1. Introduction

Agricultural production is vulnerable to various types of risks that emanate from the natural, economic and socio-political environment (

Onumah 2018). Most agricultural production risks are significantly more important for the farmers since they can cause large-scale production losses (

Kislingerova and Spicka 2022). Inadequate institutional support (access to credit, research and extension), inappropriate production systems and inadequate infrastructures and post-harvest management technology are the main contributors to the production risk for the farmers (

Yiadom-Boakye et al. 2013). However, most farmers in the least developed countries do not utilize the appropriate risk management instruments due to lack of awareness among the farming community and a lack of the scientifically recommended skills for managing risk (

Antonaci et al. 2014).

Risk considerations are necessary in the analysis of the agricultural sector as there exist a number of possible cases where an intelligent policy formulation should consider not only the marginal contribution of input use to the mean of output, but also the marginal reduction in the variance of output (

Koundouri et al. 2006). The stochastic nature of agricultural production is a major indicator of risk. Thus, variability in yield is not only explained by factors outside of the control of the farmer, such as climate change, but also by endogenously controllable factors such as varying levels of inputs (

Just and Pope 1979). Risk caused by such endogenous factors is called endogenous risk. An endogenous factor is associated with the use of the factors of production. Over and under use of input relative to the recommended rate leads to yield variability among farmers. Inputs have two effects in the production process: the first is an effect on production; the second is an effect on production risk. Inputs that increased the mean production did not necessarily have a risk reducing effect (

Ogundari and Akinbogun 2010). Improving farmers’ production skills and capacities by providing frequent access to training and institutions has been shown to be advantageous in reducing the level of the endogenous risk encountered by the farmers (

Chavas et al. 2019).

Among agricultural products, maize is the most in-demand product and plays a role in ensuring the food security of consumers. It is the second most widely grown crop, next to wheat, in the world. Maize contains about 72% starch, 10% protein, and 4% fat, supplying an energy density of 365 Kcal/100 g, as compared to rice and wheat, but has a lower protein content (

Nuss and Tanumihardjo 2010). Maize is useful for food, livestock feed and industrial processes in different countries globally. Different types of maize are grown throughout the world, with one important difference being its colour, which ranges from white to yellow to red to black (

Ranum et al. 2014).

Ethiopia is one of the major maize producing countries. About 88% of the maize produced in Ethiopia is used as food. The country has attained self-sufficiency in maize production and even exports some to Sudan, Djibouti and Kenya. Important causes of the improvement in yield include the increased availability and use of modern inputs, the availability of better extension services and an increasing demand (

Abate et al. 2015). Despite this progress in the production and marketing of maize, there is still variation in the yield levels and returns of maize in Ethiopia (

Van Ittersum et al. 2016). The variation in yield is caused by a technological gap, market imperfections, economic constraints, allocative inefficiency and poor crop management practices. Tackling such factors will require an improved extension service, good road infrastructure, liberalization of the input and output markets and also good technological policies (

Van Dijk et al. 2020). Production variation, on the other hand, causes welfare loss and brings social unrest (

Bellemare 2015), and this in turn bring about rural to urban migration (

Lee 2016).

Farmers’ perceptions about endogenous risk sources and risk management strategies are different based on the context existing in the area. They are shaped based on information obtained from various sources (

Belaineh 2003). Risk perception is a prerequisite for determining an effective coping strategy (

OECD 2011). Farmers who have no awareness of the risk could not implement an effective management strategy (

Akcaoz et al. 2009). An individual’s risk perception is influenced by three broad factors, namely, individual characteristics, risk attributes (frequency and severity) and trust in the communicating institutions (

Siegrist and Hartmann 2020). Individual characteristics make paramount contribution to the determination of individuals’ risk perception. For example, gender, age, education and wealth, as well as other innate attributes, create the lens through which a person assesses various risks and their attributes.

