Analysis and Causal Inference. London: SAGE Publications Ltd., pp. 327–58. [Google Scholar]

- Burdon, Eric. 2023. How Gender Equality Drives ESG Funds in 2023. Available online: https://www.knowesg.com/featured-article/how-gender-equality-drives-esg-funds-in-2023 (accessed on 26 July 2023).

- Byron, Kris, and Corinne Post. 2016. Women on Boards of Directors and Corporate Social Performance: A Meta-Analysis. Corporate Governance: An International Review 24: 428–42. [Google Scholar]

- Cabeza-García, Laura, Roberto Fernández-Gago, and Mariano Nieto. 2018. Do board gender diversity and director typology impact CSR reporting? European Management Review 15: 559–75. [Google Scholar] [CrossRef]

- Chebbi, Kaouther, and Mohammed Abdullah Ammer. 2022. Board Composition and ESG Disclosure in Saudi Arabia: The Moderating Role of Corporate Governance Reforms. Sustainability 14: 12173. [Google Scholar] [CrossRef]

- D’Amato, Antonio, and Camilla Falivena. 2020. Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corporate Social Responsibility and Environmental Management 27: 909–24. [Google Scholar] [CrossRef]

- del Mar Fuentes-Fuentes, Mª, Cristina Quintana-García, Macarena Marchante-Lara, and Carlos G. Benavides-Chicón. 2023. Gender diversity, inclusive innovation and firm performance. Sustainable Development 31: 3622–38. [Google Scholar] [CrossRef]

- Dobash, Russel, and Emerson Dobash. 2003. Violence in Intimate Relationships. In International Handbook of Violence Research. Edited by W. Heitmeyer and J. Hagan. Dordrecht: Springer. [Google Scholar]

- Donaldson, Thomas, and Lee E. Preston. 1995. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. The Academy of Management Review 20: 65–91. [Google Scholar] [CrossRef]

- Dwaikat, Nizar, Ihab Sameer Qubbaj, and Abdelbaset Queiri. 2021. Gender diversity on the board of directors and its impact on the Palestinian financial performance of the firm. Cogent Economics & Finance 9: 1948659. [Google Scholar]

- Ebaid, Ibrahim El-Sayed. 2022. Corporate governance mechanisms and corporate social responsibility disclosure: Evidence from an emerging market. Journal of Global Responsibility 13: 396–420. [Google Scholar] [CrossRef]

- Eliwa, Yasser, Ahmed Aboud, and Ahmed Saleh. 2023. Board gender diversity and ESG decoupling: Does religiosity matter? Business Strategy and the Environment 32: 4046–67. [Google Scholar] [CrossRef]

- EmadEldeen, Rehab, Ahmed Elbayoumi, Mohamed Basuony, and Ehab Mohamed. 2021. The effect of the board diversity on firm performance: An empirical study on the UK [Special issue]. Corporate Ownership & Control 18: 337–47. [Google Scholar]

- Escamilla-Solano, Sandra, Antonio Fernández-Portillo, Mari Cruz Sánchez-Escobedo, and Carmen Orden-Cruz. 2023. Corporate social responsibility disclosure: Mediating effects of the economic dimension on firm performance. Corporate Social Responsibility and Environmental Management, Early View. [Google Scholar] [CrossRef]

- Fayyaz, Um-E-Roman, Raja Nabeel-Ud-Din Jalal, Michelina Venditti, and Antonio Minguez-Vera. 2023. Diverse boards and firm performance: The role of environmental, social and governance disclosure. Corporate Social Responsibility and Environmental Management 30: 1457–72. [Google Scholar] [CrossRef]

- Fernández-Gago, Roberto, Laura Cabeza-García, and Mariano Nieto. 2018. Independent directors’ background and CSR disclosure. Corporate Social Responsibility and Environmental Management 25: 991–1001. [Google Scholar] [CrossRef]

