Impact of Environmental, Social, and Governance Activities on the Financial Performance of Indian Health Care Sector Firms: Using Competition as a Moderator

Abstract

1. Introduction

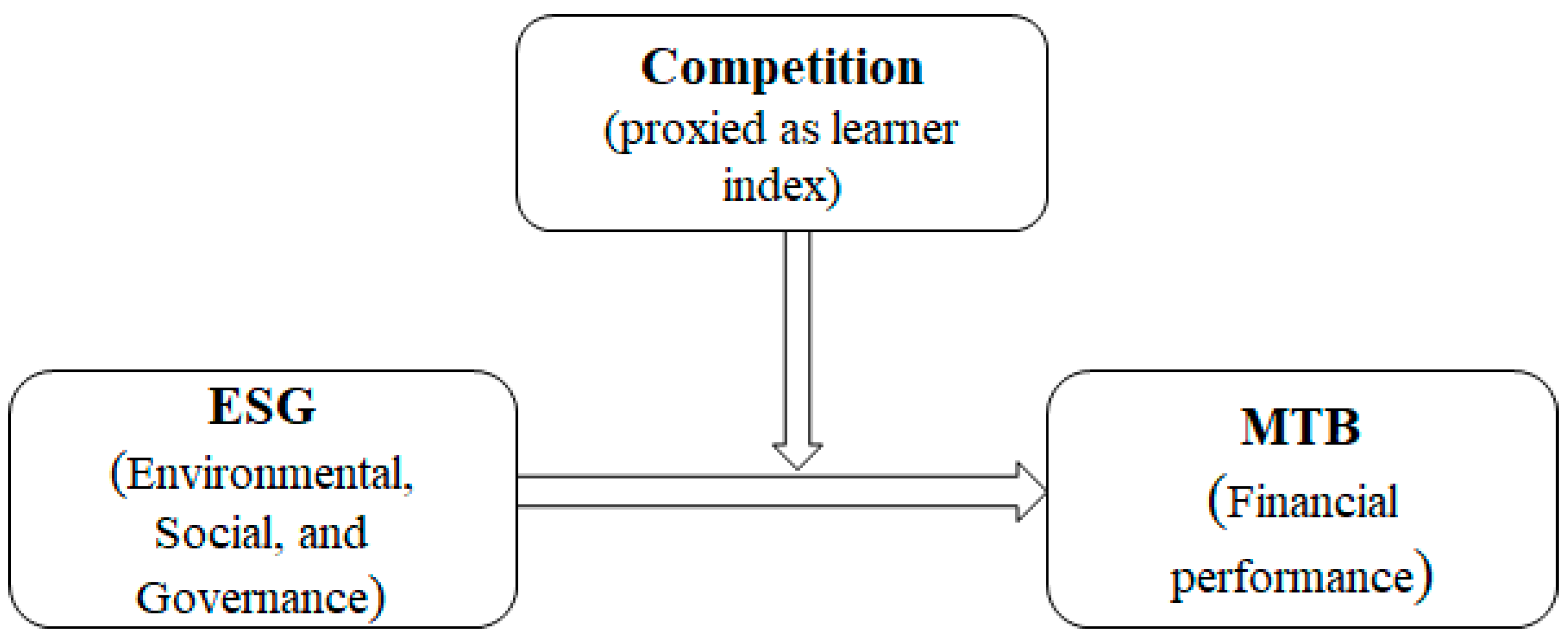

- To analyze the impact of ESG on the FP;

- To assess the effect of variation in competition on the ESG and FP of companies.

2. Review of Literature and Hypothesis Development

2.1. ESG Factors on Firm Performance

2.2. ESG Disclosure on Strong Competitiveness

2.3. Effect of ESG on Different Industries

2.4. ESG on the FP of Healthcare Companies

3. Data and Methodology

3.1. Data

3.2. Methodology

4. Results

4.1. Descriptive Analysis and Correlation

4.2. Regression Analysis

Result of Model 1 and Model 2

4.3. Robustness of the Results

4.4. Interaction Graphs

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abdi, Yaghoub, Xiaoni Li, and Xavier Càmara-Turull. 2022. Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: The moderating role of size and age. Environment, Development and Sustainability 24: 5052–79. [Google Scholar] [CrossRef]

- Acharyulu, Gvrk. 2012. Indian Healthcare and Foreign Direct Investment-Challenges and Opportunities. Asia Pacific Journal of Marketing & Management Review 1: 57–69. Available online: https://www.researchgate.net/publication/352106343 (accessed on 31 July 2020).