In addition to risk perception, the risk aversion behaviour of farmers contributes to their state of mind with regard to uncertain activities (

Hillson and Murray-Webster 2005). Risk aversion behaviour involves the propensity to assess a risk situation in a positive or adverse manner and to act accordingly (

Guan and Dragon 2018). Individuals’ risk aversion behaviours are divided into three categories: low risk averse, medium risk averse and high risk averse. Those with a low risk averse attitude incline towards uncertain activities; a medium risk averse attitude is indifferent towards risk and a high risk averse attitude gravitates towards certain rather than uncertain events (

Mitra and Sharmin 2019). The factors that induce farmers to hold certain risk attitudes are their experience as farmers, self-enhancement, pleasure from being at risk, physical enjoyment, prestige-seeking, social pressure, financial gain, lack of time or means and under-estimation of a hazard (

Rohrmann 2008).

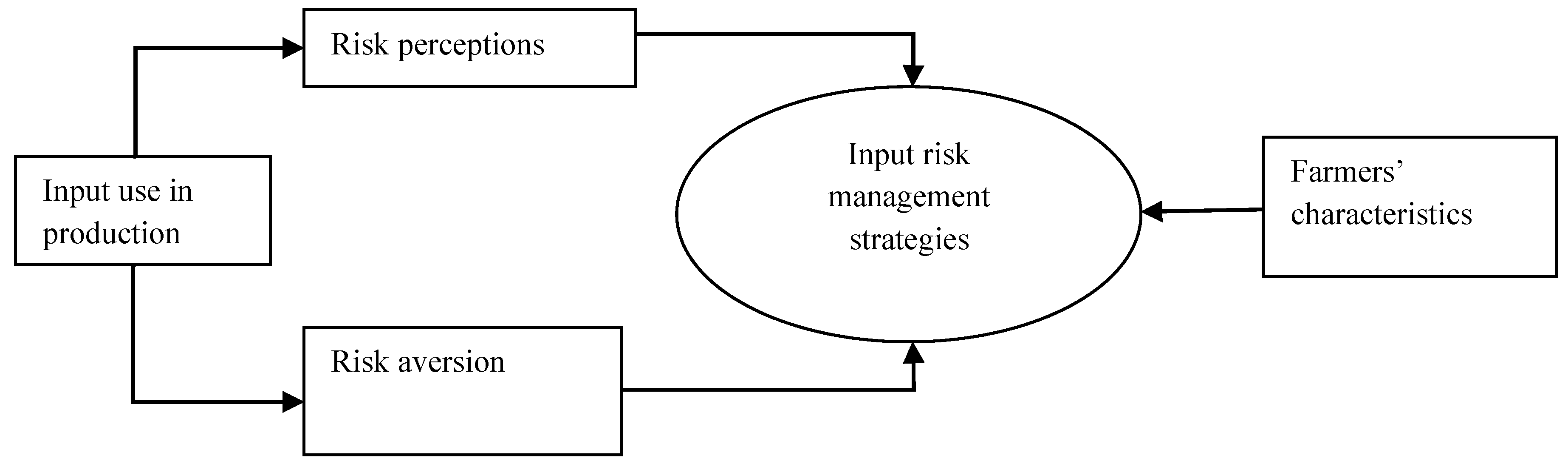

Farmers’ perceptions and attitudes about risk determine the types of risk management strategies they employ in response to the risks they encounter (

Crane et al. 2013). Risk is an unstoppable phenomenon; however, it is possible to reduce any potential loss using risk management tools (

Fitch 2007). Risk management strategies involve different steps such as risk identification, measurement, treatment and implementation. Risk identification involves defining the potential risks. Risk measurement encompasses the quantification of the identified risk. Risk treatment includes risk avoidance, risk reduction, risk acceptance and risk transfer. Finally, risk implementation involves applying risk management strategies. At the end, each risk management strategy should be evaluated. Implementation uses people, statistical models and IT infrastructure to measure the underlying risk of current and future investments. This step refers to checking whether or not the final risk-taking is in line with the chosen strategy and applies it correctly (

Wolke 2007).