- Filho, Walter Leal, Marina Kovaleva, Stella Tsani, Diana-Mihaela Țîrcă, Chris Shiel, Maria Alzira Pimenta Dinis, Melanie Nicolau, Mihaela Sima, Barbara Fritzen, Amanda Lange Salvia, and et al. 2022. Promoting gender equality across the sustainable development goals. Environment, Development and Sustainability 25: 14177–98. [Google Scholar] [CrossRef]

- Fitranita, Vika, Duta Widiyaksa, Baihaq, and Dri Asmawanti. 2023. The influence of company size, company age, profitability, leverage, sales growth, and independent board of commissioners on Islamic social reporting disclosures. Proceeding International Conference on Accounting and Finance 1: 66–75. [Google Scholar]

- Flammer, Caroline. 2015. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Management Science 61: 2549–68. [Google Scholar] [CrossRef]

- Gonçalves, Tiago Cruz, João Dias, and Victor Barros. 2022. Sustainability Performance and the Cost of Capital. International Journal of Financial Studies 10: 63. [Google Scholar] [CrossRef]

- Gunzler, Douglas, Tian Chen, Hui Zhang, and Pan Wu. 2013. Introduction to mediation analysis with structural equation modeling. Shanghai Arch Psychiatry 25: 390–4. [Google Scholar]

- Harjoto, Maretno, and Indrarini Laksmana. 2018. The Impact of Corporate Social Responsibility on Risk Taking and Firm Value. Journal of Business Ethics 151: 353–73. [Google Scholar] [CrossRef]

- Issa, Ayman, and Hong-Xing Fang. 2019. The impact of board gender diversity on corporate social responsibility in the Arab Gulf states. Gender in Management: An International Journal 34: 577–605. [Google Scholar] [CrossRef]

- Jarboui, Anis, Maali Kachouri Ben Saad, and Rakia Riguen. 2020. Tax avoidance: Do board gender diversity and sustainability performance make a difference? Journal of Financial Crime 27: 1389–408. [Google Scholar] [CrossRef]

- Jiang, Lisha, Jacob Cherian, Muhammad Safdar Sial, Peng Wan, José António Filipe, Mário Nuno Mata, and Xiangyu Chen. 2021. The moderating role of CSR in board gender diversity and firm financial performance: Empirical evidence from an emerging economy. Economic Research-Ekonomska Istraživanja 34: 2354–73. [Google Scholar] [CrossRef]

- Kabir, Ashikul, Saiyara Shabbir Ikra, Paolo Saona, and Md. Abul Kalam Azad. 2023. Board gender diversity and firm performance: New evidence from cultural diversity in the boardroom. LBS Journal of Management & Research 21: 1–12. [Google Scholar]

- Kapoor, Nimisha, and Sandeep Goel. 2019. Do diligent independent directors restrain earnings management practices? Indian lessons for the global world. Asian Journal of Accounting Research 4: 52–69. [Google Scholar] [CrossRef]

- Karamahmutoğlu, Merve Kılıç, and Cemil Kuzey. 2016. The effect of board gender diversity on firm performance: Evidence from Turkey. Gender in Management: An International Journal 31: 434–55. [Google Scholar]

- Karolak, Magdalena. 2023. Saudi Women in the Mohammed bin Salman Era: Examining the Paradigm Shift. In The Palgrave Handbook of Gender, Media and Communication in the Middle East and North Africa. Cham: Springer International Publishing. [Google Scholar] [CrossRef]

- Khatri, Ishwar. 2023. Board gender diversity and sustainability performance: Nordic evidence. Corporate Social Responsibility and Environmental Management 30: 1495–507. [Google Scholar] [CrossRef]

- Kiharo, MaryAnne Njeri, and Peter Wang’ombe Kariuki. 2018. Corporate governance practices and firm value of listed commercial banks in Kenya. The International Journal of Business and Management 6: 184–92. [Google Scholar]