- Ademi, Bejtush, and Nora Johanne Klungseth. 2022. Does it pay to deliver superior ESG performance? Evidence from US S&P 500 companies. Journal of Global Responsibility 13: 421–49. [Google Scholar] [CrossRef]

- Ahmad, Nisar, Asma Mobarek, and Naheed Nawazesh Roni. 2021. Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Business and Management 8: 1900500. [Google Scholar] [CrossRef]

- Baltagi, Badi H. 2008. What Is Econometrics? Berlin and Heidelberg: Springer, pp. 3–11. [Google Scholar]

- Boze, Brandon, Margarita Krivitski, David F. Larcker, Brian Tayan, Eva Zlotnicka, B. Brandon Boze, M. Krivitski, David F. Larcker, B. Tayan, and Eva Lotnicka. 2019. Rock Center for Corporate Governance Stanford Closer Look Series-CGRP77 the Business Case for ESG Stanford Closer Look Series Stanford Closer Look Series 1. Available online: https://ssrn.com/abstract=3393082 (accessed on 31 July 2020).

- Buallay, Amina. 2019. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal 30: 98–115. [Google Scholar] [CrossRef]

- Chang, Yu Jin, and Byung Hee Lee. 2021. The Impact of ESG activities on Firm Value: Focusing on the Moderating Effect of Competition within the Industry. 한국경영학회 융합학술대회, 2210–33. [Google Scholar]

- Chelawat, Hemlata, and Indra Vardhan Trivedi. 2016. The business value of ESG performance: The Indian context. Asian Journal of Business Ethics 5: 195–210. [Google Scholar] [CrossRef]

- Chen, Long, and Xinlei Shelly Zhao. 2004. Understanding the Role of the Market-to-Book Ratio in Corporate Financing Decisions. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Chouaibi, Yamina, Matteo Rossi, and Ghazi Zouari. 2021. The effect of corporate social responsibility and the executive compensation on implicit cost of equity: Evidence from French ESG data. Sustainability 13: 11510. [Google Scholar] [CrossRef]

- Eccles, Robert G., Ioannis Ioannou, and George Serafeim. 2014. The impact of corporate sustainability on organizational processes and performance. Management Science 60: 2835–57. [Google Scholar] [CrossRef]

- Economic Survey. 2022. Government of India, Ministry of Finance. Available online: https://www.indiabudget.gov.in/economicsurvey/ (accessed on 1 November 2022).

- Efimova, Olga V. 2018. Integrating Sustainability Issues into Investment Decision Evaluation. Journal of Reviews on Global Economics 7: 668–81. Available online: http://ratesustainability.org/core/hub/ (accessed on 21 November 2020). [CrossRef]

- Egorova, Alexandra A., Sergei V. Grishunin, and Alexander M. Karminsky. 2021. The Impact of ESG factors on the performance of Information Technology Companies. Procedia Computer Science 199: 339–45. [Google Scholar] [CrossRef]

- El Khoury, Rim, Nohade Nasrallah, and Amina Toumi. 2022. ESG and performance in public healthcare companies: The role of disclosure and director liability. Competitiveness Review 33: 203–21. [Google Scholar] [CrossRef]

- Ellili, Nejla Ould Daoud. 2022. Impact of ESG disclosure and financial reporting quality on investment efficiency. Corporate Governance (Bingley) 22: 1094–111. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 2007. Panel data analysis—Advantages and challenges. Test 16: 1–22. [Google Scholar] [CrossRef]

- Jasni, Nur Syuhada, Haslinda Yusoff, Mustaffa Mohamed Zain, Noreena Md Yusoff, and Nor Syafinaz Shaffee. 2020. Business strategy for environmental social governance practices: Evidence from telecommunication companies in Malaysia. Social Responsibility Journal 16: 271–89. [Google Scholar] [CrossRef]

- Kalia, Deepali, and Divya Aggarwal. 2022. Examining impact of ESG score on financial performance of healthcare companies. Journal of Global Responsibility 14: 155–76. [Google Scholar] [CrossRef]

- Lamba, Jonika, and Esha Jain. 2022. The Emerging Need for Corporate Social Responsibility and Sustainable Investment in the Healthcare Sector during COVID 19. International Journal on Recent Trends in Business and Tourism 6: 10–26. [Google Scholar] [CrossRef]