From the theoretical point of view, in advanced agricultural science, the dominant approach has been the stochastic production approach (

Sarker et al. 2022).In this production function, farm inputs are assumed to change the level of output variance in addition to the level of output produced. Input use, such as the utilization of fertilizers, land and labour, can change output levels and output variations or volatility. Therefore, producers can adjust the level of input use to manage the production risks in agricultural production processes (

Guan and Dragon 2018).

Just and Pope (

1979) stated that the production variation caused by input use, also known as endogenous risk, is the core issue in the agricultural production process. Farmers’ endogenous risk is caused by (1) uncertainty in the quality of one or more inputs, (2) uncertainty in the quantity of one or more inputs, (3) uncertainty in the timing of one or more inputs and (4) uncertainty in the prices of one or more inputs.

Farmers in Ethiopia have experience in identifying risk sources, and they are able to develop risk management strategies through experiential learning. However, such strategies are less effective and have no long-term ability to reduce or avoid risk, as the severity and frequency of risk persistence (

Belaineh 2003). In Ethiopia, the existence of weak institutions such as the financial, market information and extension advisory services have made farmers’ risk management strategies less effective (

Wondim et al. 2020). Smallholder farmers do not receive pertinent information about their production and marketing activities. Such a lack of reliable information deters farmers from making well-informed decisions that could reduce the agricultural risks encountered in their agricultural activities (

Kahan 2008).

Some prior studies have been conducted in Ethiopia concerning farmers’ perceptions about risk sources and about the management strategies they implement on their farms; however, these studies focused on exogenous risk sources. This study fills a knowledge gap by being geared towards endogenous risk sources in particular. Therefore, this study was aimed at discovering the perceptions about endogenous risks, the risk aversion behaviour and the risk management strategies of maize producers in Awi zone, Ethiopia.

The following research questions were designed to address the knowledge gap:

Question 1: How do endogenous risks occur?

Question 2: How do maize producers perceive the endogenous risk sources? What are the probability of occurrence and the consequences of the perceived production risks?

Question 3: What is the effect of production inputs on the production of maize?

Question 4: What is the risk aversion behaviour of farmers? What determines the risk aversion behaviour of the farmers?

Question 5: What is the effect of the farmers’ risk perceptions, their risk aversion behaviours and other factors on the input risk management practices of maize producers?

This study makes a paramount contribution to the knowledge available to the farmers, government and non-government institutions and researchers that could create awareness about endogenous risk sources and the strategies for coping with them.

The remainder of this paper is structured as follows. In

Section 2, a theoretical framework is developed in which the theories that support this study are reviewed. In

Section 3, our research method is explained, including the data gathering strategy used. Our major statistical analyses are presented in

Section 4, which includes an analysis of the relevant variables. Finally, in

Section 5, our findings are discussed, and, in

Section 6, the conclusions of our research are drawn.