- Kumar, Naveen, and Jasminde Singh. 2013. Effect of board size and promoter ownership on firm value: Some empirical findings from India. Corporate Governance 13: 88–98. [Google Scholar] [CrossRef]

- Lu, Yun, Collins G. Ntim, Qingjing Zhang, and Pingli Li. 2022. Board of directors’ attributes and corporate outcomes: A systematic literature review and future research agenda. International Review of Financial Analysis 84: 102424. [Google Scholar] [CrossRef]

- Luckerath-Rovers, Mijntje. 2013. Women on boards and firm performance. Journal of Management and Governance 17: 491–509. [Google Scholar] [CrossRef]

- Margolis, Joshua D., Hillary Anger Elfenbein, and James P. Walsh. 2009. Does it Pay to Be Good… and Does It Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1866371 (accessed on 1 March 2009). [CrossRef]

- Martínez-Ferrero, Jennifer, Eryilmaz Mehmet, and Colakoglu Nese. 2020. How Does Board Gender Diversity Influence the Likelihood of Becoming a UN Global Compact Signatory? The Mediating Effect of the CSR Committee. Sustainability 12: 4329. [Google Scholar] [CrossRef]

- Matsa, David A., and Amalia R. Miller. 2013. A Female Style in Corporate Leadership? Evidence from Quotas. American Economic Journal: Applied Economics 5: 136–69. [Google Scholar] [CrossRef]

- Mobaraki, Hosein, and B. Söderfeldt. 2010. Gender inequity in Saudi Arabia and its role in public health. Eastern Mediterranean Health Journal 16: 113–18. [Google Scholar] [CrossRef]

- Moussa, Fatma Ben, Salma Zaiane, and Nihel Ziadi. 2023. The mediating role of CSR on the relationship between gender diversity and risk taking. Journal of Environmental Planning and Management 66: 882–908. [Google Scholar] [CrossRef]

- Naghavi, Navaz, Saeed Pahlevan Sharif, and Hafezali Bin Iqbal Hussain. 2021. The role of national culture in the impact of board gender diversity on firm performance: Evidence from a multi-country study. Equality, Diversity and Inclusion 40: 631–50. [Google Scholar] [CrossRef]

- Nahshal, Maha Mohammed. 2019. Masculinity in Saudi Arabia Where we are and where we go from here. International Journal of Humanities and Social Science 9: 115–25. [Google Scholar]

- Nasr, Mahmoud, and Collin Ntim. 2018. Corporate Governance Mechanisms and Accounting Conservatism: Evidence from Egypt. Corporate Governance 18: 386–407. [Google Scholar] [CrossRef]

- Nguyen, Pascal, Nahid Rahman, Alex Tong, and Ruoyun Zhao. 2016. Board size and firm value: Evidence from Australia. Journal of Management & Governance 20: 851–73. [Google Scholar]

- Noguera, Magdy. 2020. Women directors’ effect on firm value and performance: The case of REITs. Corporate Governance 20: 1265–79. [Google Scholar] [CrossRef]

- Noja, Gratiela Georgiana, Eleftherios Thalassinos, Mirela Cristea, and Irina Maria Grecu. 2021. The interplay between board characteristics, financial performance, and risk management disclosure in the financial services sector: New empirical evidence from Europe. Journal of Risk and Financial Management 14: 79. [Google Scholar] [CrossRef]

- Post, Corinne, and Kris Byron. 2015. Women on Boards and Firm Financial Performance: A Meta-Analysis. The Academy of Management Journal 58: 1546–71. [Google Scholar] [CrossRef]

- Pucheta-Martínez, María Consuelo, Inmaculada Bel-Oms, and Gustau Olcina-Sempere. 2018. The association between board gender diversity and financial reporting quality, corporate performance and corporate social responsibility disclosure: A literature review. Academia Revista Latinoamericana de Administración 31: 177–94. [Google Scholar] [CrossRef]

- Rao, Kathyayini, and Carol Tilt. 2016. Board Composition and Corporate Social Responsibility: The Role of Diversity, Gender, Strategy and Decision Making. Journal of Business Ethics 138: 327–47. [Google Scholar] [CrossRef]

- S&P Global. 2020. How Gender Fits into ESG? Available online: https://www.spglobal.com/en/research-insights/articles/how-gender-fits-into-esg (accessed on 24 February 2020).