- Marito, Basaria Christina, and A. Dewi Sjarif. 2020. The Impact of Current Ratio, Debt to Equity Ratio, Return on Assets, Dividend Yield, and Market Capitalization on Stock Return (Evidence from Listed Manufacturing Companies in Indonesia Stock Exchange). Scientific Journal of PPI-UKM Social Sciences and Economics 7: 10–16. [Google Scholar] [CrossRef]

- Martins, Henrique Castro. 2022. Competition and ESG practices in emerging markets: Evidence from a difference-in-differences model. Finance Research Letters 46: 102371. [Google Scholar] [CrossRef]

- Megginson, William L., Robert C. Nash, and Matthias Van Randenborgh. 1994. The Financial and Operating Performance of Newly Privatized Firms: An International Empirical Analysis. The Journal of Finance 49: 403–52. [Google Scholar] [CrossRef]

- Meiling, Li, Farzan Yahya, Muhammad Waqas, Zhang Shaohua, Syed Atif Ali, and Alishba Hania. 2021. Boosting Sustainability in Healthcare Sector through Fintech: Analyzing the Moderating Role of Financial and ICT Development. Inquiry 58: 00469580211028174. [Google Scholar] [CrossRef]

- Mohammad, Wan Masliza Wan, and Shaista Wasiuzzaman. 2021. Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Cleaner Environmental Systems 2: 100015. [Google Scholar] [CrossRef]

- Nirino, Niccolò, Gabriele Santoro, Nicola Miglietta, and Roberto Quaglia. 2021. Corporate controversies and company’s financial performance: Exploring the moderating role of ESG practices. Technological Forecasting and Social Change 162: 100015. [Google Scholar] [CrossRef]

- Ramesh Bhat. 2006. Financial Performance of Private Sector Hospital in India. Available online: http://vslir.iima.ac.in:8080/jspui/bitstream/11718/407/1/2006-04-08rbhat.pdf (accessed on 2 July 2019).

- Rastogi, Shailesh, and Arpita Sharma. 2020. Expectations from a private multi-speciality hospital: A moderated-mediation analysis. International Journal of Pharmaceutical and Healthcare Marketing 14: 325–48. [Google Scholar] [CrossRef]

- Rastogi, Shailesh, Jagjeevan Kanoujiya, Venkata Mrudula Bhimavarapu, and Rahul Singh Gautam. 2022. The Impact of Competition on the Profitability and Risk-Taking of Commercial Banks in India. Journal of Asian Finance 9: 377–0388. [Google Scholar] [CrossRef]

- Reverte, Carmelo. 2009. Determinants of corporate social responsibility disclosure ratings by Spanish listed firms. Journal of Business Ethics 88: 351–66. [Google Scholar] [CrossRef]

- Vătavu, Sorana. 2015. The Impact of Capital Structure on Financial Performance in Romanian Listed Companies. Procedia Economics and Finance 32: 1314–22. [Google Scholar] [CrossRef]

- Velte, Patrick. 2017. Does ESG performance have an impact on financial performance? Evidence from Germany. Journal of Global Responsibility 8: 169–78. [Google Scholar] [CrossRef]

- Zhao, Changhong, Yu Guo, Jiahai Yuan, Mengya Wu, Daiyu Li, Yiou Zhou, and Jiangang Kang. 2018. ESG and corporate financial performance: Empirical evidence from China’s listed power generation companies. Sustainability 10: 2607. [Google Scholar] [CrossRef]

| SN | Variable | Type | Code | Definition | Citations |

|---|---|---|---|---|---|

| 1 | Market to Book Ratio | DV | MTB | MTB is a financial valuation matrix used to assess the company’s current market value in relation to its book value | (Chen and Zhao 2004) |

| 2 | Environmental, Social, and Governance | IV | ESG | ESG is a company decision process for determining environmental, social, and corporate governance performance | (Zhao et al. 2018) |

| 3 | Lerner index | IV | LI | Competition is always examined in the efficiency and customer-focused method relevant to a firm. | (Rastogi et al. 2022) |

| 4 | Market capitalization | CV | Mcap | It illustrates the measurement of the valuation of firms and is computed by multiplication of the total quantity of shares of a company by the current retail price of a share. | (Marito and Sjarif 2020) |

| 5 | Sales | CV | Sales | It is the volume of trade of services and goods for legal tender, and the natural log value of the sale is used. | (Megginson et al. 1994) |