4. Statistical Analysis

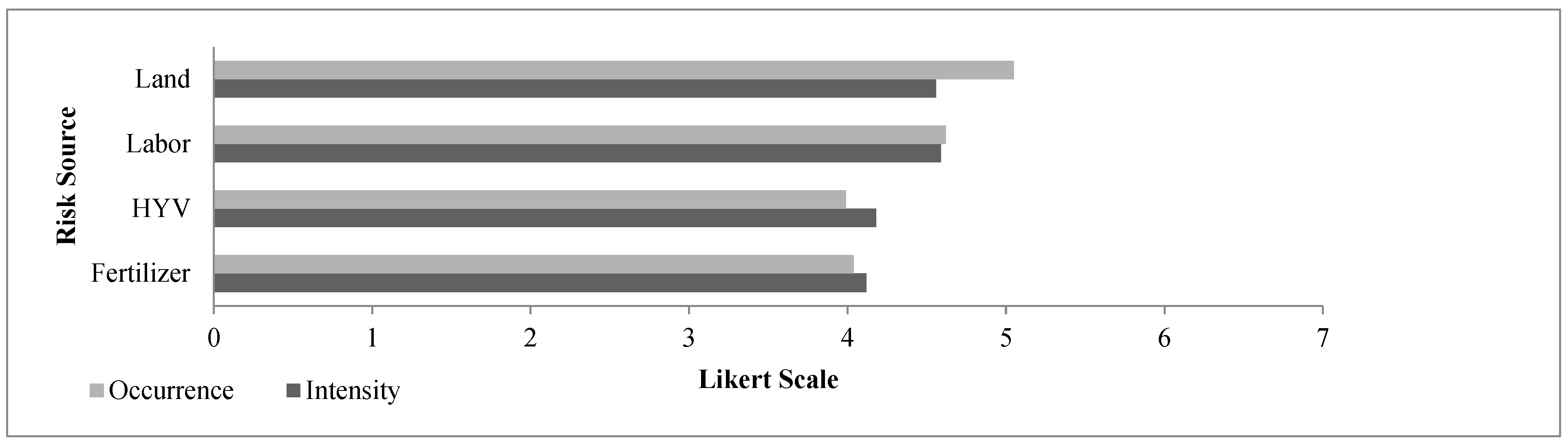

4.1. Overall Input Risk Perception of Farmers

Maize producers were interviewed about their perceptions on a seven point Liker-scale. The most serious risk was given seven points, and the least risk was given one point. For each risk, the points given by every respondent were summed, and a percentage out of the maximum score (i.e., seven points times 343 respondents) was calculated. Based on the Likert scale result, the farmers’ risk perception behaviours were classified as low and high risk. The Likert type scores for the farmers’ concerns were analysed as ordinal data to assess their perceptions of the risk related to each input risk. The input risks of maize producers were divided into two sections; one is associated with input availability risks and the other with input affordability risks. All statistical tests were conducted using STATA version 14 software after the data were collected, entered, edited and well prepared.

4.2. Risk Aversion Behaviour of Farmers

In this study, the risk aversion behaviour of maize producers was determined using the safety first model and applying the observed economic behaviour (OEB) elicitation method. The OEB approach develops the risk aversion measure based on the conditions of the factor demand and output supply (

Moscardi and de Janvry 1977). The risk aversion parameter is derived from knowledge of the production function. The OEB method is an indirect method which makes inferences about the risk attitudes of the farmers based on the behaviour predicted by an empirically predicted model. The advantages of OEB include its ability to generate quantitative measures of risk aversion, its objectivity, and the facts that it allows the analyst to handle a large amount of sample data, is less costly and avoids measuring the risk attitude from hypothetical gaming situations (

Robinson et al. 1984). To determine the risk aversion behaviour of the farmers using OEB, estimating the production function is crucial. In this study, a two-step procedure was used to determine the risk aversion behaviour of maize producers.