- Salem, Wafaa, Saad Metawe, Amr Youssef, and Mohamed Mohamed. 2019. Boards of Directors’ Characteristics and Firm Value: A Comparative Study between Egypt and USA. Open Access Library Journal 6: 1–33. [Google Scholar] [CrossRef]

- Salhi, Bassem, Rakia Riguen, Maali Kachouri, and Anis Jarbou. 2020. The mediating role of corporate social responsibility on the relationship between governance and tax avoidance: UK common law versus French civil law. Social Responsibility Journal 16: 1149–68. [Google Scholar] [CrossRef]

- Schober, Patrick, Christa Boer, and Lothar Schwarte. 2018. Correlation coefficients: Appropriate use and interpretation. Anesthesia and Analgesia 126: 1763–68. [Google Scholar] [CrossRef]

- Shen, Chenguang, Zhaoqin Wang, Fang Zhao, Yang Yang, Jinxiu Li, Jing Yuan, Fuxiang Wang, Delin Li, Minghui Yang, Li Xing, and et al. 2020. Treatment of 5 critically ill patients with COVID-19 with convalescent plasma. JAMA 323: 1582–89. [Google Scholar] [CrossRef]

- Singh, Amit Kumar, Annu Aggarwal, and Ashween Kaur Anand. 2017. Corporate governance mechanisms and earnings management in India: A study of BSE-listed companies. Delhi Business Review 18: 43–54. [Google Scholar] [CrossRef]

- Sultana, Reajmin, Ratan Ghosh, and Kanon Kumar Sen. 2022. Impact of COVID-19 pandemic on financial reporting and disclosure practices: Empirical evidence from Bangladesh. Asian Journal of Economics and Banking 6: 122–39. [Google Scholar] [CrossRef]

- Sustainable Development Report. 2023. Implementing the SDG Stimulus Includes the SDG Index and Dashboards. Available online: https://s3.amazonaws.com/sustainabledevelopment.report/2023/sustainable-development-report-2023.pdf (accessed on 2 November 2023).

- Terjesen, Siri, Eduardo Couto, and Paulo Morais Francisco. 2015. Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management and Governance 20: 447–83. [Google Scholar] [CrossRef]

- Thompson, Mark. 2019. Masculinity, Gender Relations and Marriage. In Being Young, Male and Saudi: Identity and Politics in a Globalized Kingdom. Cambridge: Cambridge University Press, pp. 196–235. [Google Scholar]

- Ullah, Irfan, Hongxing Fang, and Khalil Jebran. 2019. Do gender diversity and CEO gender enhance firm’s value? Evidence from an emerging economy. Corporate Governance 20: 44–66. [Google Scholar] [CrossRef]

- Wahab, Nor Shaipah Abdul, Collins G. Ntim, Mohd Muttaqin Mohd Adnan, and Wei Ling Tye. 2018. Top management team heterogeneity, governance changes and book-tax differences. Journal of International Accounting, Auditing and Taxation 32: 30–46. [Google Scholar] [CrossRef]

- Wang, Yilei, Deniz S. Ones, Yagizhan Yazar, and Ipek Mete. 2023. Board gender diversity and organizational environmental performance: An international perspective. Current Research in Ecological and Social Psychology 5: 100164. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2013. Introductory Econometrics: A Modern Approach, 5th ed. Mason: South-Western Pub. [Google Scholar]

- Yasser, Qaiser Rafique, Abdullah Al Mamun, and Irfan Ahmed. 2017. Corporate Social Responsibility and Gender Diversity: Insights from Asia Pacific. Corporate Social Responsibility and Environmental Management 24: 210–21. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).