| Variables | Mean | SD | Min | Max |

|---|---|---|---|---|

| MTB | 6.613,139 | 20.55668 | −23.2 | 265.79 |

| ESG | 0.4446237 | 0.0636491 | 0.2741935 | 0.5322581 |

| LI | 0.1575365 | 0.2476163 | −1.856504 | 1.001547 |

| Mcap | 16,945.78 | 27,822.84 | 14.83731 | 202,702.4 |

| Sales | 4013.542 | 5626.169 | 28.98 | 76,947 |

| Variables | ESG | Desg | dLI | i_dESG_dLI | lnmcap | Lnsales |

|---|---|---|---|---|---|---|

| ESG | 1.0000 | |||||

| Desg | 1.0000 * | 1.0000 | ||||

| (0.0000) | ||||||

| dLI | −0.0589 | −0.0589 | 1.0000 | |||

| (0.2864) | (0.2864) | |||||

| i_dESG_dLI | −0.0551 | −0.0551 | 0.9944 * | 1.0000 | ||

| (0.3181) | (0.3181) | (0.0000) | ||||

| Lnmcap | 0.1543 * | 0.1543 * | 0.1583 * | 0.1530 * | 1.0000 | |

| (0.0050) | (0.0050) | (0.0039) | (0.0054) | |||

| Lnsales | 0.0076 | 0.0076 | 0.3804 * | 0.3889 * | 0.6986 * | 1.0000 |

| (0.8901) | (0.8901) | (0.0000) | (0.0000) | (0.0000) |

| DV: MTB | Model 1 (Base Model) | Model 2 (Interaction Model) | ||||

|---|---|---|---|---|---|---|

| Coef. | SE. | p Value | Coef. | SE. | p Value | |

| ESG | −434.73 ** | 157.38 | 0.006 | |||

| dESG | −120.77 | 157.71 | 0.444 | |||

| dLI | −955.86 * | 198.06 | 0.000 | |||

| i_dESG_Dli | 714.27 ** | 335.37 | 0.033 | |||

| Lnmcap | 0.82 | 1.79 | 0.646 | −11.64 | 7.97 | 0.145 |

| Lnsales | −0.68 | 3.64 | 0.850 | −12.18 | 11.66 | 0.296 |

| Cons | 198.55 * | 79.11 | 0.012 | 209.51 *** | 123.27 | 0.089 |

| BP-test (Random effect) | 40.14 * (0.0000) | 0.00 (1.0000) | ||||

| Hausman Test | 14.67 * (0.0021) | 39.85 * (0.0000) | ||||

| F-test | 2.83 * (0.0000) | 1.56 ** (0.0373) | ||||

| Chi-square Durbin Chi-2 Wu-Hausman Test | 58.08 * (0.0000) 6.34311 * (0.0118) 6.38103 * (0.0122) | 62.07 * (0.0000) 14.7407 * (0.0001) 15.3365 * (0.0001) | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Agarwal, B.; Gautam, R.S.; Jain, P.; Rastogi, S.; Bhimavarapu, V.M.; Singh, S. Impact of Environmental, Social, and Governance Activities on the Financial Performance of Indian Health Care Sector Firms: Using Competition as a Moderator. J. Risk Financial Manag. 2023, 16, 109. https://doi.org/10.3390/jrfm16020109

Agarwal B, Gautam RS, Jain P, Rastogi S, Bhimavarapu VM, Singh S. Impact of Environmental, Social, and Governance Activities on the Financial Performance of Indian Health Care Sector Firms: Using Competition as a Moderator. Journal of Risk and Financial Management. 2023; 16(2):109. https://doi.org/10.3390/jrfm16020109

Chicago/Turabian StyleAgarwal, Bhakti, Rahul Singh Gautam, Pooja Jain, Shailesh Rastogi, Venkata Mrudula Bhimavarapu, and Saumya Singh. 2023. "Impact of Environmental, Social, and Governance Activities on the Financial Performance of Indian Health Care Sector Firms: Using Competition as a Moderator" Journal of Risk and Financial Management 16, no. 2: 109. https://doi.org/10.3390/jrfm16020109

APA StyleAgarwal, B., Gautam, R. S., Jain, P., Rastogi, S., Bhimavarapu, V. M., & Singh, S. (2023). Impact of Environmental, Social, and Governance Activities on the Financial Performance of Indian Health Care Sector Firms: Using Competition as a Moderator. Journal of Risk and Financial Management, 16(2), 109. https://doi.org/10.3390/jrfm16020109