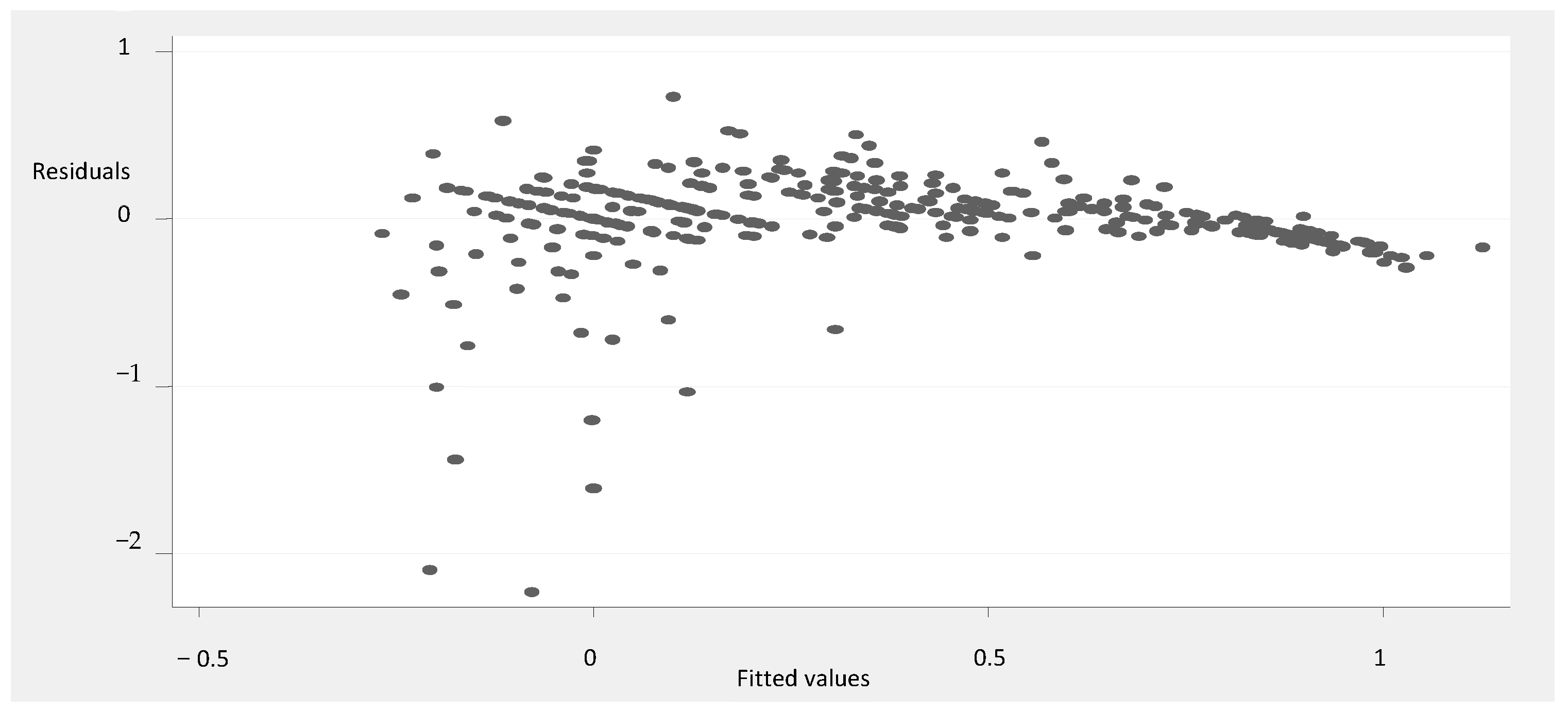

The translog, Cobb- Douglas, generalized Leontief and constant elasticity of substitution production functions were equally likely candidates for use in this study; however, for the ease of use in the subsequent section, it is better to differentiate the models. Model functional form tests such as the log likelihood, akiake information criteria (AIC), goodness of fit test and residual sum of square (RSS) value were undertaken to select the appropriate functional forms for the study. Following these tests, the translog functional form with non-linear regression model (NLS) was used in the study due to the high fitness of the model with the data.

The translog production functional form was specified as

where

Q = Maize output; X1 = Seed; X2 = DAP; X3 = UREA; X4 = Land; X5 = Oxen; X6 = Labor; α0 = Constant term; αI coefficients for inputs; αii coefficients for the square of inputs; αij coefficients for the interaction effect of inputs; μi = error term.

This production function was estimated using the NLS method. The NLS model was chosen owing to the presence of a curvy-linear relationship between the dependent and independent variables. Before commencing the NLS regression model, a test for multicollinearity was undertaken so as to protect the perfect collinearity between independent variables and hence to produce unbiased estimates. The delta method was employed to estimate the elasticity. Elasticity was used to show the percentage change effect of each input on maize production.

Following this, production estimates for the most influential inputs were selected and used to determine the risk aversion behaviour of farmers. Following

Moscardi and de Janvry (

1977), the risk aversion behaviour of farmers was formulated as

where

is the risk index of farmers

is the price ofmost influential input (UREA)

is the price of maize

is the quantity of most influential input (UREA)

is the elasticity coefficient of output with respect to the chosen input

is the mean of maize product

is standard deviation of maize product

The hypothetical values for the risk parameter () were specified as follows:

< 0.4 = low risk aversion

0.4 << 1.2 = moderate risk aversion

1.2 << 2 = high risk aversion

4.3. Risk Management Strategies of Maize Producers

Nineteen risk management strategies were applied by the farmers to cope with endogenous risk in the study area. Farmers were interviewed about the importance of each risk management strategy as rated on a seven point Likert scale. The data collected using the Likert scale underwent factor analysis so as to reduce the risk management items into smaller number of variables.

Explanatory factor analysis was applied for this study to create a summary latent variable (factor) fora large number of variables associated with input risk management strategies. Factor analysis operates by reducing dimensionality. These un-observable factors are not directly measured but are essentially hypothetical constructs that are used to represent variables (

Bartholomew et al. 2011).

Xj represents j-th variable.

αjm denotes factor loading of j-th variable on m-th factor.

Fm represents factor m.

εj indicates unique factor.

In conducting factor analysis, two methods are mostly commonly used, namely, principal axis factoring and principal component analysis. In this study, principal axis factoring with varimax rotation was employed. The justification for this was that principal axis factoring does not assume that all of the variables (items) included in the study account for 100% of the variance. Therefore, principal axis factoring categorizes the total variance into common variance, unique variance and error variance; however, principal component analysis assumes that there is no error variance, which means that the total variance of the variable is accounted for by its components (

Rietveld and Van Hout 1993).

In connection to this, factor loading indicates the contribution of the variable to each factor. A factor loading of 0.30 or greater is considered statistically meaningful (

Tabachnick and Fidell 2007). The larger the factor loading, the more the variable has contributed to that factor (

Harman 1976). Finally, Factors with Eigen values greater than 1, Bartlett’s Test of Sphericity (

p < 0.05) and the Kaiser-Meyer-Olkin Measure (KMO) of Sampling Adequacy (cut-off of above 0.50) were taken into consideration. If this requirement is not met, distinct and reliable factors cannot be produced. However, if this problem occurs, it can be solved by increasing the sample size (

Yong and Pearce 2013).

The factor analysis produced factor score. A factor score, also known as a factor loading, is a measurement that correlates a particular variable to a given factor. When a factor score is high, this suggests that there is a notably strong connection between a certain factor and a common variance in the observed data. The magnitude of the factor score (loading) determines the number of factors to retain. The extracted number of factors represented the input risk management strategies employed by the farmers. Therefore, based on the above criteria, the main risk management strategies were identified and used for further analysis.

The seemingly unrelated regression model (SUR) was selected to identify the determinants of input risk management strategies since more than one risk management strategy was continuous. The SUR model allowed correlations among the residuals of each dependent variable. The SUR model is an extension of the multiple linear regression models and is used to estimate several continuous dependent variables jointly (

Gujarathi 2004).

According to

Zellner (

1962), the SUR model is specified as

where

(m = 1, 2, 3…k) represents the dependent variables which indicate the factor score for each risk management strategy chosen by the i-th farmer,

represents the constant term,

represents coefficients of explanatory variables,

represents explanatory variables and

represents the error terms.

The above equation can be interpreted for each risk management strategies (m) as

In this study, the factor scores obtained from the factor analysis output were used as the dependent variables in SUR model. The SUR model is estimated by the usual ordinary least square method (

Cappellari and Jenkins 2003), and the model allows correlation between residuals (

Belderbos et al. 2004). The test for correlation between residuals was carried out using the Breusch–Pagan test of independence.

Before commencing the SUR model, a test for multicollinearity was undertaken to protect the perfect collinearity between independent variables and hence to produce unbiased estimates. To test multicollinearity, the variance inflation factor (VIF) was employed.

6. Conclusions and Recommendations

The agricultural sector is susceptible to various types of risk in Ethiopia. Such risks in agriculture are interconnected and sometimes offset each other. Endogenous risk which was caused by factors of production was the dominant risk affecting the production performance of farmers. Farmers strived to cope with these risks; however, the effort they made was not strong enough to control the risk. Risk is the potential deviation between expected and real outcomes. While this deviation may be positive or negative, a negative outcome has greater importance from a practical point of view and is usually the focus of decision makers.

This study was aimed at examining farmers’ endogenous risk perception, risk aversion behaviour and coping strategies in managing the risk. Regarding the production input use, farmers in the study area did not use the recommended amount of seed, DAP, UREA, labour and oxen per a given hectare of land. Such unscientific use of inputs was the cause for maize production variability in the study area. Endogenous risk was perceived by the farmers in two ways; the first was connected with input availability risk and the second with input affordability risk. Input availability risk perception has high probability of occurrence and high intensity of damage among maize farmers in the area. Moreover, with regard to input affordability risk, farmers have different perceptions about the production inputs they used in the production of maize. High perception of endogenous risk signified the presence of severe risk which could harm farmers’ production potential at large. Farmers’ perception of risk sources and risk management strategies were determined by different farm specific and systematic issues in the area. Risk perception is a prerequisite for determining effective coping strategies (

OECD 2011). Farmers could encounter high input risk if they did not provide appropriate management strategies. In the study area, human risk management, production risk management, diversification, financial and market risk management strategies were mechanisms that farmers followed to protect against endogenous risk. The input risk management strategies of maize producers were determined by various factors, such as risk perception, demographic factors, socio-economic and risk aversion behaviour of farmers.

One of the crucial factors that determine risk management strategies was the risk perception of the farmers. Risk perception is a mental interpretation of an individual produced by external stimuli (

Wachinger et al. 2013). An individual’s risk perception is influenced by three broad factors, namely, individual characteristics, risk attributes (frequency and severity) and trust in the communicating institutions (

Siegrist and Hartmann 2020). High risk perception among farmers regarding input affordability and input availability enforced the farmers to use different risk management strategies. Input affordability risk perception had a negative impact on the financial capacity of farmers, and farmers did not have the willingness to use production risk management strategies. In response to occurrences of input affordability risks, farmers in the area were more prone to use other management activities, such as human management strategies, diversification of income and marketing strategies. In addition to this, when the occurrence and severity of input unavailability is high, farmers engage in risk reduction behaviours, such as changing to cost efficient production techniques, using organic fertilizer and increasing contact with the extension personnel so as to receive advice and training about production methods.

Farmers who have no awareness about the risk could not bring effective management strategy. The awareness of farmers could be improved through education, experience, extension contact and information access from different sources.

Mishra and El-Osta (

2002) strengthened this idea, finding that farmers with higher levels of education and more experience have ahigh inclination to use risk management strategies. Most farmers have low education attainment; therefore, they developed risk management strategies through experiential learning. Moreover, farmers got information from development agent, formal and informal information sources which were crucial to improve the cognizance of the farmers about agricultural risk prevailed on the farm.

The economic characteristics of the farmers, such as farm size, off-farm income, on-farm income, farm income, livestock holdings and amount credited make significant contributions the financial power of farmers and to their application of efficient management strategies on the farm. Farmers with large farms were less prone to apply production and diversification risk management strategies. Large farm size brought a high economic of scale for the farmers, and they were not willing to use risk management strategies.

Palinkas and Székely (

2008) found out that, with smaller farm sizes, the incentives to use production risk management strategy and to participate in diversification activities decreases. Moreover, a large farm size increased application of human risk management strategies such as training requirements and collaborative activity at large.

Sherrick et al. (

2004);

Kislingerova and Spicka (

2022) depicted that large farm size provided greater power for applying various types of risk management strategies. Participation in alternative income source activities and availability of livestock were also crucial for the application of risk management practices by the farmers. Livestock and cash income are liquid assets and hence they are helpful in managing risk effectively.

Mishra and El-Osta (

2002) stated that farmers who participate off the farm, use credit, and sell their commodities across time are more likely to participate in risk management strategies.

The risk aversion behaviour of farmers signified the behavioural tendency of farmers directed to the risk in the area. UREA was determined to be the most important input in the production of maize. Using the amount of UREA as a basis, it was shown that farmers in the area do have risk aversion behaviours; however, the levels of risk aversion behaviour differ among the farmers. The majority of farmers in the area has a low risk aversion attitude, which implies that farmers have a low tendency to counteract the risk. Determining the risk aversion behaviour of farmers has implications for the government and other agents who wish to make important interventions among the farmers. The farmers’ risk aversion behaviour is an indicator of farmers’ tendency or willingness to take risk. Risk averse farmers with high level of competency and risk anticipation skill have better know-how to manage risk.

The following recommendations are put forward by the researchers:

The zonal agricultural office should develop plans to link farmers with the market. To do so, contract farming schemes should be developed well in the area to farmers to protect themselves from production risks and from price instability. Through contract farming schemes, farmers have reliable access to input and output markets. Therefore, farmer-to-industries and farmers-with-traders linkages should be strengthened to reduce the risk of maize producers. Moreover, extension workers should better understand the risks that farmers face in the study area. Based on this information, they should provide capacity building training for farmers and assist farmers in developing risk management strategies. Extension workers should educate farmers about production risks and link farmers with research information so as to reduce risk through farmers’ training centres (FTCs) in each rural kebeles in the zone.

Farmers should engage in farm planning, which means the farmers should better understand exactly what and how much input is needed at various times during the production season. To develop farmers’ planning skills, it is essential to strengthen farmers-to-extensions and also farmers-to-research-centres linkages. This helps the farmers to follow scientifically recommended practices

Strengthening traditional social bonds is also crucial for the farmers, so that they have mutual assistance. Farmers should understand well the benefits of working together to reduce the risks encountered in the area. Through social bonds, the farmers could communicate information about production practices, purchasing prices of inputs, selling prices of outputs, types of buyers and the locations of marketplaces where they can purchase/sell their input/output. Social bonds also provide security for the farmers and are helpful in supporting the most vulnerable groups in the society.

With regard to governmental institutions, financial institutions make a significant contribution toward reducing both production and market risks in the study area. Financial institutions should design mechanisms to provide loans without collateral for the farmers. Moreover, financial institutions should provide awareness about cash utilization for the farmers and should improve farmers’ ability to raise cash to use during unfavourable times. Farmers should develop assets that could be easily convert to cash since the risks associated with input affordability could be reduced by selling liquid assets.

The majority of farmers were illiterate and have no scientific know-how about maize production, and they carry out their farming activities based on experience. The provision of adult education for illiterate farmers offers them the advantage of improved awareness and powers of information analysis. Continual training for farmers is also crucial in order to improve the labour productivity and risk management ability of farmers. In addition to this, establishment of agricultural information centre is mandatory in the area since it enables farmers to receive timely and accurate information with regard to production and marketing. Therefore the risk associated with input and output risk would be reduced at large.

Rural infrastructure development should be widely expanded in the area. Infrastructures such as roads, telecom and electricity are crucial so that the farmers have easy access to different institutions, such as market and financial institutions. Good infrastructure has the potential to lessen transaction costs for maize producers, such as transportation costs, information searching costs, bargaining costs and enforcement costs. Furthermore, cooperatives should be strengthened in the zone since they provide the opportunity for maize producers to benefit from an increased volume of sales, bulk purchases of inputs and supplies and the mobilization of credit. Cooperatives are instrumental for the farmers to reduce the transaction costs associated with search for a market.

Diversification should be used to minimize the financial risks for farmers. Involvement in off-farm and non-farm activities is crucial to make farmers financially strong. Income obtained from alternative income generating activities is important for purchasing farm inputs and enables farmers to follow mechanized agriculture. Mechanized production is essential for improving the maize yield and reducing production risks for farmers.

The limitation of the study is that this study focused only on endogenous risk. In this study, farmers’ risk aversion behaviours, perceptions and management strategies were designed in relation to input utilization. Therefore, future research should focus farmers’ risk behaviour in relation to financial and marketing phenomena. Moreover, the impact of exogenous risk on production risk should be studied in future research.